QM Training January 2014 Agenda Effective January 10

- Slides: 30

QM Training January 2014

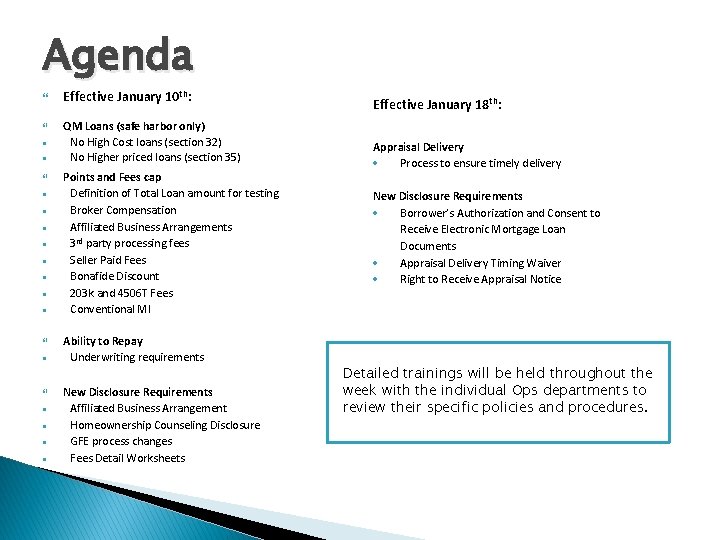

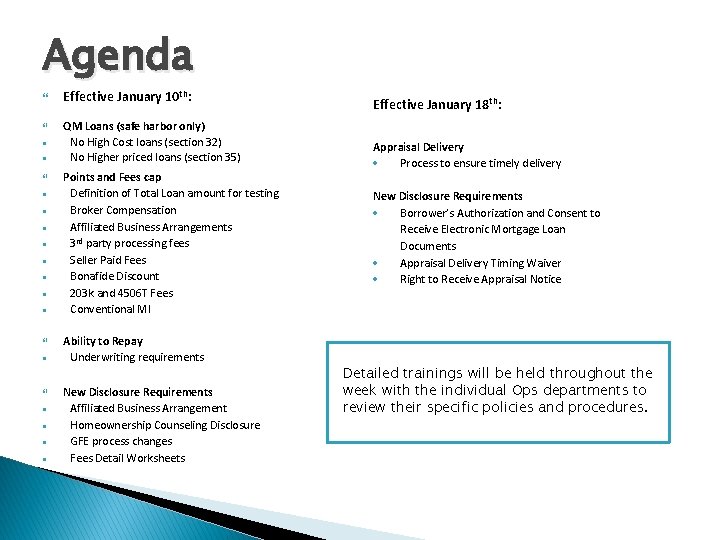

Agenda Effective January 10 th: QM Loans (safe harbor only) No High Cost loans (section 32) No Higher priced loans (section 35) Points and Fees cap Definition of Total Loan amount for testing Broker Compensation Affiliated Business Arrangements 3 rd party processing fees Seller Paid Fees Bonafide Discount 203 k and 4506 T Fees Conventional MI Ability to Repay Underwriting requirements New Disclosure Requirements Affiliated Business Arrangement Homeownership Counseling Disclosure GFE process changes Fees Detail Worksheets Effective January 18 th: Appraisal Delivery Process to ensure timely delivery New Disclosure Requirements Borrower’s Authorization and Consent to Receive Electronic Mortgage Loan Documents Appraisal Delivery Timing Waiver Right to Receive Appraisal Notice Detailed trainings will be held throughout the week with the individual Ops departments to review their specific policies and procedures.

Qualified Mortgage Rule (QM) � The components of the Qualified Mortgage Rule: Prohibit certain risky features and practices Points and fees caps Determining/documenting the borrower’s Ability to Repay (ATR)

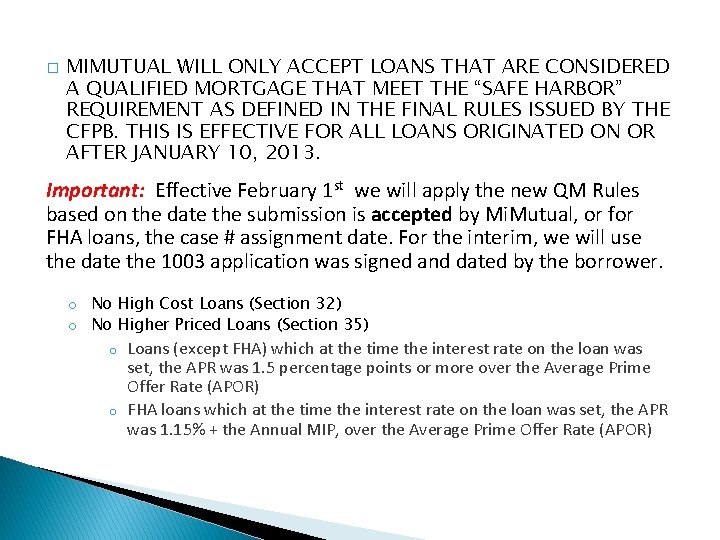

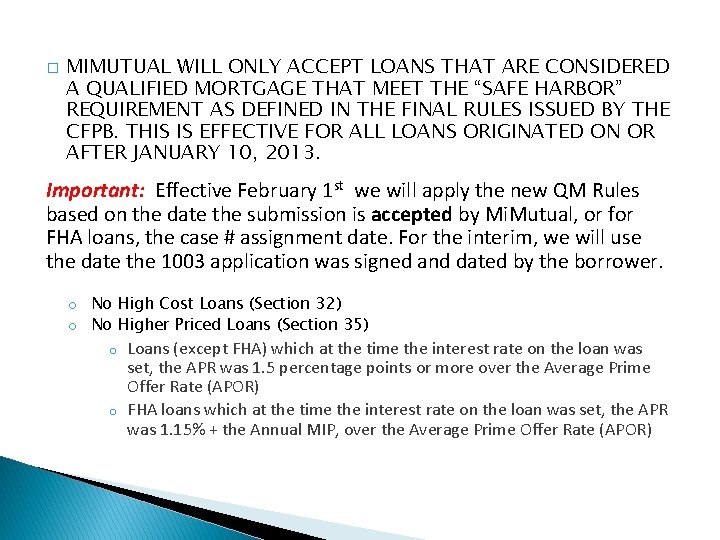

� MIMUTUAL WILL ONLY ACCEPT LOANS THAT ARE CONSIDERED A QUALIFIED MORTGAGE THAT MEET THE “SAFE HARBOR” REQUIREMENT AS DEFINED IN THE FINAL RULES ISSUED BY THE CFPB. THIS IS EFFECTIVE FOR ALL LOANS ORIGINATED ON OR AFTER JANUARY 10, 2013. Important: Effective February 1 st we will apply the new QM Rules based on the date the submission is accepted by Mi. Mutual, or for FHA loans, the case # assignment date. For the interim, we will use the date the 1003 application was signed and dated by the borrower. o No High Cost Loans (Section 32) o No Higher Priced Loans (Section 35) o o Loans (except FHA) which at the time the interest rate on the loan was set, the APR was 1. 5 percentage points or more over the Average Prime Offer Rate (APOR) FHA loans which at the time the interest rate on the loan was set, the APR was 1. 15% + the Annual MIP, over the Average Prime Offer Rate (APOR)

Points and Fees Cap

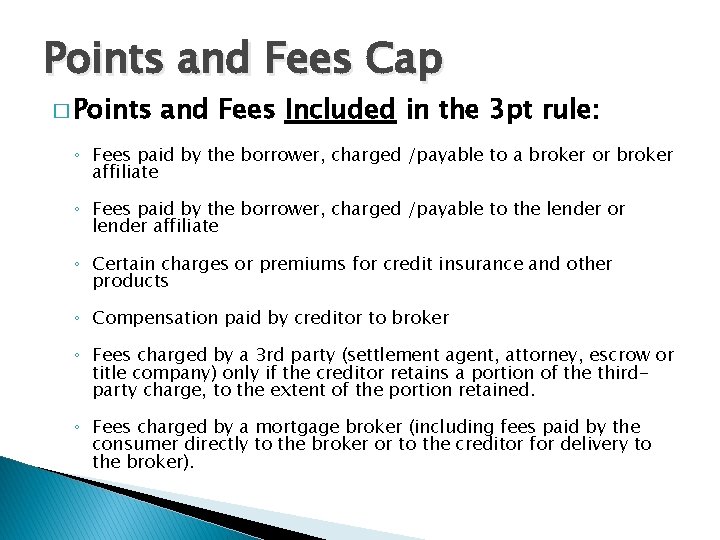

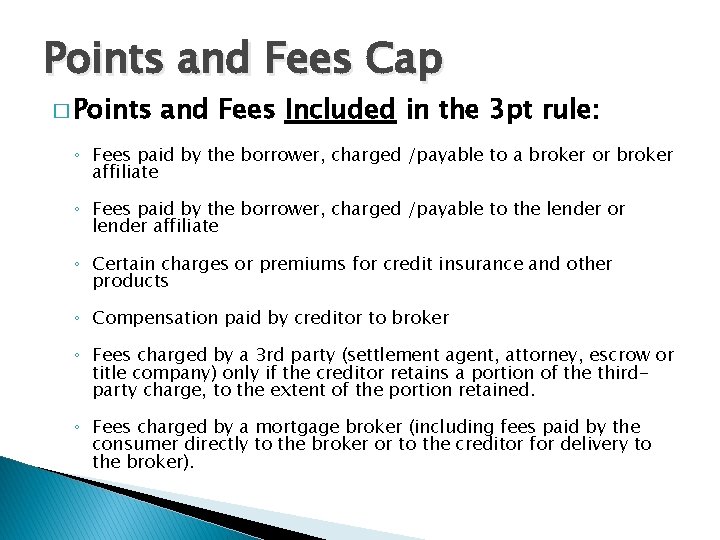

Points and Fees Cap � Points and Fees Included in the 3 pt rule: ◦ Fees paid by the borrower, charged /payable to a broker or broker affiliate ◦ Fees paid by the borrower, charged /payable to the lender or lender affiliate ◦ Certain charges or premiums for credit insurance and other products ◦ Compensation paid by creditor to broker ◦ Fees charged by a 3 rd party (settlement agent, attorney, escrow or title company) only if the creditor retains a portion of the thirdparty charge, to the extent of the portion retained. ◦ Fees charged by a mortgage broker (including fees paid by the consumer directly to the broker or to the creditor for delivery to the broker).

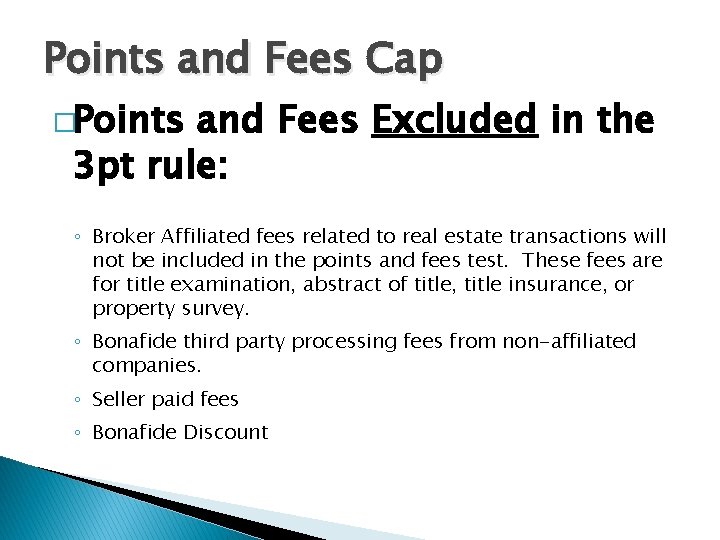

Points and Fees Cap �Points and Fees Excluded in the 3 pt rule: ◦ Broker Affiliated fees related to real estate transactions will not be included in the points and fees test. These fees are for title examination, abstract of title, title insurance, or property survey. ◦ Bonafide third party processing fees from non-affiliated companies. ◦ Seller paid fees ◦ Bonafide Discount

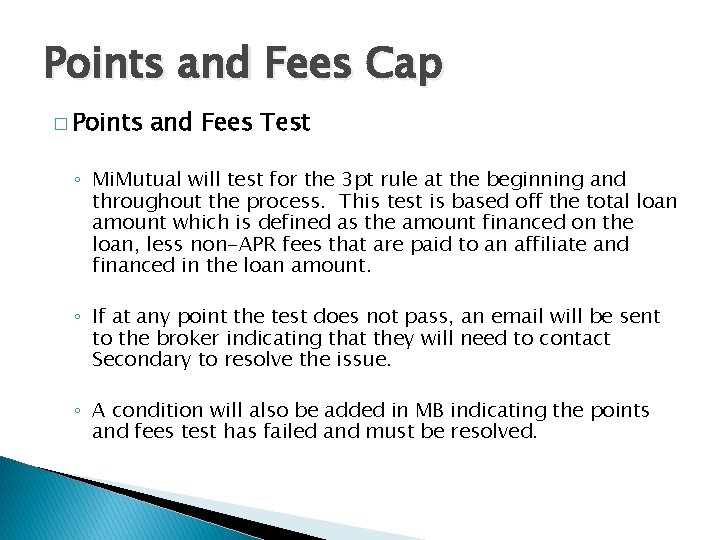

Points and Fees Cap � Points and Fees Test ◦ Mi. Mutual will test for the 3 pt rule at the beginning and throughout the process. This test is based off the total loan amount which is defined as the amount financed on the loan, less non-APR fees that are paid to an affiliate and financed in the loan amount. ◦ If at any point the test does not pass, an email will be sent to the broker indicating that they will need to contact Secondary to resolve the issue. ◦ A condition will also be added in MB indicating the points and fees test has failed and must be resolved.

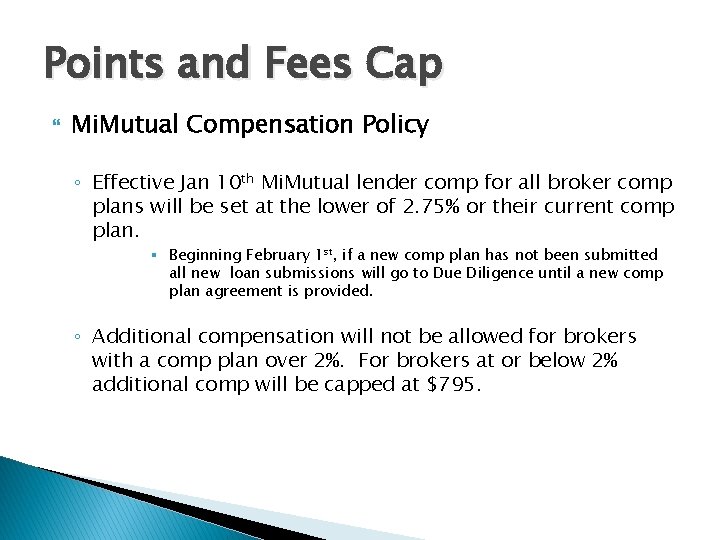

Points and Fees Cap Mi. Mutual Compensation Policy ◦ Effective Jan 10 th Mi. Mutual lender comp for all broker comp plans will be set at the lower of 2. 75% or their current comp plan. § Beginning February 1 st, if a new comp plan has not been submitted all new loan submissions will go to Due Diligence until a new comp plan agreement is provided. ◦ Additional compensation will not be allowed for brokers with a comp plan over 2%. For brokers at or below 2% additional comp will be capped at $795.

Points and Fees Cap Affiliated Business Arrangements ◦ All broker/lender Affiliated Business Arrangements must be disclosed and the fees itemized by invoice to identify any amount being retained by the affiliate (those fees are not required to be itemized on the GFE). ◦ When Mi. Mutual is aware of a broker affiliated relationship we will reach out to request the above itemized invoice so that it can be accounted for in the points/fees test.

Points and Fees Cap Third Party Processing fees ◦ Bonafide third party processing fees will be allowed for brokers on both lender and borrower paid transactions § Allowed up to $795. § Must be disclosed in box 1 of the GFE, as this is still an APR fee. § Invoice (transaction specific); and § Processor NMLS #; and o Processing Company NMLS #; or o Business License for Processing Company; or o Processing Company information reflects on the Processor’s NMLS as the current employer.

Points and Fees Cap Seller Paid Fees ◦ Fees charged to the seller and reflected on the seller’s side of the HUD-1 are not included in the points and fees test. Fees customarily charged to the borrower and reflected on the borrower’s side of the HUD-1, MUST be included in the test. ◦ When it has been negotiated that the seller is paying for fees associated with the transaction, Mi. Mutual will first apply the credit to non-APR charges on the HUD-1. Any remaining credits may then be applied toward APR charges and excluded from the points and fees test. Borrower paid compensation can never be paid by the seller.

Points and Fees Cap Bonafide Discount Points ◦ You may exclude up to 2 Bonafide discount points if the interest rate before the discount does not exceed the APOR for a comparable transaction by more than one percentage point; or ◦ You may exclude up to 1 Bonafide discount point if the interest rate before the discount does not exceed the APOR for a comparable transaction by more than 2 percentage points. Note that this will be set at rate lock and a discount point is “Bonafide” if it reduces the consumer interest rate by an amount that reflects established industry practice, such as secondary market norms.

Points and Fees Cap 203 k Supplemental Origination Fee ◦ Mi. Mutual is temporarily suspending the collection of this fee. 4506 T Processing Fee ◦ Mi. Mutual is no longer collecting a separate fee associated with the processing of 4506 T’s.

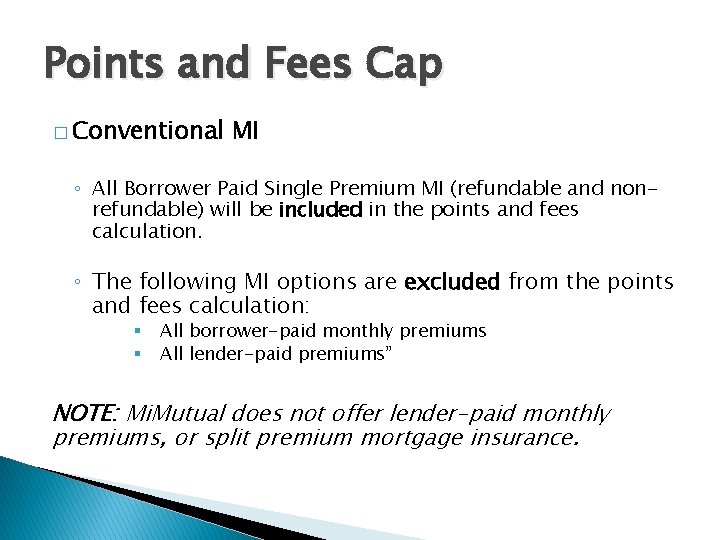

Points and Fees Cap � Conventional MI ◦ All Borrower Paid Single Premium MI (refundable and nonrefundable) will be included in the points and fees calculation. ◦ The following MI options are excluded from the points and fees calculation: § § All borrower-paid monthly premiums All lender-paid premiums” NOTE: Mi. Mutual does not offer lender-paid monthly premiums, or split premium mortgage insurance.

Ability To Repay

Ability To Repay The ATR Rule requires that you make a reasonable, goodfaith determination before or when you consummate a mortgage loan that the consumer has a reasonable ability to repay the loan, considering such factors as the consumer’s income or assets and employment status (if relied on) against: ◦ The mortgage loan payment ◦ Ongoing expenses related to the mortgage loan or the property that secures it, such as property taxes and insurance required for the consumer to buy ◦ Payments on simultaneous loans that are secured by the same property ◦ Other debt obligations, alimony, and child support payments The rule also requires you to consider and verify the consumer’s credit history.

A reasonable, good-faith ATR evaluation must include the following eight ATR underwriting factors: 1. Current or reasonably expected income or assets (other than the value of the property that secures the loan) that the consumer will rely on to repay the loan 2. Current employment status (if you rely on employment income when assessing the consumer’s ability to repay 3. Monthly mortgage payment for this loan. You calculate this using the introductory or fully-indexed rate, whichever is higher, and monthly, fully -amortizing payments that are substantially equal 4. Monthly payment on any simultaneous loans secured by the same property 5. Monthly payments for property taxes and insurance that the consumer is required to buy, and certain other costs related to the property such as homeowners association fees 6. Debts, alimony, and child support obligations 7. Monthly debt-to-income ratio or residual income, that you calculated using the total of all the mortgage and non-mortgage obligations listed above, as a ratio of gross monthly income 8. Credit history

Underwriting Requirements ◦ The underwriter is responsible for ensuring the loan is in compliance with the 8 underwriting factors associated with ATR, and will not approve any loans based on *stated income. *Non-credit and income qualifying streamlines are exempt from meeting ATR requirements, and are still defined as a Qualified Mortgage, providing all Agency guidelines are met. ◦ The borrower’s Ability to Repay must be documented on every loan.

Documenting the ATR ◦ All income calculation worksheets must be completed and clearly indicate the income used for qualifying. ◦ Complete the “Income and Debt Analysis worksheet” generated thru Mortgage Builder. This worksheet will demonstrate the underwriter’s analysis in determining the borrower’s ability to repay. ◦ The Final findings, income calculation worksheets and income/debt analysis must all be consistent and representative of the income and debts used to qualify.

Disclosures

Disclosures Affiliated Business Arrangement ◦ This disclosure will be required on all loans to indicate whether or not the broker has an affiliated relationship. ◦ If this is not provided at the time of submission, this will be conditioned for by the processor.

Disclosures Homeownership Counseling Disclosure ◦ Mi. Mutual will require the signed “Acknowledgement of Receipt of RESPA’s Homeownership Counseling Organizations List” dated within 3 days of application, along with the actual list of Counseling Agencies (pulled by property zip code) that was provided to the borrower(s). A local list of Housing Counselors can be found through the CFPB website at: www. consumerfinance. gov/find-a-housing-counselor ◦ If this is not provided at the time of submission, this will be conditioned for by the processor.

Disclosures GFE Process ◦ Upon review of the GFE, if all fees are disclosed accurately but the loan fails the points and fees test, Mi. Mutual will: § Notify the customer and Secondary via email § Disclose the TIL with the higher fees and complete the submission process. ◦ Effective February 1 st, upon Review of the GFE, if all fees are NOT disclosed accurately and the GFE is deemed unacceptable, the loan will be cancelled and the broker will be required to make the necessary corrections and upload a new submission.

Disclosures Fees Detail Worksheet ◦ The information on the itemized fee detail worksheet is necessary to ensure proper calculation of the points and fees test and proper disclosure of the Truth-in-Lending by Mi. Mutual. ◦ This document is part of the minimum submission requirement and the application will not be accepted without this information.

Appraisal Delivery

Appraisal Delivery Effective with all applications on or after January 18, 2014, all valuation tools used in the underwriting decision must be delivered to the customer by the creditor. This includes: ◦ ◦ Appraisals Desk Reviews AVM’s/BPO’s AUS Findings if a valuation is identified (FHLMC HVE value) Upon the underwriter’s approval of the appraisal/valuation tools used in the value determination, Mi. Mutual must deliver the pertinent documents to the customer within 7 days.

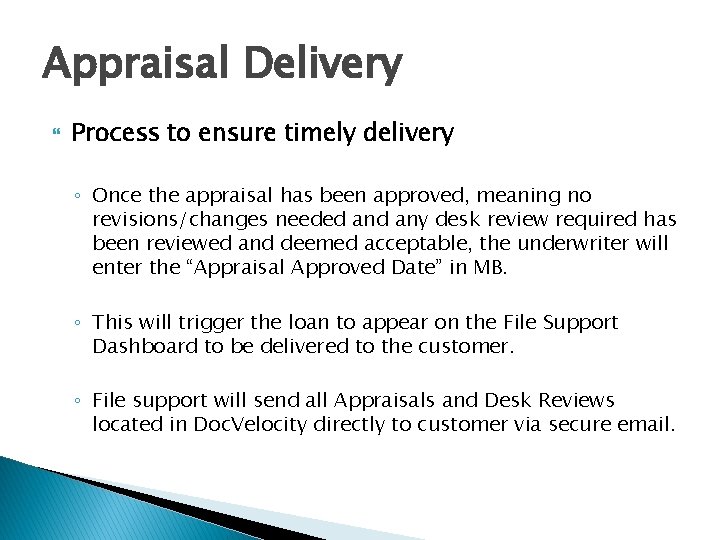

Appraisal Delivery Process to ensure timely delivery ◦ Once the appraisal has been approved, meaning no revisions/changes needed any desk review required has been reviewed and deemed acceptable, the underwriter will enter the “Appraisal Approved Date” in MB. ◦ This will trigger the loan to appear on the File Support Dashboard to be delivered to the customer. ◦ File support will send all Appraisals and Desk Reviews located in Doc. Velocity directly to customer via secure email.

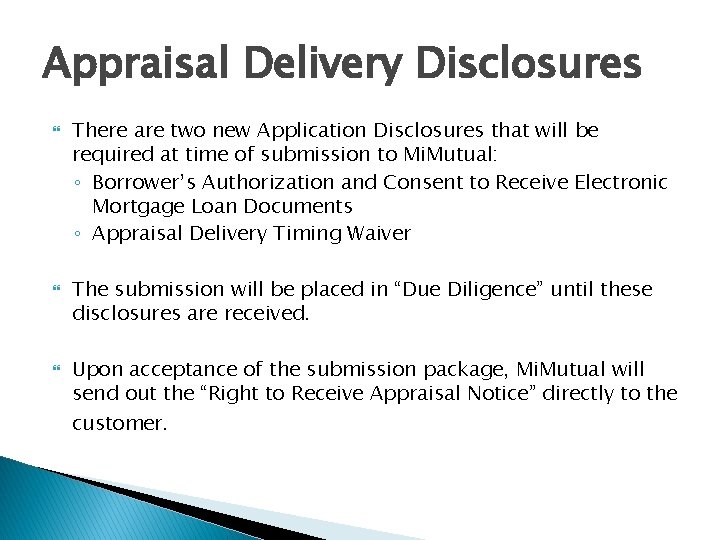

Appraisal Delivery Disclosures There are two new Application Disclosures that will be required at time of submission to Mi. Mutual: ◦ Borrower’s Authorization and Consent to Receive Electronic Mortgage Loan Documents ◦ Appraisal Delivery Timing Waiver The submission will be placed in “Due Diligence” until these disclosures are received. Upon acceptance of the submission package, Mi. Mutual will send out the “Right to Receive Appraisal Notice” directly to the customer.

Recap QM Rules effective with applications accepted on or after January 10, 2014 Appraisal Delivery requirements effective with applications accepted on or after January 18, 2014 Detailed trainings will be held throughout the week with the individual Ops departments to review their specific policies and procedures.

Agenda sistemica y agenda institucional

Agenda sistemica y agenda institucional 9101e 9101 2014 training

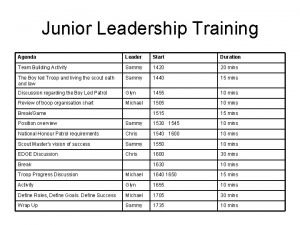

9101e 9101 2014 training Leadership training agenda

Leadership training agenda Ihrm training and development

Ihrm training and development Effective training systems strategies and practices

Effective training systems strategies and practices Effective training definition

Effective training definition Principles of effective training

Principles of effective training Training is expensive without training it is more expensive

Training is expensive without training it is more expensive Perbedaan on the job training dan off the job training

Perbedaan on the job training dan off the job training Aggression replacement training facilitator training

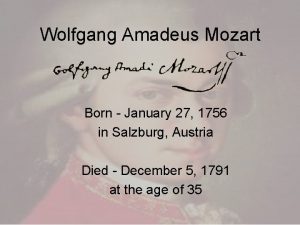

Aggression replacement training facilitator training Mozart who was born on january 27 1756

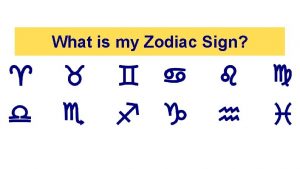

Mozart who was born on january 27 1756 Zodiac for january 20

Zodiac for january 20 Isaac newton

Isaac newton February and march season

February and march season January february march

January february march Jan 2018 chem regents

Jan 2018 chem regents Nysedregents chemistry

Nysedregents chemistry June 2012 chemistry regents answers

June 2012 chemistry regents answers January starts the year poem risa jordan

January starts the year poem risa jordan Ib grades to percentage

Ib grades to percentage Respect character trait

Respect character trait Paula hurlock birthday

Paula hurlock birthday January 27 1756

January 27 1756 When mozart born

When mozart born January february spelling

January february spelling What is the theme for the month of january

What is the theme for the month of january Our sun life cycle

Our sun life cycle January 24, 1848

January 24, 1848 William lloyd garrison jr new deal

William lloyd garrison jr new deal Polytechnic hardware store

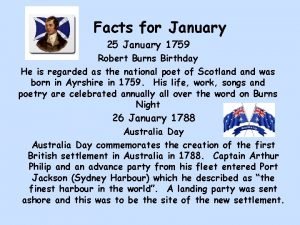

Polytechnic hardware store His birth date was on 25 january 1759

His birth date was on 25 january 1759