Rayat Shikshan Sansthas S M JOSHI COLLEGE HADAPSAR

- Slides: 22

Rayat Shikshan Sanstha’s S. M. JOSHI COLLEGE, HADAPSAR, PUNE - 411028 Department of Commerce Prof. Gulave R. G.

FINAL ACCOUNTS OF BANKING COMPANIES

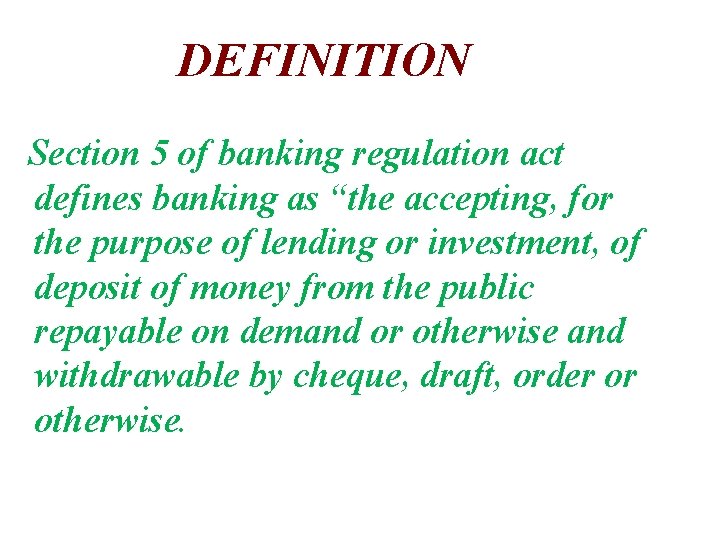

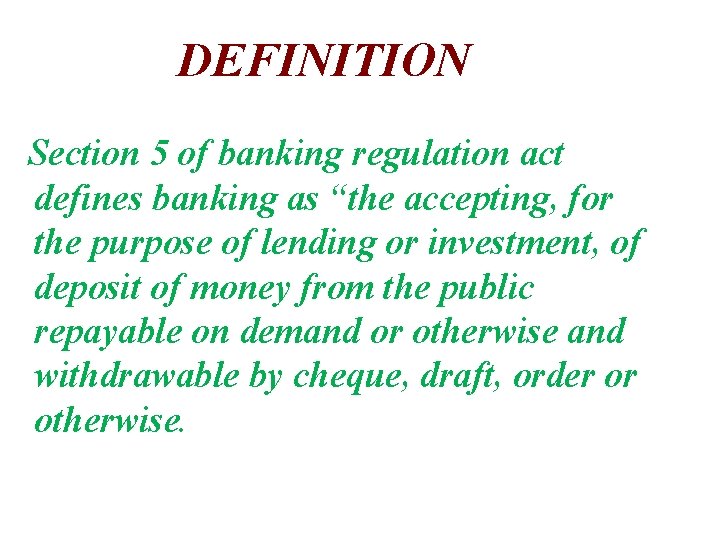

DEFINITION Section 5 of banking regulation act defines banking as “the accepting, for the purpose of lending or investment, of deposit of money from the public repayable on demand or otherwise and withdrawable by cheque, draft, order or otherwise.

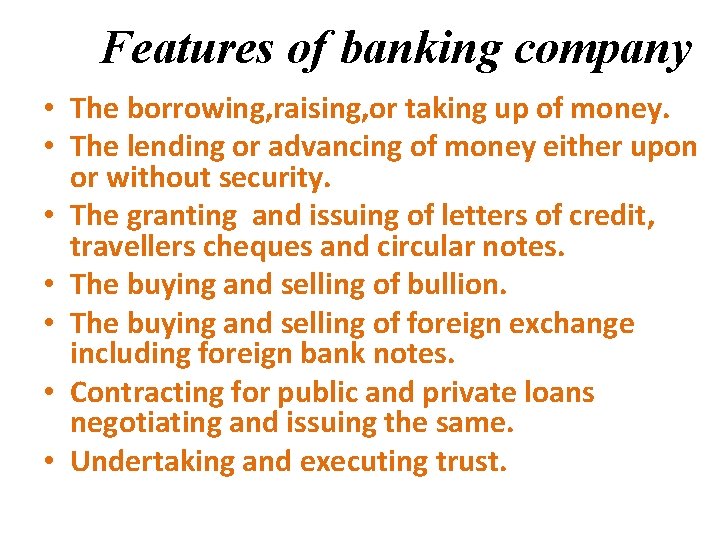

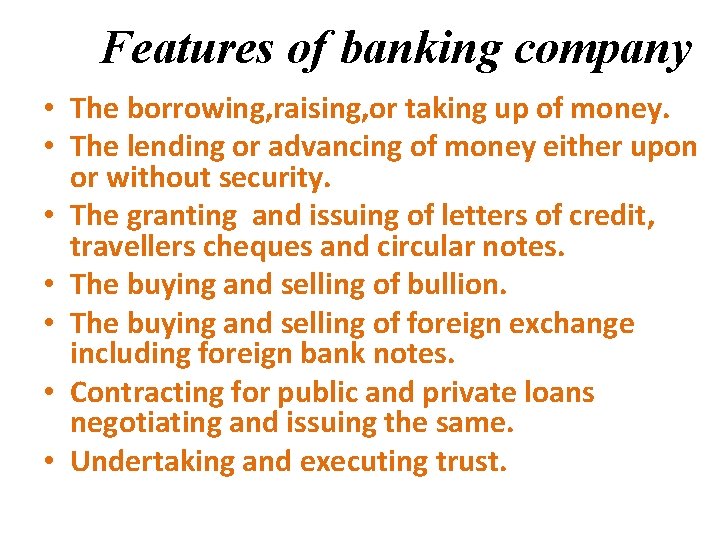

Features of banking company • The borrowing, raising, or taking up of money. • The lending or advancing of money either upon or without security. • The granting and issuing of letters of credit, travellers cheques and circular notes. • The buying and selling of bullion. • The buying and selling of foreign exchange including foreign bank notes. • Contracting for public and private loans negotiating and issuing the same. • Undertaking and executing trust.

Continued. . . • The acquisition, constructing, maintenance and alternation of any building or works necessary or convenient for the purpose of the company. • Carrying on and transacting every kind of guarantee and indemnity business. • The collecting and transmitting of money and securities. • Undertaking the administration of estates as executor, trustee or otherwise

General Information • No banking company can carry on business in India unless its subscribed capital is not less than one- half of the authorized capital and its paid up capital is not less than one – half of subs. capital. • A banking company cannot create any charge upon its uncalled capital. • Every banking co. shall transfer a sum equal to 25% of profits to statutory reserve. • A bank can open a branch only at the permission or reserve bank

Accounting System The accounting system of a banking company is different from that of a trading or manufacturing company. A bank has a large number of customers whose acc are to be maintained in such a way so that these should be kept upto date.

Features Of Banking Acc System • Entries in the personal ledgers are made directly from vouchers. • From such entries in personal acc each day summary sheets in total are prepared. • The general ledger’s trial balance is extracted and agreed every day. • A trial balance of detailed personal ledger is prepared periodically and get agreed with general ledger. • Two vouchers are prepared for every transaction not involving cash- debit and credit voucher.

Books Required • • • Receiving cashier’s counter cash book. Paying cashier’s counter cash book. Current accounts ledger. Loan ledger. Cash credit ledger. Investment ledger. Saving bank accounts ledger. Recurring deposits accounts ledger. Bill discounted and purchased ledger.

Principal Books Of Accounts Are: • Cash book: This book gives the summary of the receiving cashier’s counter cash book and paying cashier’s cash book. • General ledger: This ledger contains control acc for subsidiary ledger listed above and acc of expenses and assets not covered by the subsidiary ledger.

Notes And Instruction For Compilation • The formats of balance sheet and profit n loss acc cover all items likely to appear in these statement. • The words ‘current year’ and ‘previous year’ used in the formats are only to indicate the order of presentation and may not appear in acc. • Figures should be rounded off to nearest thousand.

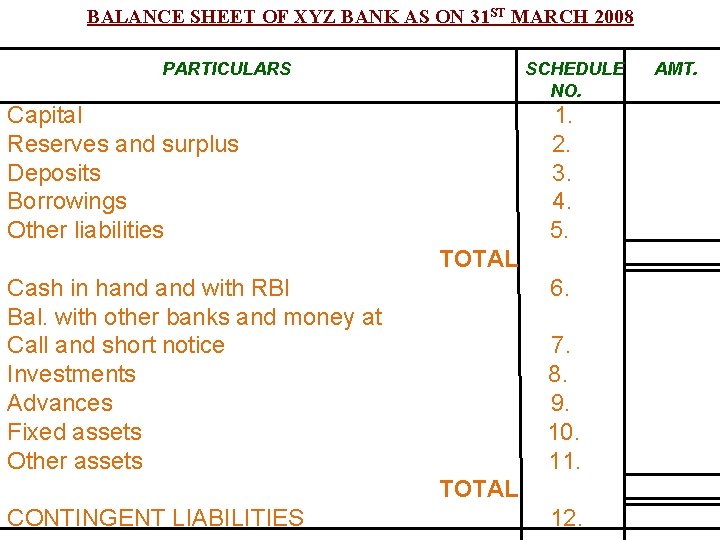

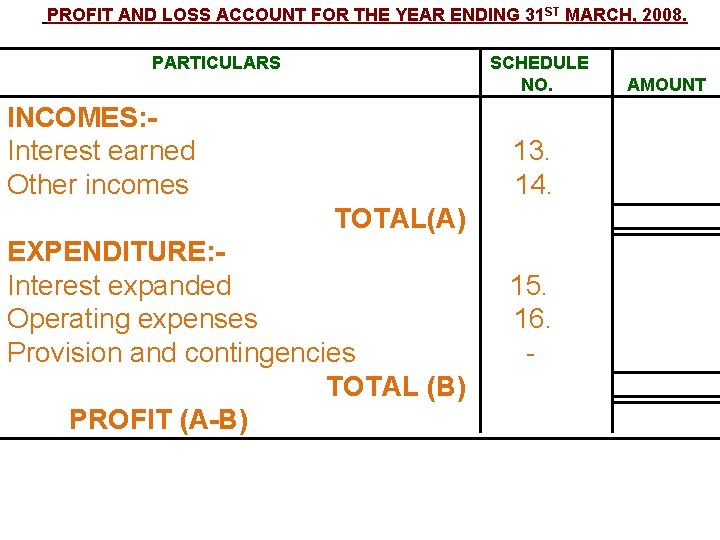

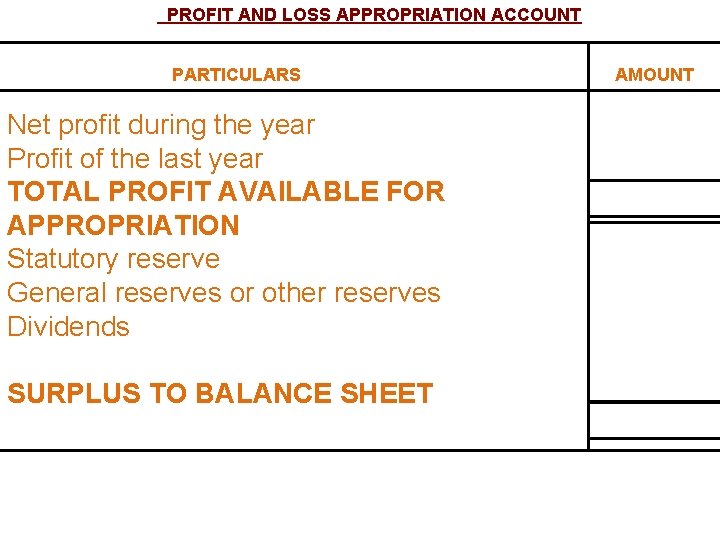

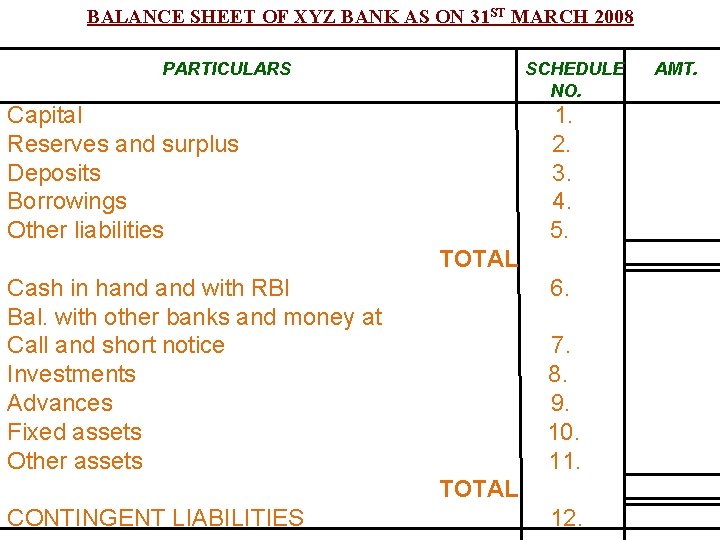

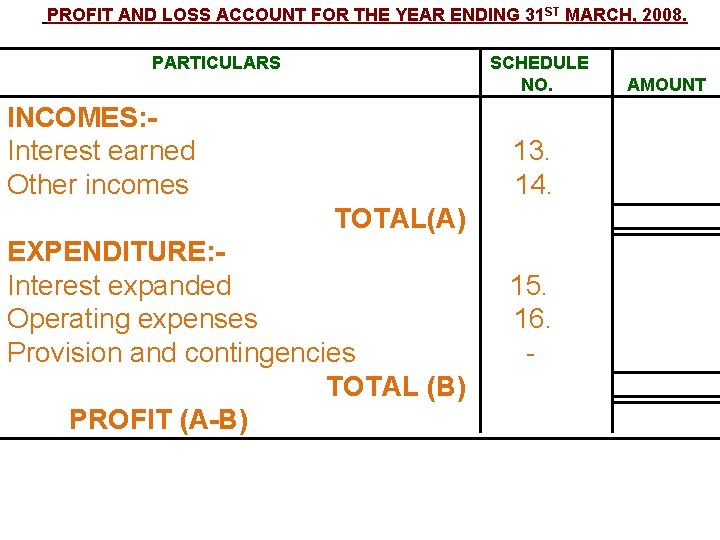

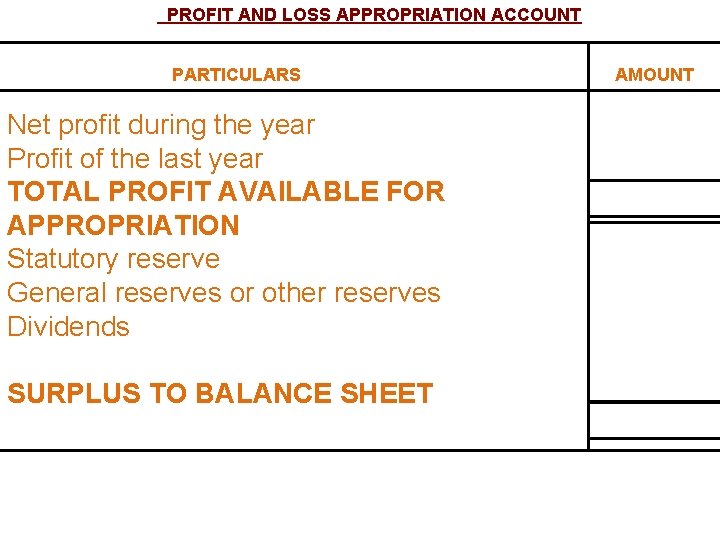

BANKS PREPARE THEIR ACCOUNTS ACCORDING TO BANKING REGULATION ACT, 1949. THE FINAL ACCOUNTSOF BANK ARE IN VERTICAL FORMAT. THE FINAL ACCOUNTS CONSIST OF : - a)PROFIT and LOSS ACCOUNT b)PROFIT and LOSS APPROPRIATION ACCOUNT c)BALANCE SHEET THERE ARE 16 SCHEDULES IN THE FINAL ACCOUNTS OF BANKS.

BALANCE SHEET OF XYZ BANK AS ON 31 ST MARCH 2008 PARTICULARS SCHEDULE NO. Capital Reserves and surplus Deposits Borrowings Other liabilities 1. 2. 3. 4. 5. TOTAL Cash in hand with RBI Bal. with other banks and money at Call and short notice Investments Advances Fixed assets Other assets 6. 7. 8. 9. 10. 11. TOTAL CONTINGENT LIABILITIES 12. AMT.

PROFIT AND LOSS ACCOUNT FOR THE YEAR ENDING 31 ST MARCH, 2008. PARTICULARS SCHEDULE NO. INCOMES: Interest earned Other incomes 13. 14. TOTAL(A) EXPENDITURE: Interest expanded Operating expenses Provision and contingencies TOTAL (B) PROFIT (A-B) 15. 16. - AMOUNT

PROFIT AND LOSS APPROPRIATION ACCOUNT PARTICULARS Net profit during the year Profit of the last year TOTAL PROFIT AVAILABLE FOR APPROPRIATION Statutory reserve General reserves or other reserves Dividends SURPLUS TO BALANCE SHEET AMOUNT

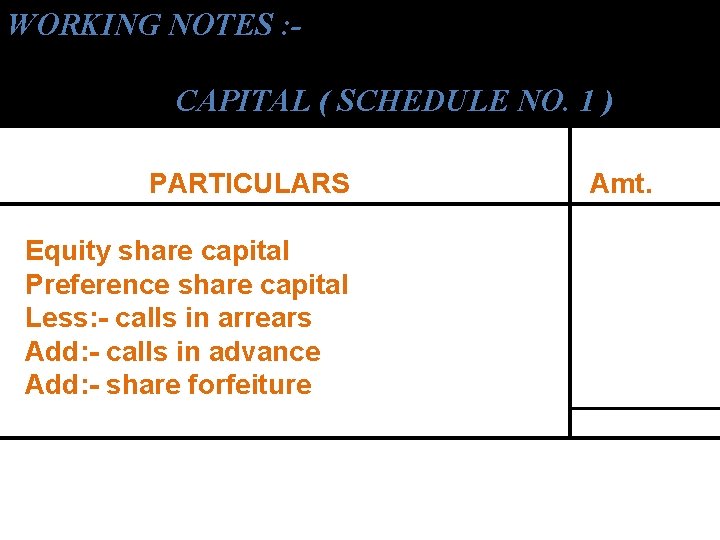

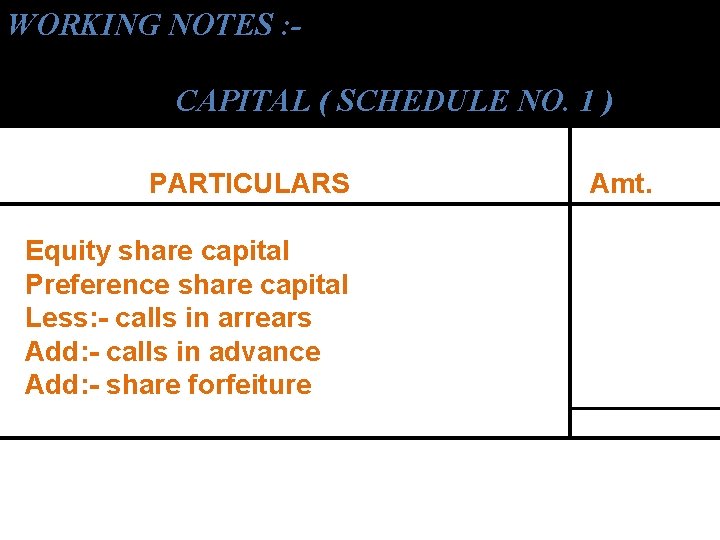

WORKING NOTES : CAPITAL ( SCHEDULE NO. 1 ) PARTICULARS Equity share capital Preference share capital Less: - calls in arrears Add: - calls in advance Add: - share forfeiture Amt.

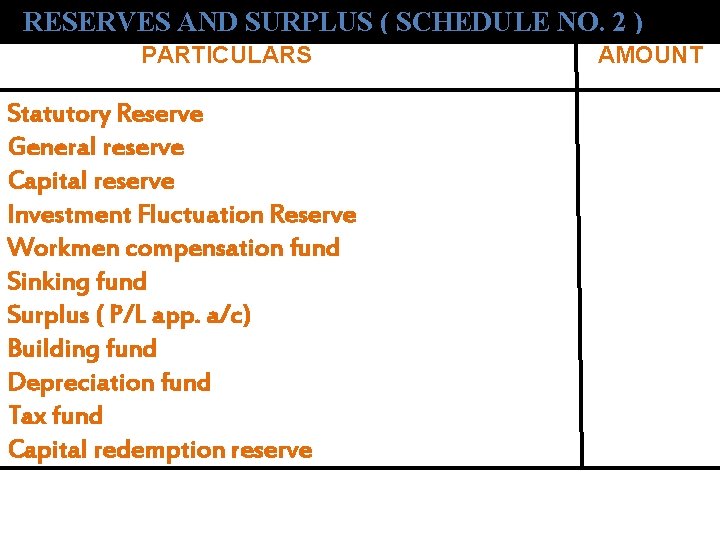

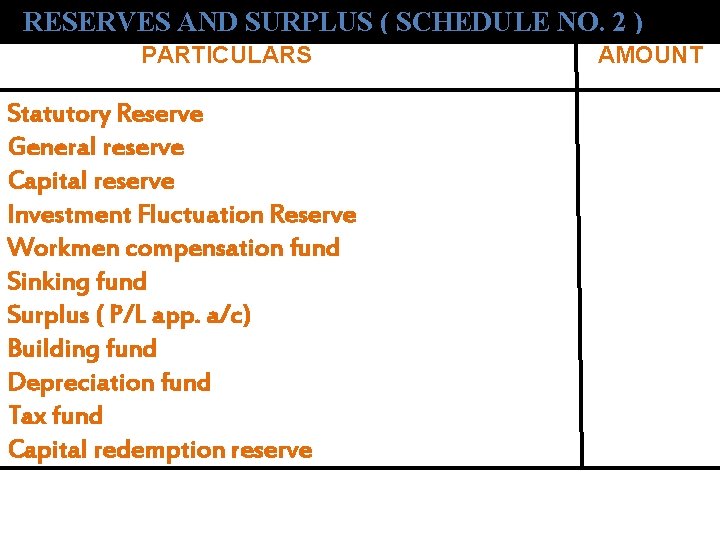

RESERVES AND SURPLUS ( SCHEDULE NO. 2 ) PARTICULARS Statutory Reserve General reserve Capital reserve Investment Fluctuation Reserve Workmen compensation fund Sinking fund Surplus ( P/L app. a/c) Building fund Depreciation fund Tax fund Capital redemption reserve AMOUNT

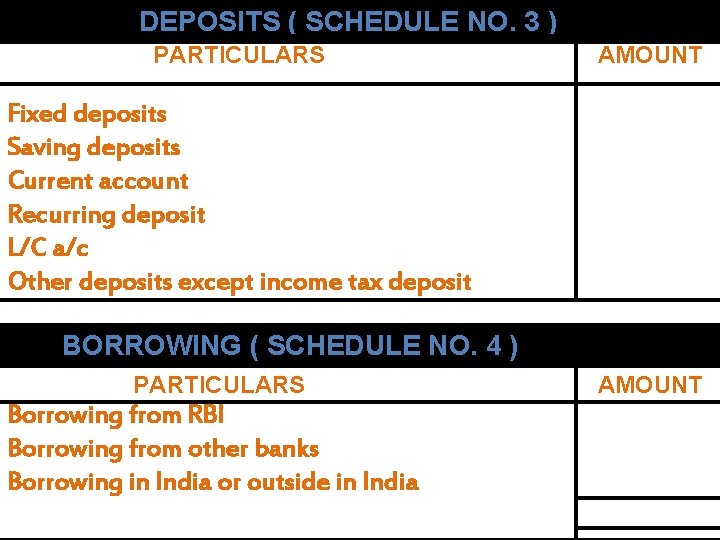

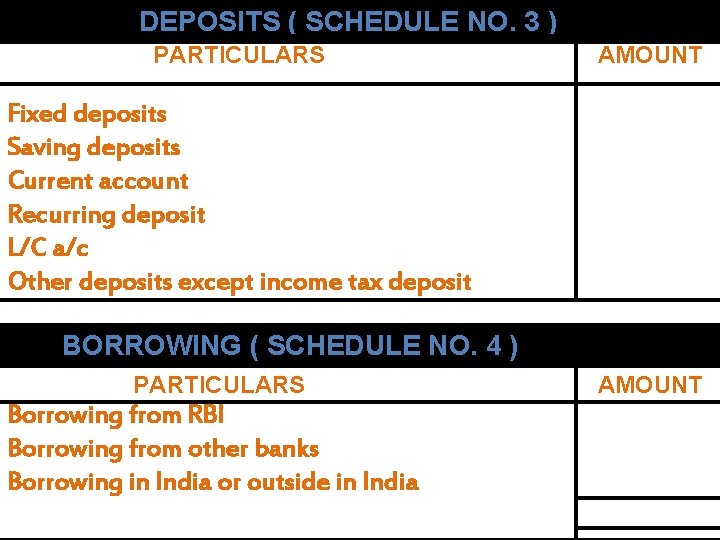

DEPOSITS ( SCHEDULE NO. 3 ) PARTICULARS AMOUNT Fixed deposits Saving deposits Current account Recurring deposit L/C a/c Other deposits except income tax deposit BORROWING ( SCHEDULE NO. 4 ) PARTICULARS Borrowing from RBI Borrowing from other banks Borrowing in India or outside in India AMOUNT

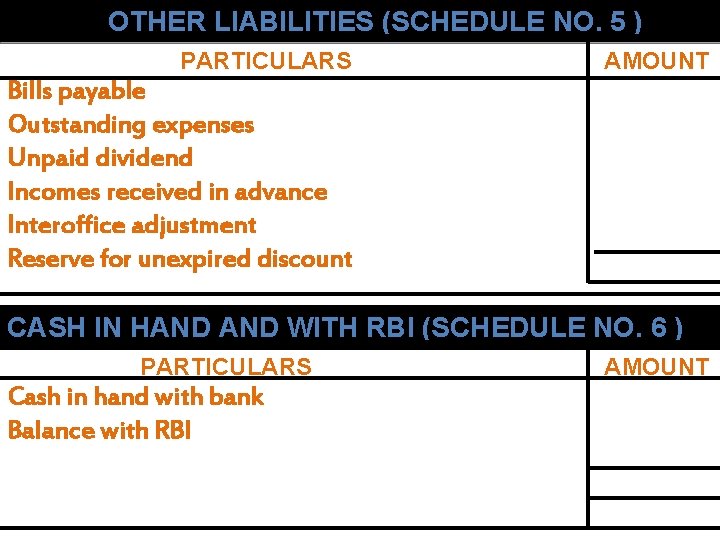

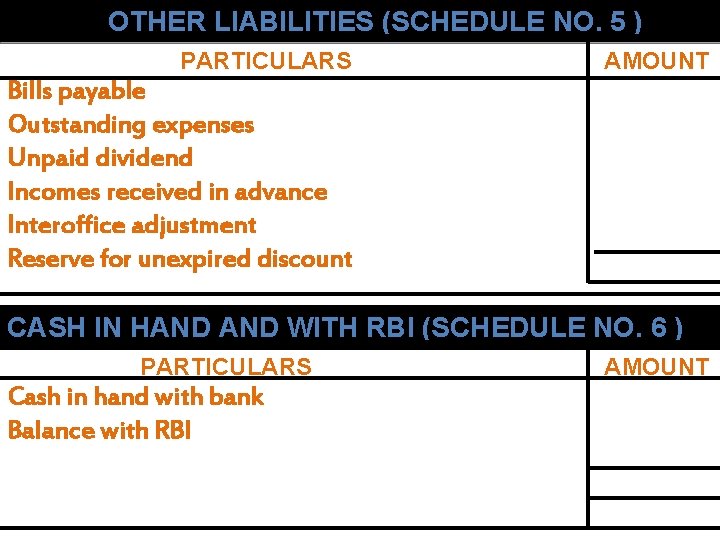

OTHER LIABILITIES (SCHEDULE NO. 5 ) PARTICULARS AMOUNT Bills payable Outstanding expenses Unpaid dividend Incomes received in advance Interoffice adjustment Reserve for unexpired discount CASH IN HAND WITH RBI (SCHEDULE NO. 6 ) PARTICULARS Cash in hand with bank Balance with RBI AMOUNT

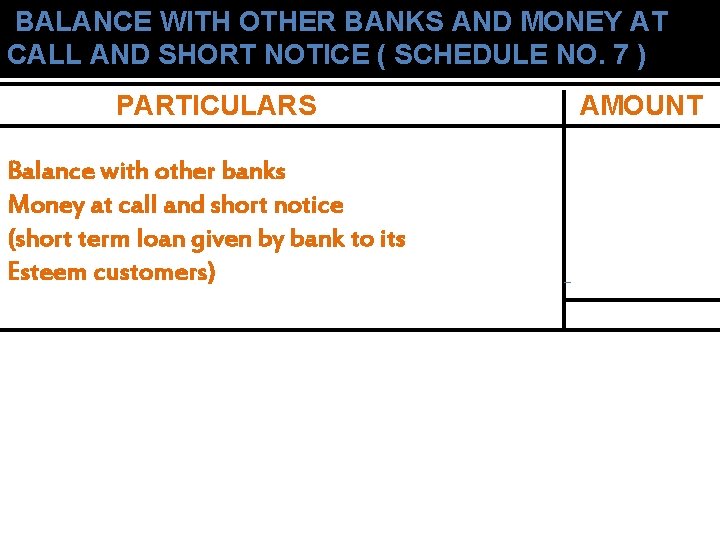

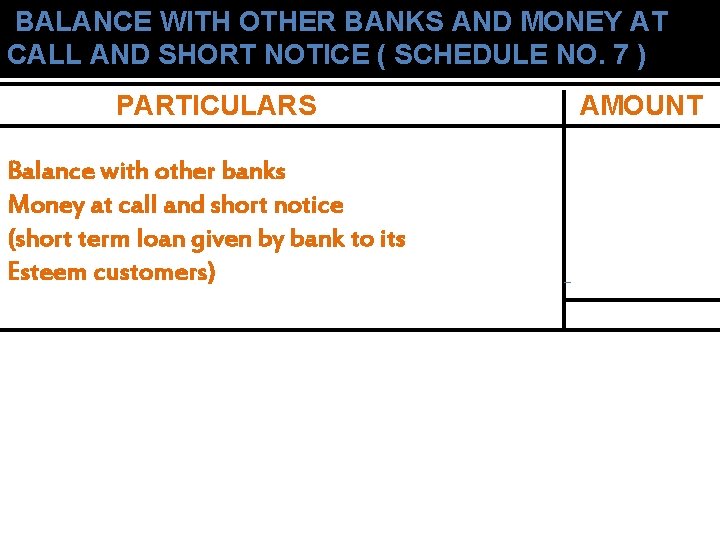

BALANCE WITH OTHER BANKS AND MONEY AT CALL AND SHORT NOTICE ( SCHEDULE NO. 7 ) PARTICULARS Balance with other banks Money at call and short notice (short term loan given by bank to its Esteem customers) AMOUNT

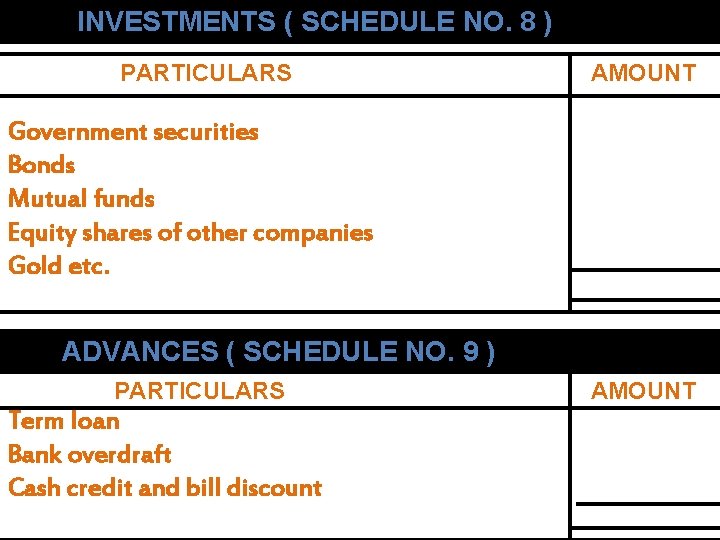

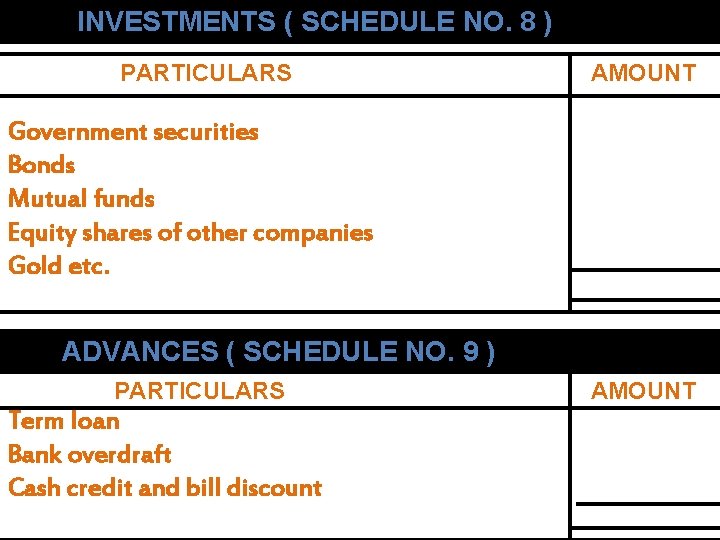

INVESTMENTS ( SCHEDULE NO. 8 ) PARTICULARS AMOUNT Government securities Bonds Mutual funds Equity shares of other companies Gold etc. ADVANCES ( SCHEDULE NO. 9 ) PARTICULARS Term loan Bank overdraft Cash credit and bill discount AMOUNT

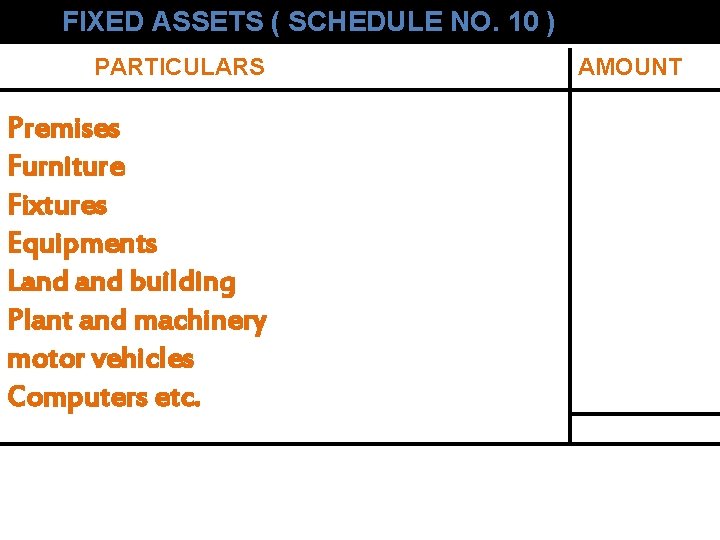

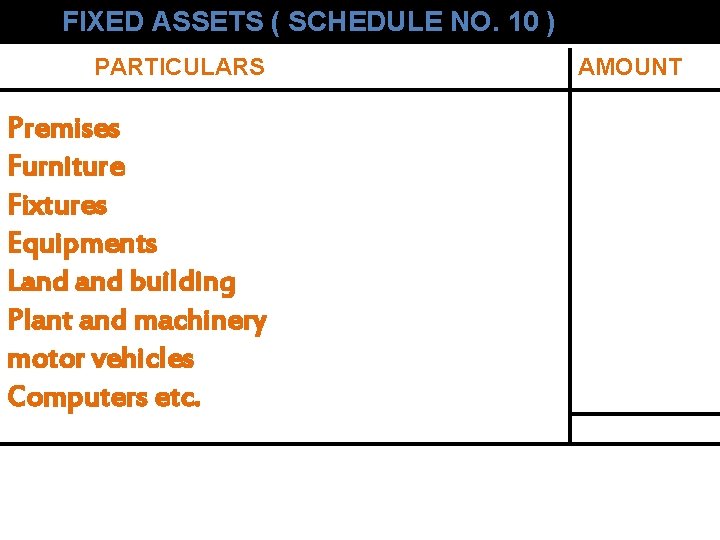

FIXED ASSETS ( SCHEDULE NO. 10 ) PARTICULARS Premises Furniture Fixtures Equipments Land building Plant and machinery motor vehicles Computers etc. AMOUNT

Sadhana vidyalaya hadapsar

Sadhana vidyalaya hadapsar Rayat shikshan sanstha sadhana vidyalaya hadapsar

Rayat shikshan sanstha sadhana vidyalaya hadapsar Rayat shikshan sanstha sadhana vidyalaya hadapsar

Rayat shikshan sanstha sadhana vidyalaya hadapsar Sm joshi college hadapsar

Sm joshi college hadapsar Rayat shikshan sanstha motto

Rayat shikshan sanstha motto Rayat shikshan sanstha loni

Rayat shikshan sanstha loni Rayat shikshan sanstha motto

Rayat shikshan sanstha motto Education through self help is our motto

Education through self help is our motto Red rose

Red rose Rayat shikshan sanstha kamothe

Rayat shikshan sanstha kamothe S.m.joshi college uniform

S.m.joshi college uniform S m joshi college

S m joshi college Sm joshi college

Sm joshi college Sadhana kanya vidyalaya hadapsar

Sadhana kanya vidyalaya hadapsar Dr kurkute hadapsar

Dr kurkute hadapsar उद्दीपकाचे

उद्दीपकाचे Smjoshi.rayat.dc

Smjoshi.rayat.dc Smjoshi.rayat.dc

Smjoshi.rayat.dc Smjoshi.rayat.dc

Smjoshi.rayat.dc Smjoshi.rayat.dc

Smjoshi.rayat.dc Mpasc.rayat.dc

Mpasc.rayat.dc Prosa lawas

Prosa lawas Smjoshi.rayat.dc

Smjoshi.rayat.dc