Regulatory Issues NCUA April 16 2019 Las Vegas

- Slides: 25

Regulatory Issues - NCUA April 16, 2019 Las Vegas, NV Presented by: Bruce A. Pearson, Senior Partner

Disclaimer §These materials were prepared by the attorneys of Styskal, Wiese & Melchione, LLP. Although this presentation was prepared with care, it is not designed to be a complete or definitive analysis of the law in this area. This is a California law specific presentation. Laws in other states may vary. Moreover, this presentation was prepared with the understanding that it reflects the authors’ perception of the state of the law as of this date. Furthermore, the information contained in this presentation is not intended to constitute and should not be received as, legal advice and does not in any way create an attorney-client relationship. §If you have any questions, or require further information on these materials, please do not hesitate to call our office at: (818) 241 -0103. 2

Bank Secrecy Act • NCUA’s Stated Focus ◦ Money Laundering ◦ Beneficial Ownership Rule • What’s Really Going On ◦ No Patriot/Act Fin Cen Penalties ◦ Cannabis Concerns 3

Bank Secrecy Act (cont. ) • Your Credit Union Should Consider ◦ How Good is Your KYC and AML Software/Vendor? ? ◦ How Much Cannabis $ is Potentially Moving Through Your Credit Union? • Cannabis Cash is Everywhere ◦ California’s #1 Cash Crop • $15 B Annually 4

Bank Secrecy Act (cont. ) • Every FI is Handling Some Cannabis Cash ◦ Openly Serve CRBs ◦ Look the Other Way • Personal Accounts • Dry Cleaners, Window Washers, Car Washes, Laundromats ◦ Unknowingly Serve CRBs • What is a CRB? • County Deposits? 5

Lending Concentration Risks • NCUA’s Stated Focus ◦ Large loss exposure caused by concentration ◦ NCUA Letter to CUs 10 -CU-43 • What It’s Really About ◦ The Next Recession is Here, and NCUA Will Be Out in Front of it This Time 6

Lending Concentration Risks (cont. ) • What Your Credit Union Should Look At ◦ Indirect Loans • Dealer agreement/recourse • Non-prime portfolio ◦ Taxi Medallions ◦ Mortgage Portfolio • HELOC - LTVs • 1 st mortgages – concentration, FICO drift 7

Consumer Compliance • NCUA’s Stated Focus ◦ HMDA data ◦ Military Lending Act ◦ ECOA/Regulation B – overdrafts • What It’s Really About ◦ Class Action Exposure 8

Consumer Compliance (cont. ) • What Your Credit Union Should Look At ◦ Courtesy pay disclosures/program practices • And why are they publicly available on your website? ? ◦ Repeat Presentment NSF Fees • Disclosure says “per item” or “per presentment”? ◦ Out of network ATM Fees • Fully disclosed? • State law compliant? 9

Consumer Compliance (cont. ) ◦ Kill switch enabled vehicles • New York law • UDAAP elsewhere? ◦ Force placed insurance ◦ How good is your arbitration provision? 10

Current Expected Credit Losses (CECL) • NCUA’s Stated Focus ◦ Analysis of How CECL Will Affect Current ALLL Funding Levels ◦ NCUA Letter to CUs 17 -CU-05 • What It’s Really About ◦ Concerns For Smaller Credit Unions ◦ May Have to Double Reserves in Implementation Year ◦ May Cause Major Capital Degradation 11

Current Expected Credit Losses (CECL) (cont. ) • What Your Credit Union Should Consider ◦ Join Industry Attempts • Push Back Effective Date • Exempt Industry ◦ Impact of CECL Upon: • Loan Types • Borrower Demographics • Loan Demand ◦ Use of CUSO Lending? 12

Information Systems and Assurance • NCUA’s Stated Focus ◦ Security, Confidentiality and Integrity of Member Information ◦ Automated Cybersecurity Examination Toolbox (ACET) • What’s Really Going On ◦ Concerns Over Industry Data Breaches ◦ NCUA Lost an Unencrypted Laptop in 2017, the Industry Shall Pay 13

Information Systems and Assurance (cont. ) • What Your Credit Union Should Focus On ◦ New Privacy Laws • GDPR ◦ CA’s New Privacy Law ◦ What Data Does your System (and 3 rd party vendors) Store ◦ Vendor Contracts • Data Storage Protocols and Security • Reporting Requirements • State/Federal Law Compliance • Indemnity 14

Liquidity and Interest Rate Risks • NCUA’s Stated Focus ◦ Liquidity in a Rising Rate Environment • What’s Really Going On ◦ Fear Over the Theoretical “Run” On the Credit Union ◦ Fear About Reaches For Yield in a Low Interest Cycle • Negative Spreads 15

The Regulator’s Unspoken Concerns ◦ NCUA is the Last “Independent” Regulator • Congressional Concerns? ◦ Can NCUA handle an increasingly sophisticated industry? ◦ Is there justification for a separate industry regulator? • OTS – The Canary in the Coal Mine ◦ Executive Compensation • Mergers ◦ Disclosure obligations ◦ Deal killer? • Board’s Level of Understanding 16

The Regulator’s Unspoken Concerns (cont. ) ◦ Insurance Coverage • CU Level of Understanding ◦ Perception of coverage vs. reality • Examples ◦ ◦ Wire Transfers D&O Insurance Application Issues Prior Dishonest Acts Condition ◦ Wall Street Mentality – Mergers • Hostile takeover approach • Buy the CEO/Management team approach 17

The Regulator’s Unspoken Concerns (cont. ) ◦ Vendor Management – “Bad” Contracts • Receivership context ◦ NCUA’s FIRREA powers ◦ But … Kaiperm FCU case • Inhibits mergers • Exams ◦ Bank examiner privilege • 12 USC 1785 j 18

What Should The Regulators REALLY Be Worrying About? ? • PACE “Loans” ◦ Energy Efficient Home Improvements ◦ Repaid through taxes ◦ Super lien priority • Independent Contractor vs. Employee Classification ◦ CA Supreme Court Decision – Dynamex ◦ Narrows use of ICs considerably ◦ Class Action Potential 19

What Else Should The Regulators REALLY Be Worrying About? ? (cont. ) • Digital Redlining ◦ Facebook suit ◦ Lender’s ability to target market 20

What Else Should The Regulators REALLY Be Worrying About? ? (cont. ) • Cannabis Litigation ◦ NIMBY lawsuits against growers ◦ Facilitator lawsuits • Regulator and bank named as defendants • Whistleblower Lawsuits ◦ Everyone is a whistleblower • Despite recent SCOTUS decision 21

What Else Should The Regulators REALLY Be Worrying About? ? (cont. ) ◦ NCUA Protections • Examiners Guide ◦ Broad State Law Protections • Immigration Status – Loan Decisions ◦ Perez v. Wells Fargo • Test case by Plaintiff’s bar • Outten and Golden law firm ◦ ECOA/Regulation B • Permits consideration of immigration status 22

What Else Should The Regulators REALLY Be Worrying About? ? (cont. ) ◦ CA State Civil Rights Act • Actual and perceived citizenship status = protected class • Damages - $4 k minimum statutory damages + attorneys fees • Form 1003 implications? • Civil Asset Forfeitures ◦ Aggressive federal and state law enforcement • DEA’s aggressive use of RICO • Revenue sharing with local law enforcement 23

What Else Should The Regulators REALLY Be Worrying About? ? (cont. ) ◦ Lien Avoidance • Know or should have known standard ◦ Must prove a negative in court • Cannabis – state level legalization ◦ Impact on secured lending • Help On the Way? ◦ SCOTUS Ruling – Timbs vs. Indiana 24

THANK YOU! QUESTIONS? Contact Us: Styskal, Wiese & Melchione, LLP 550 North Brand Boulevard, Suite 550 Glendale, CA 91203 (818) 241 -0103 www. swmllp. com bruce. pearson@swmllp. com 25

Esop conference 2019 las vegas

Esop conference 2019 las vegas Interest rate risk credit unions utah

Interest rate risk credit unions utah Legal regulatory and political issues

Legal regulatory and political issues Why is las vegas so hot

Why is las vegas so hot Bureau of vocational rehabilitation

Bureau of vocational rehabilitation Tiny homes las vegas

Tiny homes las vegas Las vegas justice court efile

Las vegas justice court efile Las vegas algorithm

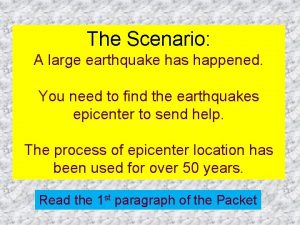

Las vegas algorithm Las vegas, nv seismic station s-p interval = seconds

Las vegas, nv seismic station s-p interval = seconds Sonitrol las vegas

Sonitrol las vegas The 2000 population of las vegas nevada was 478 000

The 2000 population of las vegas nevada was 478 000 Thermoisoplethendiagramm

Thermoisoplethendiagramm Las vegas voice over

Las vegas voice over Las vegas voice over

Las vegas voice over Qed las vegas

Qed las vegas Nicholas financial las vegas

Nicholas financial las vegas Matt kittay

Matt kittay Aiga las vegas

Aiga las vegas Desert rose high school

Desert rose high school Rafael desea ir a las vegas

Rafael desea ir a las vegas Las vegas demographics

Las vegas demographics Small claims court las vegas

Small claims court las vegas Bill paulos las vegas

Bill paulos las vegas Livanta las vegas

Livanta las vegas Maths vegas

Maths vegas Zebra chapmanova

Zebra chapmanova