Private Sector Expectations towards NAMA Financing Latin America

- Slides: 9

Private Sector Expectations towards NAMA Financing Latin America and Caribbean Regional NAMA Workshop 14 th September 2015

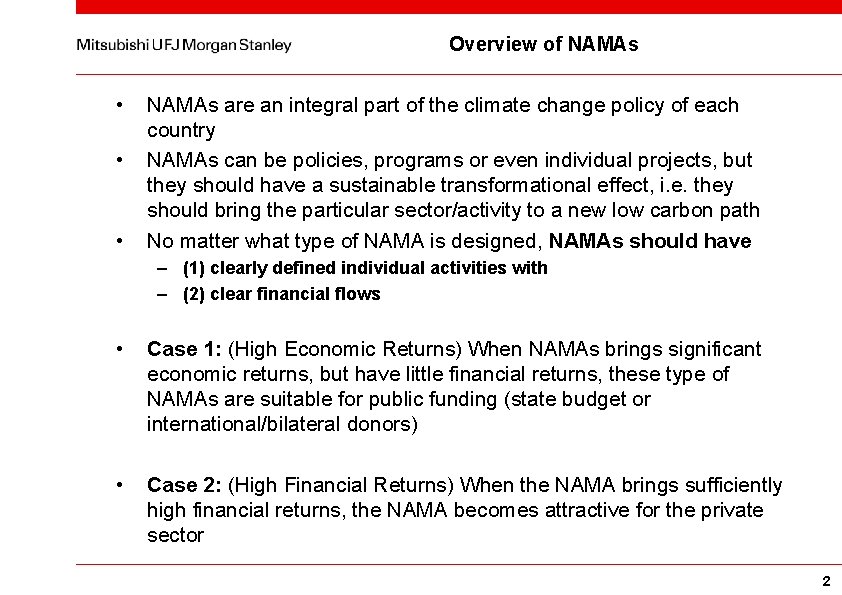

Overview of NAMAs • • • NAMAs are an integral part of the climate change policy of each country NAMAs can be policies, programs or even individual projects, but they should have a sustainable transformational effect, i. e. they should bring the particular sector/activity to a new low carbon path No matter what type of NAMA is designed, NAMAs should have – (1) clearly defined individual activities with – (2) clear financial flows • Case 1: (High Economic Returns) When NAMAs brings significant economic returns, but have little financial returns, these type of NAMAs are suitable for public funding (state budget or international/bilateral donors) • Case 2: (High Financial Returns) When the NAMA brings sufficiently high financial returns, the NAMA becomes attractive for the private sector 2

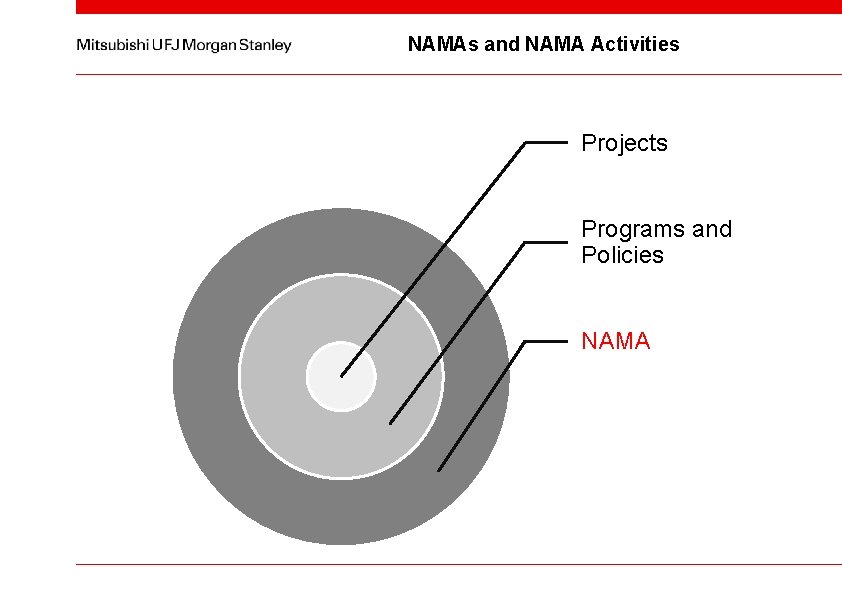

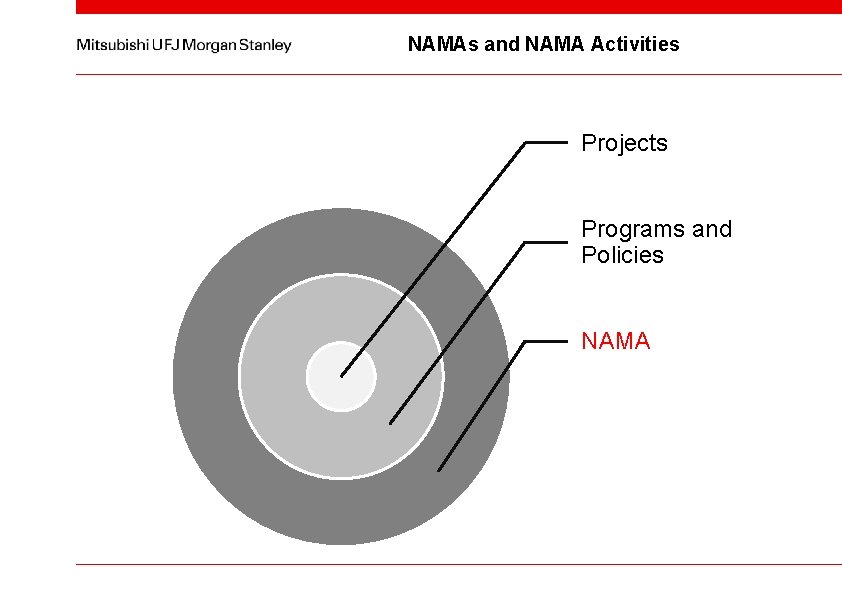

NAMAs and NAMA Activities Projects Programs and Policies NAMA

NAMA Financial Structure (Example)

NAMA Timeline (Example)

Possible Ways for Private Sector Involvement • Private sector as a technology provider – Transformational changes are associated with technology transfer – NAMAs can initiate not only technology transfer in terms of technology import, but also localization of technology production and knowhow – Strict technology performance requirements are key to sustainable transformation and attraction of high-end technology providers • Private sector as an investor – The private sector needs a clearly defined cash flow and at least a minimum rate of profitability (Financial IRR > Profitability Target) in order to invest in a NAMA – Sensitive to various types of risks (economic, political or social) • Private sector as an initiator of the NAMAs – The private sector can actively participate in the formulation and design of NAMAs, especially for NAMAs that involve local businesses – The private sector should be seen as a partner to the public sector and governments

Expectations of the Private Sector • Many activities that are covered under NAMAs are riskier for investment compared to traditional investment opportunities – New country – New technology – Larger targeted scale • It is important to develop infrastructure to accommodate private investment – Creation of policy framework and incentives (e. g. FIT and PPAs, tax benefits) – Stable legal framework – Development of new financial products (green bonds) – Use of public funds to reduce the risks for the private sector (loan guarantees, insurance products) – Involvement of MDB, bilateral donors and GCF in establishment of the NAMA financing infrastructure – Use of carbon markets mechanisms, including NMM and FVA

Final Observations • The private sector should be seen as a key to the transformation to low carbon economy • The private sector is interested in participating in NAMAs from their design stage up to actual implementation of concrete activities under NAMAs. • The NAMA design should incorporate measures to facilitate the participation of the private sector in order to stimulate the inflow of private capital and transfer of new technologies.

Vladislav Arnaoudov Senior Consultant Clean Energy Finance Division E-mail: arnaoudov-vladislav@sc. mufg. jp