Casualty Actuarial Society Casualty Loss Reserves Seminar September

Casualty Actuarial Society Casualty Loss Reserves Seminar September 14, 2004 Financial Oversight Update Kris De. Frain, FCAS, MAAA NAIC Property & Casualty Actuary National Association of Insurance Commissioners © 2004 National Association of Insurance Commissioners

Overview State of the Industry Financial Analysis Examination White Paper Risk-Focused Examinations Other Solvency Issues © 2004 National Association of Insurance Commissioners 2

How many P/C insolvencies a year? © 2004 National Association of Insurance Commissioners

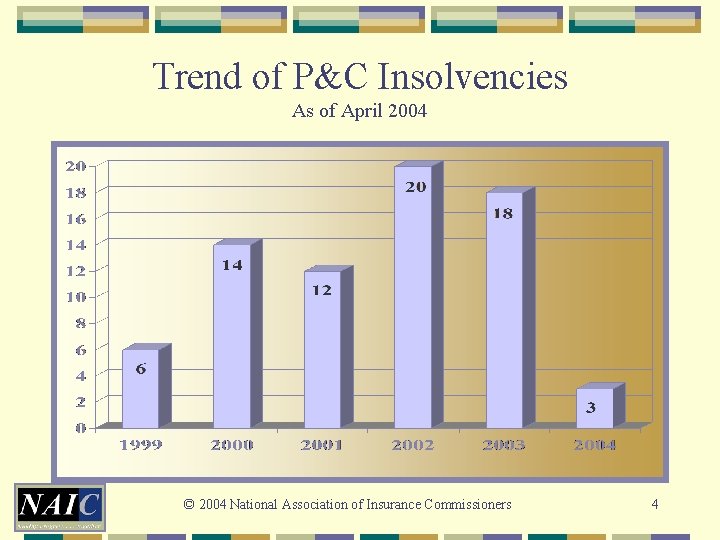

Trend of P&C Insolvencies As of April 2004 © 2004 National Association of Insurance Commissioners 4

Financial Analysis © 2004 National Association of Insurance Commissioners

Data/Information Sources Annual & Quarterly Statements Management’s Discussion & Analysis Letters Independent Auditors Reports Actuarial Reports RBC Report Holding Company Filings Securities and Exchange Commission Filings Rating Agency Reports/Actions © 2004 National Association of Insurance Commissioners 6

Ratio Analysis P/C Insurers Focus Profitability Leverage Asset and Liquidity Cashflow/Surplus © 2004 National Association of Insurance Commissioners 7

Characteristics and Causes P/C Insurers Characteristics Ownership Writings Age Growth Deficient Reserves Inadequate Pricing Rapid Growth Overstated Assets Fraud Change in Business Reinsurance Failure Catastrophic Losses © 2004 National Association of Insurance Commissioners 8

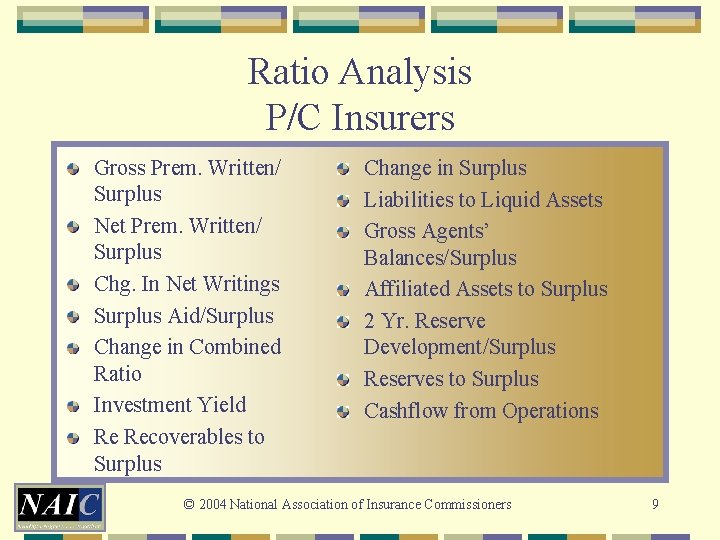

Ratio Analysis P/C Insurers Gross Prem. Written/ Surplus Net Prem. Written/ Surplus Chg. In Net Writings Surplus Aid/Surplus Change in Combined Ratio Investment Yield Re Recoverables to Surplus Change in Surplus Liabilities to Liquid Assets Gross Agents’ Balances/Surplus Affiliated Assets to Surplus 2 Yr. Reserve Development/Surplus Reserves to Surplus Cashflow from Operations © 2004 National Association of Insurance Commissioners 9

Examination Oversight Task Force © 2004 National Association of Insurance Commissioners

Examination White Paper White paper submitted to the NAIC from seven trade associations requesting the NAIC to address the following areas: • Examination fees • Enhanced coordination with CPAs • Training for regulators © 2004 National Association of Insurance Commissioners 11

Examination White Paper “A Call for Change” Recommendations Report adopted at the Spring National Meeting Referrals & proposals distributed to numerous working groups and task forces © 2004 National Association of Insurance Commissioners 12

Recommendations Report Enhance the Zone Examination Process • Referral to the FEHTG and ASWG Develop Procedures for the Utilization and Monitoring of Consultants and Contract Examiners • Referral to the FEHTG Enhance examination process with technology • Refer to the Audit Software Working Group © 2004 National Association of Insurance Commissioners 13

Recommendations Report Increase level of cooperation provided by company during a regulatory examination • Refer to the EOTF and ASWG Improve effectiveness of examination planning • Refer to the FEHTG and IHCWG Increase coordination of group-wide examinations • Refer to the IHCWG © 2004 National Association of Insurance Commissioners 14

Recommendations Report Improve the level of coordination between external auditors and regulators • Refer to the NAIC/AICPA WG Develop and document the process for accelerating statutory due date • EOTF Communicate with Audit Committees • Refer to NAIC/AICPA WG and FEHTG © 2004 National Association of Insurance Commissioners 15

Recommendations Report Eliminate the 20% Retesting of CPA work • FEHTG completed in March 2003 Increase Use of Interim External Auditor Workpapers • Refer to NAIC/AICPA WG and FEHTG Develop Enhanced Training Program for Examiners • Refer to FEHTG and EOTF Continue Development of Risk Assessment Process © 2004 National Association of Insurance Commissioners 16

Coordination Among States Enhance coordination among states Promote the Insurance Regulatory Modernization Action Plan Implement Recommendations in response to the industry’s Examination White Paper Reduce travel time and cost to states © 2004 National Association of Insurance Commissioners 17

Financial Condition (E) Committee 2004 Projects © 2004 National Association of Insurance Commissioners

Federal Tools NAIC Framework for a National System of State-Based Regulation • Developed in partnership with the House Financial Services Committee • Focus upon modernization and uniformity • NAIC Roadmap © 2004 National Association of Insurance Commissioners 19

Federal Tools Financial Focus • • Surplus Lines Reinsurance Receivership Enhancing Financial Surveillance • Permitted Practices • Institute National Practices • Meetings with Insurers • Corporate Governance • Administrative Supervision © 2004 National Association of Insurance Commissioners 20

Federal Tools Financial Focus • Enhancing Financial Surveillance • Standardize financial surveillance regarding affiliated insurers • Coordinate on-site examination scheduling • Standardize the exchange of information on affiliated insurers • Lead state concept © 2004 National Association of Insurance Commissioners 21

Risk Assessment Working Group Advantages to the proposed approach Provides clearer methodology for assessing residual risk Allows the assessment of risk management processes other than those that result in financial statement line item verifications Allows utilizing the examination findings to establish, verify or revise the uniform company priority rating system © 2004 National Association of Insurance Commissioners 22

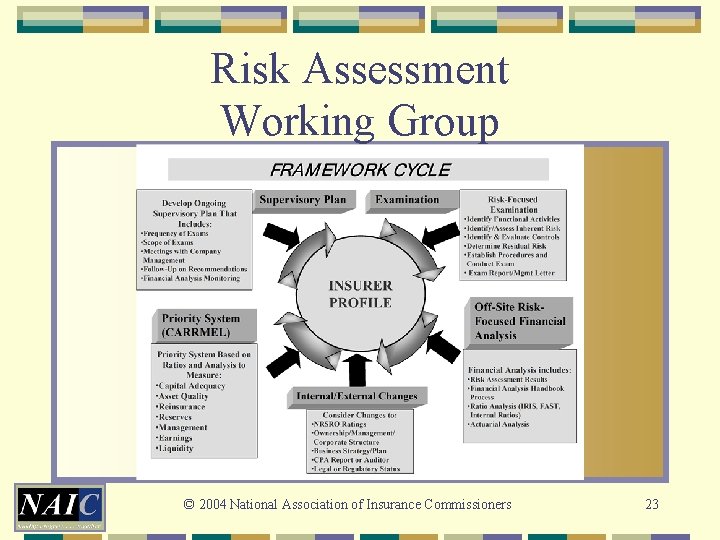

Risk Assessment Working Group © 2004 National Association of Insurance Commissioners 23

Risk-Focused Examination Seven-Phased Process Provides the “Roadmap” for a Risk Assessment • Understanding the Company and Identifying Functional Activities of Insurer • Identifying and Assessing an Inherent Risk Rating in Activity • Identify and Assess Risk Management Systems in Place to Mitigate Inherent Risk © 2004 National Association of Insurance Commissioners 24

Risk-Focused Examination (Continued) Seven-Phased Process Provides the “Roadmap” for a Risk Assessment • Assign a Residual Risk Rating, which is a function of the Inherent Risk Rating offset by the Control Assessment Rating • Establish/Conduct Examination Procedures based upon the Residual Risk Rating • Update CARRMEL Priority Rating and Supervisory Plan Based upon Findings • Draft Examination Report and Management Letter Based upon Findings © 2004 National Association of Insurance Commissioners 25

Financial Analysis Includes • • Risk Assessment Results Financial Analysis Handbook Process Ratio Analysis (IRIS, FAST, Internal Ratios) Actuarial Analysis © 2004 National Association of Insurance Commissioners 26

Internal/External Changes Consider Changes to • • • Rating Agency Ratings Ownership/Management/Corporate Structure Business Strategy/Plan CPA Report or Auditor Legal or Regulatory Status © 2004 National Association of Insurance Commissioners 27

Prioritization System Standard prioritization system • CARRMEL: Capital Adequacy, Asset Quality, Reinsurance, Reserve Adequacy, Management Assessment, Earnings, and Liquidity • Objective and mathematical based • Incorporates existing FAST Ratios • Pilot Projects © 2004 National Association of Insurance Commissioners 28

Supervisory Plan Develop Plan for Ongoing Supervision • • • Frequency of Exams Scope of Exams Meetings with Company Management Follow-Up on Recommendations Financial Analysis Monitoring © 2004 National Association of Insurance Commissioners 29

Risk Assessment Working Group Risk Focused Surveillance Framework Risk Assessment Matrix Revised CPA Checklist Insurer Profile Summary Prioritization Report © 2004 National Association of Insurance Commissioners 30

Risk Assessment Working Group Revisions to the NAIC Financial Condition Examiners Handbook Best Practices Supplement • Interviewing states to compile best practices Examiner Training Program • Currently working to get approval to engage a consultant © 2004 National Association of Insurance Commissioners 31

NAIC SVO Objectives • Assist the Regulatory Community in the Conduct of Financial Solvency Monitoring by Providing: • Classifications (Debt/Preferred/Common) • Designations (Credit Rating) • Pricing (Value for Statutory Financials) • Provide Technical Advice Relative to Investments & Identify Investment Trends and Innovations © 2004 National Association of Insurance Commissioners 32

2003 NY Proposal To Enhance The SVO Process - Goals • More Effectively Produce, or Provide Ability to Monitor/Verify, Accurate Credit Ratings and Valuations for Bonds, Preferred Stock, and Common Stock • Leverage off Rating Agencies and Market Facilitators (Stock Exchanges, Broker/Dealers) for Ratings and Valuations • Consider Enhancing the SVO’s Role via the Research Unit © 2004 National Association of Insurance Commissioners 33

2003 New York Initiatives Exempt All Rated Securities Equivalent to an NAIC 1 or 2 Designation - DONE! Have Regulators Guide Role of Research Unit DONE! Exempt All Rated Securities and Mechanize Valuation Process - DONE! Consider Alternatives to the Filing of Securities Not Rated by an NRSRO UNDER CONSIDERATION © 2004 National Association of Insurance Commissioners 34

SVO And Solvency Regulation • SVO Function is Critical • Focus As Far As Credit Review Should Be on the Universe of Non-Rated Securities • Research Function Can Better Assist State Insurance Departments • A Potential Role in Risk Assessment © 2004 National Association of Insurance Commissioners 35

Questions? If you have additional questions, please contact me! Kris De. Frain 816 -783 -8229 kdefrain@naic. org © 2004 National Association of Insurance Commissioners 36

- Slides: 36