Introduction to Auditing Introduction The role of audits

- Slides: 33

Introduction to Auditing

Introduction • The role of audits is critical in the business environment of the early twenty-first century. • Important decisions are made on the basis of accounting information. • Audits reduce the risk that these decisions will be based on inaccurate information. 2

An Example Assume that you are going to purchase a business. • Businesses are frequently valued using a multiple of earnings. Assume that your business should be valued at five times annual profit. 3

How Should Profit be Calculated? The buyer and seller should agree on the method of calculation of profit. • GAAP provides a useful guideline. 4

How Can We Trust the Financial Information The seller of the business prepares the financial statements. – The seller has a natural bias toward increasing income, which will increase the selling price. – The purchaser may not have the ability to check the accuracy themselves. 5

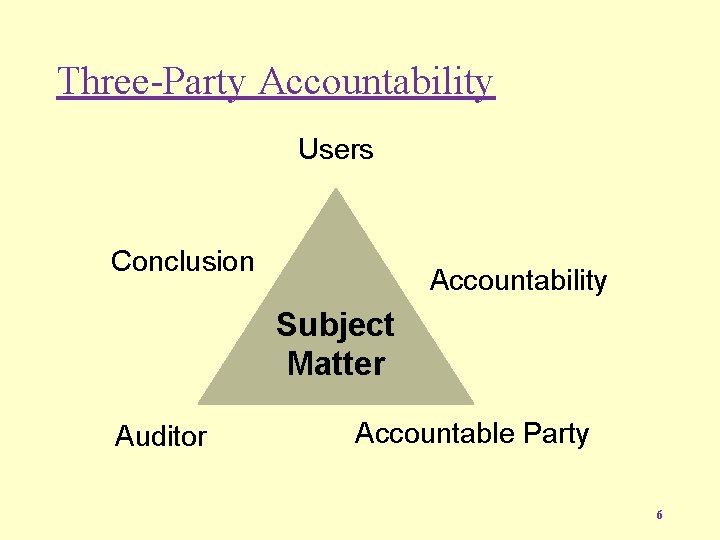

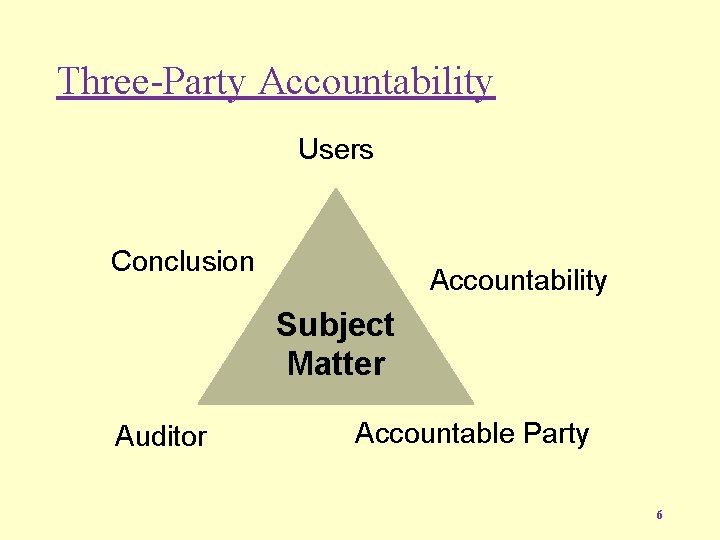

Three-Party Accountability Users Conclusion Accountability Subject Matter Auditor Accountable Party 6

Consider financial statements of an Entity 1. Accountable Party 2. Users 3. Auditor 7

The Public Interest Under three-party accountability the auditor is expected to act in the interest of the user of the information. 8

Agency Theory and Accountability When a task is delegated by one party to another (Agent) it can create a problem when three conditions are present: The Auditor monitors the Agent (management) 9

Demand for Reliable Information Accounting attempts to record and summarize a company’s transactions into financial statements for the benefit of users. 10

Auditing Preparation of financial information by management creates a conflict of interest between users of financial information and management. • The auditor serves as an independent intermediary who lends credibility to the financial information. 11

External Auditor An external auditor is independent of management and of the production of the financial information. • This creates three-party accountability. 12

Professional Judgement A professional reaching a complex decision by incorporating standards and ethics in a coherent manner. 13

Definition of Auditing is a systematic process of: 1. Objectively obtaining and evaluating evidence regarding assertions about economic actions and events 2. In order to ascertain the degree of correspondence between the assertions and established criteria 3. And communicating the results to interested parties. 14

Audit Objectives (CAS 200) The purpose of an audit is to enhance the degree of confidence of intended users in the financial statements. This is achieved by the expression of an opinion by the auditor on whether the financial statements are prepared, in all material respects, in accordance with an applicable financial reporting framework. 15

Auditing and Risk Reduction The auditor wants to reduce risk in the audit What can happen with increased risk? Business risk: 16

Information risk: Financial statements will fail to appropriately reflect economic substance of business activities, including business risks and uncertainties. Auditing: A process of reducing information risk to users of financial statements. • From the auditor’s perspective there are two major categories of information risk. 17

Audit Risk The risk of insufficient evidence being gathered on the facts concerning the entity’s economic circumstances. 18

Accounting Risk that errors associated with forecasts used in GAAP accounting estimates are not properly disclosed. 19

Internal Auditing Internal auditing is an independent, objective assurance and consulting activity designed to add value and improve an organization’s operations. 20

Internal auditors need to be independent of line managers in an organization. Internal auditors have a larger scope of activities than the external auditor. 21

Operational Auditing Operational auditing refers to the study of business operations for the purpose of making recommendations about: The goal is to help managers meet their responsibilities and improve profitability. 22

Public Sector (Governmental) Auditing Governments at all levels make use of public sector auditors. Public sector audits 23

Financial statement audits and the Public Sector Compliance audits Value-for-money audits Comprehensive governmental audits include: 24

Regulatory Auditors Canada Customs and Revenue Agency (CCRA) auditors: Federal and provincial bank examiners: 25

Fraud Auditing and Forensic Accounting Detection of fraud is not the primary responsibility of the external auditor. 26

The Accounting Profession CPA Canada Included the following: Also have: • Certified Internal Auditors • Certified Fraud Examiners 27

Public Accounting Firms Perception of public firms is dominated by the “Big Four” firms: Accounting firms are organized as partnerships, or as limited liability partnerships (LLPs). 28

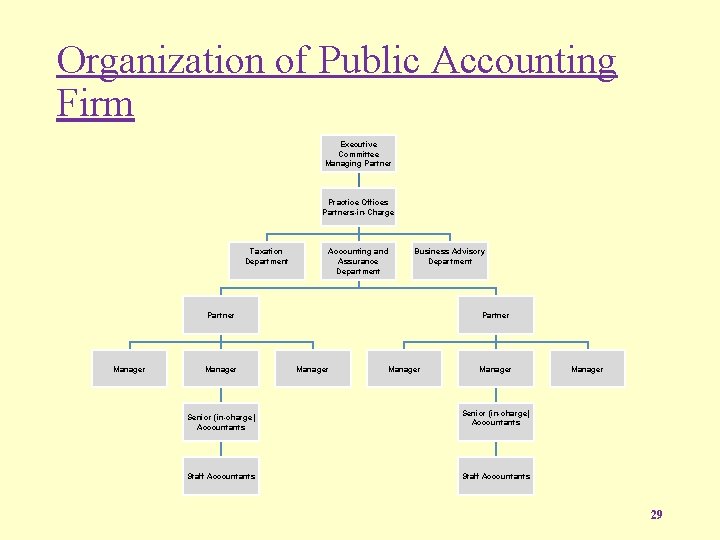

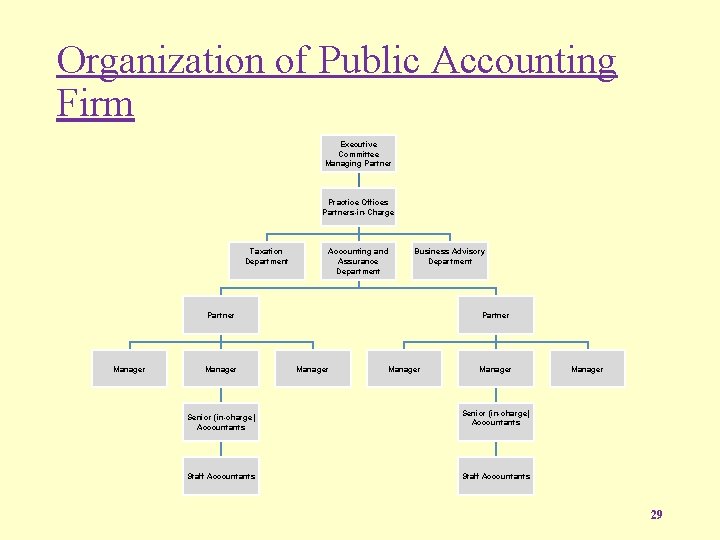

Organization of Public Accounting Firm Executive Committee Managing Partner Practice Offices Partners-in-Charge Taxation Department Accounting and Assurance Department Business Advisory Department Partner Manager Senior (in-charge) Accountants Staff Accountants Partner Manager Senior (in-charge) Accountants Staff Accountants 29

Public Accounting Services Assurance services: • Audit: • Non-audit: 30

Public Accounting Services Taxation services: • Taxation services include: • A large proportion of practice in small accounting firms is tax practice. 31

Public Accounting Services Consulting services: – All accounting firms handle a great deal of consulting – PAs compete against non-accountants for these services – SOX restricts consulting services to audit clients 32

International Auditing The International Federation of Accountants (IFAC) was created in 1977. • This body mirrors the activities of domestic institutions • Recommends international standards on auditing • International convergence of standards 33

How do auditing standards differ from auditing procedures

How do auditing standards differ from auditing procedures Parallel simulation audit

Parallel simulation audit Second party

Second party Audits personnalis s

Audits personnalis s Pantry audit in research methodology

Pantry audit in research methodology Essential elements of internal audit

Essential elements of internal audit Environmental audits

Environmental audits Iso 15189 internal auditor

Iso 15189 internal auditor Do254

Do254 Channel member performance audits:

Channel member performance audits: Dependent audits

Dependent audits Sas 70 definition

Sas 70 definition Types of project audit in project management

Types of project audit in project management Issai standards

Issai standards Ocga 30-10-2

Ocga 30-10-2 Health and food audits and analysis

Health and food audits and analysis Cjis audits

Cjis audits Infection control audits

Infection control audits Audits and inspections of clinical trials

Audits and inspections of clinical trials Prepare software audit

Prepare software audit Multimedia compliance audit

Multimedia compliance audit Nap 5 infographic

Nap 5 infographic Klinische audits

Klinische audits Introduction to auditing

Introduction to auditing Azure web role vs worker role

Azure web role vs worker role Krappmann modell

Krappmann modell Statuses and their related roles determine

Statuses and their related roles determine Hát kết hợp bộ gõ cơ thể

Hát kết hợp bộ gõ cơ thể Frameset trong html5

Frameset trong html5 Bổ thể

Bổ thể Tỉ lệ cơ thể trẻ em

Tỉ lệ cơ thể trẻ em Gấu đi như thế nào

Gấu đi như thế nào Tư thế worm breton

Tư thế worm breton Hát lên người ơi

Hát lên người ơi