ECON 152 PRINCIPLES OF MICROECONOMICS Chapter 22 Rents

- Slides: 35

ECON 152 – PRINCIPLES OF MICROECONOMICS Chapter 22: Rents, Profits, and the Financial Environment of Business Materials include content from Pearson Addison-Wesley which has been modified by the instructor and displayed with permission of the publisher. All rights reserved.

Income Sources Wages from the use of labor n Rent from the use of natural resources n Interest from the use of money capital n Profit from the risk of entrepreneurship n 2

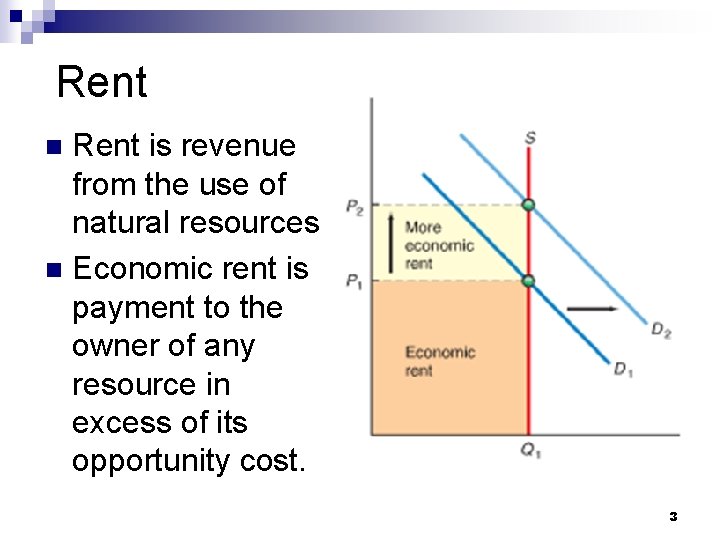

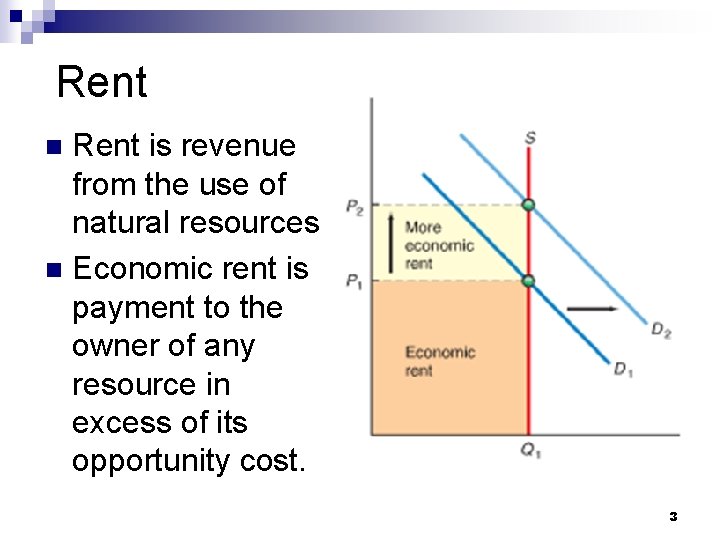

Rent is revenue from the use of natural resources n Economic rent is payment to the owner of any resource in excess of its opportunity cost. n 3

Economic Rent n Who earns economic rent for labor services? ¨ Movie Stars ¨ Top Athletes ¨ Successful innovators 4

Economic Rent n n n Superstars who earn economic rent are paid more than the minimum they would have to earn in order to continue in their work. But the rent serves an economic function of allocating their labor to the best use. The amount of rent they can earn will be determined by the demand for services only they can offer. 5

The Legal Organization of Firms Before addressing the profits of firms, it is appropriate to discuss legal organization. n Proprietorships n ¨A business owned by one individual who: Makes the business decisions n Receives all the profits n Is legally responsible for all the debts of the firm n 6

The Legal Organization of Firms n Proprietorships ¨ About 70 percent of all U. S. firms ¨ 10 million firms with sales averaging not much more than $50, 000 per year ¨ Account for 5 percent of all business revenues 7

The Legal Organization of Firms n Advantages of proprietorships ¨ ¨ ¨ Easy to form and dissolve All decision-making power resides with the sole proprietor Profit is taxed only once 8

The Legal Organization of Firms n Disadvantages of proprietorships ¨ Unlimited liability n ¨ ¨ The owner of the firm is personally responsible for all of the firm’s debts Limited ability to raise funds Proprietorship normally ends with the death of the proprietor 9

The Legal Organization of Firms n Partnerships ¨A business owned and managed by two or more co-owners, or partners, who Share the responsibilities and the profits of the firm n Are individually liable for all the debts of the partnership n 10

The Legal Organization of Firms n Advantages of partnerships ¨ ¨ Easy to form and dissolve Partners retain decision-making power Permits more effective specialization Profit is taxed only once 11

The Legal Organization of Firms n Disadvantages of partnerships ¨ ¨ ¨ Unlimited liability Decision making more costly Dissolution generally necessary when a partner dies or leaves the firm 12

The Legal Organization of Firms n Corporations ¨A legal entity that may conduct business in its own name just as an individual does ¨ The owners of a corporation, called shareholders: Own shares of the firm’s profits n Enjoy the protection of limited liability n 13

The Legal Organization of Firms n Limited Liability ¨A legal concept whereby the responsibility, or liability, of the owners of a corporation is limited to the value of the shares in the firm that they own 14

The Legal Organization of Firms n Advantages of corporations ¨ ¨ ¨ Limited liability Continues to exist when owner leaves the business Raising large sums of financial capital 15

The Legal Organization of Firms n Disadvantages of corporations ¨ ¨ Double taxation Separation of ownership and control 16

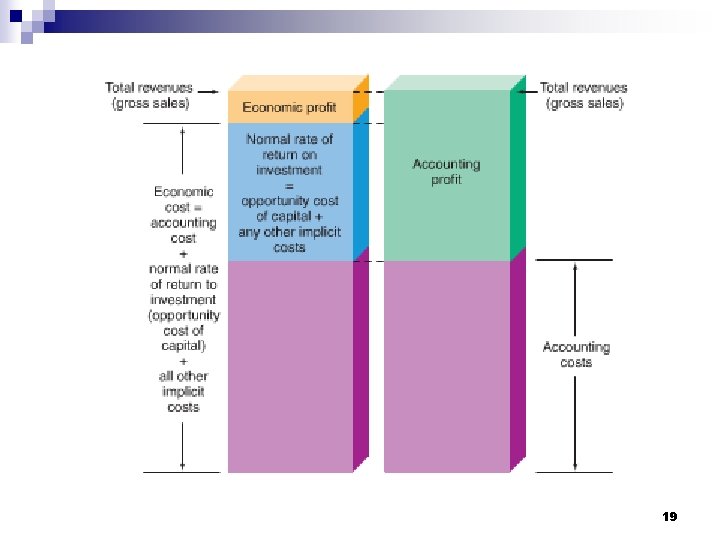

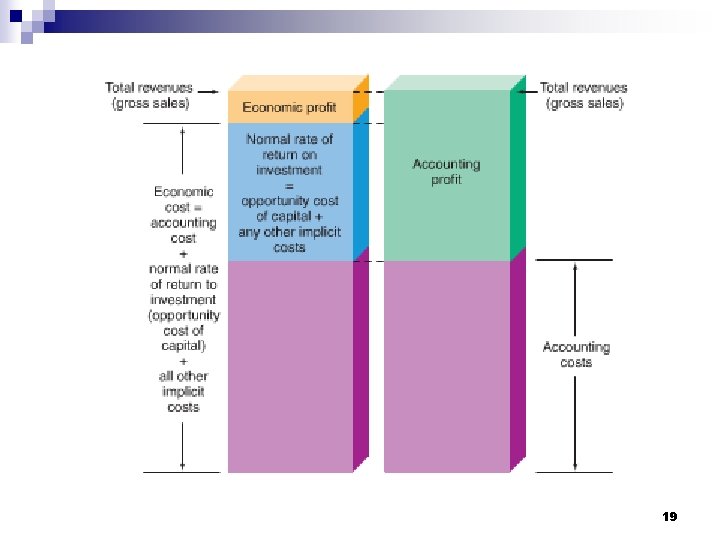

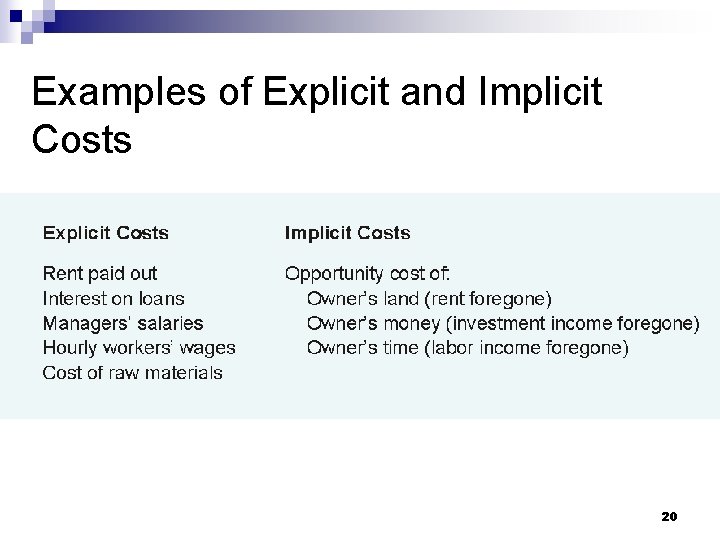

Profits Accounting profit equals total revenue minus explicit costs. n If a business earns an accounting profit that is equal to the normal rate of return, then it is earning enough to cover the opportunity cost of capital. n 17

Economic Profit Economic profit equals total revenue minus the total opportunity cost of all inputs used. n This is equivalent to saying that economic profit is what remains of total revenue once all explicit and implicit costs have been covered. n Economic profit is different than accounting profit. n 18

19

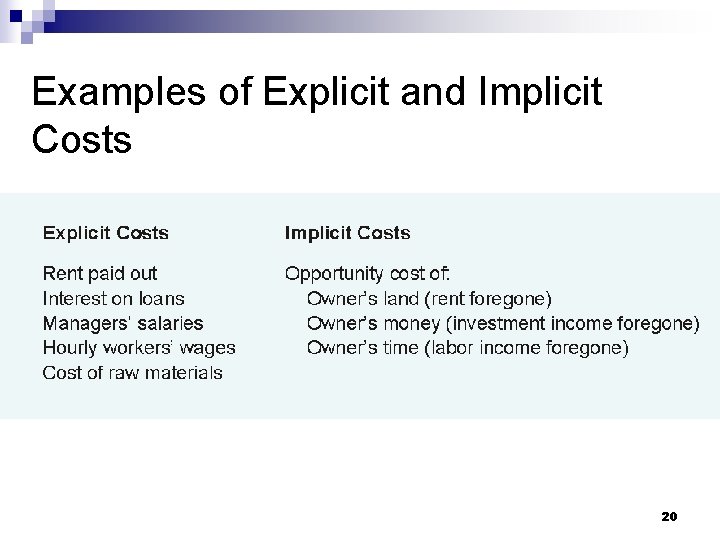

Examples of Explicit and Implicit Costs 20

Profits Economic theory assumes that the goal of any firm is to maximize profit. n An enterprise cannot obtain capital financing unless it generates the profits necessary to reward investors. n 21

Interest is the price paid by debtors to creditors for the use of financial capital. n Interest is the market return earned by capital as a factor of production. n 22

Interest and Credit n The interest rate paid depends on ¨ Length of the loan ¨ Risk ¨ Handling charges 23

Real versus Nominal Interest Rates n The nominal interest rate rises along with increases in expected inflation 24

The Allocative Role of Interest n n n Interest is a price that allocates loanable funds to consumers and businesses. Like any price set by the free market, it can serve to bring about an efficient allocation of a scarce good. In this case, the scarce good is financial capital. 25

Interest Rates and Present Value n The present value of a given amount to be received in the future is the most that someone would pay today in order to be entitled to receive that amount in the future. 26

Interest Rates and Present Value n Present value of $105 to be received one year from now, if the interest rate is 5%: PV = 105/(1. 05) = 100 ¨ The present value is $100 ¨ 27

Interest Rates and Present Value n Discounting ¨ The process of determining the present value of a sum to be received some time in the future. 28

Methods of Corporate Financing Selling ownership shares (stock) n Using notes of indebtedness (bonds) n Some profits retained for reinvestment (profits) n 29

Methods of Corporate Financing n Share of Stock ¨A legal claim to a share of a corporation’s future profits n Common stock ¨ n Incorporates certain voting rights regarding major policy decisions of the corporation Preferred stock ¨ Owners are accorded preferential treatment in the payment of dividends 30

Methods of Corporate Financing n Bond ¨A legal claim against a firm, usually entitling the owner of the bond to receive a fixed annual coupon payment, plus a lump-sum payment at the bond’s maturity date ¨ Issued in return for funds lent to the firm 31

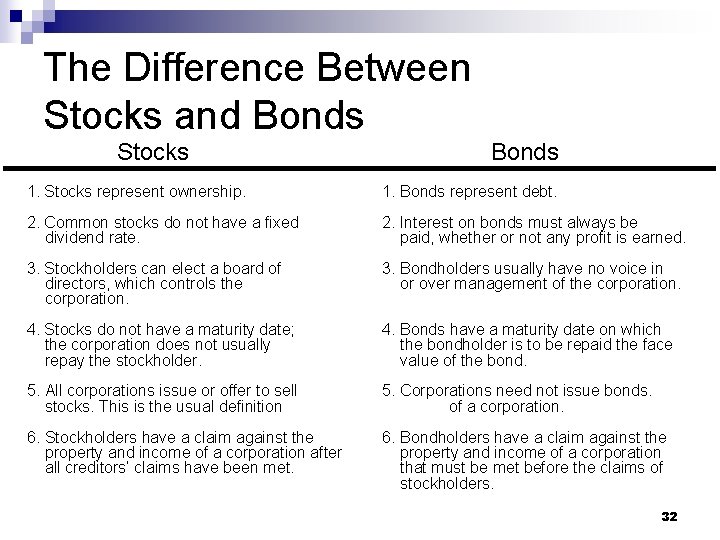

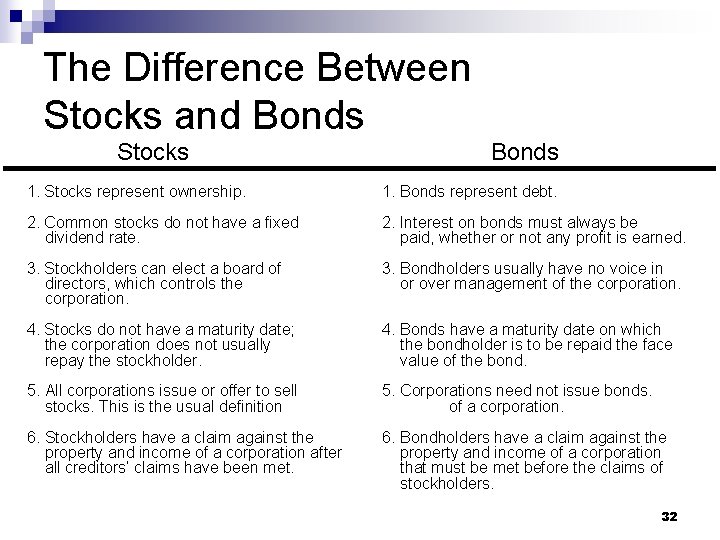

The Difference Between Stocks and Bonds Stocks Bonds 1. Stocks represent ownership. 1. Bonds represent debt. 2. Common stocks do not have a fixed dividend rate. 2. Interest on bonds must always be paid, whether or not any profit is earned. 3. Stockholders can elect a board of directors, which controls the corporation. 3. Bondholders usually have no voice in or over management of the corporation. 4. Stocks do not have a maturity date; the corporation does not usually repay the stockholder. 4. Bonds have a maturity date on which the bondholder is to be repaid the face value of the bond. 5. All corporations issue or offer to sell stocks. This is the usual definition 5. Corporations need not issue bonds. of a corporation. 6. Stockholders have a claim against the property and income of a corporation after all creditors’ claims have been met. 6. Bondholders have a claim against the property and income of a corporation that must be met before the claims of stockholders. 32

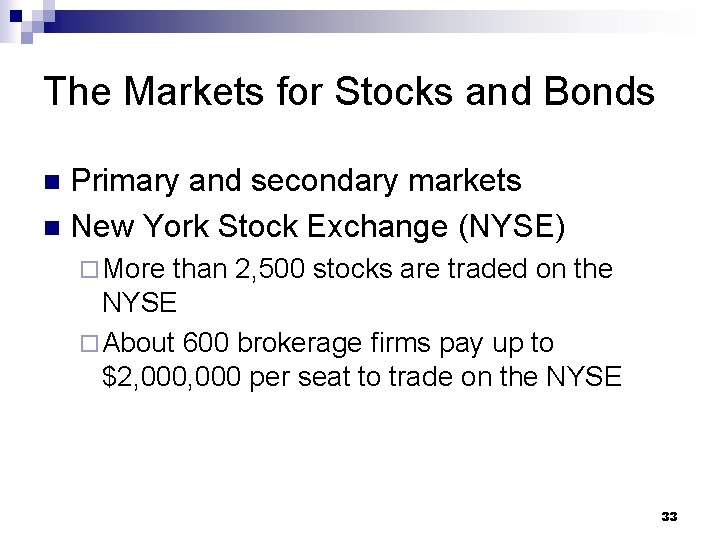

The Markets for Stocks and Bonds Primary and secondary markets n New York Stock Exchange (NYSE) n ¨ More than 2, 500 stocks are traded on the NYSE ¨ About 600 brokerage firms pay up to $2, 000 per seat to trade on the NYSE 33

The Markets for Stocks and Bonds n The theory of efficient markets ¨ If all available information about the performance of a company is incorporated in the price of its stock, then the best predictor of tomorrow’s price is today’s price. ¨ If some people are trading based on inside Information, then they have an opportunity to profit from their transactions before the market price adjusts to the information. 34

ECON 152 – PRINCIPLES OF MICROECONOMICS Chapter 22: Rents, Profits, and the Financial Environment of Business Materials include content from Pearson Addison-Wesley which has been modified by the instructor and displayed with permission of the publisher. All rights reserved.

Econ 152

Econ 152 Econ 152

Econ 152 22 rents

22 rents A company that rents dvds from vending machines

A company that rents dvds from vending machines A summer resort rents rowboats to customers

A summer resort rents rowboats to customers Microeconomics chapter 12

Microeconomics chapter 12 Econ chapter 7

Econ chapter 7 Un r 152

Un r 152 Ntuser.dat forensics

Ntuser.dat forensics Przedszkole 152 łódź

Przedszkole 152 łódź Law society of tasmania v richardson

Law society of tasmania v richardson Rounding numbers hundred thousand

Rounding numbers hundred thousand Mae 152

Mae 152 Graphics for engineers

Graphics for engineers Cs 152 stanford

Cs 152 stanford Cs 152 berkeley

Cs 152 berkeley Ba 152

Ba 152 Ece 152

Ece 152 Ba 152

Ba 152 Which layer of the osi model includes vlans?

Which layer of the osi model includes vlans? Ba 152

Ba 152 Macroob

Macroob Ba 152

Ba 152 Plasa

Plasa Ron mak sjsu

Ron mak sjsu Gfi 152

Gfi 152 Copy

Copy Example of micro economics

Example of micro economics What is the subject matter of microeconomics

What is the subject matter of microeconomics Why is microeconomics important

Why is microeconomics important Intermediate microeconomics lecture notes

Intermediate microeconomics lecture notes Intermediate microeconomics notes

Intermediate microeconomics notes Cartel microeconomics

Cartel microeconomics Walras law economics

Walras law economics Pure public good

Pure public good Cowell microeconomics

Cowell microeconomics