SOLID WASTE PROGRAM FUNDING OPTIONS Solid Waste Advisory

- Slides: 26

SOLID WASTE PROGRAM FUNDING OPTIONS Solid Waste Advisory Committee Waste and Hazardous Materials Division October 23, 2009

September 11, 2009, SWAC meeting accomplishments: • Discussed and re-evaluated criteria • Discussed all funding options brainstormed at July SWAC meeting • Agreed to complete an evaluation of each funding option as homework – 9 responses received 2

Process Goals • • Discuss level of funding necessary Evaluate top five funding options Choose funding option(s) WHMD will submit funding proposal outline to DEQ management for fiscal year (FY) 2011 on Monday • Funding proposal write-up due November 9, 2009 3

Today’s Objectives • Discuss level of activity to be funded – Current (39 Full Time Equivalent [FTE]) – Core (42 FTE) – Future (? ? FTE) • Examine the top five funding options • Decide which funding option(s) will be recommended to Governor – FY 2011 – FY 2012 + 4

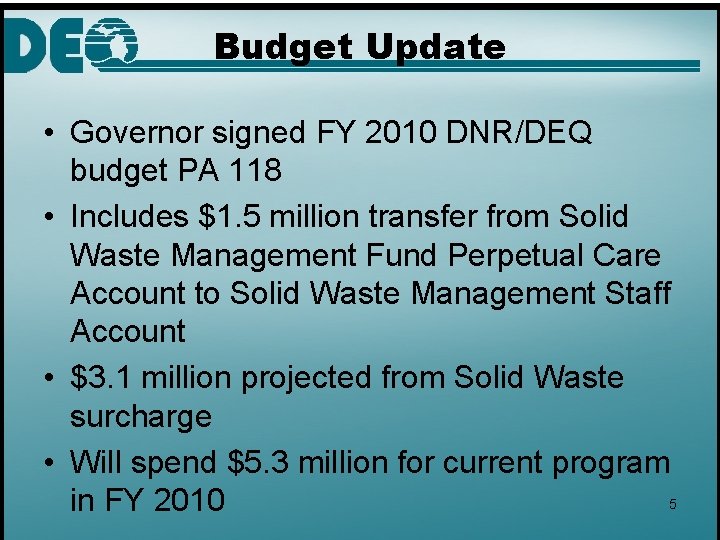

Budget Update • Governor signed FY 2010 DNR/DEQ budget PA 118 • Includes $1. 5 million transfer from Solid Waste Management Fund Perpetual Care Account to Solid Waste Management Staff Account • $3. 1 million projected from Solid Waste surcharge • Will spend $5. 3 million for current program 5 in FY 2010

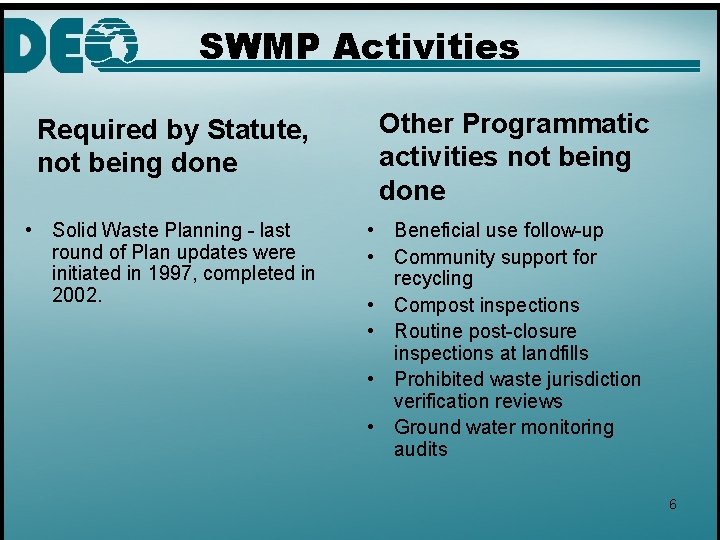

SWMP Activities Required by Statute, not being done • Solid Waste Planning - last round of Plan updates were initiated in 1997, completed in 2002. Other Programmatic activities not being done • Beneficial use follow-up • Community support for recycling • Compost inspections • Routine post-closure inspections at landfills • Prohibited waste jurisdiction verification reviews • Ground water monitoring audits 6

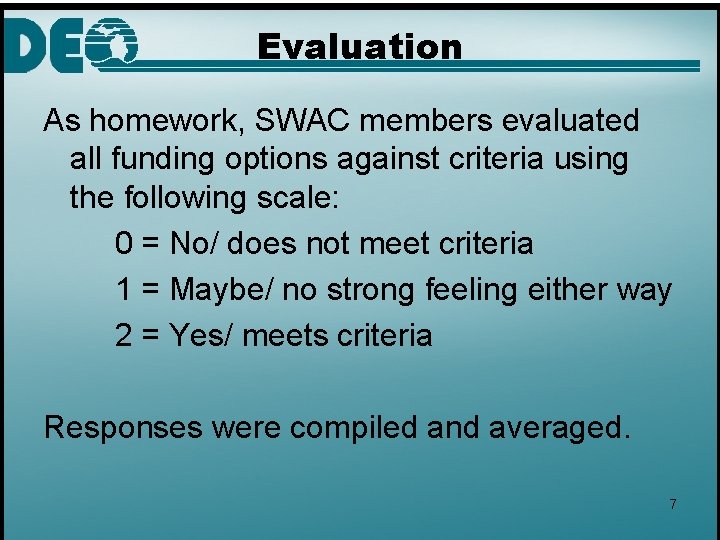

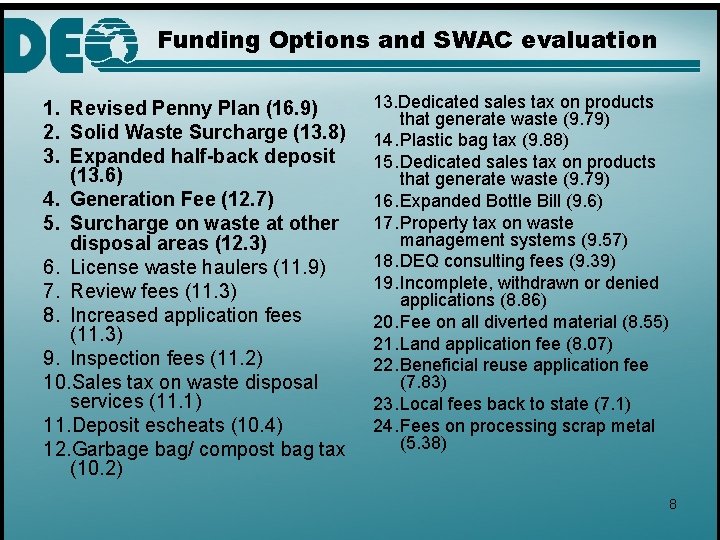

Evaluation As homework, SWAC members evaluated all funding options against criteria using the following scale: 0 = No/ does not meet criteria 1 = Maybe/ no strong feeling either way 2 = Yes/ meets criteria Responses were compiled and averaged. 7

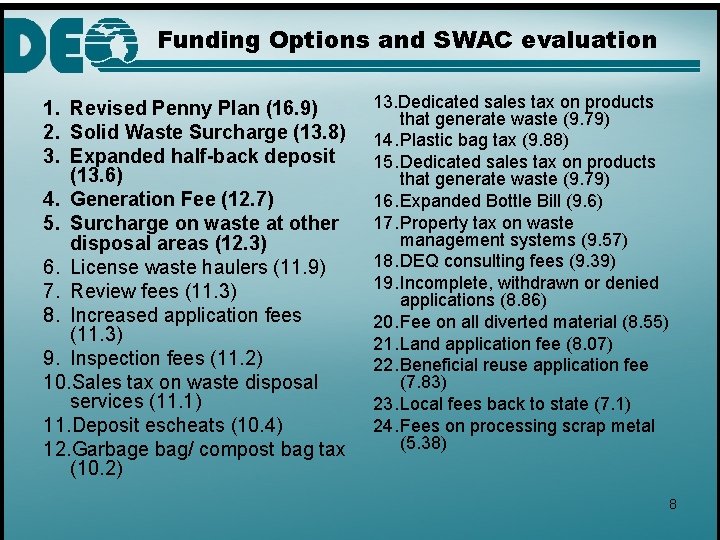

Funding Options and SWAC evaluation 1. Revised Penny Plan (16. 9) 2. Solid Waste Surcharge (13. 8) 3. Expanded half-back deposit (13. 6) 4. Generation Fee (12. 7) 5. Surcharge on waste at other disposal areas (12. 3) 6. License waste haulers (11. 9) 7. Review fees (11. 3) 8. Increased application fees (11. 3) 9. Inspection fees (11. 2) 10. Sales tax on waste disposal services (11. 1) 11. Deposit escheats (10. 4) 12. Garbage bag/ compost bag tax (10. 2) 13. Dedicated sales tax on products that generate waste (9. 79) 14. Plastic bag tax (9. 88) 15. Dedicated sales tax on products that generate waste (9. 79) 16. Expanded Bottle Bill (9. 6) 17. Property tax on waste management systems (9. 57) 18. DEQ consulting fees (9. 39) 19. Incomplete, withdrawn or denied applications (8. 86) 20. Fee on all diverted material (8. 55) 21. Land application fee (8. 07) 22. Beneficial reuse application fee (7. 83) 23. Local fees back to state (7. 1) 24. Fees on processing scrap metal (5. 38) 8

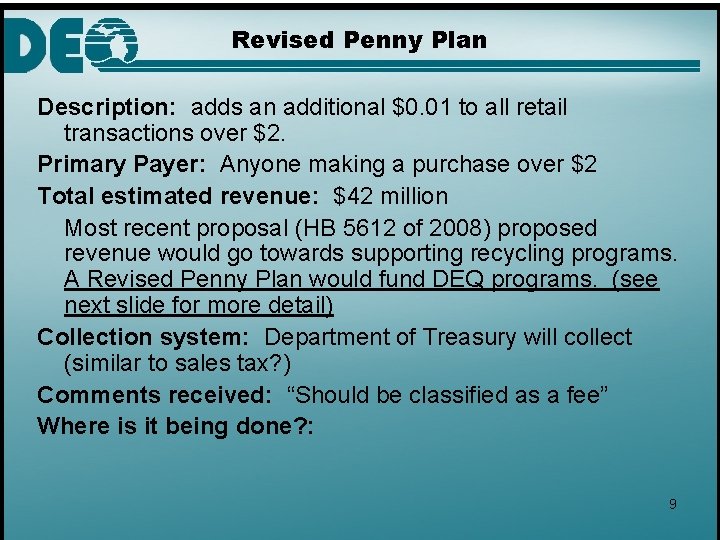

Revised Penny Plan Description: adds an additional $0. 01 to all retail transactions over $2. Primary Payer: Anyone making a purchase over $2 Total estimated revenue: $42 million Most recent proposal (HB 5612 of 2008) proposed revenue would go towards supporting recycling programs. A Revised Penny Plan would fund DEQ programs. (see next slide for more detail) Collection system: Department of Treasury will collect (similar to sales tax? ) Comments received: “Should be classified as a fee” Where is it being done? : 9

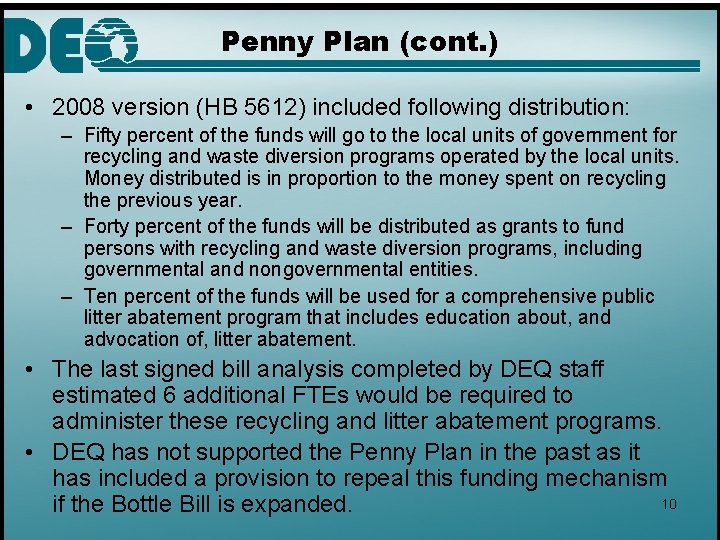

Penny Plan (cont. ) • 2008 version (HB 5612) included following distribution: – Fifty percent of the funds will go to the local units of government for recycling and waste diversion programs operated by the local units. Money distributed is in proportion to the money spent on recycling the previous year. – Forty percent of the funds will be distributed as grants to fund persons with recycling and waste diversion programs, including governmental and nongovernmental entities. – Ten percent of the funds will be used for a comprehensive public litter abatement program that includes education about, and advocation of, litter abatement. • The last signed bill analysis completed by DEQ staff estimated 6 additional FTEs would be required to administer these recycling and litter abatement programs. • DEQ has not supported the Penny Plan in the past as it has included a provision to repeal this funding mechanism 10 if the Bottle Bill is expanded.

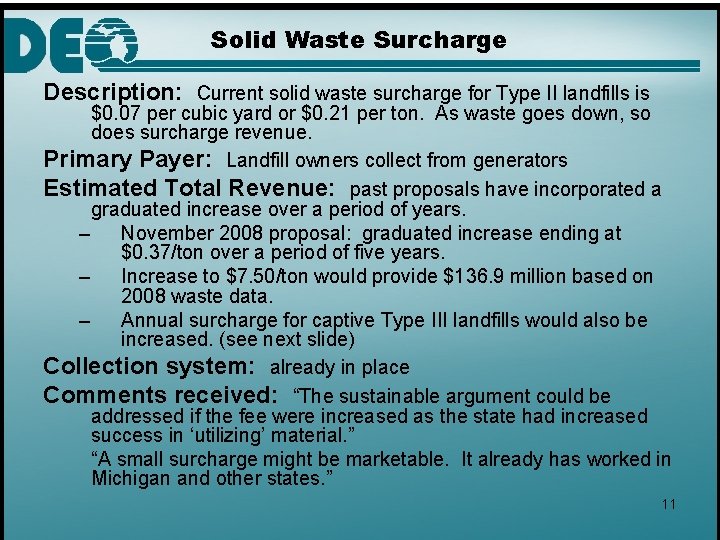

Solid Waste Surcharge Description: Current solid waste surcharge for Type II landfills is $0. 07 per cubic yard or $0. 21 per ton. As waste goes down, so does surcharge revenue. Primary Payer: Landfill owners collect from generators Estimated Total Revenue: past proposals have incorporated a graduated increase over a period of years. – November 2008 proposal: graduated increase ending at $0. 37/ton over a period of five years. – Increase to $7. 50/ton would provide $136. 9 million based on 2008 waste data. – Annual surcharge for captive Type III landfills would also be increased. (see next slide) Collection system: already in place Comments received: “The sustainable argument could be addressed if the fee were increased as the state had increased success in ‘utilizing’ material. ” “A small surcharge might be marketable. It already has worked in Michigan and other states. ” 11

Other State’s surcharges Where is it being done? Illinois approx $2. 22/ton Iowa $3. 25 to $4. 75/ton Wisconsin $5. 90/ton Ohio $3. 50/ton (proposed $4. 75) Pennsylvania $4/ton 12

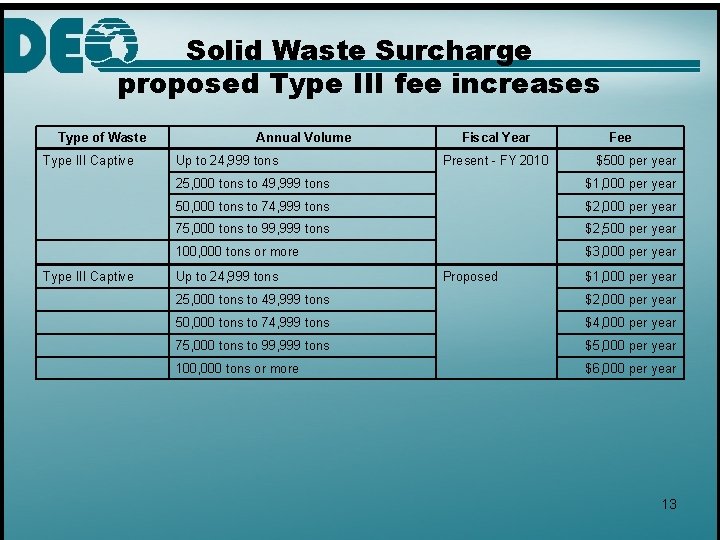

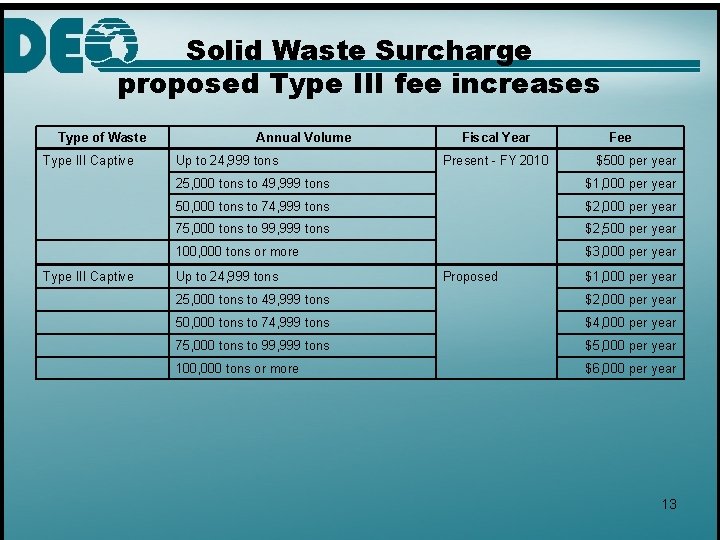

Solid Waste Surcharge proposed Type III fee increases Type of Waste Type III Captive Annual Volume Up to 24, 999 tons Fiscal Year Present - FY 2010 Fee $500 per year 25, 000 tons to 49, 999 tons $1, 000 per year 50, 000 tons to 74, 999 tons $2, 000 per year 75, 000 tons to 99, 999 tons $2, 500 per year 100, 000 tons or more $3, 000 per year Up to 24, 999 tons Proposed $1, 000 per year 25, 000 tons to 49, 999 tons $2, 000 per year 50, 000 tons to 74, 999 tons $4, 000 per year 75, 000 tons to 99, 999 tons $5, 000 per year 100, 000 tons or more $6, 000 per year 13

Expanded Half-Back Deposit Description: A $0. 10 deposit is paid on an expanded list of beverage containers and $0. 05 is returned at time of redemption. Primary Payer: Anyone purchasing a beverage container Estimated Total Revenue: $400, 000/year Collection system: similar to current system, the state would just keep half Comments received: “Need allowance for and method to direct funds redemption/take back centers to take pressure off stores. ” “NO. Deposits prevent comprehensive recycling from being implemented. ” “Concern that there will be a huge education program needed as well as a new state program to manage this. ” Where is it being done? Nova Scotia has half back deposit on all beverage containers except milk. 14

Generation Fees Description: A fee is applied to all waste generators by type; does not depend on how much is generated- flat fee Primary Payer: residential, commercial and industrial waste generators Estimated Total Revenue: $3 to $12/ton Collection system: would need to be developed Comments received: “not enough info to evaluate. ” “PAYT but it would be hard to market to the public. ” Where is it being done: Ohio, Eaton County, Genesee County 15

Surcharge assessed on waste disposed at other disposal areas . Description: Currently the solid waste surcharge is only assessed on waste in landfills, it is not charged on waste sent to municipal solid waste incinerators, materials sent to Material Recovery Facilities (MRFs), or yard clippings sent to registered composting facilities. – While Michigan’s 3 municipal solid waste incinerators currently are not required to report waste volumes to the DEQ, the DEQ understands that the volumes represent approximately 5 percent of the total volume of solid waste disposed of in Michigan each year. This would amount to 2, 855, 994 cubic yards in 2008. – According to the 2001 Recycling Measurement Project completed by the MRC (the most recent data available), approximately 5, 431, 026 cubic yards of material were processed by MRFs. – In 2008, 1, 103, 897 cubic yards of yard clippings were at registered compost sites. 16

Expanded Surcharge (cont. ) Primary Payer: Landfills, Incinerators, MRF owners and/or registered compost facilities Where is it being done? Estimated Total Revenue: If the current surcharge was extended to include all listed disposal options it would generate an additional $657, 364 annually. • Could assess different rates for different disposal options Collection system: Already set up and working, would have to include Incinerators, MRFs, and/or registered composting facilities. Comments received: “It is fair and may encourage recycling since it supports a PAYT system. ” 17

Funding Option Discussion • Which options should we focus on? • Can any of these work together to provide a “portfolio” approach? 18

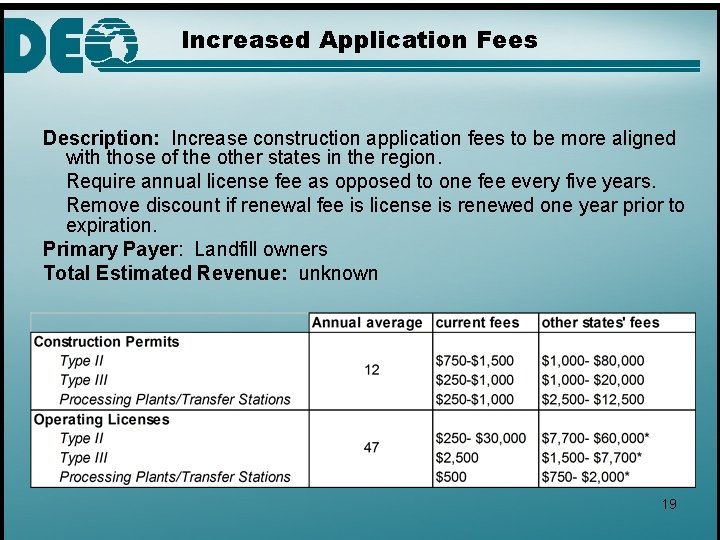

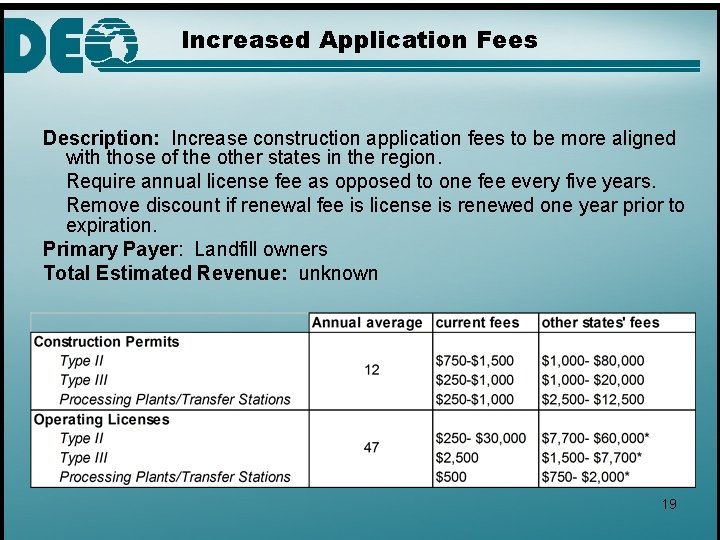

Increased Application Fees Description: Increase construction application fees to be more aligned with those of the other states in the region. Require annual license fee as opposed to one fee every five years. Remove discount if renewal fee is license is renewed one year prior to expiration. Primary Payer: Landfill owners Total Estimated Revenue: unknown 19

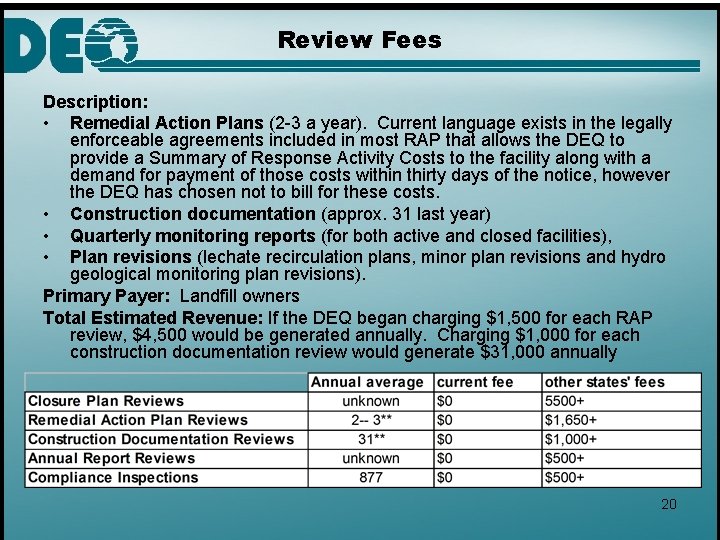

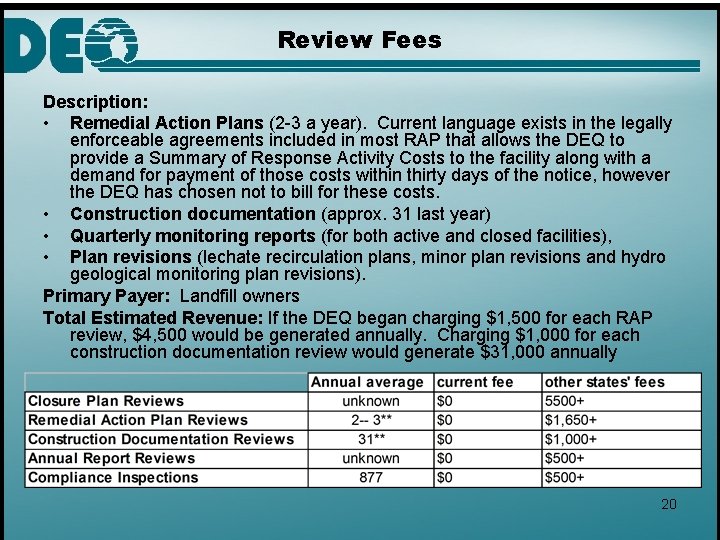

Review Fees Description: • Remedial Action Plans (2 -3 a year). Current language exists in the legally enforceable agreements included in most RAP that allows the DEQ to provide a Summary of Response Activity Costs to the facility along with a demand for payment of those costs within thirty days of the notice, however the DEQ has chosen not to bill for these costs. • Construction documentation (approx. 31 last year) • Quarterly monitoring reports (for both active and closed facilities), • Plan revisions (lechate recirculation plans, minor plan revisions and hydro geological monitoring plan revisions). Primary Payer: Landfill owners Total Estimated Revenue: If the DEQ began charging $1, 500 for each RAP review, $4, 500 would be generated annually. Charging $1, 000 for each construction documentation review would generate $31, 000 annually 20

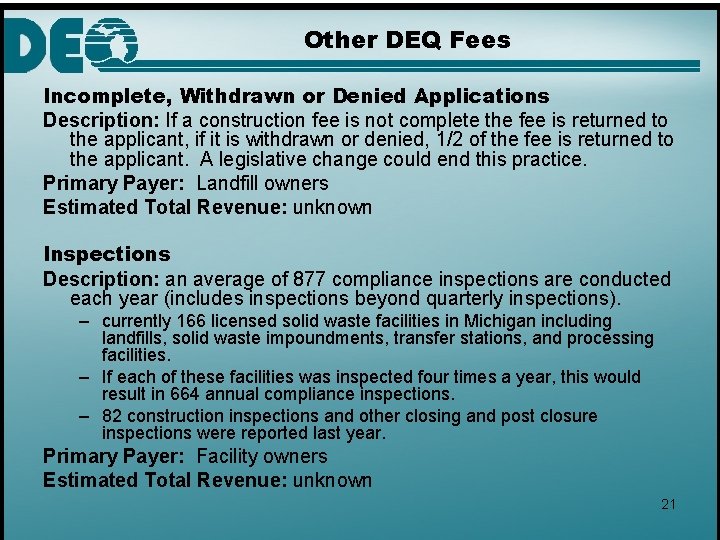

Other DEQ Fees Incomplete, Withdrawn or Denied Applications Description: If a construction fee is not complete the fee is returned to the applicant, if it is withdrawn or denied, 1/2 of the fee is returned to the applicant. A legislative change could end this practice. Primary Payer: Landfill owners Estimated Total Revenue: unknown Inspections Description: an average of 877 compliance inspections are conducted each year (includes inspections beyond quarterly inspections). – currently 166 licensed solid waste facilities in Michigan including landfills, solid waste impoundments, transfer stations, and processing facilities. – If each of these facilities was inspected four times a year, this would result in 664 annual compliance inspections. – 82 construction inspections and other closing and post closure inspections were reported last year. Primary Payer: Facility owners Estimated Total Revenue: unknown 21

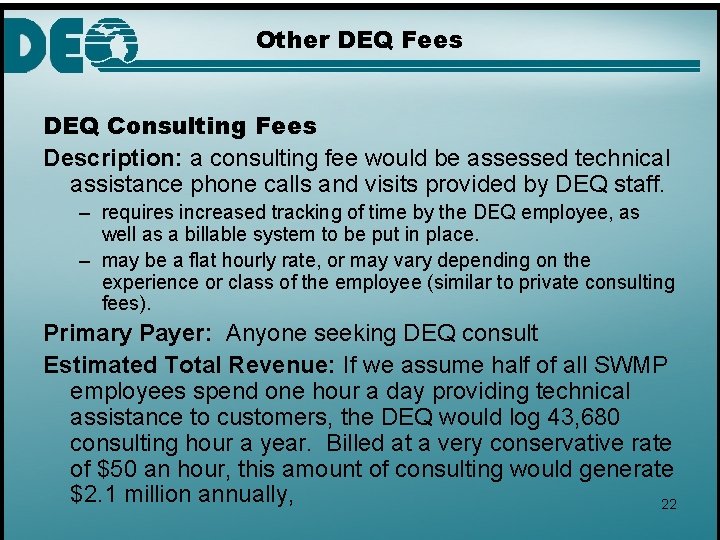

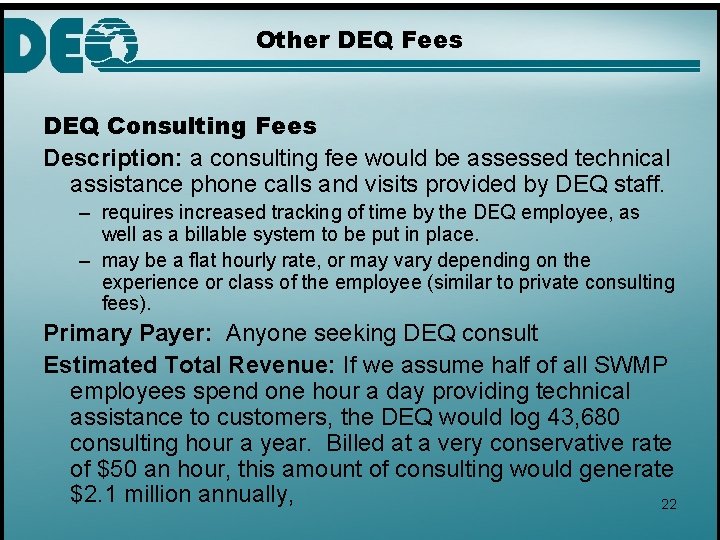

Other DEQ Fees DEQ Consulting Fees Description: a consulting fee would be assessed technical assistance phone calls and visits provided by DEQ staff. – requires increased tracking of time by the DEQ employee, as well as a billable system to be put in place. – may be a flat hourly rate, or may vary depending on the experience or class of the employee (similar to private consulting fees). Primary Payer: Anyone seeking DEQ consult Estimated Total Revenue: If we assume half of all SWMP employees spend one hour a day providing technical assistance to customers, the DEQ would log 43, 680 consulting hour a year. Billed at a very conservative rate of $50 an hour, this amount of consulting would generate $2. 1 million annually, 22

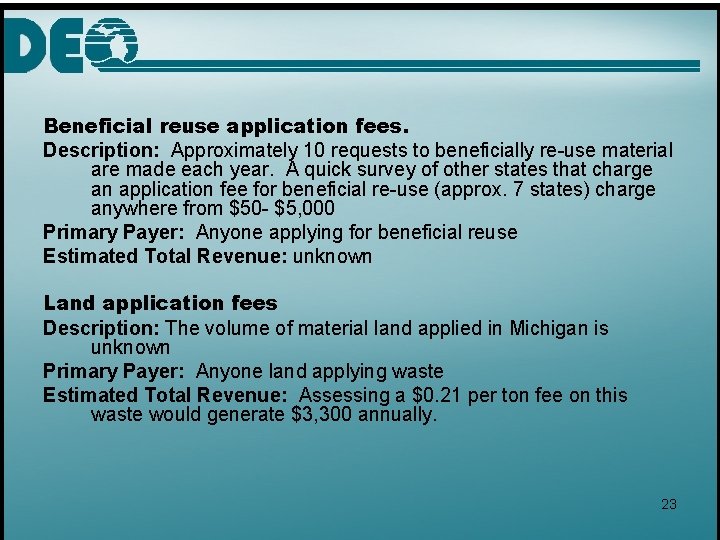

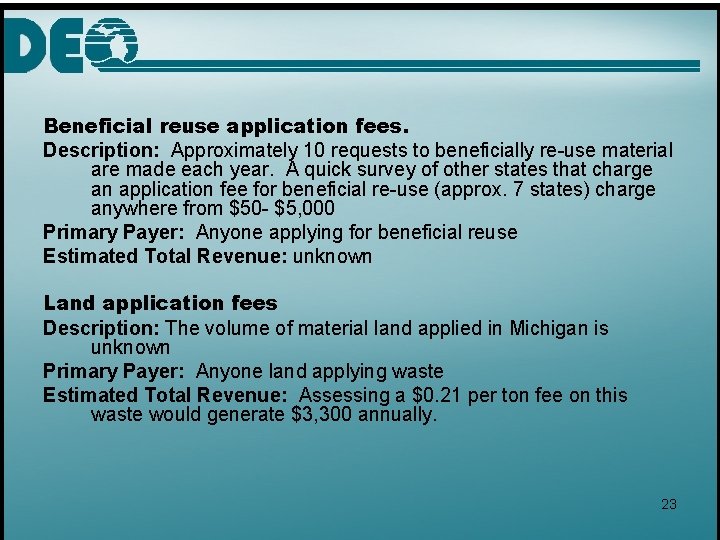

Beneficial reuse application fees. Description: Approximately 10 requests to beneficially re-use material are made each year. A quick survey of other states that charge an application fee for beneficial re-use (approx. 7 states) charge anywhere from $50 - $5, 000 Primary Payer: Anyone applying for beneficial reuse Estimated Total Revenue: unknown Land application fees Description: The volume of material land applied in Michigan is unknown Primary Payer: Anyone land applying waste Estimated Total Revenue: Assessing a $0. 21 per ton fee on this waste would generate $3, 300 annually. 23

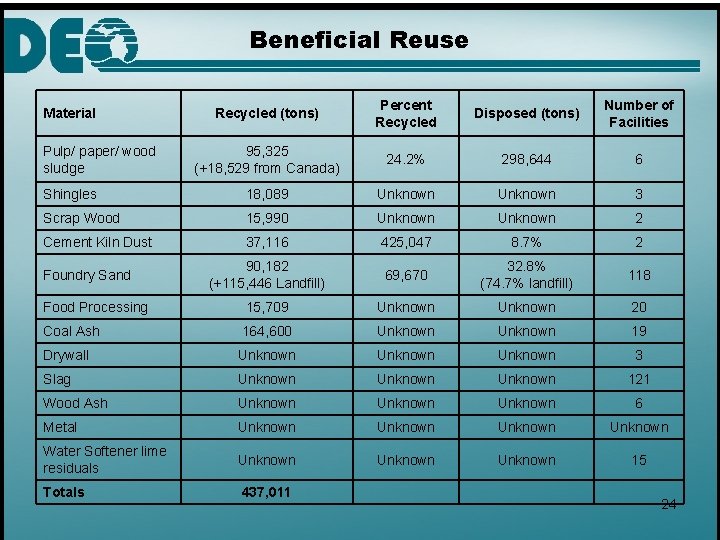

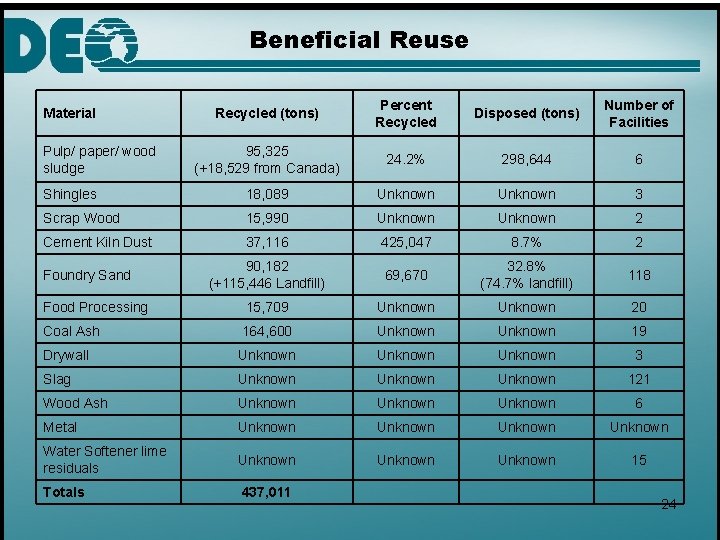

Beneficial Reuse Recycled (tons) Percent Recycled Disposed (tons) Number of Facilities 95, 325 (+18, 529 from Canada) 24. 2% 298, 644 6 Shingles 18, 089 Unknown 3 Scrap Wood 15, 990 Unknown 2 Cement Kiln Dust 37, 116 425, 047 8. 7% 2 90, 182 (+115, 446 Landfill) 69, 670 32. 8% (74. 7% landfill) 118 Food Processing 15, 709 Unknown 20 Coal Ash 164, 600 Unknown 19 Drywall Unknown 3 Slag Unknown 121 Wood Ash Unknown 6 Metal Unknown Water Softener lime residuals Unknown 15 Totals 437, 011 Material Pulp/ paper/ wood sludge Foundry Sand 24

Criteria • • Equitable Broad Based Reliable and Enforceable Easy to Pay and Collect Sustainable Marketable Encourages choices consistent with the goals of the Solid Waste Policy • Provides long term funding • Provides short term funding 25

Next Steps • Future meeting dates – Friday, November 6 9: 30 a. m. – 3 p. m. 26