pwc University of California Audit and Service Plan

- Slides: 23

pwc University of California Audit and Service Plan For the Year Ending June 30, 2002

University of California January 24, 2002 To The Regents’ Committee on Audit The purpose of this document is to discuss our year 2002 audit and service plan. In this plan, we discuss current year developments at the University, as well as risk factors and professional and regulatory changes which will impact our audit. This document is intended to serve as a basis for further discussion as we refine and formalize our audit approach. We welcome any comments on this document that you might have at our March meeting. In the interim, should you have any questions, please contact Mike Schini at 408. 817. 4478. Very truly yours, Pw. C 2

University of California - Table of Contents • Introduction and Current Developments • Assessing Risk • Our Audit Approach • How We Plan to Work with the Committee on Audit • Senior Service Team • Audit Timing Note: This document is intended solely for the use of the Committee on Audit and the Management of the University. Pw. C 3

University of California We are pleased to present our audit and service plan for the year ending June 30, 2002. In our current year planning, we considered the results of our recently completed audit, organizational and operating changes, as well as regulatory and other professional matters that might affect the University. Some of the more significant factors that we have considered in our plan are as follows: Reporting changes – during the year ending June 30, 2002, the University will make significant changes to its external financial reporting to conform with the requirements of new Governmental Accounting Standards Board (GASB) Statements Nos. 34, 35 and 38, as it applies to footnote disclosures. These new Statements will dramatically change how the University’s financial statements present the financial position and results of operations. The principal changes will involve reflecting depreciation expense, presenting a classified statement of financial position, categorizing the previously used fund balances into net asset categories and including both a cash flows statement and a management discussion and analysis. The University is in the process of implementing the requirements of the new GASB Statements throughout the campuses and system-wide financial reporting process. We believe that the University’s proactive efforts will allow the University to close its books and report in a timeframe consistent with prior years. Pw. C 4

University of California Regulatory changes - while there always regulatory issues to deal with, the level of new initiatives related to reporting and accounting for sponsored programs has diminished compared to recent years. Although the government continues to make changes in regulations, we do not anticipate the current year to have many farreaching changes, but rather modifications and clarifications to existing regulations. Industry trends - higher education has not been as affected by the change in the economy as have many other sectors such as technology, with the notable exception of the decline in the equity markets. Relative to the downturn in the equity markets, we anticipate spending additional time in the current year reviewing the investment valuations. Moreover, potential effects on donors’ ability to fulfil pledges will also be considered in reviewing the allowances for unrecoverable pledges. In the healthcare area, the University continues to expend resources and efforts to assist the medical centers achieve appropriate operating results. The issues faced by the medical centers are not unique to the University, and are reflective of both industry issues and healthcare trends in California. From an audit standpoint, we plan to continue with our close communication between the campuses and medical centers’ audit teams to understand how these business issues are considered in the audit of the financial statements. We will also consider the potential effects of these issues on the consolidated financial statements of the University. Pw. C 5

University of California Changes in the Accounting Profession – as a result of recent developments surrounding the failure of Enron, eleven Congressional committees, the Securities and Exchange Commission, the Department of Justice and several state boards of accountancy have now launched investigations. While it is too early to know exactly what happened, it is clear that many critics are questioning key components of the U. S. capital markets. While we await for changes in the reporting, disclosures or roles accounting firms may take at clients, Pricewaterhouse. Coopers has already made certain commitments to eliminate any future questions by the public regarding integrity issues of the accounting profession. In an effort to address concerns over the appearance of a conflict of interest between auditing and consulting, Pricewaterhouse. Coopers is moving forward with an initial public offering this Spring of Pricewaterhouse. Coopers Consulting. We also support prohibiting the provision of large-scale information technology design and implementation services and internal audit services by auditors to their audit client as this can indeed give an appearance of a conflict to the audit process. We note that we have not recently performed either of these services for the University and have no plans to do so. Utilizing our industry and technical knowledge and creativity to assist our clients does not appear to be contrary to the audit function to most people. In addition, we believe the accounting standard setting process must be overhauled. We advocate replacing the current, cumbersome standard setting process with a single, private sector standard setting organization whose goal is to establish principle-based accounting standards. These standards should focus on the substance of transactions and be consistent with providing financial information that is transparent, understandable and written in plain English. Pw. C 6

University of California Beginning this fiscal year, we will issue an annual report to our clients on our financial performance, quality practices and initiatives and other relevant matters. In addition we will add three outside, independent Directors to our Global Board. These outside Directors will be charged with the responsibility of overseeing our auditing quality, independence and objectivity. We will also share our partner evaluation and compensation policies with client audit committees. Audit committees need to have complete trust and confidence that our audit partners are rewarded for audit performance. Lastly, for fiscal year 2003, we will develop an Annual Engagement Contract with the Committee on Audit that will lay out in detail our role in supporting audit committees as they discharge their fiduciary responsibilities. Pw. C 7

University of California Changes in Government Audit Standards – in January 2002, the General Accounting Office announced certain changes to the independence requirements for Government Auditing Standards. The new standards deal with a range of audit independence issues, the most significant change relates to the rules associated with nonaudit, or consulting services. The new standards are effective for audit for periods beginning after October 1, 2002. The new independence standards for nonaudit services is based on two overarching principles: auditors should not perform management functions or make management decisions; and auditors should not audit their own work or provide non-audit services in situations where the amounts or services involved are significant or material to the subject matter of the audit. The new standards are more restrictive than those of the AICPA and require documentation as to why any nonaudit services do not violate the overarching principles. We have reviewed the new independence requirements and will ensure we are compliant with them. Pw. C 8

University of California Other areas of emphasis - in addition to the consideration of industry and regulatory trends discussed above, we will also plan to place a continuing emphasis on certain other areas, which have also been the focus of the University initiatives. Those areas are as follows: Information Technology The University continues to implement new technology. In connection with our current year audit, we will review the technology initiatives that the University has underway with the goal of understanding those that might impact financial statement processes such as procurement, revenue and the like. We will also review security issues that arise from new systems efforts. As the University operates in an open computing environment, security will always be an area of concern, and we will update our understanding of the University’s current procedures. Taxes As part of the audit, we meet periodically with University management to discuss changes in tax regulations which may impact the University and to discuss IRS audit initiatives. We will continue to have ongoing dialogue on tax matters to identify areas of concern. Pw. C 9

University of California - Assessing Risk We have developed our current year audit plan that builds upon our knowledge of the University and that is focused on concentrating on the areas of greatest risk from a financial statement viewpoint. The more significant areas of audit risk considered in our audit plan include sponsored research, investments, medical centers as well as the decentralized nature of the University’s operations. Although, as we have discussed, there are fewer regulatory and industry specific changes in these areas during the current year as compared to past years, sponsored research, state funding, and investments continue to have the most significant impact on the University’s financial statements. Pw. C 10

University of California - Assessing Risk Sponsored research presents perhaps the most pervasive audit risk area from a financial statement perspective due to the volume of research and the complex regulations related to its administration. Moreover, the complexity of federal regulations has increased over the years. While the University has made good progress over the years in implementing new regulations, there are ongoing audit initiatives as well as changing interpretations. During the year 2002, we will continue to work with management to complete the audit under OMB Circular A 133. Although there were not any material weaknesses in controls or material instances of non-compliance identified in the prior A-133 audit, the audit did disclose a few instances of non-compliance. We will continue to focus on these areas, as well as understand the current status of national initiatives. We will consider the potential impact of control and compliance issues identified in the A-133 audit on the financial statements. During the current year, we will place special emphasis on the follow-up of prior comments, including those in the main letter as well as those made in less formal communications. Pw. C 11

University of California- Assessing Risk Investments are another area of significant audit risk. The University has a large investment portfolio which includes some complex and alternative investments. While the University has developed controls and policies governing its investments, audit and control risks exist due to the liquid nature of investments in general, as well as the continued volatility of the financial markets. Our audit approach includes the use of a specialized team of professionals who are knowledgeable in investments and investment issues. During the current year, we will update our understanding of the control environment, investment strategies and policies, as well as be alert to any system or other changes. As mentioned previously, we will consider the effects of recent declines in the financial markets on the valuations of investee companies. An additional area of emphasis during the current year will be in the area of healthcare. As we are the auditors of the medical centers, we will be cognizant of healthcare issues that could have an effect on the University on a consolidated basis. Healthcare, like sponsored research, is a very complex area subject to extensive regulation. While the changes in regulation have slowed in higher education, it should be noted that extensive new regulations in healthcare, including HIPPA, are in a phase-in period, and these will impact the University as well as the medical centers. These risk factors and others are considered in developing our audit plan, which is directed primarily toward opining on the financial statements of the University, taken as a whole. While we may provide commentary on various elements of the internal control structure, it should be noted that these comments are compiled only in the context of the financial statement audit. Pw. C 12

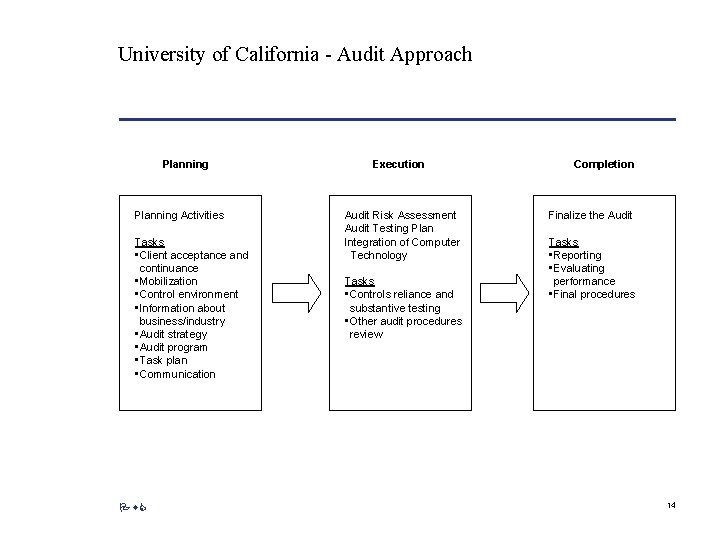

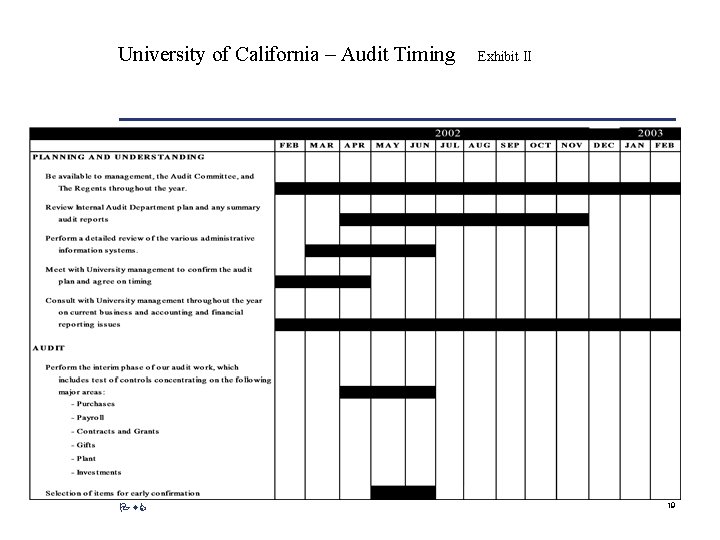

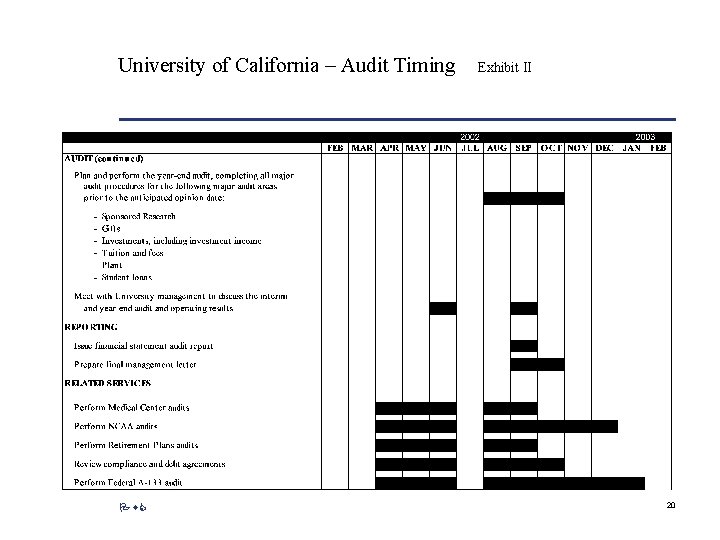

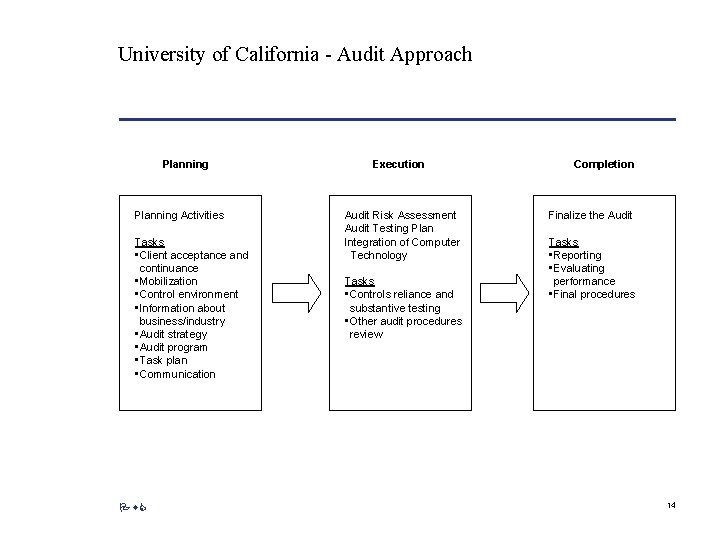

University of California - Audit Approach Phases of our Audit Our audit is conducted in three principal phases as depicted on the following page. Consistent with prior years, we plan to place maximum reliance on the University’s systems to reduce the level of year end testing required. Our testing of internal controls will occur in the Spring, with our substantive work on year end balances occurring in August/September. The phases of our audit and the execution of our plan build in the areas of risk that we have assessed. Liaison with Internal Audit In connection with our audit, we liase and interact with Internal Audit. We will review the reports that Internal Audit has issued throughout the current fiscal year and will modify our workplan accordingly. Pw. C 13

University of California - Audit Approach Planning Activities Tasks • Client acceptance and continuance • Mobilization • Control environment • Information about business/industry • Audit strategy • Audit program • Task plan • Communication Pw. C Execution Audit Risk Assessment Audit Testing Plan Integration of Computer Technology Tasks • Controls reliance and substantive testing • Other audit procedures review Completion Finalize the Audit Tasks • Reporting • Evaluating performance • Final procedures 14

University of California - Our Audit Approach Fraud and Illegal Acts Our audit is designed primarily to opine on the presentation of the University’s financial statements in accordance with Generally Accepted Auditing Standards and Government Auditing Standards. These audits are based upon selective testing of transactions. Audits are not designed with a primary emphasis on detecting fraud or violations of laws or regulations. Audits are subject to the limitation that existing material errors or fraud or other illegal acts having a direct and material financial statement impact may not be detected. Therefore, we cannot ensure that errors, fraud or other illegal acts, if present, will be detected. However, we will communicate to you, as appropriate, any detected illegal acts, material errors or evidence that fraud may exist. Government Auditing Standards As a recipient of federal funds, the University is subject to an audit under Government Auditing Standards (GAS). An audit under these standards includes procedures and tests which are beyond those required in connection with an audit under generally accepted auditing standards. The additional requirements under GAS include tests of compliance with applicable laws and regulations and obtaining an understanding of the control environment relative to federal awards. Although we perform additional procedures under GAS, our audit is based upon selective testing of compliance, and does not consider compliance with all laws and regulations; it also does not provide an opinion on the University’s internal control system, thus, this audit may not meet the needs of all potential users of the financial statements. Pw. C 15

University of California - How We Plan to Work with the Committee on Audit and Management During 2001, we met with management and the Committee on Audit to discuss our audit and emerging issues. We worked jointly with management in dealing with many areas, including changes in presentation of the financial statements and the other impacts of the new GASB Statements. In the current year, we plan to continue our regular scheduled meetings with the Committee on Audit, Vice President, Assistant Vice President, Internal Audit as well as continued interaction with management at the campuses and medical centers. These meetings would be in addition to our contacts with others at the University, Offices of Extramural Funds, Athletics, the National Laboratories and other departments. We will also be available, as desired, for other informal meetings on emerging issues. Pw. C 16

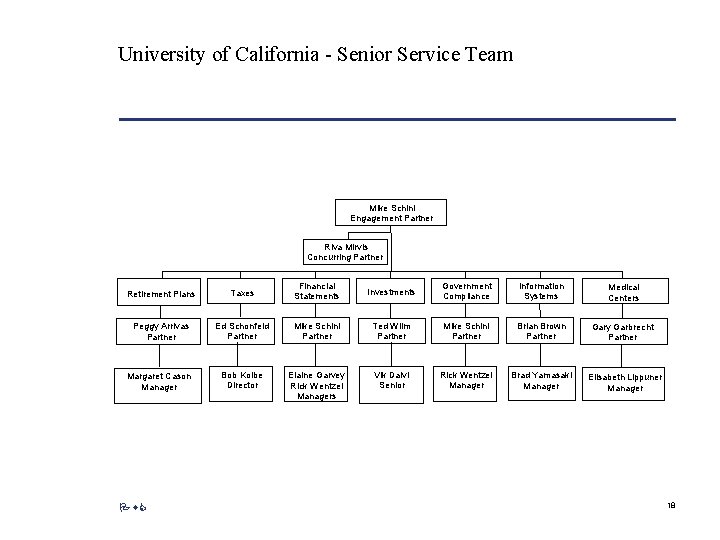

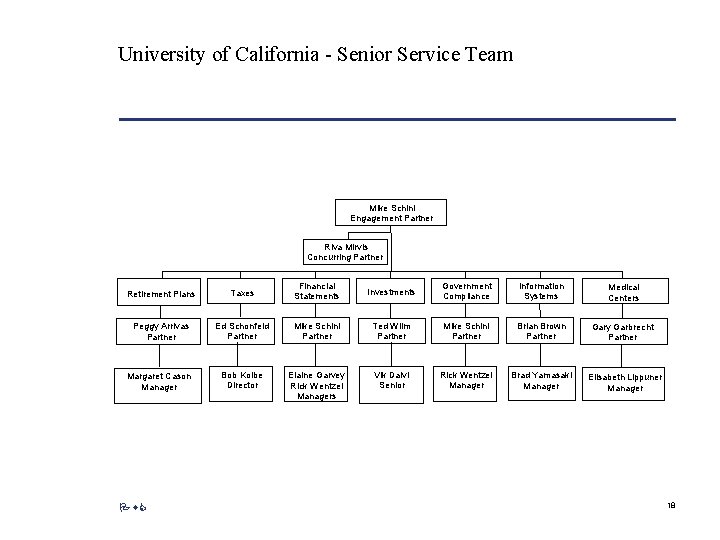

University of California - How We Plan to Work with the Audit Committee and Management Your basic team will be unchanged-- Mike Schini will continue as your client service partner. Assisting him will be Riva Mirvis, who will serve as review partner, Gary Garbrecht, who will serve as the lead partner on the medical centers, and Elaine Garvey and Rick Wentzel, who will continue to serve as the primary audit managers. In addition, this team will be supported by specialty partners in various functional areas – Ted Wilm in the area of investments, Ed Schonfeld for taxes, and Brian Brown in the information systems area. There also other partners and managers who will support the University audit team through their responsibilities of being the lead contacts at the campuses and medical centers. Pw. C 17

University of California - Senior Service Team Mike Schini Engagement Partner Riva Mirvis Concurring Partner Retirement Plans Taxes Financial Statements Investments Government Compliance Information Systems Medical Centers Peggy Arrivas Partner Ed Schonfeld Partner Mike Schini Partner Ted Wilm Partner Mike Schini Partner Brian Brown Partner Gary Garbrecht Partner Margaret Cason Manager Bob Kolbe Director Elaine Garvey Rick Wentzel Managers Vik Dalvi Senior Rick Wentzel Manager Brad Yamasaki Manager Elisabeth Lippuner Manager Pw. C 18

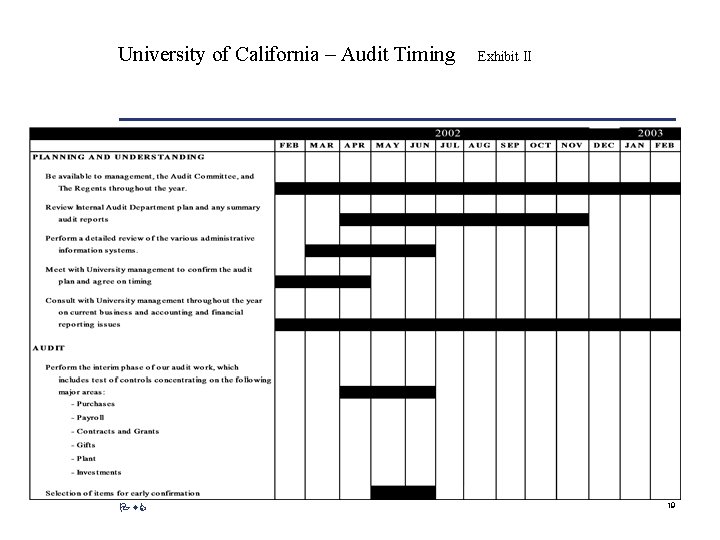

University of California – Audit Timing Pw. C Exhibit II 19

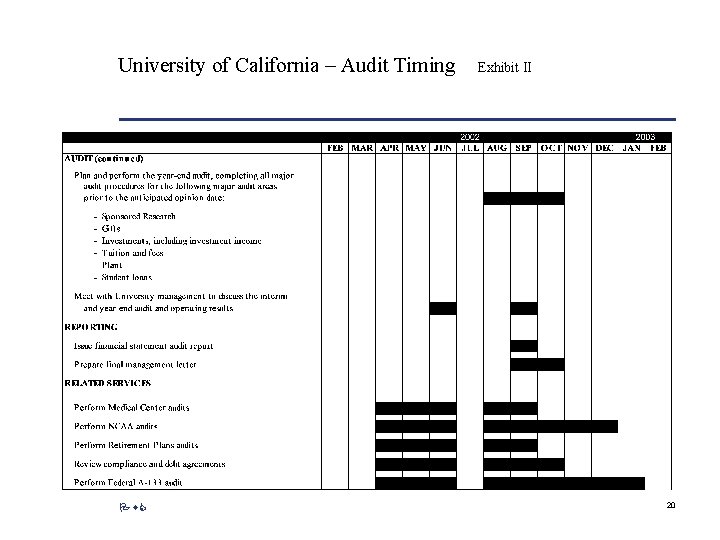

University of California – Audit Timing Pw. C Exhibit II 20

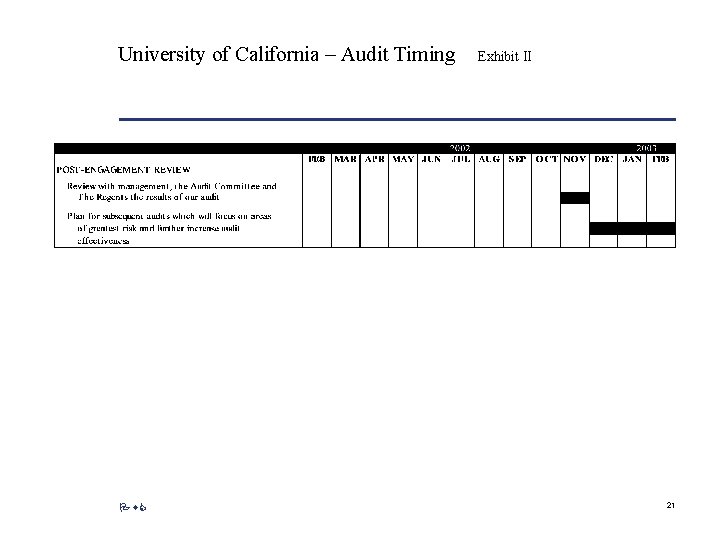

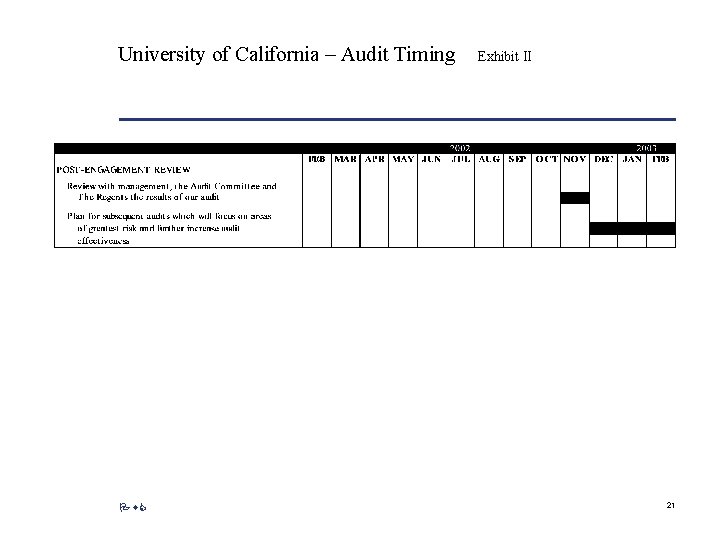

University of California – Audit Timing Pw. C Exhibit II 21

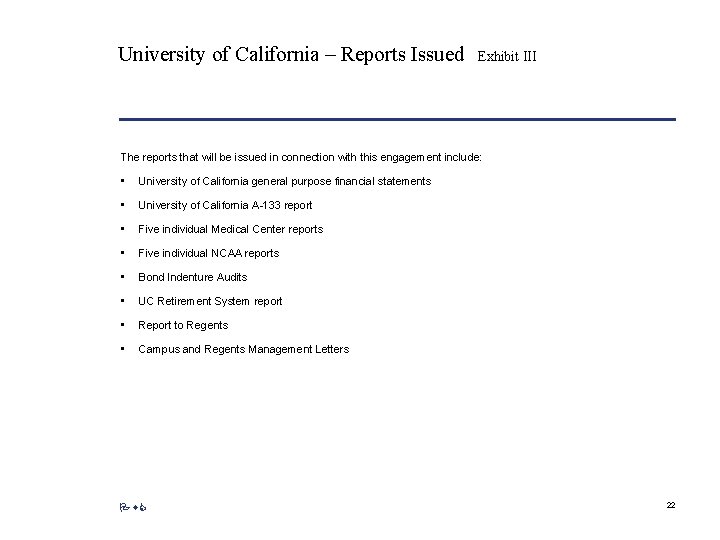

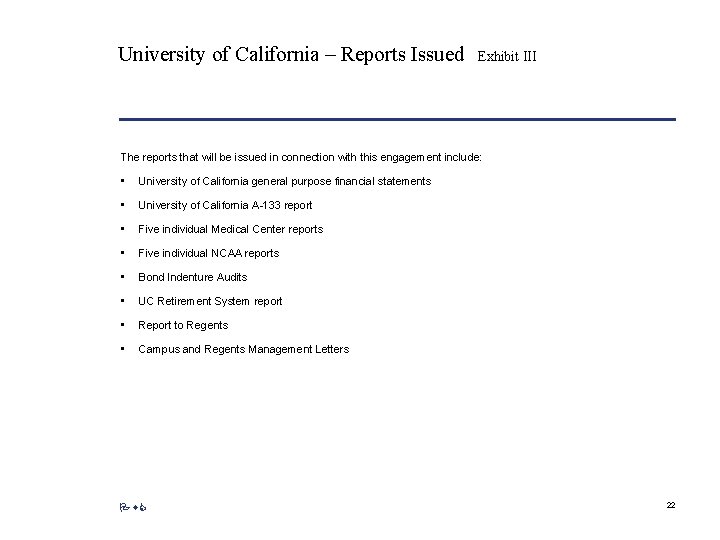

University of California – Reports Issued Exhibit III The reports that will be issued in connection with this engagement include: • University of California general purpose financial statements • University of California A-133 report • Five individual Medical Center reports • Five individual NCAA reports • Bond Indenture Audits • UC Retirement System report • Report to Regents • Campus and Regents Management Letters Pw. C 22

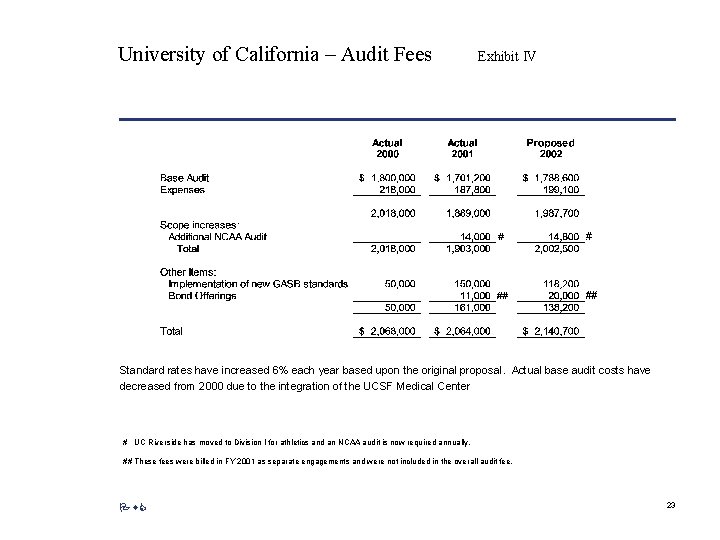

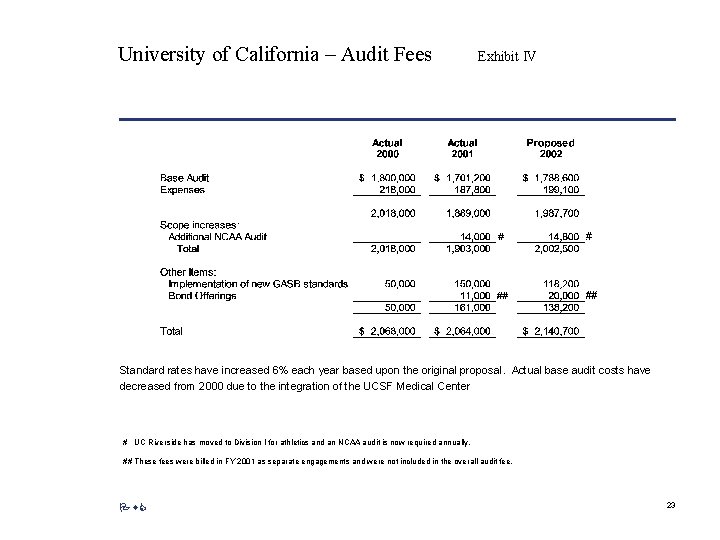

University of California – Audit Fees Exhibit IV Standard rates have increased 6% each year based upon the original proposal. Actual base audit costs have decreased from 2000 due to the integration of the UCSF Medical Center # UC Riverside has moved to Division I for athletics and an NCAA audit is now required annually. ## These fees were billed in FY 2001 as separate engagements and were not included in the overall audit fee. Pw. C 23

Overall audit plan and audit program

Overall audit plan and audit program Audit planning memorandum pwc

Audit planning memorandum pwc Audit comfort cycle uitleg

Audit comfort cycle uitleg Pwc site:yahoo.com

Pwc site:yahoo.com Janette loveys

Janette loveys Auditor definition

Auditor definition Service improvement plan for service desk

Service improvement plan for service desk California state university long beach nursing

California state university long beach nursing Csu fresno foundation

Csu fresno foundation Uci webreg

Uci webreg Ccu final exam schedule

Ccu final exam schedule University of california

University of california University of california

University of california California university of pennsylvania global online

California university of pennsylvania global online University of southern california

University of southern california University of southern california

University of southern california Regents of university of california v bakke

Regents of university of california v bakke Perbedaan audit konvensional dengan audit berbasis risiko

Perbedaan audit konvensional dengan audit berbasis risiko Audit rekam medis adalah

Audit rekam medis adalah Beda audit medis dan audit klinis

Beda audit medis dan audit klinis Penyelesaian audit dan tanggung jawab pasca audit

Penyelesaian audit dan tanggung jawab pasca audit Perbedaan audit manajemen dan audit keuangan

Perbedaan audit manajemen dan audit keuangan Perbedaan prosedur audit top-down dengan bottom-up

Perbedaan prosedur audit top-down dengan bottom-up Perbedaan audit konvensional dengan audit berbasis risiko

Perbedaan audit konvensional dengan audit berbasis risiko