FDIC Money Smart Elaine M Hunter Community Affairs

- Slides: 21

FDIC Money Smart Elaine M. Hunter Community Affairs Specialist Federal Deposit Insurance Corporation ehunter@fdic. gov

Money Smart is FDIC’s Financial Education Curriculum, developed in 2001 • Over 2. 75 million people reached • Over 1, 600 Organizations are Members of the Money Smart Alliance • First curriculum developed for adults 2

Money Smart Curricula Adults Young Adults Elementary School Students • Young People • Older Americans • Small Business School • • • 3

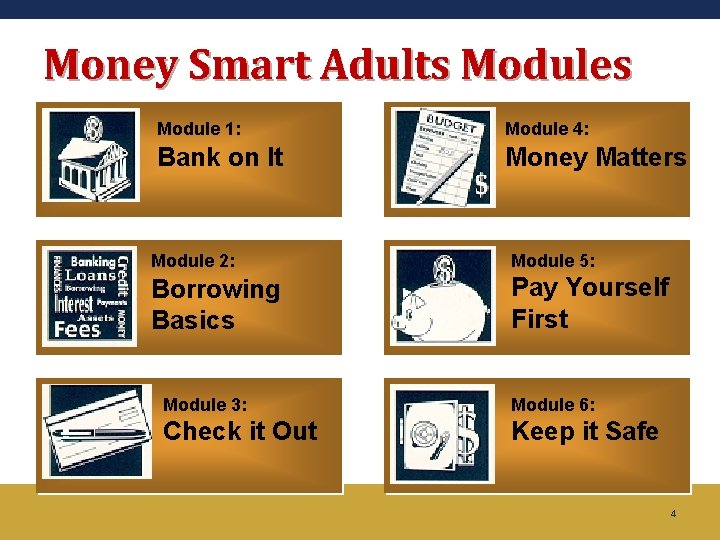

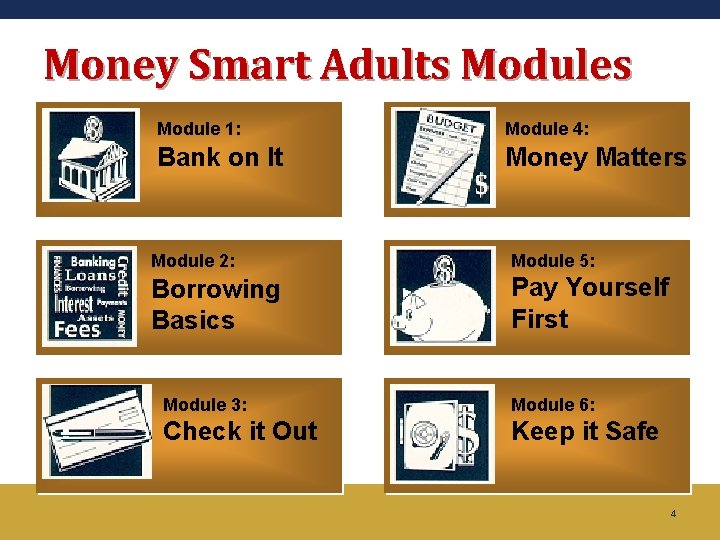

Money Smart Adults Module 1: Module 4: Bank on It Money Matters Module 2: Module 5: Borrowing Basics Pay Yourself First Module 3: Module 6: Check it Out Keep it Safe 4

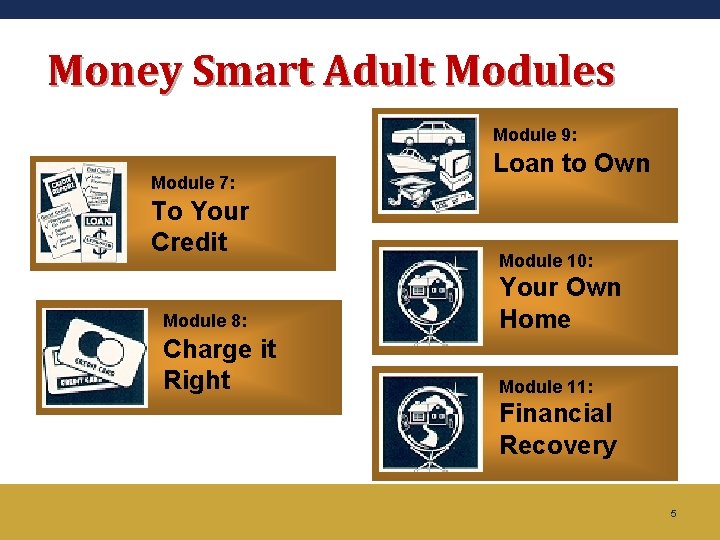

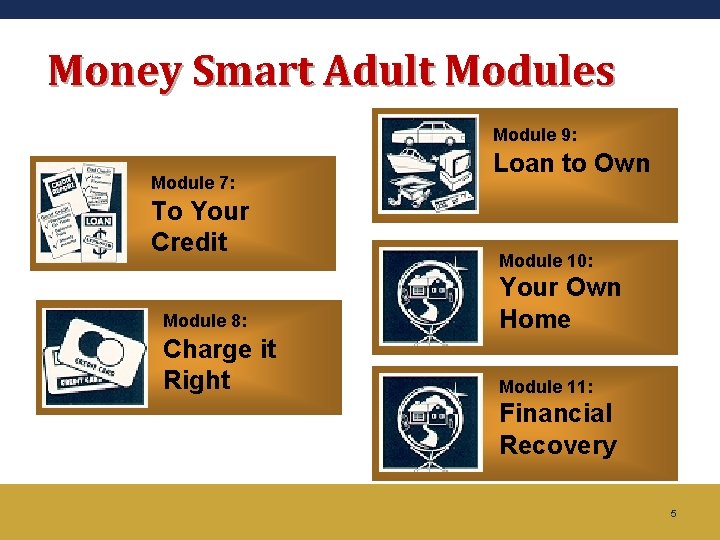

Money Smart Adult Modules Module 9: Module 7: To Your Credit Loan to Own Module 10: Module 8: Your Own Home Charge it Right Module 11: Financial Recovery 5

MS Adult Instructor-Led Curriculum • Available in: English, Spanish, Chinese, Korean, Vietnamese, Haitian-Creole, Hmong & Russian • Version for the Visually Impaired available 6

Money Smart for Young Adults ● Targeted towards Teens &Young Adults, ages 12 -20, Grades 7 -12, first & second years of college ● Aligned with educational standards for all 50 states, the District of Columbia, Guam and the Virgin Islands, as well as Jump$tart financial education standards and National Council on Economic Education economic education standards ● Instructor-led and computer-based available 7

Money Smart for Young Adults 1. 2. 3. 4. 5. 6. 7. 8. Bank On It Check It Out Setting Financial Goals Pay Yourself First Borrowing Basics Charge It Right Paying for College and Cars A Roof Over Your Head 8

Money Smart for Elementary Students For ages 5 – 8 Instructor guides & participant guides (coloring activities) Available via download at www. fdic. gov/moneysmat 9

Money Smart for Elementary Students Activity 1: Needs versus Wants Activity 2: My Spending Plan Activity 3: Savings Goal Activity 4: Savings Tips Activity 5: Grow Your Money Activity 6: Race to the Bank Maze Activity 7: : Money Smart Posters ● 10

Money Smart for Young People FDIC is developing a new instructor-led Money Smart Curriculum series: ● Grades Pre-K - second grade (pre-pilot currently available) § Educators’ and Parents’/Caregivers’ guides, teacher presentation slides and student handouts § Available via download at. fdic. gov/moneysmart ● Available in early 2015 § Grades 3 -5 § Grades 6 -8 § Grades 9 -12 11

Money Smart for Small Business In partnership with the Small Business Administration (SBA), the FDIC developed Money Smart curriculum for small businesses Purpose: to provide business owners or entrepreneurs considering establishing a small business with a basic understanding of the financial aspects of running a small business Instructor-led 12

Money Smart for Older Americans Introduced in June 2013 in partnership with the CFPB Designed to raise awareness among older adults and their caregivers on how to prevent, identify and respond to elder financial exploitation, plan in advance for a secure financial future, and make informed financial decisions. • Power. Point slides, instructor guides & participant guides • Available via download at www. fdic. gov/moneysmart 13

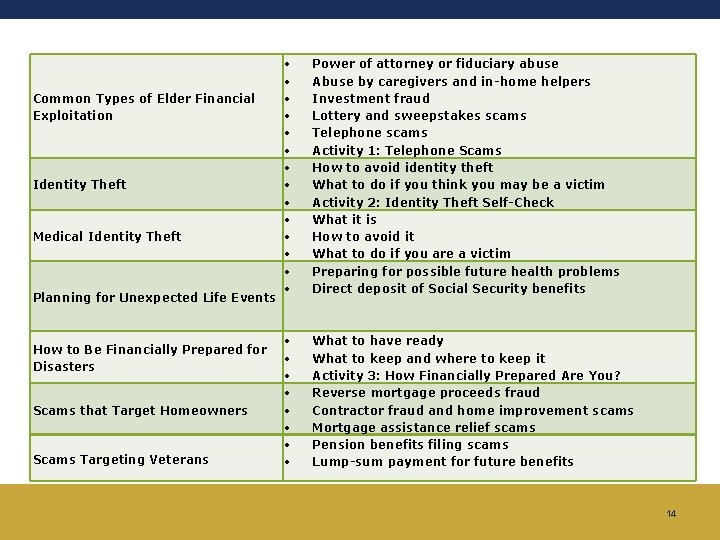

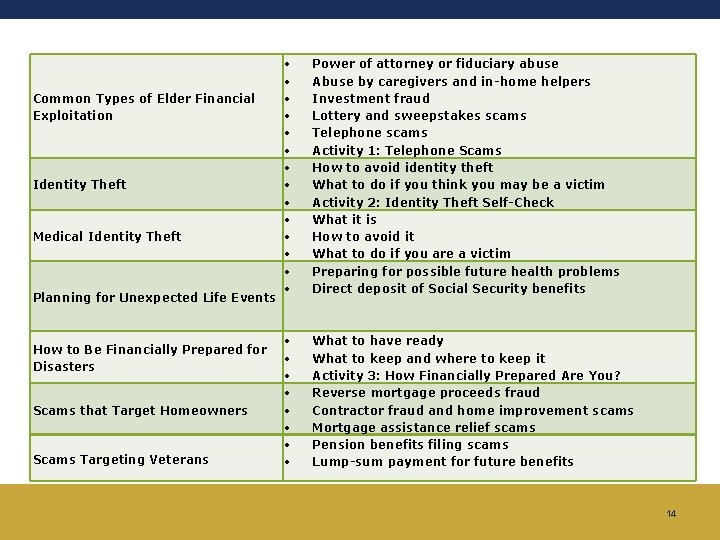

Common Types of Elder Financial Exploitation Identity Theft Medical Identity Theft Planning for Unexpected Life Events How to Be Financially Prepared for Disasters Scams that Target Homeowners Scams Targeting Veterans Power of attorney or fiduciary abuse Abuse by caregivers and in-home helpers Investment fraud Lottery and sweepstakes scams Telephone scams Activity 1: Telephone Scams How to avoid identity theft What to do if you think you may be a victim Activity 2: Identity Theft Self-Check What it is How to avoid it What to do if you are a victim Preparing for possible future health problems Direct deposit of Social Security benefits What to have ready What to keep and where to keep it Activity 3: How Financially Prepared Are You? Reverse mortgage proceeds fraud Contractor fraud and home improvement scams Mortgage assistance relief scams Pension benefits filing scams Lump-sum payment for future benefits 14

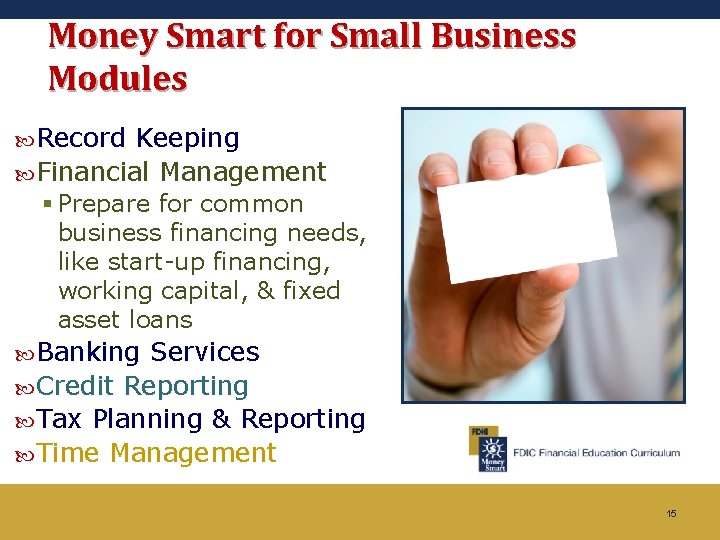

Money Smart for Small Business Modules Record Keeping Financial Management § Prepare for common business financing needs, like start-up financing, working capital, & fixed asset loans Banking Services Credit Reporting Tax Planning & Reporting Time Management 15

Money Smart for Small Business Modules (con’t) Insurance Selling a Small Business & Succession Planning Types of Organizations for Small Business & Their Advantages, Disadvantages and Other Impact on the Finances of Small Businesses 16

Money Smart for Small Business Instructors ● Should have experience in the delivery of training, technical assistance or coaching to small businesses. ● The FDIC recognizes select organizations that deliver the Money Smart for Small Business curriculum through the Money Smart Alliance Program. § Potential Alliance Partners should be able to conduct and market the training in their community, provide follow-up training, referrals, or technical support to graduates of this training. § Formal partner agreement with FDIC. 17

Money Smart Website www. fdic. gov/moneysmart 18

Commonality of all Money Smart Curricula Instructor Guides (for modules & general guide) Participant Guides Icons and Prompts Power. Point Presentations Evaluation Surveys Interactive Scenarios 19 20

Money Smart is Unique 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Easy to Teach Easy to Learn Flexible Targeted to Cash Consumer Universal Appeal No Copyrights Multiple Media Multiple Languages FDIC Seal of Approval Free!!! 20

QUESTIONS? 21

Fdic community affairs

Fdic community affairs Fdic money smart for young adults

Fdic money smart for young adults Joe hunter treasure hunter

Joe hunter treasure hunter Dana damian

Dana damian Money smart money match

Money smart money match Ministry of east african community affairs uganda

Ministry of east african community affairs uganda Not fdic insured may lose value

Not fdic insured may lose value Fdic san francisco

Fdic san francisco May lose value

May lose value May lose value

May lose value Fdic jfsr conference

Fdic jfsr conference Martin henning fdic

Martin henning fdic Not fdic insured may lose value

Not fdic insured may lose value Fdic affordable housing program

Fdic affordable housing program Money on money multiple

Money on money multiple Tom buchanan symbolism

Tom buchanan symbolism Context of the great gatsby

Context of the great gatsby Old money vs new money

Old money vs new money Shel silverstein money poem smart

Shel silverstein money poem smart Smart india hackathon prize money

Smart india hackathon prize money Street smart vs book smart quotes

Street smart vs book smart quotes It's not how smart you are

It's not how smart you are