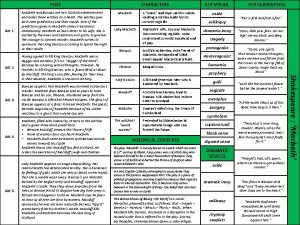

CUSTOMS ACT 1962 ASSESSMENT ASSESSMENT Assessment is the

- Slides: 26

CUSTOMS ACT 1962 ASSESSMENT

ASSESSMENT �Assessment is the process of quantification of duty liability. As per Section 2(2), ‘ Assessment includes provisional assessment, reassessment and any order of assessment in which the duty assessed is Nil.

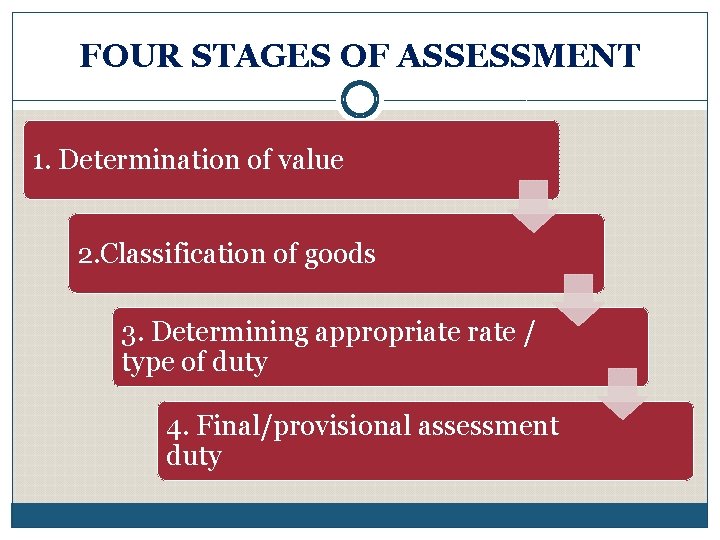

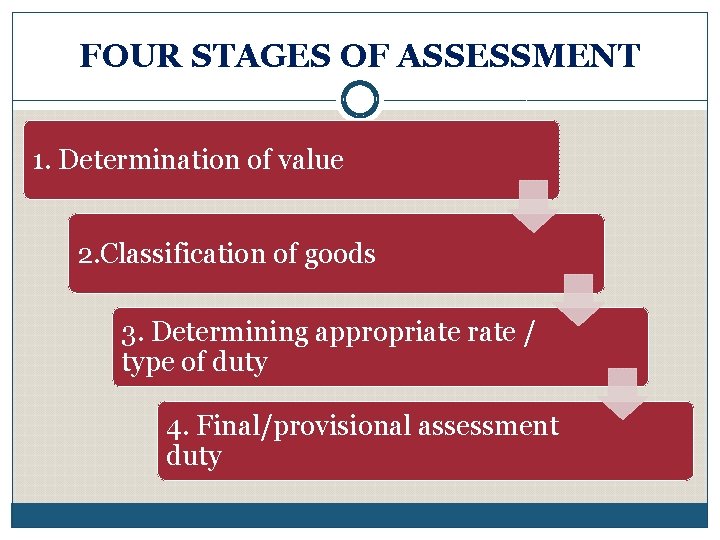

FOUR STAGES OF ASSESSMENT 1. Determination of value 2. Classification of goods 3. Determining appropriate rate / type of duty 4. Final/provisional assessment duty

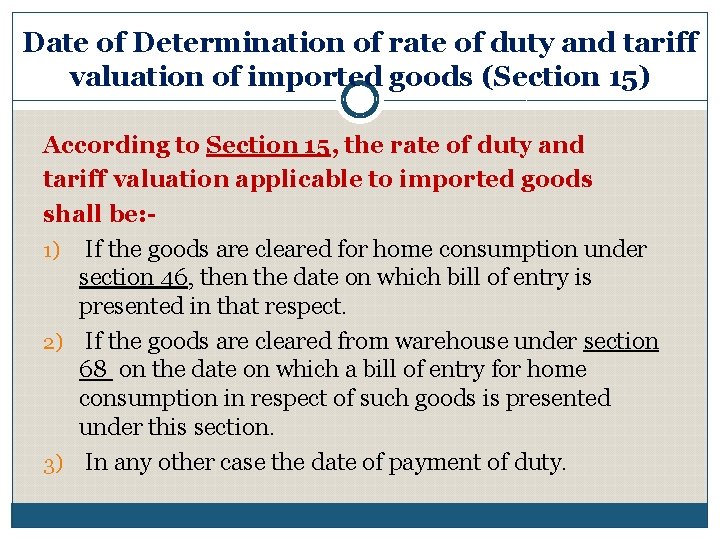

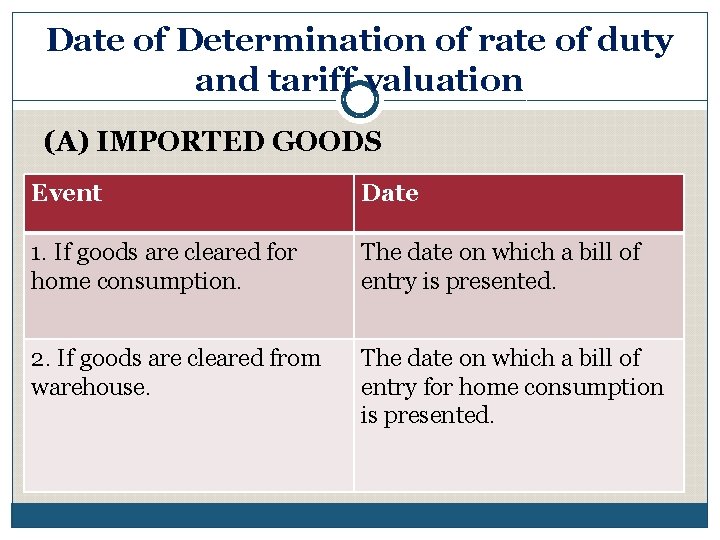

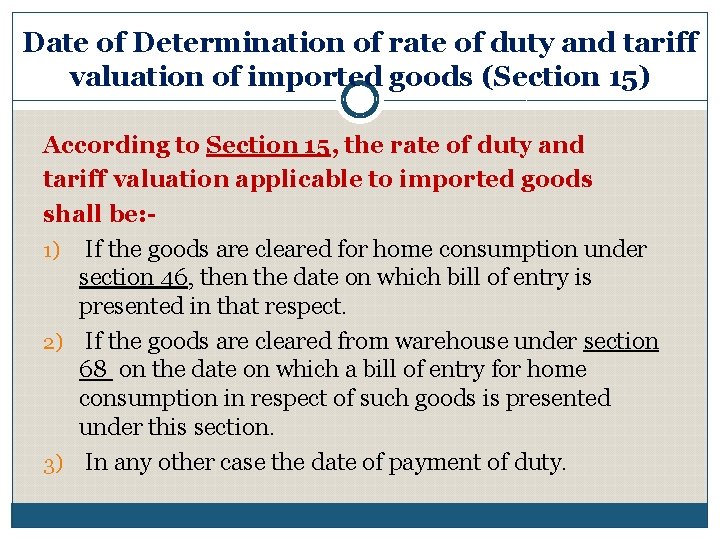

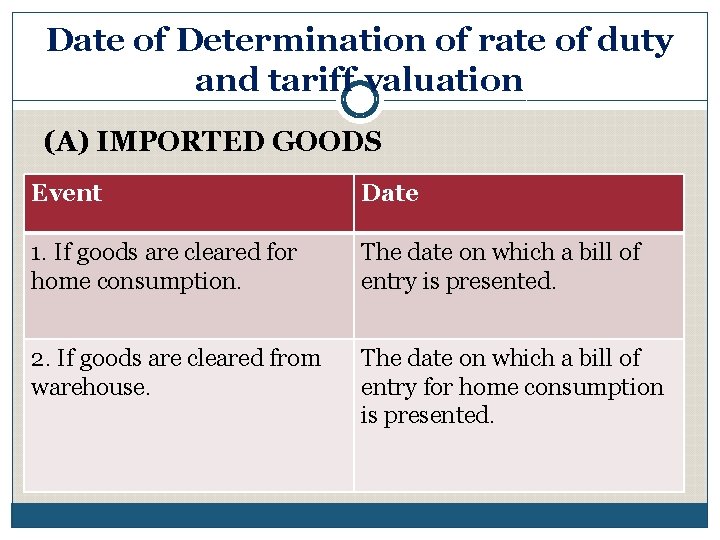

Date of Determination of rate of duty and tariff valuation of imported goods (Section 15) According to Section 15, the rate of duty and tariff valuation applicable to imported goods shall be: 1) If the goods are cleared for home consumption under section 46, then the date on which bill of entry is presented in that respect. 2) If the goods are cleared from warehouse under section 68 on the date on which a bill of entry for home consumption in respect of such goods is presented under this section. 3) In any other case the date of payment of duty.

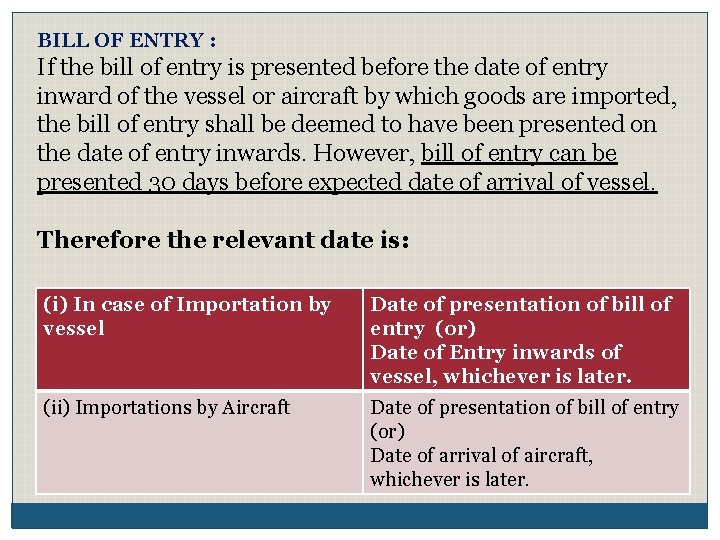

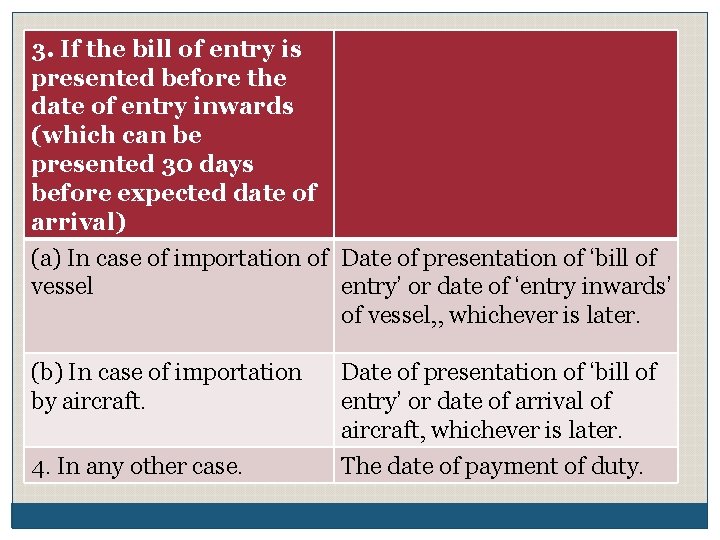

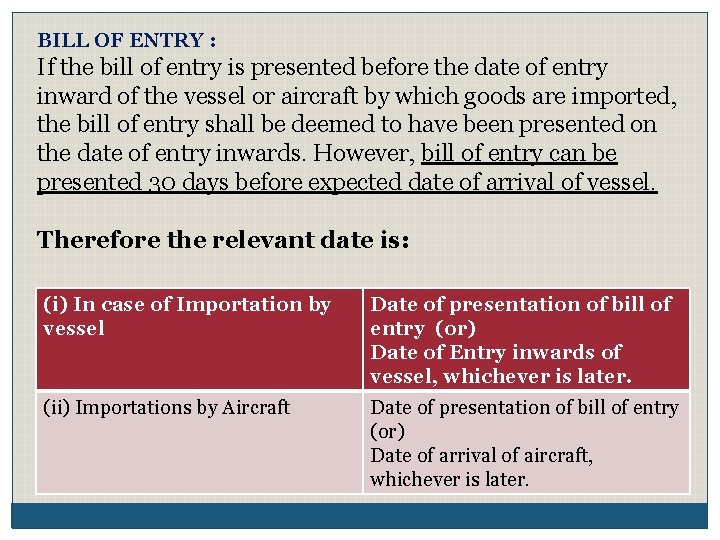

BILL OF ENTRY : If the bill of entry is presented before the date of entry inward of the vessel or aircraft by which goods are imported, the bill of entry shall be deemed to have been presented on the date of entry inwards. However, bill of entry can be presented 30 days before expected date of arrival of vessel. Therefore the relevant date is: (i) In case of Importation by vessel Date of presentation of bill of entry (or) Date of Entry inwards of vessel, whichever is later. (ii) Importations by Aircraft Date of presentation of bill of entry (or) Date of arrival of aircraft, whichever is later.

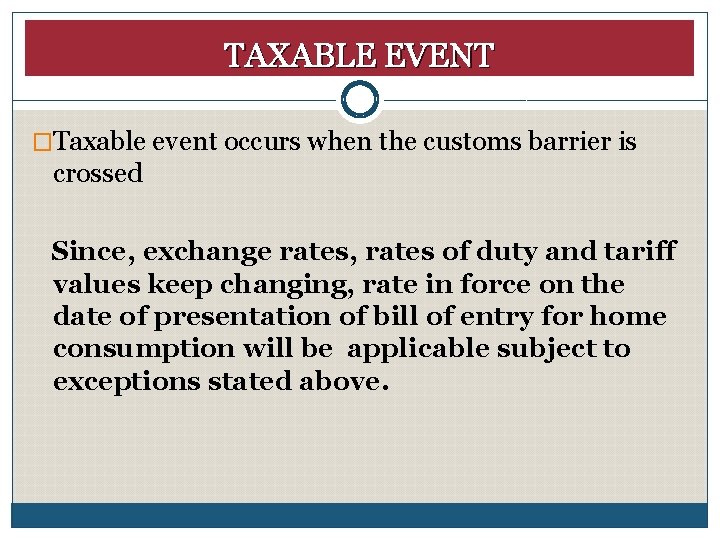

TAXABLE EVENT �Taxable event occurs when the customs barrier is crossed Since, exchange rates, rates of duty and tariff values keep changing, rate in force on the date of presentation of bill of entry for home consumption will be applicable subject to exceptions stated above.

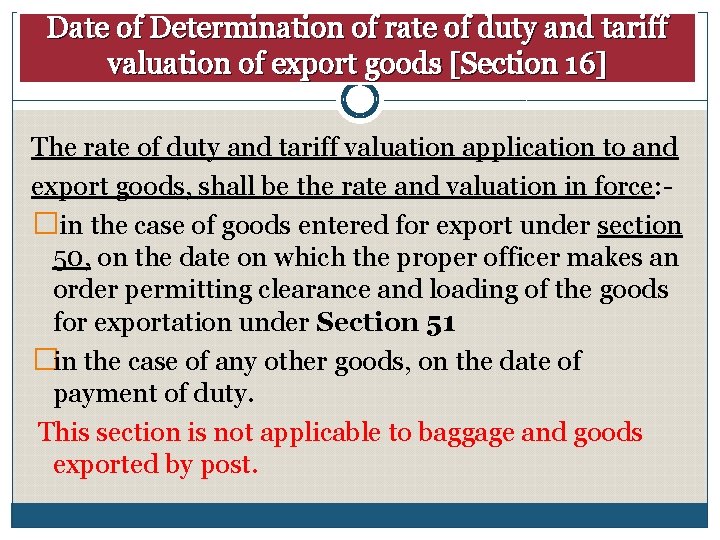

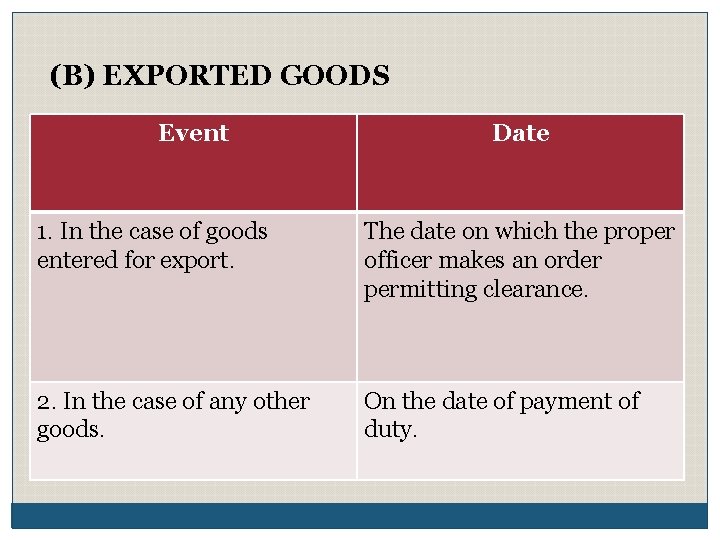

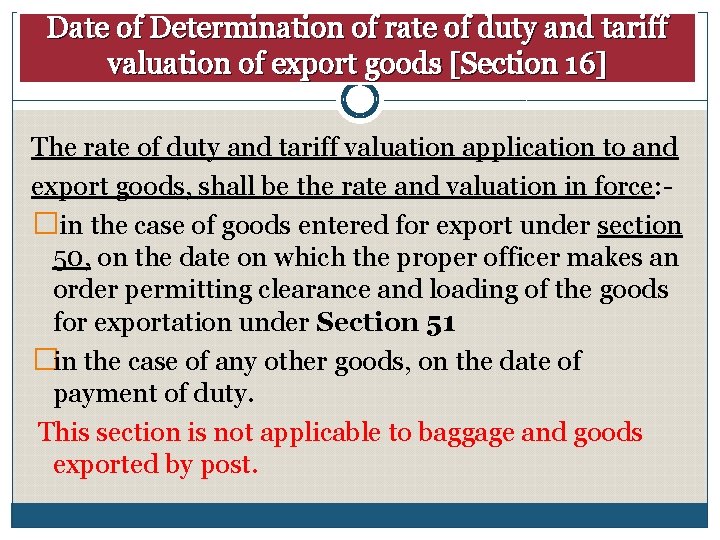

Date of Determination of rate of duty and tariff valuation of export goods [Section 16] The rate of duty and tariff valuation application to and export goods, shall be the rate and valuation in force: �in the case of goods entered for export under section 50, on the date on which the proper officer makes an order permitting clearance and loading of the goods for exportation under Section 51 �in the case of any other goods, on the date of payment of duty. This section is not applicable to baggage and goods exported by post.

Date of Determination of rate of duty and tariff valuation (A) IMPORTED GOODS Event Date 1. If goods are cleared for home consumption. The date on which a bill of entry is presented. 2. If goods are cleared from warehouse. The date on which a bill of entry for home consumption is presented.

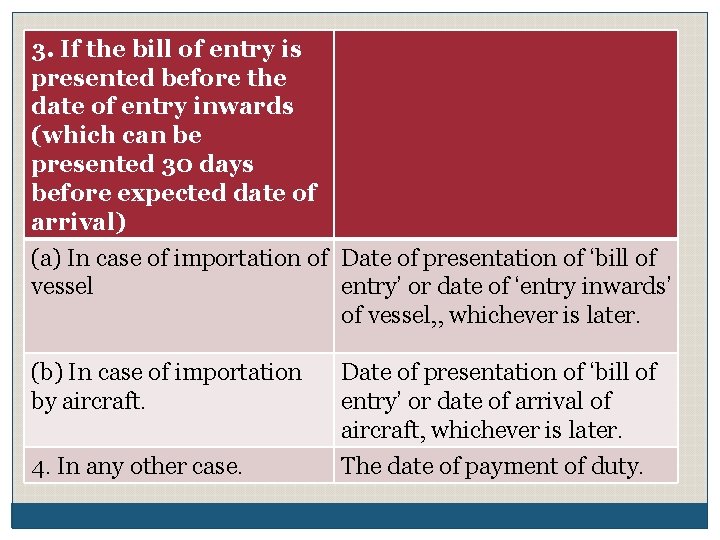

3. If the bill of entry is presented before the date of entry inwards (which can be presented 30 days before expected date of arrival) (a) In case of importation of Date of presentation of ‘bill of vessel entry’ or date of ‘entry inwards’ of vessel, , whichever is later. (b) In case of importation by aircraft. Date of presentation of ‘bill of entry’ or date of arrival of aircraft, whichever is later. 4. In any other case. The date of payment of duty.

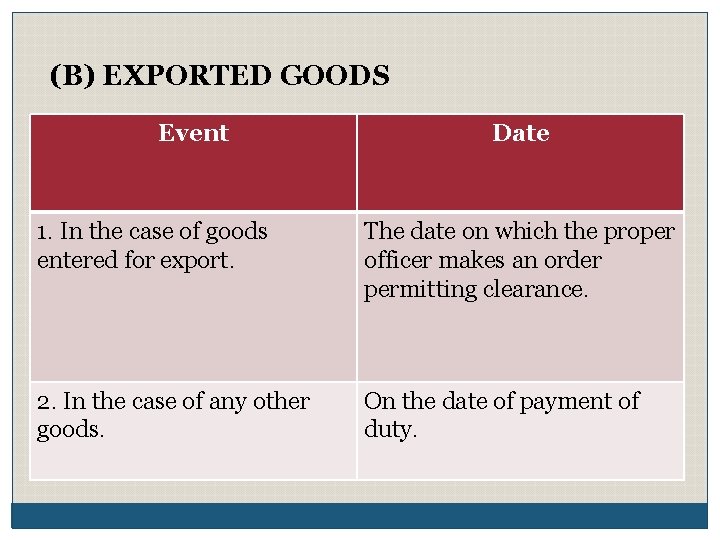

(B) EXPORTED GOODS Event Date 1. In the case of goods entered for export. The date on which the proper officer makes an order permitting clearance. 2. In the case of any other goods. On the date of payment of duty.

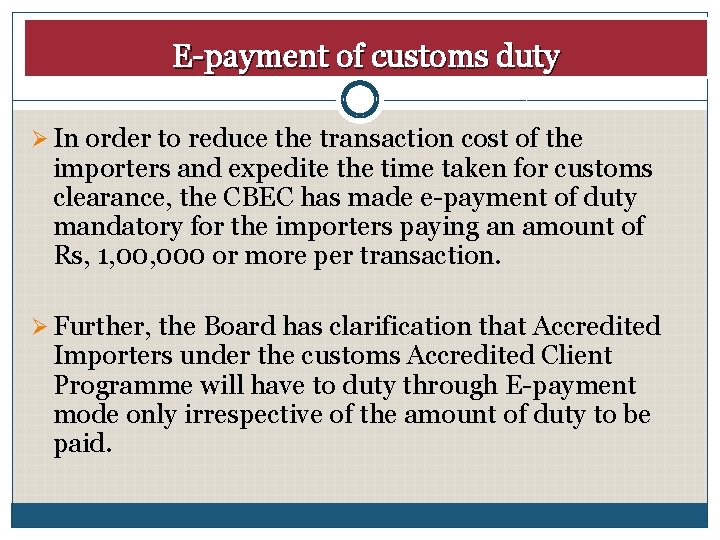

E-payment of customs duty Ø In order to reduce the transaction cost of the importers and expedite the time taken for customs clearance, the CBEC has made e-payment of duty mandatory for the importers paying an amount of Rs, 1, 000 or more per transaction. Ø Further, the Board has clarification that Accredited Importers under the customs Accredited Client Programme will have to duty through E-payment mode only irrespective of the amount of duty to be paid.

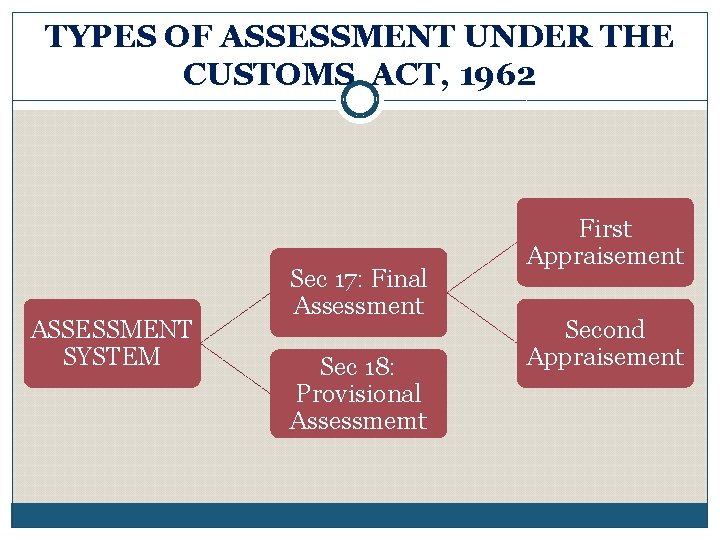

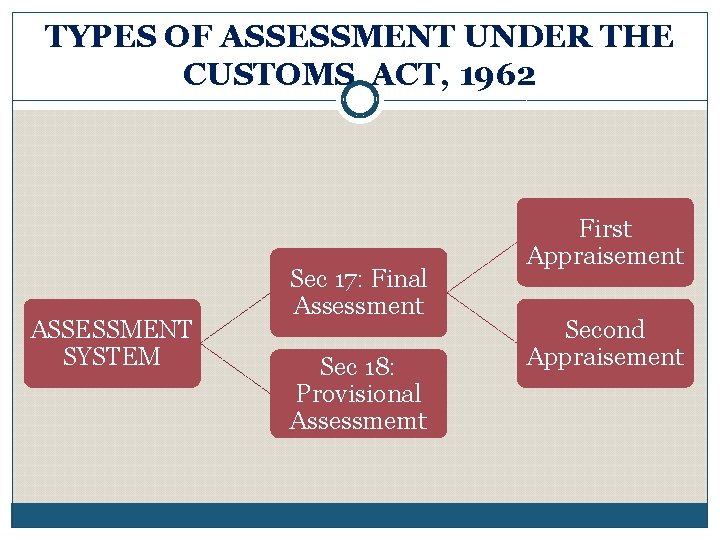

TYPES OF ASSESSMENT UNDER THE CUSTOMS ACT, 1962 ASSESSMENT SYSTEM Sec 17: Final Assessment Sec 18: Provisional Assessmemt First Appraisement Second Appraisement

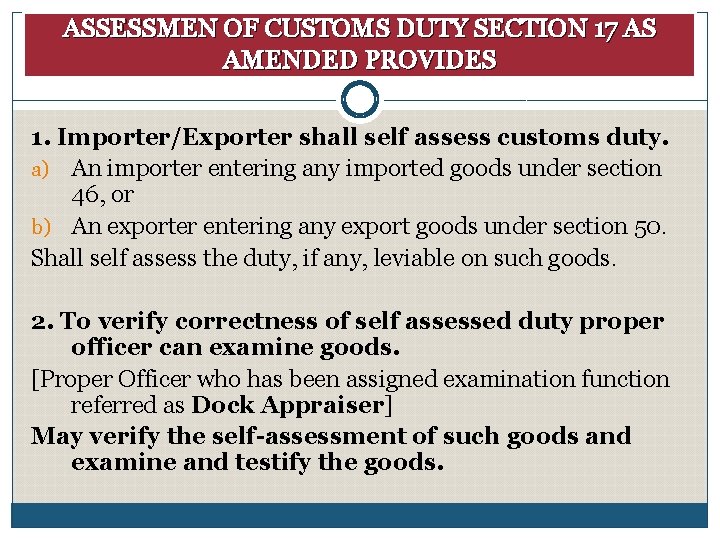

ASSESSMEN OF CUSTOMS DUTY SECTION 17 AS AMENDED PROVIDES 1. Importer/Exporter shall self assess customs duty. a) An importer entering any imported goods under section 46, or b) An exporter entering any export goods under section 50. Shall self assess the duty, if any, leviable on such goods. 2. To verify correctness of self assessed duty proper officer can examine goods. [Proper Officer who has been assigned examination function referred as Dock Appraiser] May verify the self-assessment of such goods and examine and testify the goods.

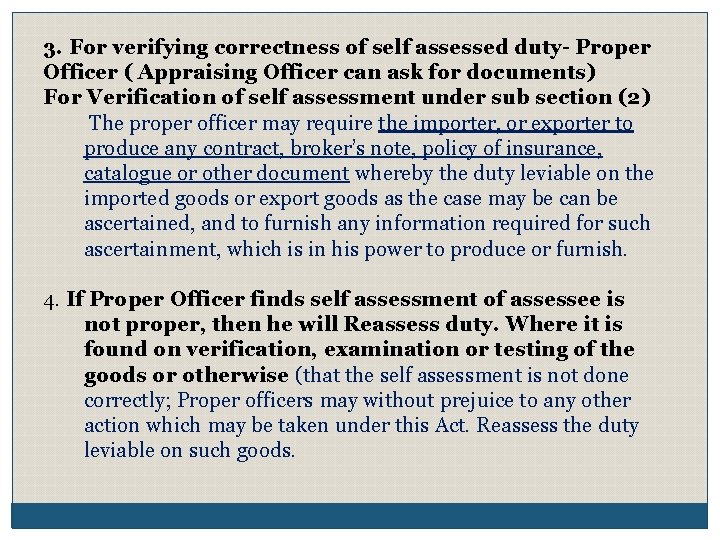

3. For verifying correctness of self assessed duty- Proper Officer ( Appraising Officer can ask for documents) For Verification of self assessment under sub section (2) The proper officer may require the importer, or exporter to produce any contract, broker’s note, policy of insurance, catalogue or other document whereby the duty leviable on the imported goods or export goods as the case may be can be ascertained, and to furnish any information required for such ascertainment, which is in his power to produce or furnish. 4. If Proper Officer finds self assessment of assessee is not proper, then he will Reassess duty. Where it is found on verification, examination or testing of the goods or otherwise (that the self assessment is not done correctly; Proper officers may without prejuice to any other action which may be taken under this Act. Reassess the duty leviable on such goods.

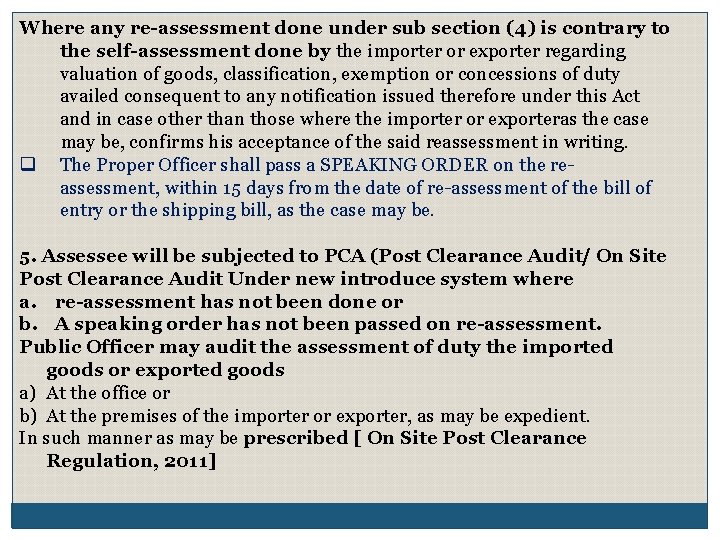

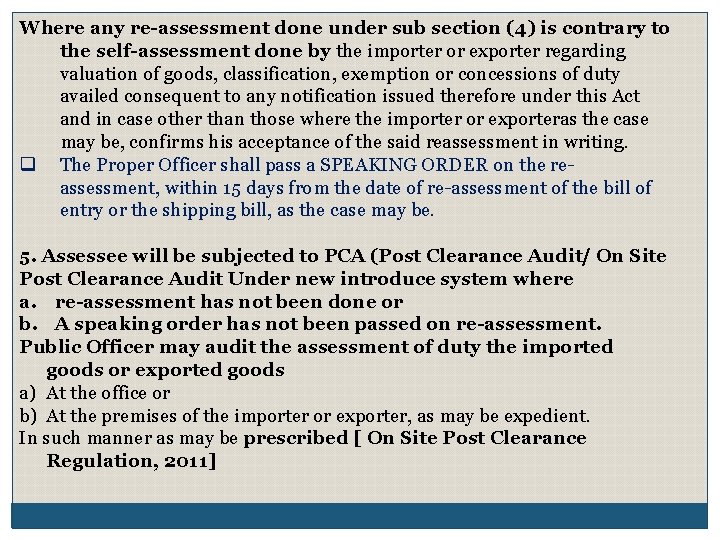

Where any re-assessment done under sub section (4) is contrary to the self-assessment done by the importer or exporter regarding valuation of goods, classification, exemption or concessions of duty availed consequent to any notification issued therefore under this Act and in case other than those where the importer or exporteras the case may be, confirms his acceptance of the said reassessment in writing. q The Proper Officer shall pass a SPEAKING ORDER on the reassessment, within 15 days from the date of re-assessment of the bill of entry or the shipping bill, as the case may be. 5. Assessee will be subjected to PCA (Post Clearance Audit/ On Site Post Clearance Audit Under new introduce system where a. re-assessment has not been done or b. A speaking order has not been passed on re-assessment. Public Officer may audit the assessment of duty the imported goods or exported goods a) At the office or b) At the premises of the importer or exporter, as may be expedient. In such manner as may be prescribed [ On Site Post Clearance Regulation, 2011]

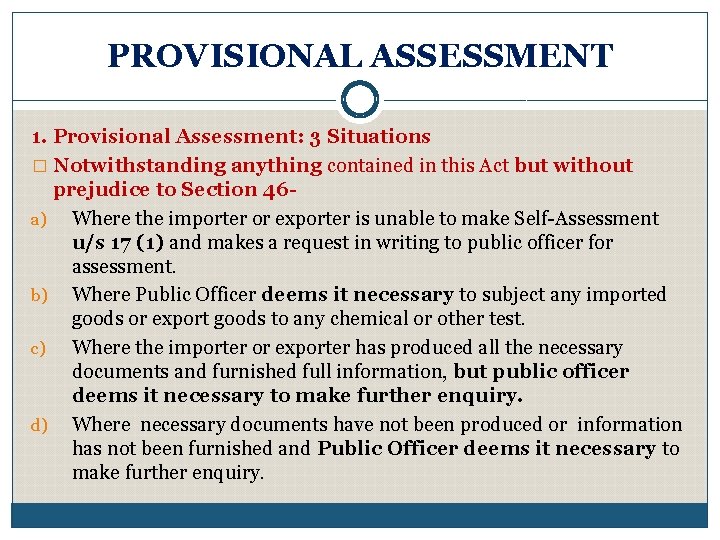

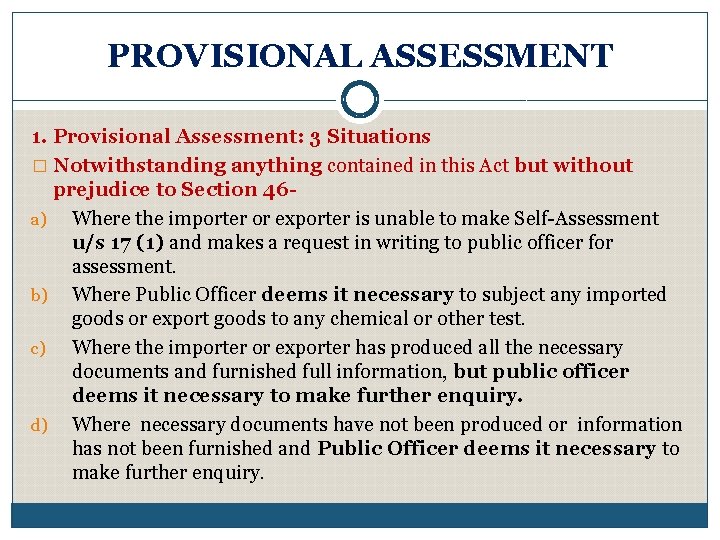

PROVISIONAL ASSESSMENT 1. Provisional Assessment: 3 Situations � Notwithstanding anything contained in this Act but without prejudice to Section 46 a) Where the importer or exporter is unable to make Self-Assessment u/s 17 (1) and makes a request in writing to public officer for assessment. b) Where Public Officer deems it necessary to subject any imported goods or export goods to any chemical or other test. c) Where the importer or exporter has produced all the necessary documents and furnished full information, but public officer deems it necessary to make further enquiry. d) Where necessary documents have not been produced or information has not been furnished and Public Officer deems it necessary to make further enquiry.

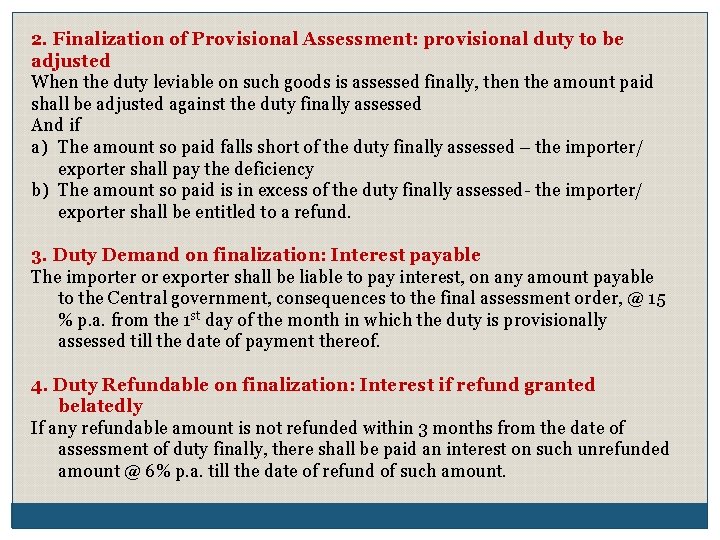

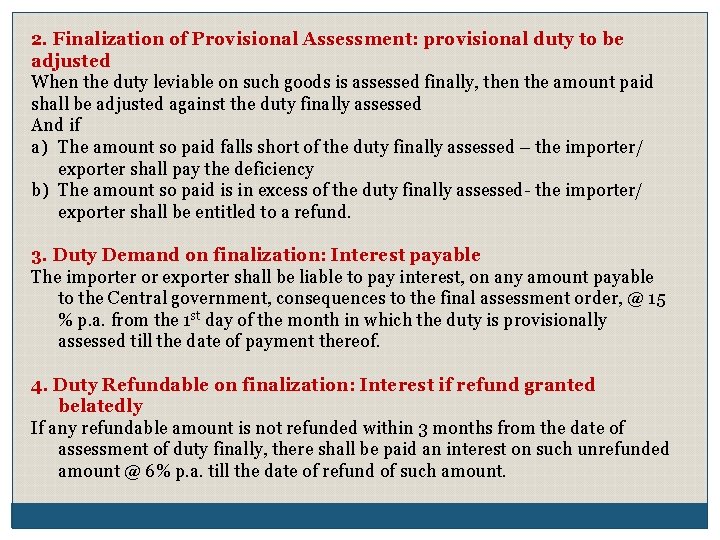

2. Finalization of Provisional Assessment: provisional duty to be adjusted When the duty leviable on such goods is assessed finally, then the amount paid shall be adjusted against the duty finally assessed And if a) The amount so paid falls short of the duty finally assessed – the importer/ exporter shall pay the deficiency b) The amount so paid is in excess of the duty finally assessed- the importer/ exporter shall be entitled to a refund. 3. Duty Demand on finalization: Interest payable The importer or exporter shall be liable to pay interest, on any amount payable to the Central government, consequences to the final assessment order, @ 15 % p. a. from the 1 st day of the month in which the duty is provisionally assessed till the date of payment thereof. 4. Duty Refundable on finalization: Interest if refund granted belatedly If any refundable amount is not refunded within 3 months from the date of assessment of duty finally, there shall be paid an interest on such unrefunded amount @ 6% p. a. till the date of refund of such amount.

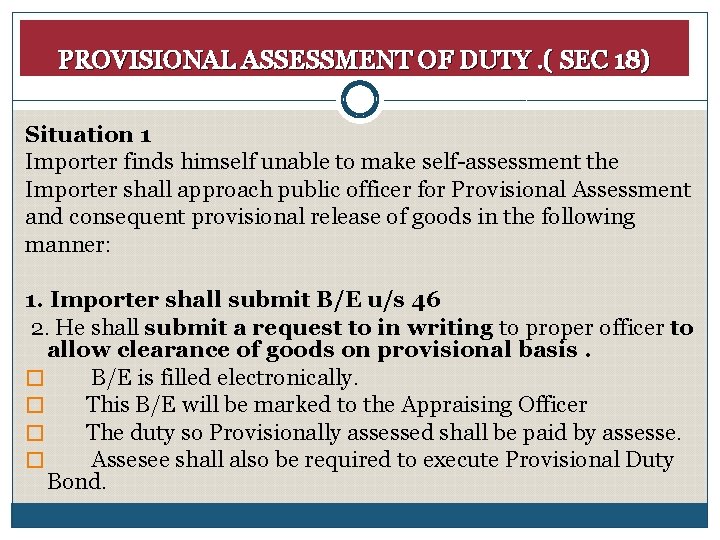

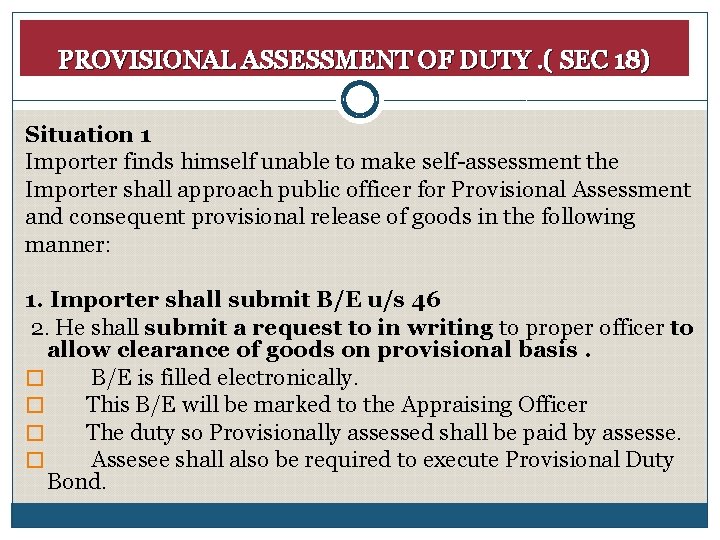

PROVISIONAL ASSESSMENT OF DUTY. ( SEC 18) Situation 1 Importer finds himself unable to make self-assessment the Importer shall approach public officer for Provisional Assessment and consequent provisional release of goods in the following manner: 1. Importer shall submit B/E u/s 46 2. He shall submit a request to in writing to proper officer to allow clearance of goods on provisional basis. � B/E is filled electronically. � This B/E will be marked to the Appraising Officer � The duty so Provisionally assessed shall be paid by assesse. � Assesee shall also be required to execute Provisional Duty Bond.

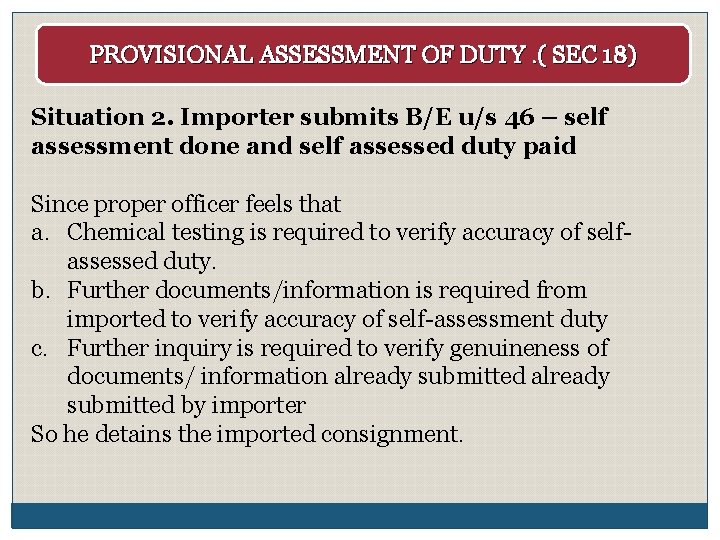

PROVISIONAL ASSESSMENT OF DUTY. ( SEC 18) Situation 2. Importer submits B/E u/s 46 – self assessment done and self assessed duty paid Since proper officer feels that a. Chemical testing is required to verify accuracy of selfassessed duty. b. Further documents/information is required from imported to verify accuracy of self-assessment duty c. Further inquiry is required to verify genuineness of documents/ information already submitted by importer So he detains the imported consignment.

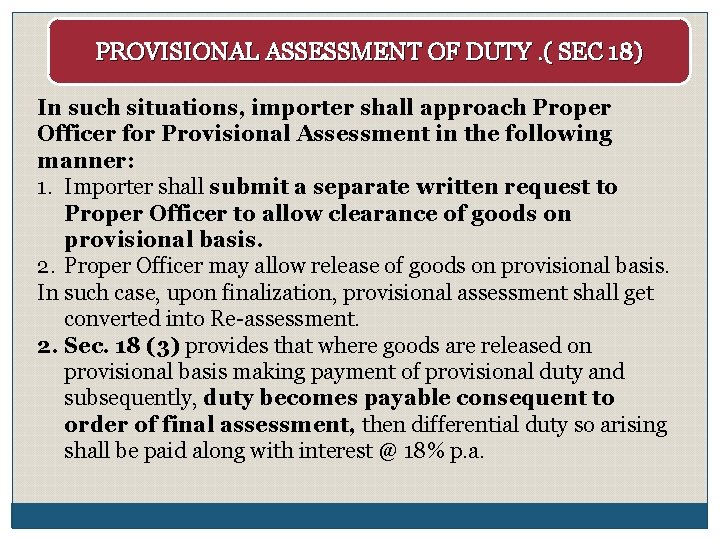

PROVISIONAL ASSESSMENT OF DUTY. ( SEC 18) In such situations, importer shall approach Proper Officer for Provisional Assessment in the following manner: 1. Importer shall submit a separate written request to Proper Officer to allow clearance of goods on provisional basis. 2. Proper Officer may allow release of goods on provisional basis. In such case, upon finalization, provisional assessment shall get converted into Re-assessment. 2. Sec. 18 (3) provides that where goods are released on provisional basis making payment of provisional duty and subsequently, duty becomes payable consequent to order of final assessment, then differential duty so arising shall be paid along with interest @ 18% p. a.

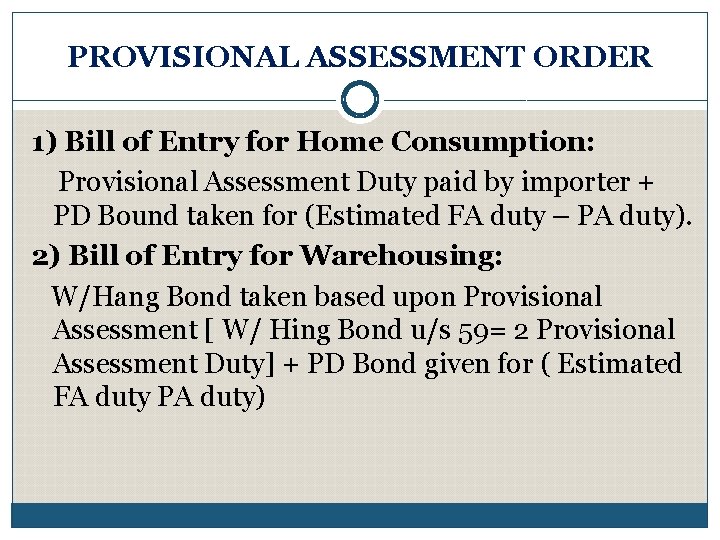

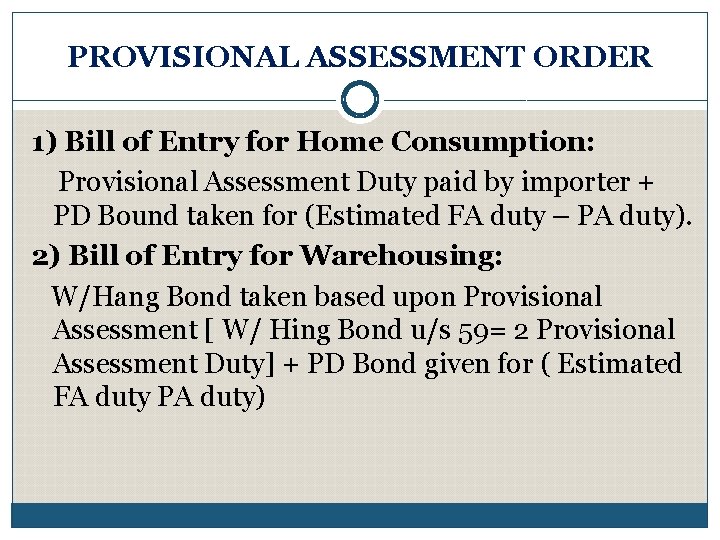

PROVISIONAL ASSESSMENT ORDER 1) Bill of Entry for Home Consumption: Provisional Assessment Duty paid by importer + PD Bound taken for (Estimated FA duty – PA duty). 2) Bill of Entry for Warehousing: W/Hang Bond taken based upon Provisional Assessment [ W/ Hing Bond u/s 59= 2 Provisional Assessment Duty] + PD Bond given for ( Estimated FA duty PA duty)

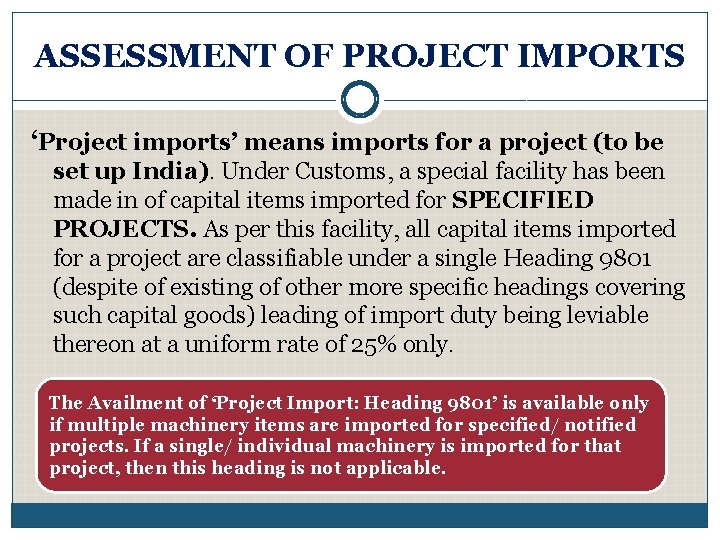

ASSESSMENT OF PROJECT IMPORTS ‘Project imports’ means imports for a project (to be set up India). Under Customs, a special facility has been made in of capital items imported for SPECIFIED PROJECTS. As per this facility, all capital items imported for a project are classifiable under a single Heading 9801 (despite of existing of other more specific headings covering such capital goods) leading of import duty being leviable thereon at a uniform rate of 25% only. The Availment of ‘Project Import: Heading 9801’ is available only if multiple machinery items are imported for specified/ notified projects. If a single/ individual machinery is imported for that project, then this heading is not applicable.

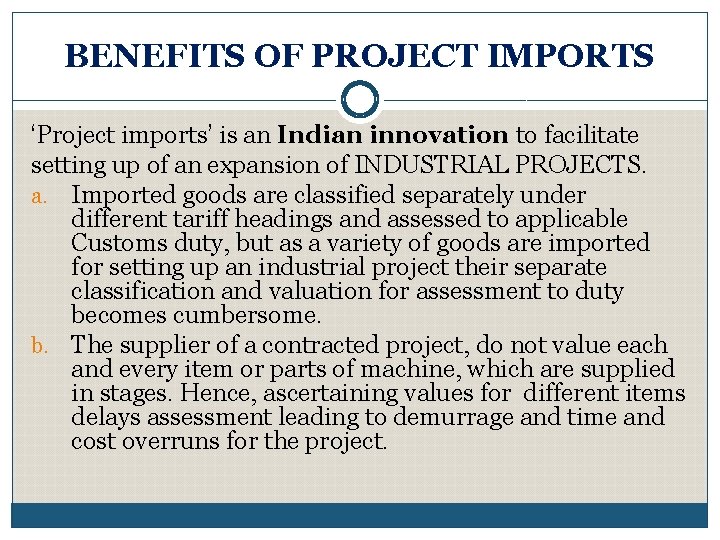

BENEFITS OF PROJECT IMPORTS ‘Project imports’ is an Indian innovation to facilitate setting up of an expansion of INDUSTRIAL PROJECTS. a. Imported goods are classified separately under different tariff headings and assessed to applicable Customs duty, but as a variety of goods are imported for setting up an industrial project their separate classification and valuation for assessment to duty becomes cumbersome. b. The supplier of a contracted project, do not value each and every item or parts of machine, which are supplied in stages. Hence, ascertaining values for different items delays assessment leading to demurrage and time and cost overruns for the project.

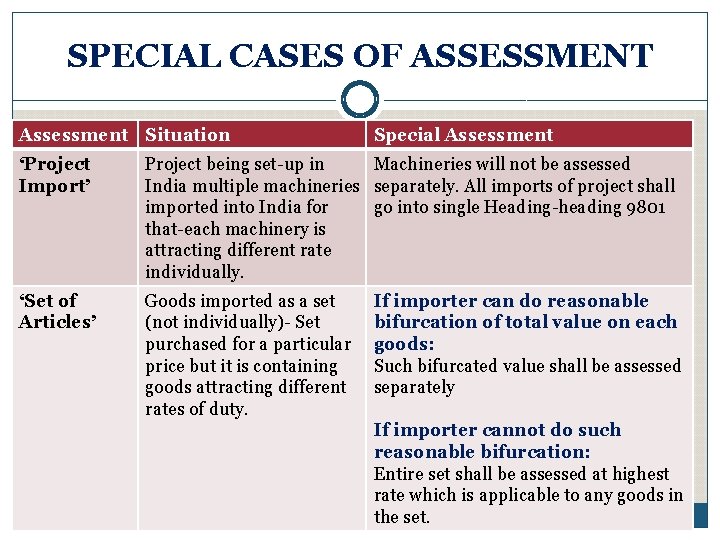

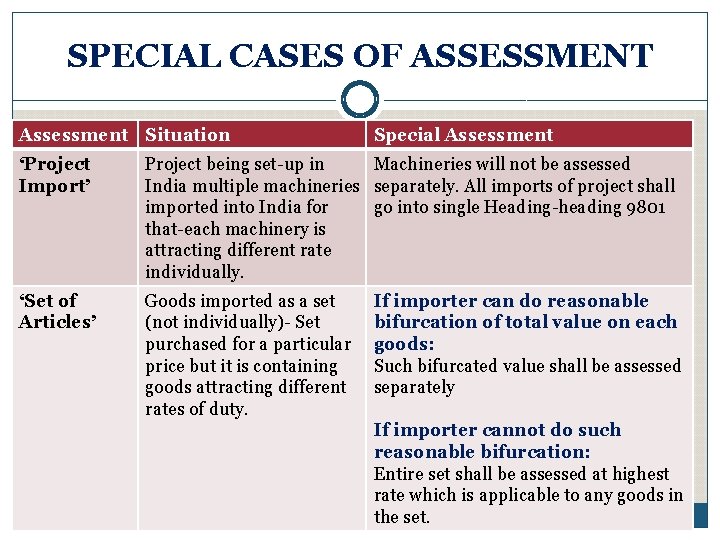

SPECIAL CASES OF ASSESSMENT Assessment Situation Special Assessment ‘Project Import’ Project being set-up in Machineries will not be assessed India multiple machineries separately. All imports of project shall imported into India for go into single Heading-heading 9801 that-each machinery is attracting different rate individually. ‘Set of Articles’ Goods imported as a set (not individually)- Set purchased for a particular price but it is containing goods attracting different rates of duty. If importer can do reasonable bifurcation of total value on each goods: Such bifurcated value shall be assessed separately If importer cannot do such reasonable bifurcation: Entire set shall be assessed at highest rate which is applicable to any goods in the set.

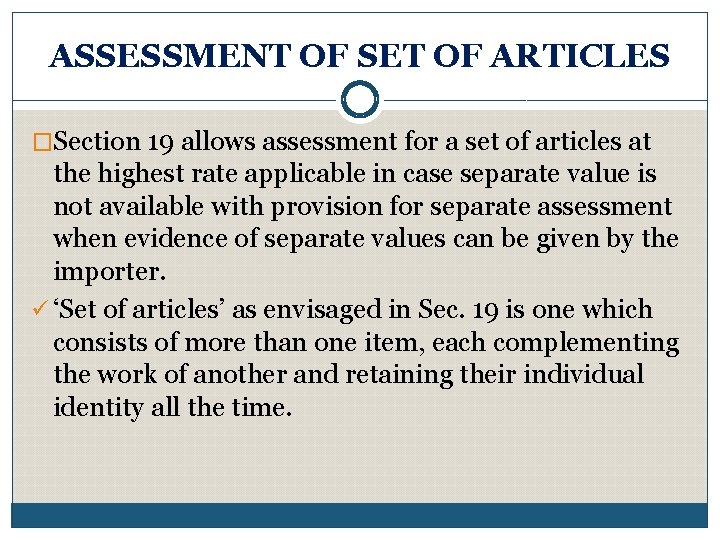

ASSESSMENT OF SET OF ARTICLES �Section 19 allows assessment for a set of articles at the highest rate applicable in case separate value is not available with provision for separate assessment when evidence of separate values can be given by the importer. ü ‘Set of articles’ as envisaged in Sec. 19 is one which consists of more than one item, each complementing the work of another and retaining their individual identity all the time.

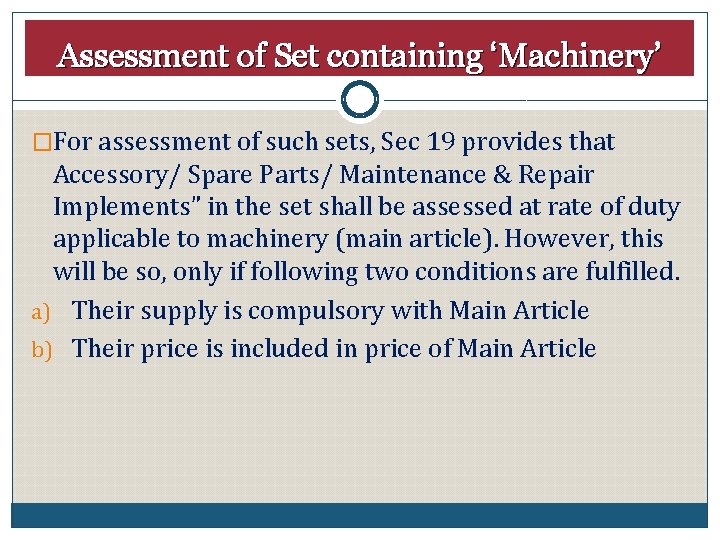

Assessment of Set containing ‘Machinery’ �For assessment of such sets, Sec 19 provides that Accessory/ Spare Parts/ Maintenance & Repair Implements” in the set shall be assessed at rate of duty applicable to machinery (main article). However, this will be so, only if following two conditions are fulfilled. a) Their supply is compulsory with Main Article b) Their price is included in price of Main Article

Filosofi customs services dan customs controls

Filosofi customs services dan customs controls Section 32 customs act

Section 32 customs act Assessment duty

Assessment duty Taba's curriculum model

Taba's curriculum model Nobel peace prize 1962

Nobel peace prize 1962 Gale shapley 1962

Gale shapley 1962 Lei nº4.119/1962

Lei nº4.119/1962 Kirk y bateman (1962/73)

Kirk y bateman (1962/73) Salient features of 1962 constitution of pakistan

Salient features of 1962 constitution of pakistan Winter 1962 63

Winter 1962 63 Cuba 1962

Cuba 1962 Philippe dreyfus 1962

Philippe dreyfus 1962 Primer proyecto arpanet 1962

Primer proyecto arpanet 1962 Sejarah palang merah malaysia

Sejarah palang merah malaysia I

I 1962-1975

1962-1975 1962 war

1962 war 1962

1962 Tomkins emozioni

Tomkins emozioni 1980-1962

1980-1962 Erf requirements for teacher 1 to teacher 3

Erf requirements for teacher 1 to teacher 3 William faulkner

William faulkner Schachter singer theory

Schachter singer theory Schachter and singer

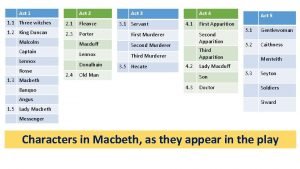

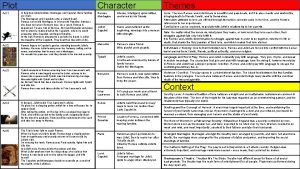

Schachter and singer Macbeth act 2 summary

Macbeth act 2 summary Hình ảnh bộ gõ cơ thể búng tay

Hình ảnh bộ gõ cơ thể búng tay Frameset trong html5

Frameset trong html5