e Commerce Technology 20 763 Lecture 10 Micropayments

- Slides: 18

e. Commerce Technology 20 -763 Lecture 10 Micropayments I

Micropayments • Replacement of cash – Cheaper (cash very expensive to handle) – Electronic moves faster – Easier to count, audit, verify • Small transactions – Beverages – Phone calls – Tolls, transportation, parking – Copying – Internet content – Lotteries, gambling 20 -763 ELECTRONIC PAYMENT SYSTEMS FALL 2001 COPYRIGHT © 2001 MICHAEL I. SHAMOS

Micropayments • Transactions have low value, e. g. less than $1. 00 • Must process the transaction at low cost • Technological savings: – Don’t verify every transaction – Use symmetric encryption • Float-preserving methods – Prepayment – Grouping • Aggregate purchases (to amortize fixed costs) • Provide float to processor • Partial anonymity (individual purchases disguised) 20 -763 ELECTRONIC PAYMENT SYSTEMS FALL 2001 COPYRIGHT © 2001 MICHAEL I. SHAMOS

Micropayments • Prepaid cards – Issued by non-banks – Represent call on future service – Not money since usable only with one seller • Electronic purse – Issued by bank – Holds representation of real money – In form of a card (for face-to-face or Internet use) – In virtual form (computer file for Internet use) – The two forms are converging, e. g. wireless 20 -763 ELECTRONIC PAYMENT SYSTEMS FALL 2001 COPYRIGHT © 2001 MICHAEL I. SHAMOS

Electronic Purse Issues • Loading (charging) the purse with money • Making a payment (removing money from the card) • Clearance (getting money into the seller’s account) 20 -763 ELECTRONIC PAYMENT SYSTEMS FALL 2001 COPYRIGHT © 2001 MICHAEL I. SHAMOS

Geld. Karte • Smart card system • Issued by Zentraler Kreditausschuß (Germany) • Card contains counters representing money value – Max balance 400 DEM = $188 • Card is loaded through a loading terminal – Debits customer’s bank account • Spending at merchant terminal or on Internet – Amount deducted from card, added to merchant terminal (card) – No real-time authorization • End-of-day: merchant uploads transactions • Money credited to merchant account • Bank fee: 0. 3%, minimum $0. 01 20 -763 ELECTRONIC PAYMENT SYSTEMS FALL 2001 COPYRIGHT © 2001 MICHAEL I. SHAMOS

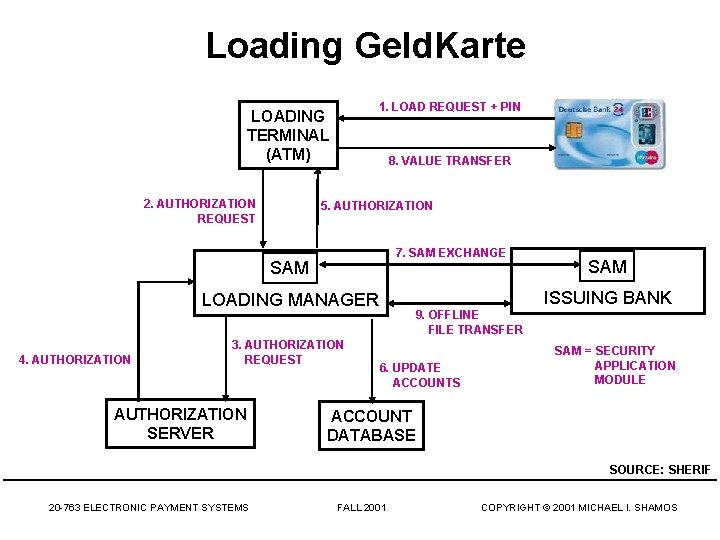

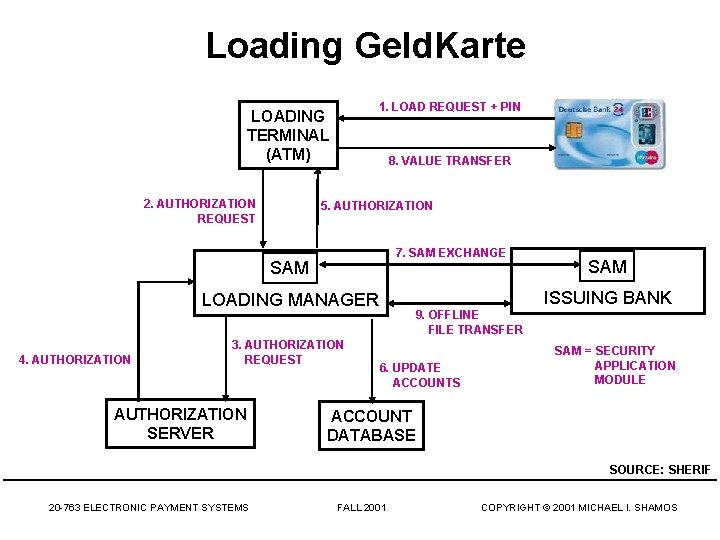

Loading Geld. Karte 1. LOAD REQUEST + PIN LOADING TERMINAL (ATM) 2. AUTHORIZATION REQUEST 8. VALUE TRANSFER 5. AUTHORIZATION 7. SAM EXCHANGE SAM ISSUING BANK LOADING MANAGER 4. AUTHORIZATION 3. AUTHORIZATION REQUEST AUTHORIZATION SERVER SAM 9. OFFLINE FILE TRANSFER 6. UPDATE ACCOUNTS SAM = SECURITY APPLICATION MODULE ACCOUNT DATABASE SOURCE: SHERIF 20 -763 ELECTRONIC PAYMENT SYSTEMS FALL 2001 COPYRIGHT © 2001 MICHAEL I. SHAMOS

Geld. Karte Payment • Customer inserts Geld. Karte in slot (at merchant terminal or PCMCIA card) • Merchant authenticates customer card OFFLINE • Customer authenticates merchant card (NO THIRD PARTY) • Transfer purchase amount • Generate electronic receipts • (Later) Merchant presents receipt to issuing bank to obtain credit to merchant account • No purse-to-purse transactions 20 -763 ELECTRONIC PAYMENT SYSTEMS FALL 2001 COPYRIGHT © 2001 MICHAEL I. SHAMOS

Geld. Karte Card Authentication • Merchant SAM generates a random number RAND (to prevent replay attack), sends to customer card with request for customer card ID (CID) • Card sends CID, a generated sequence number SNo, RAND, and H(CID) encrypted with a symmetric secret key SKC (known to card, not customer) • No public-key encryption • Merchant computes SKC from CID and his own secret key SKM (known to card, not merchant) • Merchant can now validate integrity of the card message by computing H(CID) 20 -763 ELECTRONIC PAYMENT SYSTEMS FALL 2001 COPYRIGHT © 2001 MICHAEL I. SHAMOS

Geld. Karte Value Exchange • Customer sends Start. Payment message • Merchant sends MID, merchant’s transaction number TNo, SNo, a MAC encrypted with SKC, CID and the value M to be transferred, all encrypted with SKC • Customer can decrypt this message with SKC and validate merchant • Customer checks CID, M and SNo (prevent replay) • Customer card verifies at least M remaining, subtracts M, increments SNo, records payment data, generates proof of payment: { M, MID, SNo, TNo, ANo, MAC }, send to merchant card 20 -763 ELECTRONIC PAYMENT SYSTEMS FALL 2001 COPYRIGHT © 2001 MICHAEL I. SHAMOS

Geld. Karte Value Exchange, cont. • Merchant verifies payment: – compute actual payment amount M' from the proof of payment, compare with M – verify MID and TNo – increment TNo, increase balance by M – notify merchant of success – record transaction data with different secret key KZD • Merchant requests payment from bank (later) – sends encrypted proofs of payment to bank – TNo prevents more than one credit per transaction 20 -763 ELECTRONIC PAYMENT SYSTEMS FALL 2001 COPYRIGHT © 2001 MICHAEL I. SHAMOS

Geld. Karte Clearance • Uses a “shadow account” (Börsenverechnungskonto) to track the contents of the card – When card is loaded, shadow account is credited – When money is spent, shadow account is debited • online transactions immediately • offline transactions later • If card is lost or damaged, money can be replaced • Problem: every transaction is recorded, no anonymity • Solution: “Weisse Karte. ” Bought for cash, not connected to any bank account 20 -763 ELECTRONIC PAYMENT SYSTEMS FALL 2001 COPYRIGHT © 2001 MICHAEL I. SHAMOS

Geld. Karte Security • DES (customer), triple DES (merchant) (cipher block chaining or cipher feedback mode) • 128 -bit hashes • Each card has unique ID, unique symmetric key, PIN stored in “secret zone” and in bank • Unique transaction numbers 20 -763 ELECTRONIC PAYMENT SYSTEMS FALL 2001 COPYRIGHT © 2001 MICHAEL I. SHAMOS

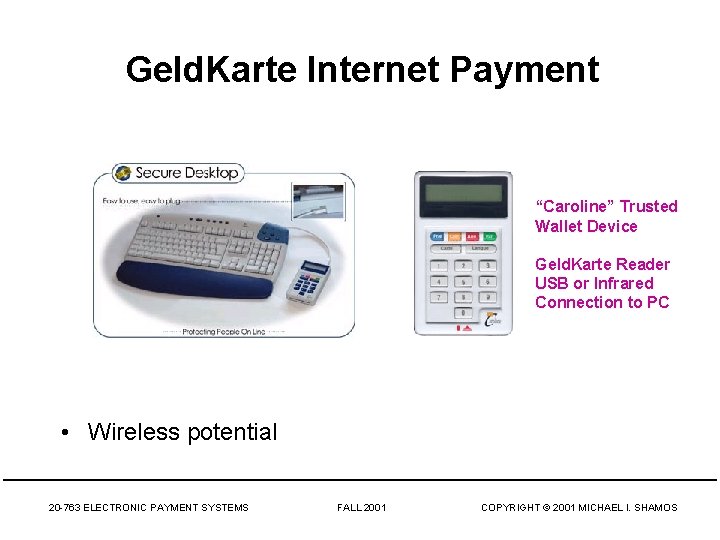

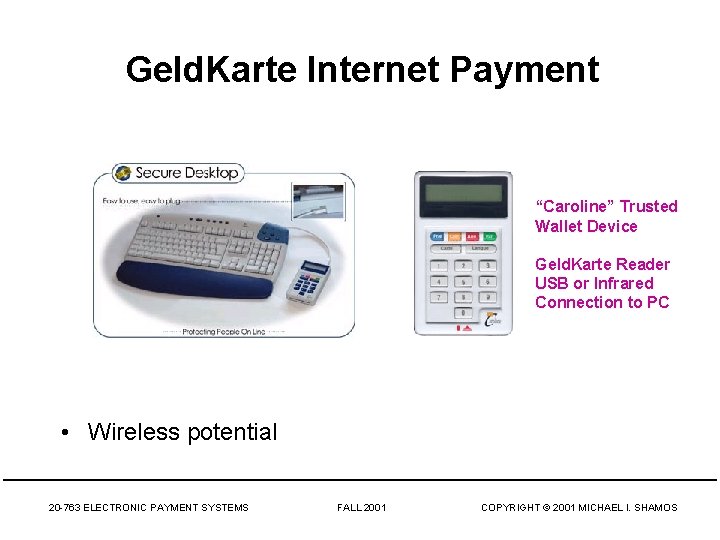

Geld. Karte Internet Payment “Caroline” Trusted Wallet Device Geld. Karte Reader USB or Infrared Connection to PC • Wireless potential 20 -763 ELECTRONIC PAYMENT SYSTEMS FALL 2001 COPYRIGHT © 2001 MICHAEL I. SHAMOS

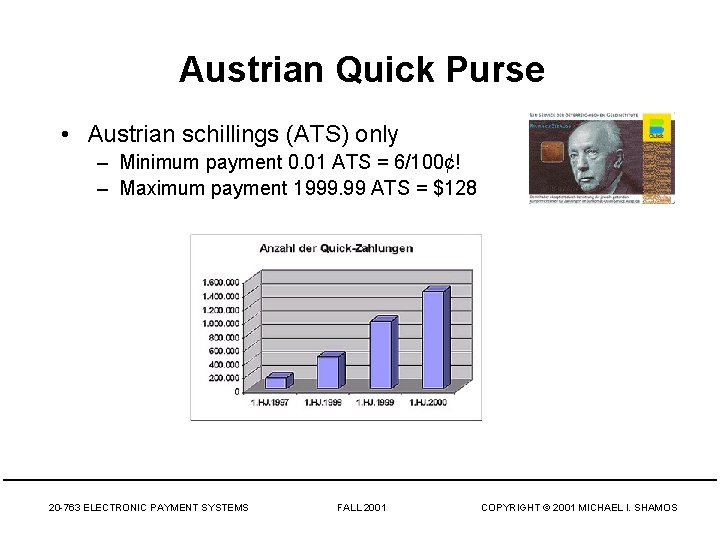

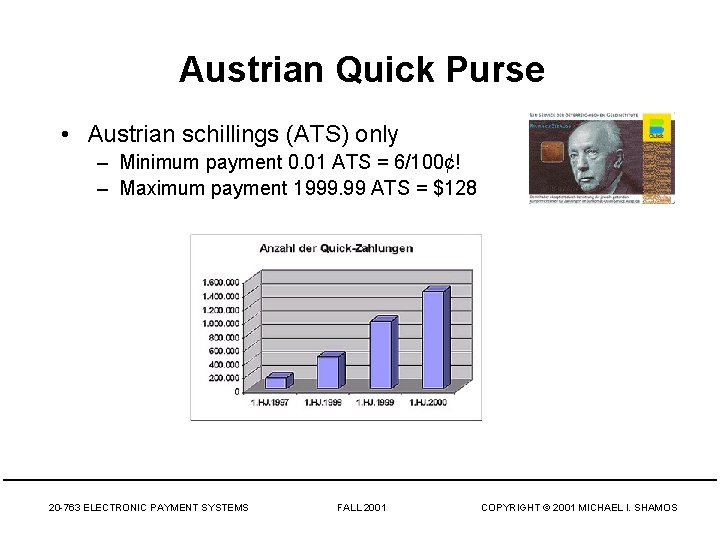

Austrian Quick Purse • Austrian schillings (ATS) only – Minimum payment 0. 01 ATS = 6/100¢! – Maximum payment 1999. 99 ATS = $128 20 -763 ELECTRONIC PAYMENT SYSTEMS FALL 2001 COPYRIGHT © 2001 MICHAEL I. SHAMOS

Quick Card Clearing • Money accumulates on merchant card • Merchant terminal uploads summary auditing data (not all data: transactions cannot be traced) • Bank downloads redlist (stolen cards) database • If merchant has no terminal, card can be brought to value transfer terminal 20 -763 ELECTRONIC PAYMENT SYSTEMS FALL 2001 COPYRIGHT © 2001 MICHAEL I. SHAMOS

Quick Internet Payment • Customer selects goods on the Web and chooses the "Quick payment” option • Merchant server contacts the payment server, transmits client's IPaddress and transaction value, short description of goods and merchant ID • Payment server locks the merchant for the transaction, contacts wallet over TCP at a special port designated for Quick im Internet. The client then accesses the card reader and looks for customer Quick card • Before card is debited, client displays a message box to the customer that describes the ordered goods as well as the total amount of the transaction and allows the customer to either permit the transaction or cancel it. 20 -763 ELECTRONIC PAYMENT SYSTEMS FALL 2001 COPYRIGHT © 2001 MICHAEL I. SHAMOS

Q&A 20 -763 ELECTRONIC PAYMENT SYSTEMS FALL 2001 COPYRIGHT © 2001 MICHAEL I. SHAMOS