Income Exempt from Tax Agricultural income US 101

![3. Partner’s share in the profit of the firm: [U/S 10(2 A)] • In 3. Partner’s share in the profit of the firm: [U/S 10(2 A)] • In](https://slidetodoc.com/presentation_image/0e7dad7028fd9686c23a1404d2aeadc7/image-4.jpg)

![7. Remuneration received by foreign Diplomat [U/S 10(6)(ii)] • The exemption from tax is 7. Remuneration received by foreign Diplomat [U/S 10(6)(ii)] • The exemption from tax is](https://slidetodoc.com/presentation_image/0e7dad7028fd9686c23a1404d2aeadc7/image-7.jpg)

![Foreign Allowances and perquisites to Government Employees outside India [U/S 10(7) ] • Sub-section Foreign Allowances and perquisites to Government Employees outside India [U/S 10(7) ] • Sub-section](https://slidetodoc.com/presentation_image/0e7dad7028fd9686c23a1404d2aeadc7/image-8.jpg)

![LIC/PF Exemptions • 8. Amount received in life insurance policy: [U/S 10(10 D)] • LIC/PF Exemptions • 8. Amount received in life insurance policy: [U/S 10(10 D)] •](https://slidetodoc.com/presentation_image/0e7dad7028fd9686c23a1404d2aeadc7/image-9.jpg)

![RPF • 10. Accumulated balance from a recognized provident fund[u/s 10(12)] • The accumulated RPF • 10. Accumulated balance from a recognized provident fund[u/s 10(12)] • The accumulated](https://slidetodoc.com/presentation_image/0e7dad7028fd9686c23a1404d2aeadc7/image-10.jpg)

![Scholarship/ MP Allowance • 13. Scholarship [ U/S 10(16)] • Scholarship granted to meet Scholarship/ MP Allowance • 13. Scholarship [ U/S 10(16)] • Scholarship granted to meet](https://slidetodoc.com/presentation_image/0e7dad7028fd9686c23a1404d2aeadc7/image-12.jpg)

![Awards • 15. Awards[U/S 10(17 A)] • Awards received , whether in cash or Awards • 15. Awards[U/S 10(17 A)] • Awards received , whether in cash or](https://slidetodoc.com/presentation_image/0e7dad7028fd9686c23a1404d2aeadc7/image-13.jpg)

![18. Pension received by a person , Honored by a Gallantry Award U/S 10(18)] 18. Pension received by a person , Honored by a Gallantry Award U/S 10(18)]](https://slidetodoc.com/presentation_image/0e7dad7028fd9686c23a1404d2aeadc7/image-14.jpg)

![19. Clubbed Income of a Minor Child {U/S 10[32]} • In case of the 19. Clubbed Income of a Minor Child {U/S 10[32]} • In case of the](https://slidetodoc.com/presentation_image/0e7dad7028fd9686c23a1404d2aeadc7/image-15.jpg)

- Slides: 19

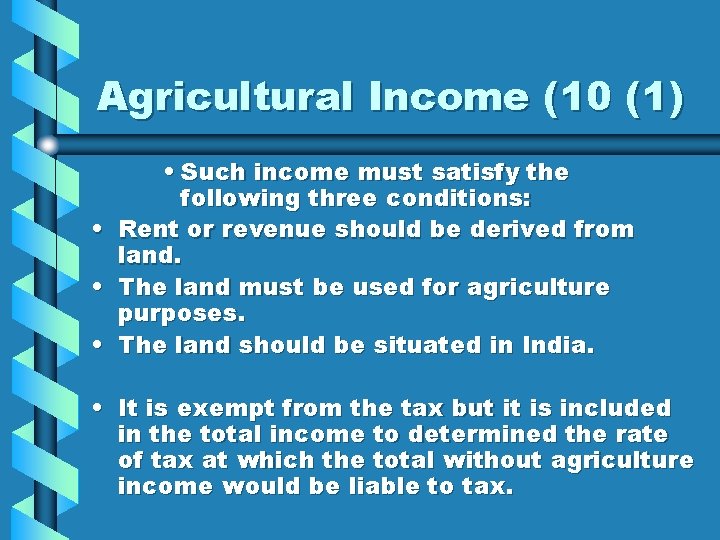

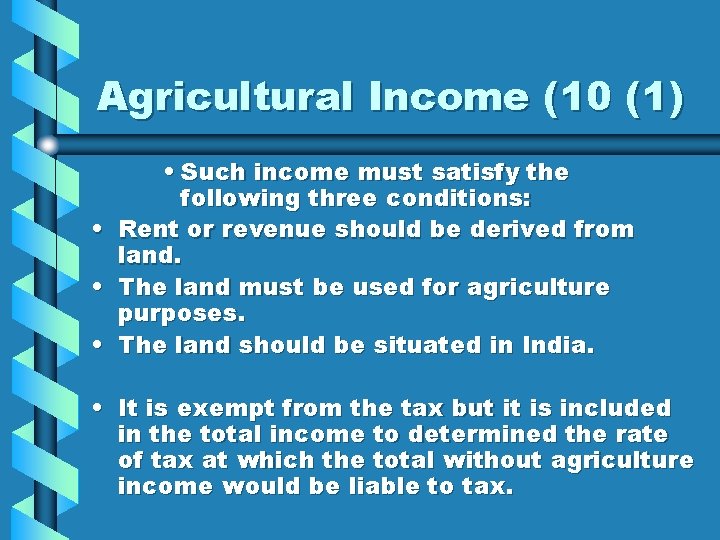

Income Exempt from Tax • Agricultural income ( U/S 10(1) ) – Agriculture income means any income derived from land which is used for agriculture purpose and which is assessed to land Revenue in India.

Agricultural Income (10 (1) • • Such income must satisfy the following three conditions: Rent or revenue should be derived from land. The land must be used for agriculture purposes. The land should be situated in India. • It is exempt from the tax but it is included in the total income to determined the rate of tax at which the total without agriculture income would be liable to tax.

2. Receipt from HUF (U/S 10(2) • Any sum received by an individual as a member of HUF out of the estate of income of the family is exempt from tax and not included in the total income of the individual. • The logic behind this is that HUF is already taxed on this income and hence no tax should be levied on distribution of the income of HUF.

![3 Partners share in the profit of the firm US 102 A In 3. Partner’s share in the profit of the firm: [U/S 10(2 A)] • In](https://slidetodoc.com/presentation_image/0e7dad7028fd9686c23a1404d2aeadc7/image-4.jpg)

3. Partner’s share in the profit of the firm: [U/S 10(2 A)] • In case of a person who is a partner of a firm which is separately assessed in that case the amount of this share in the profits of the firm ascertain as per the partnership deed is exempted from tax.

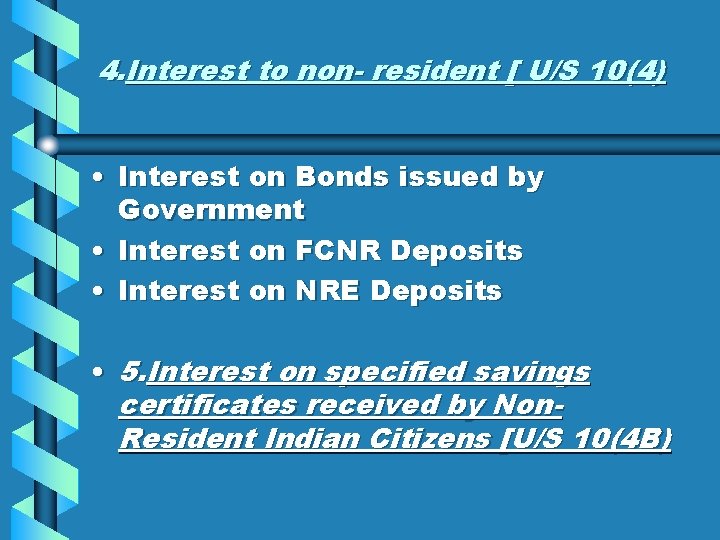

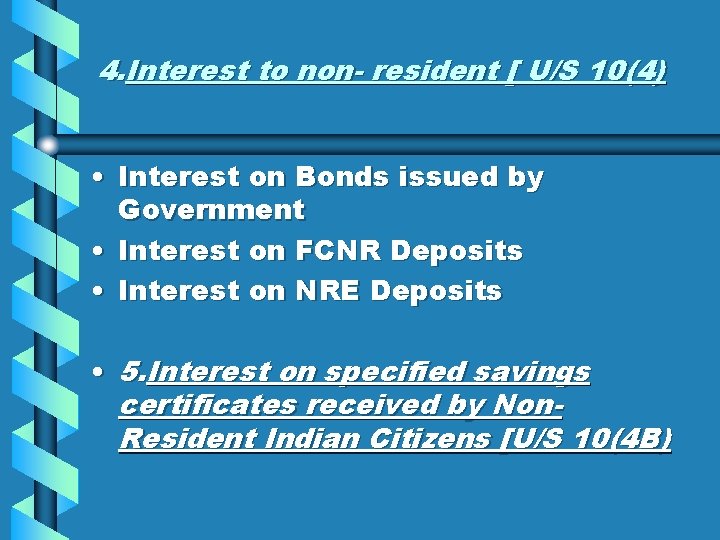

4. Interest to non- resident [ U/S 10(4) • Interest on Bonds issued by Government • Interest on FCNR Deposits • Interest on NRE Deposits • 5. Interest on specified savings certificates received by Non. Resident Indian Citizens [U/S 10(4 B)

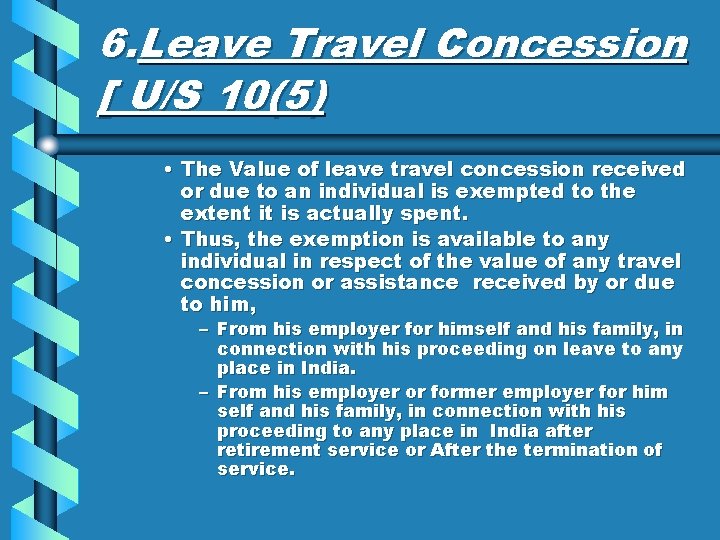

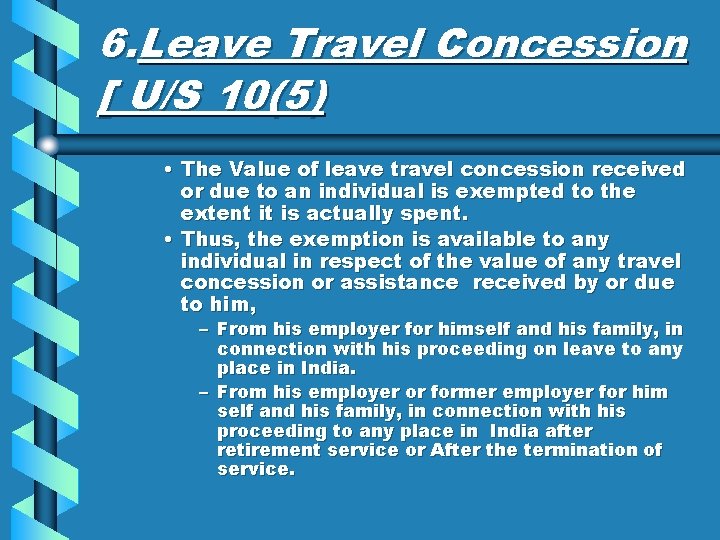

6. Leave Travel Concession [ U/S 10(5) • The Value of leave travel concession received or due to an individual is exempted to the extent it is actually spent. • Thus, the exemption is available to any individual in respect of the value of any travel concession or assistance received by or due to him, – From his employer for himself and his family, in connection with his proceeding on leave to any place in India. – From his employer or former employer for him self and his family, in connection with his proceeding to any place in India after retirement service or After the termination of service.

![7 Remuneration received by foreign Diplomat US 106ii The exemption from tax is 7. Remuneration received by foreign Diplomat [U/S 10(6)(ii)] • The exemption from tax is](https://slidetodoc.com/presentation_image/0e7dad7028fd9686c23a1404d2aeadc7/image-7.jpg)

7. Remuneration received by foreign Diplomat [U/S 10(6)(ii)] • The exemption from tax is available in the case of an individual who is not a citizen of India in respect of the remuneration received by him as an official by whatever name called, of an embassy, high commission, legation, commission, consulate or the trade representations of a foreign state, or as a member of the staff of any of these officials, for service in such capacity. • The exemption is given only to those officials of foreign country in which corresponding Indian officials enjoy a similar exemption.

![Foreign Allowances and perquisites to Government Employees outside India US 107 Subsection Foreign Allowances and perquisites to Government Employees outside India [U/S 10(7) ] • Sub-section](https://slidetodoc.com/presentation_image/0e7dad7028fd9686c23a1404d2aeadc7/image-8.jpg)

Foreign Allowances and perquisites to Government Employees outside India [U/S 10(7) ] • Sub-section (7) of section 10 states that any allowance or perquisites paid or allowed as such out side India by the Government to a citizen of India for rendering services outside India will be totally exempted from tax.

![LICPF Exemptions 8 Amount received in life insurance policy US 1010 D LIC/PF Exemptions • 8. Amount received in life insurance policy: [U/S 10(10 D)] •](https://slidetodoc.com/presentation_image/0e7dad7028fd9686c23a1404d2aeadc7/image-9.jpg)

LIC/PF Exemptions • 8. Amount received in life insurance policy: [U/S 10(10 D)] • Any sum received under a life insurance policy, including the sum allocated by way of bonus on such policy shall be totally exempt from tax. • 9. Payment from provident fund[ U/S 10(11) • Any payment from a provident fund to which the provident funds Act, 1925, applies or from any other provident fund set up by the central Government and notified in the official gazette (i. e. public provident fund)is totally exempted from tax.

![RPF 10 Accumulated balance from a recognized provident fundus 1012 The accumulated RPF • 10. Accumulated balance from a recognized provident fund[u/s 10(12)] • The accumulated](https://slidetodoc.com/presentation_image/0e7dad7028fd9686c23a1404d2aeadc7/image-10.jpg)

RPF • 10. Accumulated balance from a recognized provident fund[u/s 10(12)] • The accumulated balance due and becoming payable to an employee participating a recognized provident fund, to the extent provided in rule 8 of part A of schedule, is exempted from tax. • 11. Payment from an approved superannuating fund [ U/S 10(13)]

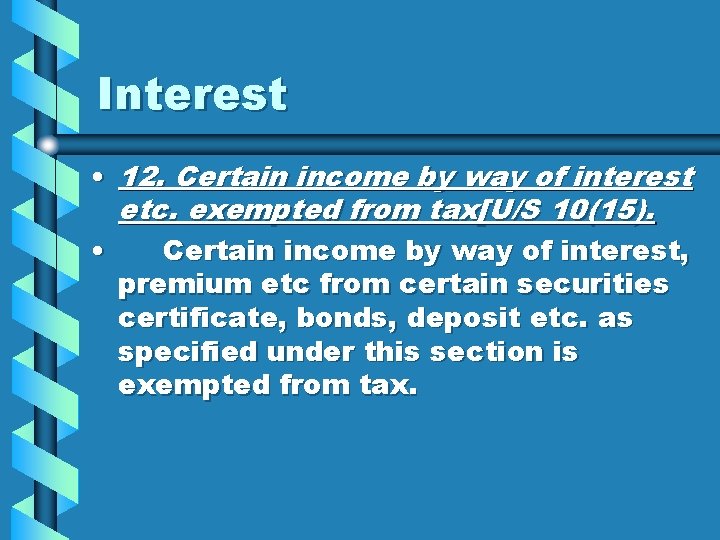

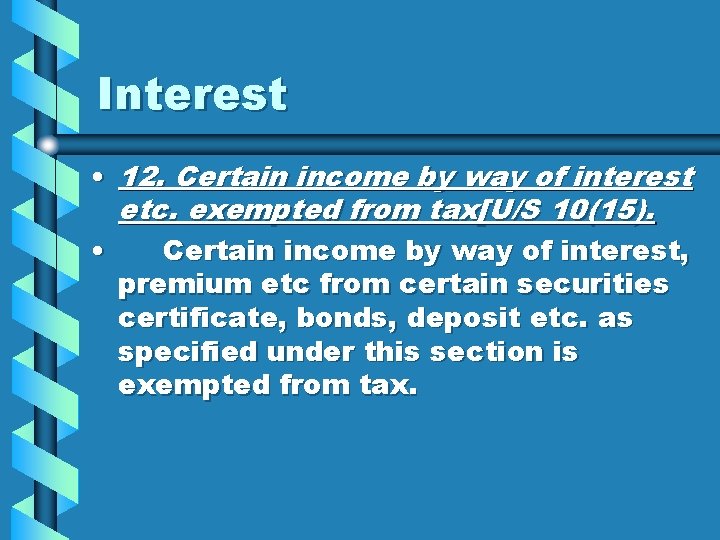

Interest • 12. Certain income by way of interest etc. exempted from tax[U/S 10(15). • Certain income by way of interest, premium etc from certain securities certificate, bonds, deposit etc. as specified under this section is exempted from tax.

![Scholarship MP Allowance 13 Scholarship US 1016 Scholarship granted to meet Scholarship/ MP Allowance • 13. Scholarship [ U/S 10(16)] • Scholarship granted to meet](https://slidetodoc.com/presentation_image/0e7dad7028fd9686c23a1404d2aeadc7/image-12.jpg)

Scholarship/ MP Allowance • 13. Scholarship [ U/S 10(16)] • Scholarship granted to meet the cost of education is totally exempt from tax and will not be included in the computation of income. • 14. Allowances received by the member of parliament or state legislature[U/S 10(17)

![Awards 15 AwardsUS 1017 A Awards received whether in cash or Awards • 15. Awards[U/S 10(17 A)] • Awards received , whether in cash or](https://slidetodoc.com/presentation_image/0e7dad7028fd9686c23a1404d2aeadc7/image-13.jpg)

Awards • 15. Awards[U/S 10(17 A)] • Awards received , whether in cash or kind, as stated below shall be exempted from tax as per sub section 17 A of section 10 • 16. Family pension received by the family member of armed forces[ U/S 10(19)] • Family pension received by the widow or children or nominated heirs, of a member of armed forces including parliament forces of the union , where the said member dies in the course of operation duties shall be exempted from tax. • 17. Annual value of one palace of a ruler[ U/S 10(19 A)]

![18 Pension received by a person Honored by a Gallantry Award US 1018 18. Pension received by a person , Honored by a Gallantry Award U/S 10(18)]](https://slidetodoc.com/presentation_image/0e7dad7028fd9686c23a1404d2aeadc7/image-14.jpg)

18. Pension received by a person , Honored by a Gallantry Award U/S 10(18)] • This clause provides exemption for any income by way of : • a) Pension received by an individual who has been in service of central or state Gov. and has been awarded, ”Parama Vir Chakra)””Maha Vir Chakra” or Vir Chakra • b) Family pension received by any member of the family in case of death of the awards. •

![19 Clubbed Income of a Minor Child US 1032 In case of the 19. Clubbed Income of a Minor Child {U/S 10[32]} • In case of the](https://slidetodoc.com/presentation_image/0e7dad7028fd9686c23a1404d2aeadc7/image-15.jpg)

19. Clubbed Income of a Minor Child {U/S 10[32]} • In case of the income of a minor child clubbed with that of the parent U/S 64(1 A), such income is exempted from tax upto Rs. 1500/- in respect of each minor child whose income is clubbed.

20. Income arising from Transfer of Units, 1964 {U/S 10(33)} • Any income arising from transfer of capital asset being a unit of Unit Scheme, 1964 and where the transfer of such an asset takes place on or after 1 st April 2002, it shall be exempt from tax

21. Income by way of Dividend {U/S 10(34)} • Income by way of dividend as referred in section 115 -0 is exempted from tax in the hands of the shareholders. Section 115 -0 provides that every domestic company declaring dividend (including interim dividend) shall pay the tax on dividend. In view of this, tax being levied on a company on distributed profits, the dividend income in the hands of the shareholders will now be exempt from tax u/s 10(34).

• 22. Income from Mutual Fund etc. {U/S 10(35)} •

• 23 Capital Gain on compensation received on compulsory acquisition of Agricultural Land in certain urban Areas {U/S 10(37)} • • 24. Long Term capital gains or Transfer of Equity Shares in a Company or Units of an Equity oriented fund {u/S 10(38)}

Gsa tax exempt map

Gsa tax exempt map E595 tax exempt form

E595 tax exempt form Are local governments tax exempt

Are local governments tax exempt Are city governments tax exempt

Are city governments tax exempt Non assessable income

Non assessable income Ralphs annual income is about $32 000

Ralphs annual income is about $32 000 Gst conclusion

Gst conclusion Exempt and complying development code

Exempt and complying development code Transaction deemed sale example

Transaction deemed sale example What is mean by virgin

What is mean by virgin Michigan historic preservation tax credit

Michigan historic preservation tax credit Historic tax credits 101

Historic tax credits 101 The plaza apartments toledo ohio

The plaza apartments toledo ohio Combining new markets and historic tax credits

Combining new markets and historic tax credits New market tax credits 101

New market tax credits 101 Income tax in russia

Income tax in russia Form 35 income tax

Form 35 income tax Income tax expense

Income tax expense Perquisites in income tax

Perquisites in income tax What is mcit in taxation

What is mcit in taxation