Mortgage Insurance and Lender Captives 2002 Casualty Loss

- Slides: 23

Mortgage Insurance and Lender Captives 2002 Casualty Loss Reserve Seminar (CLRS) September 24, 2002 Presented by: Michael C. Schmitz, F. C. A. S. , M. A. A. A. Principal and Consulting Actuary Milliman USA, Brookfield, Wisconsin Milliman USA 1

Overview of Presentation Background on Milliman’s typical role for lender reinsurers l Types of Reinsurance companies and structures/features l Regulatory issues l Accounting issues l Milliman USA 2

Milliman Role-Mortgage Reinsurance Front-End Role l l l l Request lender’s historical MI data from the primary insurers Conduct a portfolio risk analysis Determine benchmark risk assumptions Evaluate alternative structures Conduct feasibility study – assist in set-up Regulatory assistance Risk transfer/pricing opinions Milliman USA 3

Milliman Role-Lender Reinsurers - Ongoing Role If Milliman not involved in up-front, consider: § Request lender’s historical MI data from the primary insurers § Conduct a portfolio risk analysis § Determine benchmark risk assumptions l Loss reserve analysis/opinion l Reinsurance Performance Metrics (RPM) services § Loan Reconciliation § Reinsured Risk Analysis/Segmentation § Economic Analysis § Benchmarking of experience § Forecasting of premium and losses l Miscellaneous assistance § Sounding board – ad hoc requests § Mortgage Reinsurance Conference (MRC) l Milliman USA 4

Types of Reinsurance Companies Milliman USA l Single parent captives l Sponsored Captives l Licensed Insurers 5

Sponsored Captives l l l The sponsored captive allows lenders, through a participation agreement, to assume risk on loss performance of the mortgage loans the participant has insured with the sponsored captive’s parent company. Sponsored captives are capitalized by mortgage insurers (parent) for participation by several lenders. Lenders must contribute capital to support losses on their loans Parent provides mortgage insurance to specific lenders who enter into participation agreements with the sponsored captive. The lender receives a percentage of the mortgage insurance premium as a participation fee in return for assumption of part of the insured risk. Milliman USA 6

Sponsored Captives Each lender has a protected cell which separates the risks assumed by an individual lender from the risks of other participants (lenders). l Structure is different, but sponsored captives operate essentially the same as wholly-owned subsidiaries of lenders. l Sponsored captive enters into a reinsurance agreement with its parent, and assumes business written by its parent for the mortgage lender. l Milliman USA 7

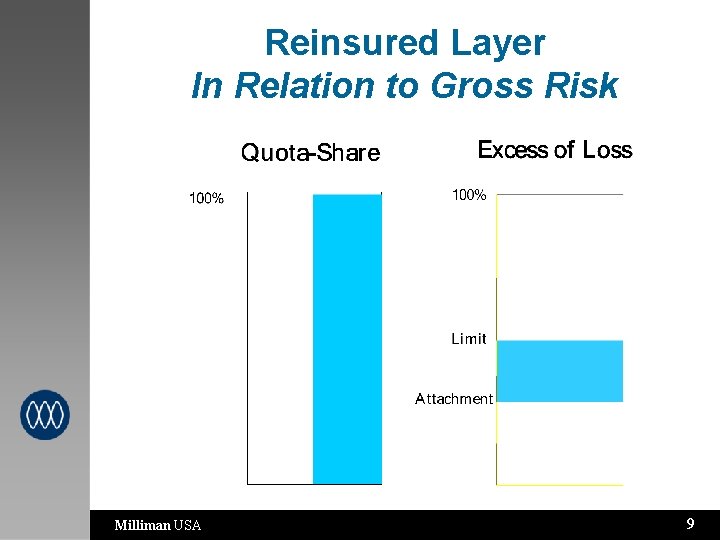

Reinsurance Structures l Quota-share: pro-rata sharing of premium and losses l Excess of Loss: Reinsurer covers a layer of losses once the primary carrier's direct losses exceed an attachment point for a book year Milliman USA 8

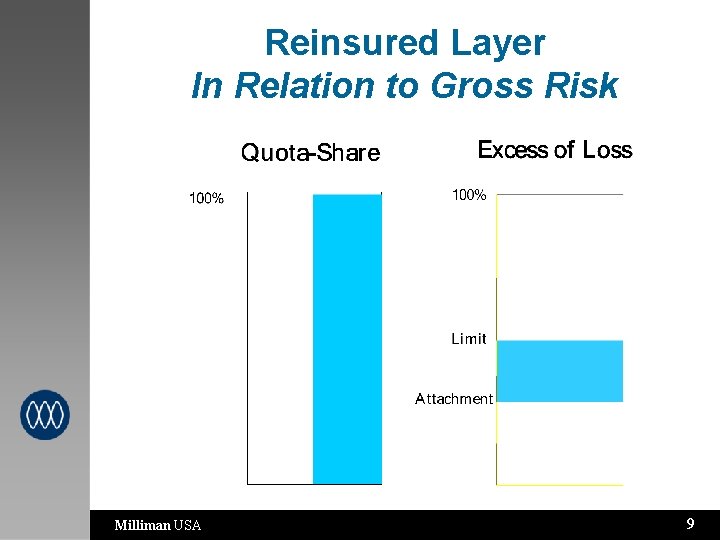

Reinsured Layer In Relation to Gross Risk Milliman USA 9

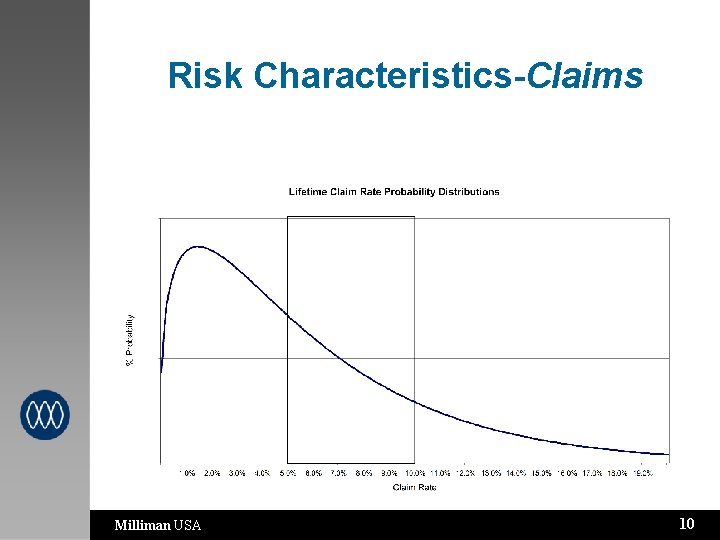

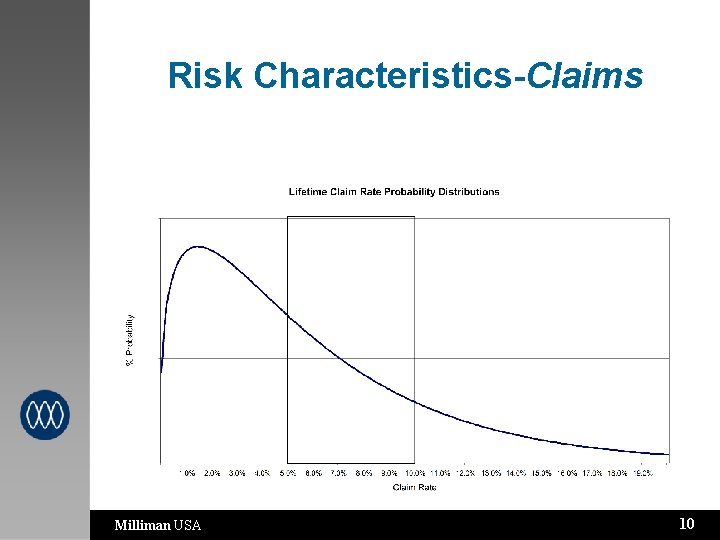

Risk Characteristics-Claims Milliman USA 10

MI Reinsurance Regulations Due to potential size of ceded reserves, it is important for MIs to be able to obtain reinsurance credit. l Contingency Reserve is currently largest issue l Security - Licensed or trust accounts or LOC’s with unaffiliated financial institutions. l Milliman USA 11

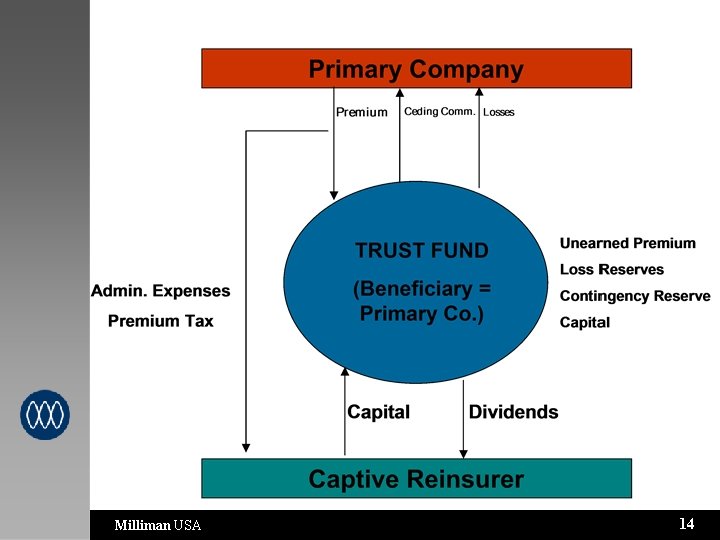

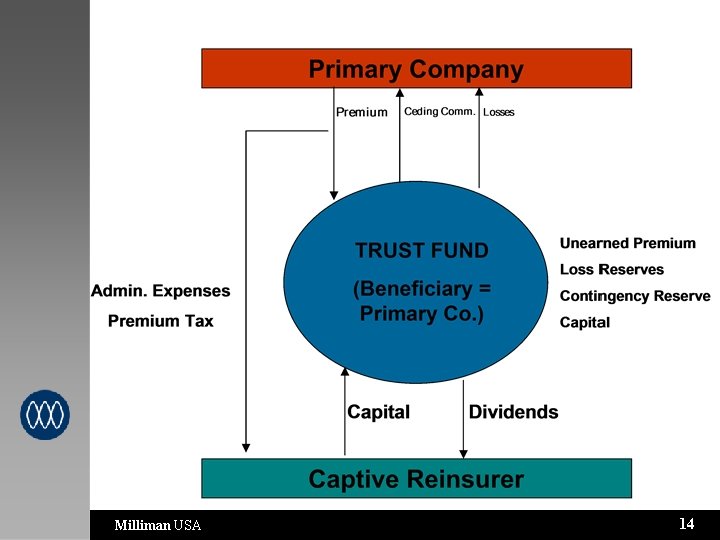

Trust Accounts Reinsurer establishes a separate trust account for each mortgage insurer l Essentially all capital infusions, premiums, losses and expense cash flows go through the trust account. l Reinsurers typically maintain reinsurance arrangements with several different mortgage insurers l Separate trust for each l Milliman USA 12

Trust Accounts Assets restricted for the sole use and benefit of the ceding mortgage insurer. l Cannot be drawn down to cover losses reinsured on behalf of other mortgage insurers. l If trust account depleted by losses, certain important remedies apply. l Excess funds in the trust account are eligible for release (and dividended to parent) subject to various restrictions. l Milliman USA 13

Milliman USA 14

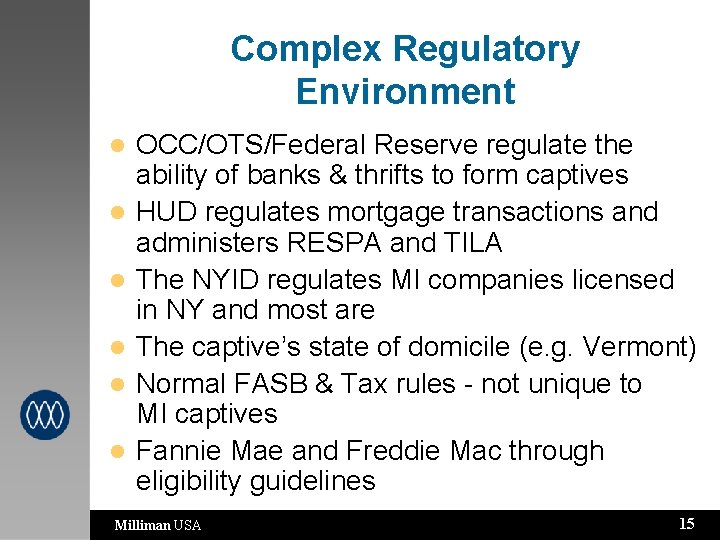

Complex Regulatory Environment l l l OCC/OTS/Federal Reserve regulate the ability of banks & thrifts to form captives HUD regulates mortgage transactions and administers RESPA and TILA The NYID regulates MI companies licensed in NY and most are The captive’s state of domicile (e. g. Vermont) Normal FASB & Tax rules - not unique to MI captives Fannie Mae and Freddie Mac through eligibility guidelines Milliman USA 15

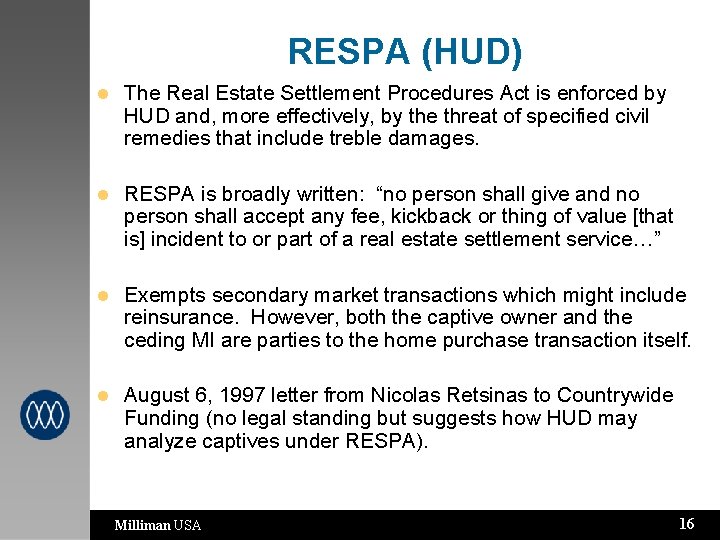

RESPA (HUD) l The Real Estate Settlement Procedures Act is enforced by HUD and, more effectively, by the threat of specified civil remedies that include treble damages. l RESPA is broadly written: “no person shall give and no person shall accept any fee, kickback or thing of value [that is] incident to or part of a real estate settlement service…” l Exempts secondary market transactions which might include reinsurance. However, both the captive owner and the ceding MI are parties to the home purchase transaction itself. l August 6, 1997 letter from Nicolas Retsinas to Countrywide Funding (no legal standing but suggests how HUD may analyze captives under RESPA). Milliman USA 16

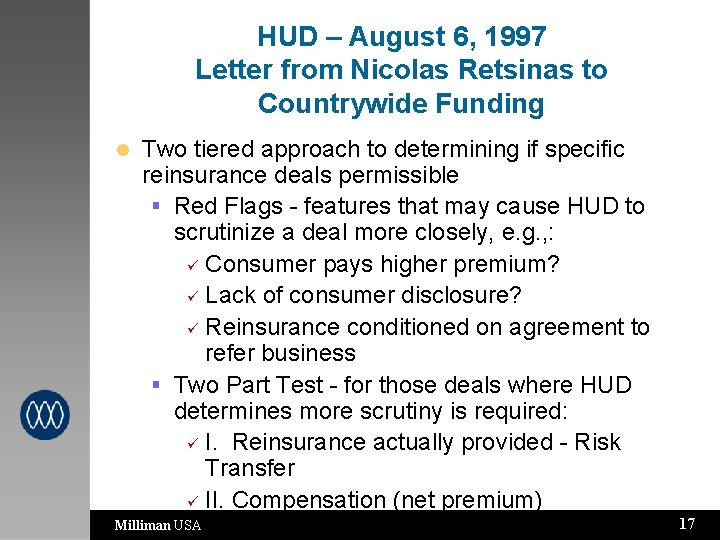

HUD – August 6, 1997 Letter from Nicolas Retsinas to Countrywide Funding Two tiered approach to determining if specific reinsurance deals permissible § Red Flags - features that may cause HUD to scrutinize a deal more closely, e. g. , : ü Consumer pays higher premium? ü Lack of consumer disclosure? ü Reinsurance conditioned on agreement to refer business § Two Part Test - for those deals where HUD determines more scrutiny is required: ü I. Reinsurance actually provided - Risk Transfer ü II. Compensation (net premium) Milliman USA commensurate with risk l 17

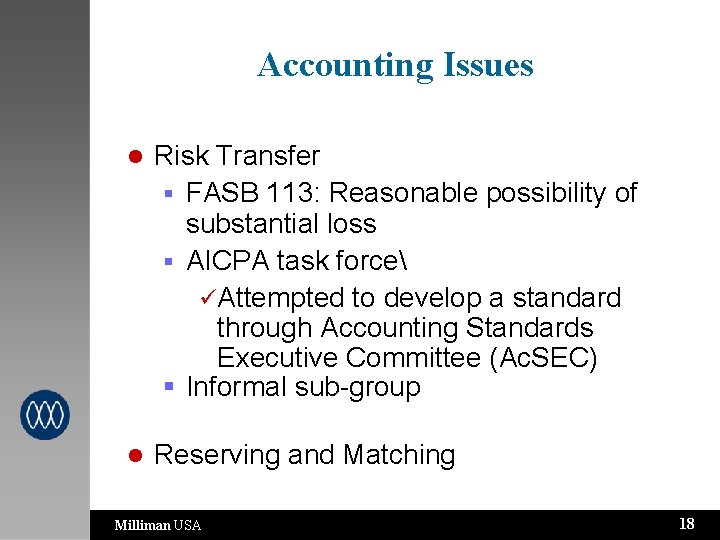

Accounting Issues l Risk Transfer § FASB 113: Reasonable possibility of substantial loss § AICPA task force üAttempted to develop a standard through Accounting Standards Executive Committee (Ac. SEC) § Informal sub-group l Reserving and Matching Milliman USA 18

Reserving Practices for Mortgage Insurance Financials For Primary Company Primary loss incurred when loan defaults (delinquent) l Primary company reserves only for current delinquencies § Known delinquencies (case reserves) § Unreported current delinquencies (IBNR) § Statutory contingency reserve l Milliman USA 19

Reserving Practices for Mortgage Insurance - Reinsurance l l l Excess of loss coverage on a book year basis Reinsurers generally follow primary model Reinsurer accrues when Primary (groundup) incurred losses exceed attachment point Cumulative paid losses + reserve for current delinquencies = cumulative incurred losses Likely no losses for first 3 -5 years for each aggregate excess of loss book year Milliman USA 20

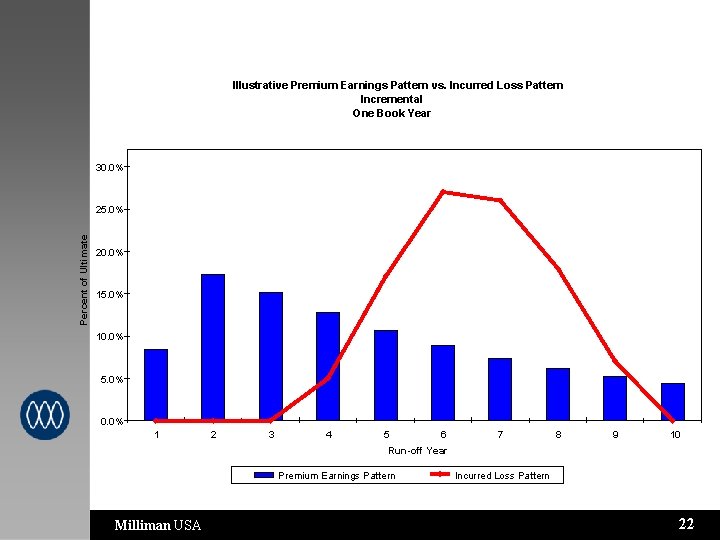

Reserving Practices for Mortgage Insurance - Matching l l l Deferred losses for excess of loss structures However, premium is front loaded § Reflects declining insurance in-force for book year Poor matching Contingency reserve mitigates this on a statutory basis Premium Deficiency Reserve if extreme on a cumulative run-off basis Milliman USA 21

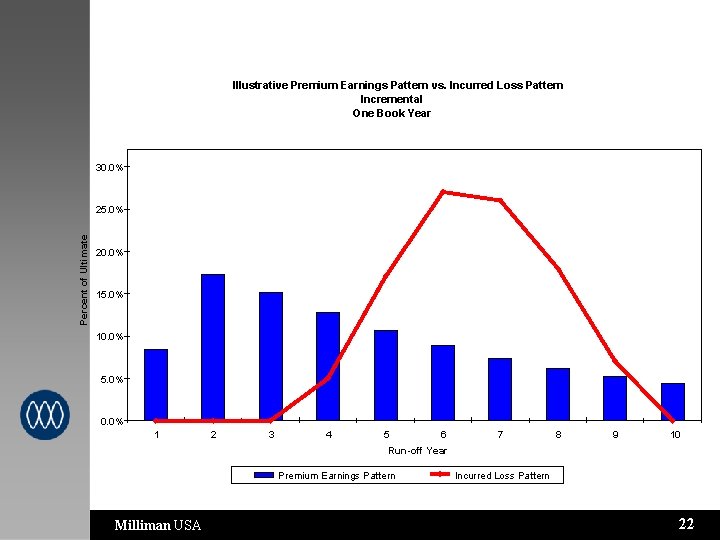

Illustrative Premium Earnings Pattern vs. Incurred Loss Pattern Incremental One Book Year 30. 0% Percent of Ultimate 25. 0% 20. 0% 15. 0% 10. 0% 5. 0% 0. 0% 1 2 3 4 5 6 7 8 9 10 Run-off Year Premium Earnings Pattern Milliman USA Incurred Loss Pattern 22

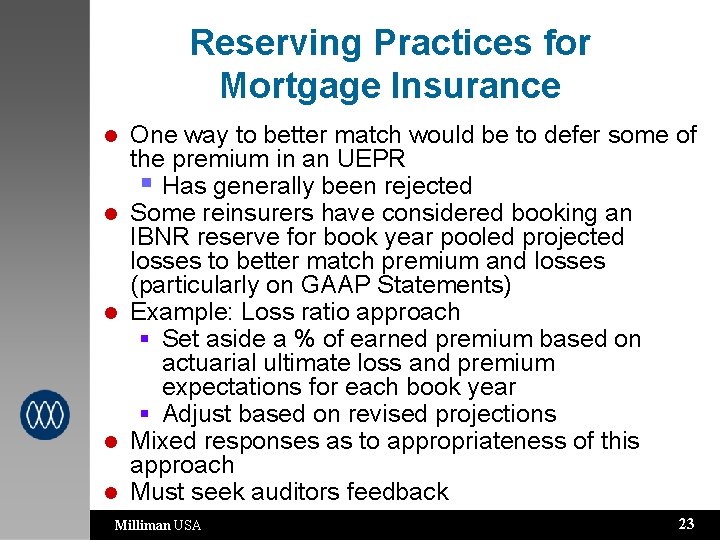

Reserving Practices for Mortgage Insurance l l l One way to better match would be to defer some of the premium in an UEPR § Has generally been rejected Some reinsurers have considered booking an IBNR reserve for book year pooled projected losses to better match premium and losses (particularly on GAAP Statements) Example: Loss ratio approach § Set aside a % of earned premium based on actuarial ultimate loss and premium expectations for each book year § Adjust based on revised projections Mixed responses as to appropriateness of this approach Must seek auditors feedback Milliman USA 23

Setting captives free weight loss

Setting captives free weight loss Captive insurance 101

Captive insurance 101 Order of the most holy trinity

Order of the most holy trinity How do the white crewmen view their captives

How do the white crewmen view their captives 831b captives

831b captives William shakespeare education

William shakespeare education Never a lender or a borrower be

Never a lender or a borrower be Which sentence best describes a title pawn lender

Which sentence best describes a title pawn lender Scrap account

Scrap account Marine insurance act 2002

Marine insurance act 2002 081-com-1001

081-com-1001 081-831-1001

081-831-1001 How did the minie-ball affect the casualty rate of the war?

How did the minie-ball affect the casualty rate of the war? California casualty claims

California casualty claims Task conditions and standards

Task conditions and standards Casualty assistance officer training

Casualty assistance officer training Mass casualty triage guidelines

Mass casualty triage guidelines Auscultation

Auscultation How will you open the casualty's airway

How will you open the casualty's airway New consultant in casualty

New consultant in casualty Insurance loss assessor leicester

Insurance loss assessor leicester Nature of fire insurance

Nature of fire insurance Difference between hypothecation and mortgage

Difference between hypothecation and mortgage Legal and general surveyors

Legal and general surveyors