CUSTOMS TARIFF MODERNIZATION ACT OF 2008 PHILEXPORT 4

- Slides: 36

CUSTOMS & TARIFF MODERNIZATION ACT OF 2008 PHILEXPORT 4 th Quarter General Membership Me October 30, 2008

BOC Modernization Efforts • RATS program • BOC Processes and systems enhancements • Legal and Regulatory Reforms • BOC Integrity Development Plan Customs and Tariff Modernization Act 2008

“Customs & Tariff Modernization Act is the backbone of Philippine Modern Customs” Customs and Tariff Modernization Act 2008

CTMA 2008 crafted pulling together - Books I and II of the TCCP, as amended Inputs from TWG and Workshop Discussion Meetings with key BOC Officials RKC General Annex—mandatory standards RKC Specific Annex—not otherwise reserved Bo. C Wishlist—(e. g. authority to outsource) Anti-Smuggling Bill Legislative Agenda courtesy of PACT Project Amendatory Bill on RA 9280 (Customs Brokers’ Act) International Agreements/Best Customs Practices Customs and Tariff Modernization Act 2008

“ 1978 Tariff and Customs Code of the Philippines is no longer responsive to the present demands of trade and commerce. ” Customs and Tariff Modernization Act 2008

EXPORT and IMPORT for RE-EXPORT Provisions in the CTMA Customs and Tariff Modernization Act 2008

NEW PROVISIONS ON EXPORT & IMPORT FOR RE-EXPORT Sec. 124. Application of Information and Communication Technology Sec. 131. Free and Regulated Importations and Exportations Sec. 407. Mode and Manner of Payment Trade Terms Sec. 500. Export Declaration Sec. 501. Lodgement and Processing of Export Declaration Sec. 600. Customs Transit in the Customs Territory Sec. 603. Customs Transhipment Sec. 802. Types of warehouses Sec. 813. Free Zones Sec. 901. Prescription of Drawback claim Sec. 1711. Tariff nomenclature and rates of export duty Customs and Tariff Modernization Act 2008

Section 124. APPLICATION OF INFORMATION AND COMMUNICATION TECHNOLOGY • Application of cost-effective and efficient information and communication technology to enhance customs control and operations for a paperless customs environment. • Introduction of ICT shall be carried out in consultation with parties directly affected. Customs and Tariff Modernization Act 2008

TYPES OF IMPORTATION SEC. 131. FREE AND REGULATED IMPORTATIONS AND EXPORTATIONS FREE IMPORTATIONS/EXPORTATIONS -articles which may be imported and exported without need for permits, clearances or licenses. REGULATED IMPORTATIONS/EXPORTATIONS -articles that are subjected to government regulations which may be brought in or exported only after securing the required permits, clearances, licenses, prior to importation or exportation and if allowed by governing laws or regulations, after arrival of the articles but prior to release from customs custody in case of importation. Customs and Tariff Modernization Act 2008

IMPORT CLEARANCE AND FORMALITIES SEC. 407. MODE AND MANNER OF PAYMENT; TRADE TERMS SUBJECT TO EXISTING LAWS AND RULES ON FOREIGN CURRENCY EXCHANGE, THE INTERNATIONALLY-ACCEPTED STANDARDS AND PRACTICES ON THE MODE OF PAYMENT OR REMITTANCE COVERING IMPORT AND EXPORT TRANSACTIONS, INCLUDING STANDARDS DEVELOPED BY INTERNATIONAL TRADING BODIES SUCH AS THE INTERNATIONAL CHAMBER OF COMMERCE (ICC) ON TRADING TERMS E. G. , INCOTERMS 2000, AND ON INTERNATIONAL LETTERS OF CREDIT SUCH AS THE UNIFORM CUSTOMS AND PRACTICE FOR DOCUMENTARY CREDITS (UCP 600), SHALL BE RECOGNIZED. Customs and Tariff Modernization Act 2008

Section 500. EXPORT DECLARATION All articles exported from the Philippines, whether subject to export duty or not, shall be declared through competent custom office. Export declaration shall be in such form as prescribed by regulations: > signed by the person making the declaration. > contain the number and marks of packages, or the quantity >if in bulk, nature and correct commodity description of articles contained therein and value thereof. Section 501. LODGEMENT AND PROCESSING OF EXPORT DECLARATION Rules and regulations allowing manual and electronic lodgement and processing of export declaration shall be promulgated. Customs and Tariff Modernization Act 2008

TITLE 6. CUSTOMS TRANSIT AND TRANSSHIPMENT “Transit” is defined as the customs procedure under which goods are transported under customs control from one customs office to another or to a free zone. (Sec. 102, CTMA) “Transshipment” means the customs procedure under which goods are transferred under customs control from the importing means of transport to the exporting means of transport within the area of one customs office which is one of both importation and exportation. (Sec. 102, CTMA) Customs and Tariff Modernization Act 2008

Section 600. Customs Transit in the Customs Territory Customs shall allow articles to be transported under customs transit in the customs territory: a. From port of entry to another port of entry for exit point for outright exportation; b. From port of entry to another port of entry/inland customs office; c. From inland customs office to a port of entry as exit point for outright exportation; d. From one port of entry/inland customs office to another port of entry/inland customs office. • Articles being carried under customs transit shall not be subject to the payment of duties and taxes, provided the conditions laid down by customs are complied with and any security and/or insurance required has been furnished. Customs and Tariff Modernization Act 2008

(Formalities at the office of departure) • Any commercial or transport document setting out clearly the necessary particulars shall be accepted as the descriptive part of the goods declaration for customs transit and this acceptance shall be noted on the document. Customs and Tariff Modernization Act 2008

(Sealing and identification of consignments) The customs shall accept as the goods declaration for customs transit any commercial or transport document for the consignment concerned which meets all the customs requirements. This acceptance shall be noted on the document. Customs at the office of departure shall take all necessary action to enable the office of destination to identify the consignment and to detect any unauthorized interference. Transfer of articles from one means of transport to another shall be allowed without customs authorization provided that any customs seals or fastenings are not broken or interfered with. Failure to follow itinerary or to comply with a prescribed time limit should not entail the collection of any duties and taxes potentially chargeable, provided the customs are satisfied that all other requirements have been met. Customs and Tariff Modernization Act 2008

Sec. 603. CUSTOMS TRANSHIPMENT Goods admitted for transshipment shall not be subject to the payment of duties and taxes provided conditions laid down by the customs are complied with. Any commercial or transport document setting out clearly the necessary particulars shall be accepted as the descriptive part of the goods declaration for transshipment and this acceptance shall be noted on the document. Exportation of goods declared for transshipment shall be made within 30 days from arrival of carrier from the foreign territory, subject to extension for valid reasons and upon approval of the commissioner of customs. Customs and Tariff Modernization Act 2008

CHAPTER 2. CUSTOMS BONDED WAREHOUSE Sec. 802. Types of warehouses. INDUSTRY-SPECIFIC CUSTOMS BONDED WAREHOUSES Common CUSTOMS BONDED WAREHOUSE CONTAINER YARD/CONTAINER FREIGHT STATION Customs and Tariff Modernization Act 2008

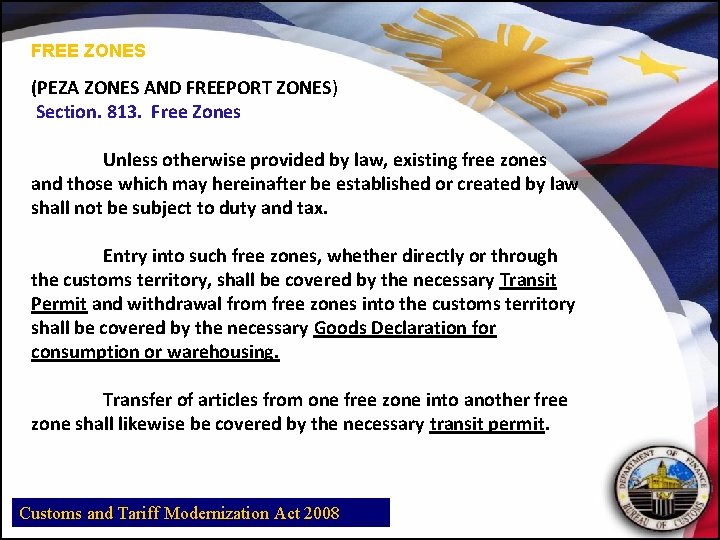

FREE ZONES (PEZA ZONES AND FREEPORT ZONES) Section. 813. Free Zones Unless otherwise provided by law, existing free zones and those which may hereinafter be established or created by law shall not be subject to duty and tax. Entry into such free zones, whether directly or through the customs territory, shall be covered by the necessary Transit Permit and withdrawal from free zones into the customs territory shall be covered by the necessary Goods Declaration for consumption or warehousing. Transfer of articles from one free zone into another free zone shall likewise be covered by the necessary transit permit. Customs and Tariff Modernization Act 2008

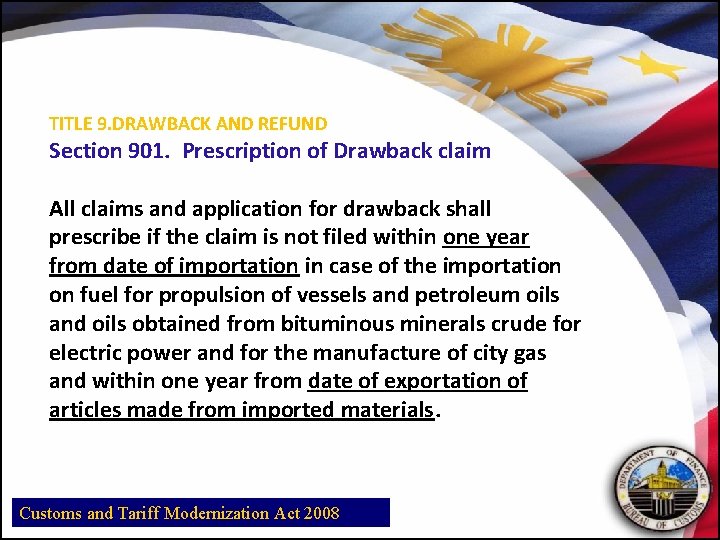

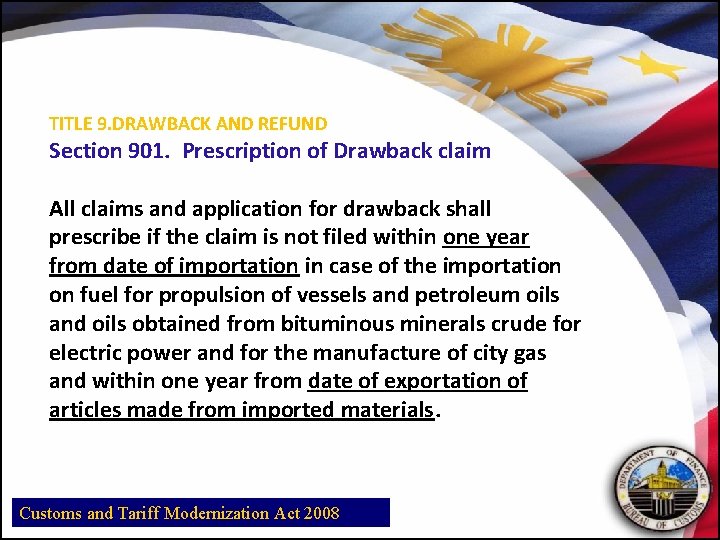

TITLE 9. DRAWBACK AND REFUND Section 901. Prescription of Drawback claim All claims and application for drawback shall prescribe if the claim is not filed within one year from date of importation in case of the importation on fuel for propulsion of vessels and petroleum oils and oils obtained from bituminous minerals crude for electric power and for the manufacture of city gas and within one year from date of exportation of articles made from imported materials. Customs and Tariff Modernization Act 2008

Title 17. TARIFF ADMINISTRATION AND POLICY Section 1711. Tariff nomenclature and rates of export duty The president shall issue an executive order prescribing the Tariff Sections, Chapters, headings and subheading and the rate of EXPORT duty based on the harmonized system, the AHTN and other International Agreement, and consistent with section 1608 of this act. The president upon recommendation of NEDA may subject any of the EXPORT products to ANY RATE OF EXPORT DUTY. In the exercise of this authority the president shall take into account: Policy of encouraging domestic processing Prevailing prices of export products in the world market Advantages obtained by export products form international agreements to which Philippines is signatory; The preferential treatment granted to our export products by foreign governments; and Need to meet domestic consumption requirements. Customs and Tariff Modernization Act 2008

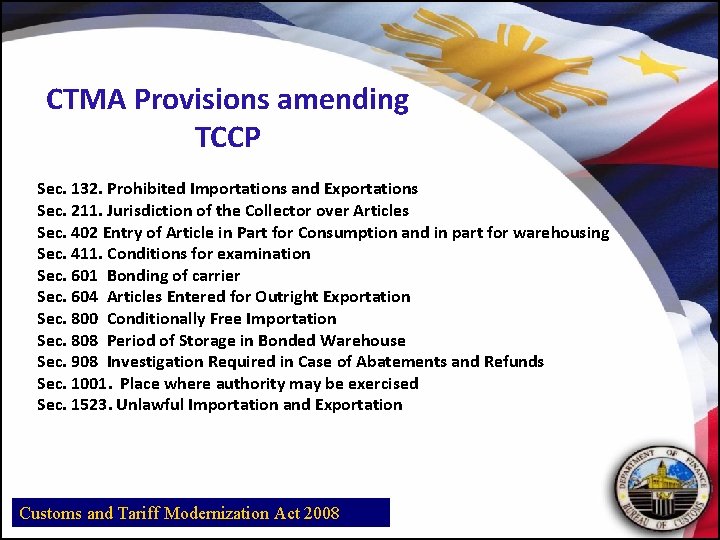

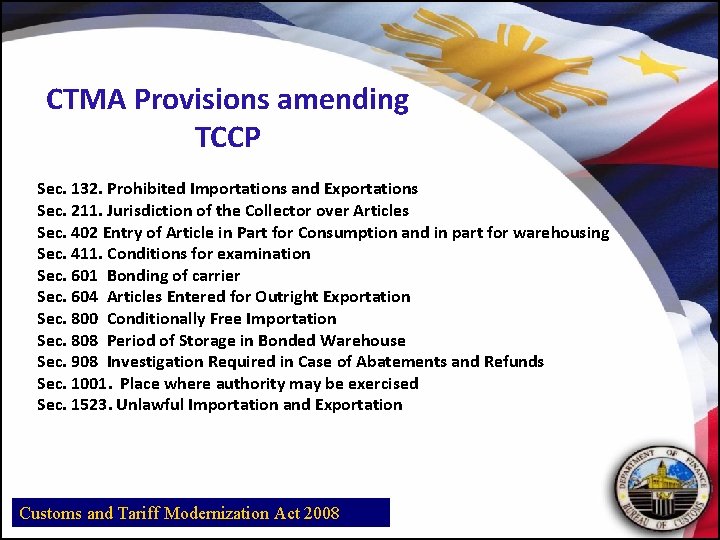

CTMA Provisions amending TCCP Sec. 132. Prohibited Importations and Exportations Sec. 211. Jurisdiction of the Collector over Articles Sec. 402 Entry of Article in Part for Consumption and in part for warehousing Sec. 411. Conditions for examination Sec. 601 Bonding of carrier Sec. 604 Articles Entered for Outright Exportation Sec. 800 Conditionally Free Importation Sec. 808 Period of Storage in Bonded Warehouse Sec. 908 Investigation Required in Case of Abatements and Refunds Sec. 1001. Place where authority may be exercised Sec. 1523. Unlawful Importation and Exportation Customs and Tariff Modernization Act 2008

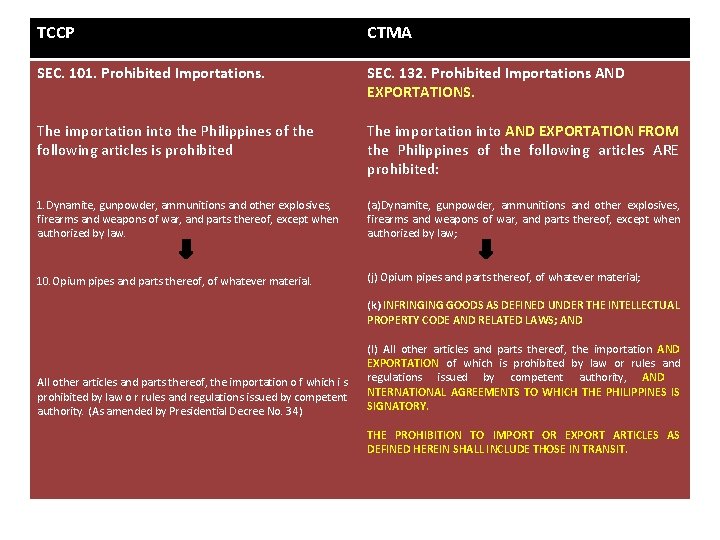

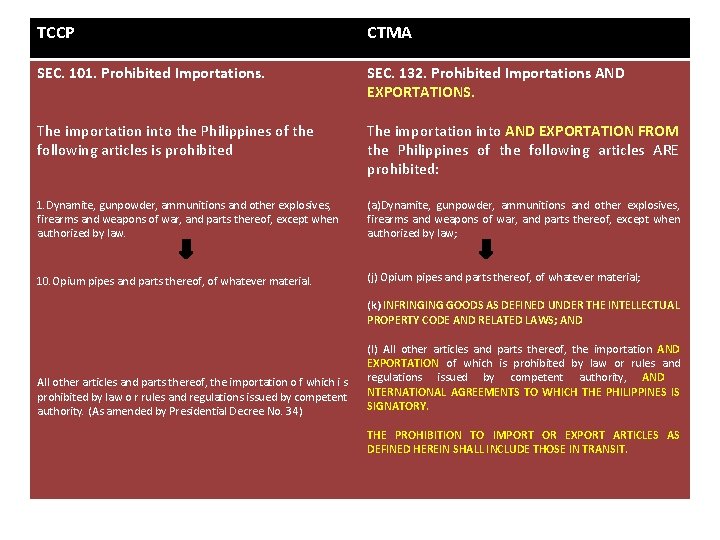

TCCP CTMA SEC. 101. Prohibited Importations. SEC. 132. Prohibited Importations AND EXPORTATIONS. The importation into AND EXPORTATION FROM the Philippines of the following articles ARE prohibited: 10. Opium pipes and parts thereof, of whatever material. (j) Opium pipes and parts thereof, of whatever material; The importation into the Philippines of the following articles is prohibited 1. Dynamite, gunpowder, ammunitions and other explosives, firearms and weapons of war, and parts thereof, except when authorized by law. (a)Dynamite, gunpowder, ammunitions and other explosives, firearms and weapons of war, and parts thereof, except when authorized by law; (k) INFRINGING GOODS AS DEFINED UNDER THE INTELLECTUAL PROPERTY CODE AND RELATED LAWS; AND All other articles and parts thereof, the importation o f which i s prohibited by law o r rules and regulations issued by competent authority. (As amended by Presidential Decree No. 34) (I) All other articles and parts thereof, the importation AND EXPORTATION of which is prohibited by law or rules and regulations issued by competent authority, AND NTERNATIONAL AGREEMENTS TO WHICH THE PHILIPPINES IS SIGNATORY. THE PROHIBITION TO IMPORT OR EXPORT ARTICLES AS DEFINED HEREIN SHALL INCLUDE THOSE IN TRANSIT.

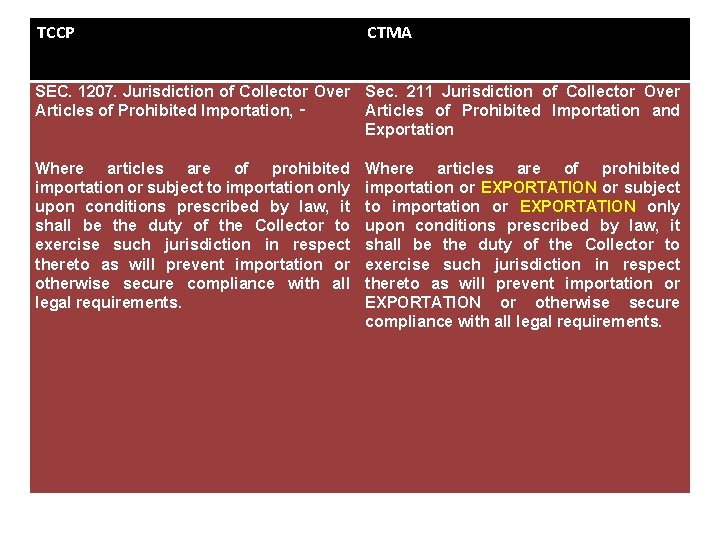

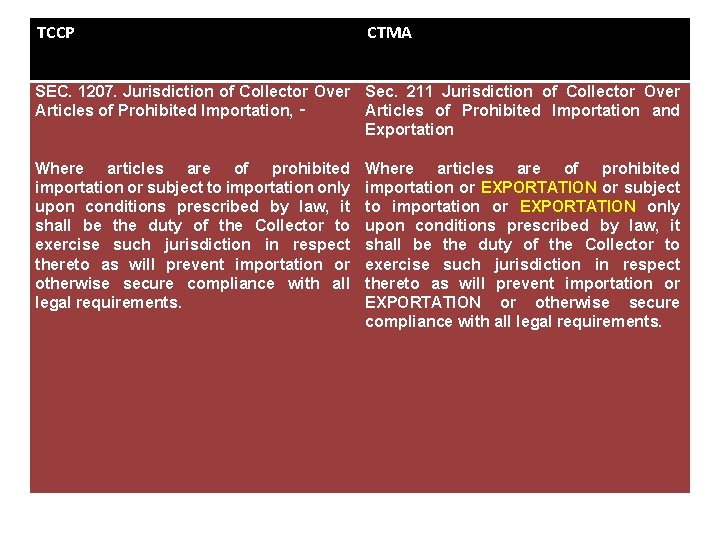

TCCP CTMA SEC. 1207. Jurisdiction of Collector Over Sec. 211 Jurisdiction of Collector Over Articles of Prohibited Importation, ‑ Articles of Prohibited Importation and Exportation Where articles are of prohibited importation or subject to importation only upon conditions prescribed by law, it shall be the duty of the Collector to exercise such jurisdiction in respect thereto as will prevent importation or otherwise secure compliance with all legal requirements. Where articles are of prohibited importation or EXPORTATION or subject to importation or EXPORTATION only upon conditions prescribed by law, it shall be the duty of the Collector to exercise such jurisdiction in respect thereto as will prevent importation or EXPORTATION or otherwise secure compliance with all legal requirements.

TCCP CTMA SEC. 1303. Entry of Article in Part for Consumption and in SEC. 402. Entry of Article in Part for Consumption and in Part for Warehousing. Import entries of articles covered by one bill of lading may be made simultaneously for both consumption and warehousing. Where an intent to export the articles is shown by the bill of lading and invoice, the whole or a part of a bill of lading not less than one package ) may be entered for warehousing and immediate exportation. Articles received at any port from another port in the on any entry for immediate transportation entered at the port of delivery either for consumption or warehousing. IMPORT ENTRIES OF ARTICLES COVERED BY ONE BILL OF LADING OR AIRWAY BILL CONTAINING ARTICLES IN PART FOR CONSUMPTION AND IN PART FOR WAREHOUSING MAY BE BOTH ENTERED SIMULTANEOUSLY AT THE ONE FOR CONSUMPTION AND THE OTHER FOR WAREHOUSING. Where an intent to export the articles is shown by the bill of lading and invoice, the whole or a part of a bill of lading (not less than one package) may be COVERED BY GOODS DECLARATION FOR TRANSSHIPMENT. Articles UNDER CUSTOMS TRANSIT received at any port from another port in the may be entered at the port of delivery either for consumption or warehousing.

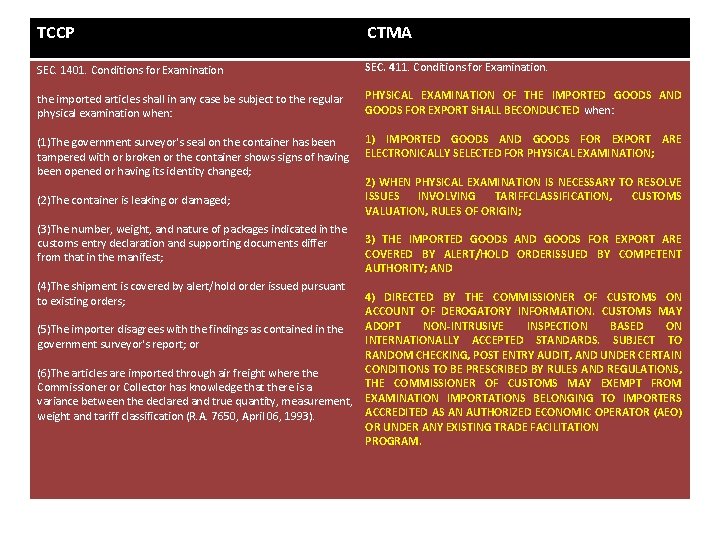

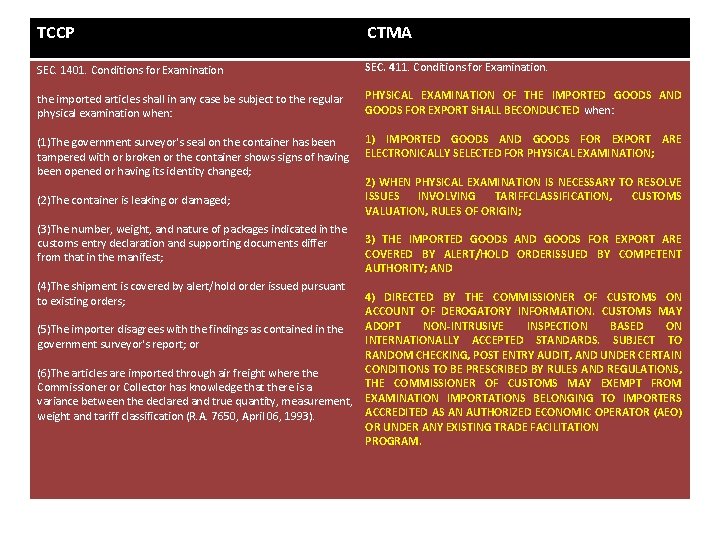

TCCP CTMA SEC. 1401. Conditions for Examination the imported articles shall in any case be subject to the regular physical examination when: (1)The government surveyor's seal on the container has been tampered with or broken or the container shows signs of having been opened or having its identity changed; (2)The container is leaking or damaged; (3)The number, weight, and nature of packages indicated in the customs entry declaration and supporting documents differ from that in the manifest; (4)The shipment is covered by alert/hold order issued pursuant to existing orders; (5)The importer disagrees with the findings as contained in the government surveyor's report; or (6)The articles are imported through air freight where the Commissioner or Collector has knowledge that there is a variance between the declared and true quantity, measurement, weight and tariff classification (R. A. 7650, April 06, 1993). SEC. 411. Conditions for Examination. PHYSICAL EXAMINATION OF THE IMPORTED GOODS AND GOODS FOR EXPORT SHALL BECONDUCTED when: 1) IMPORTED GOODS AND GOODS FOR EXPORT ARE ELECTRONICALLY SELECTED FOR PHYSICAL EXAMINATION; 2) WHEN PHYSICAL EXAMINATION IS NECESSARY TO RESOLVE ISSUES INVOLVING TARIFFCLASSIFICATION, CUSTOMS VALUATION, RULES OF ORIGIN; 3) THE IMPORTED GOODS AND GOODS FOR EXPORT ARE COVERED BY ALERT/HOLD ORDERISSUED BY COMPETENT AUTHORITY; AND 4) DIRECTED BY THE COMMISSIONER OF CUSTOMS ON ACCOUNT OF DEROGATORY INFORMATION. CUSTOMS MAY ADOPT NON-INTRUSIVE INSPECTION BASED ON INTERNATIONALLY ACCEPTED STANDARDS. SUBJECT TO RANDOM CHECKING, POST ENTRY AUDIT, AND UNDER CERTAIN CONDITIONS TO BE PRESCRIBED BY RULES AND REGULATIONS, THE COMMISSIONER OF CUSTOMS MAY EXEMPT FROM EXAMINATION IMPORTATIONS BELONGING TO IMPORTERS ACCREDITED AS AN AUTHORIZED ECONOMIC OPERATOR (AEO) OR UNDER ANY EXISTING TRADE FACILITATION PROGRAM.

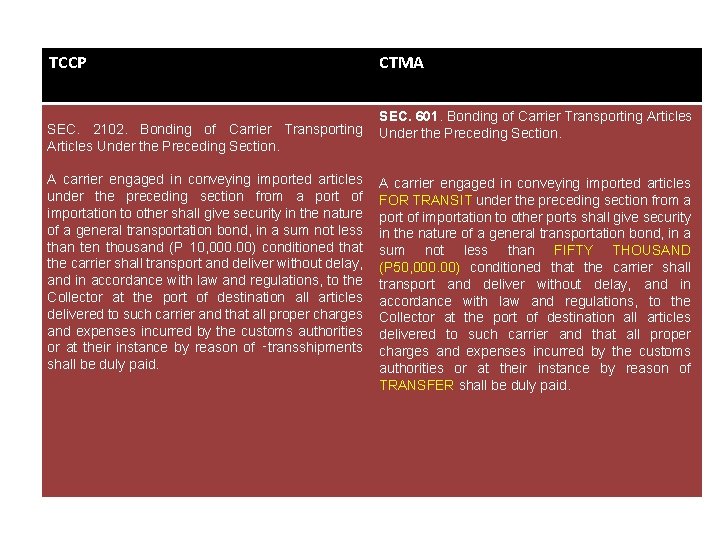

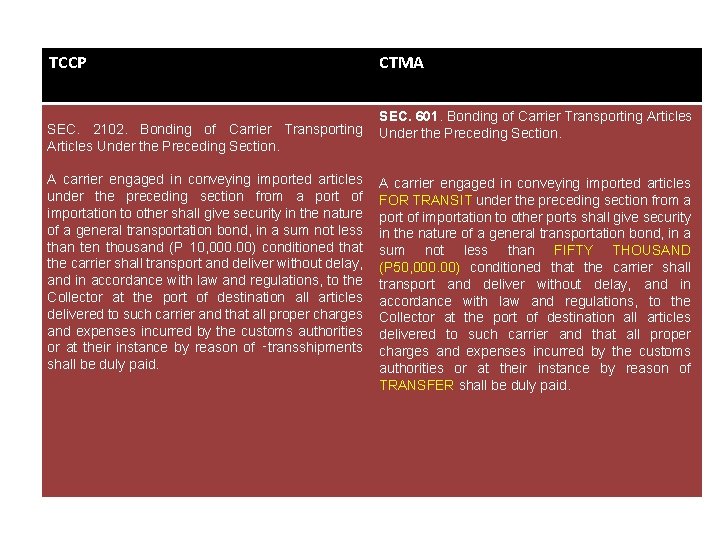

TCCP SEC. 2102. Bonding of Carrier Transporting Articles Under the Preceding Section. A carrier engaged in conveying imported articles under the preceding section from a port of importation to other shall give security in the nature of a general transportation bond, in a sum not less than ten thousand (P 10, 000. 00) conditioned that the carrier shall transport and deliver without delay, and in accordance with law and regulations, to the Collector at the port of destination all articles delivered to such carrier and that all proper charges and expenses incurred by the customs authorities or at their instance by reason of ‑transshipments shall be duly paid. CTMA SEC. 601. Bonding of Carrier Transporting Articles Under the Preceding Section. A carrier engaged in conveying imported articles FOR TRANSIT under the preceding section from a port of importation to other ports shall give security in the nature of a general transportation bond, in a sum not less than FIFTY THOUSAND (P 50, 000. 00) conditioned that the carrier shall transport and deliver without delay, and in accordance with law and regulations, to the Collector at the port of destination all articles delivered to such carrier and that all proper charges and expenses incurred by the customs authorities or at their instance by reason of TRANSFER shall be duly paid.

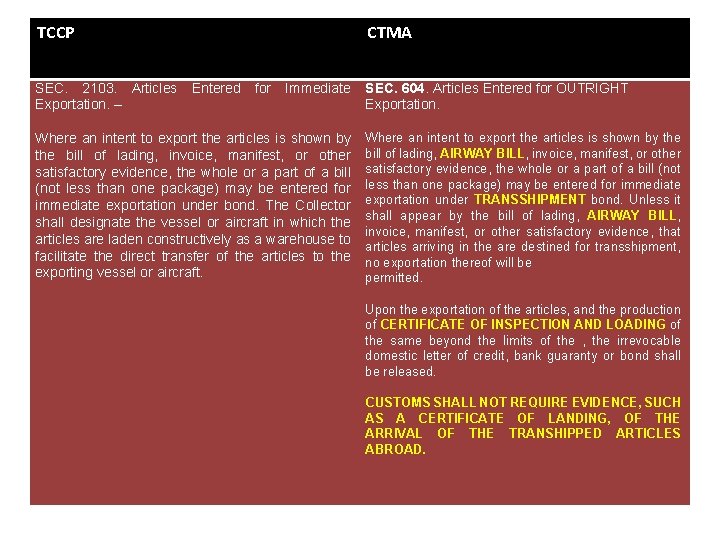

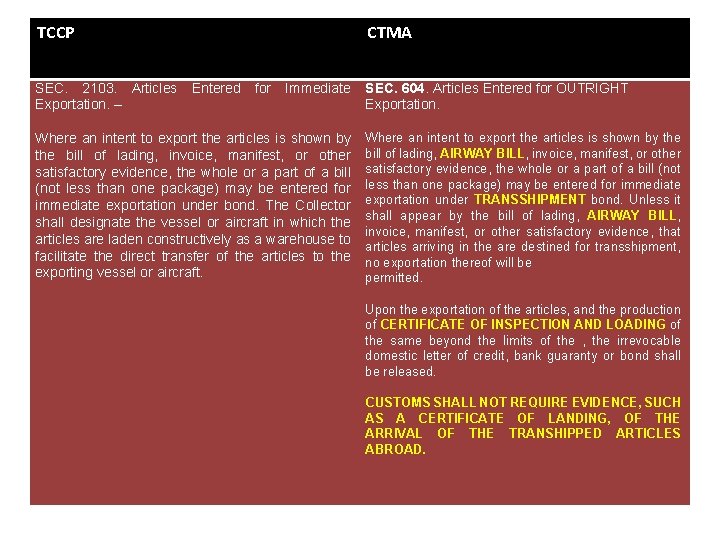

TCCP CTMA SEC. 2103. Articles Entered for Immediate SEC. 604. Articles Entered for OUTRIGHT Exportation. – Exportation. Where an intent to export the articles is shown by the bill of lading, invoice, manifest, or other satisfactory evidence, the whole or a part of a bill (not less than one package) may be entered for immediate exportation under bond. The Collector shall designate the vessel or aircraft in which the articles are laden constructively as a warehouse to facilitate the direct transfer of the articles to the exporting vessel or aircraft. Where an intent to export the articles is shown by the bill of lading, AIRWAY BILL, invoice, manifest, or other satisfactory evidence, the whole or a part of a bill (not less than one package) may be entered for immediate exportation under TRANSSHIPMENT bond. Unless it shall appear by the bill of lading, AIRWAY BILL, invoice, manifest, or other satisfactory evidence, that articles arriving in the are destined for transshipment, no exportation thereof will be permitted. Upon the exportation of the articles, and the production of CERTIFICATE OF INSPECTION AND LOADING of the same beyond the limits of the , the irrevocable domestic letter of credit, bank guaranty or bond shall be released. CUSTOMS SHALL NOT REQUIRE EVIDENCE, SUCH AS A CERTIFICATE OF LANDING, OF THE ARRIVAL OF THE TRANSHIPPED ARTICLES ABROAD.

TCCP CTMA SECTION 105. Conditionally-Free Importations. SEC. 800. Conditionally-Free Importation • Bond requirement- one and one half times the • Bond requirement – equal to one hundred percent the ascertained duties, taxes and other charges x. Articles of easy identification exported from the Philippines for repair and subsequently reimported upon proof satisfactory to the Collector of Customs that such article is not capable of being repaired locally: Provided, That the cost of the repairs made to any such article shall pay rate of duty of thirty percent ad valorem. * Amount of privilege for personal effects P 10, 000 X. Articles of easy identification exported from the Philippines for repair, PROCESSING OR RECONDITIONING and subsequently reimported upon proof satisfactory to the Collector of Customs that such articles is not capable of being repaired, PROCESSED OR RECONDITIONED locally: Provided, That A THIRTY PERCENT AD VALOREM SHALL BE IMPOSED ON the cost of repair, PROCESSING OR RECONDITIONING ON such article. * Amount of privilege for personal effect P 50, 000

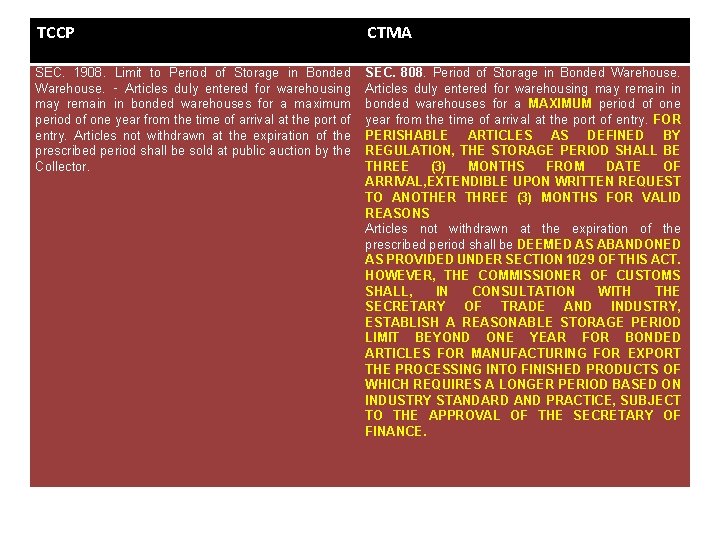

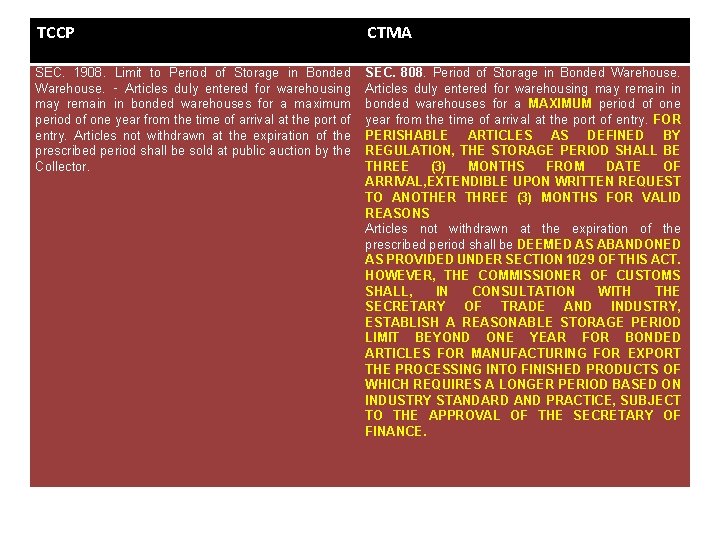

TCCP CTMA SEC. 1908. Limit to Period of Storage in Bonded Warehouse. ‑ Articles duly entered for warehousing may remain in bonded warehouses for a maximum period of one year from the time of arrival at the port of entry. Articles not withdrawn at the expiration of the prescribed period shall be sold at public auction by the Collector. SEC. 808. Period of Storage in Bonded Warehouse. Articles duly entered for warehousing may remain in bonded warehouses for a MAXIMUM period of one year from the time of arrival at the port of entry. FOR PERISHABLE ARTICLES AS DEFINED BY REGULATION, THE STORAGE PERIOD SHALL BE THREE (3) MONTHS FROM DATE OF ARRIVAL, EXTENDIBLE UPON WRITTEN REQUEST TO ANOTHER THREE (3) MONTHS FOR VALID REASONS Articles not withdrawn at the expiration of the prescribed period shall be DEEMED AS ABANDONED AS PROVIDED UNDER SECTION 1029 OF THIS ACT. HOWEVER, THE COMMISSIONER OF CUSTOMS SHALL, IN CONSULTATION WITH THE SECRETARY OF TRADE AND INDUSTRY, ESTABLISH A REASONABLE STORAGE PERIOD LIMIT BEYOND ONE YEAR FOR BONDED ARTICLES FOR MANUFACTURING FOR EXPORT THE PROCESSING INTO FINISHED PRODUCTS OF WHICH REQUIRES A LONGER PERIOD BASED ON INDUSTRY STANDARD AND PRACTICE, SUBJECT TO THE APPROVAL OF THE SECRETARY OF FINANCE.

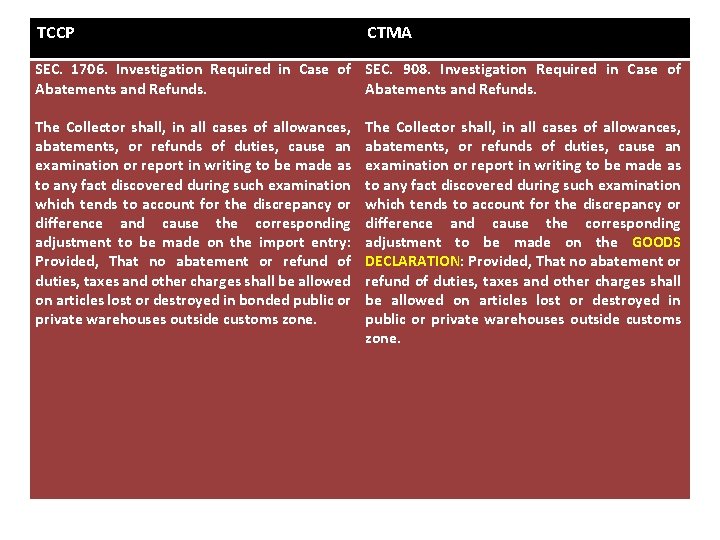

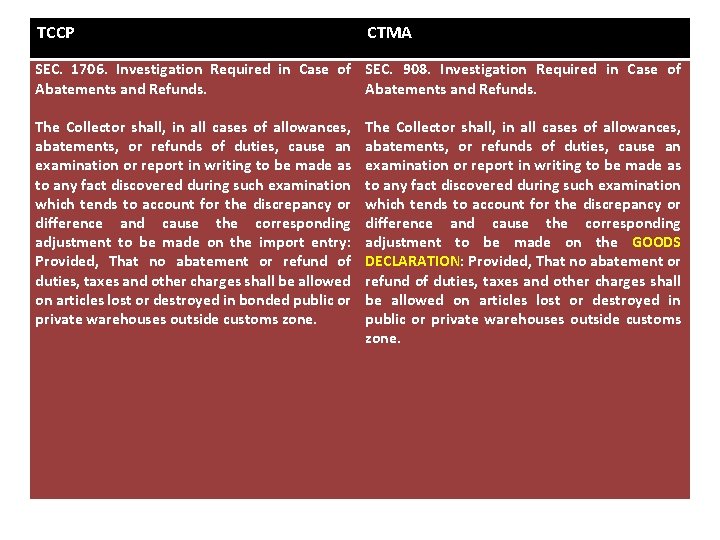

TCCP CTMA SEC. 1706. Investigation Required in Case of SEC. 908. Investigation Required in Case of Abatements and Refunds. The Collector shall, in all cases of allowances, abatements, or refunds of duties, cause an examination or report in writing to be made as to any fact discovered during such examination which tends to account for the discrepancy or difference and cause the corresponding adjustment to be made on the import entry: Provided, That no abatement or refund of duties, taxes and other charges shall be allowed on articles lost or destroyed in bonded public or private warehouses outside customs zone. The Collector shall, in all cases of allowances, abatements, or refunds of duties, cause an examination or report in writing to be made as to any fact discovered during such examination which tends to account for the discrepancy or difference and cause the corresponding adjustment to be made on the GOODS DECLARATION: Provided, That no abatement or refund of duties, taxes and other charges shall be allowed on articles lost or destroyed in public or private warehouses outside customs zone.

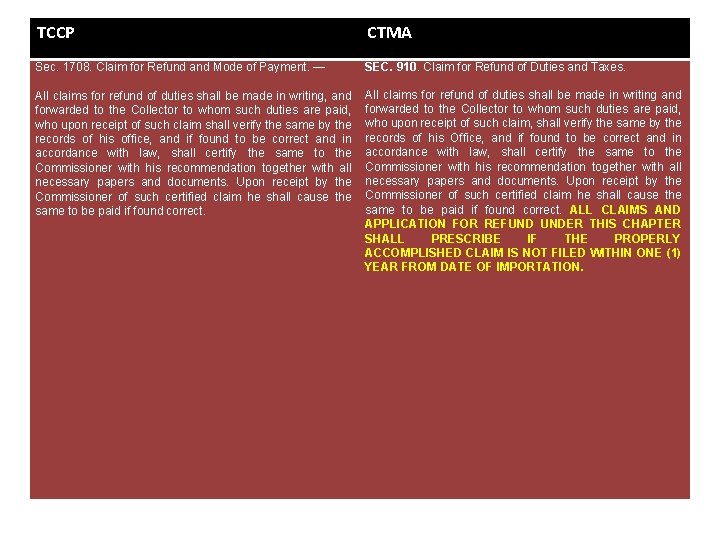

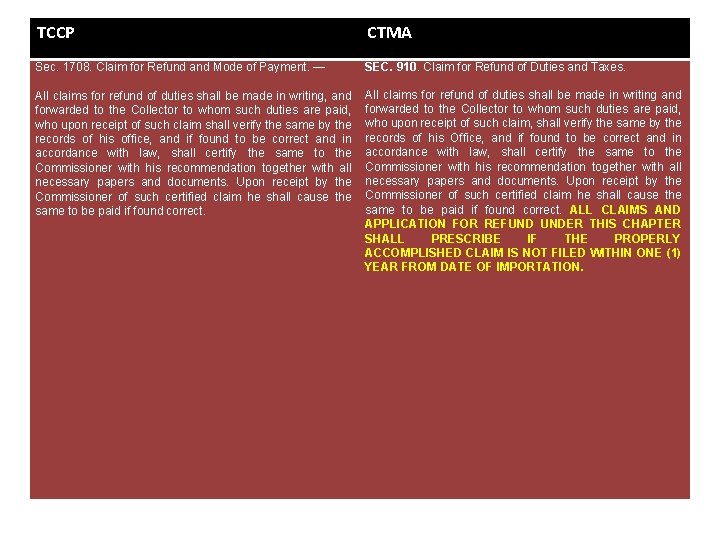

TCCP CTMA Sec. 1708. Claim for Refund and Mode of Payment. — SEC. 910. Claim for Refund of Duties and Taxes. All claims for refund of duties shall be made in writing, and forwarded to the Collector to whom such duties are paid, who upon receipt of such claim shall verify the same by the records of his office, and if found to be correct and in accordance with law, shall certify the same to the Commissioner with his recommendation together with all necessary papers and documents. Upon receipt by the Commissioner of such certified claim he shall cause the same to be paid if found correct. All claims for refund of duties shall be made in writing and forwarded to the Collector to whom such duties are paid, who upon receipt of such claim, shall verify the same by the records of his Office, and if found to be correct and in accordance with law, shall certify the same to the Commissioner with his recommendation together with all necessary papers and documents. Upon receipt by the Commissioner of such certified claim he shall cause the same to be paid if found correct. ALL CLAIMS AND APPLICATION FOR REFUND UNDER THIS CHAPTER SHALL PRESCRIBE IF THE PROPERLY ACCOMPLISHED CLAIM IS NOT FILED WITHIN ONE (1) YEAR FROM DATE OF IMPORTATION.

TCCP CTMA Sec. 2204. Place Where Authority May Be Exercised. — SEC. 1001. Place Where Authority May be Exercised. Persons acting under authority conferred pursuant to subsection (e) of the preceding section may exercise their authority within the limits of the collection district only and in or upon the particular vessel or aircraft, or in the particular place, or in respect to the particular article specified in the appointment. All such appointments shall be in writing, and the original shall be filed in the customhouse of the district where made. All other persons exercising the powers hereinabove conferred may exercise the same at any place within the jurisdiction of the Bureau of Customs. All persons conferred with powers in the preceding section may exercise the same at any place within the jurisdiction of the Bureau of Customs. THE BUREAU OF CUSTOMS ALL EXERCISE POLICE AUTHORITY IN ALL AREAS DEFINED IN SECTION 300 OF THIS ACT. PORT AUTHORITIES SHALL PROVIDE AUTHORIZED CUSTOM OFFICIALS WITH UNHAMPERED ACCESS TO ALL PREMISES OF THE CUSTOMS ZONE WITHIN THEIR ADMINISTRATIVE JURISDICTION. THE BUREAU OF CUSTOMS MAY EXERCISE OVERSIGHT POLICE AUTHORITY IN ECONOMIC OR FREE PORT ZONE SUBJECT TO PROPER COORDINATION WITH THE GOVERNING AUTHORITY OF THE ZONE. FOR THIS PURPOSE, TO ENSURE CONSISTENCY AND HARMONY IN THE FORMULATION AND IMPLEMENTATION OF CUSTOMS POLICIES AFFECTING THE ZONE, THE COMMISSIONER OF CUSTOMS SHALL SIT AS AN EX-OFICIO MEMBER OF THE BOARD OF DIRECTORS OF ALL ECONOMIC OR ZONE AUTHORITIES.

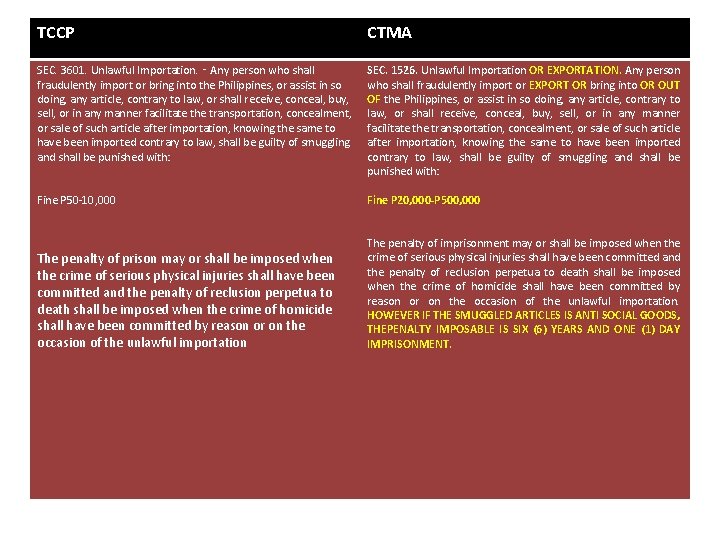

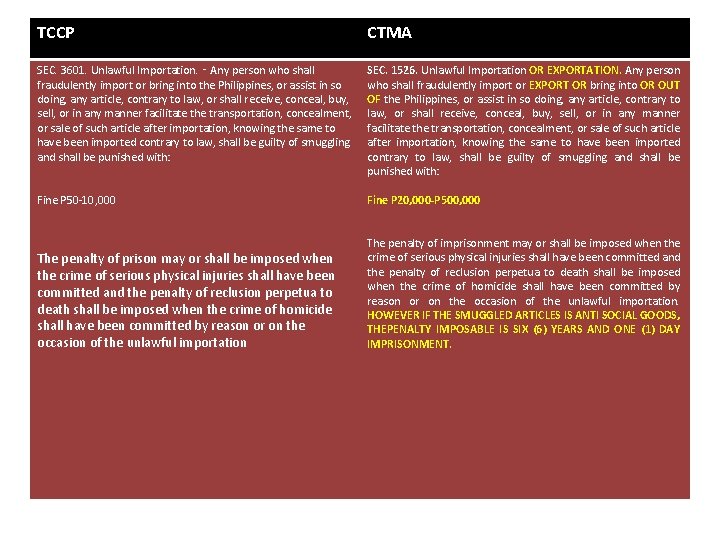

TCCP CTMA SEC. 3601. Unlawful Importation. ‑ Any person who shall fraudulently import or bring into the Philippines, or assist in so doing, any article, contrary to law, or shall receive, conceal, buy, sell, or in any manner facilitate the transportation, concealment, or sale of such article after importation, knowing the same to have been imported contrary to law, shall be guilty of smuggling and shall be punished with: SEC. 1526. Unlawful Importation OR EXPORTATION. Any person who shall fraudulently import or EXPORT OR bring into OR OUT OF the Philippines, or assist in so doing, any article, contrary to law, or shall receive, conceal, buy, sell, or in any manner facilitate the transportation, concealment, or sale of such article after importation, knowing the same to have been imported contrary to law, shall be guilty of smuggling and shall be punished with: Fine P 50 -10, 000 Fine P 20, 000 -P 500, 000 The penalty of prison may or shall be imposed when the crime of serious physical injuries shall have been committed and the penalty of reclusion perpetua to death shall be imposed when the crime of homicide shall have been committed by reason or on the occasion of the unlawful importation The penalty of imprisonment may or shall be imposed when the crime of serious physical injuries shall have been committed and the penalty of reclusion perpetua to death shall be imposed when the crime of homicide shall have been committed by reason or on the occasion of the unlawful importation. HOWEVER IF THE SMUGGLED ARTICLES IS ANTI SOCIAL GOODS, THEPENALTY IMPOSABLE IS SIX (6) YEARS AND ONE (1) DAY IMPRISONMENT.

CTMA is the answer to a Philippine Modernized Customs, thus it must be passed into law. Customs and Tariff Modernization Act 2008

Modernization of Customs is not the sole responsibility of the government. It can only be achieved through partnership with the trading community and other relevant sectors. Customs and Tariff Modernization Act 2008

Thank you Customs and Tariff Modernization Act 2008

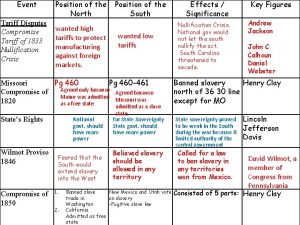

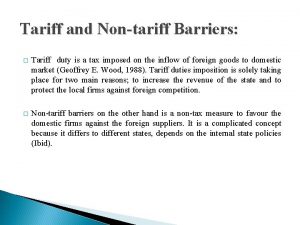

Ad valorem tariff vs specific tariff

Ad valorem tariff vs specific tariff Ad valorem tariff vs specific tariff

Ad valorem tariff vs specific tariff Filosofi customs services dan customs controls

Filosofi customs services dan customs controls 2008 2008

2008 2008 Wisconsin aprn modernization act

Wisconsin aprn modernization act Housing opportunity through modernization act

Housing opportunity through modernization act Financial modernization act of 1999

Financial modernization act of 1999 Section 32 customs act

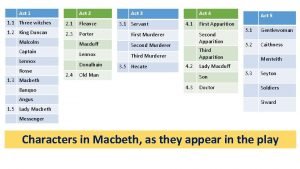

Section 32 customs act Macbeth summary

Macbeth summary Health and safety social care act 2008

Health and safety social care act 2008 Rail safety improvement act of 2008

Rail safety improvement act of 2008 Dublin transport authority act 2008

Dublin transport authority act 2008 Health and safety care act 2008

Health and safety care act 2008 Modernization

Modernization Nhtsa data modernization

Nhtsa data modernization Modernization in japan

Modernization in japan Height modernization programs

Height modernization programs Modernization in japan

Modernization in japan Neb modernization

Neb modernization Conclusion of modernization

Conclusion of modernization Oracle forms modernization

Oracle forms modernization Modernization theory vs dependency theory

Modernization theory vs dependency theory Data modernization to azure

Data modernization to azure Role of rrrlf in modernisation of libraries

Role of rrrlf in modernisation of libraries Endemoty

Endemoty Conclusion on kothari commission

Conclusion on kothari commission Illinois height modernization

Illinois height modernization Idmsx modernization

Idmsx modernization Classical modernization theory

Classical modernization theory Benefits delivery modernization

Benefits delivery modernization Media imperialism

Media imperialism Illinois height modernization

Illinois height modernization Oracle forms modernization

Oracle forms modernization Powerbuilder modernization

Powerbuilder modernization Importance of dependency theory

Importance of dependency theory Height modernization programs

Height modernization programs High performance computing modernization program

High performance computing modernization program