Keeping Track of Your Money How to use

- Slides: 15

Keeping Track of Your Money How to use your checkbook.

Choosing a Bank • Location, Location! – Choose a bank that is close to your home for easy access. • Fees! – Check for minimum balance and checking account fees. • Availability of Funds! – When will your money be available for you to withdrawal.

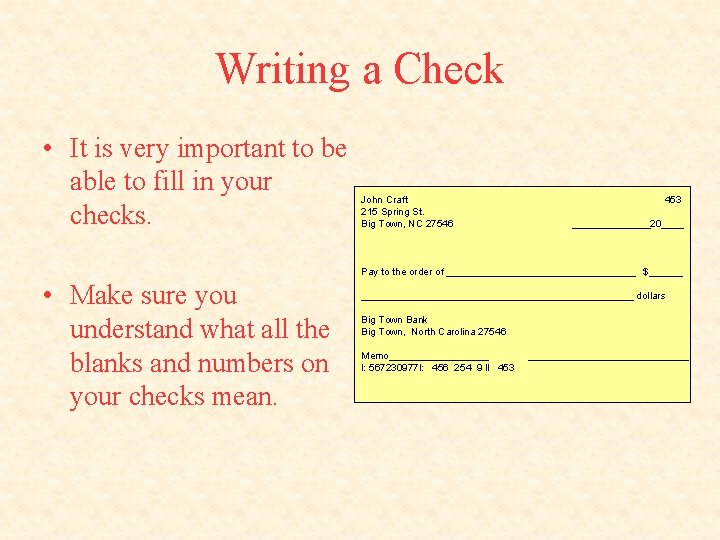

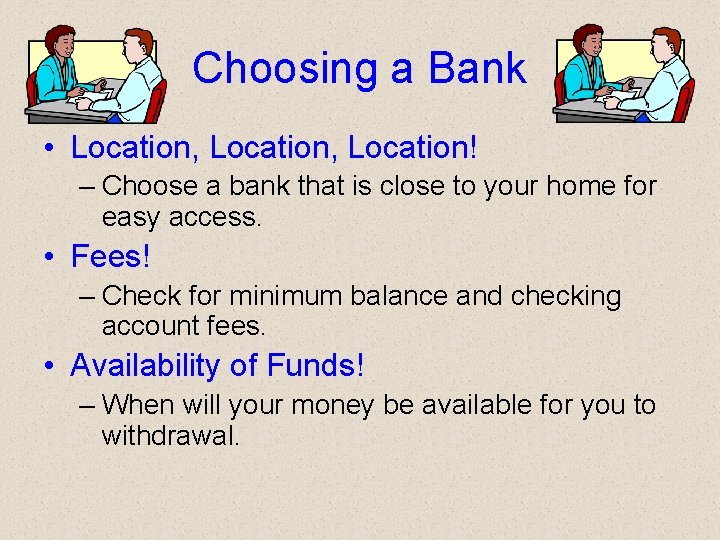

Writing a Check • It is very important to be able to fill in your checks. John Craft 215 Spring St. Big Town, NC 27546 453 _______20____ Pay to the order of _________________ $______ • Make sure you understand what all the blanks and numbers on your checks mean. _________________________ dollars Big Town Bank Big Town, North Carolina 27546 Memo_________ l: 567230977 l: 456 254 9 ll 453 _______________

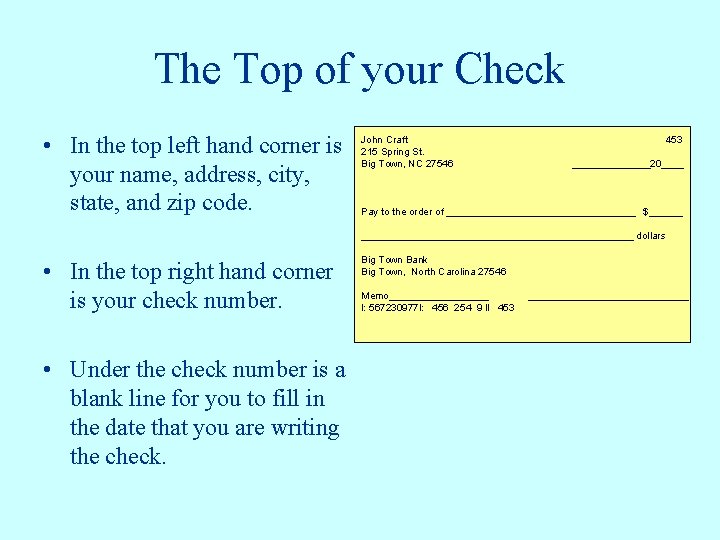

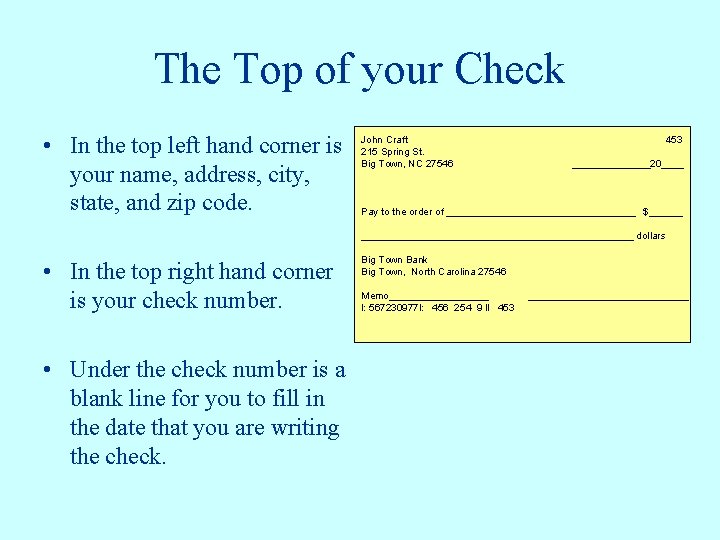

The Top of your Check • In the top left hand corner is your name, address, city, state, and zip code. John Craft 215 Spring St. Big Town, NC 27546 453 _______20____ Pay to the order of _________________ $_________________________ dollars • In the top right hand corner is your check number. • Under the check number is a blank line for you to fill in the date that you are writing the check. Big Town Bank Big Town, North Carolina 27546 Memo_________ l: 567230977 l: 456 254 9 ll 453 _______________

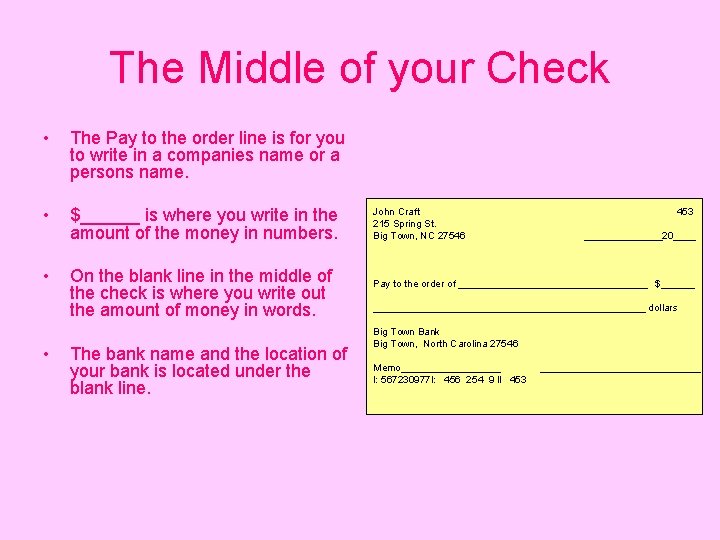

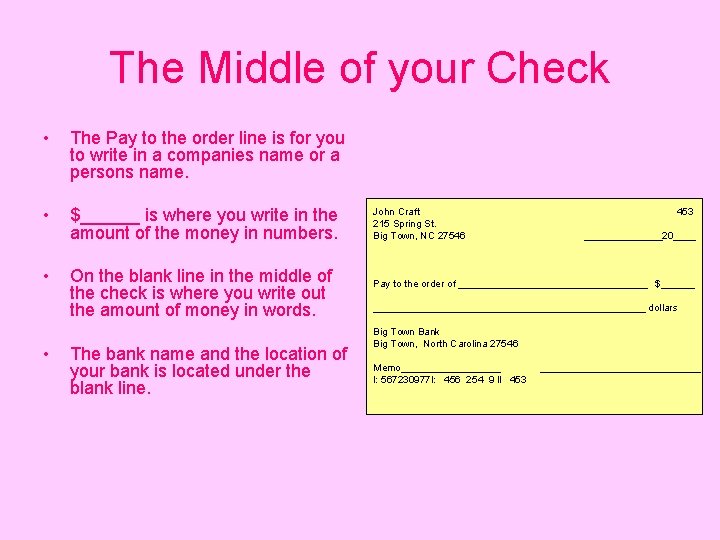

The Middle of your Check • The Pay to the order line is for you to write in a companies name or a persons name. • $______ is where you write in the amount of the money in numbers. • • On the blank line in the middle of the check is where you write out the amount of money in words. The bank name and the location of your bank is located under the blank line. John Craft 215 Spring St. Big Town, NC 27546 453 _______20____ Pay to the order of _________________ $_________________________ dollars Big Town Bank Big Town, North Carolina 27546 Memo_________ l: 567230977 l: 456 254 9 ll 453 _______________

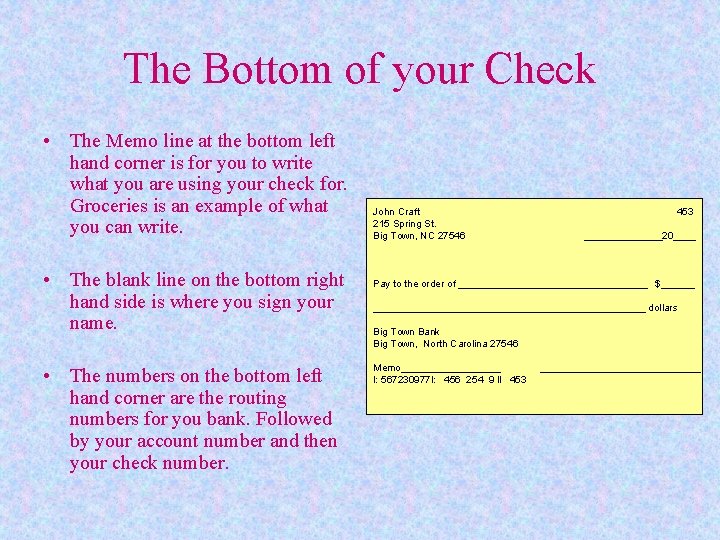

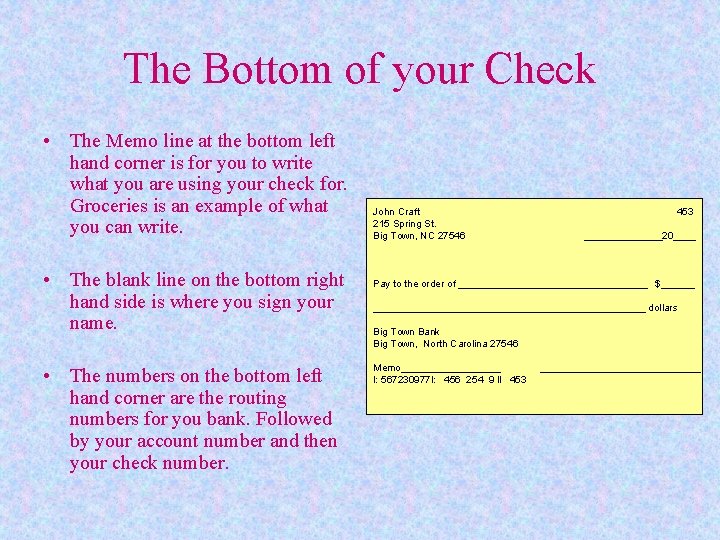

The Bottom of your Check • The Memo line at the bottom left hand corner is for you to write what you are using your check for. Groceries is an example of what you can write. • The blank line on the bottom right hand side is where you sign your name. • The numbers on the bottom left hand corner are the routing numbers for you bank. Followed by your account number and then your check number. John Craft 215 Spring St. Big Town, NC 27546 453 _______20____ Pay to the order of _________________ $_________________________ dollars Big Town Bank Big Town, North Carolina 27546 Memo_________ l: 567230977 l: 456 254 9 ll 453 _______________

Using Your ATM Card • You can use you debit/ATM card anywhere credit cards are accepted. • Your card is NOT a credit card. When you make a purchase the money comes out of your checking account. • You can use your card to get cash from an ATM. • Remember to deduct your debit/ATM card purchases from your checkbook register.

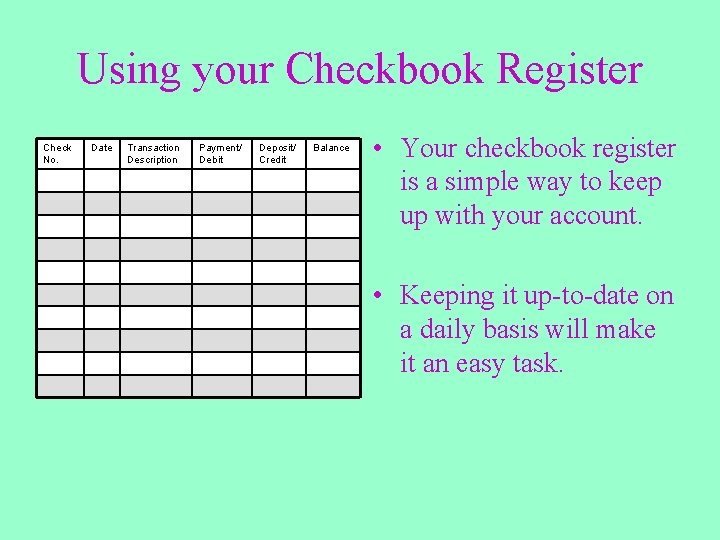

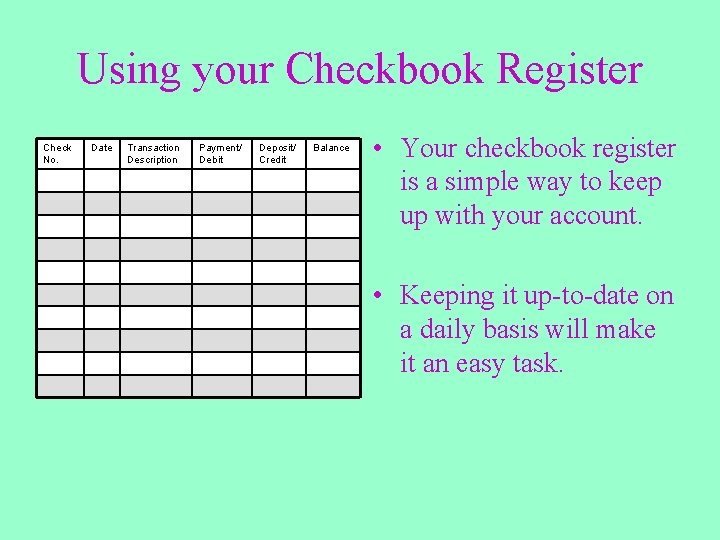

Using your Checkbook Register Check No. Date Transaction Description Payment/ Debit Deposit/ Credit Balance • Your checkbook register is a simple way to keep up with your account. • Keeping it up-to-date on a daily basis will make it an easy task.

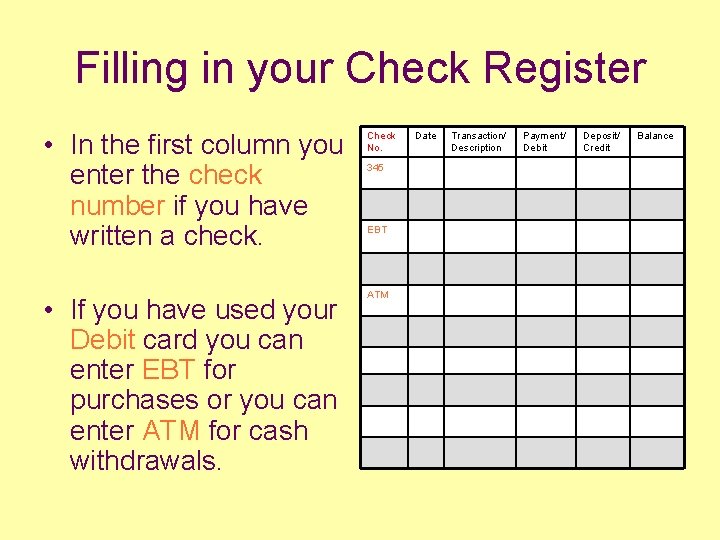

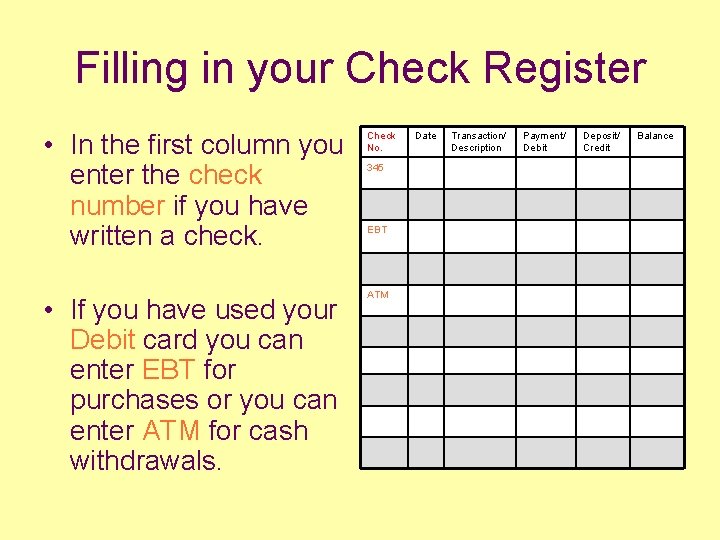

Filling in your Check Register • In the first column you enter the check number if you have written a check. Check No. • If you have used your Debit card you can enter EBT for purchases or you can enter ATM for cash withdrawals. ATM 345 EBT Date Transaction/ Description Payment/ Debit Deposit/ Credit Balance

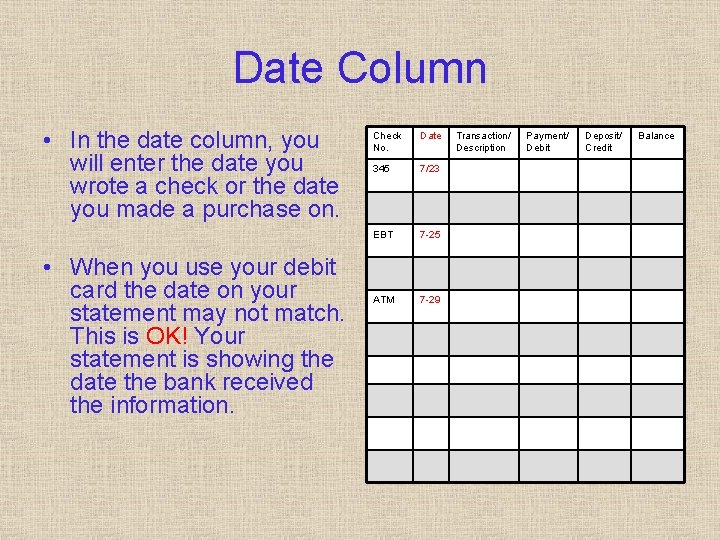

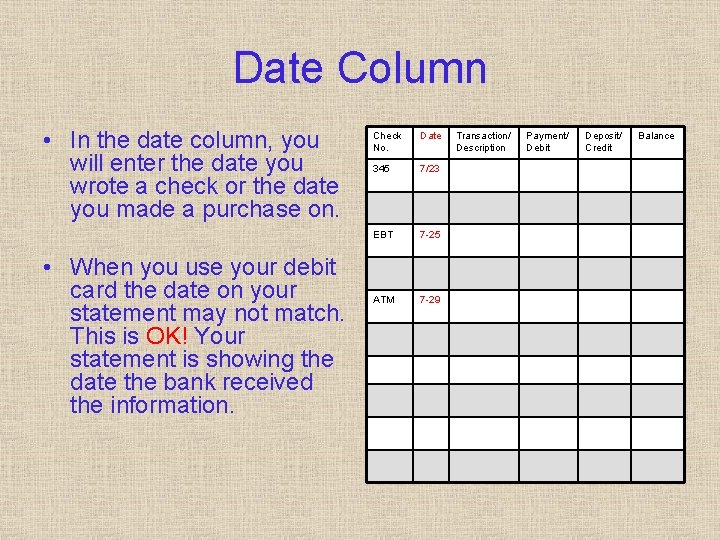

Date Column • In the date column, you will enter the date you wrote a check or the date you made a purchase on. • When you use your debit card the date on your statement may not match. This is OK! Your statement is showing the date the bank received the information. Check No. Date 345 7/23 EBT 7 -25 ATM 7 -29 Transaction/ Description Payment/ Debit Deposit/ Credit Balance

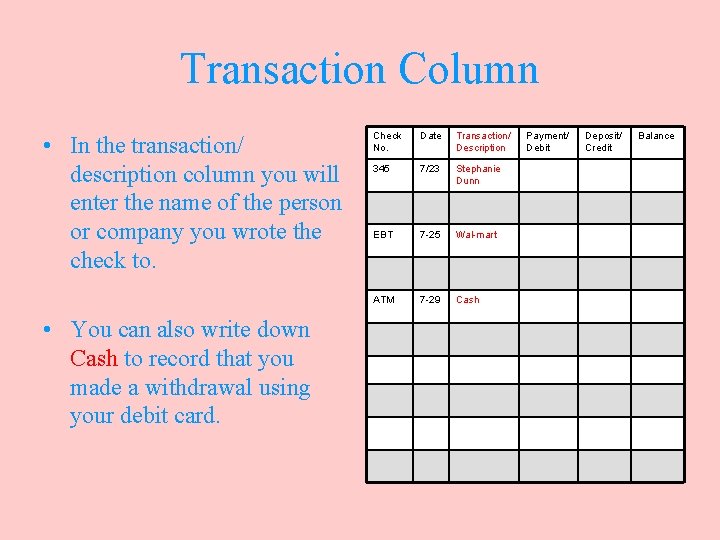

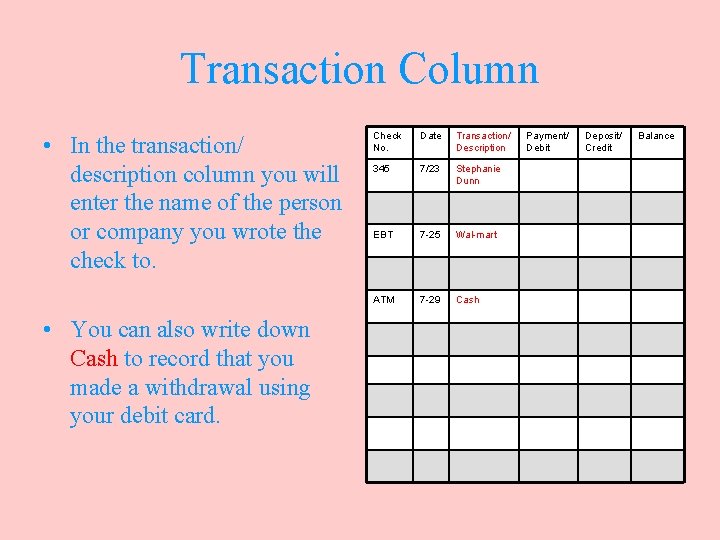

Transaction Column • In the transaction/ description column you will enter the name of the person or company you wrote the check to. • You can also write down Cash to record that you made a withdrawal using your debit card. Check No. Date Transaction/ Description 345 7/23 Stephanie Dunn EBT 7 -25 Wal-mart ATM 7 -29 Cash Payment/ Debit Deposit/ Credit Balance

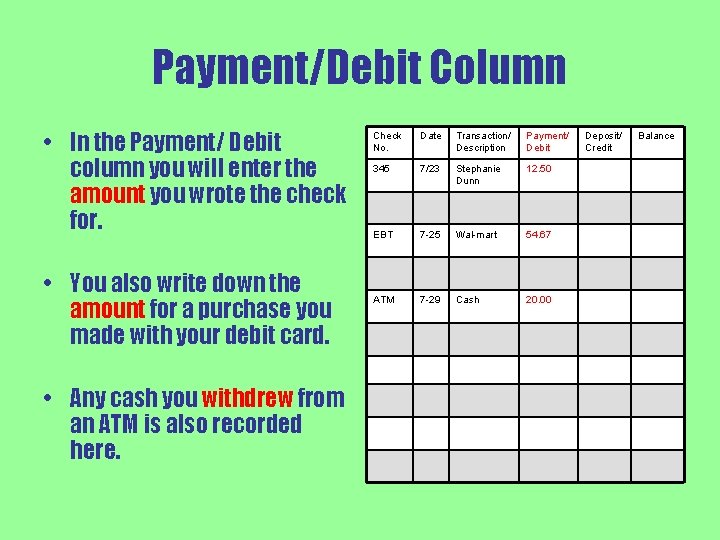

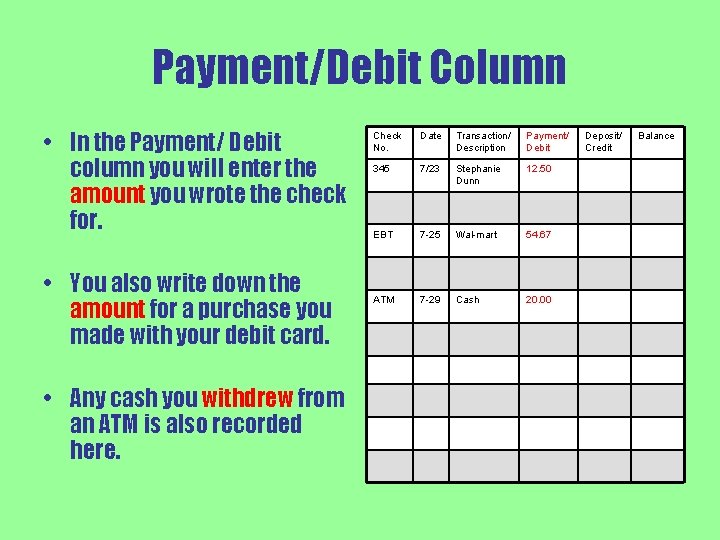

Payment/Debit Column • In the Payment/ Debit column you will enter the amount you wrote the check for. • You also write down the amount for a purchase you made with your debit card. • Any cash you withdrew from an ATM is also recorded here. Check No. Date Transaction/ Description Payment/ Debit 345 7/23 Stephanie Dunn 12. 50 EBT 7 -25 Wal-mart 54. 67 ATM 7 -29 Cash 20. 00 Deposit/ Credit Balance

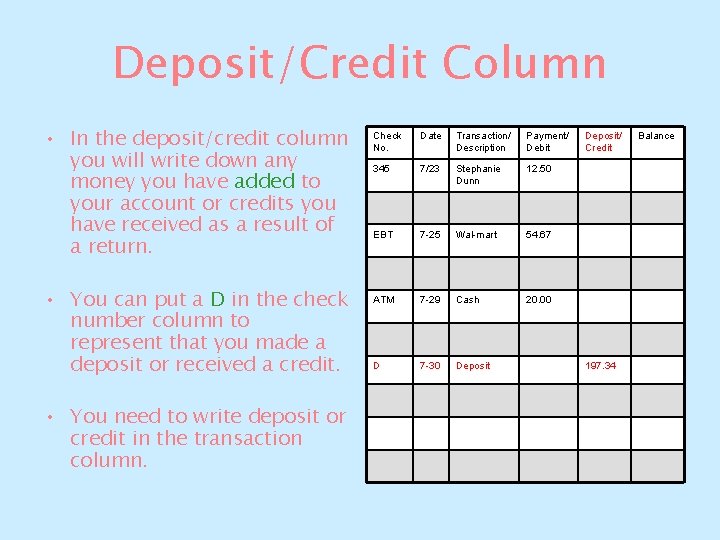

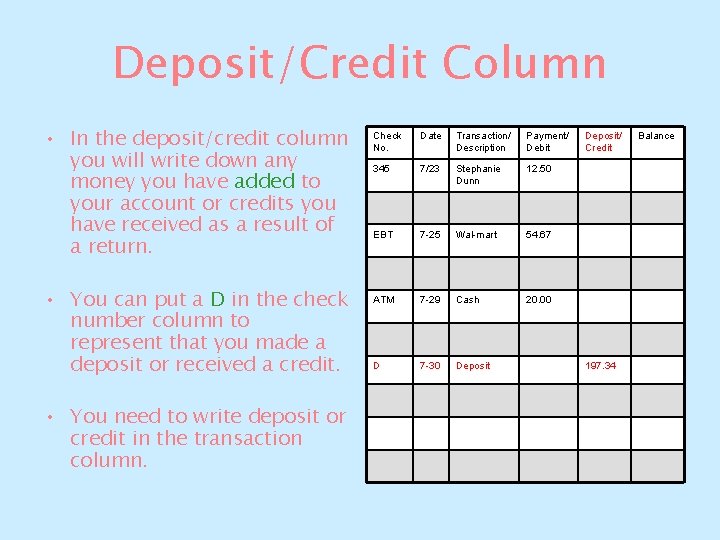

Deposit/Credit Column • In the deposit/credit column you will write down any money you have added to your account or credits you have received as a result of a return. • You can put a D in the check number column to represent that you made a deposit or received a credit. • You need to write deposit or credit in the transaction column. Check No. Date Transaction/ Description Payment/ Debit 345 7/23 Stephanie Dunn 12. 50 EBT 7 -25 Wal-mart 54. 67 ATM 7 -29 Cash 20. 00 D 7 -30 Deposit/ Credit 197. 34 Balance

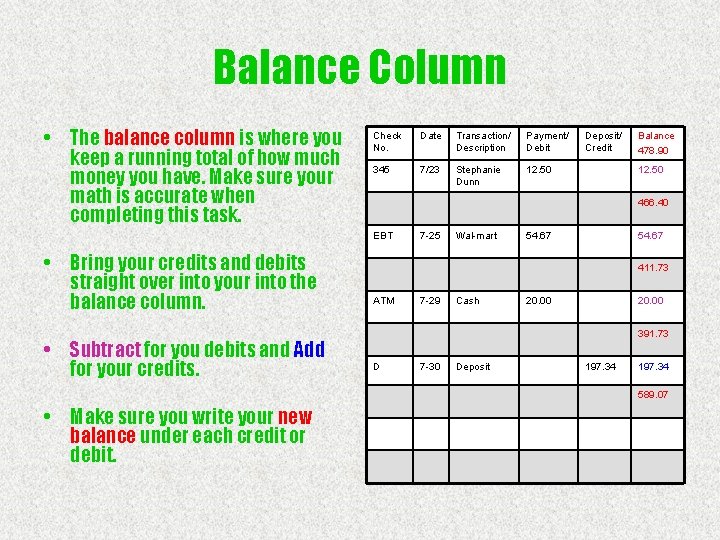

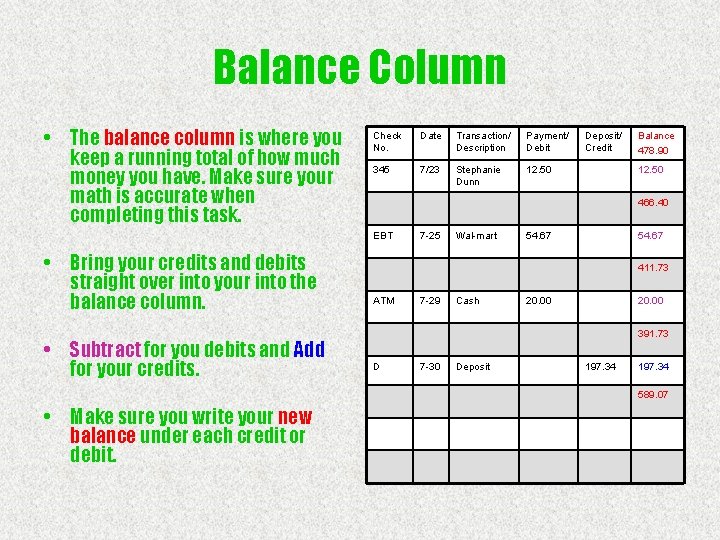

Balance Column • The balance column is where you keep a running total of how much money you have. Make sure your math is accurate when completing this task. Check No. Date Transaction/ Description Payment/ Debit 345 7/23 Stephanie Dunn 12. 50 • Subtract for you debits and Add for your credits. Balance 478. 90 12. 50 466. 40 EBT • Bring your credits and debits straight over into your into the balance column. Deposit/ Credit 7 -25 Wal-mart 54. 67 411. 73 ATM 7 -29 Cash 20. 00 391. 73 D 7 -30 Deposit 197. 34 589. 07 • Make sure you write your new balance under each credit or debit.

Conclusion • Know that you know the basics here are few rules to follow by. • Don’t let anyone else use your checkbook or debit card! • Don’t give out checks that you have signed, but did not fill in! • Do Not give anyone your PIN number! • If you suspect something has happened to your checkbook or debit card, contact you bank IMMEDIATELY!

Keeping your career on track

Keeping your career on track Money money money team

Money money money team Chapter 7 business management

Chapter 7 business management Shana ross bayhealth

Shana ross bayhealth An institution for receiving keeping and lending money

An institution for receiving keeping and lending money Your money your goals toolkit

Your money your goals toolkit Keeping your hands clean and dry essay

Keeping your hands clean and dry essay Valley of ashes great gatsby

Valley of ashes great gatsby Money smart money match

Money smart money match Money on money multiple

Money on money multiple The great gatsby historical context

The great gatsby historical context Context of the great gatsby

Context of the great gatsby Give us your hungry your tired your poor

Give us your hungry your tired your poor Bully taking lunch money

Bully taking lunch money Your money briefing

Your money briefing I love your money

I love your money