INCOME EXEMPT FROM TAX Chapter III of the

- Slides: 25

INCOME EXEMPT FROM TAX

ØChapter III of the Income-tax Act, 1961 deals with the Incomes which do not form part of total income. Ø This Chapter covers sections 10 to 13 A

Ø Section 10 contains numerous clauses subject to amendments, exempting various kinds of income from inclusion for purposes of tax. These exemptions have been inserted from social, economic, political, international and other considerations and the contents and scope of the exemptions change from time to time.

Ø Ø Section 10 : Any income of any persons falling within any of the clauses of section 10 shall not be included in the total income. EXEMPTION VS DEDUCTION

Ø Agricultural Income is exempt from tax if it comes within the definition of “agricultural income” as given in Section 2(1 A)

Ø Subject to the provisions of 64(2), any sum received by an individual as a member of a HUF, where such sum has been paid out of the income of the family, or, in the case of any impartible estate, where such sum has been paid out of the income of the estate belonging to the family.

Ø In the case of a person being a partner of a firm which is separately assessed as such, his share in the total income of the firm.

Ø Ø Any sum received on life insurance policies (including bonus) is exempt. Exclusions : any sum received u/s. 80 DD(3) b. any sum received under a Keyman Insurance Policy c. any sum received under an insurance policy (issued after 31. 03. 2003) in respect of which the premium paid in any year during the term of policy, exceeds 20% of the actual sum assured However, sum received under such policy on the death of a person shall continue to be exempt a. Actual sum assured does not include any premiums agreed to be returned or any benefits by way of bonus

Deduction is available to an Individual or HUF who is resident in India. Individual can be a resident or a non resident or a foreign national. Deduction is available for any amount paid for the medical treatment (including nursing), training and rehabilitation of a handicapped dependent. Deduction is also available for any amount deposited in a scheme with LIC or any other insurer or UTI in this regard for the maintenance of a person who is dependent and disabled. This scheme should provide for the payment of money in lump sum for the benefit of dependent in the event of death of a person making such deposit. Deduction is available for expenditure done on the treatment of dependent that is a person with a disability. The person should be atleast 40% disabled. If individual is less than 40% disabled then no deduction is allowed. Deduction allowed is Rs. 50000 in case of a dependent being a disabled and has a disability of atleast 40% but less or equal to 80% or Rs. 75000 in case a person is dependent and severely disable i. e. disability of more than 80% of one or more disabilities The amount of deduction is not dependent on the amount of actual expenditure incurred by the assessee. Dependent means in case of Individual spouse, children, parents, brothers and sisters and in case of HUF any member of HUF.

Such person should be wholly and mainly dependent for support and maintenance on such individual or HUF. Dependent himself should not claim deduction under section 80 U in computing his own total income. If the person being a person with a disability in whose name the sum has been deposited with LIC or any other insurer or UTI, dies before the assessee then the amount equal to the amount which has been deposited shall be deemed to be the income of the assessee in the previous year in which sum has been received from insurer and shall be chargeable to tax in the year of receipt. For claiming the deduction the assessee has to furnish a certificate from the medical authorities and has to file it along with ITR under section 139(1). Disability for this section would mean blindness, low vision, leprosycured---meaning person who has been cured of leprosy but is suffering from loss of sensation in feet or hands, hearing impairment, locomotors disability---means disability of bones, joints or muscles leading to substantial restriction of the movement of the limbs, mental retardation---means incomplete development of mind, which is specially characterized by sub normality of intelligence, mental illness.

Ø In case the income of an individual includes the income of his minor child in terms of section 64(1 A), such an individual shall be entitled to exemption of Rs. 1, 500/- in respect of each minor child if the income of such minor is includible under section 64(1 A) exceeds that amount.

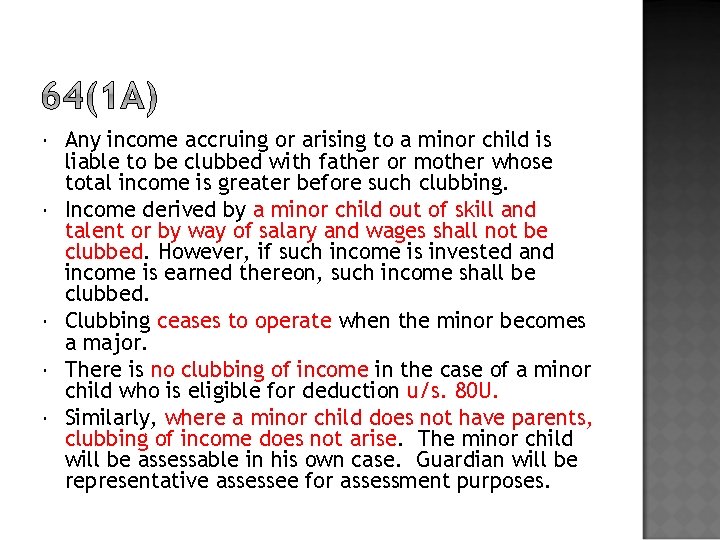

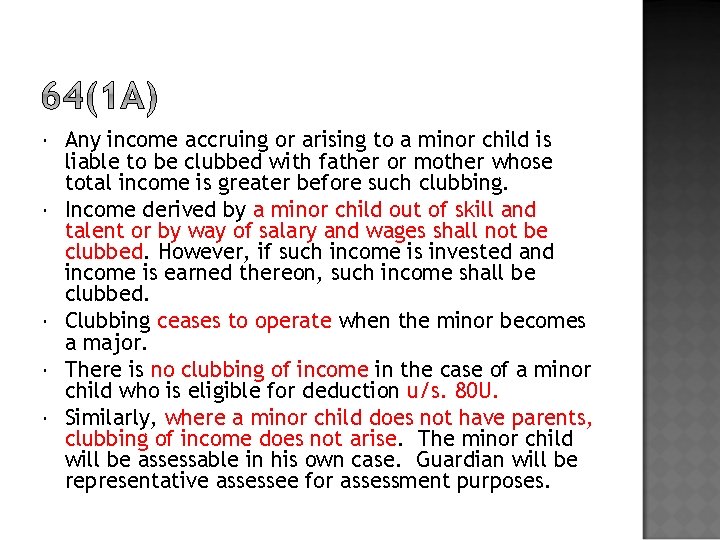

Any income accruing or arising to a minor child is liable to be clubbed with father or mother whose total income is greater before such clubbing. Income derived by a minor child out of skill and talent or by way of salary and wages shall not be clubbed. However, if such income is invested and income is earned thereon, such income shall be clubbed. Clubbing ceases to operate when the minor becomes a major. There is no clubbing of income in the case of a minor child who is eligible for deduction u/s. 80 U. Similarly, where a minor child does not have parents, clubbing of income does not arise. The minor child will be assessable in his own case. Guardian will be representative assessee for assessment purposes.

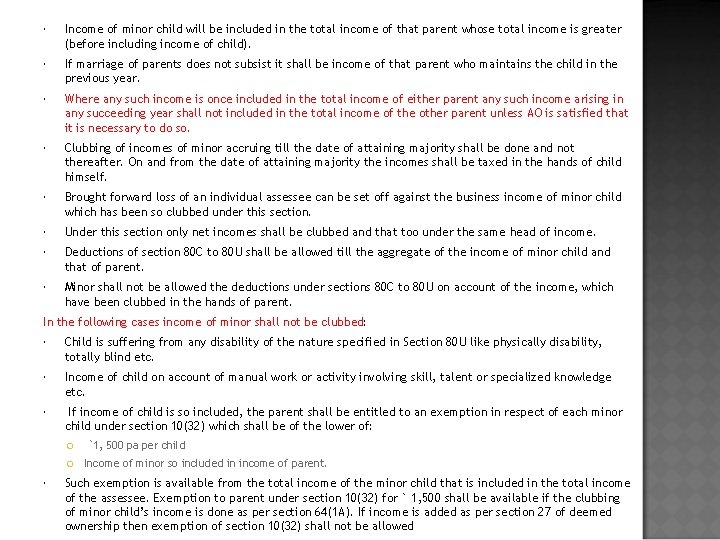

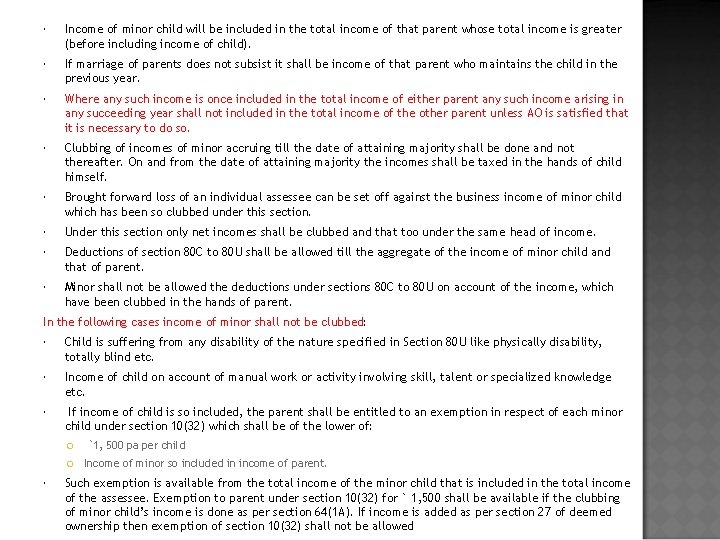

Income of minor child will be included in the total income of that parent whose total income is greater (before including income of child). If marriage of parents does not subsist it shall be income of that parent who maintains the child in the previous year. Where any such income is once included in the total income of either parent any such income arising in any succeeding year shall not included in the total income of the other parent unless AO is satisfied that it is necessary to do so. Clubbing of incomes of minor accruing till the date of attaining majority shall be done and not thereafter. On and from the date of attaining majority the incomes shall be taxed in the hands of child himself. Brought forward loss of an individual assessee can be set off against the business income of minor child which has been so clubbed under this section. Under this section only net incomes shall be clubbed and that too under the same head of income. Deductions of section 80 C to 80 U shall be allowed till the aggregate of the income of minor child and that of parent. Minor shall not be allowed the deductions under sections 80 C to 80 U on account of the income, which have been clubbed in the hands of parent. In the following cases income of minor shall not be clubbed: Child is suffering from any disability of the nature specified in Section 80 U like physically disability, totally blind etc. Income of child on account of manual work or activity involving skill, talent or specialized knowledge etc. If income of child is so included, the parent shall be entitled to an exemption in respect of each minor child under section 10(32) which shall be of the lower of: `1, 500 pa per child Income of minor so included in income of parent. Such exemption is available from the total income of the minor child that is included in the total income of the assessee. Exemption to parent under section 10(32) for ` 1, 500 shall be available if the clubbing of minor child’s income is done as per section 64(1 A). If income is added as per section 27 of deemed ownership then exemption of section 10(32) shall not be allowed

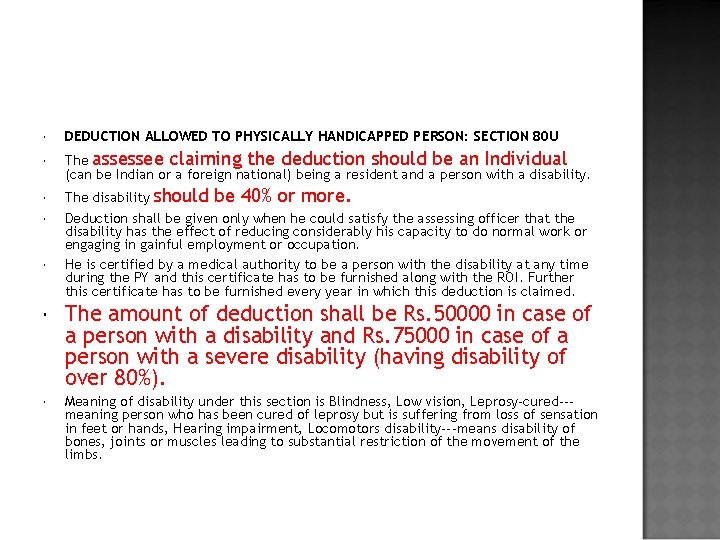

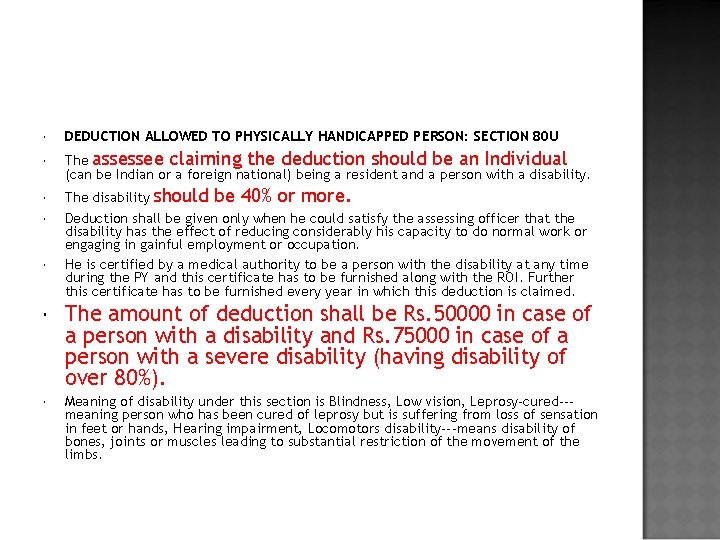

DEDUCTION ALLOWED TO PHYSICALLY HANDICAPPED PERSON: SECTION 80 U The assessee claiming the deduction should be an Individual (can be Indian or a foreign national) being a resident and a person with a disability. The disability should be 40% or more. Deduction shall be given only when he could satisfy the assessing officer that the disability has the effect of reducing considerably his capacity to do normal work or engaging in gainful employment or occupation. He is certified by a medical authority to be a person with the disability at any time during the PY and this certificate has to be furnished along with the ROI. Further this certificate has to be furnished every year in which this deduction is claimed. The amount of deduction shall be Rs. 50000 in case of a person with a disability and Rs. 75000 in case of a person with a severe disability (having disability of over 80%). Meaning of disability under this section is Blindness, Low vision, Leprosy-cured--meaning person who has been cured of leprosy but is suffering from loss of sensation in feet or hands, Hearing impairment, Locomotors disability---means disability of bones, joints or muscles leading to substantial restriction of the movement of the limbs.

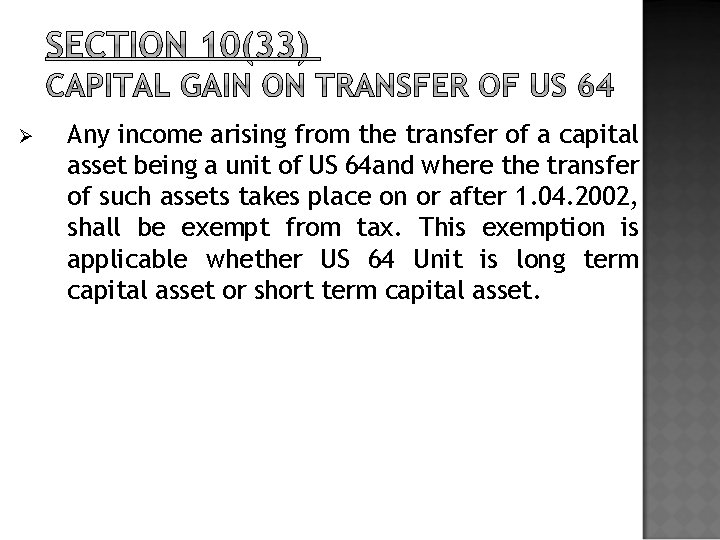

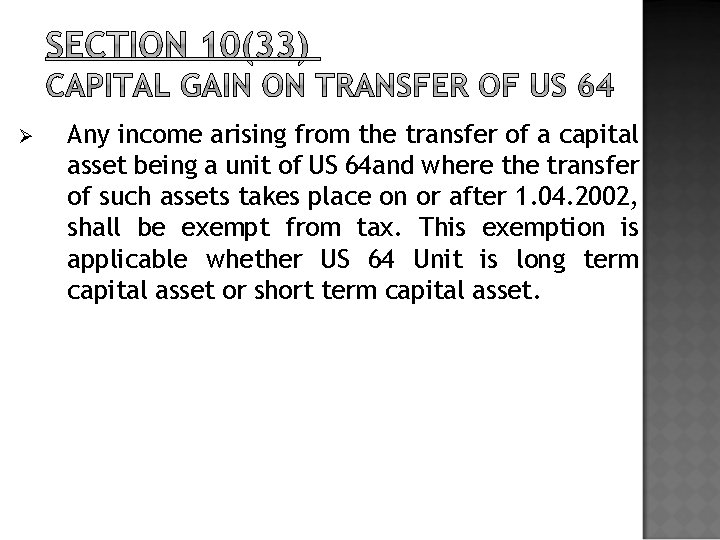

Ø Any income arising from the transfer of a capital asset being a unit of US 64 and where the transfer of such assets takes place on or after 1. 04. 2002, shall be exempt from tax. This exemption is applicable whether US 64 Unit is long term capital asset or short term capital asset.

Ø Any income by way of dividends received from Domestic Company. As per Section 2(22 A), Domestic Company means an Indian Company, or any other company which, in respect of its income liable to tax under this Act, has made the prescribed arrangements for the declaration and payment, within India, of the dividends (including dividends on preference shares) payable out of such income.

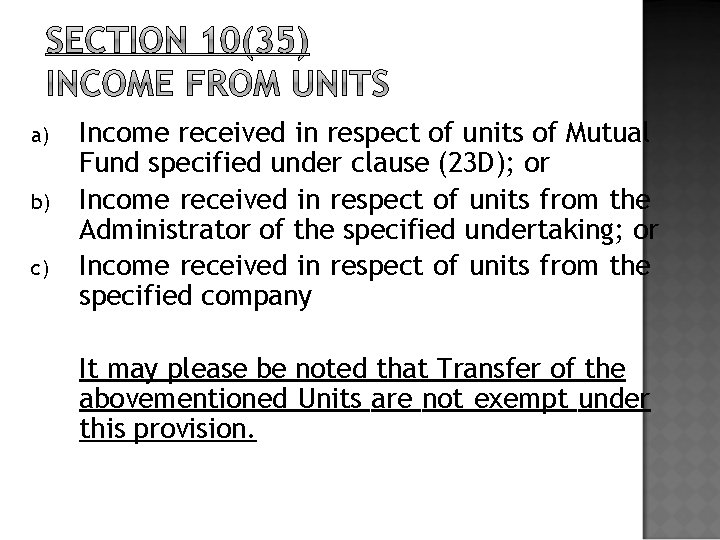

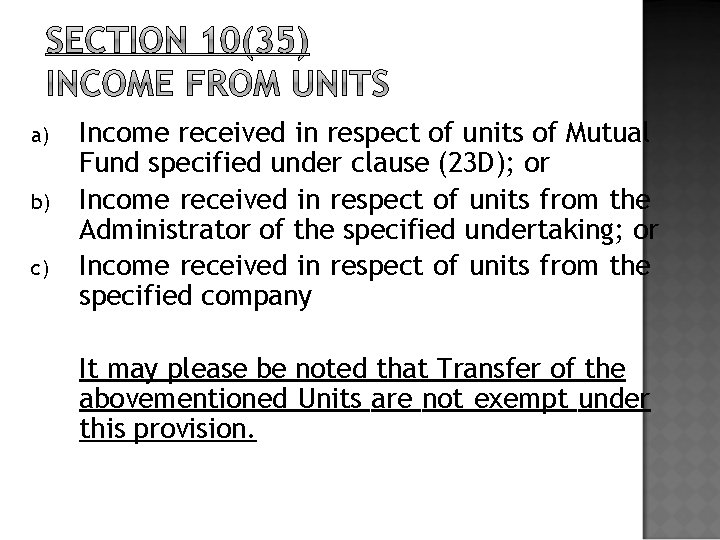

a) b) c) Income received in respect of units of Mutual Fund specified under clause (23 D); or Income received in respect of units from the Administrator of the specified undertaking; or Income received in respect of units from the specified company It may please be noted that Transfer of the abovementioned Units are not exempt under this provision.

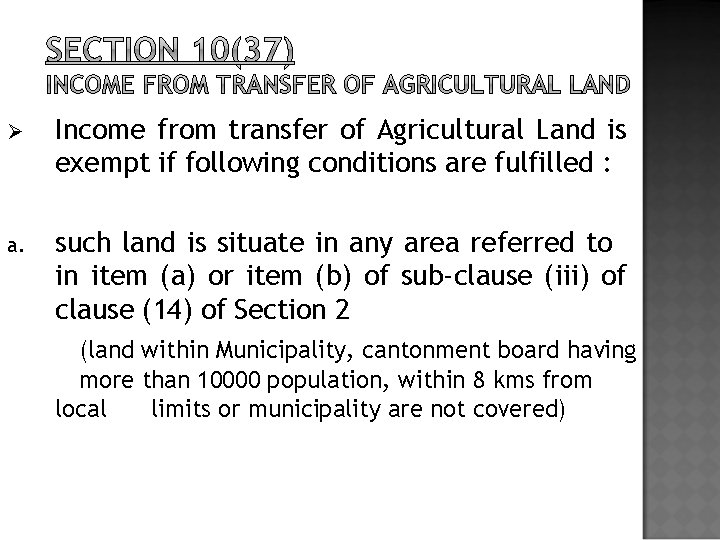

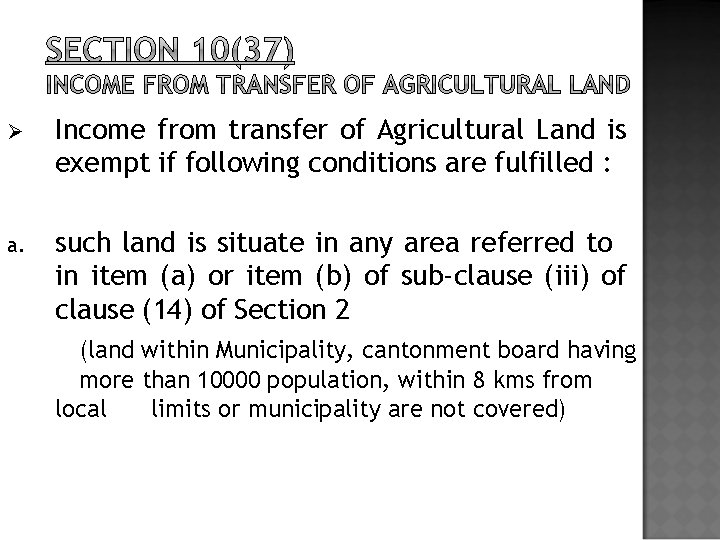

Ø Income from transfer of Agricultural Land is exempt if following conditions are fulfilled : a. such land is situate in any area referred to in item (a) or item (b) of sub-clause (iii) of clause (14) of Section 2 (land within Municipality, cantonment board having more than 10000 population, within 8 kms from local limits or municipality are not covered)

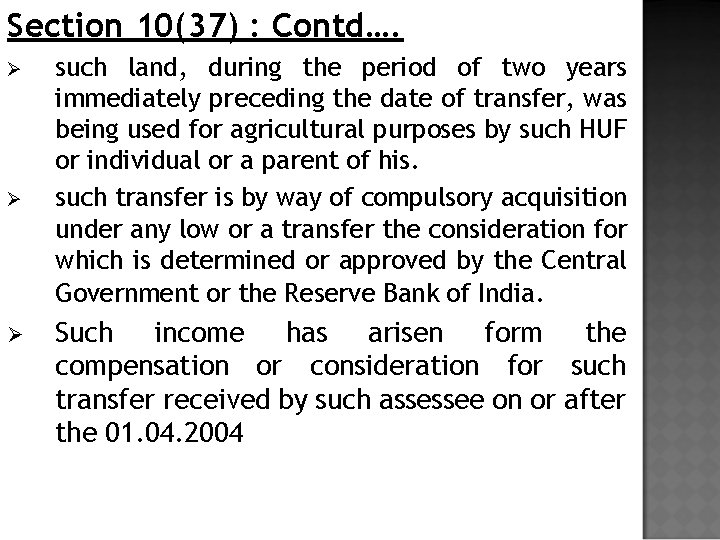

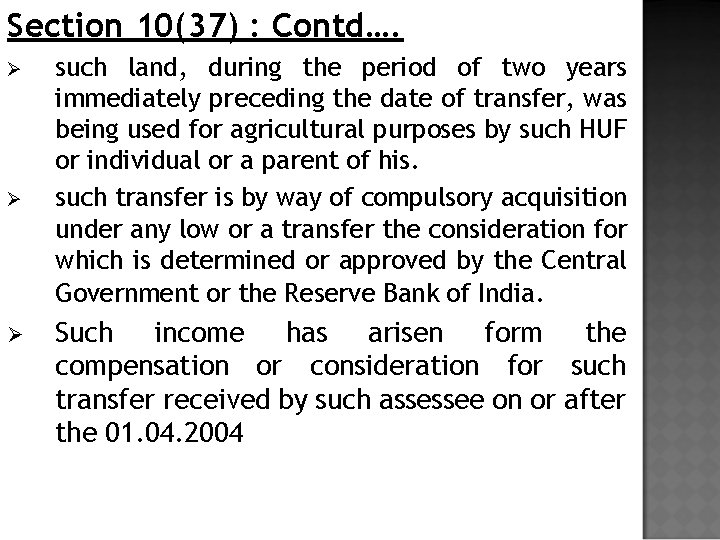

Section 10(37) : Contd…. Ø Ø Ø such land, during the period of two years immediately preceding the date of transfer, was being used for agricultural purposes by such HUF or individual or a parent of his. such transfer is by way of compulsory acquisition under any low or a transfer the consideration for which is determined or approved by the Central Government or the Reserve Bank of India. Such income has arisen form the compensation or consideration for such transfer received by such assessee on or after the 01. 04. 2004

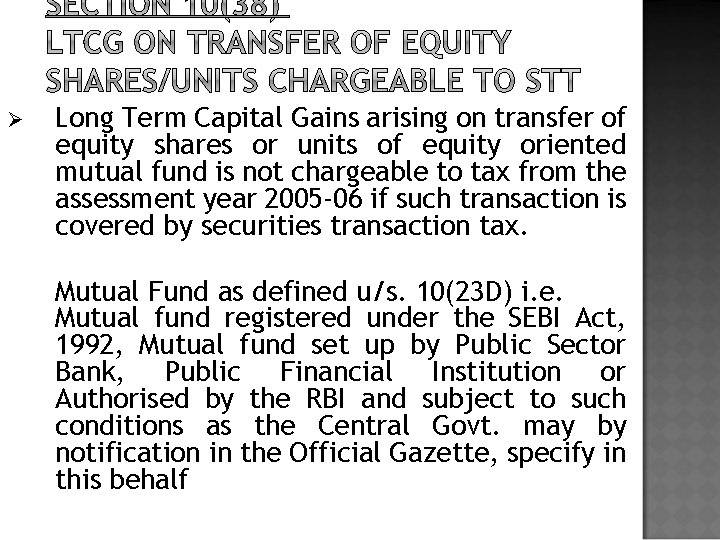

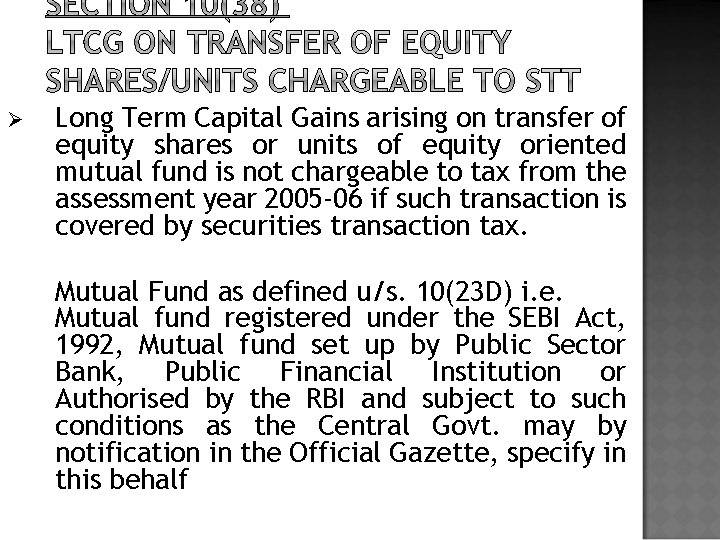

Ø Long Term Capital Gains arising on transfer of equity shares or units of equity oriented mutual fund is not chargeable to tax from the assessment year 2005 -06 if such transaction is covered by securities transaction tax. Mutual Fund as defined u/s. 10(23 D) i. e. Mutual fund registered under the SEBI Act, 1992, Mutual fund set up by Public Sector Bank, Public Financial Institution or Authorised by the RBI and subject to such conditions as the Central Govt. may by notification in the Official Gazette, specify in this behalf

(a) (b) (c) (d) Amount received (Compensation) at the time of voluntary retirement or separation is exempt from tax if the following conditions are satisfied : Compensation is received at the time retirement or termination. Compensation is received by an employee of the specified undertakings. Compensation is received in accordance with the scheme of voluntary retirement/separation which is framed in accordance with prescribed guidelines. Maximum amount of exemption is Rs. 5, 000/-.

INTEREST ON SECURITIES: SECTION 10(15): Interest income exempt from tax are given under section 10(15) some of which are: Interest on post office saving bank account. Interest on fixed deposits with government or with post office. Interest on capital investment bonds. Interest on relief bonds. 10(16) Scholarships grant for education 10(17) Daily allowances of MP 10(17 A) Award of Central or State Govt 10(18) Pension income of winners of gallantry awards 10(19) Family pension in case of death of members of armed forces .

SECTION 10(39): INCOME EARNED FROM THE NOTIFIED INTERNATIONAL SPORTING EVENTS held in India are exempt from tax if such events are approved by the international bodies and has a participation of more than 2 countries. SECTION 10(43): REVERSE MORTGAGE: Any amount received by an individual as a loan, either in lump sum or in installment, in a transaction of reverse mortgage is exempt. SECTION 10(44): NEW PENSION TRUST: Any income received by any person on behalf of the New Pension System Trust established on 27 -2 -2008 under the provision of the Indian Trust Act of 1882 shall be exempt from income tax.

COMPENSATION ON DISASTER: SECTION 10(10 BC) COMPENSATION RECEIVED OR RECEIVABLE BY AN INDIVIDUAL OR HIS LEGAL HEIR ON ACCOUNT OF DISASTER FROM CENTRAL GOVERNMENT, STATE GOVERNMENT OR LOCAL AUTHORITY. HOWEVER IF THE LOSS DUE TO DISASTER HAS BEEN CLAIMED AS DEDUCTION WHILE CALCULATING PGBP INCOME THEN SUCH COMPENSATION SHALL NOT BE EXEMPT 70

"disaster" means a catastrophe, mishap, calamity or grave occurrence in any area, arising from natural or man made causes, or by accident or negligence which results in substantial loss of life or human suffering or damage to, and destruction of, property, or damage to, or degradation of, environment, and is of such a nature or magnitude as to be beyond the coping capacity of the community of the affected area

Non assessable income examples

Non assessable income examples Are local governments tax exempt

Are local governments tax exempt Are city governments tax exempt

Are city governments tax exempt Gsa tax exempt form florida

Gsa tax exempt form florida E595 tax exempt form

E595 tax exempt form Chapter 7 federal income tax

Chapter 7 federal income tax Hamlet act iii scene iii

Hamlet act iii scene iii Allianz simple income iii rider

Allianz simple income iii rider Gdp calculation expenditure approach

Gdp calculation expenditure approach 30% income tax

30% income tax Income statement

Income statement Deferred tax asset journal entry

Deferred tax asset journal entry Winman software download

Winman software download Movable assets

Movable assets Salient features of income tax act 1961

Salient features of income tax act 1961 195 of income tax act

195 of income tax act Kansas income tax rates

Kansas income tax rates Perquisites in income tax

Perquisites in income tax Individual tax computation format

Individual tax computation format Income tax computation format

Income tax computation format James wilson income tax

James wilson income tax Calculate federal income tax

Calculate federal income tax Individual tax computation format

Individual tax computation format Easy office software

Easy office software Income tax expense

Income tax expense Income tax meaning

Income tax meaning