Facilities and Administrative Indirect Costs at The Ohio

- Slides: 15

Facilities and Administrative (Indirect) Costs at The Ohio State University Administrative Research Council April 15, 2008 Tom Ewing, Associate University Controller Phil Schirtzinger, Sr. Cost Allocation Analyst

Overview of Today’s Presentation • What are indirect (F&A) costs? • What is an F&A cost rate? • How are F&A rates calculated? • The proposal and negotiation process • Trends in F&A rates, total annual cost recoveries, and distribution of cost recoveries • What are we doing to maintain or increase the University’s F&A rate? The Ohio State University - Office of the Controller April 15, 2008

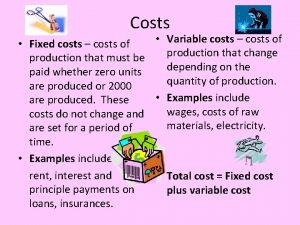

What are Indirect (F&A) Costs? • The federal government funds most sponsored research (and certain other instructional and public service programs) on a cost reimbursement basis. • Institutions bill federal sponsor agencies for the direct and indirect costs of a project. • Direct costs are those costs that can be directly attributed to an activity (or “function”) of the institution. • Indirect costs are all other costs that are, at least in part, attributable to an activity. The federal government refers to these costs as “facilities and administrative” or F&A costs. • OMB Circular A-21, Cost Principles for Educational Institutions, which is issued by the U. S. Office of Management and Budget, is the federal government’s “rule book” for college/university cost accounting. The Ohio State University - Office of the Controller April 15, 2008

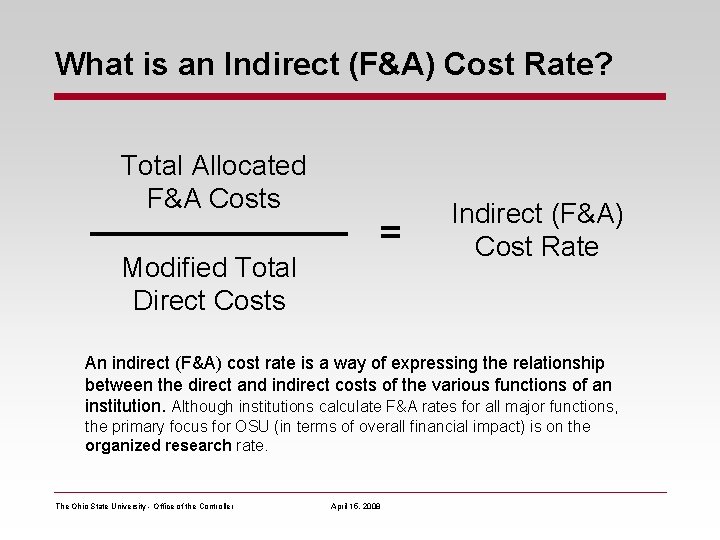

What is an Indirect (F&A) Cost Rate? Total Allocated F&A Costs Modified Total Direct Costs = Indirect (F&A) Cost Rate An indirect (F&A) cost rate is a way of expressing the relationship between the direct and indirect costs of the various functions of an institution. Although institutions calculate F&A rates for all major functions, the primary focus for OSU (in terms of overall financial impact) is on the organized research rate. The Ohio State University - Office of the Controller April 15, 2008

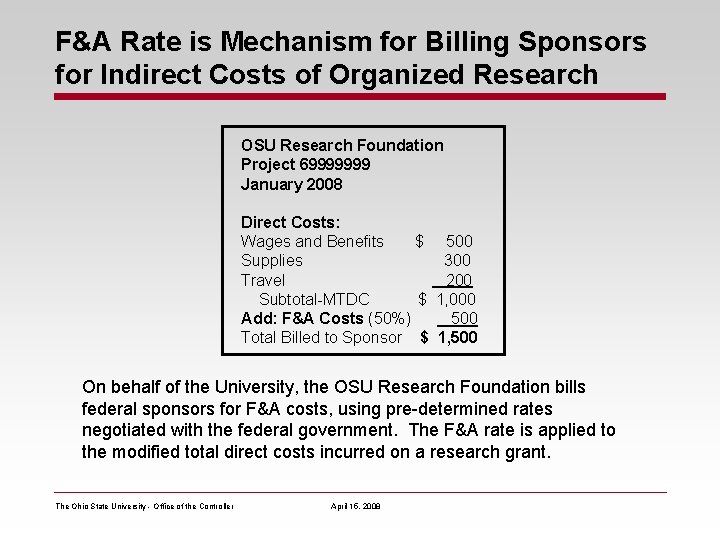

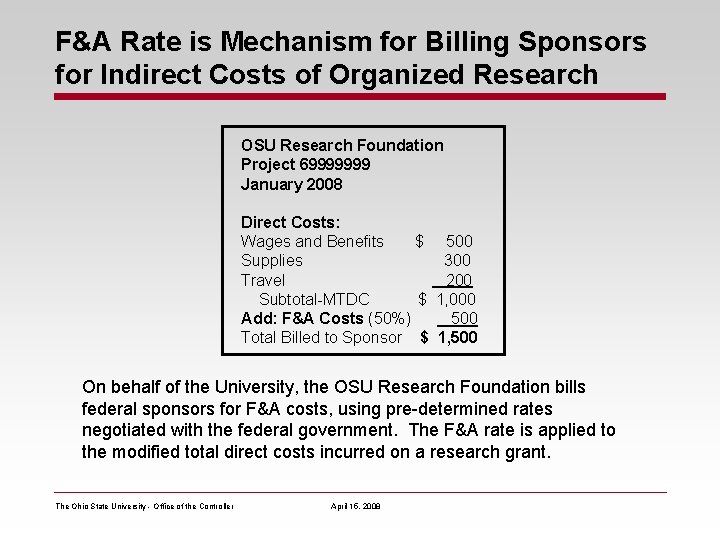

F&A Rate is Mechanism for Billing Sponsors for Indirect Costs of Organized Research OSU Research Foundation Project 69999999 January 2008 Direct Costs: Wages and Benefits $ 500 Supplies 300 Travel 200 Subtotal-MTDC $ 1, 000 Add: F&A Costs (50%) 500 Total Billed to Sponsor $ 1, 500 On behalf of the University, the OSU Research Foundation bills federal sponsors for F&A costs, using pre-determined rates negotiated with the federal government. The F&A rate is applied to the modified total direct costs incurred on a research grant. The Ohio State University - Office of the Controller April 15, 2008

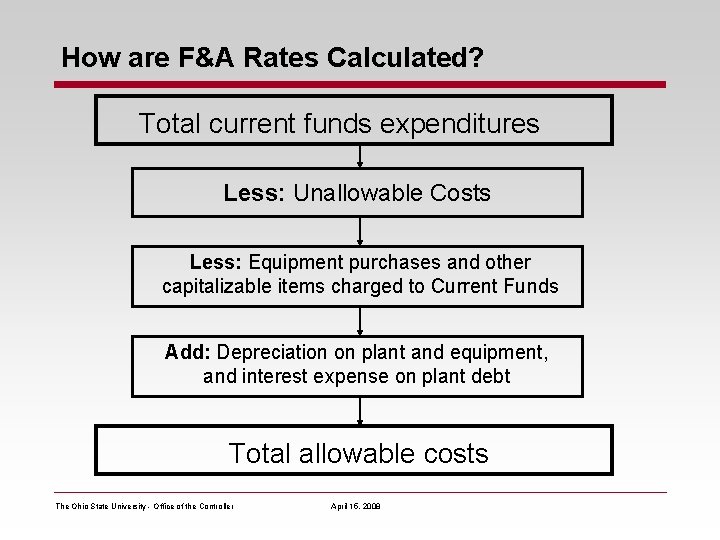

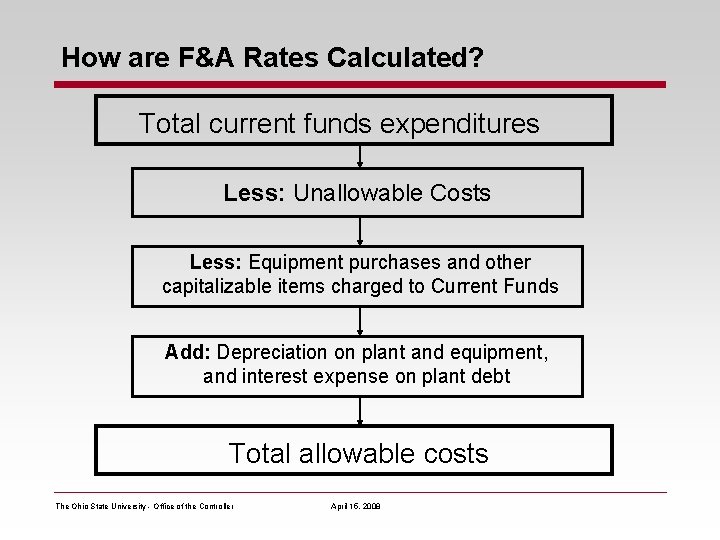

How are F&A Rates Calculated? Total current funds expenditures Less: Unallowable Costs Less: Equipment purchases and other capitalizable items charged to Current Funds Add: Depreciation on plant and equipment, and interest expense on plant debt Total allowable costs The Ohio State University - Office of the Controller April 15, 2008

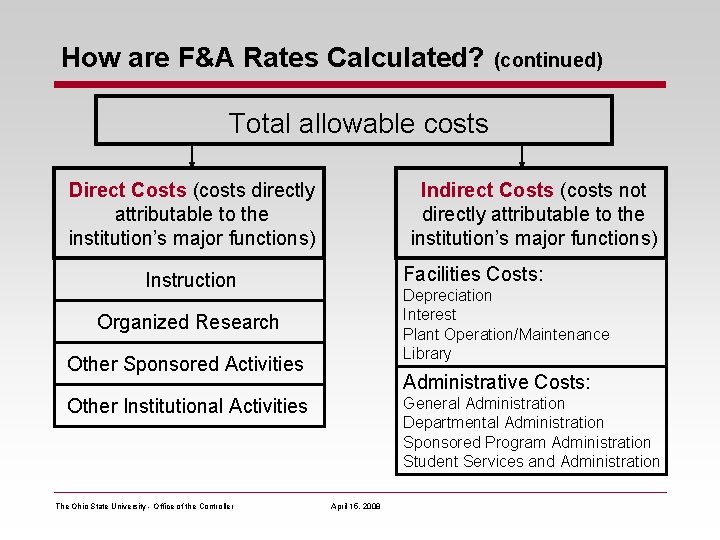

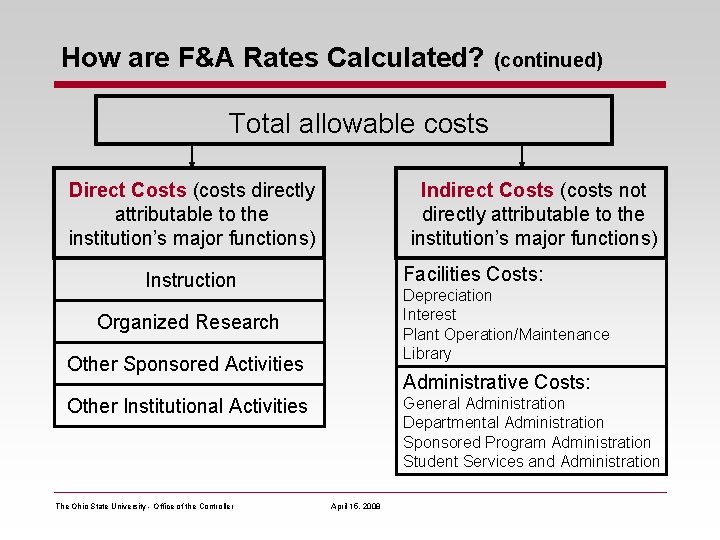

How are F&A Rates Calculated? (continued) Total allowable costs Direct Costs (costs directly attributable to the institution’s major functions) Indirect Costs (costs not directly attributable to the institution’s major functions) Facilities Costs: Instruction Depreciation Interest Plant Operation/Maintenance Library Organized Research Other Sponsored Activities Administrative Costs: General Administration Departmental Administration Sponsored Program Administration Student Services and Administration Other Institutional Activities The Ohio State University - Office of the Controller April 15, 2008

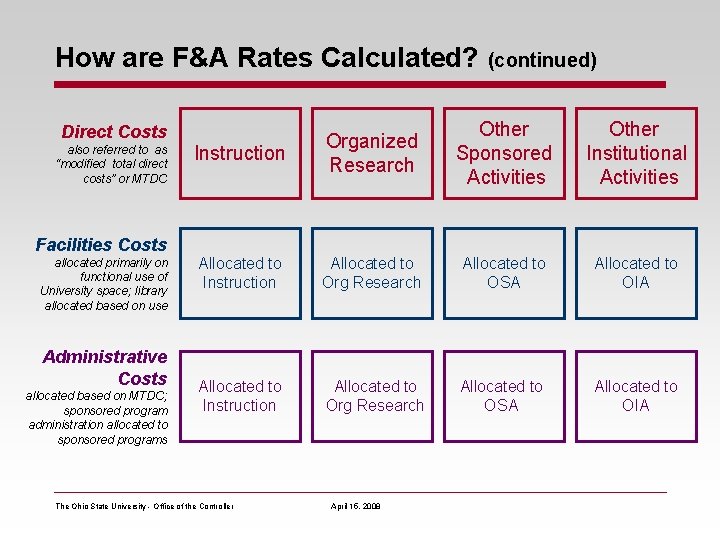

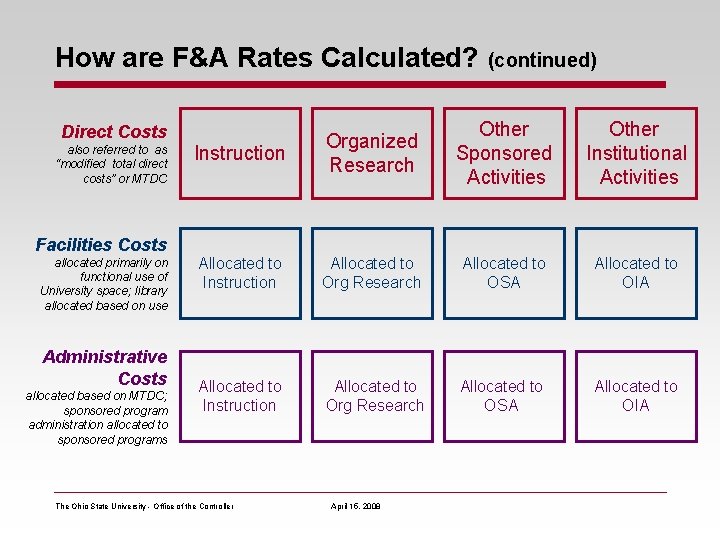

How are F&A Rates Calculated? (continued) Instruction Organized Research Other Sponsored Activities Other Institutional Activities Allocated to Instruction Allocated to Org Research Allocated to OSA Allocated to OIA Direct Costs also referred to as “modified total direct costs” or MTDC Facilities Costs allocated primarily on functional use of University space; library allocated based on use Administrative Costs allocated based on MTDC; sponsored program administration allocated to sponsored programs The Ohio State University - Office of the Controller April 15, 2008

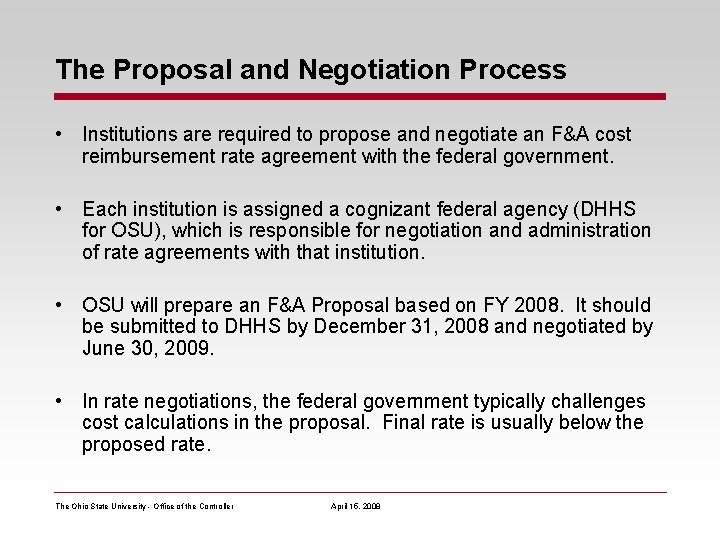

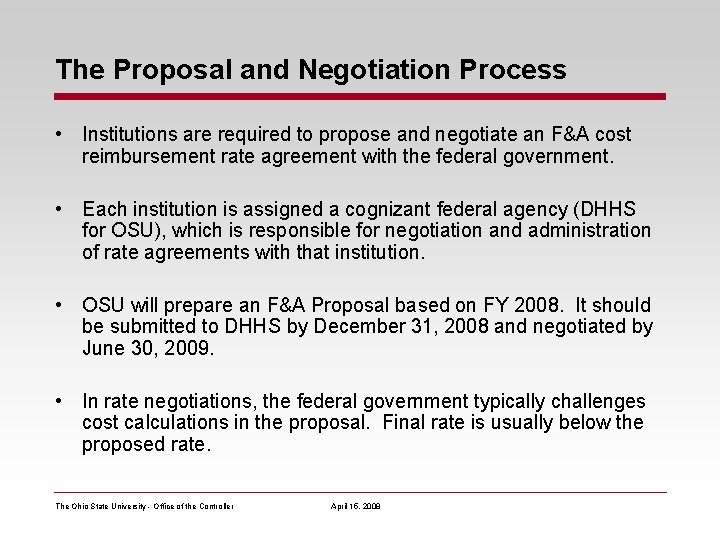

The Proposal and Negotiation Process • Institutions are required to propose and negotiate an F&A cost reimbursement rate agreement with the federal government. • Each institution is assigned a cognizant federal agency (DHHS for OSU), which is responsible for negotiation and administration of rate agreements with that institution. • OSU will prepare an F&A Proposal based on FY 2008. It should be submitted to DHHS by December 31, 2008 and negotiated by June 30, 2009. • In rate negotiations, the federal government typically challenges cost calculations in the proposal. Final rate is usually below the proposed rate. The Ohio State University - Office of the Controller April 15, 2008

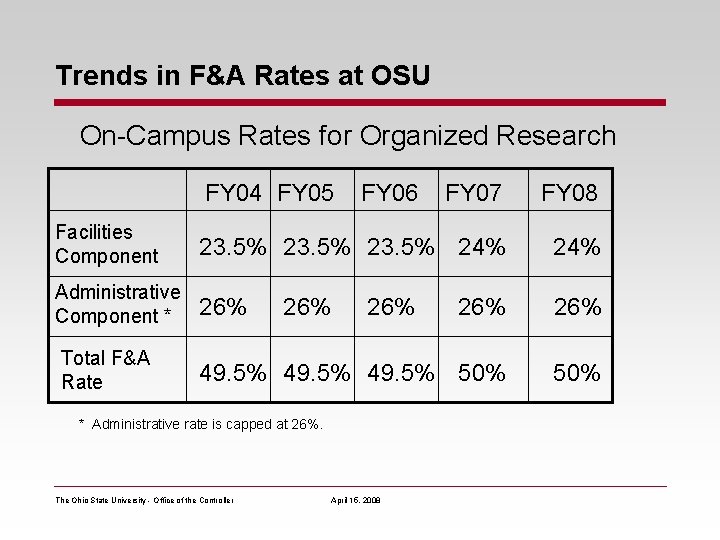

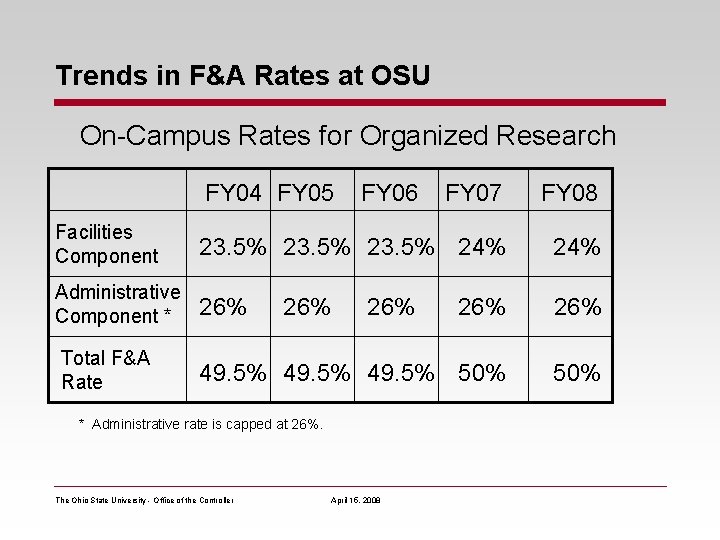

Trends in F&A Rates at OSU On-Campus Rates for Organized Research FY 04 FY 05 FY 07 FY 08 Facilities Component 23. 5% 24% Administrative Component * 26% 26% Total F&A Rate 49. 5% 50% 26% FY 06 26% * Administrative rate is capped at 26%. The Ohio State University - Office of the Controller April 15, 2008

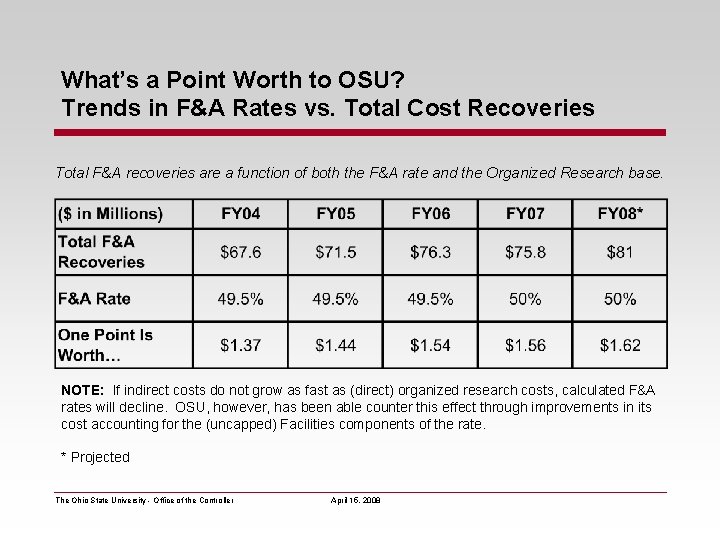

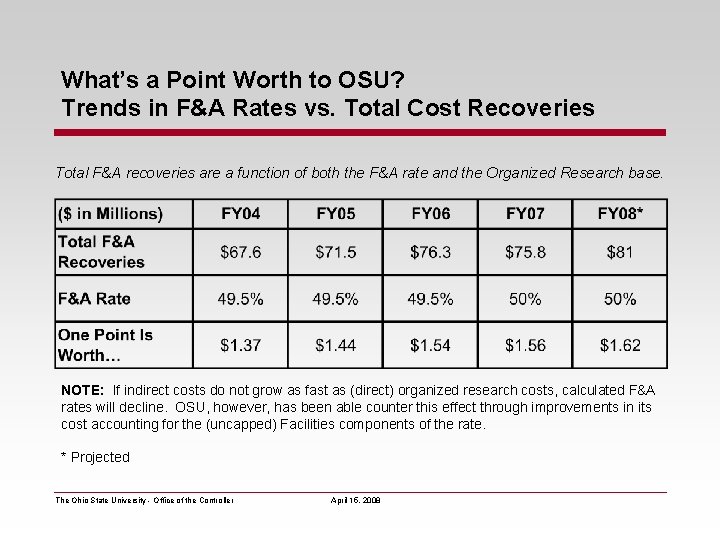

What’s a Point Worth to OSU? Trends in F&A Rates vs. Total Cost Recoveries Total F&A recoveries are a function of both the F&A rate and the Organized Research base. NOTE: If indirect costs do not grow as fast as (direct) organized research costs, calculated F&A rates will decline. OSU, however, has been able counter this effect through improvements in its cost accounting for the (uncapped) Facilities components of the rate. * Projected The Ohio State University - Office of the Controller April 15, 2008

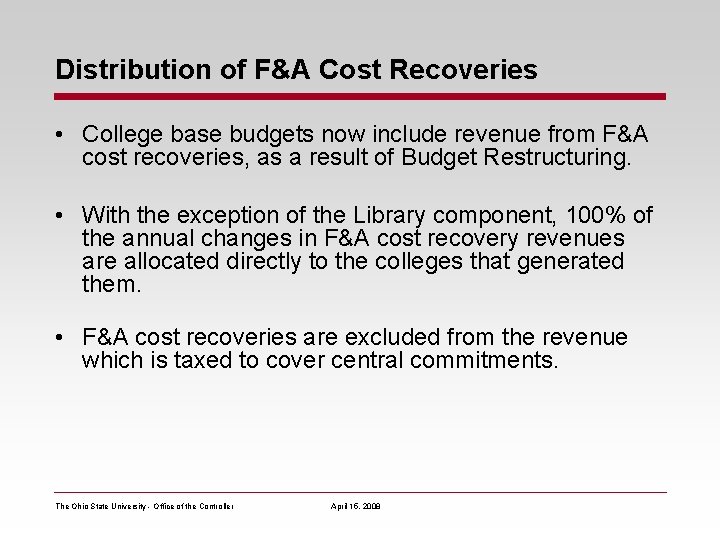

Distribution of F&A Cost Recoveries • College base budgets now include revenue from F&A cost recoveries, as a result of Budget Restructuring. • With the exception of the Library component, 100% of the annual changes in F&A cost recovery revenues are allocated directly to the colleges that generated them. • F&A cost recoveries are excluded from the revenue which is taxed to cover central commitments. The Ohio State University - Office of the Controller April 15, 2008

What are We Doing to Maintain or Increase the University’s F&A Rate? • Building Componentization and Room-by-Room Cost Allocation (special studies allow OSU to depreciate buildings more quickly and to specifically identify the higher construction costs associated with research space). • Increased Capitalization Thresholds from $500 to $3, 000 on equipment, and from $25, 000 to $100, 000 on building repair/renovation projects (accelerates cost recovery by replacing multi-year depreciation with current-year charges to expense) • Expanded Space Survey (to identify functional breakouts of all rooms on campus and tie OSURF projects and employees to specific rooms). Space drives most facilities cost allocations. The Ohio State University - Office of the Controller April 15, 2008

Summary • Indirect costs are costs that cannot be directly attributed to a major function of an institution. They are now known as facilities and administrative (or F&A) costs. • A-21, the federal government’s rule book on cost reimbursement, sets forth a methodology for allocating F&A costs to all major functions of an institution. • OSU’s F&A rate, which is a negotiated figure that reflects allocated F&A costs as a percentage of total direct costs, is currently 50% for on-campus organized research. The OSU Research Foundation is expected to bill sponsors for approximately $81 million in F&A costs during FY 08. • To maintain or increase the F&A rate, we will need to make continued improvements in our cost accounting for the (uncapped) facilities components of the rate. The Ohio State University - Office of the Controller April 15, 2008

Questions? Please feel free to contact a member of our cost allocation team • Tom Ewing, Associate University Controller 688 -3113 ewing. 6@osu. edu • Phil Schirtzinger, Sr. Cost Allocation Analyst 688 -3672 schirtzinger. 17@osu. edu • Allan Freeman, Cost Allocation Analyst 688 -4134 freeman. 6@osu. edu The Ohio State University - Office of the Controller April 15, 2008

2 cfr 200 indirect costs

2 cfr 200 indirect costs Indirect costs

Indirect costs Servsafe chapter 10

Servsafe chapter 10 Public area cleaning equipment

Public area cleaning equipment Food receiving procedure

Food receiving procedure Hotel sizes classifications

Hotel sizes classifications Iso 17025 facilities and environmental conditions

Iso 17025 facilities and environmental conditions Retail storage with customer pickup

Retail storage with customer pickup Cross connection servsafe

Cross connection servsafe Facility planning

Facility planning Providing support services facilities and other amenities

Providing support services facilities and other amenities Translators and facilities of languages

Translators and facilities of languages Safe facilities and pest management

Safe facilities and pest management Hình ảnh bộ gõ cơ thể búng tay

Hình ảnh bộ gõ cơ thể búng tay Slidetodoc

Slidetodoc Bổ thể

Bổ thể