Dr Harvey Stern Climate Manager Victoria and Griffith

- Slides: 20

Dr Harvey Stern, Climate Manager, Victoria and Griffith University Mr Glen Dixon, Associate Lecturer (Finance), Brisbane

Ergon Energy Staff Meeting Seminar Brisbane (Head Office), Wednesday 13 th of November 2002 Time: 2: 00 to 3: 15 (including questions) Pricing Weather Derivatives in the Australian Electricity Market

Introduction Evidence of the challenge faced by the meteorological community to become skilled in applying risk management products from financial markets is growing. An empirical approach to the pricing of weather derivatives is presented. The approach is illustrated with several examples with focus on Energy and Agriculture.

Outline of Presentation • • • The increasing focus on weather risk. Weather in company reports. Mitigating weather risk. New developments. Quantifying uncertainty in forecasts. Ensemble forecasting.

Background • Weather risk is one of the biggest uncertainties facing business. • We get droughts, floods, fire, cyclones (hurricanes), snow & ice. • Nevertheless, economic adversity is not restricted to disaster conditions. • A mild winter ruins a skiing season, dry weather reduces crop yields, & rain shuts-down entertainment & construction.

Weather & Climate Forecasts • Daily weather forecasts may be used to manage short-term risk (e. g. pouring concrete). • Seasonal climate forecasts may be used to manage risk associated with long-term activities (e. g. sowing crops). • Forecasts are based on a combination of solutions to the equations of physics, and some statistical techniques. • With the focus upon managing risk, the forecasts are increasingly being couched in probabilistic terms.

First Weather Derivative in Australia It is the energy and power industry that has, so far, taken best advantage of the opportunities presented by weather derivatives. Indeed, the first weather derivative contract was a temperature-related power swap transacted in August 1996.

First Weather Derivative Payout in Australia (1) • Two temperature-based options contracts, which are claimed as Australia’s first weather derivatives deals, expired at the end of March 1998 with a pay-out for the purchasing party. • US Electric Utility Utilicorp sold the options to United Energy Marketing in late January, with a profit for United if during February and March temperatures hit 35 deg C or above on 5 days or more in Melbourne, Victoria or 33 deg C or above on 3 days or more in Sydney, News South Wales. Source: Energy and Power Risk Management June, 1998

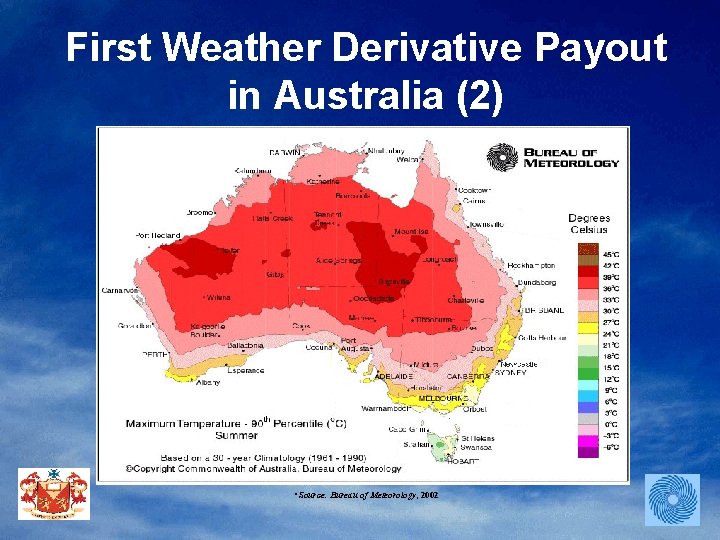

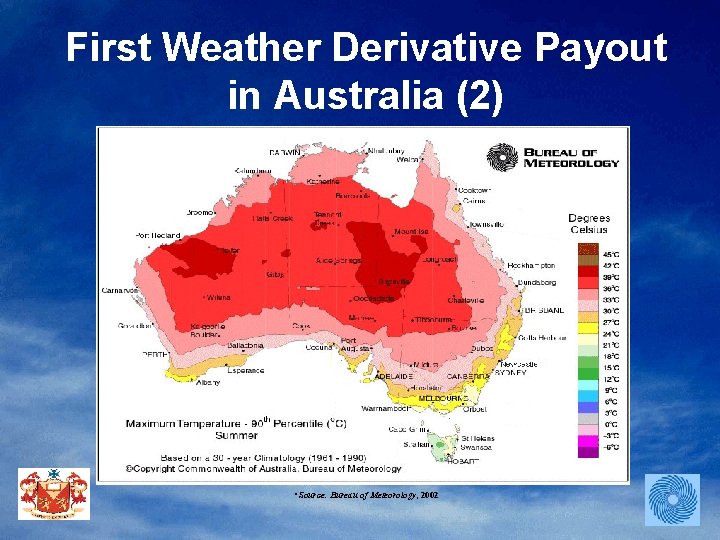

First Weather Derivative Payout in Australia (2) • Source: Bureau of Meteorology, 2002

First Weather Derivative Payout in Australia (3) • By the end of March, temperatures had hit the required level on 5 different days in Sydney, and 6 days in Melbourne, triggering payouts. • Alan Rattray, VP of International Risk Management of Utilicorp Australia said “the Sydney contract returned eight times the premium paid”. Source: Energy and Power Risk Management June, 1998

Weather Derivatives Defined Clewlow et al. . . (2000) describe weather derivatives as being similar "to conventional financial derivatives, the basic difference coming from the underlying variables that determine the pay-offs", such as temperature, precipitation, wind, heating degree days, and cooling degree days.

Weather Derivatives • Weather derivatives are similar to conventional financial derivatives. • The basic difference lies in the underlying variables that determine the pay-offs. • These underlying variables include temperature, precipitation, wind, and heating (& cooling) degree days as described by Clewlow and Strickland.

Asian Players Currently 2002 • Australia: Aquila Energy stopped alliance with Macquarie Bank (Credit Ratings), Westpac (Enron Weather Book), Societe Generale, AXA Corporate Solutions, Zurich, Swiss Re New Markets, Element Re Capital Products Inc (Norman Trethewey - Ex Enron ~ collapsed). • Australian Weather Retailers: Origin Energy (Dr Christian Werner - Ex Enron ~ collapsed) Integral Energy (Dr Adam Kucera - Ex Edge. Cap ~ collapsed)

Asian Players Membership 2002 • Asia: Bank of Tokyo-Mitsubishi Ltd. , BNP Paribas, Cargill Incorporated, El Paso Merchant Energy, Entergy-Koch (formerly Axia Energy), Hess Energy Trading Company, Mirant Americas Energy Marketing LP, Mitsui Sumitomo Insurance Company, Ltd. (formerly Mitsui Marine and Fire Insurance Company Ltd. ), Mizuho Corporate Bank (formerly Industrial Bank of Japan), Reliant Energy Services, Inc. , The Tokio Marine and Fire Insurance Co. Ltd. , Tokyo Electric Power Company, Inc. and TXU Europe Energy Trading Ltd. • Membership is currently 70 global. Cost: US$5, 000 Membership US$2, 500 Associate Membership to WRMA • Source: Weather Risk Management Association Annual Survey (2002)

Black- Scholes won’t do (1) • Black-Scholes modelling may be the standard approach for options pricing in many derivatives markets, but applying it to weather derivatives is hazardous. One might even say it is wrong. • The primary reason not to use a Black-Scholes model to price weather options is that the model is based on an underlying tradeable commodity, and in weather derivatives there is no underlying commodity. • Source: Energy and Power Risk Management, October, 1998

Black- Scholes won’t do (2) • In the natural gas market, for example the model derives the price of the gas derivative from the price of physical gas itself. But weather doesn’t have a price. • The payoff of the Weather option is instead based on a series of weather events, not the value of weather. • • Black-Scholes is inappropriate for another reason. Weather options, as they are traded in today’s market, accumulate value over a strike period. Source: Energy and Power Risk Management, October, 1998

Black- Scholes won’t do (3) • For example, every day of colder-than normal weather over the term of an option might add to the total payout at expiry. • This accumulation is similar to the averaging feature in the Asian-style options, under which the payout is based on the average value of the underlying over the option’s life. • Source: Energy and Power Risk Management, October, 1998

Pricing Methodologies • Historical simulation (look at examples using this technique). • Direct modeling of the underlying variable’s distribution. • Indirect modeling of the underlying variable’s distribution (via a Monte Carlo technique as this involves simulating a sequence of data).

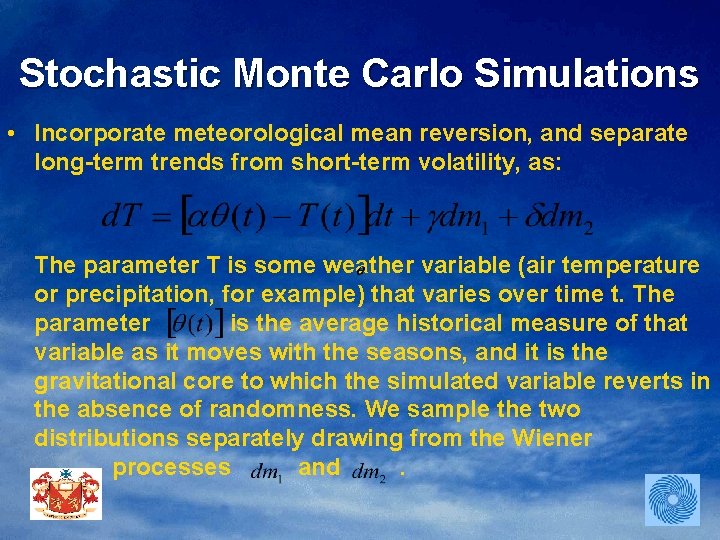

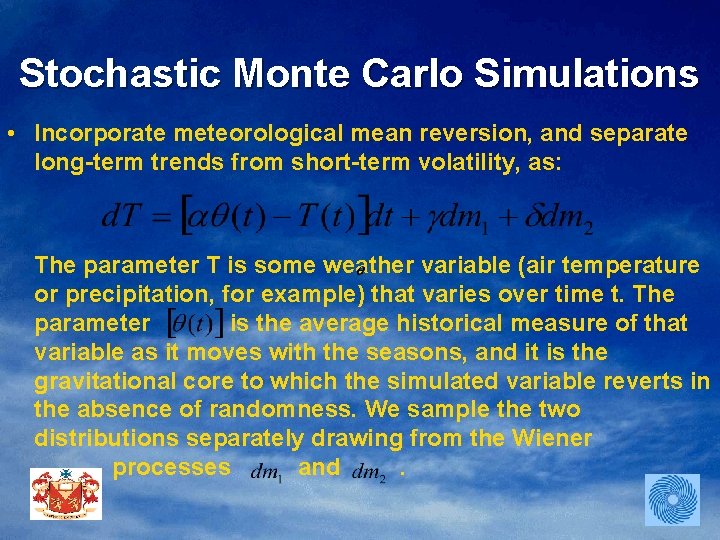

Stochastic Monte Carlo Simulations • Incorporate meteorological mean reversion, and separate long-term trends from short-term volatility, as: The parameter T is some weather variable (air temperature or precipitation, for example) that varies over time t. The parameter is the average historical measure of that variable as it moves with the seasons, and it is the gravitational core to which the simulated variable reverts in the absence of randomness. We sample the two distributions separately drawing from the Wiener processes and.

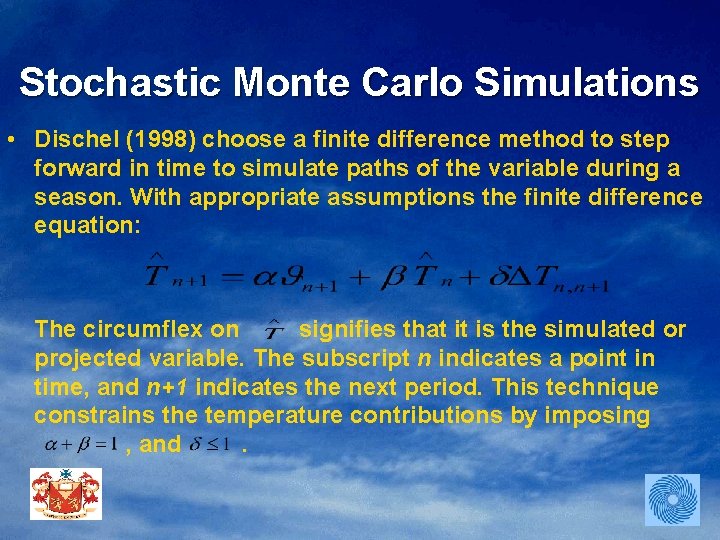

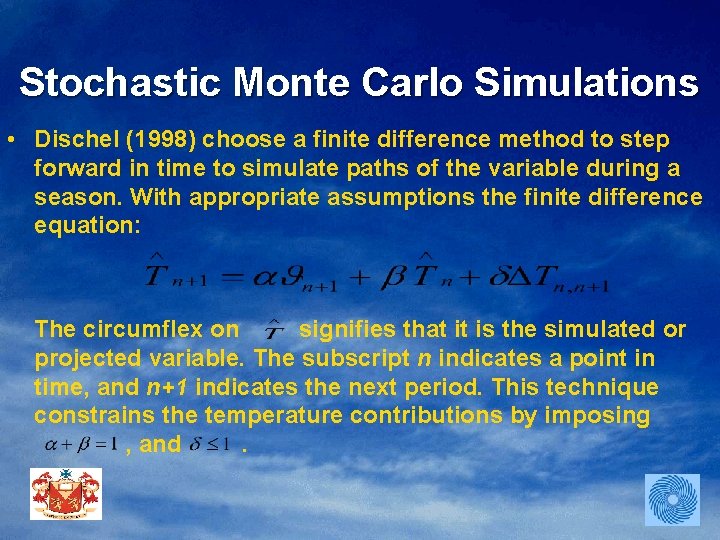

Stochastic Monte Carlo Simulations • Dischel (1998) choose a finite difference method to step forward in time to simulate paths of the variable during a season. With appropriate assumptions the finite difference equation: The circumflex on signifies that it is the simulated or projected variable. The subscript n indicates a point in time, and n+1 indicates the next period. This technique constrains the temperature contributions by imposing , and.

Aft end

Aft end Dr harvey stern

Dr harvey stern Centros alternativos de los 7 habitos

Centros alternativos de los 7 habitos Climate change 2014 mitigation of climate change

Climate change 2014 mitigation of climate change Senior manager vs general manager

Senior manager vs general manager Portfolio manager synergy manager parental developer

Portfolio manager synergy manager parental developer Krackhardt and stern's e-i index

Krackhardt and stern's e-i index Crossroads international church singapore

Crossroads international church singapore Vandewalles appleton

Vandewalles appleton Niesha griffith

Niesha griffith Griffith thomas

Griffith thomas Dr rick griffith

Dr rick griffith Monomer of dna

Monomer of dna Melanie griffith

Melanie griffith Dw griffith

Dw griffith Chipper griffith

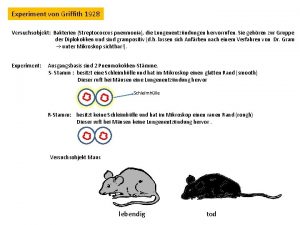

Chipper griffith In his transformation experiments what did griffith observe

In his transformation experiments what did griffith observe Rick griffith bible study downloads

Rick griffith bible study downloads Dr rick griffith

Dr rick griffith Experiment mit mäusen von griffith 1928

Experiment mit mäusen von griffith 1928 Dr rick griffith

Dr rick griffith