Managerial Economics Applications Strategies and Tactics 14 e

- Slides: 34

Managerial Economics Applications, Strategies and Tactics, 14 e James R. Mc. Guigan R. Charles Moyer Frederick H. de. B. Harris © 2017 Cengage Learning® May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website or school-approved learning management system for classroom use. 1

PART IV – PRICING & OUTPUT DECISIONS: STRATEGY AND TACTICS Chapter 11 – Price and Output Determination: Monopoly and Dominant Firms © 2017 Cengage Learning® May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website or school-approved learning management system for classroom use. 2

Chapter 11 – Price & Output Determination: Monopoly and Dominant Firms Overview (1 of 1) • MONOPOLY DEFINED • SOURCES OF MARKET POWER FOR A MONOPOLIST • PRICE AND OUTPUT DETERMINATION FOR A MONOPOLIST • THE OPTIMAL MARKUP, CONTRIBUTION MARGIN, AND CONTRIBUTION MARGIN PERCENTAGE • REGULATED MONOPOLIES • THE ECONOMIC RATIONALE FOR REGULATION © 2017 Cengage Learning® May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website or school-approved learning management system for classroom use. 3

Ch 11 – Monopoly Defined (1 of 1) • Monopoly is defined as a market structure with significant barriers to entry in which a single firm produces a highly differentiated product • Without any close substitutes for the product, the demand curve for a monopolist is often an entire relevant market demand • Just as purely competitive market structures are rare, so too pure monopoly markets are rare © 2017 Cengage Learning® May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website or school-approved learning management system for classroom use. 4

Ch 11 – Sources of Market Power for a Monopolist (1 of 1) • Monopolist or near-monopoly dominant firms enjoy several sources of market power • A firm may possess a patent or copyright that prevents others from producing the same product • A firm may control critical resources • A third source may be a government-authorized franchise • Monopoly power also happens in natural monopolies because of significant economies of scale over a wide range of output © 2017 Cengage Learning® May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website or school-approved learning management system for classroom use. 5

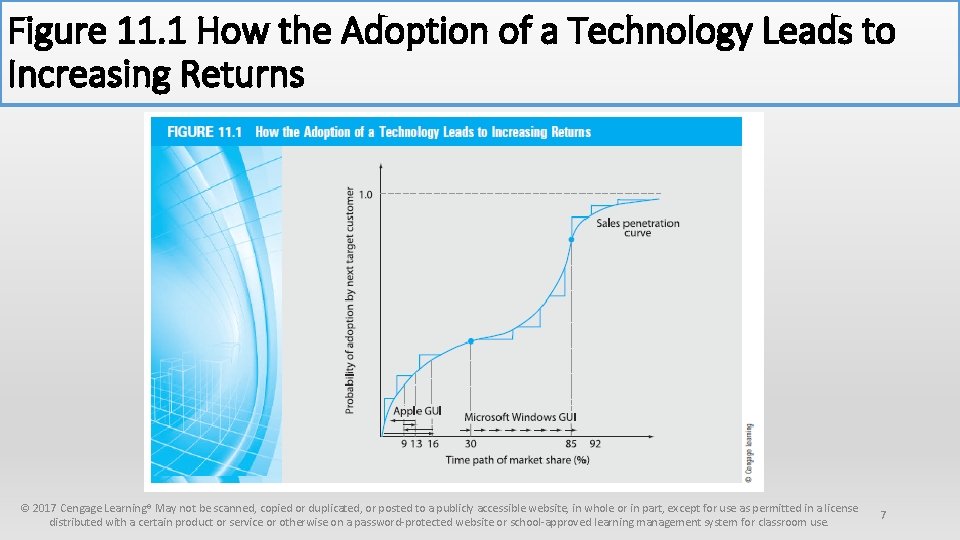

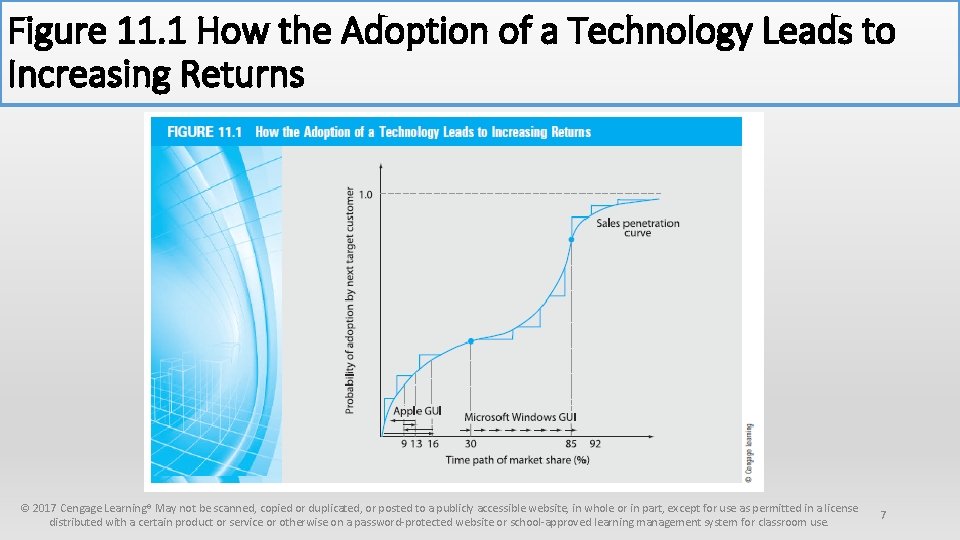

Ch 11 – Sources of Market Power for a Monopolist Increasing Returns from Network Effects (1 of 2) • These can also be a source of monopoly market power • Marketing and promotions are generally subject to diminishing returns; See Figure 11. 1; example: Microsoft and Apple • Sales penetration curve – An S-shaped curve relating current market share to the probability of adoption by the next garget customer, reflecting the presence of increasing returns • By achieving more than 30% acceptance in the marketplace, the technology becomes the industry standard • Achieving greater than 30% share, leads to increasing returns in marketing caused by a network effect that displaces other competitors © 2017 Cengage Learning® May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website or school-approved learning management system for classroom use. 6

Figure 11. 1 How the Adoption of a Technology Leads to Increasing Returns © 2017 Cengage Learning® May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website or school-approved learning management system for classroom use. 7

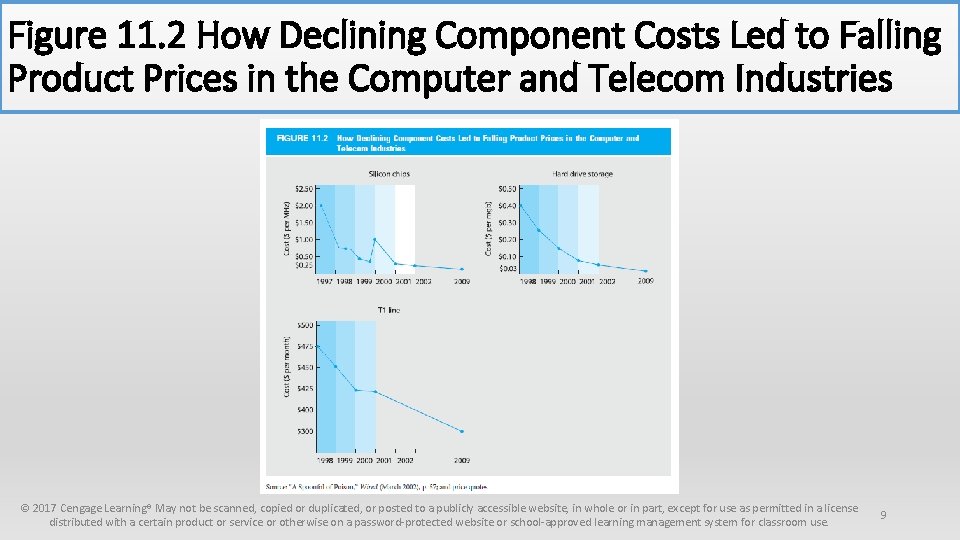

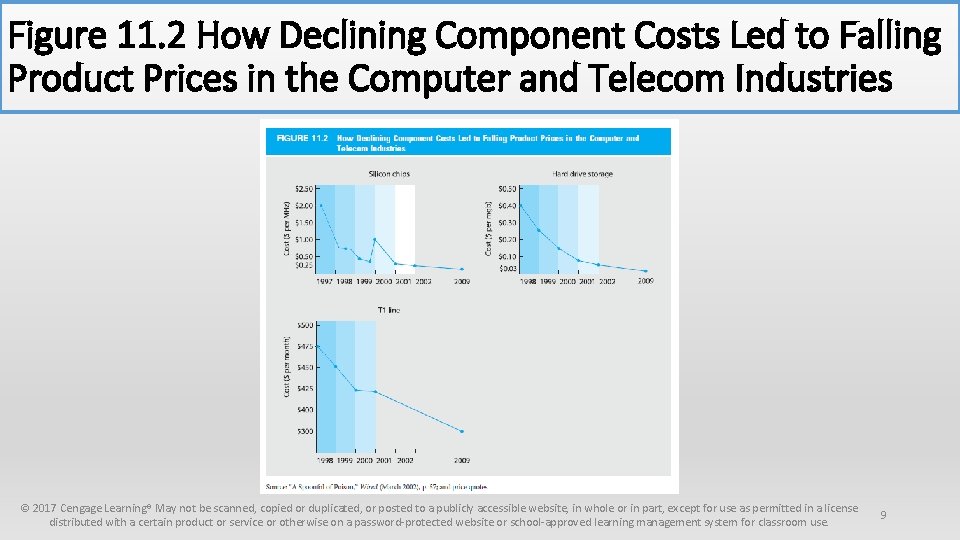

Ch 11 – Sources of Market Power for a Monopolist Increasing Returns from Network Effects (2 of 2) • But monopoly is seldom assured for 3 reasons: • First, a higher price point for innovative new products can offset cost savings from increasing returns of a competitor (Example: Apple) • Second network effects tend to occur in technology-based industries that have experienced falling input prices; Figure 11. 2 • Third, technology products whose primary value lies in their intellectual property have revenue sources dependent on renewals of governmental licensures and product standards • Firms try to get around the inflection point of Figure 11. 1 and achieve increasing returns by free trials for a limited time, or giving the technology away if it can be bundled with other revenue-generating product offerings © 2017 Cengage Learning® May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website or school-approved learning management system for classroom use. 8

Figure 11. 2 How Declining Component Costs Led to Falling Product Prices in the Computer and Telecom Industries © 2017 Cengage Learning® May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website or school-approved learning management system for classroom use. 9

What Went Right? ● What Went Wrong? What Went Right at Microsoft but Wrong at Apple Computer • Historically, Apple Computer hovered at 7 -10% market share in the U. S. personal computer industry, never coming close to the 30% inflection point for declining selling costs (See Fig 11. 1). • Apple attempted to become an industry standard in several PC submarkets, like desktop publishing, journalism, advertising & entertainment. • Also, after defending its GUI code for 2 decades, Apple reversed course, and began licensing agreements with MS & IBM, to achieve the widespread adoption of Mac programming; this strategy led to success in smart phones • Although Apple’s GUI code was superior to the original MS code, the superior product lost to the product that first reached increasing returns - MS © 2017 Cengage Learning® May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website or school-approved learning management system for classroom use. 10

What Went Right? ● What Went Wrong? Pilot Error at Palm • Despite having 80% of the handheld operating system market and despite producing 60% of the handheld hardware at its peak in 2000, Palm has now lost most of its market share to its rivals. • Palm grew so fast (165% year-over-year sales increases) that it gave little attention to operational issues such as managing the supply of inputs and forecasting demand. • It mistimed the announcement of its m 500 product upgrades, which were delayed by supply chain bottlenecks, and Palm’s customers stopped buying older models. • Handspring, Sony, HP, MS’s Pocket PC and Blackberry drove prices lower and offered newer product features • Almost overnight, excess Palm IV and V inventories piled up on shelves; Palm took a $300 million write-down on its inventory losses and its stock price fell from $25 to $2 per share. © 2017 Cengage Learning® May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website or school-approved learning management system for classroom use. 11

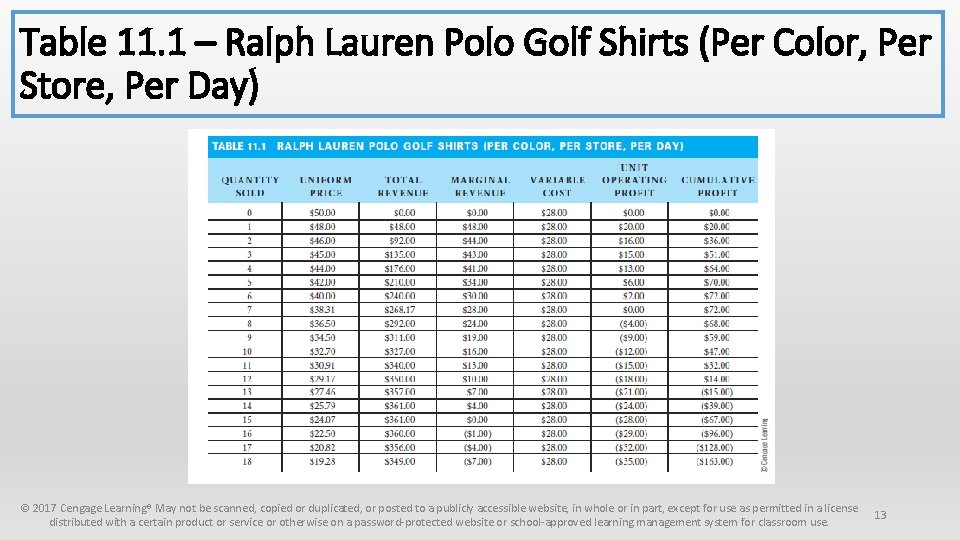

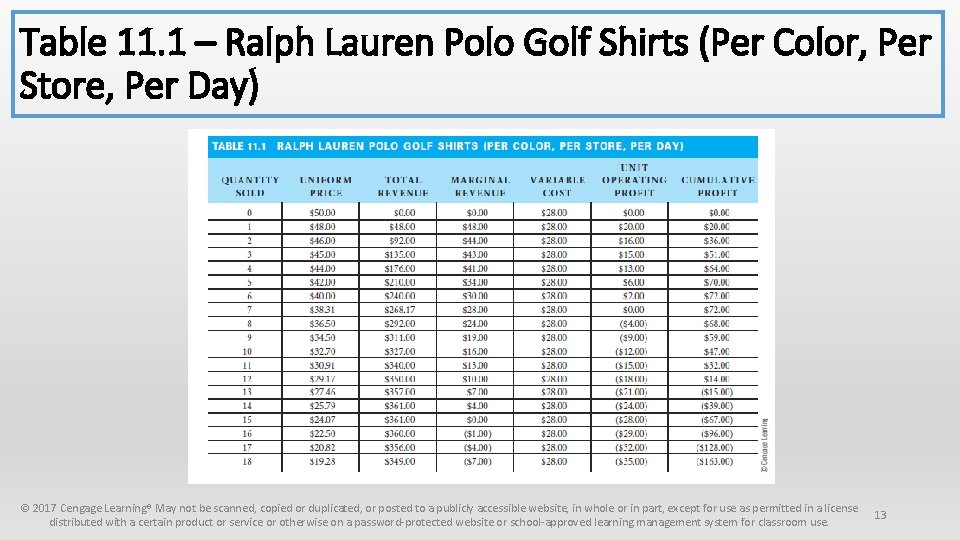

Ch 11 – Price and Output Determination for a Monopolist Spreadsheet Approach: Profit v. Revenue Maximization… (1 of 1) • Table 11. 1 shows the demand projections for daily sales of Polo golf shirts at an outlet store • Sales floor personnel are paid a salary plus commission based on their sales • Such an employee wants the price to continue dropping as long as total sales revenue rises (MR remains positive up to and including 14 shirts/day at $25. 79; any fewer shirts, and total revenue would be smaller, reducing commissions • The store manager & parent company are concerned that the 14 th shirt imposes a unit operating loss of -$24; (MR in column 4 falls below the variable cost in column 5) • Not until the price is raised and MR is increased back to $28 will operating losses be eliminated © 2017 Cengage Learning® May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website or school-approved learning management system for classroom use. 12

Table 11. 1 – Ralph Lauren Polo Golf Shirts (Per Color, Per Store, Per Day) © 2017 Cengage Learning® May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website or school-approved learning management system for classroom use. 13

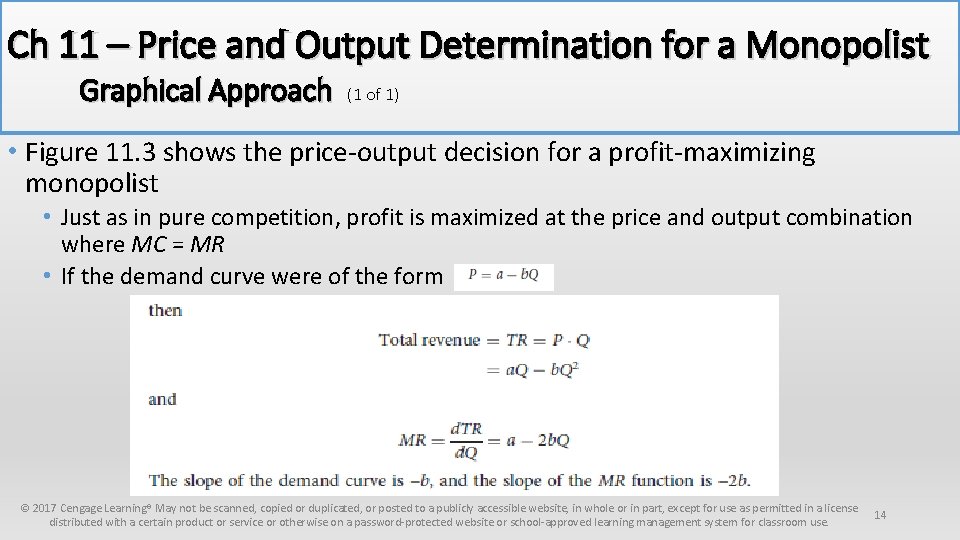

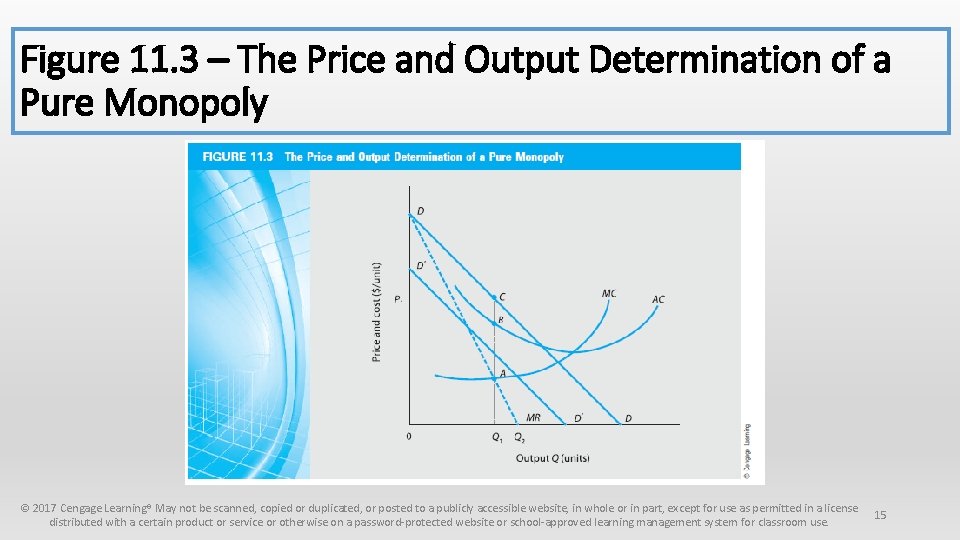

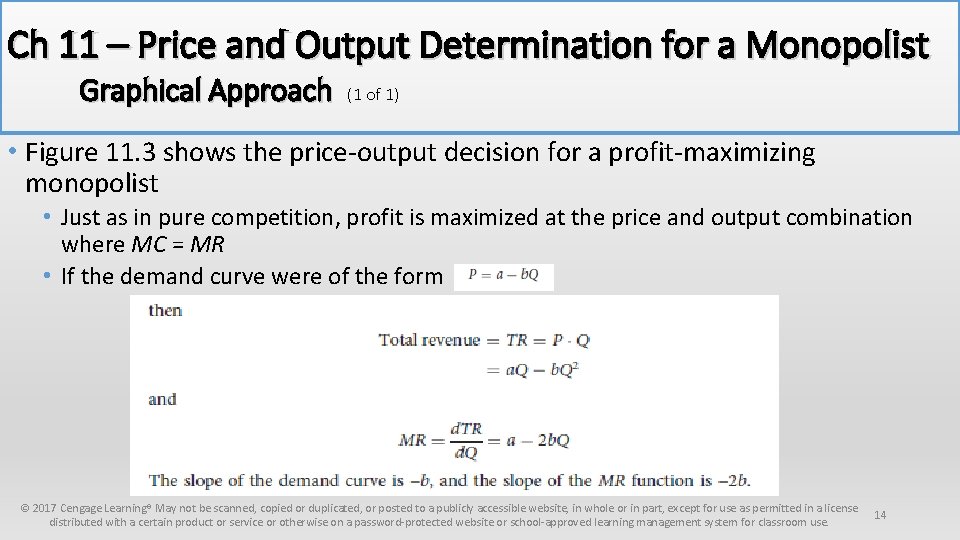

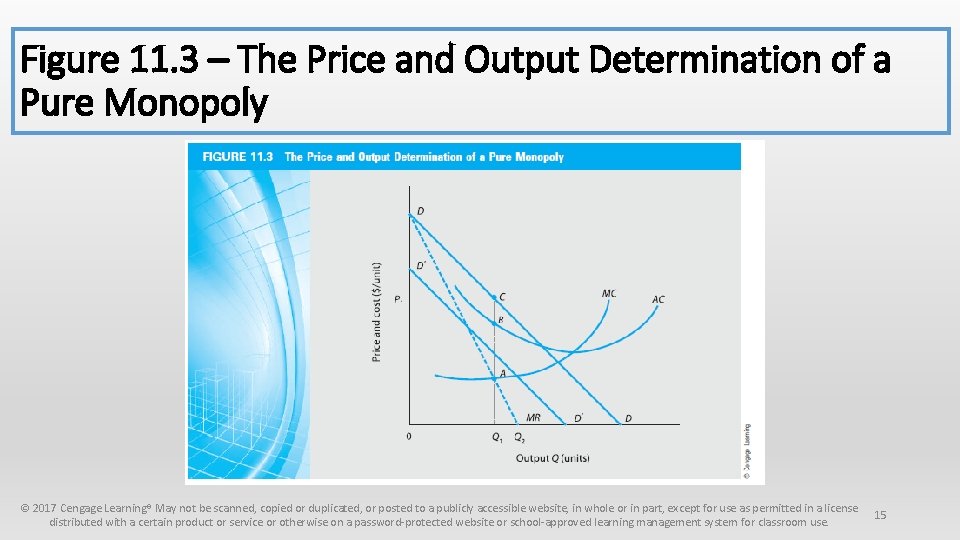

Ch 11 – Price and Output Determination for a Monopolist Graphical Approach (1 of 1) • Figure 11. 3 shows the price-output decision for a profit-maximizing monopolist • Just as in pure competition, profit is maximized at the price and output combination where MC = MR • If the demand curve were of the form © 2017 Cengage Learning® May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website or school-approved learning management system for classroom use. 14

Figure 11. 3 – The Price and Output Determination of a Pure Monopoly © 2017 Cengage Learning® May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website or school-approved learning management system for classroom use. 15

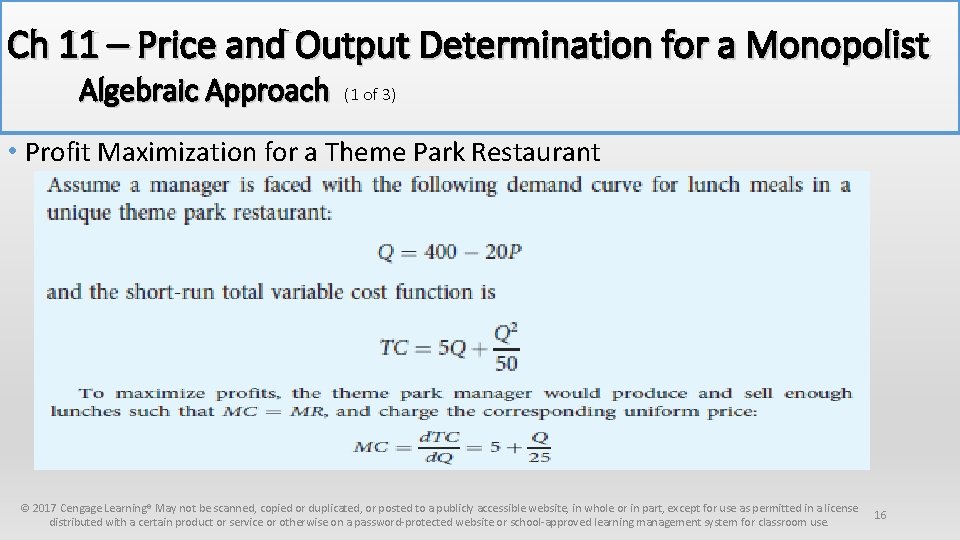

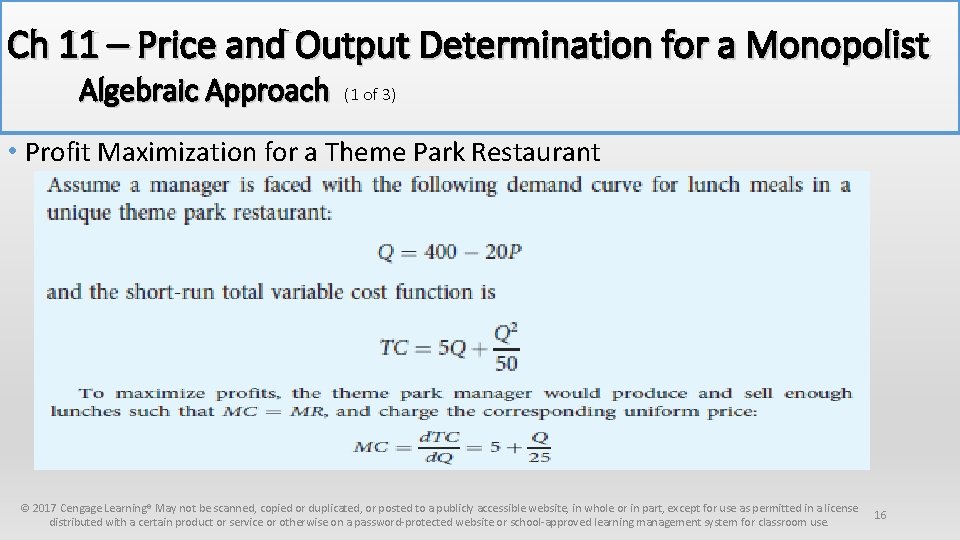

Ch 11 – Price and Output Determination for a Monopolist Algebraic Approach (1 of 3) • Profit Maximization for a Theme Park Restaurant © 2017 Cengage Learning® May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website or school-approved learning management system for classroom use. 16

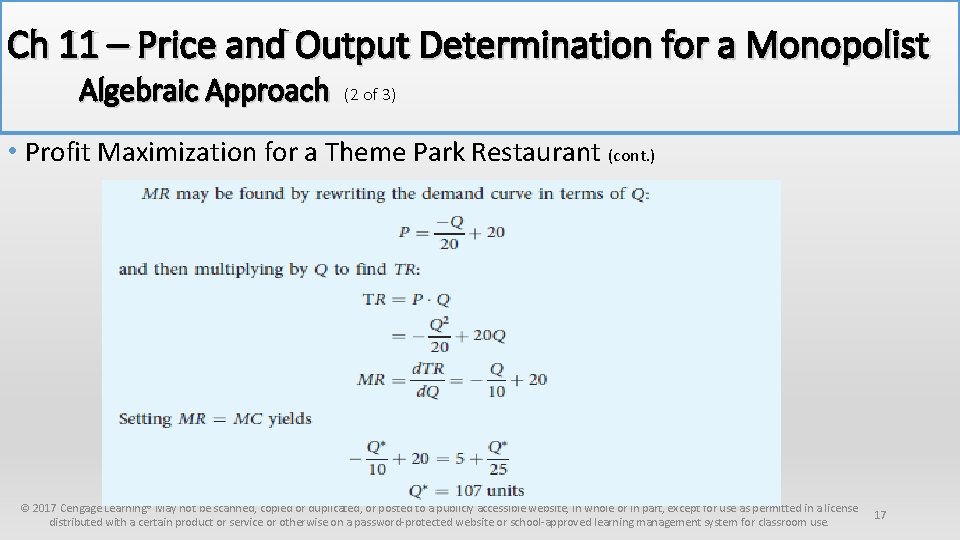

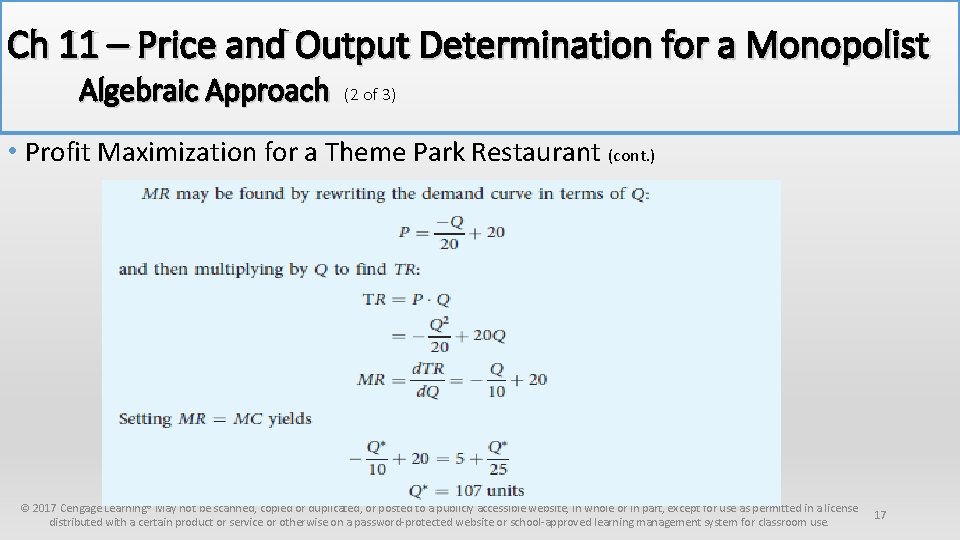

Ch 11 – Price and Output Determination for a Monopolist Algebraic Approach (2 of 3) • Profit Maximization for a Theme Park Restaurant (cont. ) © 2017 Cengage Learning® May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website or school-approved learning management system for classroom use. 17

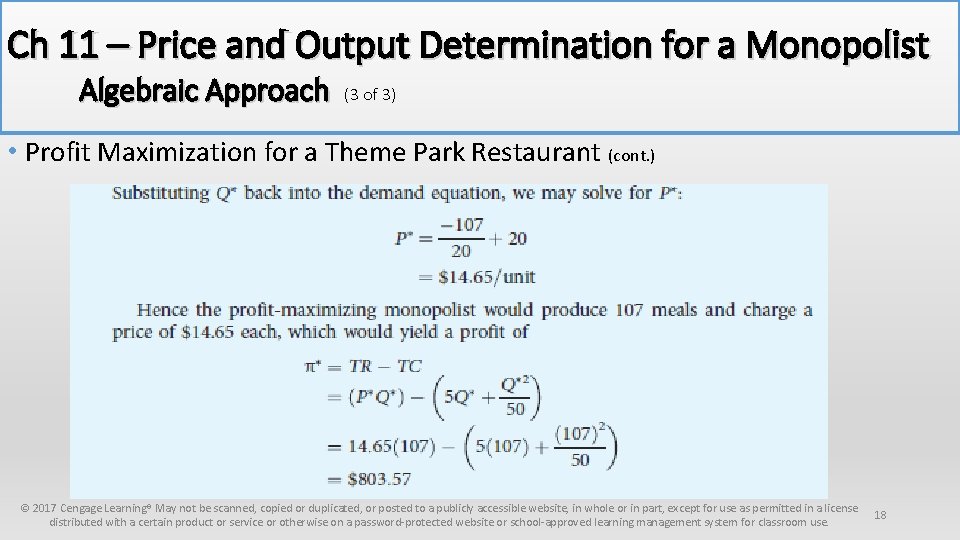

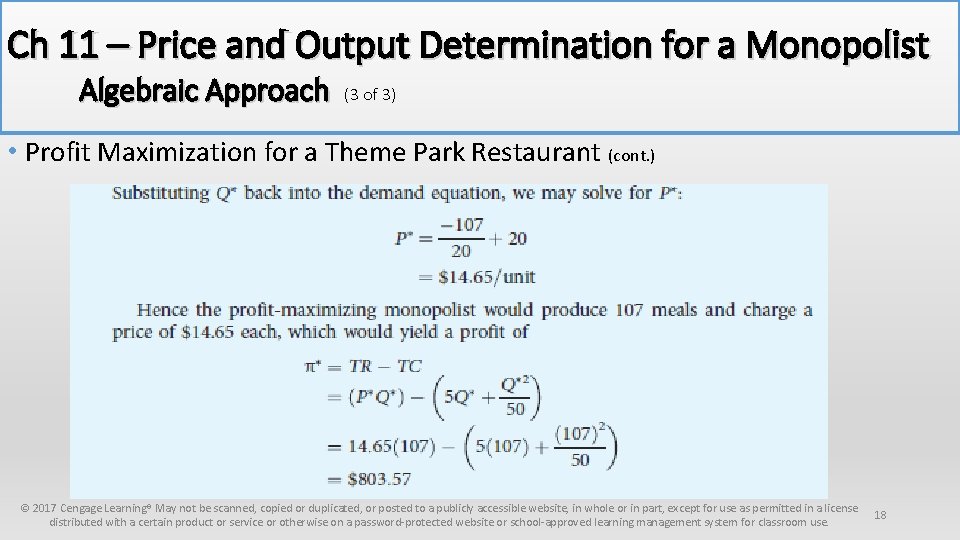

Ch 11 – Price and Output Determination for a Monopolist Algebraic Approach (3 of 3) • Profit Maximization for a Theme Park Restaurant (cont. ) © 2017 Cengage Learning® May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website or school-approved learning management system for classroom use. 18

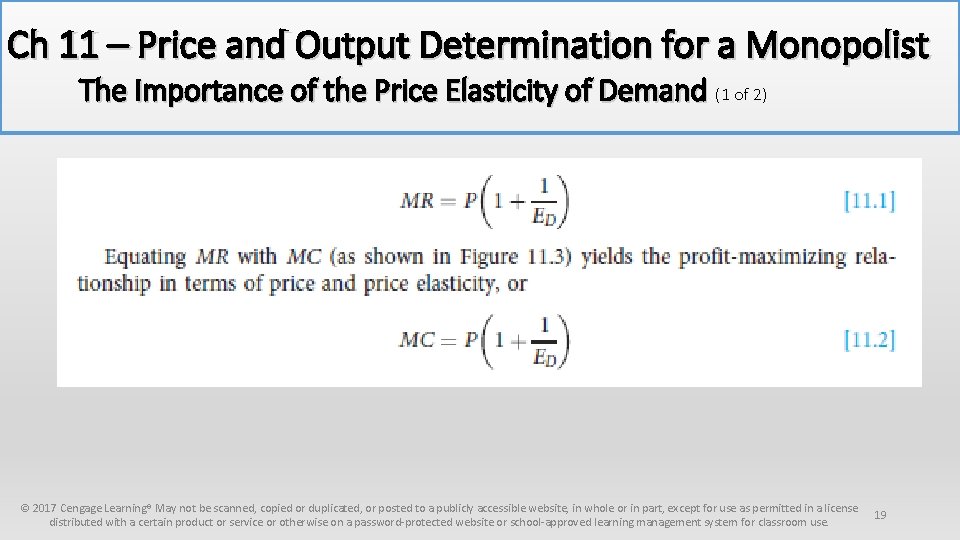

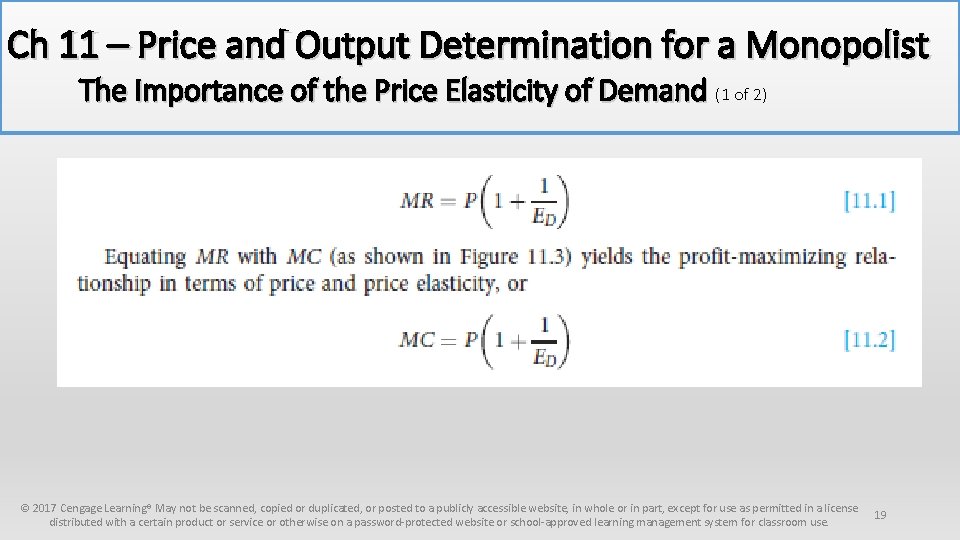

Ch 11 – Price and Output Determination for a Monopolist The Importance of the Price Elasticity of Demand (1 of 2) © 2017 Cengage Learning® May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website or school-approved learning management system for classroom use. 19

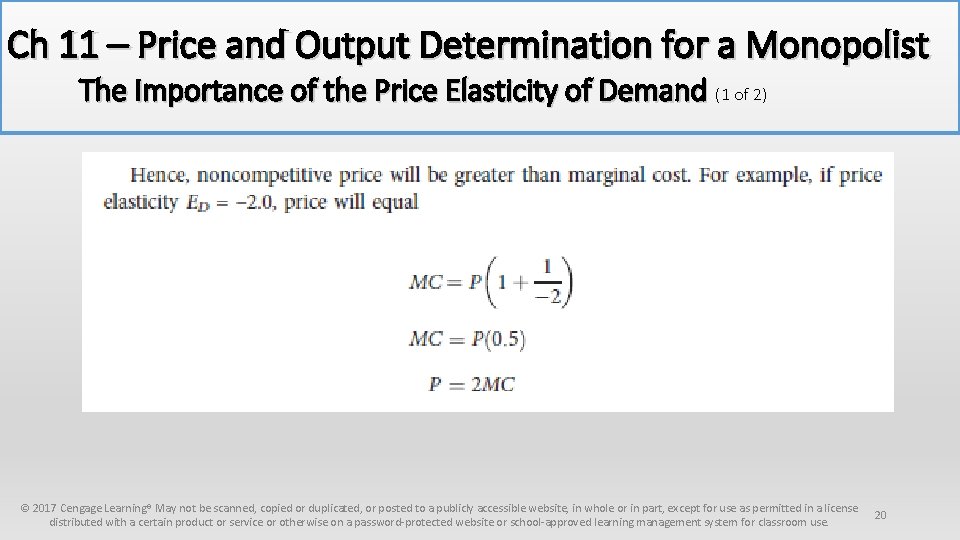

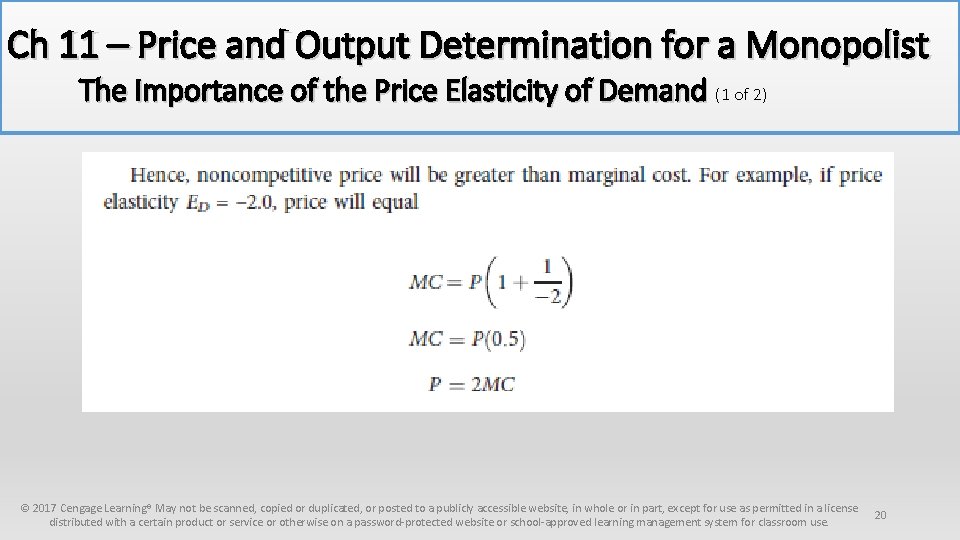

Ch 11 – Price and Output Determination for a Monopolist The Importance of the Price Elasticity of Demand (1 of 2) © 2017 Cengage Learning® May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website or school-approved learning management system for classroom use. 20

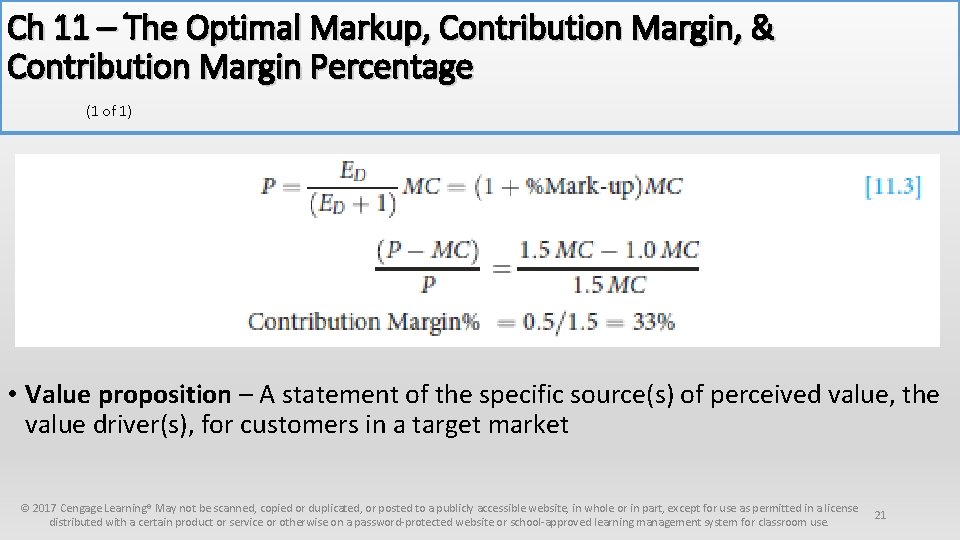

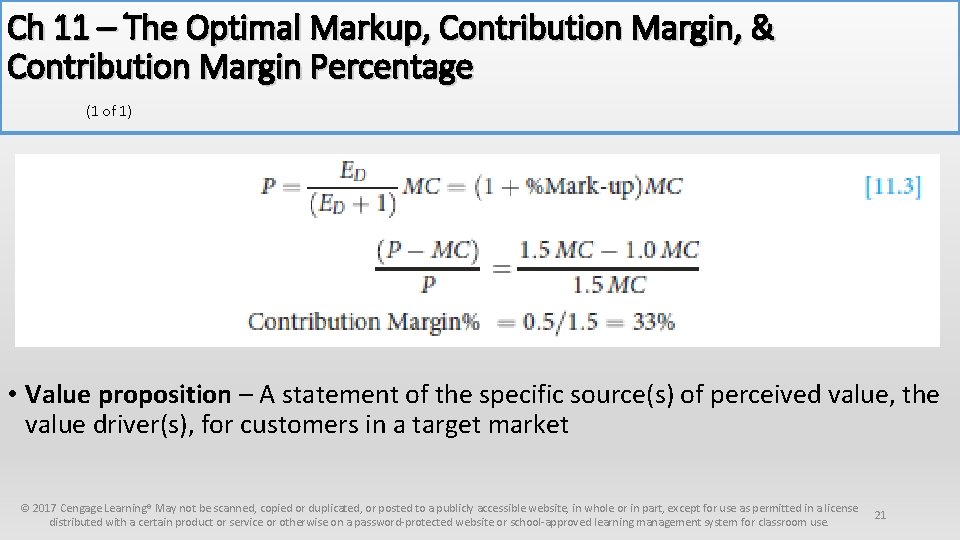

Ch 11 – The Optimal Markup, Contribution Margin, & Contribution Margin Percentage (1 of 1) • Value proposition – A statement of the specific source(s) of perceived value, the value driver(s), for customers in a target market © 2017 Cengage Learning® May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website or school-approved learning management system for classroom use. 21

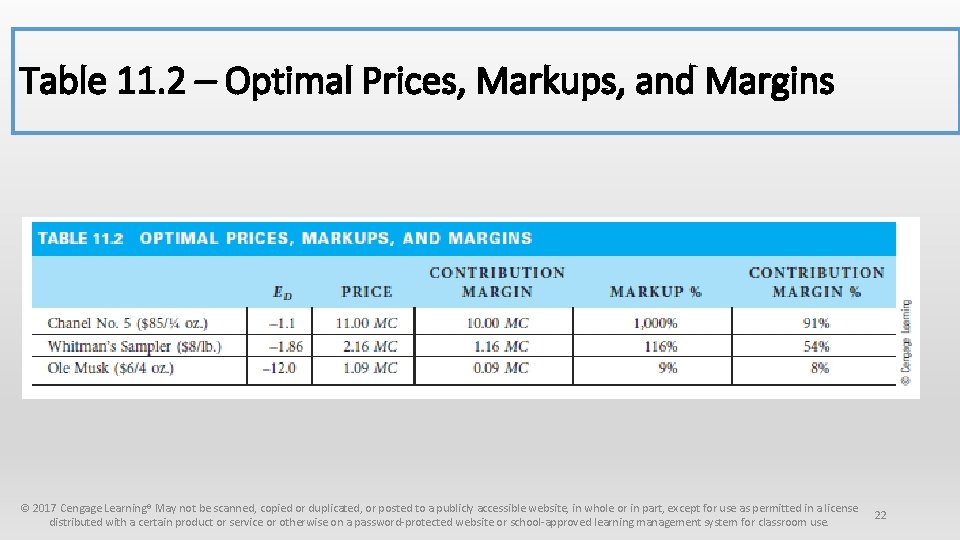

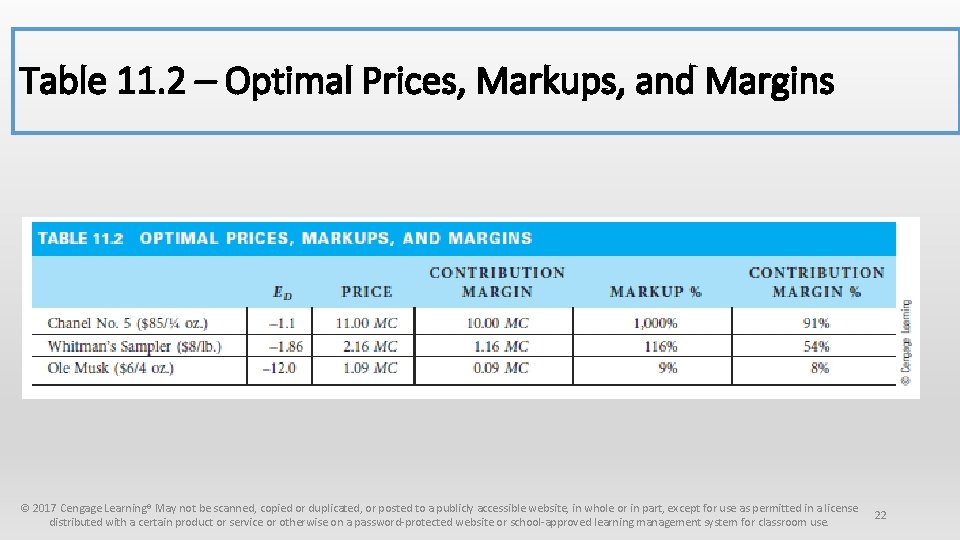

Table 11. 2 – Optimal Prices, Markups, and Margins © 2017 Cengage Learning® May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website or school-approved learning management system for classroom use. 22

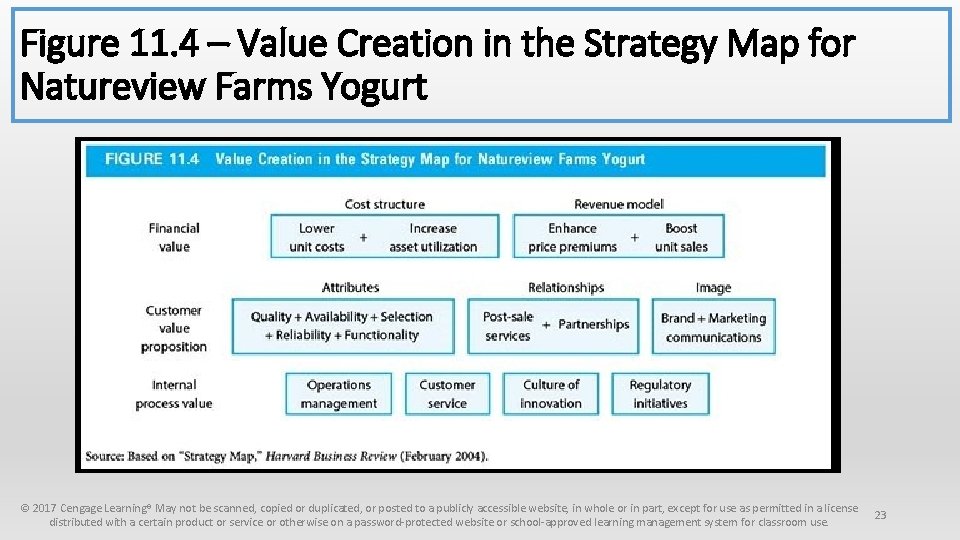

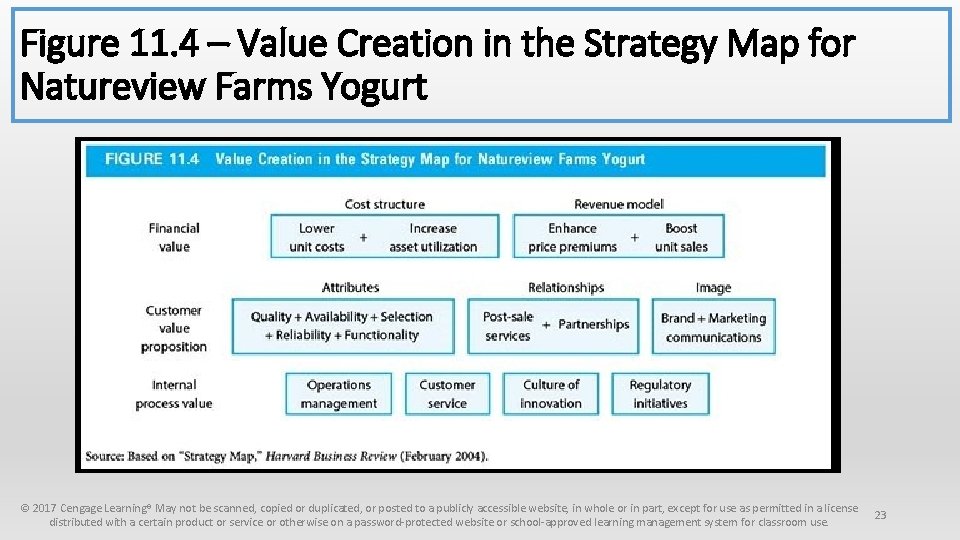

Figure 11. 4 – Value Creation in the Strategy Map for Natureview Farms Yogurt © 2017 Cengage Learning® May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website or school-approved learning management system for classroom use. 23

Ch 11 – The Optimal Markup, Contribution Margin, & Contribution Margin Percentage (1 of 1) • Gross Profit Margins • Gross profit margin – Revenue minus the sum of variable cost plus direct fixed cost, also known as direct costs of goods sold in manufacturing • Components of the Margin • Contribution margins and gross profit margins differ across industries and across firms within the same industry for many reasons • • Some industries are more capital intensive than others Differences in margins reflect differences in advertising, promotion & selling costs Differences in gross margins arise because of differential overhead in some businesses Finally, after accounting for any differences in the indirect fixed costs of capital equipment, advertising, selling expenses and overhead, the remaining differences in profit margins reflect differential profitability © 2017 Cengage Learning® May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website or school-approved learning management system for classroom use. 24

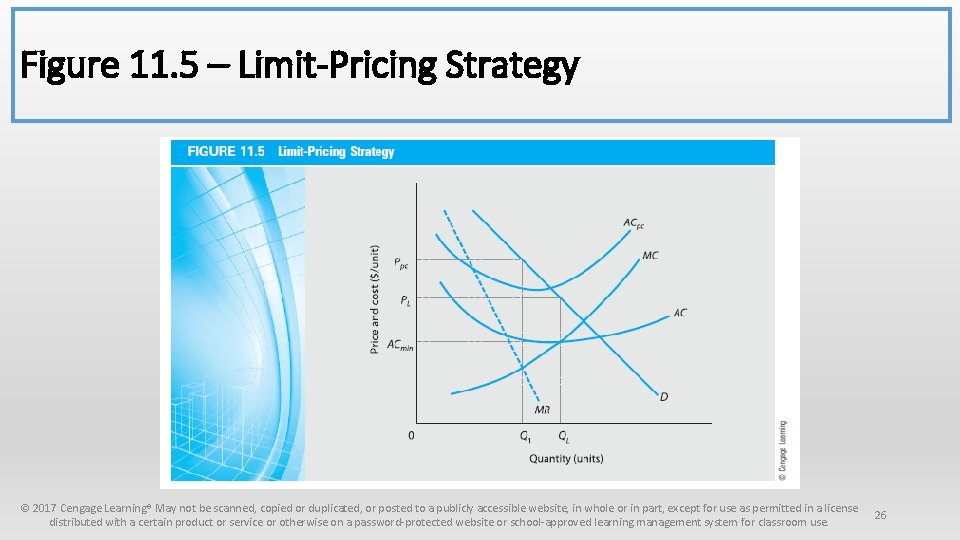

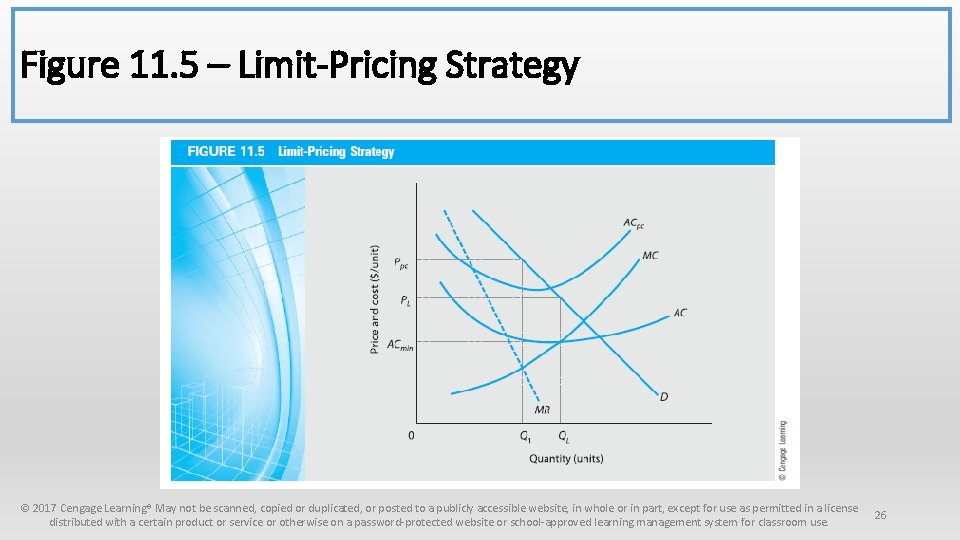

Ch 11 – The Optimal Markup, Contribution Margin, & Contribution Margin Percentage (1 of 1) • Monopolists and Capacity Investments • Because monopolists do not face the discipline of strong competition, they tend to install excess capacity or fail to install enough capacity • Even regulated monopolies over or underinvest generating capacity • Limit Pricing • Maximizing short-run profits may not necessarily maximize the long-run profits of the firm • The monopolist firm may decide instead to engage in limit pricing where it charges a lower price to discourage entry into the industry by potential rivals • The firm foregoes some of its short-run monopoly profits in order to sustain its monopoly position © 2017 Cengage Learning® May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website or school-approved learning management system for classroom use. 25

Figure 11. 5 – Limit-Pricing Strategy © 2017 Cengage Learning® May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website or school-approved learning management system for classroom use. 26

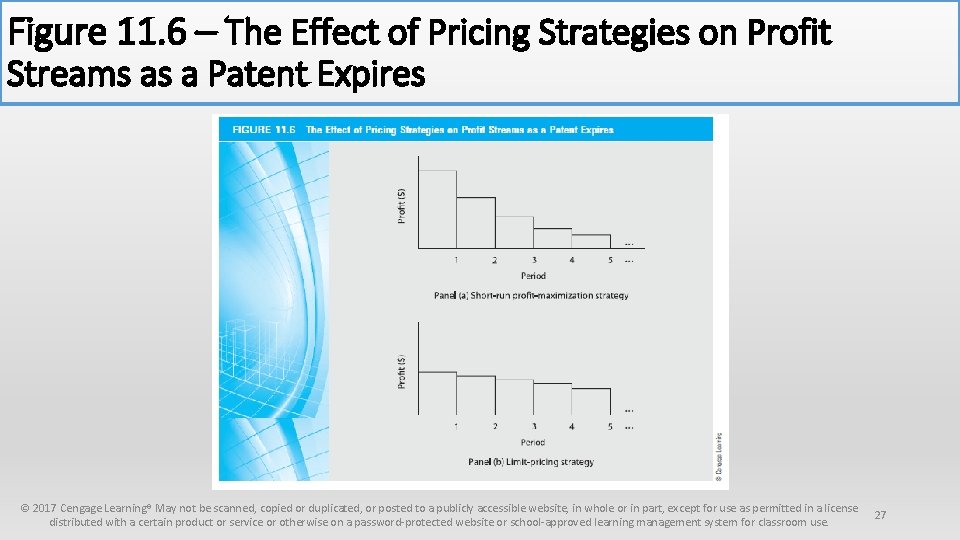

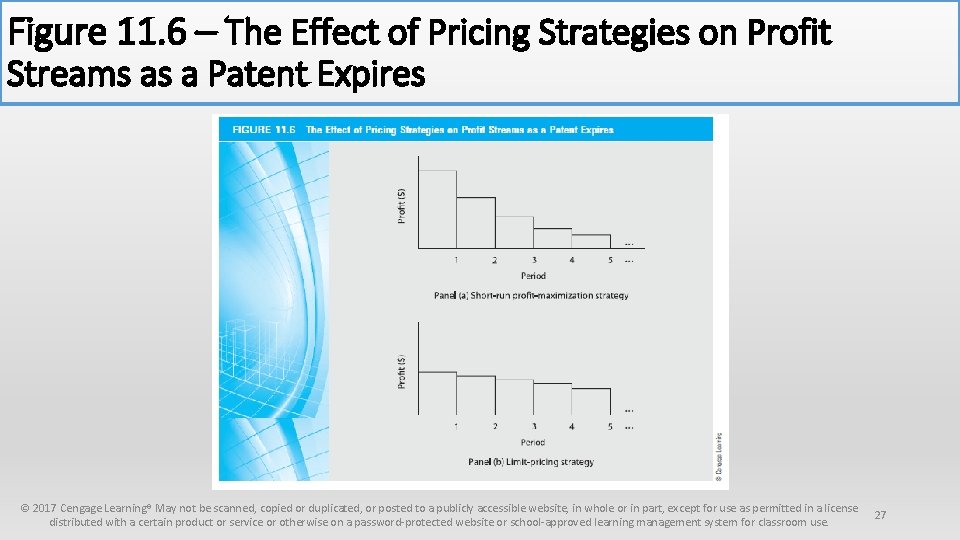

Figure 11. 6 – The Effect of Pricing Strategies on Profit Streams as a Patent Expires © 2017 Cengage Learning® May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website or school-approved learning management system for classroom use. 27

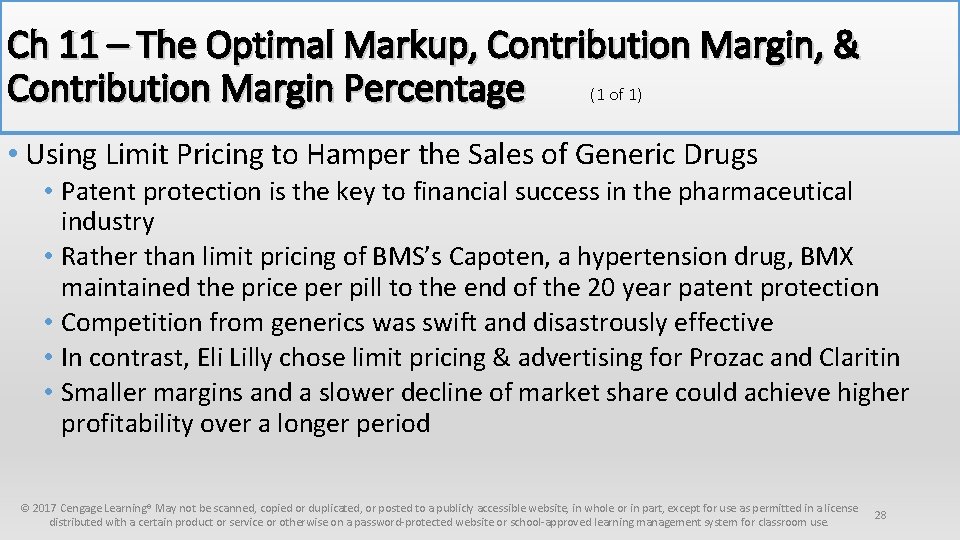

Ch 11 – The Optimal Markup, Contribution Margin, & Contribution Margin Percentage (1 of 1) • Using Limit Pricing to Hamper the Sales of Generic Drugs • Patent protection is the key to financial success in the pharmaceutical industry • Rather than limit pricing of BMS’s Capoten, a hypertension drug, BMX maintained the price per pill to the end of the 20 year patent protection • Competition from generics was swift and disastrously effective • In contrast, Eli Lilly chose limit pricing & advertising for Prozac and Claritin • Smaller margins and a slower decline of market share could achieve higher profitability over a longer period © 2017 Cengage Learning® May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website or school-approved learning management system for classroom use. 28

Ch 11 – Regulated Monopolies (1 of 1) • Several important industries in the U. S. operate as regulated monopolies, including electric power companies, natural gas companies and communications companies • Public utilities – A group of firms, mostly in the electric power, natural gas, and communications industries, that are closely regulated by one or more government agencies. The agencies control entry into the business, set prices, establish product quality standards, and influence these total profits that may be earned by the firms subject to scale economies © 2017 Cengage Learning® May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website or school-approved learning management system for classroom use. 29

Ch 11 – Regulated Monopolies Electric Power Companies (1 of 1) • Electric power is made available to the consumer through a production process characterized by 3 stages • Power is generated in generating plants • Power is transmitted from the generating site to the locality where it is used • The power is distributed to individual users • Integrated firms that carry out all 3 stages of production are usually regulated by state public utility commissions • These commissions set the rates to be charged to consumers • The firms normally receive exclusive rights to serve localities through franchisees granted by local governing bodies • As a result, electric power firms have well-defined markets within which they are the sole provider of output • Finally, the FERC has the authority to set rates on power that crosses state lines, and on wholesale power sales © 2017 Cengage Learning® May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website or school-approved learning management system for classroom use. 30

What Went Right? ● What Went Wrong? The Public Service Company of New Mexico • This firm provides electric power service and natural gas distribution services to most of New Mexico’s population • Although PNM was authorized to earn a return of 12. 5% on common equity, it was unable to do so • Faced with high growth in demand, PNM joined other regional utilities in the construction of several large coal-fired plants and a nuclear power plant, but load growth did not materialize as expected • The projects were plagued by cost overruns, delays and costly safety modifications • At completion, PNM found itself with a capacity in excess of 80% of peak demand for which it could not recover • The regulatory process does not ensure that a firm will earn its authorized return © 2017 Cengage Learning® May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website or school-approved learning management system for classroom use. 31

Ch 11 – Regulated Monopolies Natural Gas Companies (1 of 1) • This highly regulated industry is also a 3 -stage process • Production of the gas in the field • Transportation to the consuming locality through pipelines • Distribution to the final user • FERC historically set the field price of natural gas, but regulation at the wellhead has been effectively phased out • Today, FERC overseas the interstate transportation of gas by approving pipeline routes and by controlling the wholesale rates charged by pipeline firms to distribution firms • The distribution function may be carried out by a private firm or a municipal government agency • In either event, the rates charged to final users are also subject to regulatory control © 2017 Cengage Learning® May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website or school-approved learning management system for classroom use. 32

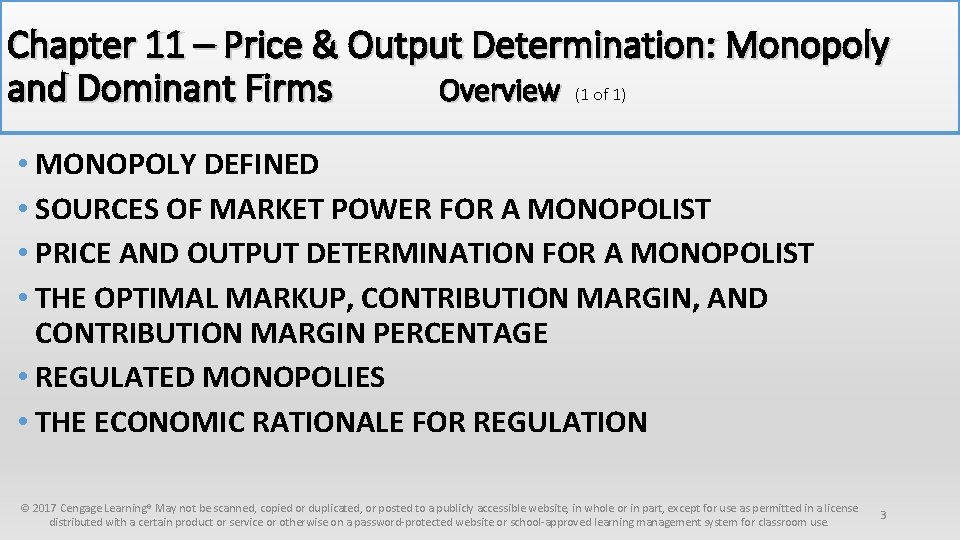

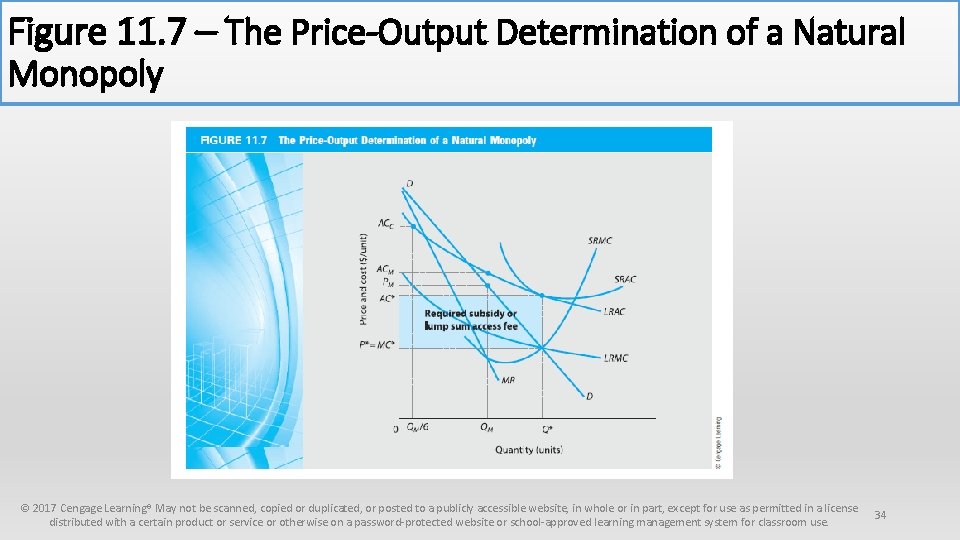

Ch 11 – The Economic Rationale for Regulation Natural Monopoly Argument (1 of 1) • Firms operating in the regulated sector are often natural monopolies in which a single supplier emerges because of a production process characterized by massive economies of scale • Natural monopoly - An industry in which maximum economic efficiency is obtained when the firm produces, distributes, and transmits all of the commodity or service produced in that industry. The production of natural monopolists is typically characterized by increasing returns to scale throughout the relevant range of output © 2017 Cengage Learning® May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website or school-approved learning management system for classroom use. 33

Figure 11. 7 – The Price-Output Determination of a Natural Monopoly © 2017 Cengage Learning® May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website or school-approved learning management system for classroom use. 34

Managerial economics applications strategy and tactics

Managerial economics applications strategy and tactics Managerial economics: theory, applications, and cases

Managerial economics: theory, applications, and cases Unethical political tactics and strategies

Unethical political tactics and strategies Volleyball positions diagram

Volleyball positions diagram Public relations strategies and tactics

Public relations strategies and tactics Sequencing strategies and tactics

Sequencing strategies and tactics Nyit blackboard

Nyit blackboard Demand estimation methods

Demand estimation methods Nature and scope of managerial economics

Nature and scope of managerial economics Managerial economics define

Managerial economics define Managerial economics questions and answers

Managerial economics questions and answers Definition of managerial economics

Definition of managerial economics Managerial economics nature and scope

Managerial economics nature and scope Engineering and managerial economics

Engineering and managerial economics Cost theory and estimation

Cost theory and estimation Determinants of demand in managerial economics

Determinants of demand in managerial economics Adjusted discount rate formula

Adjusted discount rate formula Managerial economics and decision sciences

Managerial economics and decision sciences The incremental principle

The incremental principle Managerial economics

Managerial economics Ecomics

Ecomics Contribution concept in managerial economics

Contribution concept in managerial economics Pricing methods in managerial economics

Pricing methods in managerial economics Game theory in managerial economics

Game theory in managerial economics Managerial economics hirschey

Managerial economics hirschey Discounting principle in managerial economics

Discounting principle in managerial economics Regression analysis in managerial economics

Regression analysis in managerial economics Pricing practices in managerial economics

Pricing practices in managerial economics Profit management in managerial economics

Profit management in managerial economics Example of managerial economics

Example of managerial economics Goals of the firm

Goals of the firm Demand estimation in managerial economics

Demand estimation in managerial economics Fundamentals of managerial economics mark hirschey

Fundamentals of managerial economics mark hirschey Production theory and estimation

Production theory and estimation Nature of management accounting

Nature of management accounting