1 of 33 Chapter 26 LongRun Economic Growth

- Slides: 41

1 of 33 Chapter 26 Long-Run Economic Growth Copyright © 2011 Pearson Canada Inc.

2 of 33 In this chapter you will learn. . . 1. …about the costs and benefits of economic growth. 2. …the four fundamental determinants of growth in real GDP. 3. …the main elements of Neoclassical growth theory. 4. …about new growth theories based on endogenous technical change and increasing returns. 5. …why resource exhaustion and environmental degradation create serious challenges for public policy directed at sustaining economic growth. Copyright © 2011 Pearson Canada Inc.

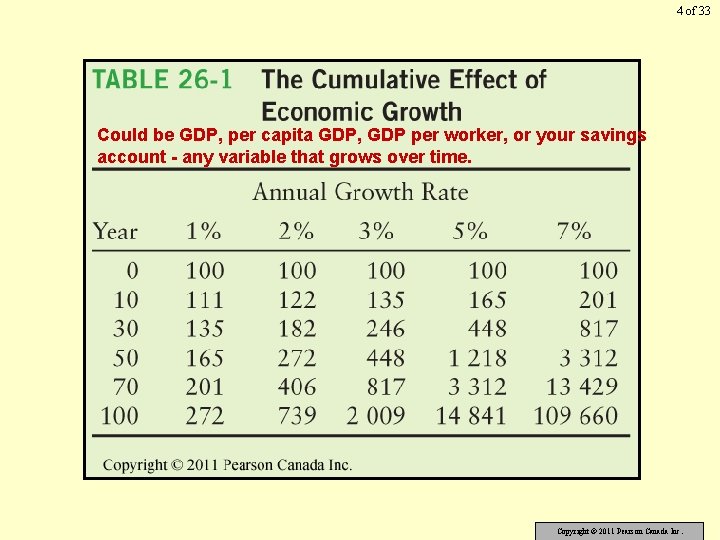

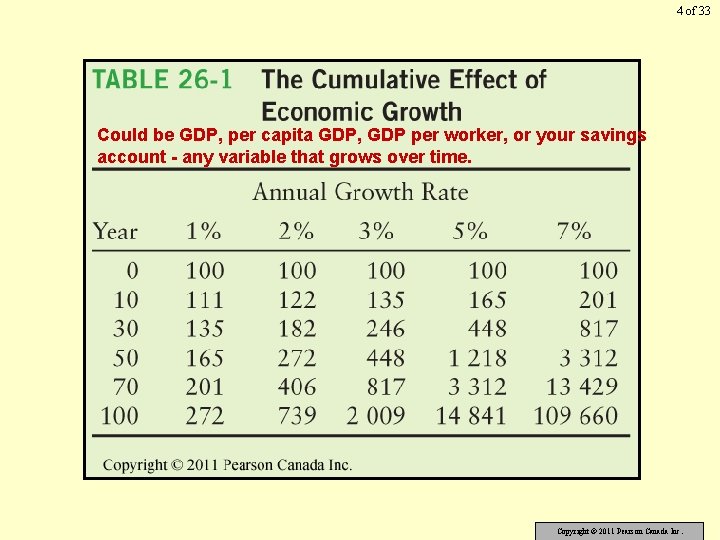

3 of 33 26. 1 The Nature of Economic Growth Sustained increases in Y* are more powerful method of raising material living standards than the removal of recessionary gaps. Even small differences in annual growth rates can result in large changes in living standards after many years. Consider GDP, per capita GDP, and GDP per worker. Copyright © 2011 Pearson Canada Inc.

4 of 33 Could be GDP, per capita GDP, GDP per worker, or your savings account - any variable that grows over time. Copyright © 2011 Pearson Canada Inc.

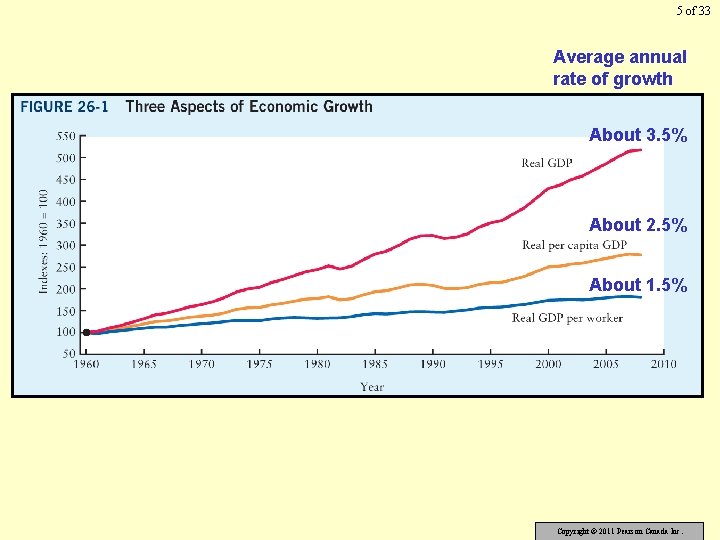

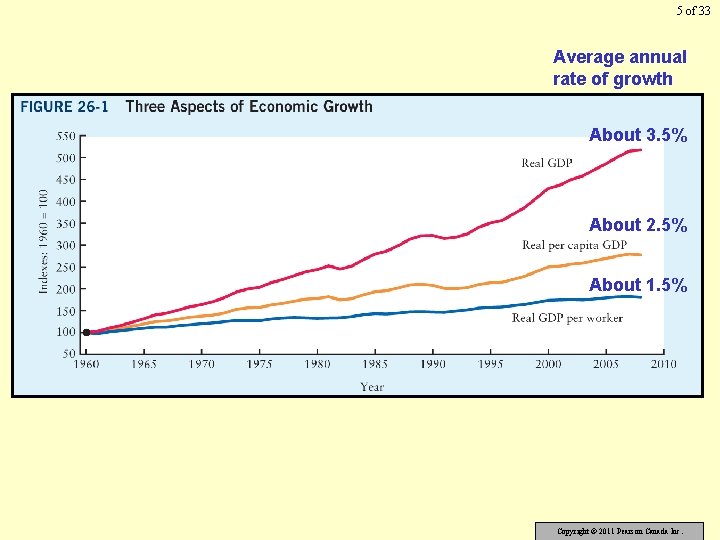

5 of 33 Average annual rate of growth About 3. 5% About 2. 5% About 1. 5% Copyright © 2011 Pearson Canada Inc.

6 of 33 Benefits of Economic Growth 1. Rising average living standards 2. Alleviation of poverty - many do not share directly in the growth - but redistribution is easier in a growing economy APPLYING ECONOMIC CONCEPTS 26 -1 An Open Letter from a Supporter of the “Growth Is Good” School Copyright © 2011 Pearson Canada Inc.

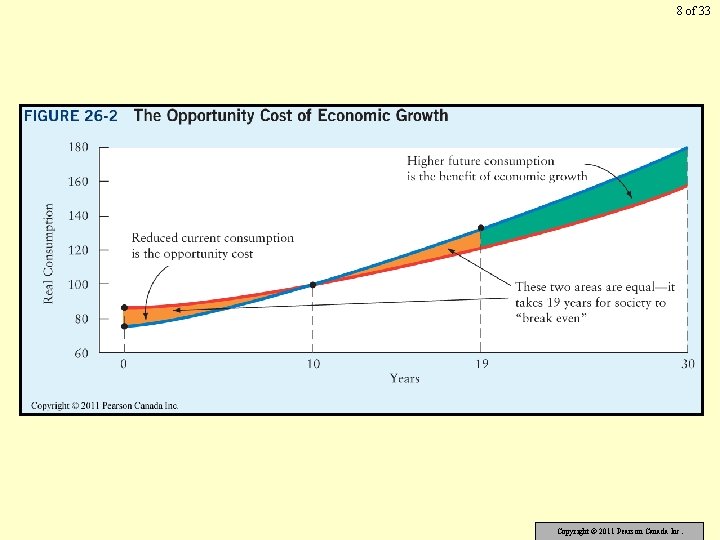

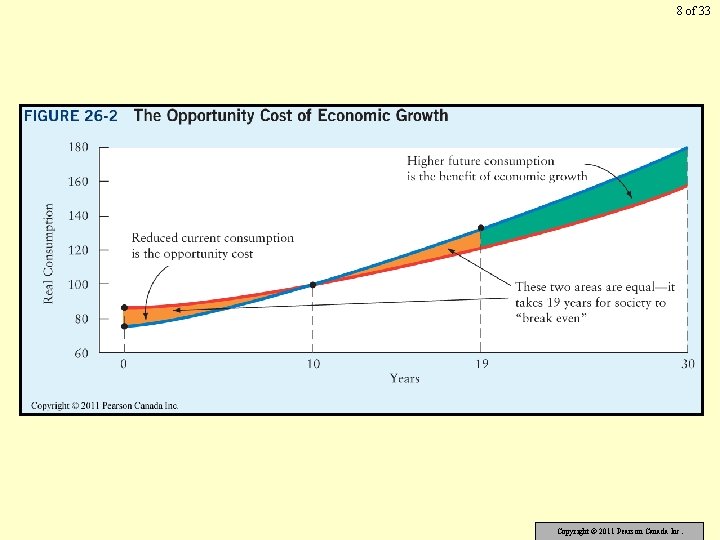

7 of 33 Costs of Economic Growth 1. Sacrifice of Current Consumption - growth is often encouraged by increasing investment and saving - which requires less consumption the opportunity cost of growth Copyright © 2011 Pearson Canada Inc.

8 of 33 Copyright © 2011 Pearson Canada Inc.

9 of 33 2. Social Costs of Growth - growth usually involves the displacement of some firms and workers - this process involves real transition costs APPLYING ECONOMIC CONCEPTS 26 -2 An Open Letter from a Supporter of the “Growth Is Bad” School Copyright © 2011 Pearson Canada Inc.

10 of 33 We have been discussing the benefits of economic growth – sustained increases in per capita incomes. Some modern research, however, suggests that rising income is less important for people’s happiness than traditionally thought. For more information, go to What Makes People Happy? in the Additional Topics section of this book’s My. Econ. Lab. www. myeconlab. com Copyright © 2011 Pearson Canada Inc.

of 33 Sources of Economic Growth The four fundamental sources of economic growth are: 1. Growth in the labour force. F 2. Growth in human capital. F quality (productivity) 3. Growth in physical capital. F 4. Technological improvement. productivity Different theories emphasize different sources of growth. MFC 2007, MFC 2007 MFC 2007

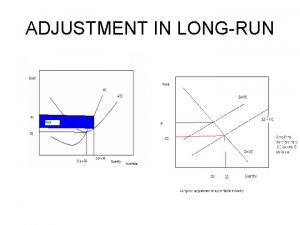

12 of 33 26. 2 Established Theories of Economic Growth Focus on the Long Run We focus on the long run, when real GDP is equal to potential output, Y*. We hold Y* constant and let the interest rate be determined endogenously - by desired saving and desired investment Copyright © 2011 Pearson Canada Inc.

13 of 33 Investment, Saving, and Growth Our model has two parts: Investment — increases in the stock of capital — lead to increases in the future level of Y*. Saving by households (and firms) is used to finance this investment. interest rate is the “price” that equilibrates this market Copyright © 2011 Pearson Canada Inc.

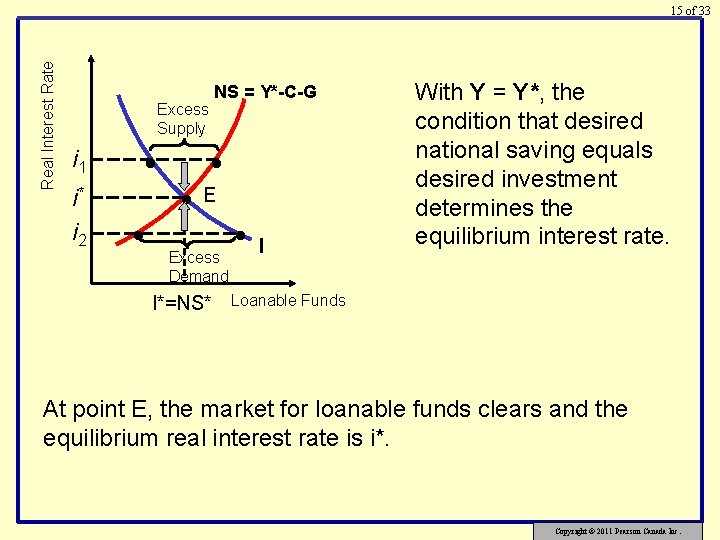

14 of 33 Firms’ investment demand is negatively related to the real interest rate. National saving = private saving + public saving NS = Y* - T - C + (T - G) NS = Y* - C - G If C is negatively related to the interest rate, then NS is positively related to the interest rate. Copyright © 2011 Pearson Canada Inc.

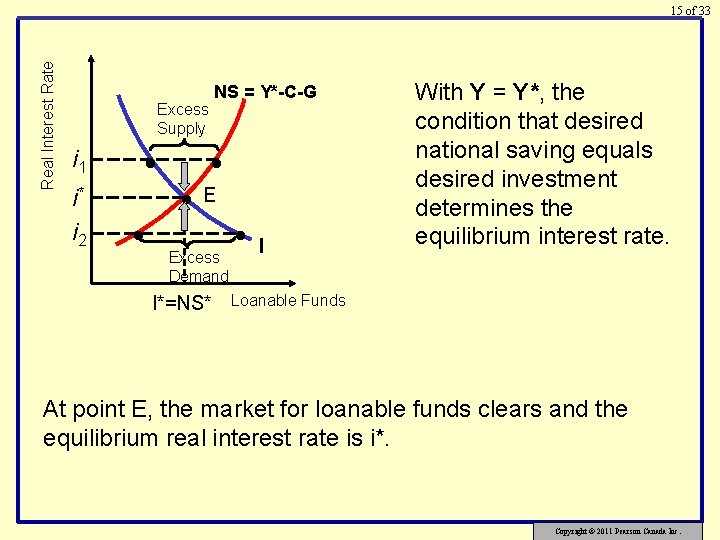

Real Interest Rate 15 of 33 NS = Y*-C-G Excess Supply • i 1 i* i 2 • • • E Excess Demand I*=NS* • I With Y = Y*, the condition that desired national saving equals desired investment determines the equilibrium interest rate. Loanable Funds At point E, the market for loanable funds clears and the equilibrium real interest rate is i*. Copyright © 2011 Pearson Canada Inc.

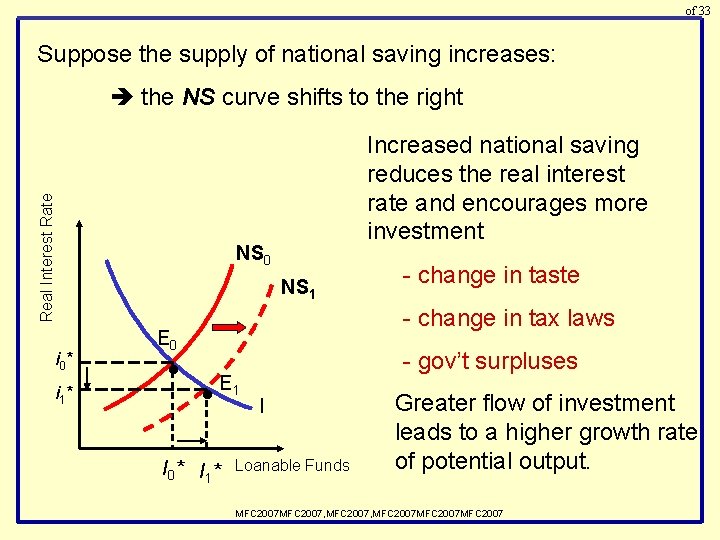

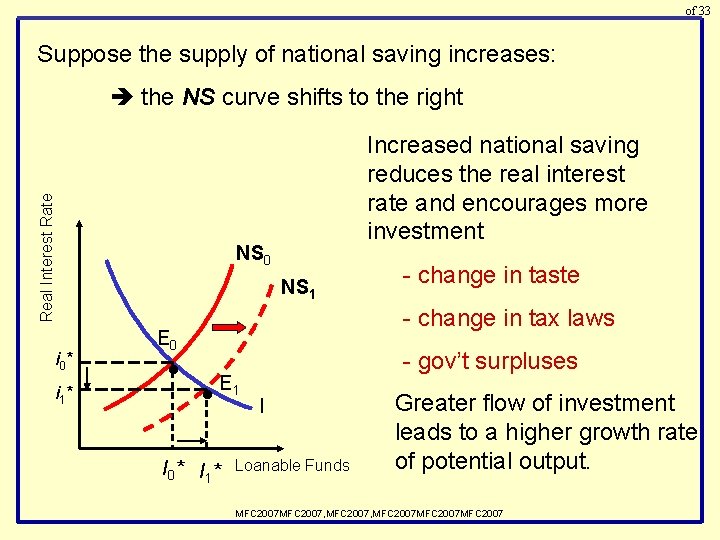

of 33 Suppose the supply of national saving increases: Real Interest Rate the NS curve shifts to the right i 0 * i 1 * Increased national saving reduces the real interest rate and encourages more investment NS 0 NS 1 - change in tax laws E 0 • - change in taste • E 1 I 0 * I 1 * - gov’t surpluses I Loanable Funds Greater flow of investment leads to a higher growth rate of potential output. MFC 2007, MFC 2007 MFC 2007

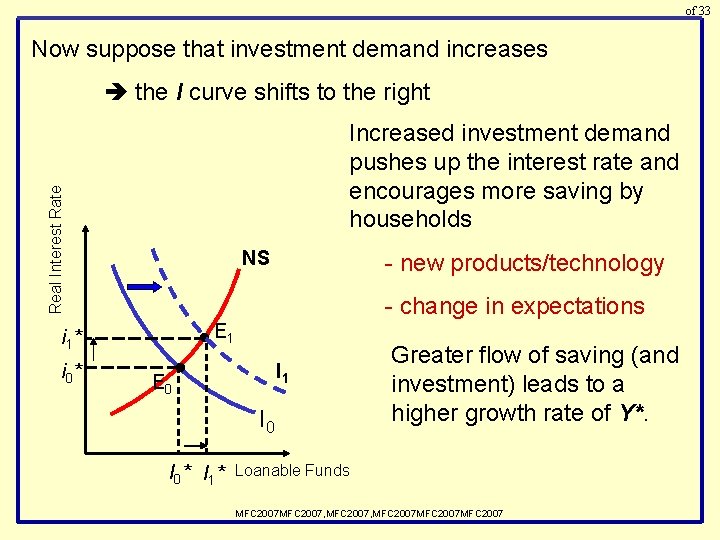

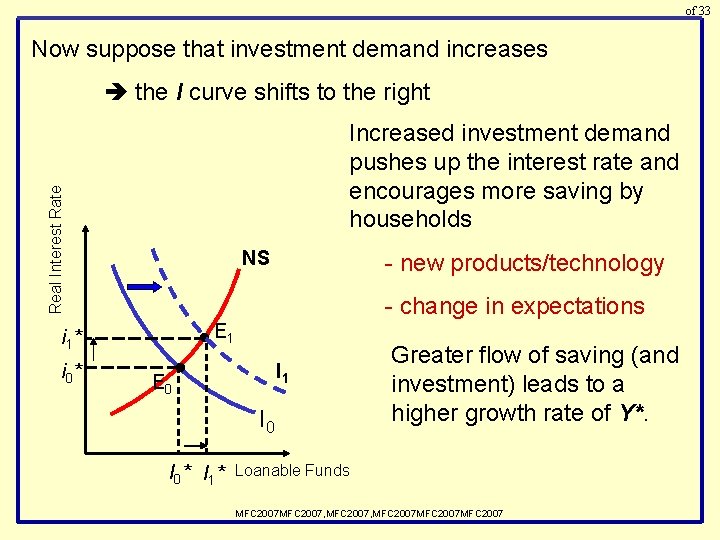

of 33 Now suppose that investment demand increases the I curve shifts to the right Real Interest Rate Increased investment demand pushes up the interest rate and encourages more saving by households NS i 1 * i 0 * E 0 • - new products/technology - change in expectations • E 1 I 0 I 0 * I 1 * Greater flow of saving (and investment) leads to a higher growth rate of Y*. Loanable Funds MFC 2007, MFC 2007 MFC 2007

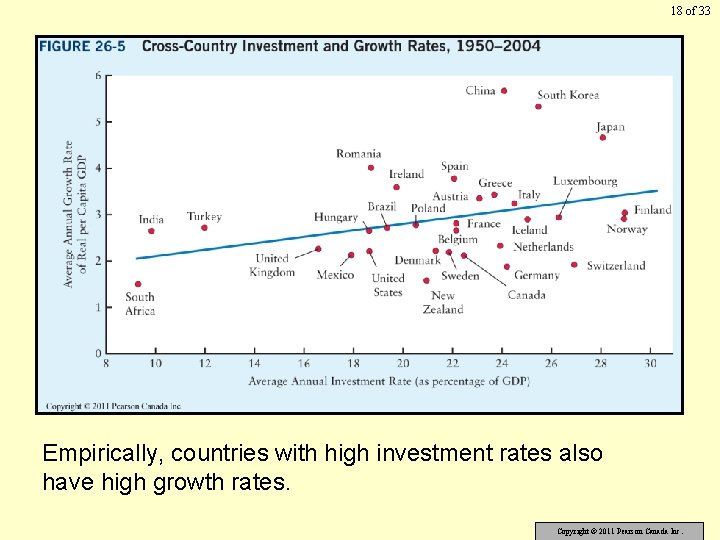

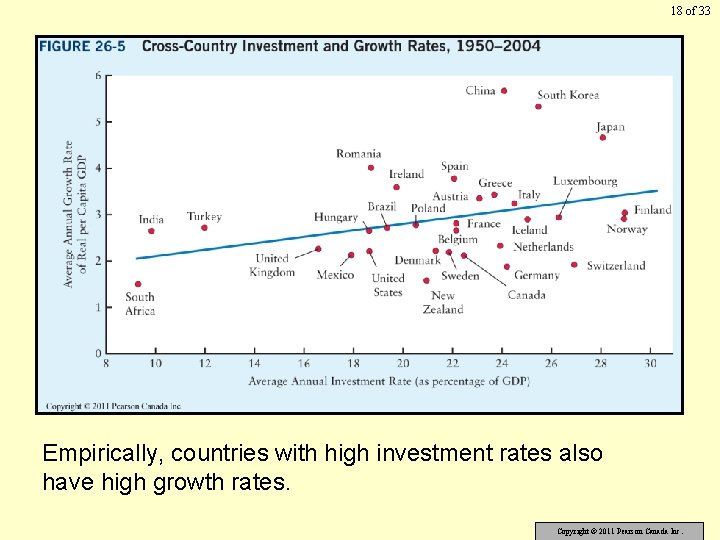

18 of 33 Empirically, countries with high investment rates also have high growth rates. Copyright © 2011 Pearson Canada Inc.

19 of 33 We have been discussing the relationship between investment and saving in a model of a closed economy. In the reality of today’s globalized financial markets, however, billions of dollars of financial capital flow across international boundaries every day. For more details about how our model can be modified for an open economy, look for Investment and Saving in Globalized Financial Markets in the Additional Topics section of this book’s My. Econ. Lab. www. myeconlab. com Copyright © 2011 Pearson Canada Inc.

20 of 33 Neoclassical Growth Theory This theory begins with the idea of an aggregate production function: GDP = FT(L, K, H) - L is the total amount of labour - K is the stock of physical capital (including natural resources) - H is the quality of human capital - T is the state of technology The notation FT reflects the assumption that changes in technology will change the production function. Copyright © 2011 Pearson Canada Inc.

21 of 33 The key assumptions about the aggregate production function are: 1. Diminishing marginal product of both K and L - when either factor is changed in isolation 2. Constant returns to scale - when both K and L are changed in equal proportions Copyright © 2011 Pearson Canada Inc.

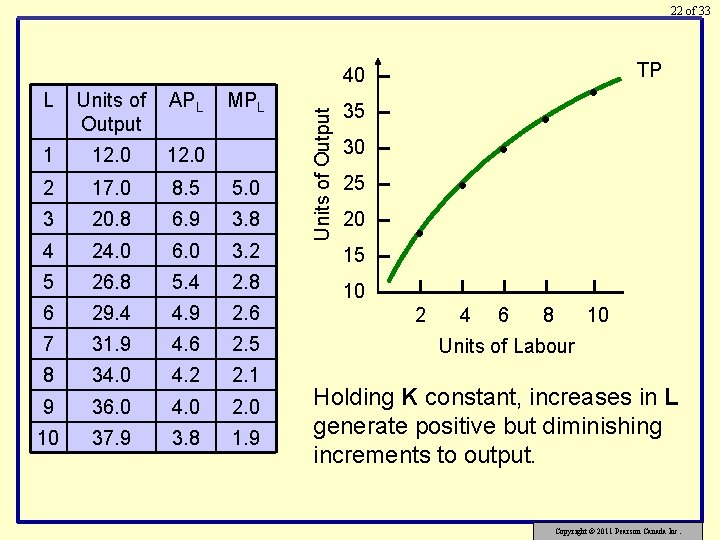

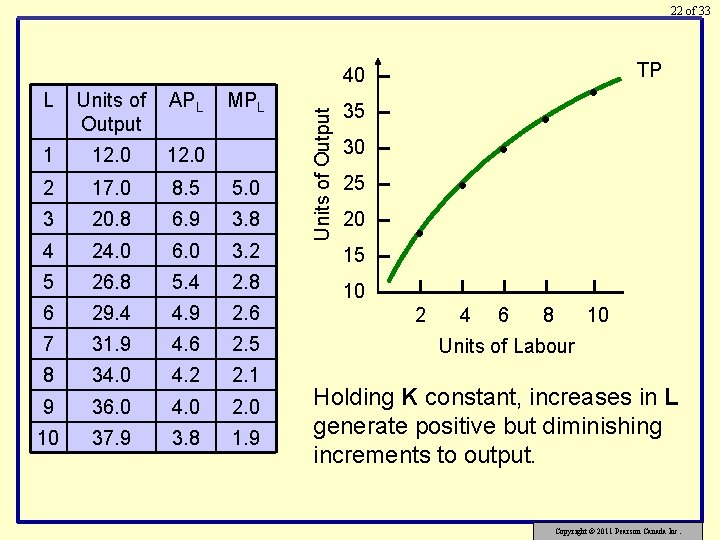

22 of 33 L Units of Output APL MPL 1 12. 0 2 17. 0 8. 5 5. 0 3 20. 8 6. 9 3. 8 4 24. 0 6. 0 3. 2 5 26. 8 5. 4 2. 8 6 29. 4 4. 9 2. 6 7 31. 9 4. 6 2. 5 8 34. 0 4. 2 2. 1 9 36. 0 4. 0 2. 0 10 37. 9 3. 8 1. 9 Units of Output 40 • 35 • 30 • 25 20 15 TP • • 10 2 4 6 8 10 Units of Labour Holding K constant, increases in L generate positive but diminishing increments to output. Copyright © 2011 Pearson Canada Inc.

23 of 33 What are the central predictions for this model? According to the law of diminishing returns, the MP of L eventually falls as each successive unit of L is used (for a fixed amount of other factors). increases in population lead to increases in GDP but eventually to reductions in per capita GDP MP of L falling implies AP of L is falling average living standards Copyright © 2011 Pearson Canada Inc.

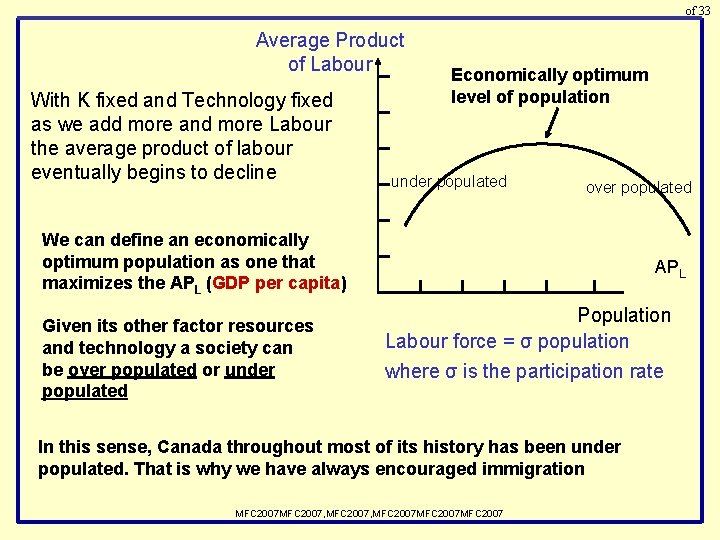

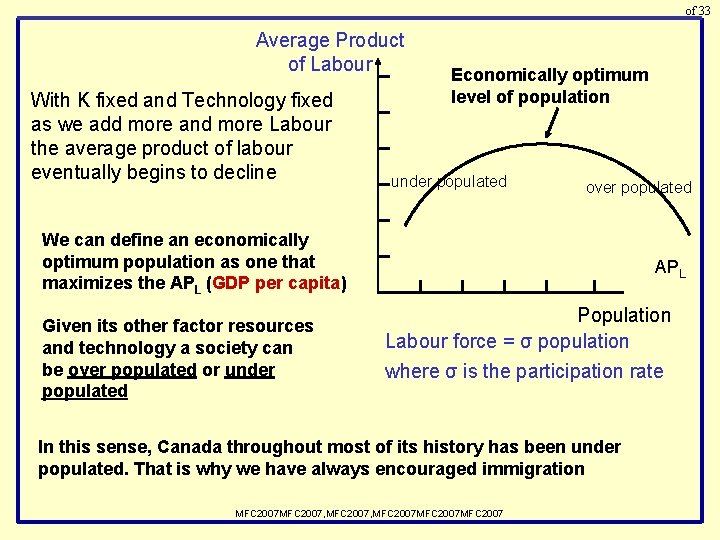

of 33 Average Product of Labour With K fixed and Technology fixed as we add more and more Labour the average product of labour eventually begins to decline Economically optimum level of population under populated over populated We can define an economically optimum population as one that maximizes the APL (GDP per capita) Given its other factor resources and technology a society can be over populated or under populated APL Population Labour force = σ population where σ is the participation rate In this sense, Canada throughout most of its history has been under populated. That is why we have always encouraged immigration MFC 2007, MFC 2007 MFC 2007

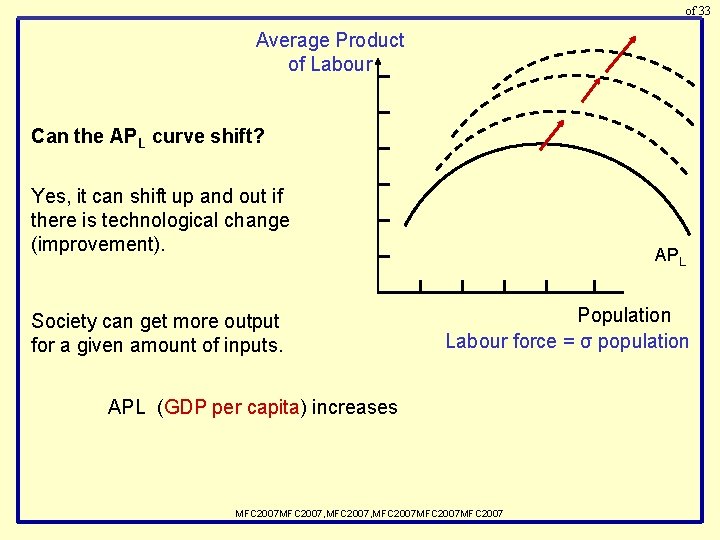

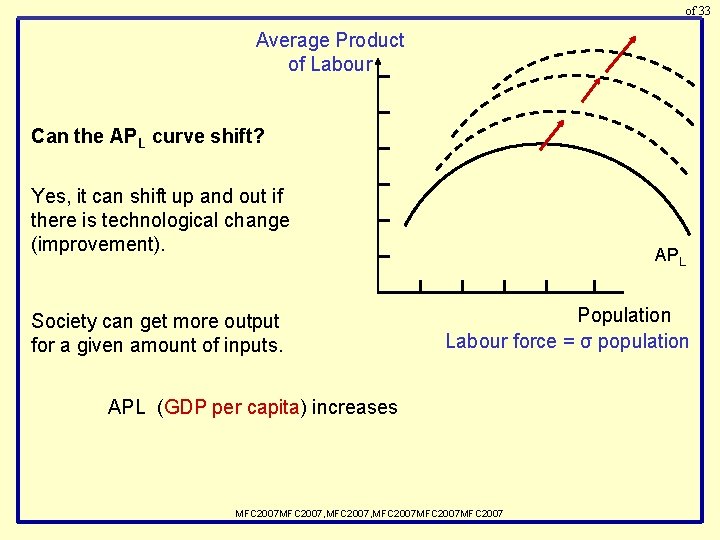

of 33 Average Product of Labour Can the APL curve shift? Yes, it can shift up and out if there is technological change (improvement). Society can get more output for a given amount of inputs. APL Population Labour force = σ population APL (GDP per capita) increases MFC 2007, MFC 2007 MFC 2007

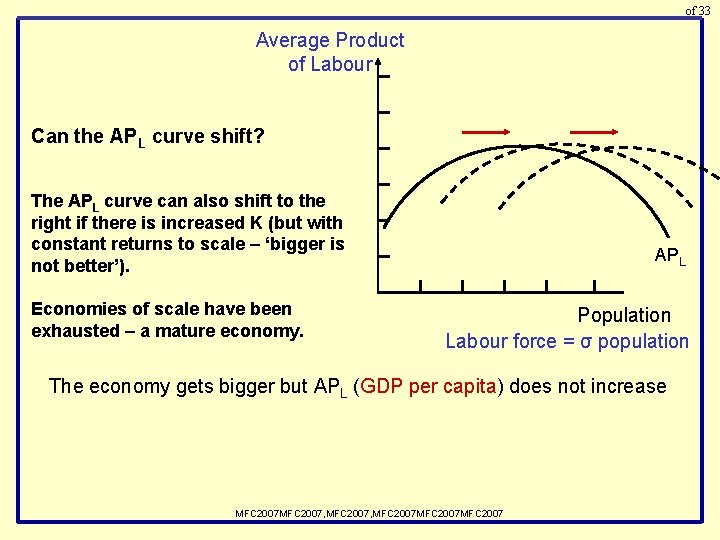

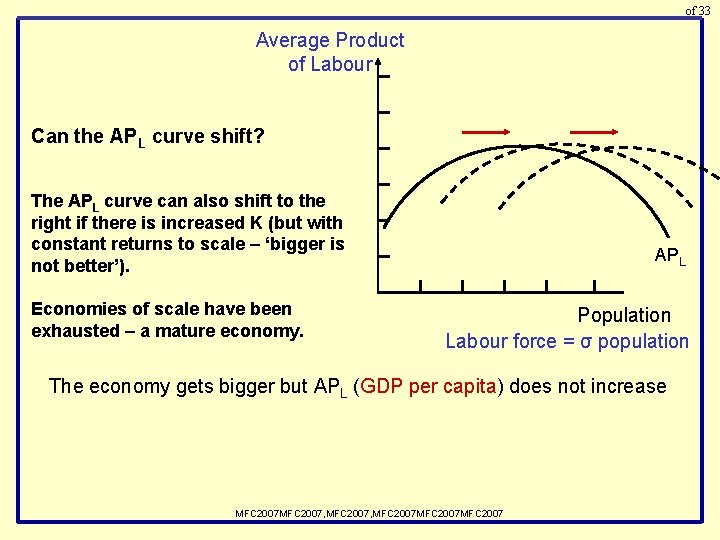

of 33 Average Product of Labour Can the APL curve shift? The APL curve can also shift to the right if there is increased K (but with constant returns to scale – ‘bigger is not better’). Economies of scale have been exhausted – a mature economy. APL Population Labour force = σ population The economy gets bigger but APL (GDP per capita) does not increase MFC 2007, MFC 2007 MFC 2007

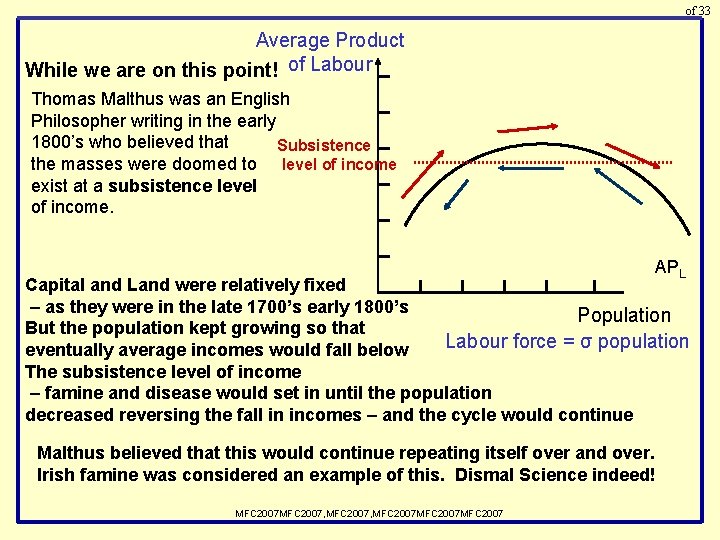

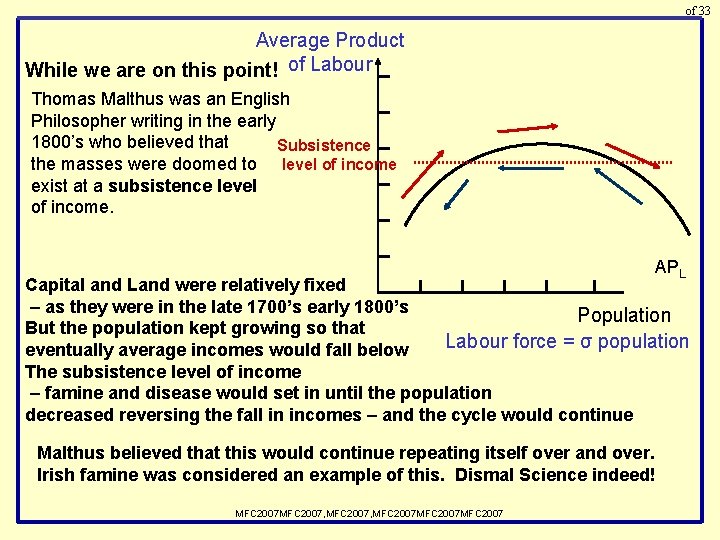

of 33 Average Product While we are on this point! of Labour Thomas Malthus was an English Philosopher writing in the early 1800’s who believed that Subsistence the masses were doomed to level of income exist at a subsistence level of income. APL Capital and Land were relatively fixed – as they were in the late 1700’s early 1800’s Population But the population kept growing so that Labour force = σ population eventually average incomes would fall below The subsistence level of income – famine and disease would set in until the population decreased reversing the fall in incomes – and the cycle would continue Malthus believed that this would continue repeating itself over and over. Irish famine was considered an example of this. Dismal Science indeed! MFC 2007, MFC 2007 MFC 2007

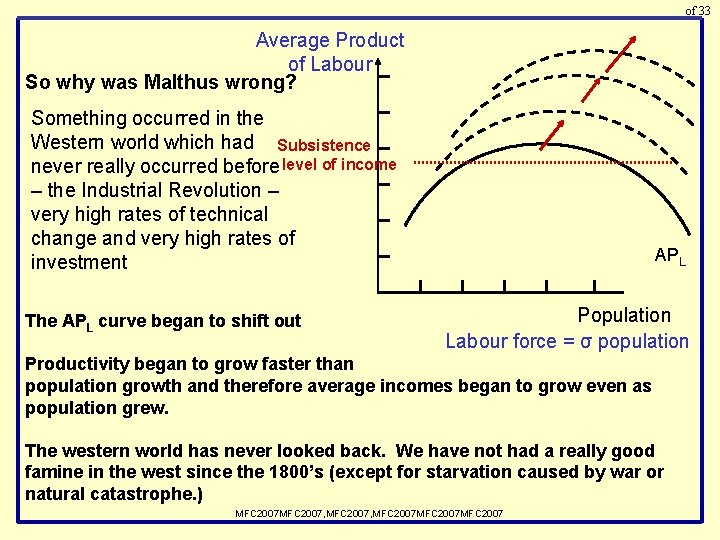

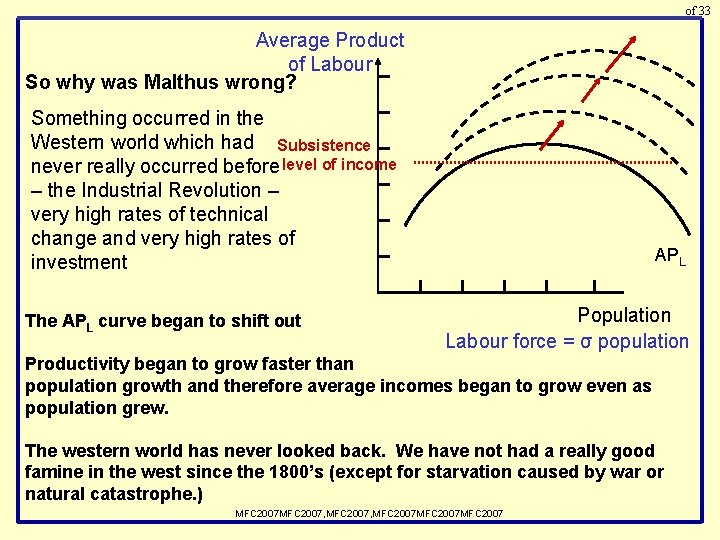

of 33 Average Product of Labour So why was Malthus wrong? Something occurred in the Western world which had Subsistence never really occurred before level of income – the Industrial Revolution – very high rates of technical change and very high rates of investment The APL curve began to shift out APL Population Labour force = σ population Productivity began to grow faster than population growth and therefore average incomes began to grow even as population grew. The western world has never looked back. We have not had a really good famine in the west since the 1800’s (except for starvation caused by war or natural catastrophe. ) MFC 2007, MFC 2007 MFC 2007

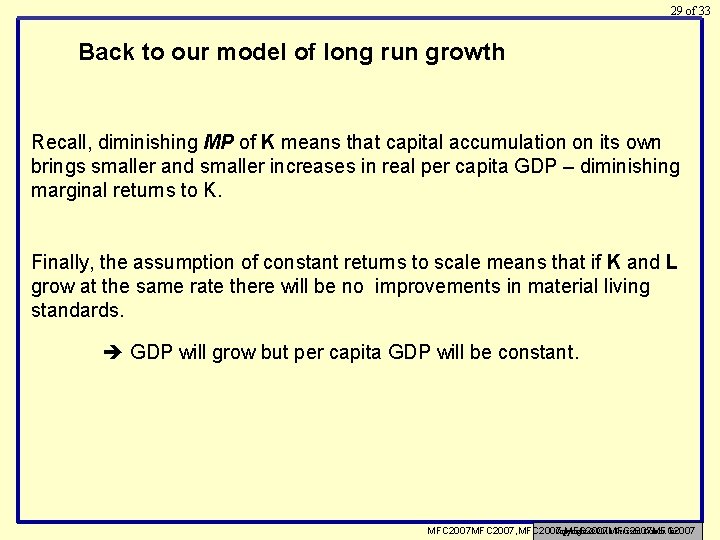

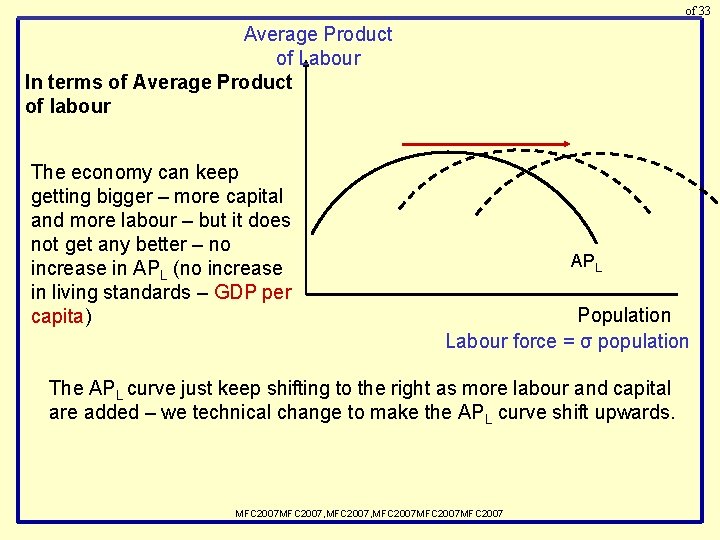

29 of 33 Back to our model of long run growth Recall, diminishing MP of K means that capital accumulation on its own brings smaller and smaller increases in real per capita GDP – diminishing marginal returns to K. Finally, the assumption of constant returns to scale means that if K and L grow at the same rate there will be no improvements in material living standards. GDP will grow but per capita GDP will be constant. Copyright © 2011 Pearson Canada Inc. MFC 2007, MFC 2007 MFC 2007

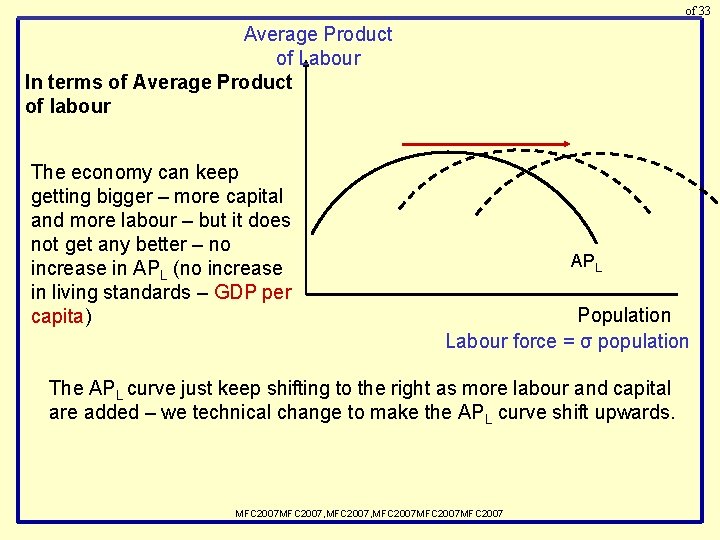

of 33 Average Product of Labour In terms of Average Product of labour The economy can keep getting bigger – more capital and more labour – but it does not get any better – no increase in APL (no increase in living standards – GDP per capita) APL Population Labour force = σ population The APL curve just keep shifting to the right as more labour and capital are added – we technical change to make the APL curve shift upwards. MFC 2007, MFC 2007 MFC 2007

31 of 33 In the Neoclassical growth model, technological change is necessary for sustained growth in living standards. Much technological change is embodied in new capital equipment investment is crucial Measuring the extent of technological change is difficult – because it is not directly observable. Copyright © 2011 Pearson Canada Inc.

of 33 In the Neoclassical growth model, technological change is necessary for sustained growth in living standards – for mature economies. What about LDC’s? But the process of technical change itself is not explained. Technical change is exogenous in the Neoclassical Growth Model. All the can be said is that much technological change is embodied in new capital equipment investment is crucial MFC 2007, MFC 2007 MFC 2007

33 of 33 Robert Solow (MIT) - his “growth accounting” method estimates technical change as the part of growth that is unexplained by capital accumulation or labour-force growth the “Solow Residual” The most important element of the growth model for mature economies remains a mystery in the Neoclassical Growth Model LESSONS FROM HISTORY 26 -1 Should Workers Be Afraid of Technological Change? Copyright © 2011 Pearson Canada Inc.

34 of 33 The aging of Canada’s baby-boom generation over the next three decades will lead to a reduction in Canadian economic growth and will produce challenges for Canadian governments. For more details, see The Economic and Fiscal Challenges of Population Aging in the Additional Topics section of this book’s My. Econ. Lab. www. myeconlab. com Copyright © 2011 Pearson Canada Inc.

35 of 33 26. 3 New Growth Theories Endogenous Technological Change New growth theory emphasizes the process of innovation and the incorporation of new technology: • learning-by-doing ‘the more you do the more you can do’ • knowledge transfer ‘hands on’ experience • market structure and innovation • shocks and innovation competitive pressure spur innovation Copyright © 2011 Pearson Canada Inc.

36 of 33 Increasing Marginal Returns New growth theories also emphasize the possibility that each new increment of investment is more productive than the last. - contrasts with the Neoclassical assumption of diminishing marginal returns. The sources of increasing returns usually fall into one of two categories: • market-development costs • increasing returns to knowledge Copyright © 2011 Pearson Canada Inc.

of 33 Increasing Marginal Returns • market-development costs (all of these decrease cost as more and more investment is made) • Externalities in factor supplies as the investment grows • Development of infrastructure as investment grows • Fixed start-up design and production cost are less as investment grows • increasing returns to knowledge • The ‘public good’ nature of new ideas (as opposed to physical goods) – and ‘idea’ economy grows faster than a ‘goods’ economy MFC 2007, MFC 2007 MFC 2007

38 of 33 26. 4 Are There Limits to Growth? Resource Exhaustion Current technology and resources could not support the entire world’s population at the average Canadian standard of living. - but absolute limits to growth may not be relevant - technology is constantly improving, suggesting that living standards can continually improve - but technological improvements are not automatic — they do not “just happen” Copyright © 2011 Pearson Canada Inc.

39 of 33 Environmental Degradation Conscious management of pollution was unnecessary when the world’s population was one billion people, but such management has now become a pressing matter. Conclusion Growth can help the world address many problems. But further growth must be sustainable growth, which should be based on knowledge-driven technological change. Copyright © 2011 Pearson Canada Inc.

40 of 33 APPLYING ECONOMIC CONCEPTS 26 -3 Climate Change and Economic Growth Many of the insights about the determinants of economic growth that we explored in this chapter apply also to economic growth in the developing countries. But the developing countries also have some unique economic and institutional challenges, some which have plagued them for many years. For a detailed discussion, look for Challenges Facing the Developing Countries in the Additional Topics section of this book’s My. Econ. Lab. www. myeconlab. com Copyright © 2011 Pearson Canada Inc.

41 of 33 Copyright © 2011 Pearson Canada Inc.

Longrun cost

Longrun cost Economic growth vs economic development

Economic growth vs economic development Economic growth vs economic development

Economic growth vs economic development What is plant growth analysis

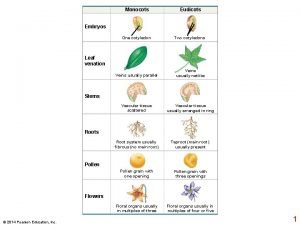

What is plant growth analysis Monocots eudicots

Monocots eudicots Step growth polymerization vs chain growth

Step growth polymerization vs chain growth Primary growth and secondary growth in plants

Primary growth and secondary growth in plants Vascular ray

Vascular ray Geometric growth population

Geometric growth population Neoclassical growth theory vs. endogenous growth theory

Neoclassical growth theory vs. endogenous growth theory Difference between organic and inorganic growth

Difference between organic and inorganic growth Harrod domar growth model

Harrod domar growth model Solow's model of economic growth

Solow's model of economic growth Interest rates and economic growth

Interest rates and economic growth Ppc curve economic growth

Ppc curve economic growth Long run economic growth

Long run economic growth Long run economic growth graph

Long run economic growth graph Stages of development geography

Stages of development geography Solow model of economic growth

Solow model of economic growth Solow's model of economic growth

Solow's model of economic growth Short run economic growth graph

Short run economic growth graph Real business cycle theory

Real business cycle theory Importance of economic growth

Importance of economic growth Brazil's quest for economic growth

Brazil's quest for economic growth Economic growth is defined as

Economic growth is defined as Economic growth is defined as

Economic growth is defined as Economic growth and development

Economic growth and development Economic growth occurs when

Economic growth occurs when Models of development ppt

Models of development ppt Economic growth trends

Economic growth trends Combination of inflation and unmoving economic growth

Combination of inflation and unmoving economic growth Saving makes economic growth possible because

Saving makes economic growth possible because Linear stage theory

Linear stage theory Corporate governance and economic growth

Corporate governance and economic growth Lesson 2 our economic choices

Lesson 2 our economic choices Growth curve microbiology

Growth curve microbiology Nail structure and growth

Nail structure and growth Chapter 30 money growth and inflation

Chapter 30 money growth and inflation Copyright

Copyright Section 8-2 cell division

Section 8-2 cell division Lesson 2 moving west

Lesson 2 moving west Chapter 25 production and growth

Chapter 25 production and growth