Mergers Acquisitions Presentation outline What is MA Key

- Slides: 51

Mergers & Acquisitions

Presentation outline • What is M&A • Key structuring Processes • Key Legislations/Regulations

What is M&A?

What is M&A In Business Parlance • Merger is an operation in which two or more companies (including those situated in different countries) – decide to pool their assets to form a single company – in the process one or more companies disappear completely • Acquisition does not constitute a merger if the acquired company does not disappear Further Classification • Inward M&A – Where the Transferee/Targets are located in India • Outward M&A – Where the Transferee Co. /Targets are located outside India (Not permitted under Company Law)

Key Structuring Processes

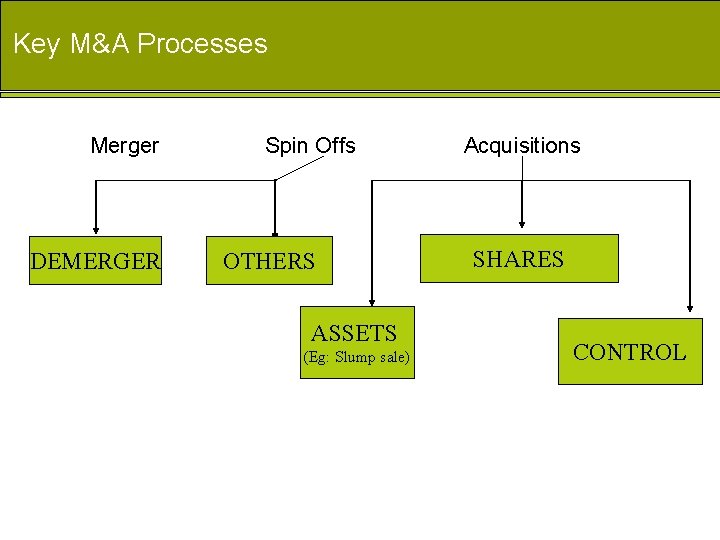

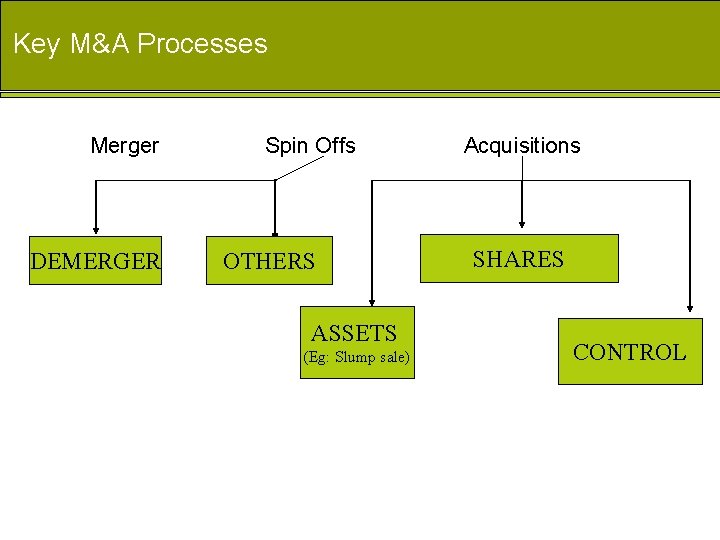

Key M&A Processes Merger DEMERGER Spin Offs OTHERS ASSETS (Eg: Slump sale) Acquisitions SHARES CONTROL

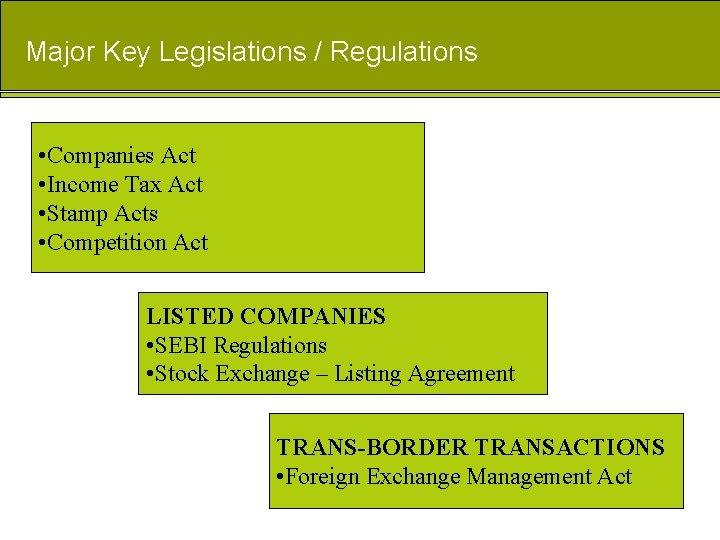

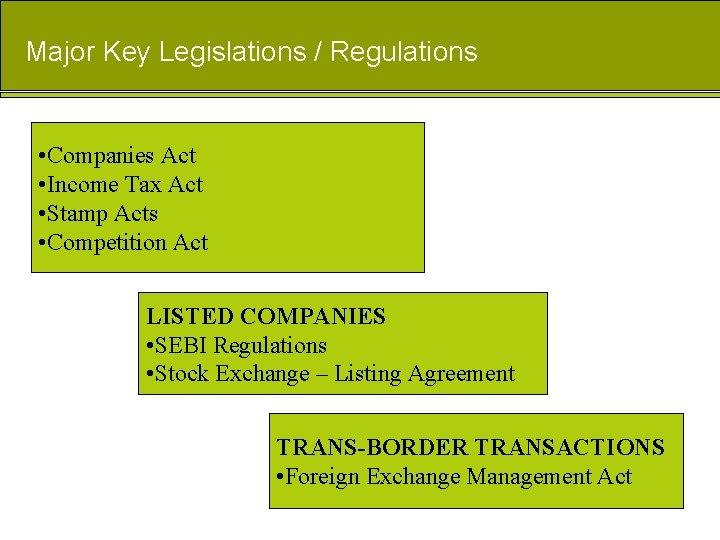

Major Key Legislations / Regulations • Companies Act • Income Tax Act • Stamp Acts • Competition Act LISTED COMPANIES • SEBI Regulations • Stock Exchange – Listing Agreement TRANS-BORDER TRANSACTIONS • Foreign Exchange Management Act

Companies Act

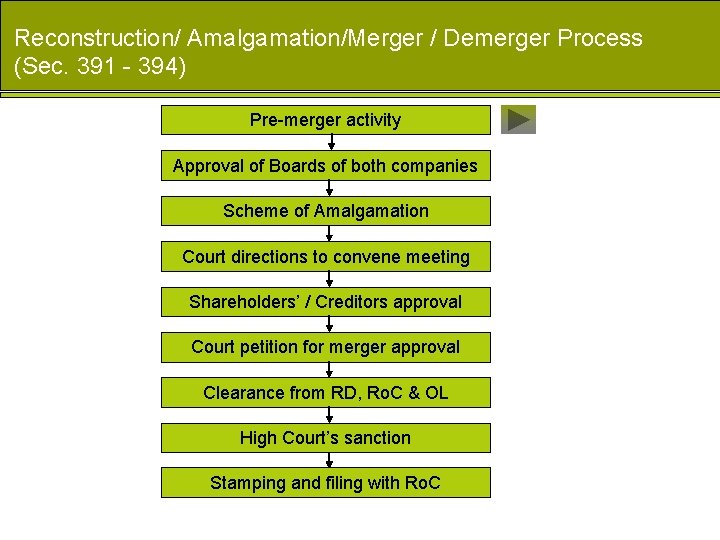

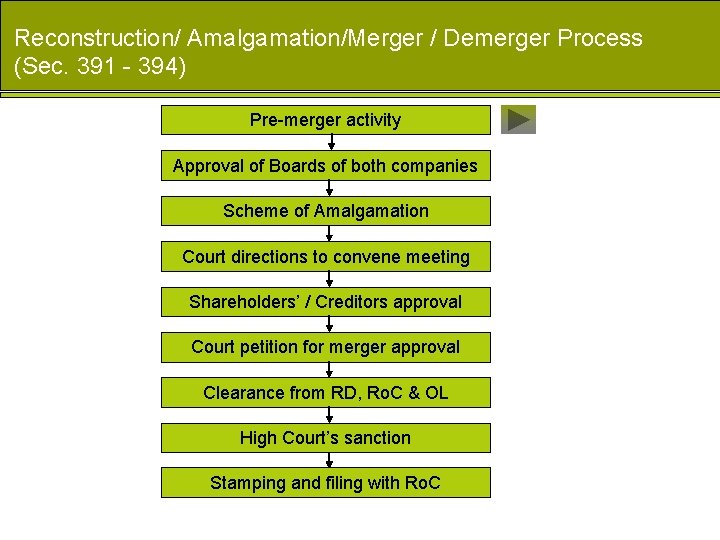

Reconstruction/ Amalgamation/Merger / Demerger Process (Sec. 391 - 394) Pre-merger activity Approval of Boards of both companies Scheme of Amalgamation Court directions to convene meeting Shareholders’ / Creditors approval Court petition for merger approval Clearance from RD, Ro. C & OL High Court’s sanction Stamping and filing with Ro. C

Significant Points( 391 -394) • Meetings of members/creditors held according to the directions of Court. • Notice of meeting to be published in newspaper at least 21 clear days before the date of meeting. • Voting only by poll; proxies allowed to vote in the meeting. • Majority in number (50%) representing three fourths in value(75%) to approve the scheme. • With reference to the members and creditors present and voting at the meeting. • Substantial compliance allowed. (e. g. : individual affidavits given by creditors/members, banks/financial institutions giving consent in writing).

Significant Points( 391 -394) • The dissenting shareholders to the scheme should be paid for their shareholding in the transferor company. • In this regard the court in Dena Bank’s case has interpreted that: The dissenting shareholders shall be paid a lesser amount than the value per share as per the scheme. An amount somewhere between 15 to 20 percent less than the value per share as per the scheme would be a fair price that would be paid to the dissenting shareholders. So once the scheme is approved by the majority, the dissenting shareholders shall be given a cash option which is less than the price at which the shares are valued for the purpose of allotment of shares by the transferee company. • Dissolution of the transferor company without winding up process. (subject to the clearance from Official Liquidators.

Significant Points( 391 -394) • Court shall stay all the commencement or continuation of any suit or proceedings against the company on any terms as the court may think fit. • Regarding, the criminal proceedings against the company and its directors there is a controversy. The Bombay and the Calcutta High Court have held that the criminal proceedings against the company cannot be stayed. But the Gujarat High Court has held that the High Court has powers to stay even the criminal proceedings against the company and its directors. • Only Merging entity can be a foreign company –Sec. 394(4)(b) read with Sec. 2(7) of Cos. Act. (Transferee company- Include only companies covered under Cos Act (Sec 3). Transferor company can be body corporate also. ) • Reverse pattern not allowed under Cos Act –JJ Irani recommendations. • Sec. 394 Court Order has no extra-territorial effect –Local foreign laws to be complied with. Section 81(1)(a): • Shareholders resolution for further issue of shares.

Acquisitions Share Acquisition: Section 108 A • Central Government permission required if the acquisition exceeds the threshold limit. (>25%)108 A Section 108 B • Central Government Intimation-Transfer of shares–Bodies corporate-(>10%)-108 B Applicability of the above sections(108 G) • Increase in the production, supply, provision of services rendered in India of the dominant undertaking. • Change in the ownership of the dominant undertaking. • Dominant undertaking defined under MRTP Act. (supplies goods/services more than one fourth of the total goods/services produced in India. ) • Section 372 A(Share Acquisition): • Transferee company need to pass resolution in general meeting. Inter-corporate Loans and Investments beyond 60% of paid up capital and free reserves or 100% of free reserves require Shareholders’ approval.

Acquisitions Share Acquisition Section 395: (specifically applies to unlisted company) • Compulsory acquisition mode for transferee company to acquire shares of the dissentient minority shareholders holding less than 10%. • Scheme to be filed with the Registrar. • Scheme approved by nine tenth(9/10 th) in value within four months after the date of making offer for acquisition. • Notice to be given to dissentient within two months from the expiry of four months. Dissentient shareholders to apply to the court within one month. • If shares are already held by transferee company is more than 1/10 th in value = then 9/10 th in value giving their consent must be at least 3/4 th in number. • Consideration held in trust by the transferor company on behalf of its shareholders. Section 108: • Share Transfer deed duly executed and stamped required for physical share transfer.

Acquisitions Business Acquisition Section 293(1)(a): • General meeting resolution required to sell or dispose of whole or any part of the undertaking. Postal Ballot: • Shareholders approval for sale of business through postal ballot in case of public cos/subs of public companies. Control Acquisition: Postal Ballot: • Special resolution to be passed by members through postal ballot.

FEMA/FDI

Merger/Demerger Inward No FIPB Approval required for shares issued under merger/demerger if: • Non-resident shareholding retained within the prescribed sectoral cap/approval of Government. (If exceeded prior approval of RBI/Government required. ) • Transferor/Transferee Companies not to engage in activities prohibited under FDI policy • Transferee company files requisite report with RBI. Outward • Not permitted under Co. Law

Share Acquisition-Inward • Governed by FEMA read together with FDI Guidelines - Minimum Pricing norm (atleast CCI Guideline pricing) - FIPB/RBI Approval/Post facto RBI filings • NR to NR transfer – exempt except for previous venture/tie up

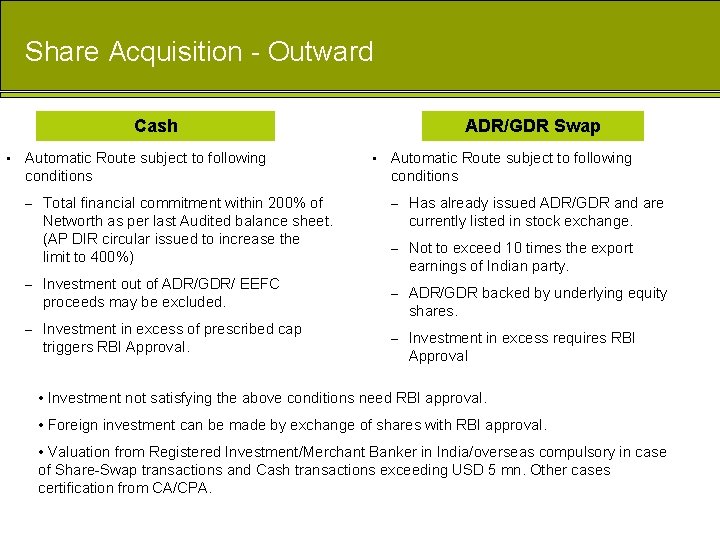

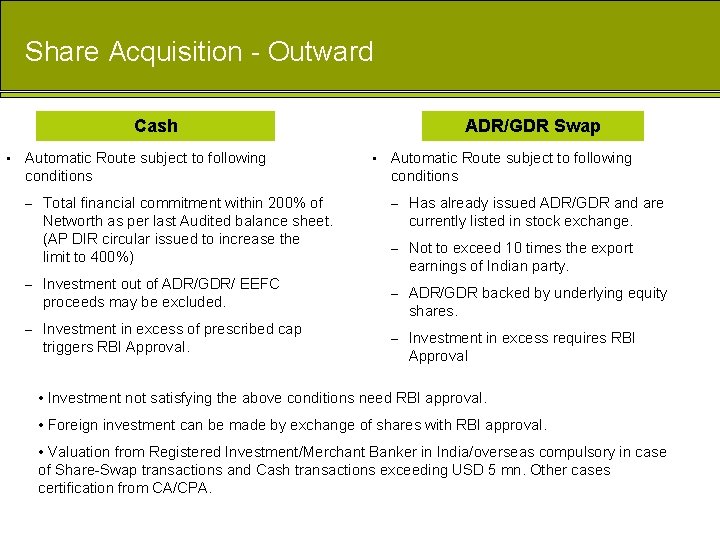

Share Acquisition - Outward Cash • Automatic Route subject to following conditions – Total financial commitment within 200% of Networth as per last Audited balance sheet. (AP DIR circular issued to increase the limit to 400%) ADR/GDR Swap • Automatic Route subject to following conditions – Has already issued ADR/GDR and are currently listed in stock exchange. – Not to exceed 10 times the export earnings of Indian party. – Investment out of ADR/GDR/ EEFC proceeds may be excluded. – ADR/GDR backed by underlying equity shares. – Investment in excess of prescribed cap triggers RBI Approval. – Investment in excess requires RBI Approval • Investment not satisfying the above conditions need RBI approval. • Foreign investment can be made by exchange of shares with RBI approval. • Valuation from Registered Investment/Merchant Banker in India/overseas compulsory in case of Share-Swap transactions and Cash transactions exceeding USD 5 mn. Other cases certification from CA/CPA.

Asset Acquisition Inward • Foreign Cos needs to have registered presence (Branch/Subsidiary) in India for making asset acquisition Outward • Governed by the laws of the overseas jurisdiction

SEBI Takeover Code/ Listing Agreement with Stock Exchange

Merger-Listing Agreement & SEBI Listing Agreement: • • Scheme before the Court must not violate, override or circumscribe the securities laws or stock exchange requirements Prior approval of Stock exchange necessary for the Scheme (Clause 24(f) of the listing agreement). Three copies of all notices, circulars, etc. , issued or advertised in the press either by the Company, or by any company which the Company proposes to merge or amalgamate to be forwarded to exchange. Constitutes ‘Price Sensitive Information’ in terms of Insider Trading Regulations.

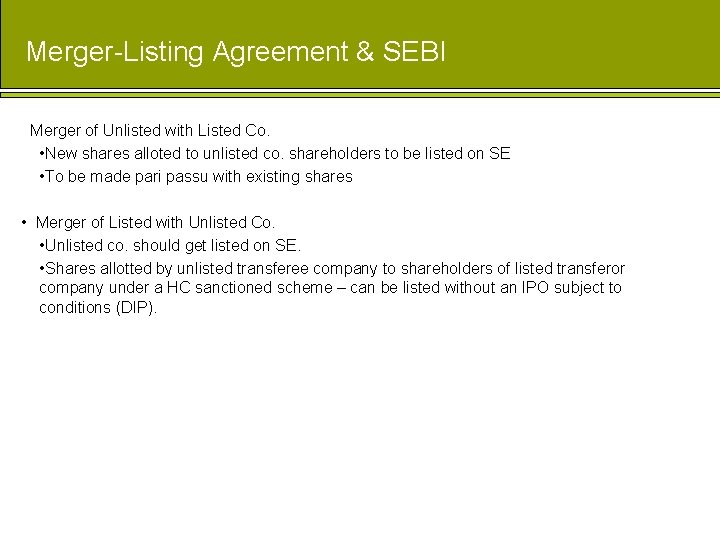

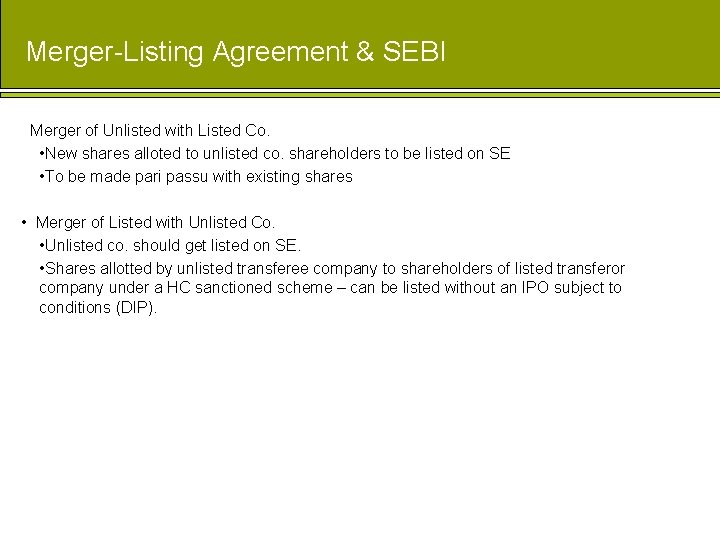

Merger-Listing Agreement & SEBI Merger of Unlisted with Listed Co. • New shares alloted to unlisted co. shareholders to be listed on SE • To be made pari passu with existing shares • Merger of Listed with Unlisted Co. • Unlisted co. should get listed on SE. • Shares allotted by unlisted transferee company to shareholders of listed transferor company under a HC sanctioned scheme – can be listed without an IPO subject to conditions (DIP).

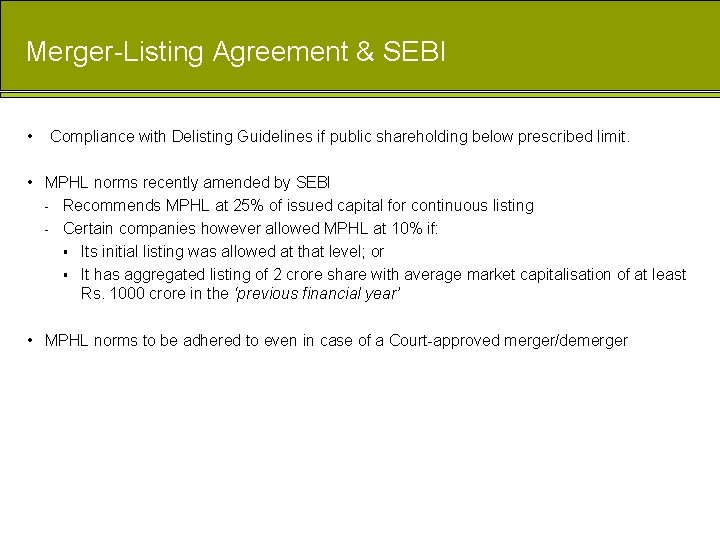

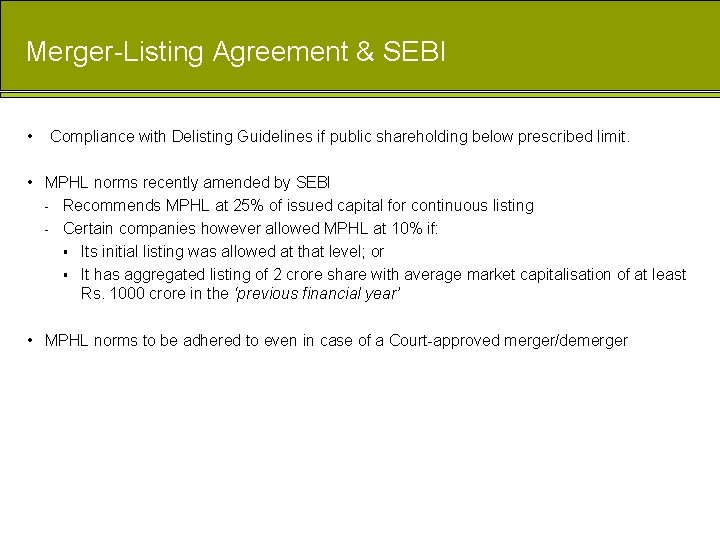

Merger-Listing Agreement & SEBI • Compliance with Delisting Guidelines if public shareholding below prescribed limit. • MPHL norms recently amended by SEBI - Recommends MPHL at 25% of issued capital for continuous listing - Certain companies however allowed MPHL at 10% if: § Its initial listing was allowed at that level; or § It has aggregated listing of 2 crore share with average market capitalisation of at least Rs. 1000 crore in the ‘previous financial year’ • MPHL norms to be adhered to even in case of a Court-approved merger/demerger

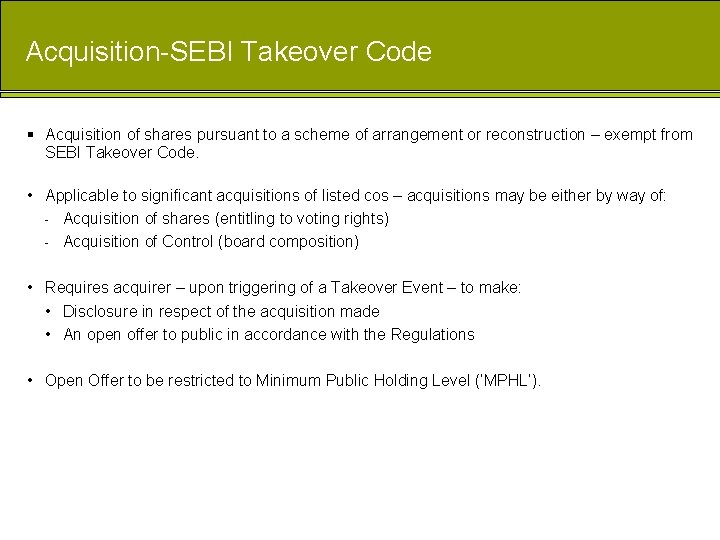

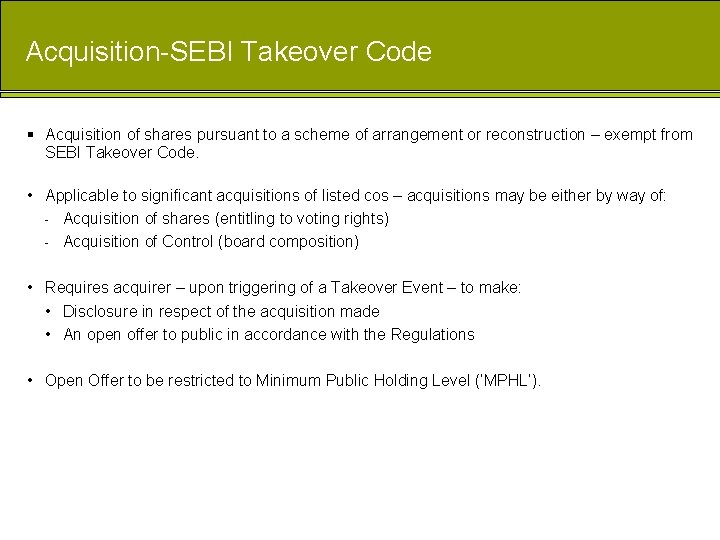

Acquisition-SEBI Takeover Code § Acquisition of shares pursuant to a scheme of arrangement or reconstruction – exempt from SEBI Takeover Code. • Applicable to significant acquisitions of listed cos – acquisitions may be either by way of: - Acquisition of shares (entitling to voting rights) - Acquisition of Control (board composition) • Requires acquirer – upon triggering of a Takeover Event – to make: • Disclosure in respect of the acquisition made • An open offer to public in accordance with the Regulations • Open Offer to be restricted to Minimum Public Holding Level (‘MPHL’).

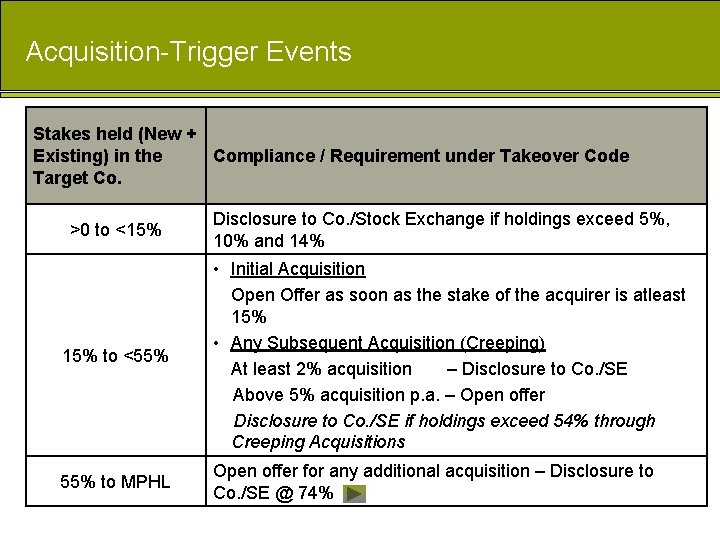

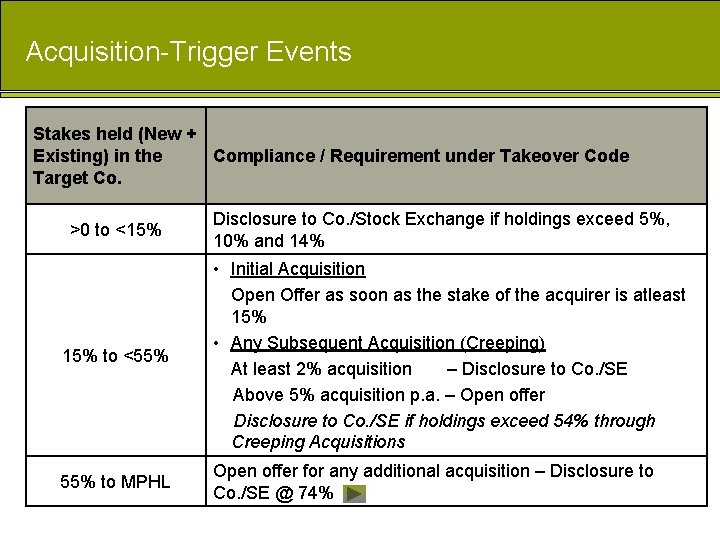

Acquisition-Trigger Events Stakes held (New + Existing) in the Compliance / Requirement under Takeover Code Target Co. >0 to <15% Disclosure to Co. /Stock Exchange if holdings exceed 5%, 10% and 14% 15% to <55% • Initial Acquisition Open Offer as soon as the stake of the acquirer is atleast 15% • Any Subsequent Acquisition (Creeping) At least 2% acquisition – Disclosure to Co. /SE Above 5% acquisition p. a. – Open offer Disclosure to Co. /SE if holdings exceed 54% through Creeping Acquisitions 55% to MPHL Open offer for any additional acquisition – Disclosure to Co. /SE @ 74%

Open Offer • Minimum size - 20% shares of Target - Open Offers may be for stakes larger than 20% at the Acquirer’s sole discretion - Open offer can be made for a lower % for complying MPHL • Threshold pricing of the Open offer – prescribed • Forms of Offer Price - Cash - Issue, exchange and / transfer of shares of Acquirer company, if listed - Issue, exchange and / transfer of secured instrument of Acquirer company with minimum “A” grade rating from a credit rating agency registered with SEBI. - Combination of the above

Stamp Duty

Stamp Duty- for court order passed under section 394 • – – – – • High Court Order approving the Scheme whether an “instrument” effecting the transfer( Li Taka Pharmaceuticals vs. State of Maharashtra 8 SCL 102 and Hindustan Lever v State of Maharashtra confirmed by Supreme Court) Transfer of property including liabilities from transferor to transferee and hence conveyance. (for transfer of title court order is used) Therefore, only state legislation/practice followed by respective court relevant. Specific entry in the Stamp Duty Schedule for the High Court Order sanctioning merger Eg. Maharashtra, Karnataka, Gujarat, Rajasthan, Madhya Pradesh, West Bengal, Andhra Pradesh Mostly determined on the value of shares allotted and other considerations paid -for merger Value of gross assets transferred- for other arrangements/schemes/demerger approved by the court. Some states specify maximum percentage/amount limit of stamp duty. (Eg: Karnataka – 7% of the market value of immovable or 0. 7% of the market value of shares allotted plus consideration amount whichever is higher. Remission – merger is with 90% subsidiary/ 90% of capital is with transferee company (not available in states having specific legislations)

Stamp Duty Share Acquisition: • 0. 25% on the consideration. • No stamp duty in demat mode Asset Acquisition: • As per the state legislation and the duty applicable. Slump Sale: • On the value of assets transferred.

Competition Act

Competition Act, 2002 (Partially notified) • Merger or Acquisition = “Combination” if stipulated thresholds respecting aggregate asset or turnover is exceeded • Prior approval of combination is not mandatory. Notice to be given. • Test – “Cause or likely to cause an appreciable adverse effect on competition within the relevant market in India”

Income tax

Merger/Demerger-Meaning and Tests • Section 2(1 B) (‘Amalgamation’) lays down tests for a tax compliant merger • Section 2(19 AA) lays down tests for a tax compliant demerger • No tax exemption under Income-tax Act, 1961 in case of amalgamation of an Indian company into a foreign company wherein the amalgamated company is a foreign company. • Such a merger would result in a foreign company having assets or business in India and therefore may cause a Permanent Establishment of foreign company in India.

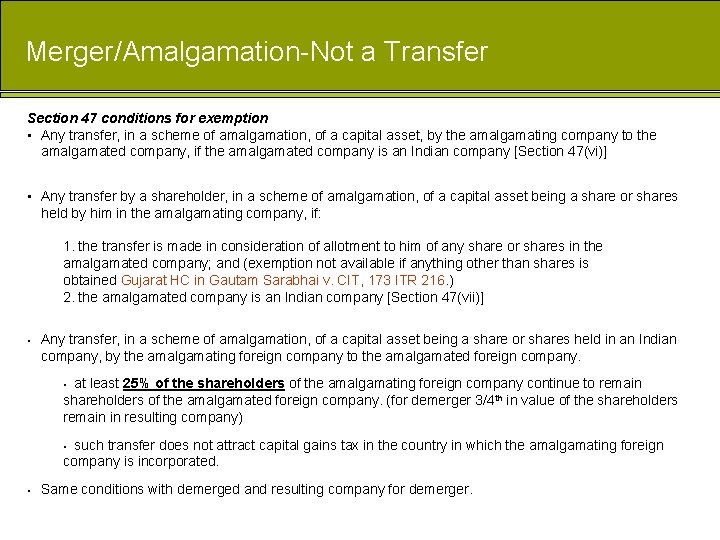

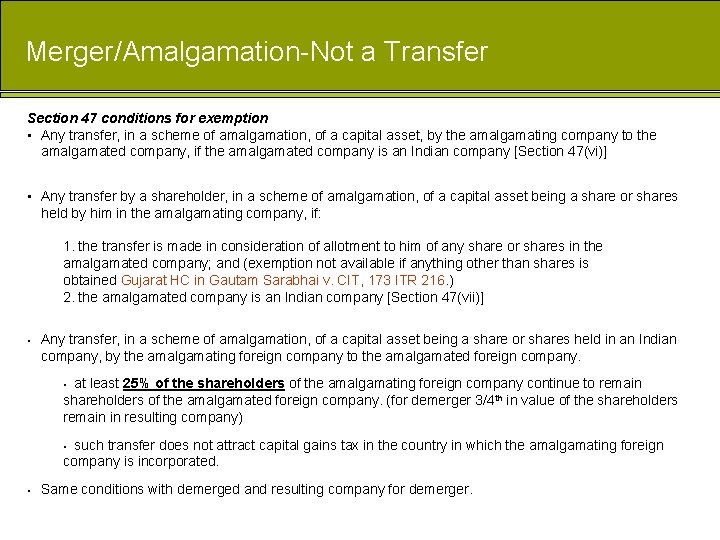

Merger/Amalgamation-Not a Transfer Section 47 conditions for exemption • Any transfer, in a scheme of amalgamation, of a capital asset, by the amalgamating company to the amalgamated company, if the amalgamated company is an Indian company [Section 47(vi)] • Any transfer by a shareholder, in a scheme of amalgamation, of a capital asset being a share or shares held by him in the amalgamating company, if: 1. the transfer is made in consideration of allotment to him of any share or shares in the amalgamated company; and (exemption not available if anything other than shares is obtained Gujarat HC in Gautam Sarabhai v. CIT, 173 ITR 216. ) 2. the amalgamated company is an Indian company [Section 47(vii)] • Any transfer, in a scheme of amalgamation, of a capital asset being a share or shares held in an Indian company, by the amalgamating foreign company to the amalgamated foreign company. at least 25% of the shareholders of the amalgamating foreign company continue to remain shareholders of the amalgamated foreign company. (for demerger 3/4 th in value of the shareholders remain in resulting company) • such transfer does not attract capital gains tax in the country in which the amalgamating foreign company is incorporated. • • Same conditions with demerged and resulting company for demerger.

Merger/Amalgamation –Carry forward and Set off of Losses • Benefit of carry forward and set-off of loss / depreciation to Indian company subject to certain conditions [Section 72 A(2)] Eligibility-72 A. • Company owning an industrial undertaking or ship or hotel with another company. • Banking company with a specified bank. • 2 PSUs engaged in in the business of operation of aircraft • Additional conditions for carry forward and set-off of losses (not depreciation) in case of a closely held company [Section 79] • on the last day of the previous year, the shares of the company carrying not less than fifty-one per cent of the voting power were beneficially held by persons who beneficially held shares of the company carrying not less than fifty-one per cent of the voting power on the last day of the year or years in which the loss was incurred.

Demerger –Carry forward and Set off of Losses • Directly relatable to the undertakings transferred to the resulting company: • allowed in the hands of the resulting company • Not directly relatable to the undertakings transferred to the resulting company: • apportioned between the demerged and the resulting company in the same proportion in which the assets of the undertakings have been retained by the demerged company and transferred to the resulting company.

Merger/Amalgamation/Demerger – Specific Provisions • Capital expenditure in the nature of scientific research. • Expenditure on acquisition of copyright/patent/ know how. • Expenditure for obtaining license to operate telecommunication services • Amortization of Preliminary expenses.

Slump Sale § Slump Sale = Transfer of undertaking without itemizing individual assets and liabilities - s. 2(42 C) Income Tax Act § Treated as capital gains § If undertaking is older than 3 years, long term capital gains rates apply even if individual assets are new. § Carry forward of losses and unabsorbed depreciation unavailable.

Miscellaneous Issues

Human Resource • Workmen entitled to retrenchment benefits unless retained in employment on same terms. • Adjustments of pay scale needs to be resolved. ü Global Trust employees were retained on same terms in OBC. Pay packages of former GTB staff could be altered only after 3 years. OBC management had to contend with GTB’s complex salary structure.

Sales Tax § Where effective date is retrospective, any transfers between amalgamating company and amalgamated company retrospectively cease to be liable to sales tax- Mad HC Castrol Oil v. State of TN, 114 STC 468 § Some Sales Tax enactments contain specific provisions to tax such transactions eg. S. 33 C, Bombay Sales Tax Act. § No such provision in Central Sales Tax Act.

Thank you

Annexures

Pre Merger Activity • Power to merge (Object clause of the Memorandum should contain the provision) • Object Clause of the transferee company to include objects of transferor company. • Authorised Share Capital of Transferee Company to be increased to accommodate allotment of shares.

Exemptions from Open Offer - Allotment pursuant to a public issue/ rights issue (stakes post rights should be below 55%)/made to underwriters. - Inter-se transfer of shares amongst: - § Group Companies as defined in the MRTP Act, 1969. (exercise control directly or indirectly on the other company) § Indian promoters and foreign collaborators who are shareholders § Promoters § Relatives By a registered stock broker/market maker/by succession or inheritance. - Pursuant to a Scheme § Under Section 18 of Sick Industrial Companies (Special Provisions) Act, 1985 § Of arrangement or reconstruction (including mergers/demerger) under any law regulation – Indian or foreign - Acquisition of unlisted Co. shares if no control is acquired over a listed company by virtue of this acquisition. - ADRs/GDRs unless not converted - Application can be made to the Exemption Panel – to seek exemption in non-specified cases

Open Offer Pricing • Threshold pricing of the Open offer - Higher of the following: - Negotiated Price under an agreement, if any, triggering the code - Highest Price paid by the Acquirer during the 26 -week period prior to the date of public announcement for acquiring shares of Target Company in any mode - The Average of the weekly high and low of the closing prices of the shares of the target company on the most frequently traded stock exchange during 26 weeks preceding the date of the public announcement - The Average of the daily high and low prices of the shares of the target company on the most frequently traded stock exchange during 2 weeks preceding the date of the public announcement

Section 2(1 B) • All properties of Amalgamating Co. should become property of the amalgamated co • All the Liabilities of Amalgamating Co. should become property of the amalgamated co • Shareholders holding not less than 3/4 th in value of shares in amalgamating co. (other than shares already held by the amalgamated co or its subsidiaries) become shareholders of the amalgamated company

Section 2(19 AA) • All Properties and Liabilities of the Demerged Co. Undertaking to become property of the Resulting Co. • Transfer should be at book values immediately before the demerger • Resulting Co. to issue its shares to the shareholders of the Demerged company on a proportionate basis • Shareholders holding atleast 3/4 th of the value of the Demerged Co. shares should become shareholders of the resulting co. • Transfer should be on a going-concern basis • Fulfilment of such further condition as may be prescribed under Section 72 A(5)

Conditions to be satisfied by Amalgamating/Amalgamated company By amalgamating company: • Engaged in the business in which the loss occurred or depreciation remains unabsorbed for 3 or more years. • Held continuously as on the date of amalgamation atleast 3/4 th of the book value of fixed assets held by it two years prior to the date of amalgamation. By amalgamated company: • Held continuously for a minimum period of 5 years from the date of amalgamation at least 3/4 th of the book value of fixed assets of the amalgamating company acquired in a scheme of amalgamation. • Continues the business of the amalgamating company for a minimum period of 5 years from the date of amalgamation.

Industrial undertaking- Section 72 A • Manufacture or processing of goods • Manufacture or processing of computer software • Generation or distribution of electricity • Providing telecommunication services • Mining • Construction of ships, aircrafts or rail systems