Lecture 9 Chapter THREE Life Insurance And Annuities

- Slides: 16

Lecture 9 Chapter THREE Life Insurance And Annuities Instructor: Dr. Lobna M Farid, Copy rights for Dr. Ibrahim Morgan and Dr. Raafat A. Ibrahim, " Life Insurance", Faculty of Commerce, Cairo University 1

3. 3 Annuities : A life annuity is a contract that provides for a regular, periodic income for the life of the annuitant. Instructor: Dr. Lobna M Farid, Copy rights for Dr. Ibrahim Morgan and Dr. Raafat A. Ibrahim, " Life Insurance", Faculty of Commerce, Cairo University 2

Annuities may be classified according to six elements: (1)the number of lives covered, (2)how premiums are paid, (3)when benefits begin, (4)whether the annuity involves life contingencies, (5)how long (if at all) payments continue after the death of a life annuitant, and (6)how the benefit payments are measured. Instructor: Dr. Lobna M Farid, Copy rights for Dr. Ibrahim Morgan and Dr. Raafat A. Ibrahim, " Life Insurance", Faculty of Commerce, Cairo University 3

1 - Number of lives covered: Usually the annuitant is one individual, but not always. For example, the joint - and survivor annuity is available to cover two or more annuitants. Under this contract, payments continue throughout the joint lifetime of two or more annuitants and until the death of the last survivor. Instructor: Dr. Lobna M Farid, Copy rights for Dr. Ibrahim Morgan and Dr. Raafat A. Ibrahim, " Life Insurance", Faculty of Commerce, Cairo University 4

2 - How premiums are paid: Two methods of paying premiums for annuities are possible: single premium and annual premium. Life insurance cash values and death proceeds frequently are converted to single premium annuities through the use of settlement options. Instructor: Dr. Lobna M Farid, Copy rights for Dr. Ibrahim Morgan and Dr. Raafat A. Ibrahim, " Life Insurance", Faculty of Commerce, Cairo University 5

3 - When benefits begin: Annuities may be classified either as immediate or deferred. Under an immediate annuity periodic payments to the annuitant begin immediately with the period following its purchase. Ordinarily, the payments begin at the end of the first income period. Instructor: Dr. Lobna M Farid, Copy rights for Dr. Ibrahim Morgan and Dr. Raafat A. Ibrahim, " Life Insurance", Faculty of Commerce, Cairo University 6

4 - Annuities and life contingencies: An annuity of the former type is called a life annuity. An annuity of the latter type is called an "annuity certain". Instructor: Dr. Lobna M Farid, Copy rights for Dr. Ibrahim Morgan and Dr. Raafat A. Ibrahim, " Life Insurance", Faculty of Commerce, Cairo University 7

5 - Payments after the death of a life annuity: Life annuities may be classified as straight life annuities or guaranteed minimum annuities. Under the straight life annuity, a periodic income is paid to the annuitant as long as he or she lives. Upon death, no further payments are trade. The guarantee may be in the form of either a full refund of the invested principal (called a refund annuity) or a guaranteed minimum number of payments (called a life income period-certain annuity). Instructor: Dr. Lobna M Farid, Copy rights for Dr. Ibrahim Morgan and Dr. Raafat A. Ibrahim, " Life Insurance", Faculty of Commerce, Cairo University 8

6. How benefit payments are measured. Until 1995 , all annuities were expressed in terms of fixed dollars. Under the fixed dollar annuity, the annuitant is guaranteed a specified minimum number of dollars at each payment period regardless of the purchasing power of these dollars. If the annuity is written on a participating basis, the amount of each payment might be higher than the guaranteed minimum amount. . Instructor: Dr. Lobna M Farid, Copy rights for Dr. Ibrahim Morgan and Dr. Raafat A. Ibrahim, " Life Insurance", Faculty of Commerce, Cairo University 9

3. 3. 1 Variable annuity: In the variable annuity, the dollar amount of the periodic payments is based on the asset value of the investment portfolio behind this class of annuities. Variable annuities pay a monthly amount which will fluctuate according to investment results. The theory behind the variable annuity is giving the annuitant a fairly stable amount of purchasing power. Reasons for a variable annuity, two basic objectives of the variable annuity are to give the annuitant some protection against inflation and an opportunity to share in the economic growth of the country as reflected in increased stock prices. Instructor: Dr. Lobna M Farid, Copy rights for Dr. Ibrahim Morgan and Dr. Raafat A. Ibrahim, " Life Insurance", Faculty of Commerce, Cairo University 10

Questions pages 125 -127 A) Indicate whether each of the following statements is true or false by placing "T" or "F" in the space provided : 1 - A term insurance policy offers insurance protection for a flyed period of time in which little or no cash value is accumulated. False The contract of term insurance offers protection for a fixed period 2 - Renewable term insurance is a type of contract under which the insured may renew a policy before its expiration date, providing the medical examination can still be passed. False Renewal is before its expiration date without taking another medical Instructor: Dr. Lobna M Farid, Copy rights for Dr. Ibrahim Morgan and Dr. Raafat A. Ibrahim, examination or otherwise proving be still insurable. " Life Insurance", Faculty of Commerce, to Cairo University 11

3 - Under an endowment policy, the insurer pays the face amount of the policy only if the insured dies during the endowment period. False Insurer pays the face amount either to beneficiary if the insured dies during the life of the policy or to the insured if he or she survives the endowment policy. 4 - Premium for endowment comparatively high. True 5 - Whole life insurance , as the name implies , covers the subject of the insurance for an entire life. True Is life insurance contract under which subject of insurance is covered for entire life regardless of the number of premiums scheduled to be paid Instructor: Dr. Lobna M Farid, Copy rights for Dr. Ibrahim Morgan and Dr. Raafat A. Ibrahim, " Life Insurance", Faculty of Commerce, Cairo University 12

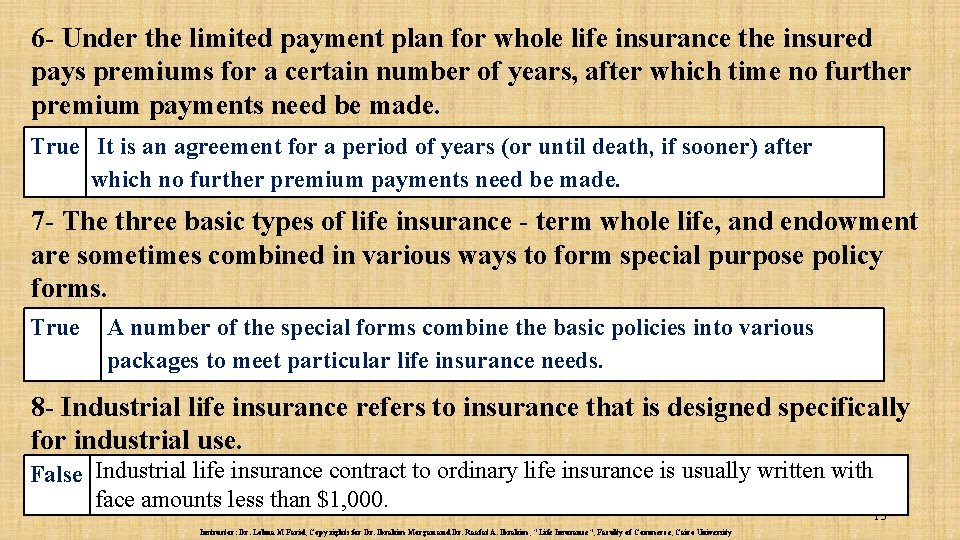

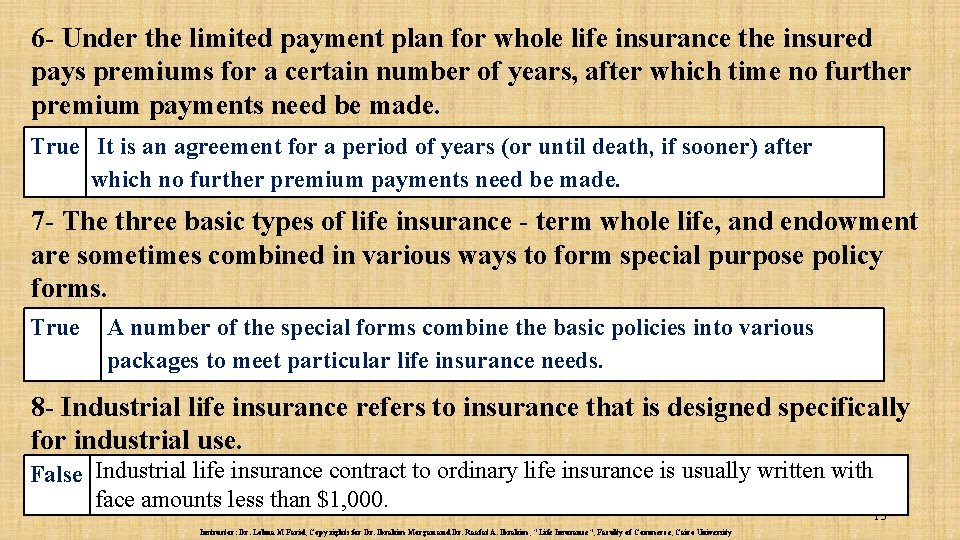

6 - Under the limited payment plan for whole life insurance the insured pays premiums for a certain number of years, after which time no further premium payments need be made. True It is an agreement for a period of years (or until death, if sooner) after which no further premium payments need be made. 7 - The three basic types of life insurance - term whole life, and endowment are sometimes combined in various ways to form special purpose policy forms. True A number of the special forms combine the basic policies into various packages to meet particular life insurance needs. 8 - Industrial life insurance refers to insurance that is designed specifically for industrial use. False Industrial life insurance contract to ordinary life insurance is usually written with face amounts less than $1, 000. 13 Instructor: Dr. Lobna M Farid, Copy rights for Dr. Ibrahim Morgan and Dr. Raafat A. Ibrahim, " Life Insurance", Faculty of Commerce, Cairo University

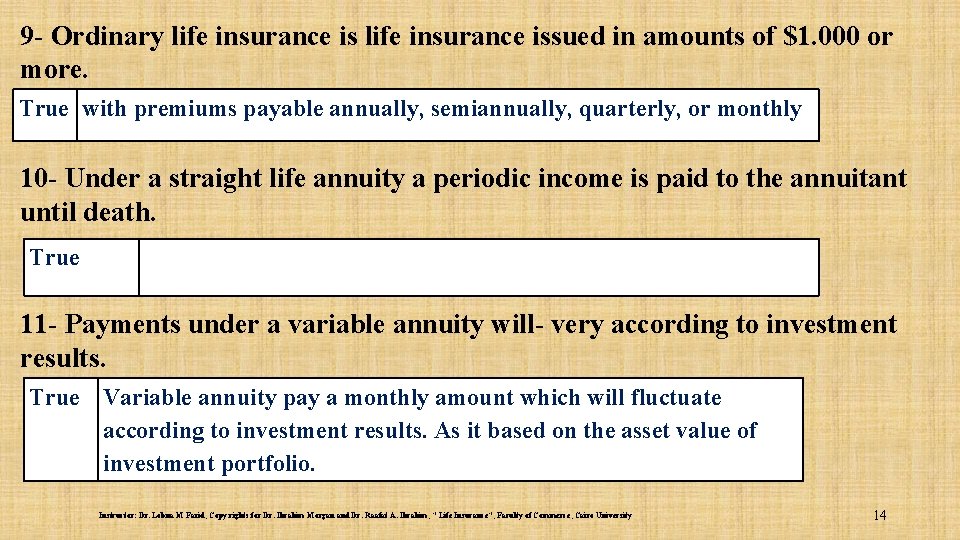

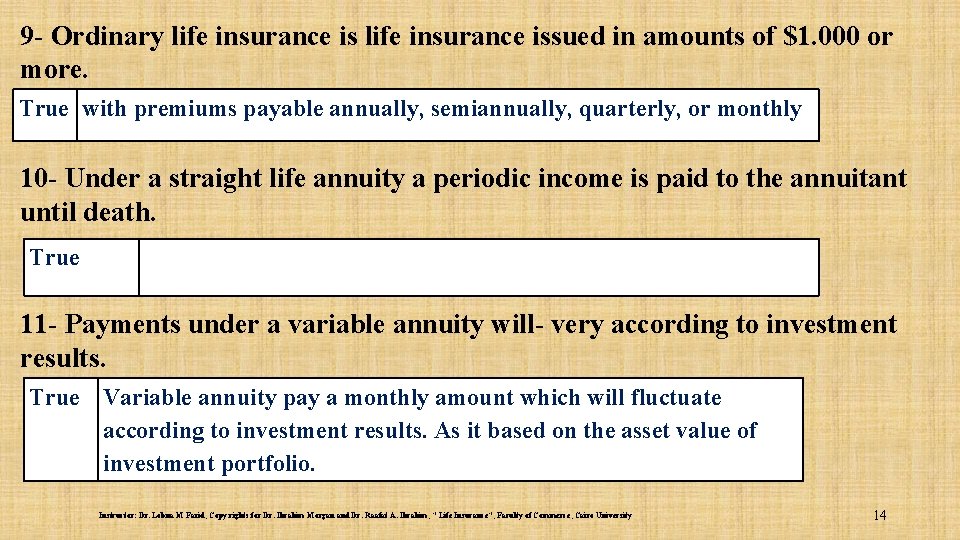

9 - Ordinary life insurance issued in amounts of $1. 000 or more. True with premiums payable annually, semiannually, quarterly, or monthly 10 - Under a straight life annuity a periodic income is paid to the annuitant until death. True 11 - Payments under a variable annuity will- very according to investment results. True Variable annuity pay a monthly amount which will fluctuate according to investment results. As it based on the asset value of investment portfolio. Instructor: Dr. Lobna M Farid, Copy rights for Dr. Ibrahim Morgan and Dr. Raafat A. Ibrahim, " Life Insurance", Faculty of Commerce, Cairo University 14

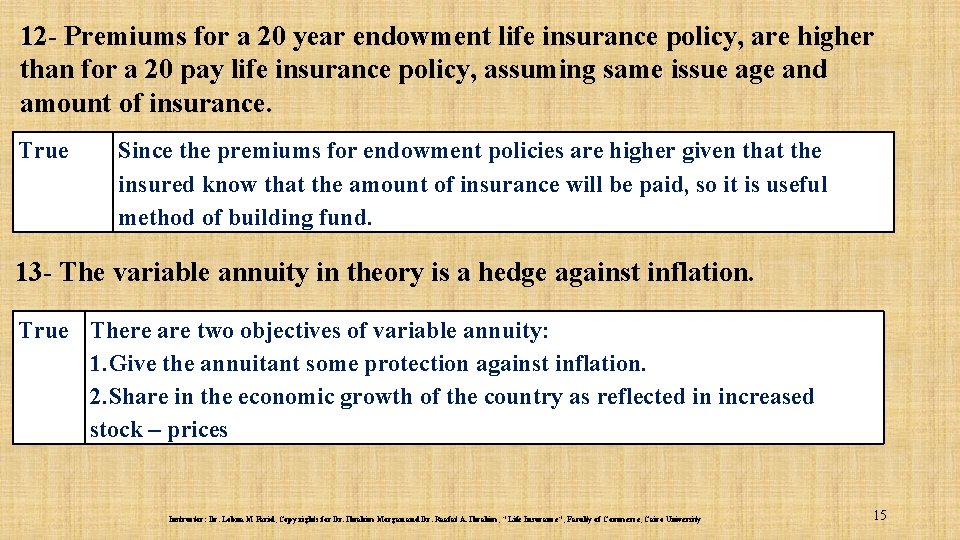

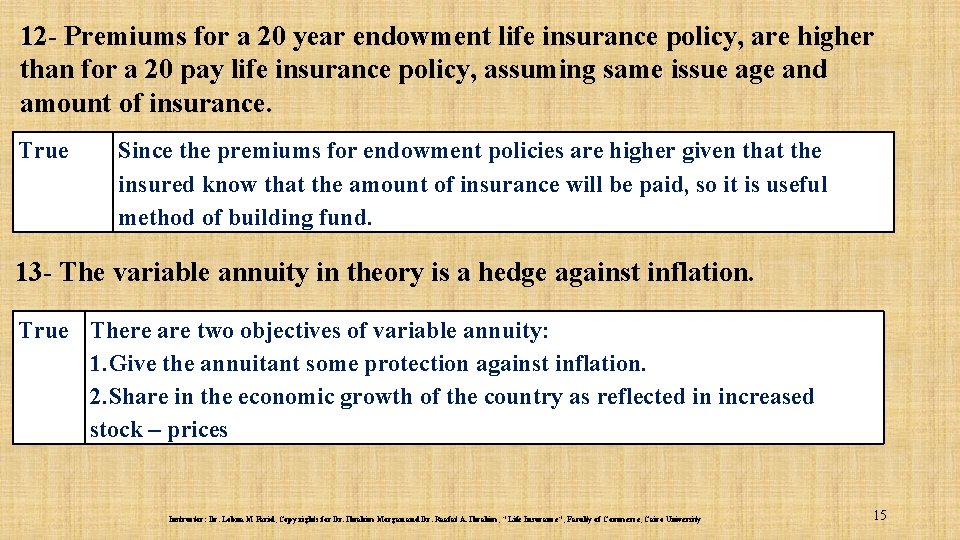

12 - Premiums for a 20 year endowment life insurance policy, are higher than for a 20 pay life insurance policy, assuming same issue age and amount of insurance. True Since the premiums for endowment policies are higher given that the insured know that the amount of insurance will be paid, so it is useful method of building fund. 13 - The variable annuity in theory is a hedge against inflation. True There are two objectives of variable annuity: 1. Give the annuitant some protection against inflation. 2. Share in the economic growth of the country as reflected in increased stock – prices Instructor: Dr. Lobna M Farid, Copy rights for Dr. Ibrahim Morgan and Dr. Raafat A. Ibrahim, " Life Insurance", Faculty of Commerce, Cairo University 15

Thank You 16