CORPORATE LAW PREINCORPORATION CONTRACTS PRE INCORPORATION CONTRACTS v

- Slides: 31

CORPORATE LAW

PRE-INCORPORATION CONTRACTS

PRE- INCORPORATION CONTRACTS v. Companies Act No. 07 of 2007 Section 23 - Section 25 v. Case Law

PRE- INCORPORATION CONTRACTS What is a pre-incorporation contract? A contract entered in to before the incorporation of a corporation Sec 23 – "pre-incorporation contract" means – (a) a contract purported to have been entered into by a company before its incorporation; or (b) a contract entered into by a person on behalf of a company before and in contemplation of its incorporation.

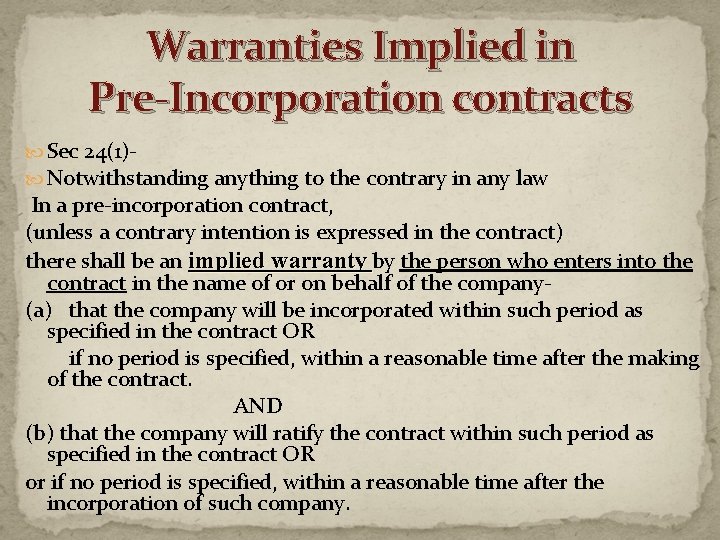

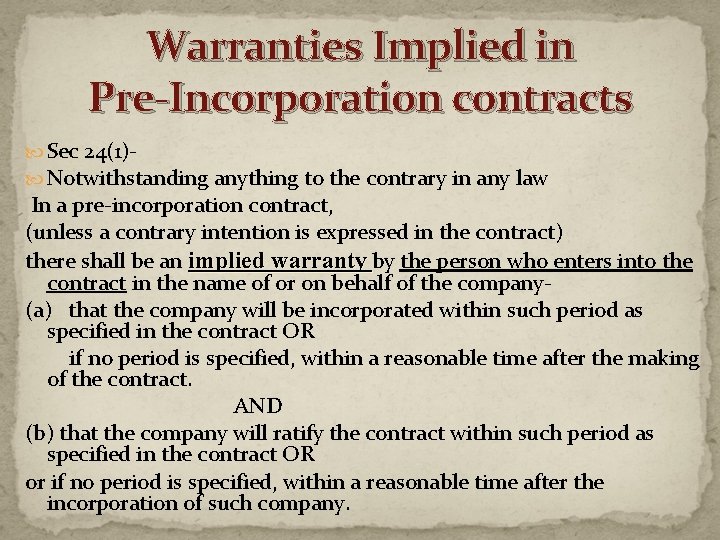

Warranties Implied in Pre-Incorporation contracts Sec 24(1) Notwithstanding anything to the contrary in any law In a pre-incorporation contract, (unless a contrary intention is expressed in the contract) there shall be an implied warranty by the person who enters into the contract in the name of or on behalf of the company(a) that the company will be incorporated within such period as specified in the contract OR if no period is specified, within a reasonable time after the making of the contract. AND (b) that the company will ratify the contract within such period as specified in the contract OR or if no period is specified, within a reasonable time after the incorporation of such company.

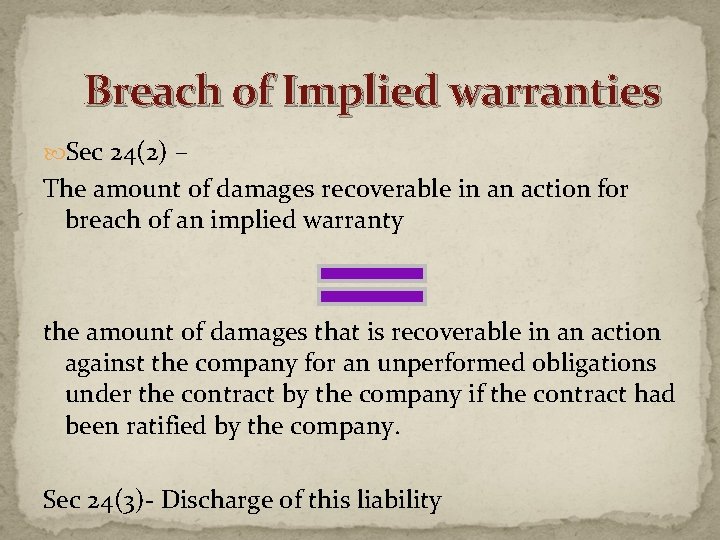

Breach of Implied warranties Sec 24(2) – The amount of damages recoverable in an action for breach of an implied warranty the amount of damages that is recoverable in an action against the company for an unperformed obligations under the contract by the company if the contract had been ratified by the company. Sec 24(3)- Discharge of this liability

According to the Companies Act of 2007 A promoter’s liability can be avoided in 2 methods: 1. Ratification – Sec 23(2) 2. The co. makes a fresh agreement with the third person – Sec 24(3)

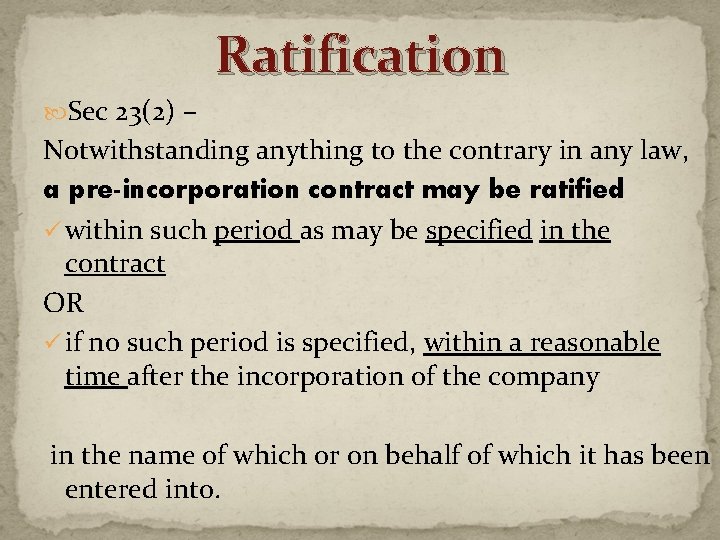

Ratification Sec 23(2) – Notwithstanding anything to the contrary in any law, a pre-incorporation contract may be ratified ü within such period as may be specified in the contract OR ü if no such period is specified, within a reasonable time after the incorporation of the company in the name of which or on behalf of which it has been entered into.

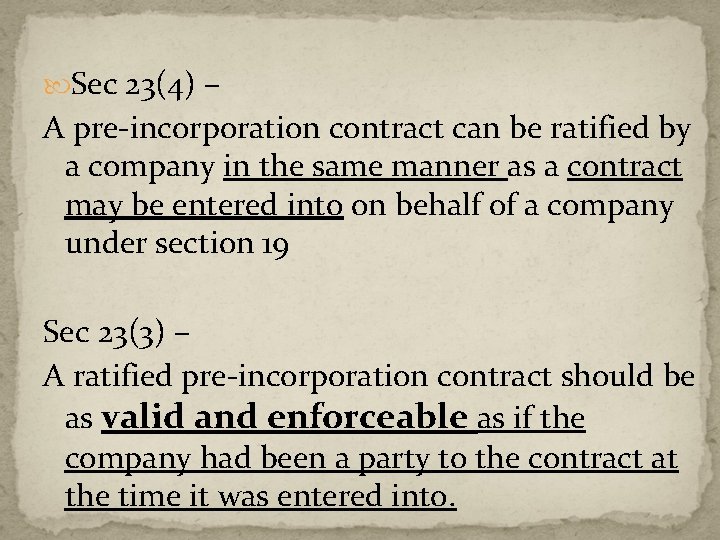

Sec 23(4) – A pre-incorporation contract can be ratified by a company in the same manner as a contract may be entered into on behalf of a company under section 19 Sec 23(3) – A ratified pre-incorporation contract should be as valid and enforceable as if the company had been a party to the contract at the time it was entered into.

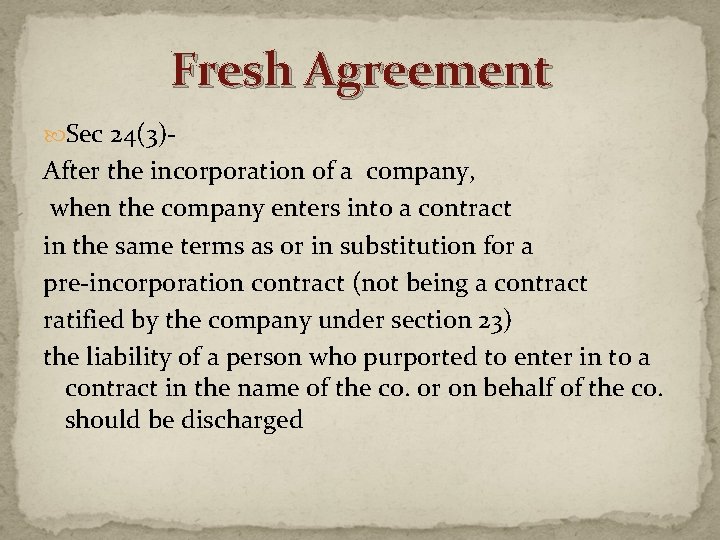

Fresh Agreement Sec 24(3)- After the incorporation of a company, when the company enters into a contract in the same terms as or in substitution for a pre-incorporation contract (not being a contract ratified by the company under section 23) the liability of a person who purported to enter in to a contract in the name of the co. or on behalf of the co. should be discharged

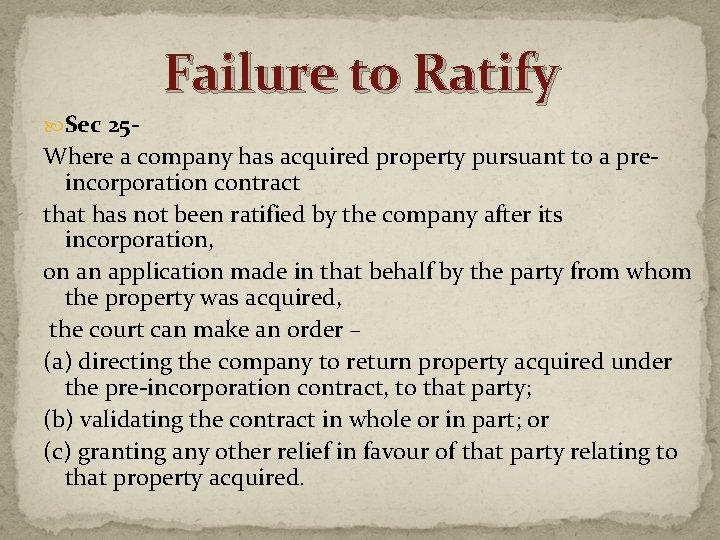

Failure to Ratify Sec 25 - Where a company has acquired property pursuant to a preincorporation contract that has not been ratified by the company after its incorporation, on an application made in that behalf by the party from whom the property was acquired, the court can make an order – (a) directing the company to return property acquired under the pre-incorporation contract, to that party; (b) validating the contract in whole or in part; or (c) granting any other relief in favour of that party relating to that property acquired.

Case Law A co. becomes a legal person only after it is incorporated Therefore, before the incorporation, a co. cannot make a contract either personally or through an agent (as there cannot be an agent to a non-existing principal) A pre-incorporation contract does not bind the company

• Kelner v. Baxter A pre-incorporation contract binds the promoter not the co. • Re English Colonial Produce Co. Ltd The mere fact that a benefit was taken does not change this position.

• Turnvelly Sugar Refining Co. Ltd. V. Mirlees Watson & Yarington Co. Ltd Correspondingly, a co. cannot, even after its incorporation enforce a contract made name prior to the incorporation.

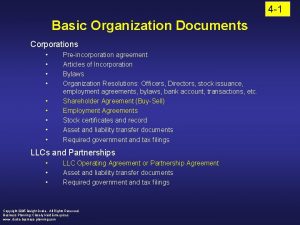

Articles of Association

Articles of Association Most important document in a company Called “the constitution of a company” • Sec 4(1) To register a co. the articles of Association signed by each of the initial shareholders must be submitted together with other documents.

The A. O. A of a company and its by laws are regulations which govern the management of its affairs and the conduct of its business they define the duties, rights, powers, and authority of the shareholders and the directors in their respective capacities and of the company and the mode and form in which the business of a company is to be carried out.

Contents of Articles Sec 13 – The articles of association of a company can provide for - any matter not inconsistent with the provisions of this Act, and -in particular can provide for (a) the objects of the company ; (b) the rights and obligations of shareholders of the company ; (c) the management and administration of the company.

Application of Model Articles Sec 14 - The articles of association set out in the First Schedule (called as “Model Articles") should apply in respect of any company (other than a company limited by guarantee), except to the extent that the company adopts articles which exclude, modify or are inconsistent with the model articles.

Right of shareholders to a copy of the Articles. Sec 18 - A shareholder has a right at any time to request a company in writing for a copy of the articles of the company And the company should comply with such request within five working days of the date of receipt and such request. The co. can ask for Rs 500/= to povide a copy of the articles Co. can decline to provide a copy if a copy has been provided to that shareholder within the previous six months.

Effect of articles Sec 16 The articles of a company should bind the company and its share holders as if there is a contract between the s/hs and the co. Therefore, members can bring action against the co. for breach of contract Eg: Hickman v. Kent Wood v. Odessa Waterworks co.

Contd. . It is a contract between the co. and s/hs and between the s/hs. Therefore, the members can only bring action in the capacity of shareholder. Eg: Elley v. Positive Government Life Assurance Co.

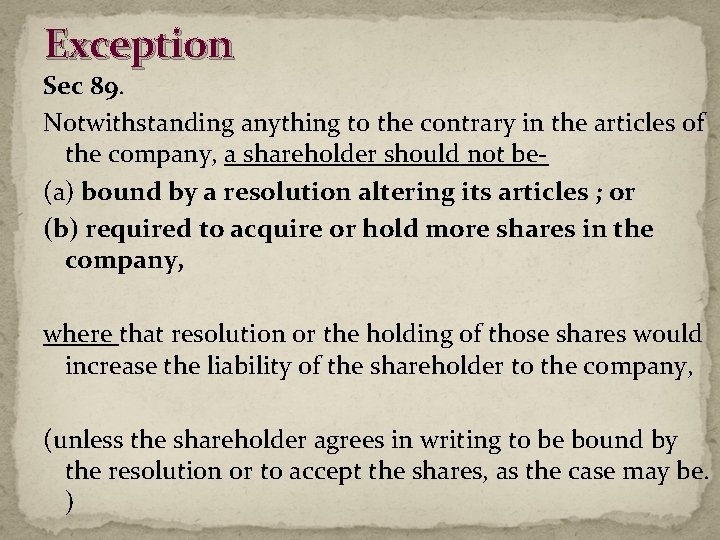

Exception Sec 89. Notwithstanding anything to the contrary in the articles of the company, a shareholder should not be(a) bound by a resolution altering its articles ; or (b) required to acquire or hold more shares in the company, where that resolution or the holding of those shares would increase the liability of the shareholder to the company, (unless the shareholder agrees in writing to be bound by the resolution or to accept the shares, as the case may be. )

Effect of statement of objects Ashbury Railway Carriages and Iron Co. Ltd v. Hector Richie (14 -75) L. R. 7 H. L. 653 Jupiter Cigarrate Tobacco co. Ltd v. Soyza

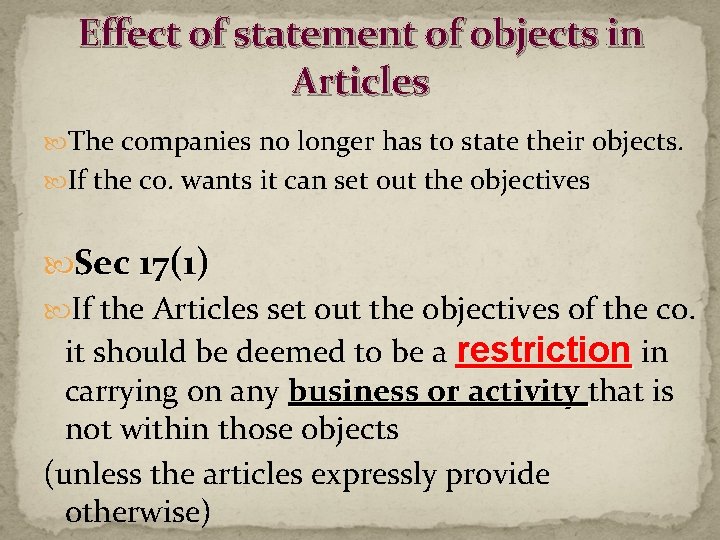

Effect of statement of objects in Articles The companies no longer has to state their objects. If the co. wants it can set out the objectives Sec 17(1) If the Articles set out the objectives of the co. it should be deemed to be a restriction in carrying on any business or activity that is not within those objects (unless the articles expressly provide otherwise)

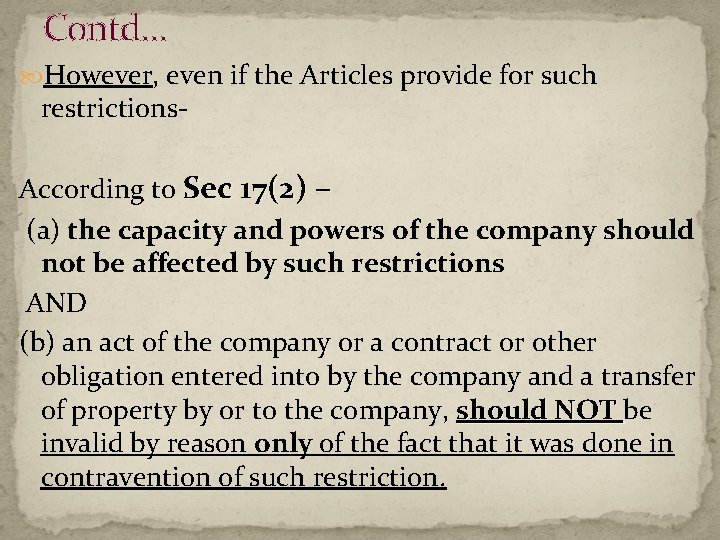

Contd… However, even if the Articles provide for such restrictions- According to Sec 17(2) – (a) the capacity and powers of the company should not be affected by such restrictions AND (b) an act of the company or a contract or other obligation entered into by the company and a transfer of property by or to the company, should NOT be invalid by reason only of the fact that it was done in contravention of such restriction.

Rational for the position To strike a balance between the interests of the co. members and 3 rd parties who deal with the co. Ensure that the co. does not suffer from any limitations upon its legal capacity Recognise that the objects clause is not a suitable vehicle for controlling commercial activities

Contd… Sec 17(3) Nothing in subsection (2) should affect – (a)the ability of a shareholder or director of the company to make an application to court under section 233 to restrain the company from acting in a manner inconsistent with a restriction placed by the articles (unless the company has entered into a contract or other binding obligation to do so) OR (b) the liability of a director of the company for acting in breach of the provisions of section 188. (Directors to comply with Act and company's articles)

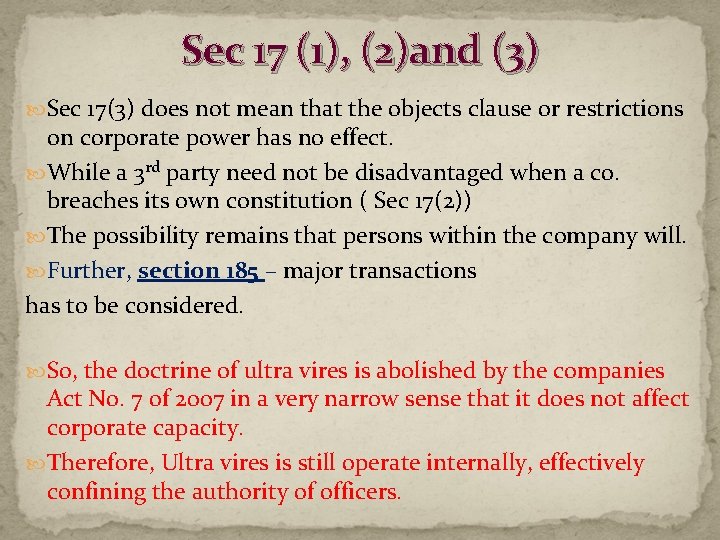

Sec 17 (1), (2)and (3) Sec 17(3) does not mean that the objects clause or restrictions on corporate power has no effect. While a 3 rd party need not be disadvantaged when a co. breaches its own constitution ( Sec 17(2)) The possibility remains that persons within the company will. Further, section 185 – major transactions has to be considered. So, the doctrine of ultra vires is abolished by the companies Act No. 7 of 2007 in a very narrow sense that it does not affect corporate capacity. Therefore, Ultra vires is still operate internally, effectively confining the authority of officers.

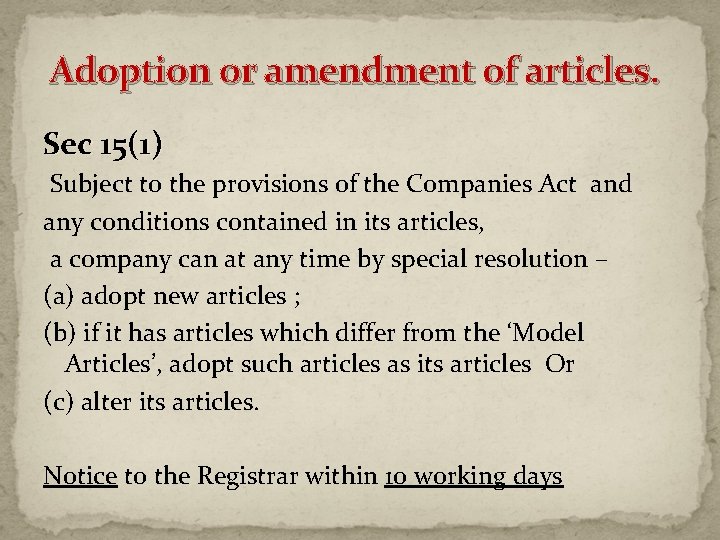

Adoption or amendment of articles. Sec 15(1) Subject to the provisions of the Companies Act and any conditions contained in its articles, a company can at any time by special resolution – (a) adopt new articles ; (b) if it has articles which differ from the ‘Model Articles’, adopt such articles as its articles Or (c) alter its articles. Notice to the Registrar within 10 working days

What is pre incorporation contracts in company law

What is pre incorporation contracts in company law 450000/12

450000/12 Objective of corporate governance

Objective of corporate governance Znacznik pre /pre jest stosowany w celu wyświetlenia

Znacznik pre /pre jest stosowany w celu wyświetlenia Definition of selective incorporation

Definition of selective incorporation Selective incorporation definition

Selective incorporation definition Incorporation day.

Incorporation day. Consequences of incorporation

Consequences of incorporation Alpha kappa alpha national hymn

Alpha kappa alpha national hymn What is the criteria for selection of ointment base?

What is the criteria for selection of ointment base? Asas place of incorporation

Asas place of incorporation Legal status of company

Legal status of company Profit prior to incorporation

Profit prior to incorporation Procedure for incorporation of company

Procedure for incorporation of company Bvi incorporation

Bvi incorporation Newton's first law and second law and third law

Newton's first law and second law and third law Newton's first law of motion

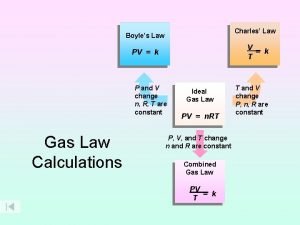

Newton's first law of motion Boyles law

Boyles law How to calculate boyle's law

How to calculate boyle's law Corporate law definition

Corporate law definition Charltons law

Charltons law Corporate banking law

Corporate banking law Supremecourt.gove

Supremecourt.gove Baylor pre law

Baylor pre law Pre law advising uf

Pre law advising uf Csu pre law

Csu pre law More things can be dissolved in sulfuric acid than in water

More things can be dissolved in sulfuric acid than in water Software contracts in professional practices

Software contracts in professional practices Litter picking contracts

Litter picking contracts System operation contracts

System operation contracts International contract

International contract Item rate contract

Item rate contract