Radiology PPMC Strategies Tactics and Key Issues April

- Slides: 27

Radiology PPMC Strategies, Tactics and Key Issues April 6, 2018 W. Kenneth Davis, Jr. Partner Katten Muchin Rosenman LLP

Introduction • These are the words of a “private equity agnostic. ” 1

Introduction (cont’d) • The history and evolution of next generation physician practice management companies (“PPMCs”) in radiology. • For this presentation, using “PPMC” somewhat broadly. • The role that private equity firms are playing in the radiology M&A milieu. 2

Introduction (cont’d) • Why sell to a PPMC? • Initial process decision: how to “sell. ” • Strategic objectives of today’s radiology PPMCs. • How radiology PPMCs tactically do what they do. • Threshold and document issues that will have to be worked through in any transaction with a radiology PPMC. 3

PPMCs: Their History • Over the past 5 -10 years, there’s been a resurgence of PPMCs. • In virtually all specialties. • As far back as 20 years ago, most of the early PPMCs were struggling operationally and financially, and eventually most of them went into bankruptcy. • They tended to be purely financially-driven plays, with few plans for how they were going to create value and achieve growth. • They would buy an EBITDA stream (out of the pockets of the physicians) at “x” multiple with a mix of equity, debt and/or cash as the consideration, and then go public or sell to a strategic buyer at “x plus” multiple, with the PPMC benefitting from the “plus” part of the multiple. • Usually the equity and the debt was, or quickly became, worthless. • They wanted total control. • They often demonstrated an acute ignorance of how to work with physicians, and. . . • They were often willing to take significant regulatory compliance risks. 4

PPMCs: Their History (cont’d) • Despite this ignominious history, a second (and perhaps even a third) generation of PPMCs has begun to proliferate throughout medicine. • Most recently, PPMCs (and companies that want to behave like PPMCs) have begun to move much more aggressively into the practice of radiology. • They are still often owned by private equity. • Some base themselves around the technical component (the “TC”). • Others are focusing on teleradiology and tout themselves as being tantamount to “super groups. ” • These “new” PPMCs tend to have different strategic objectives than their ancestors. • And although their tactics for achieving these objectives have some components in common with the old way of doing things, . . . • They also have some new twists. • Who are today’s players: Radiology Partners, MEDNAX, Premier, Envision, others). 5

Roles of Private Equity Firms in Radiology M&A Milieu • Identify a platform, or a “flagship” for the fleet. • Build out the platform/identify early “tuck-in” candidates. • Capitalize the platform. • Monetize the equity in the platform. • Exit. • Private to private. • Private to public. 6

Why Sell to a PPMC? • What does my group need? • What is my group’s value proposition? • Can my group survive, and indeed flourish, in the future? • How? • For how long? • Does my group like what that future may hold? 7

Why Sell to a PPMC? (cont’d) • Integration is the name of the game: is my group going to have a major role, or are we going to be a bit player? • Who should my group “partner” with, i. e. , stake our future with? • Radiology groups are selling and/or consolidating all over the place: is my group going to be left out if I don’t sell? 8

Why Sell to a PPMC? (cont’d) • . . . and don’t kid yourself: you are “selling, ” and the PPMC is “buying, ” your practice. • Always subject to applicable law. • Of course, perhaps your radiology group can be the flagship for the carrier battle group. • Can my group be the next Gerald R. Ford-class supercarrier? 9

Why Sell to a PPMC? (cont’d) • Some observations based on experience. • “Value” is all in the eyes of the beholder: what are PPMCs and radiology groups looking for in each other today? • Even a private equity agnostic has to recognize that the water has been chummed over the last 6 -12 months. • Your group needs to think strategically, and then be measured and intentional in whatever you do (or, perhaps, in whatever you decide not to do), . . . • . . . but remember that there’s a difference between status quo and “deer in the headlights. ” 10

Initial Process Decision: How to “Sell” • What are the options: • “FSBO. ” • Engage a consultant. • As an advisor to the FSBO process? • Potentially acting in a limited broker capacity, with compensation based, in part, on a success fee? • Engage an investment bank. 11

Initial Process Decision: How to “Sell” (cont’d) • Pros and cons of each option: • Partially dependent upon what you think the “sale” should look like. • • • Strategic and/or financial buyers? • Narrow versus broad targeting? Partially dependent upon the size/complexity of your group. Will likely impact both the economic and non-economic terms and conditions of your deal. Can impact the timing of getting a deal done. Success fees can appear sizeable, but they only get paid for “success” and may be more than offset by achieving better economic terms. • It’s a judgment call for you to make. • Negotiate any engagement agreement. 12

Strategic Objectives of Today’s Radiology PPMCs • Today’s Radiology PPMCs want high quality groups with capacity and/or a clear history of driving revenue growth. • The PPMCs can then use “their” radiology groups to: • Compete for business on a national scale using teleradiology and/or. . . • Staff their TC facilities. • The PPMCs also believe that they are better positioned than the typical radiology group to participate in accountable care organizations (“ACOs”) and clinically integrated networks (CINs”). 13

Strategic Objectives of Today’s Radiology PPMCs (cont’d) • Today’s radiology PPMCs usually still want to “own” the radiology group, and “buy” an income stream. • However, they tend to be less interested in buying a “significant” stream than in the past, and. . . • The upfront payment tends to be smaller (you’re probably not going to retire on the payment), and. . . • The payment tends to be mostly cash (possibly with a relatively small equity sliver of the PPMC). 14

Strategic Objectives of Today’s Radiology PPMCs (cont’d) • On the one hand, the PPMCs usually want a very high level of control, right to the edge of violating any corporate practice of medicine prohibition (“CPOM”). • On the other hand, the new PPMCs have generally learned from the mistakes of the past, i. e. , that it is usually beneficial to leave some control in the hands of the physicians, and to exert whatever control that the PPMC does retain in a less heavy-handed, and more selective, fashion. 15

Tactics: How Radiology PPMCs Do What They Do • Engage in dialogue. • Emphasize the PPMC’s value proposition for the radiology group. • • • Today the “sell” by the PPMC is less about current monetization for the physicians of future earnings, rather. . . The PPMC tends to focus on the additional revenue that the PPMC believes it can help generate for the radiology group. Beware of simply accepting the PPMC’s propositions: challenge the assumptions. • Emphasize the level and types of control that the radiologists will retain. • Beware: the devil’s in the details. • To a certain extent, play to the insecurities, if not outright paranoia, of the radiology group. • • The radiology group must have a realistic sense for its strengths and weaknesses, and for its relative position in the market served by the radiology group. Beware of starting down the path to a deal with a PPMC, because it can be very difficult to turn around. • Connect the target with other radiology groups who are affiliated with the PPMC. • Beware of groups who have financial incentives to “gild the lily” (such as “founding groups” or “flagship groups”). 16

Tactics: How Radiology PPMCs Do What They Do (cont’d) • Determine a value for the practice (a “price”) and for the ongoing relationship (the “compensation”). • When you’ve seen one valuation, you’ve seen one valuation. • But also beware of the “bait and switch. ” • Develop preliminary structure for the transaction. • TAX, TAX (more in a later slide)! • Don’t assume that certain structures won’t work. • But also don’t simply accept that the structure proposed by the PPMC will work. • Persuade (co-opt? ) the radiology group’s key leadership. • Real-world application: the “silverbacks” versus the “alpha wolves. ” • Enter into a letter of intent (“LOI”) with a binding “no shop” provision. • Query how much effort should be put into the LOI? • Query when to sign the LOI? • DO NOT SIGN A LOI UNLESS/UNTIL YOU HAVE A CLEAR UNDERSTANDING OF HOW THE DEAL WILL BE STRUCTURED FROM A TAX/ACCOUNTING PERSPECTIVE. 17

Tactics: How Radiology PPMCs Do What They Do (cont’d) • Prepare documents. • Beware of “these are our documents, and we can’t move off of them. ” • Beware of “trust us, that’s never going to happen. ” • And beware of signing anything that’s: • • Incomprehensible (it just doesn’t make sense), or. . . Potentially illegal. • If it’s important or needs more clarity, then put it in the documents. • Negotiate the deal. • If a point is important to you, don’t give up on it. • Beware of artificial pressure. • At the same time, remember that today’s world of radiology is much different from what it was 20, 10 or even 5 years ago. • Close. 18

Threshold Issues • What’s the deal that’s on the table? • • Purchase price and then ongoing compensation? Form of consideration, i. e. , cash, equity and/or debt? Carefully analyze any earnout because they are generally disfavored under the law. Will there by any escrow; what are the terms and conditions? – TAX CONSIDERATIONS, PARTICULARLY AS THEY PERTAIN TO THE INITIAL “SALE, ” MUST BE ADDRESSED AT THE OUTSET OF THE STRUCTURING PART OF THE DIALOGUE. • AND REMEMBER ANY TAX/ACCOUNTING “SKELETONS IN THE CLOSET” THE RADIOLOGY GROUP MIGHT HAVE. • EXAMPLES. 19

Threshold Issues (cont’d) • Impact on radiology group’s relationship with its hospital(s). • When a radiology group does a deal with a PPMC, the radiologists likely, in effect, give up any meaningful control of the radiology group, and. . . • The PPMC’s interest may not align with the interest of the group’s hospital(s), so. . . • What happens if a conflict develops between the radiology group’s hospital(s) and the PPMC? • What is happening to any TC owned by the group. • Be aware of PPMC evolving views on TC. • What is structurally being implemented to address potential conflicts between the PPMC and any TC that remains with the group. • How much commitment is the PPMC making to the radiology group? • Are they willing to put it in writing? • Restrictive covenants? • Exclusivity and/or rights of first refusal? 20

Threshold Issues (cont’d) • Critically important to “connect the dots. ” • The interplay of all of the documents and all of the moving parts of the arrangement, on a going forward basis, can disguise somewhat insidious consequences for the radiologists. • So, put it all together and understand exactly what the radiology group and each of the individual radiologists are agreeing to and what the potential consequences are. 21

Document Issues • Purchase Agreement. • • Likely will be transacted as an asset purchase. In certain states, might be able to transact as an equity acquisition or as a merger. Form of consideration , i. e. , cash, equity and/or debt. Earnout (if any). Reps and warranties. Indemnification. Escrow (if any). Restrictive covenants. • • Should conform with all other negotiated restrictive covenants. What does this mean: an anecdote? 22

Document Issues (cont’d) • Management Services Agreement. • Why it’s used? • And when it might not be as important? • What is the PPMC supposed to do? • What does it control? • What is the radiology group supposed to do? • What does it control? • How does the PPMC get paid? • • Need a “waterfall” provision describing order of priority for payments. Should clearly state (not subject to amendment, with intended third party beneficiary rights of enforcement) that the radiologists get paid first, under their respective employment agreements, before the PPMC gets paid. • Restrictive covenants? • • For radiology group? For PPMC? • Amendments? • Beware if the PPMC has deployed a “friendly physician model” (see subsequent slide). 23

Document Issues (cont’d) • Employment Agreements. • • What they require of each radiologist? What does the group retain control over and what does the PPMC have control over? • • How is compensation calculated and paid? • • • Closely scrutinize any variation of a “physician advisory council. ” Base plus incentive? Draw plus bonus? Regulatory compliance? Should be objectively calculable; nothing should be left to the discretion of the PPMC. Expenses? Professional liability insurance? • Obligation upon termination of the employment agreement? • • • Restrictive covenants? Ability of radiologists to “talk among themselves. ” Term and termination? • Amendments? • • Are they terminable without cause, and if so, when, and is that desirable? What if a single radiologist wants to terminate and/or amend her/his employment agreement? 24

Document Issues (cont’d) • Option Agreement. • Implements the “friendly physician model. ” • • What is this? Be aware of applicable state law. • Why and how the Option Agreement accomplishes this? • When an Option Agreement might not be necessary. • Beware of how this agreement interacts with all of the other “going forward” agreements. • • Management Services Agreement. Employment Agreements. 25

THANK YOU! www. kattenlaw. com

Factors contributing to organizational politics

Factors contributing to organizational politics Volleyball tipping drills

Volleyball tipping drills Types of public relations

Types of public relations Sequencing strategies and tactics

Sequencing strategies and tactics Calcul ppmc

Calcul ppmc Ppmcs

Ppmcs Nyit blackboard

Nyit blackboard Jingles are the message written around the brand

Jingles are the message written around the brand Implementing strategies management and operations issues

Implementing strategies management and operations issues Implement strategies management issues

Implement strategies management issues Implementing strategies: management and operations issues

Implementing strategies: management and operations issues Matching structure with strategy

Matching structure with strategy Ch 7

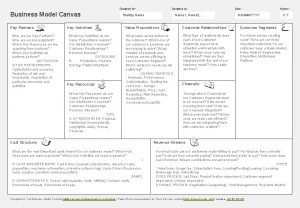

Ch 7 What are key activities in a business model

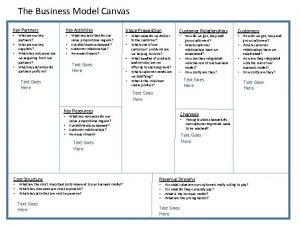

What are key activities in a business model Key partners

Key partners Layered pattern

Layered pattern Managerial economics applications strategy and tactics

Managerial economics applications strategy and tactics Strategy and tactics of integrative negotiation

Strategy and tactics of integrative negotiation Tactics and strategy

Tactics and strategy Integrating communications assessment and tactics

Integrating communications assessment and tactics Chapter 17 promotional concepts and strategies

Chapter 17 promotional concepts and strategies Pharmacology and venipuncture

Pharmacology and venipuncture Radiology mergers and acquisitions

Radiology mergers and acquisitions American academy of oral and maxillofacial radiology

American academy of oral and maxillofacial radiology Oral disease

Oral disease Five key issues of data gathering

Five key issues of data gathering Five key issues of data gathering

Five key issues of data gathering Environmental issues cloze notes 1 answer key

Environmental issues cloze notes 1 answer key