Ch 6 Markets in Action Price ceiling and

- Slides: 41

Ch. 6: Markets in Action. § § § Price ceiling and inefficiencies. Price floors (minimum wage) and inefficiency. Sales tax Volatility of farm prices and revenues How production subsidies and quotas influence farm production, costs, and prices

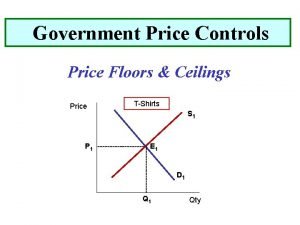

The effect of price ceilings. • Price ceiling is a “maximum” price. • A price ceilinig is “binding” only if ceiling is below equilibrium price. • A binding price ceiling causes a shortage.

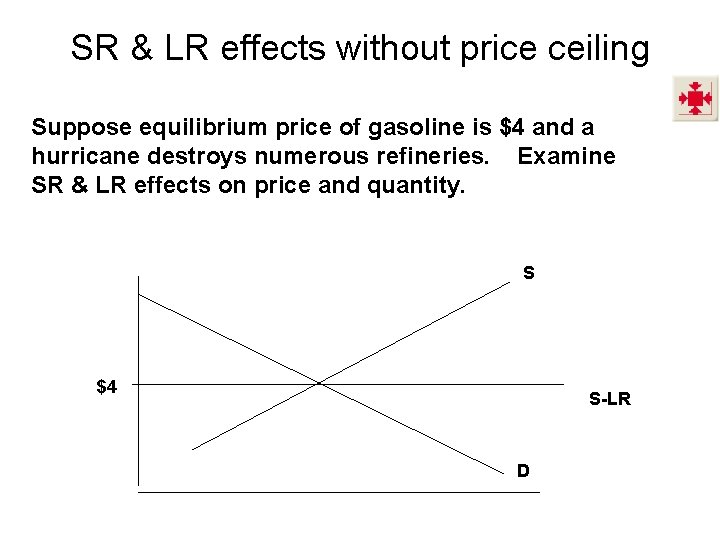

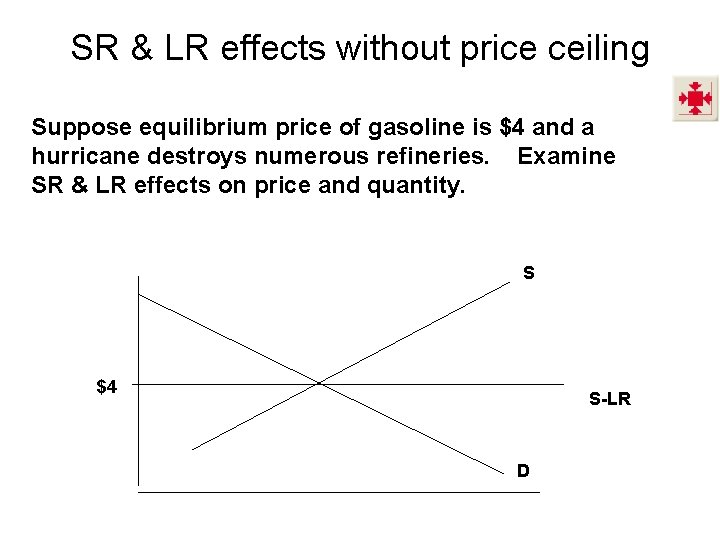

SR & LR effects without price ceiling Suppose equilibrium price of gasoline is $4 and a hurricane destroys numerous refineries. Examine SR & LR effects on price and quantity. S $4 S-LR D

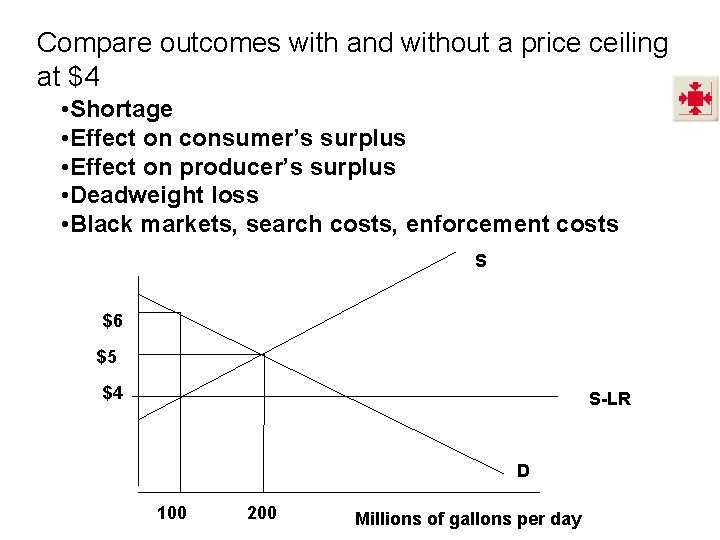

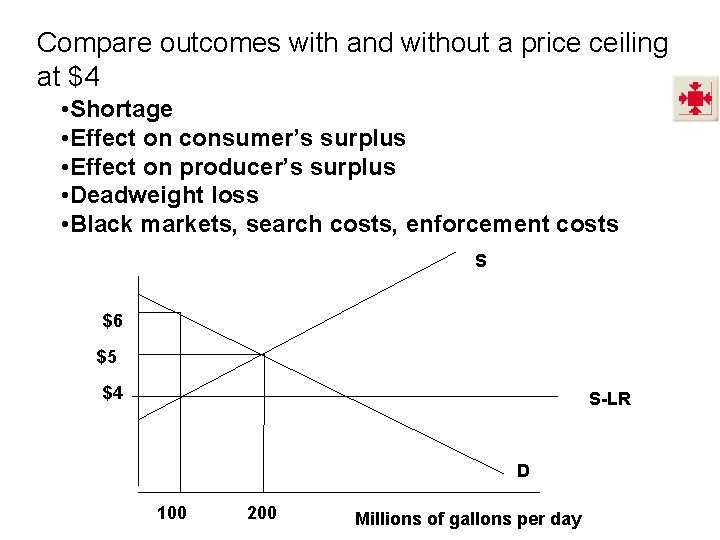

Compare outcomes with and without a price ceiling at $4 • Shortage • Effect on consumer’s surplus • Effect on producer’s surplus • Deadweight loss • Black markets, search costs, enforcement costs S $6 $5 $4 S-LR D 100 200 Millions of gallons per day

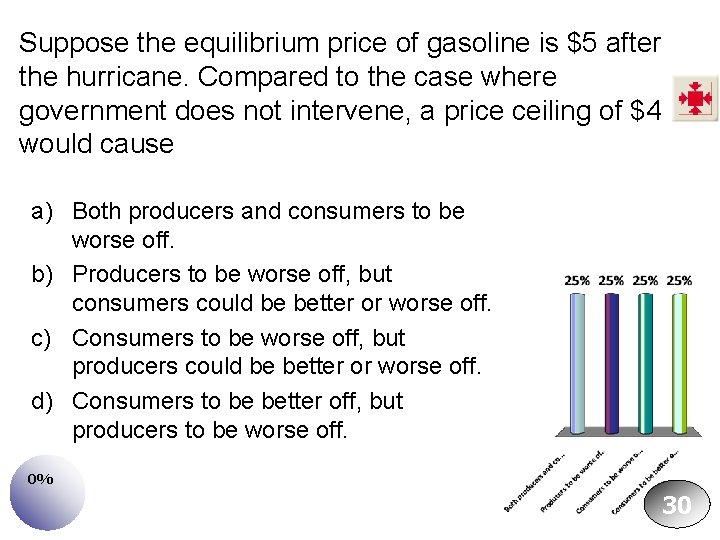

Suppose the equilibrium price of gasoline is $5 after the hurricane. Compared to the case where government does not intervene, a price ceiling of $4 would cause a) Both producers and consumers to be worse off. b) Producers to be worse off, but consumers could be better or worse off. c) Consumers to be worse off, but producers could be better or worse off. d) Consumers to be better off, but producers to be worse off. 0% 30

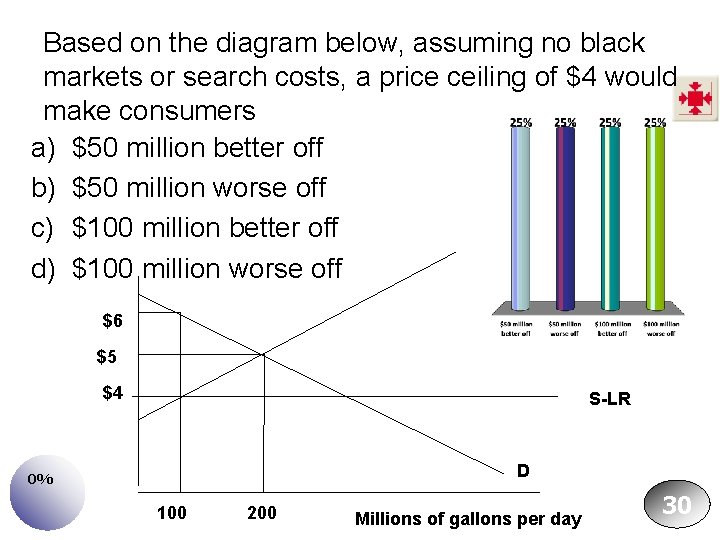

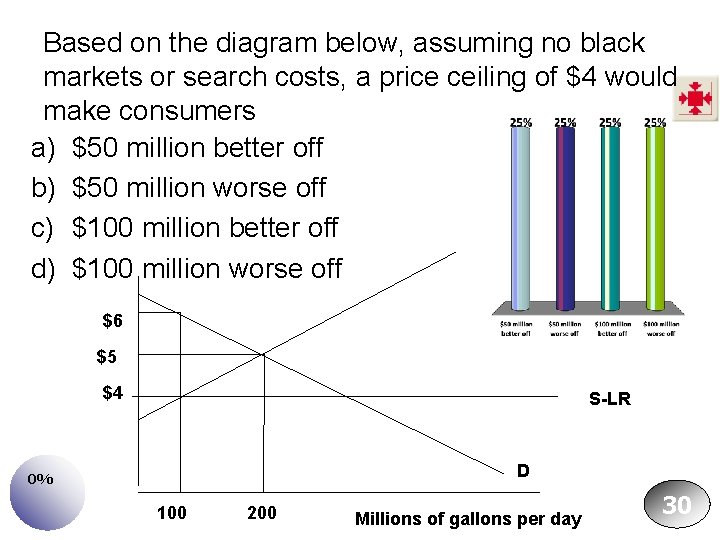

Based on the diagram below, assuming no black markets or search costs, a price ceiling of $4 would make consumers a) $50 million better off b) $50 million worse off c) $100 million better off d) $100 million worse off $6 $5 $4 S-LR D 0% 100 200 Millions of gallons per day 30

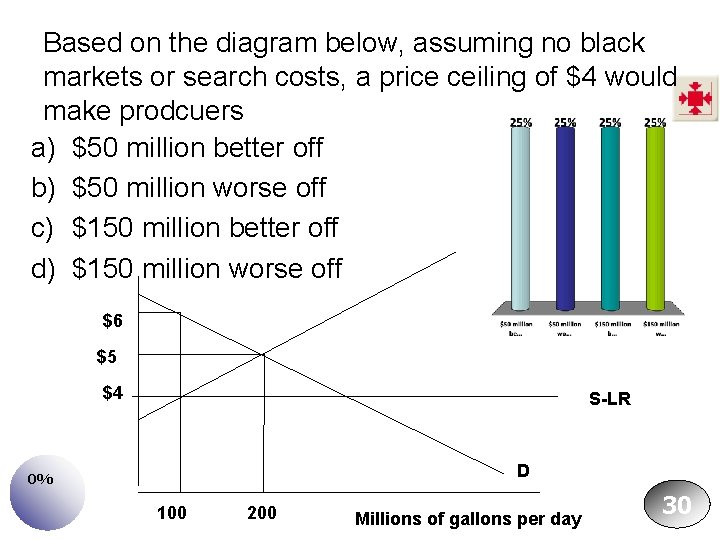

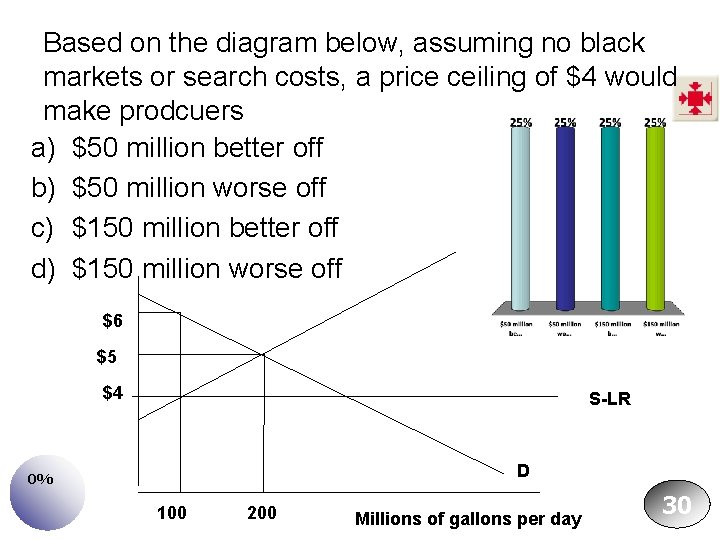

Based on the diagram below, assuming no black markets or search costs, a price ceiling of $4 would make prodcuers a) $50 million better off b) $50 million worse off c) $150 million better off d) $150 million worse off $6 $5 $4 S-LR D 0% 100 200 Millions of gallons per day 30

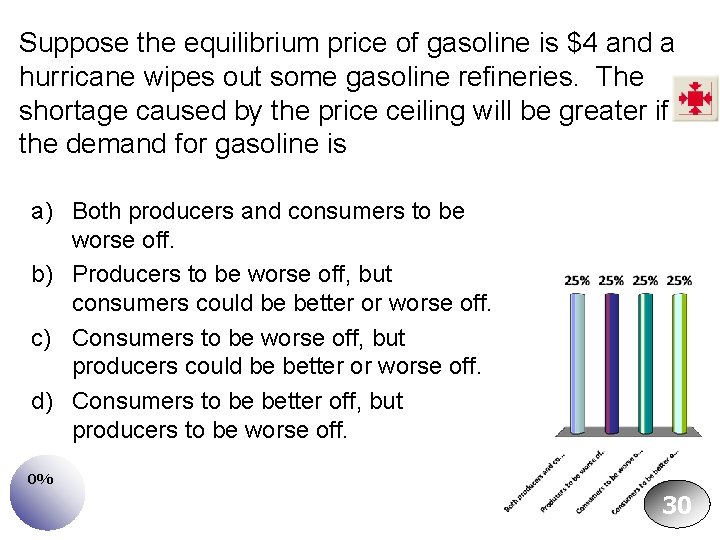

Suppose the equilibrium price of gasoline is $4 and a hurricane wipes out some gasoline refineries. The shortage caused by the price ceiling will be greater if the demand for gasoline is a) Both producers and consumers to be worse off. b) Producers to be worse off, but consumers could be better or worse off. c) Consumers to be worse off, but producers could be better or worse off. d) Consumers to be better off, but producers to be worse off. 0% 30

Minimum Wage • Is a price floor on labor. • Why is there a minimum wage? • Would a higher minimum wage make workers better off? • Efficiency versus equity

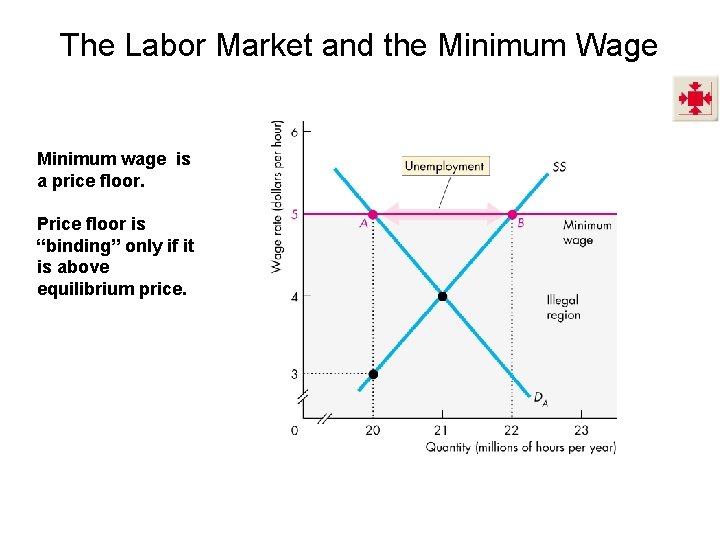

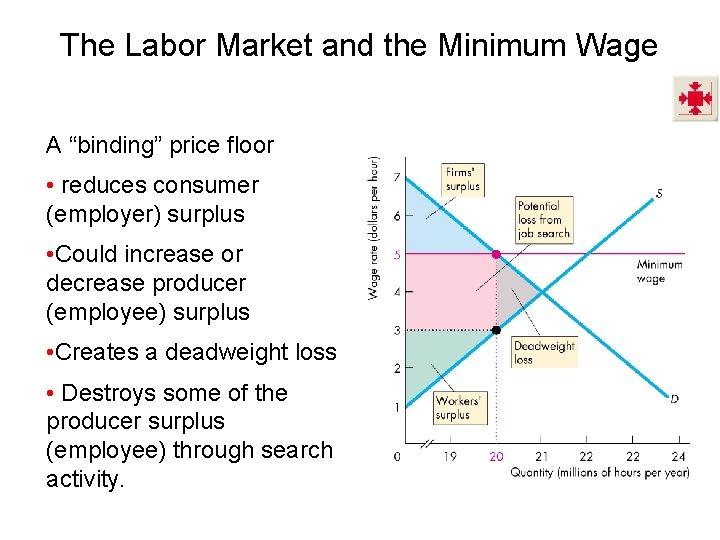

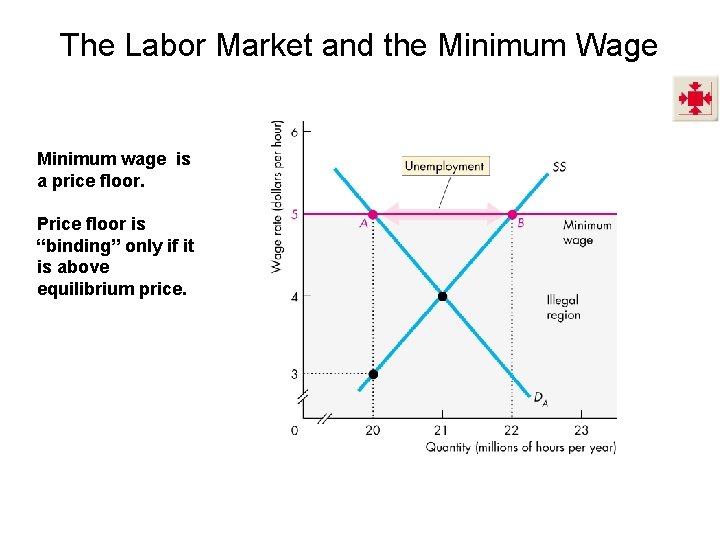

The Labor Market and the Minimum Wage Minimum wage is a price floor. Price floor is “binding” only if it is above equilibrium price.

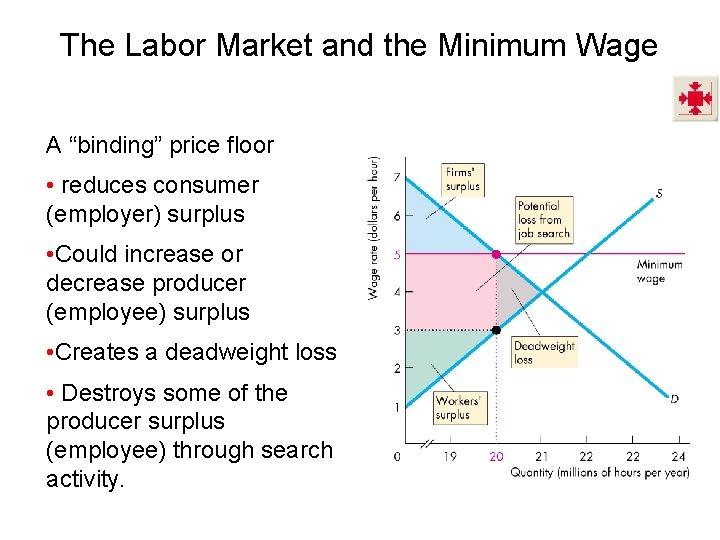

The Labor Market and the Minimum Wage A “binding” price floor • reduces consumer (employer) surplus • Could increase or decrease producer (employee) surplus • Creates a deadweight loss • Destroys some of the producer surplus (employee) through search activity.

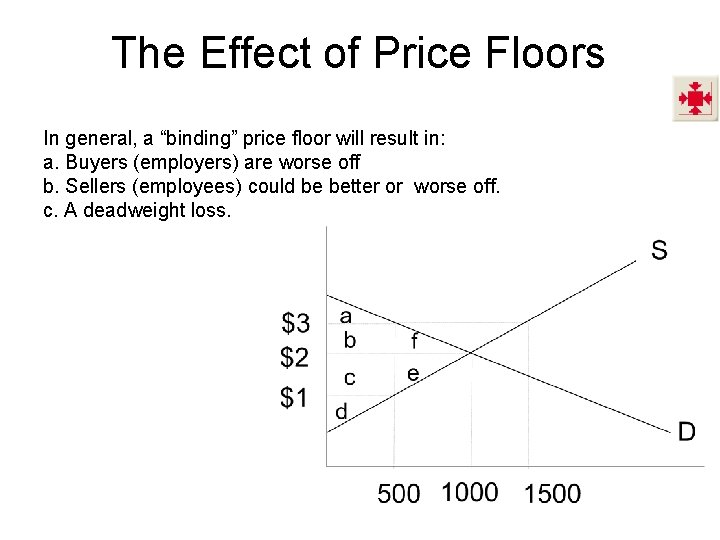

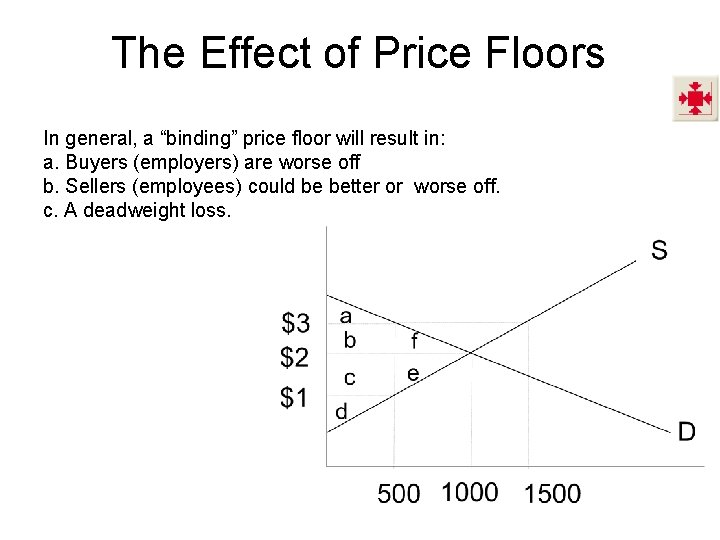

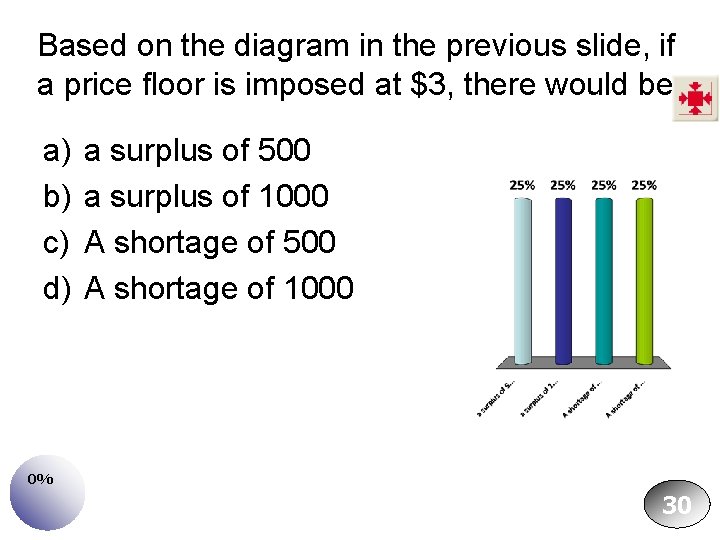

The Effect of Price Floors In general, a “binding” price floor will result in: a. Buyers (employers) are worse off b. Sellers (employees) could be better or worse off. c. A deadweight loss.

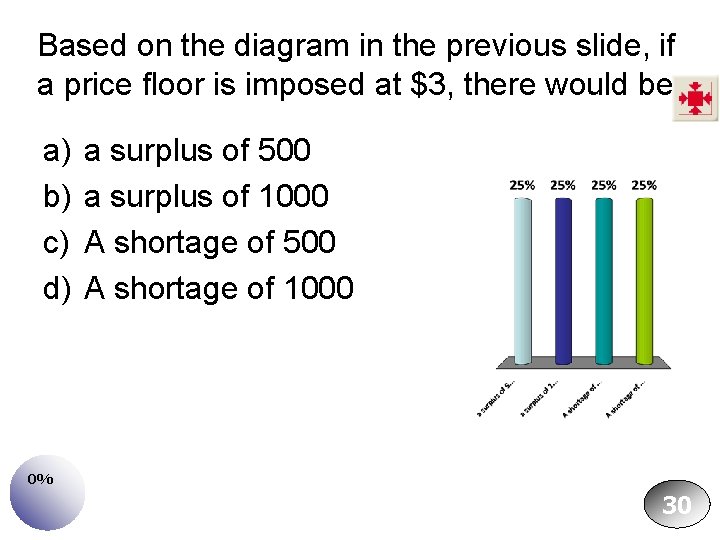

Based on the diagram in the previous slide, if a price floor is imposed at $3, there would be a) b) c) d) a surplus of 500 a surplus of 1000 A shortage of 500 A shortage of 1000 0% 30

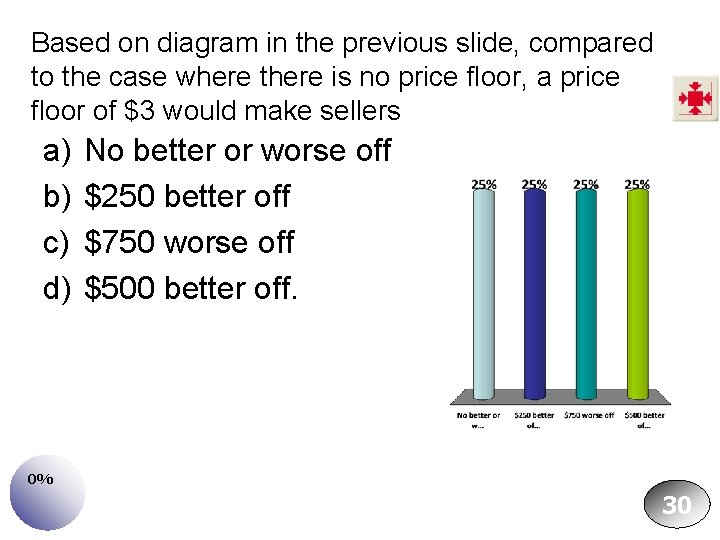

Based on diagram in the previous slide, compared to the case where there is no price floor, a price floor of $3 would make sellers a) b) c) d) No better or worse off $250 better off $750 worse off $500 better off. 0% 30

Based on diagram in the previous slide, compared to the case where there is no price floor, a price floor of $3 would make buyers a) b) c) d) No better or worse off $250 better off $750 worse off $500 worse off. 0% 30

Based on diagram in the previous slide, a price floor of $3 would cause a deadweight loss of: a) b) c) d) $0 $250 $500 $750 0% 30

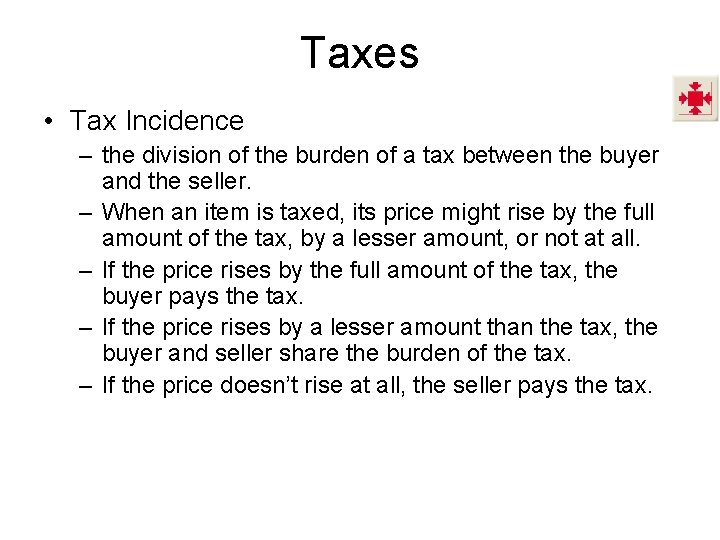

Taxes • Tax Incidence – the division of the burden of a tax between the buyer and the seller. – When an item is taxed, its price might rise by the full amount of the tax, by a lesser amount, or not at all. – If the price rises by the full amount of the tax, the buyer pays the tax. – If the price rises by a lesser amount than the tax, the buyer and seller share the burden of the tax. – If the price doesn’t rise at all, the seller pays the tax.

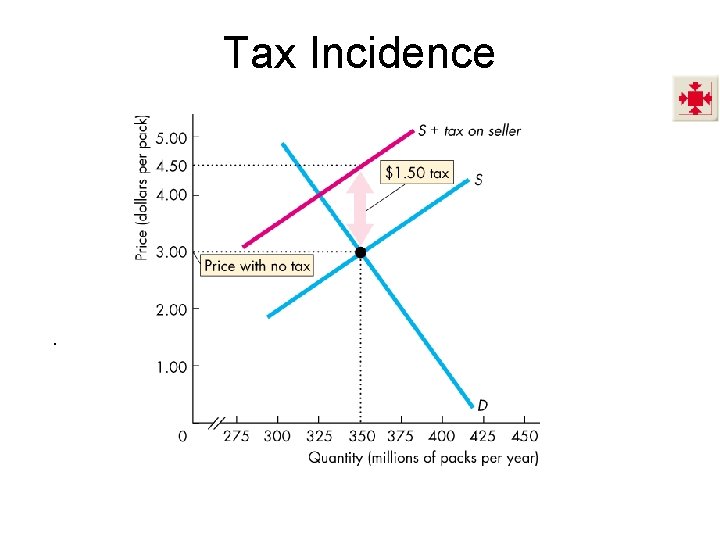

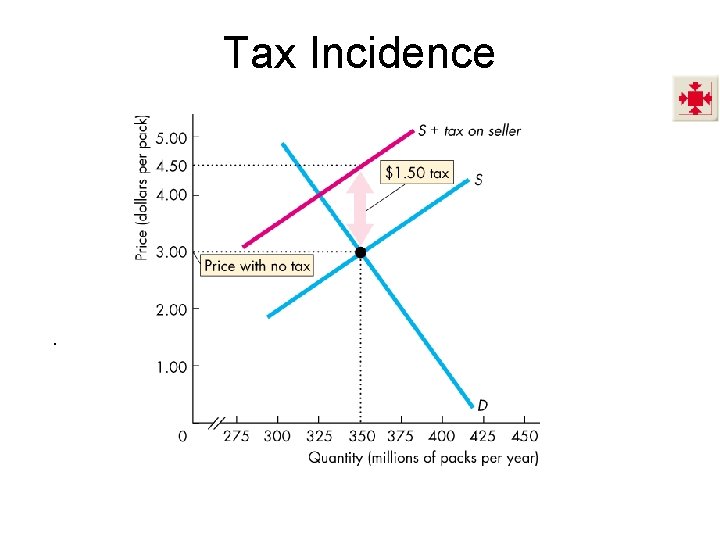

Taxes • Tax Incidence – Tax incidence doesn’t depend on tax law. – The law might impose a tax on the buyer or the seller, but the outcome will be the same. – Example: On July 1, 2002, Mayor Bloomberg upped the cigarette tax in New York City from almost nothing to $1. 50 a pack.

Tax Incidence .

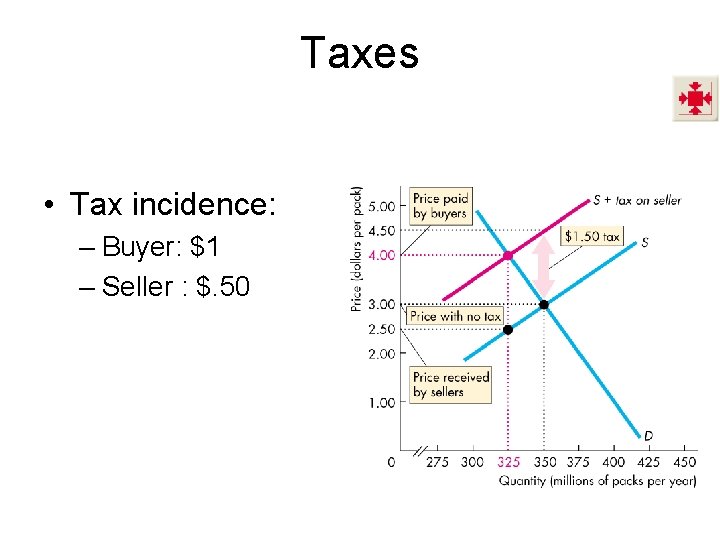

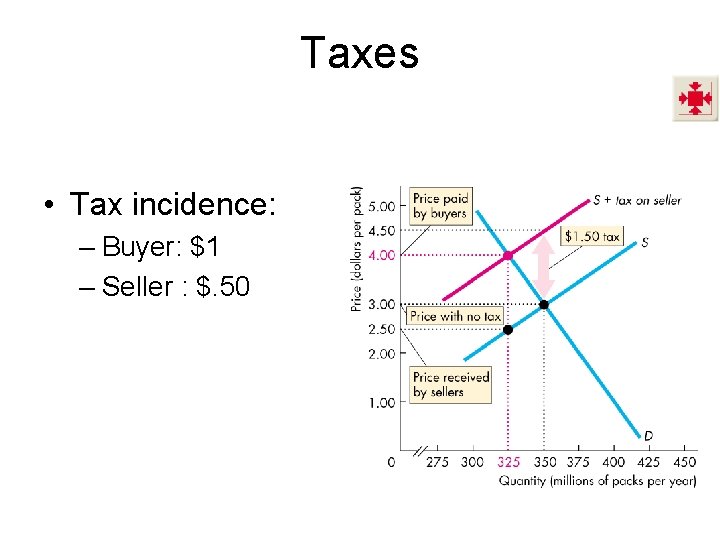

Taxes • Tax incidence: – Buyer: $1 – Seller : $. 50

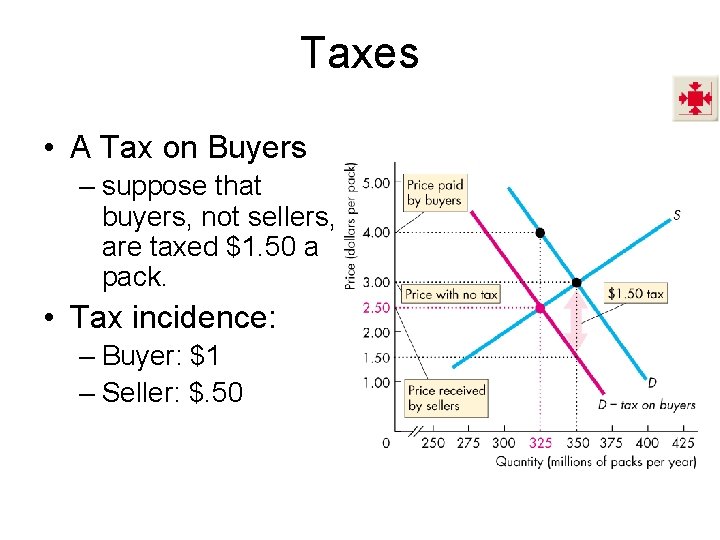

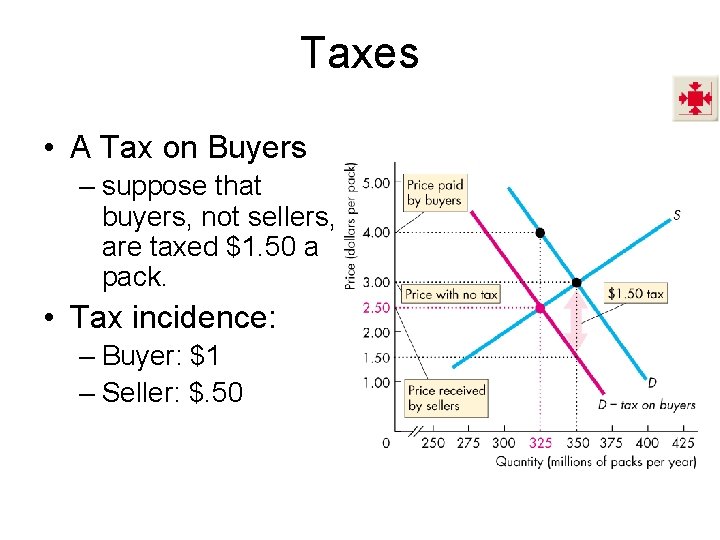

Taxes • A Tax on Buyers – suppose that buyers, not sellers, are taxed $1. 50 a pack. • Tax incidence: – Buyer: $1 – Seller: $. 50

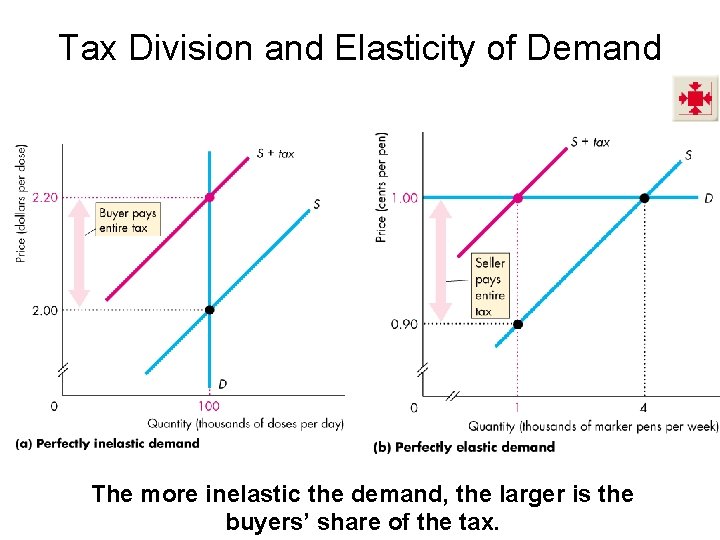

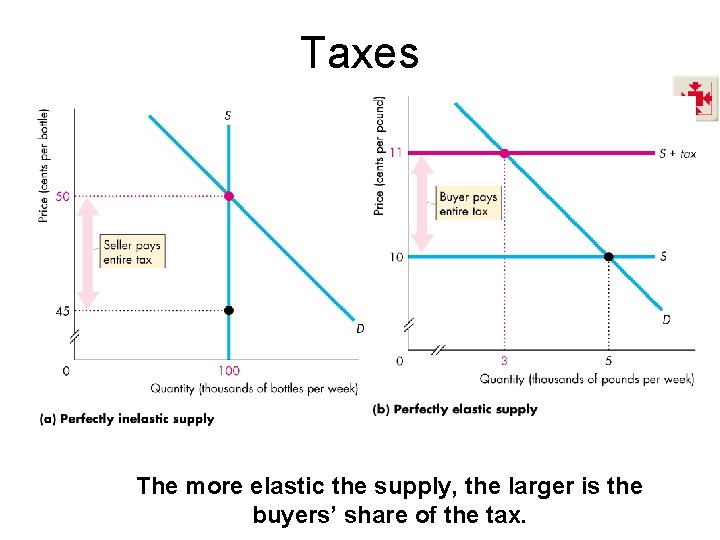

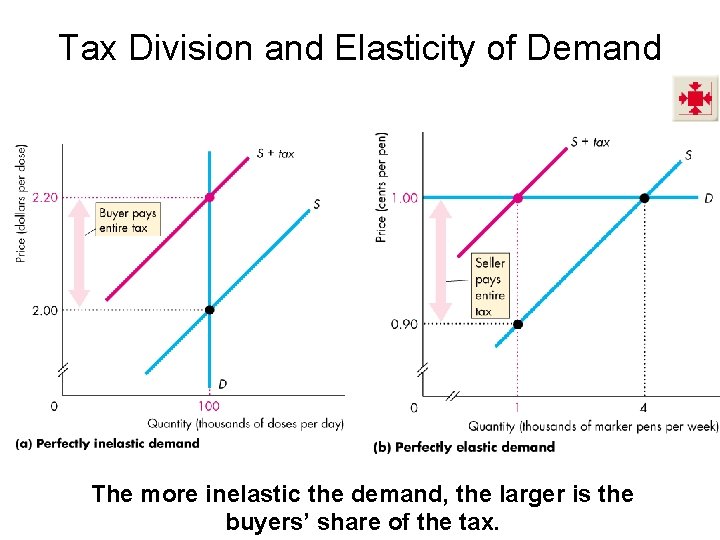

Tax Division and Elasticity of Demand The more inelastic the demand, the larger is the buyers’ share of the tax.

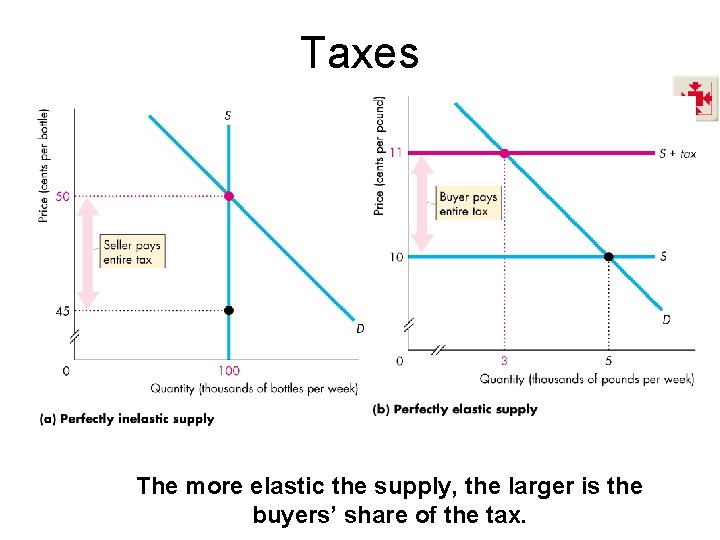

Taxes The more elastic the supply, the larger is the buyers’ share of the tax.

Income is lower on average among smokers in Mexico than in the U. S. This means that the consumers’ share of a tax on cigarettes would likely be greater in Mexico. a) True b) False 0% 30

The supply of apples is highly inelastic in the short run. Consequently, any tax on apples will be borne primarily by a) Apple producers b) Apple buyers. 0% 30

Taxes • Taxes in Practice – Taxes usually are levied on goods and services with an inelastic demand or an inelastic supply. – Alcohol, tobacco, and gasoline have inelastic demand, so the buyers of these items pay most the tax on them. – Labor has a low elasticity of supply, so the seller—the worker—pays most of the income tax and most of the Social Security tax.

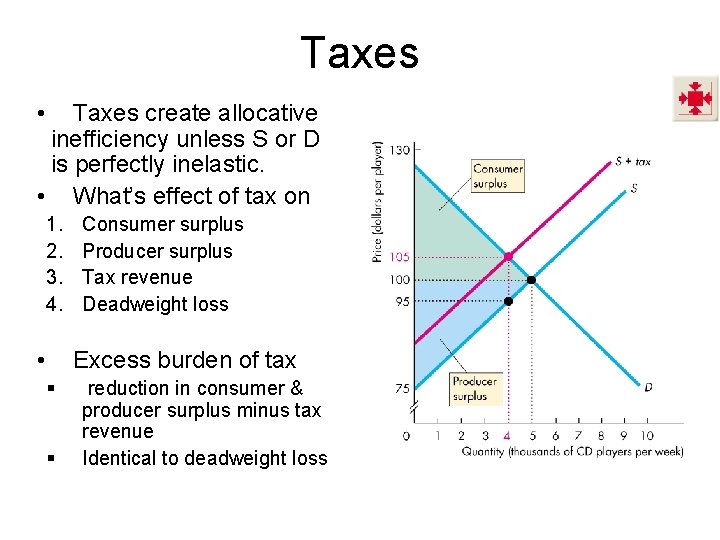

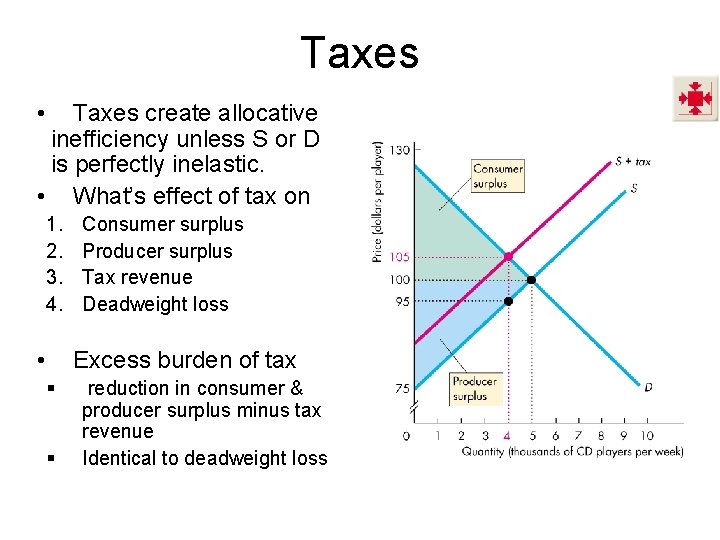

Taxes • Taxes create allocative inefficiency unless S or D is perfectly inelastic. • What’s effect of tax on 1. 2. 3. 4. • Consumer surplus Producer surplus Tax revenue Deadweight loss Excess burden of tax § § reduction in consumer & producer surplus minus tax revenue Identical to deadweight loss

Consider the market for insulin. Suppose demand is perfectly inelastic, equilibrium price per dose is $10, and equilibrium quantity is 1 million per year. If a $2 tax is imposed on each dose, the annual tax revenue would be a) $2 million b) Less than $2 million c) More than $2 million. 0% 30

Consider the market for insulin described above. A $2 tax would cause consumer’s surplus to ____. a) Not change b) Decrease $2 million c) Decrease by less than $2 million. 0% 30

Consider the market for insulin described above. A $2 tax would cause producer’s surplus to ____. a) Not change b) Decrease $2 million c) Decrease by less than $2 million. 0% 30

Subsidies and Quotas – Fluctuations in the weather bring big fluctuations in farm output. – How do changes in farm output affect the prices of farm products and farm revenues? – How might farmers be helped by intervention in markets for farm products?

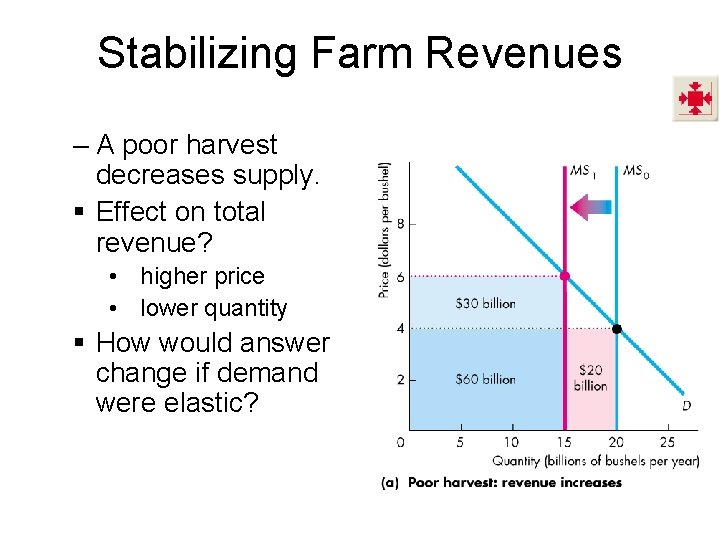

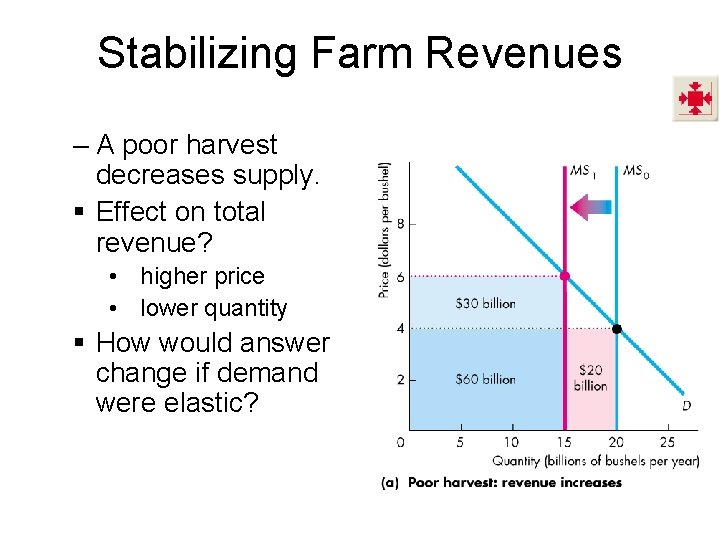

Stabilizing Farm Revenues – A poor harvest decreases supply. § Effect on total revenue? • higher price • lower quantity § How would answer change if demand were elastic?

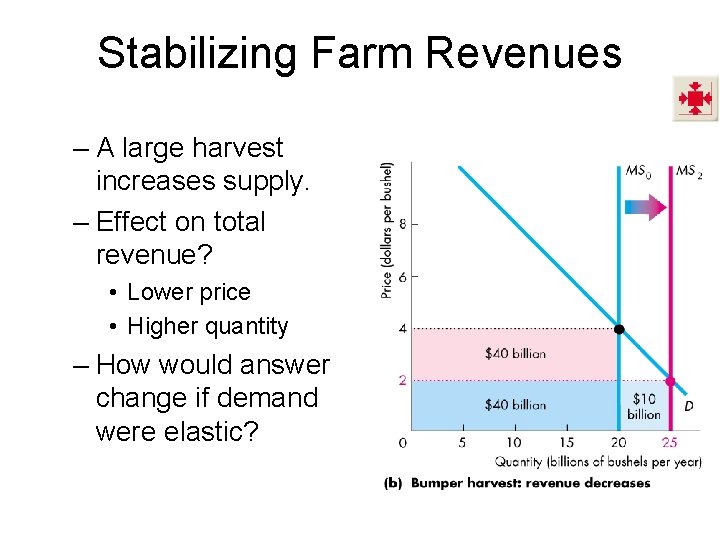

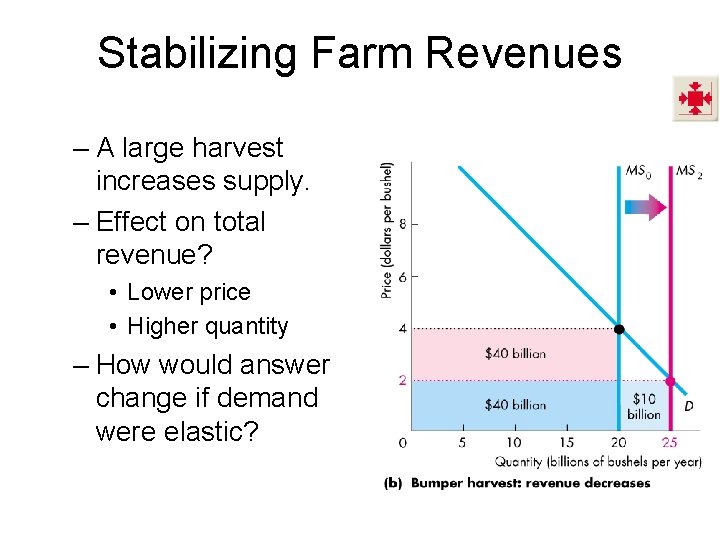

Stabilizing Farm Revenues – A large harvest increases supply. – Effect on total revenue? • Lower price • Higher quantity – How would answer change if demand were elastic?

Stabilizing Farm Revenues Intervention in markets for farm products takes two main forms: § Subsidies a payment made by the government to a producer that’s in addition to market price received. § Production quotas an upper limit on the quantity of a good that may be produced during a specified period.

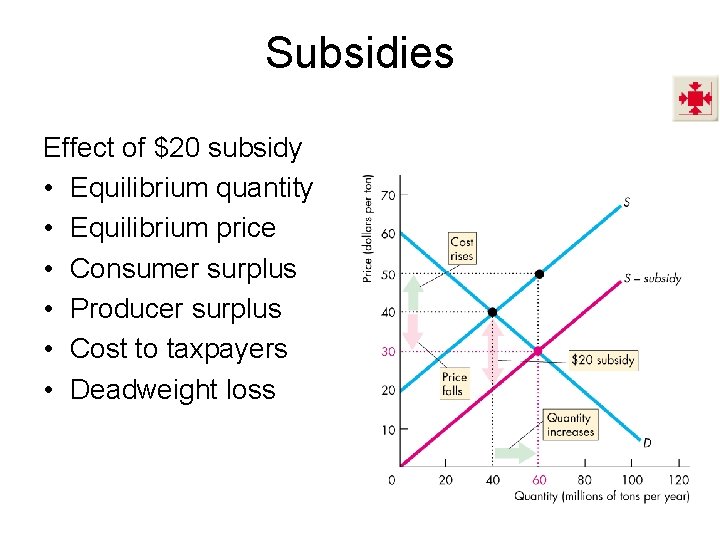

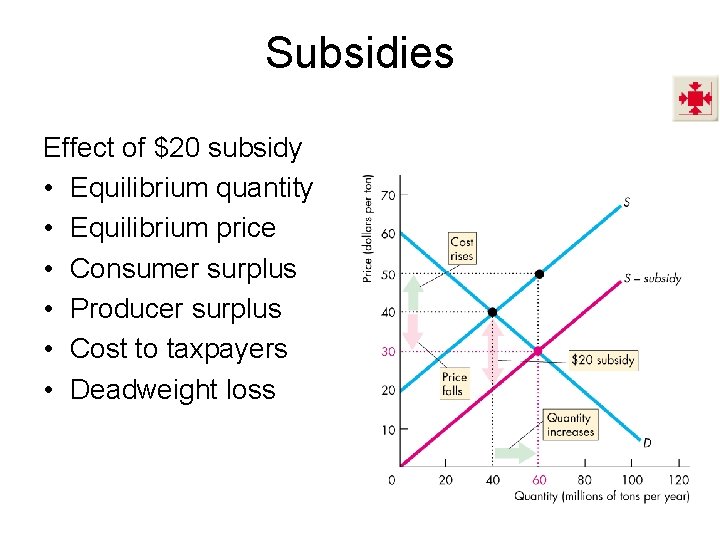

Subsidies Effect of $20 subsidy • Equilibrium quantity • Equilibrium price • Consumer surplus • Producer surplus • Cost to taxpayers • Deadweight loss

The $20 subsidy would cause consumers to be a) b) c) d) $500 million better off $600 million better off $400 million worse off 0% 30

The $20 subsidy would cause producers to be a) b) c) d) $500 million better off $600 million better off $400 million worse off 0% 30

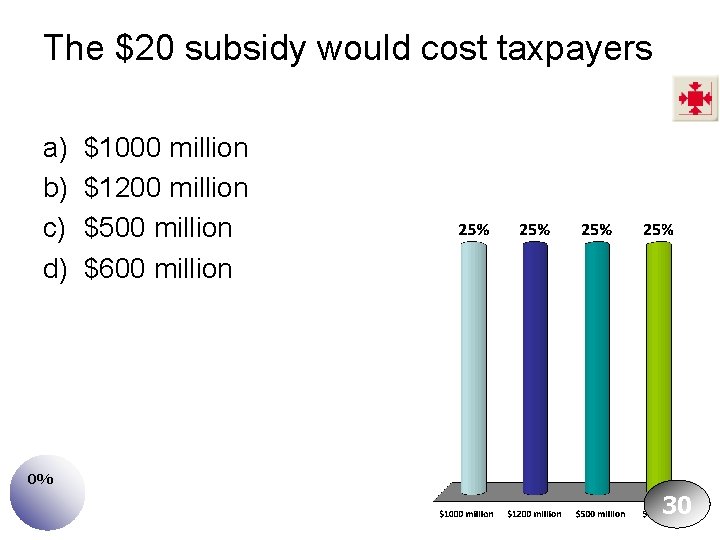

The $20 subsidy would cost taxpayers a) b) c) d) $1000 million $1200 million $500 million $600 million 0% 30

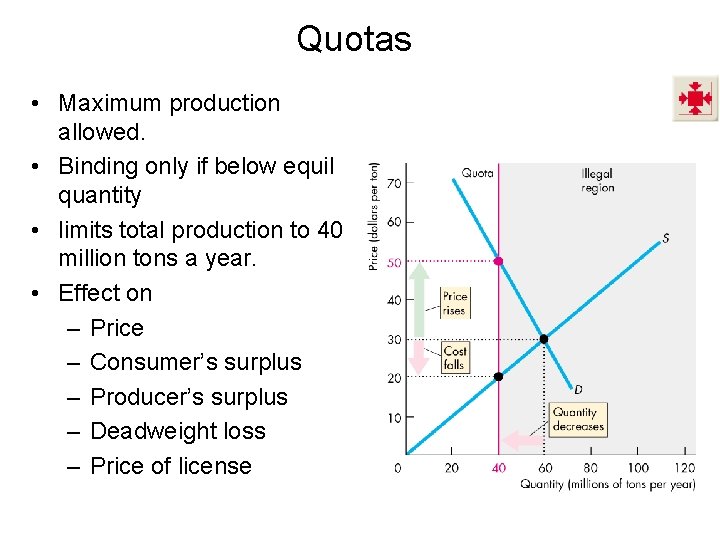

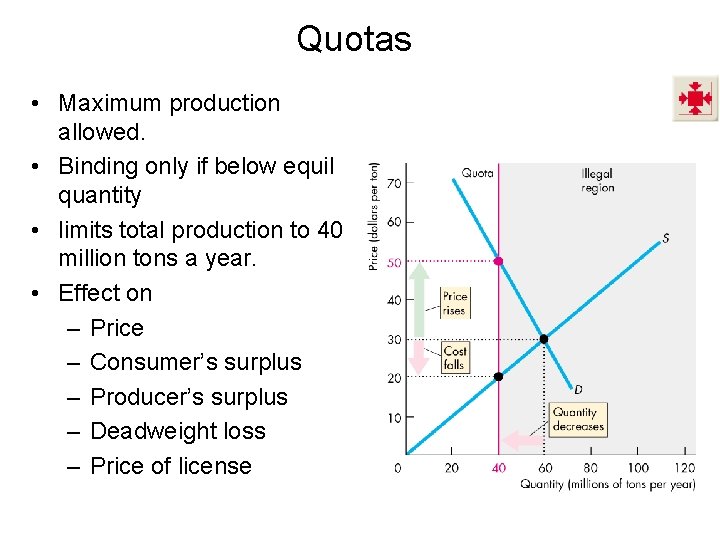

Quotas • Maximum production allowed. • Binding only if below equil quantity • limits total production to 40 million tons a year. • Effect on – Price – Consumer’s surplus – Producer’s surplus – Deadweight loss – Price of license

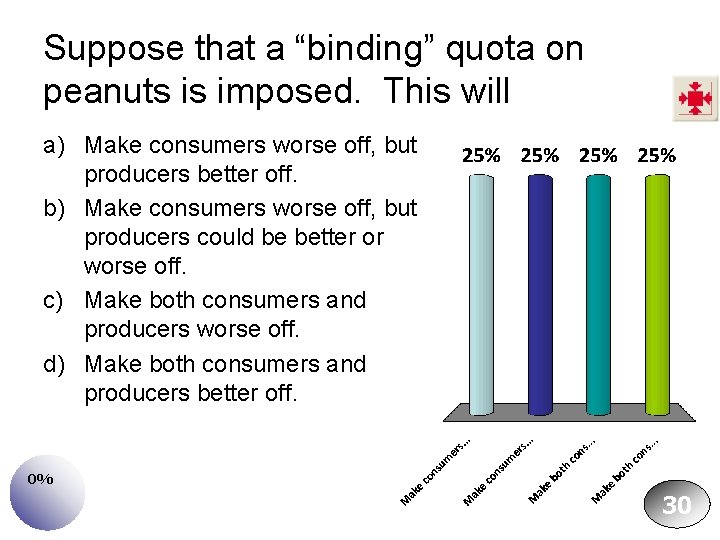

Suppose that a “binding” quota on peanuts is imposed. This will a) Make consumers worse off, but producers better off. b) Make consumers worse off, but producers could be better or worse off. c) Make both consumers and producers worse off. d) Make both consumers and producers better off. 0% 30

Markets for Illegal Goods • How do increased penalties on sellers affect price, quantity? • How do increased penalties on buyers affect price, quantity? • Illegal immigration?

Ito ay kilala rin sa katawagan bilang maximum price policy

Ito ay kilala rin sa katawagan bilang maximum price policy Price ceiling and deadweight loss

Price ceiling and deadweight loss Binding price floor

Binding price floor Binding price ceiling graph

Binding price ceiling graph Binding price ceiling

Binding price ceiling Price ceiling on monopoly

Price ceiling on monopoly Binding price floor

Binding price floor Monopoly price ceiling

Monopoly price ceiling Is rent control a price ceiling or floor

Is rent control a price ceiling or floor If an effective ceiling price is placed on hamburgers, then

If an effective ceiling price is placed on hamburgers, then Price discovery and price determination

Price discovery and price determination Marked price-selling price=

Marked price-selling price= Narrate the qualities of hire purchase system

Narrate the qualities of hire purchase system 7 step sourcing methodology

7 step sourcing methodology Basal and ceiling rules for woodcock johnson

Basal and ceiling rules for woodcock johnson Correspondence function examples

Correspondence function examples Vineland 3 basal and ceiling rules

Vineland 3 basal and ceiling rules Gfta bell curve

Gfta bell curve Wall and ceiling finishes

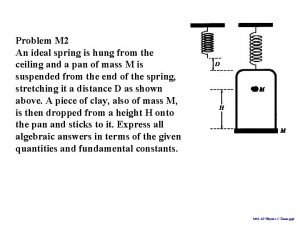

Wall and ceiling finishes An ideal spring is hung from the ceiling

An ideal spring is hung from the ceiling Plot sequence

Plot sequence Exposition of the lion and the mouse

Exposition of the lion and the mouse What are plot stages

What are plot stages The black cat exposition

The black cat exposition Suit the action to the word the word to the action meaning

Suit the action to the word the word to the action meaning Glass ceiling glass escalator

Glass ceiling glass escalator Umur basal adalah

Umur basal adalah Framing ceiling joists

Framing ceiling joists A block is suspended from the ceiling by a long

A block is suspended from the ceiling by a long A block is suspended from the ceiling by a long

A block is suspended from the ceiling by a long Low floor high ceiling math tasks

Low floor high ceiling math tasks Fixing stainless steel rib lath

Fixing stainless steel rib lath Tightly attached ceiling

Tightly attached ceiling Osha ceiling tile requirements

Osha ceiling tile requirements Standard ceiling drywall thickness

Standard ceiling drywall thickness Homophone for leek

Homophone for leek Skoring tes binet

Skoring tes binet What is ftens

What is ftens Ceiling effekt psychologie

Ceiling effekt psychologie Cal grant income ceiling 2020-21

Cal grant income ceiling 2020-21 Flat roof trusses for sale

Flat roof trusses for sale Interstitial ceilings are useful where:

Interstitial ceilings are useful where: