Incomes exempt from tax Incomes exempt under section

- Slides: 7

Incomes exempt from tax Incomes exempt under section 10

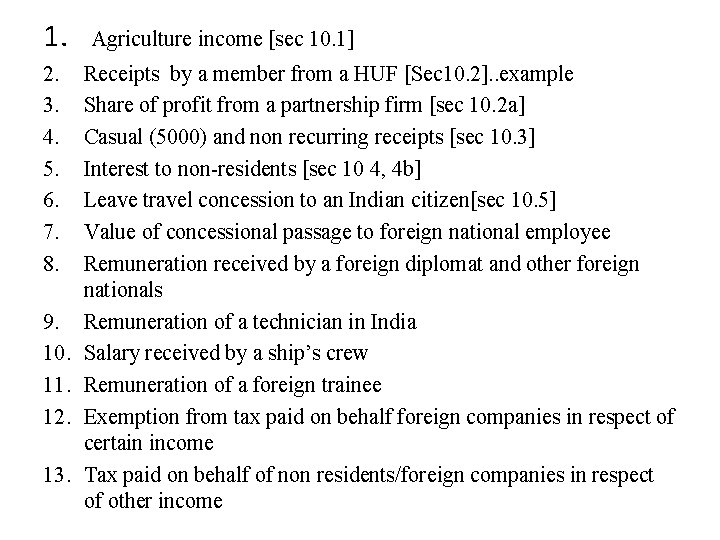

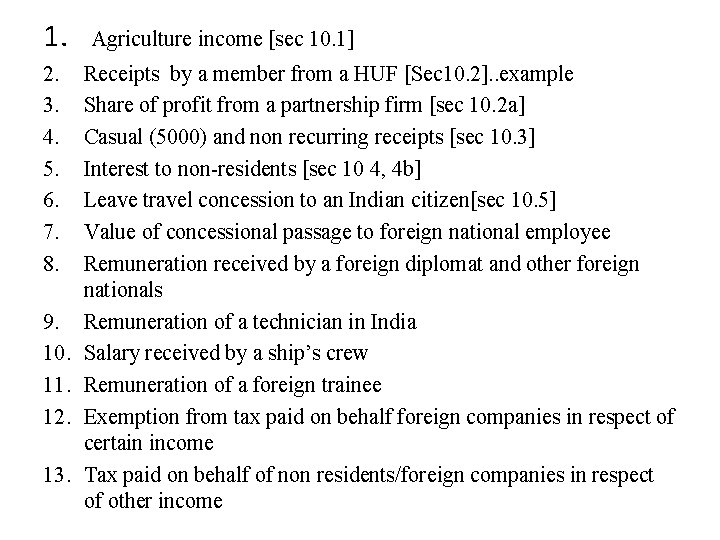

1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. Agriculture income [sec 10. 1] Receipts by a member from a HUF [Sec 10. 2]. . example Share of profit from a partnership firm [sec 10. 2 a] Casual (5000) and non recurring receipts [sec 10. 3] Interest to non-residents [sec 10 4, 4 b] Leave travel concession to an Indian citizen[sec 10. 5] Value of concessional passage to foreign national employee Remuneration received by a foreign diplomat and other foreign nationals Remuneration of a technician in India Salary received by a ship’s crew Remuneration of a foreign trainee Exemption from tax paid on behalf foreign companies in respect of certain income Tax paid on behalf of non residents/foreign companies in respect of other income

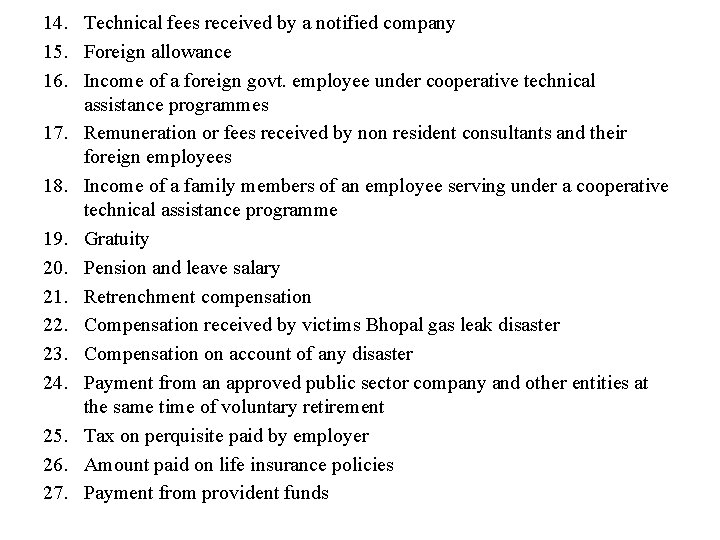

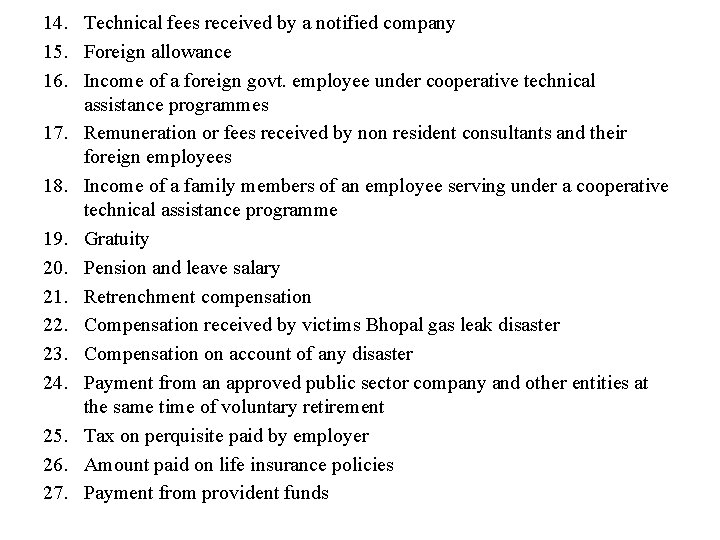

14. Technical fees received by a notified company 15. Foreign allowance 16. Income of a foreign govt. employee under cooperative technical assistance programmes 17. Remuneration or fees received by non resident consultants and their foreign employees 18. Income of a family members of an employee serving under a cooperative technical assistance programme 19. Gratuity 20. Pension and leave salary 21. Retrenchment compensation 22. Compensation received by victims Bhopal gas leak disaster 23. Compensation on account of any disaster 24. Payment from an approved public sector company and other entities at the same time of voluntary retirement 25. Tax on perquisite paid by employer 26. Amount paid on life insurance policies 27. Payment from provident funds

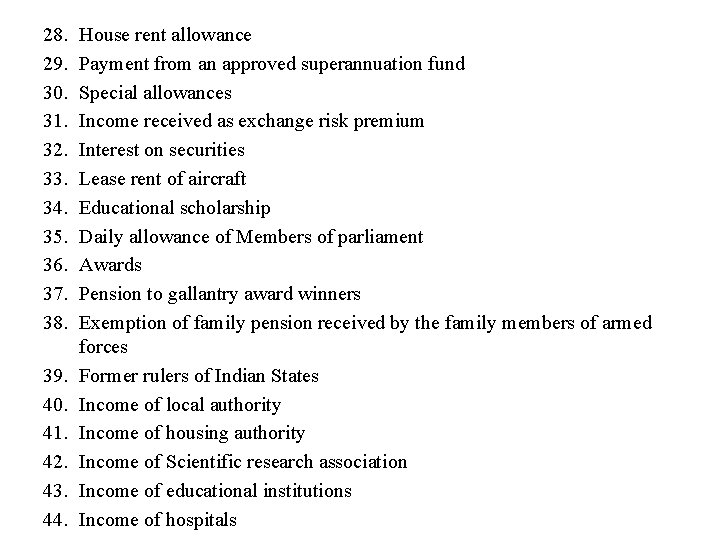

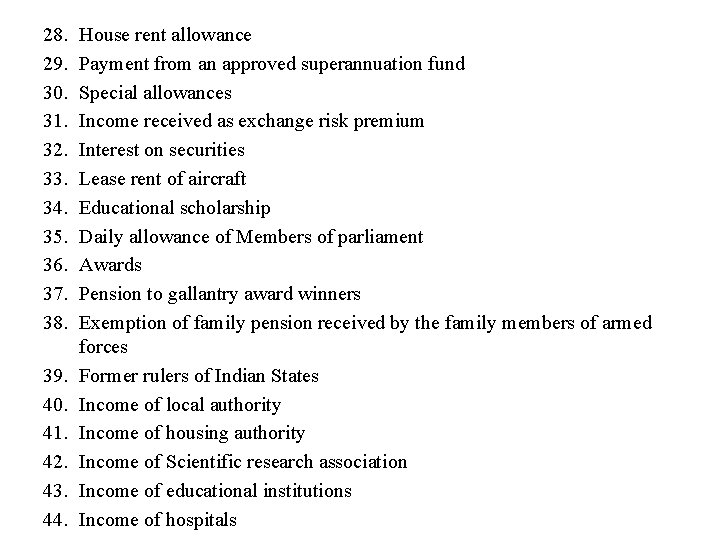

28. 29. 30. 31. 32. 33. 34. 35. 36. 37. 38. 39. 40. 41. 42. 43. 44. House rent allowance Payment from an approved superannuation fund Special allowances Income received as exchange risk premium Interest on securities Lease rent of aircraft Educational scholarship Daily allowance of Members of parliament Awards Pension to gallantry award winners Exemption of family pension received by the family members of armed forces Former rulers of Indian States Income of local authority Income of housing authority Income of Scientific research association Income of educational institutions Income of hospitals

45. 46. 47. 48. 49. 50. 51. 52. 53. 54. 55. 56. 57. 58. 59. 60. 61. 62. Income of specifies news agencies Income of games associations Income of professional institution Income received on behalf of Regimental Fun Income of fund established for welfare of employees Income of pension fund Income from khadi or village industries Boards Income of statutory bodies for the administration of public charitable trust Income of European Economic Community Income of SAARC Income of Insurance Regulatory Authority Income of certain National funds, educational institutions and hospitals Income of a mutual fund Income of investor protector fund Income of Venture Capital fund or venture capital company Income of an infrastructure capital fund Income of trade union

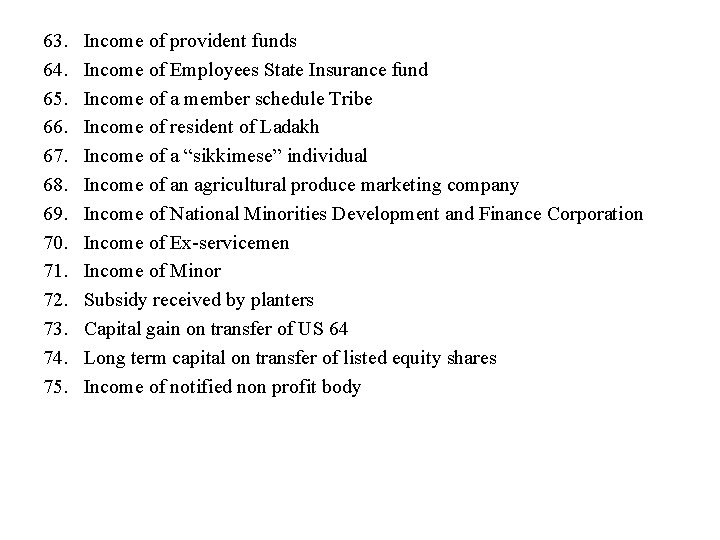

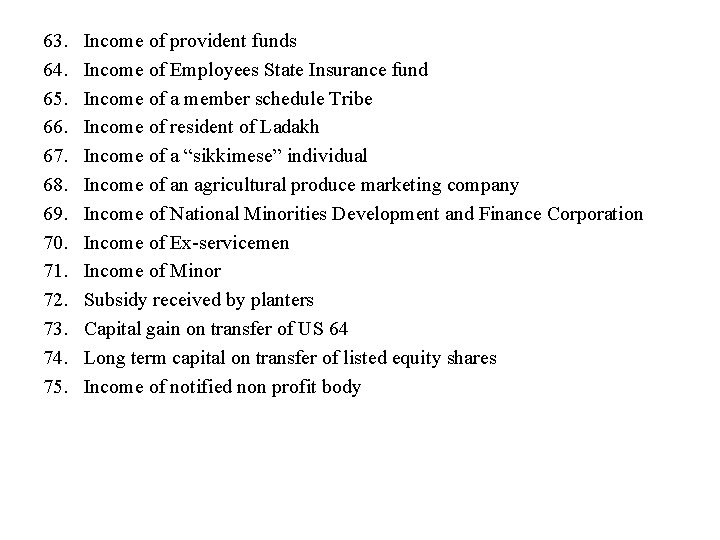

63. 64. 65. 66. 67. 68. 69. 70. 71. 72. 73. 74. 75. Income of provident funds Income of Employees State Insurance fund Income of a member schedule Tribe Income of resident of Ladakh Income of a “sikkimese” individual Income of an agricultural produce marketing company Income of National Minorities Development and Finance Corporation Income of Ex-servicemen Income of Minor Subsidy received by planters Capital gain on transfer of US 64 Long term capital on transfer of listed equity shares Income of notified non profit body

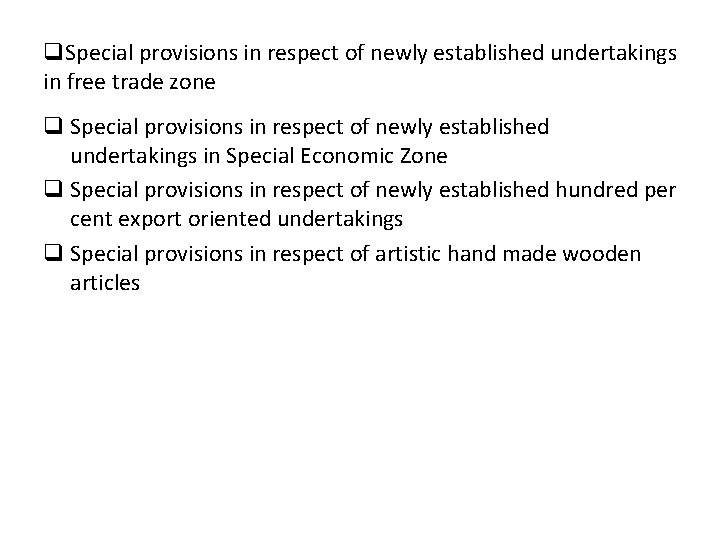

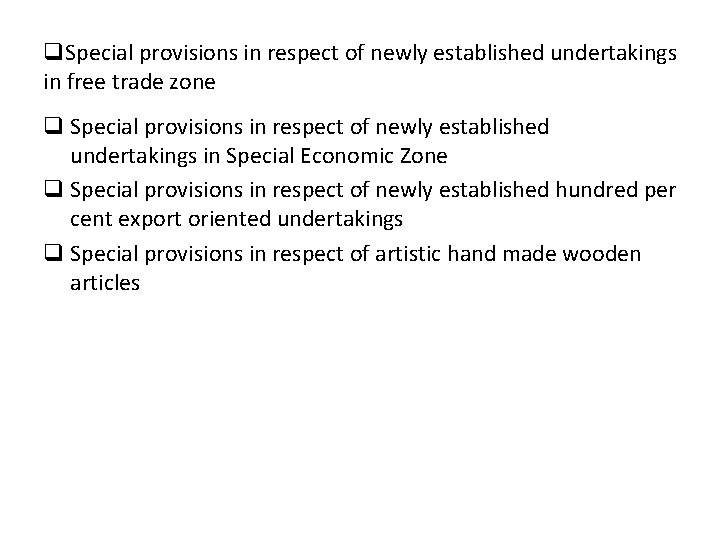

q. Special provisions in respect of newly established undertakings in free trade zone q Special provisions in respect of newly established undertakings in Special Economic Zone q Special provisions in respect of newly established hundred per cent export oriented undertakings q Special provisions in respect of artistic hand made wooden articles