Economics of Forestland Use and EvenAged Rotations Land

- Slides: 27

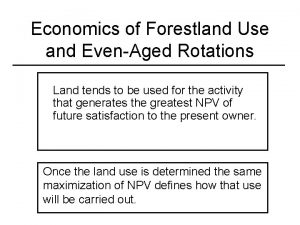

Economics of Forestland Use and Even-Aged Rotations Land tends to be used for the activity that generates the greatest NPV of future satisfaction to the present owner. Once the land use is determined the same maximization of NPV defines how that use will be carried out.

Stand Level Decisions • Assumptions – Competitive market conditions • Landowners are price takers – Non-monetary values ignored – All cash flows and interest rates are real – Taxes “ignored” • Assume cash flows are after taxes, or • Assume public agency context – Cash flows are “expected values” – Discount rate may also need to be increased to account for increased level of risk

Expected Value • Way to account for the risk associated with an investment • Weighted average outcome – Weights are probabilities of possible outcomes – Example • 80% of time investment expected to yield $1, 000 • 20% of time investment expected to yield $500 • Expected value is, 0. 80 x $1, 000 + 0. 20 x $500 = $900

Land Use In An Unregulated Market - land will be purchased by highest bidder • Example – rural tract of cutover timberland of all one site quality, – not suitable for agriculture because of slope and soil type, – three basic land uses are possible • Even-aged sawtimber production • Even-aged pulpwood production • Grazing

Land Use In An Unregulated Market - land will be purchased by highest bidder • Example – Potential buyers will • project their expected cost and revenue stream from the tract • Estimate a WPL∞ (SEV) using their minimum acceptable rate of return (MAR)

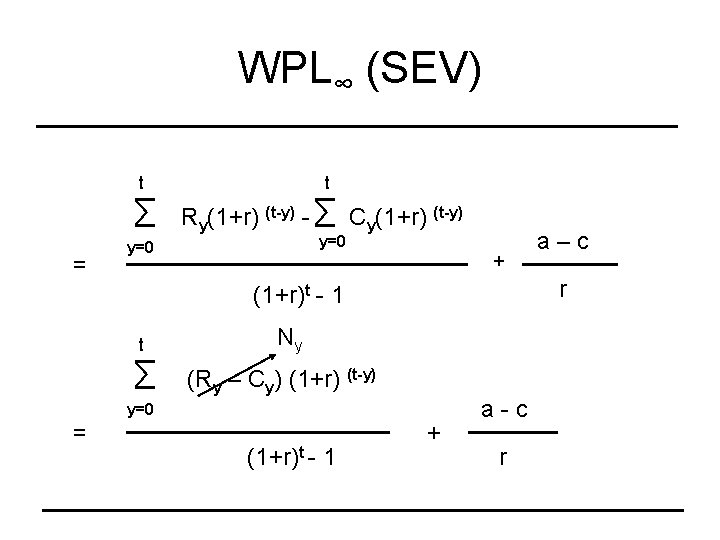

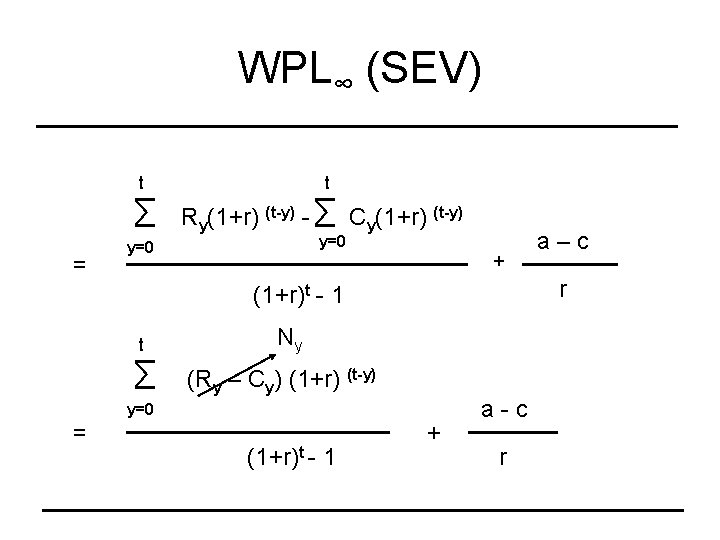

WPL∞ (SEV) t ∑ = t Ry(1+r) (t-y) - ∑ Cy(1+r) (t-y) y=0 + r (1+r)t - 1 t ∑ Ny (Ry – Cy) (1+r) (t-y) y=0 = (1+r)t - 1 a–c + a-c r

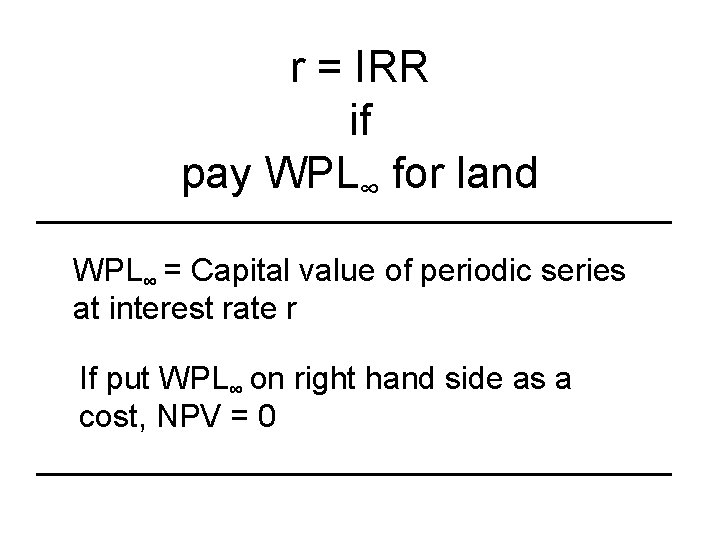

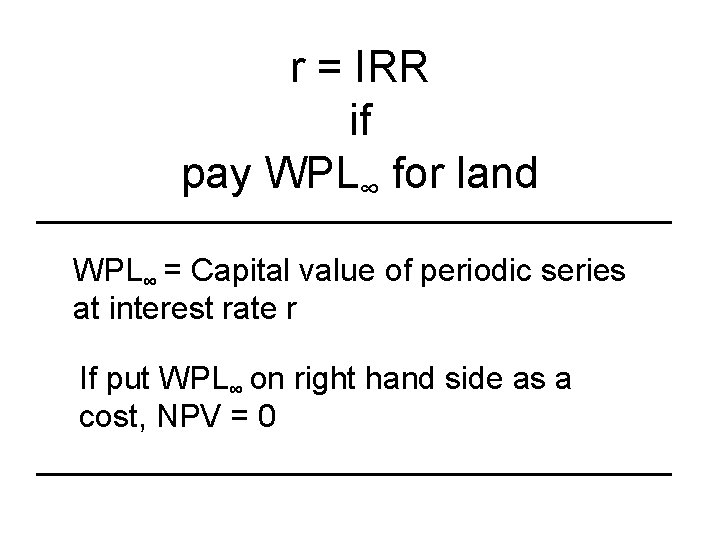

r = IRR if pay WPL∞ for land WPL∞ = Capital value of periodic series at interest rate r If put WPL∞ on right hand side as a cost, NPV = 0

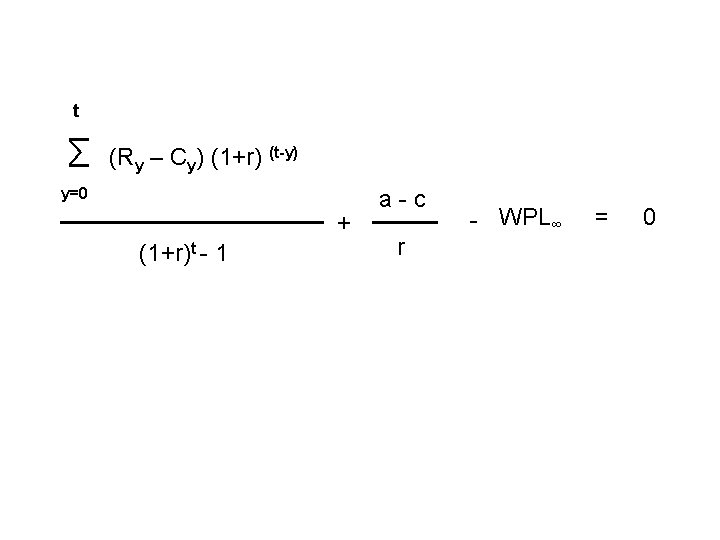

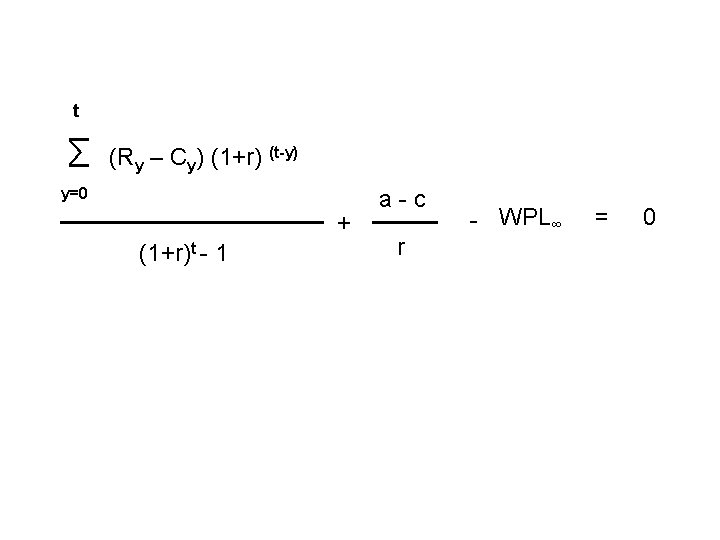

t ∑ (Ry – Cy) (1+r) (t-y) y=0 + (1+r)t - 1 a-c r - WPL∞ = 0

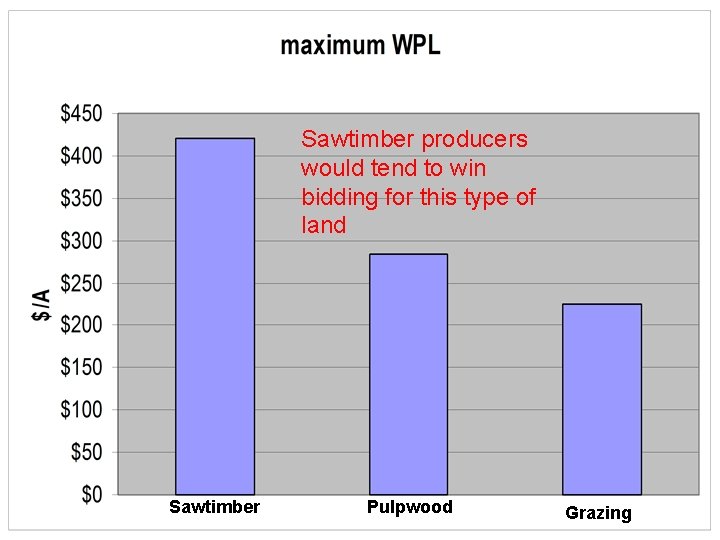

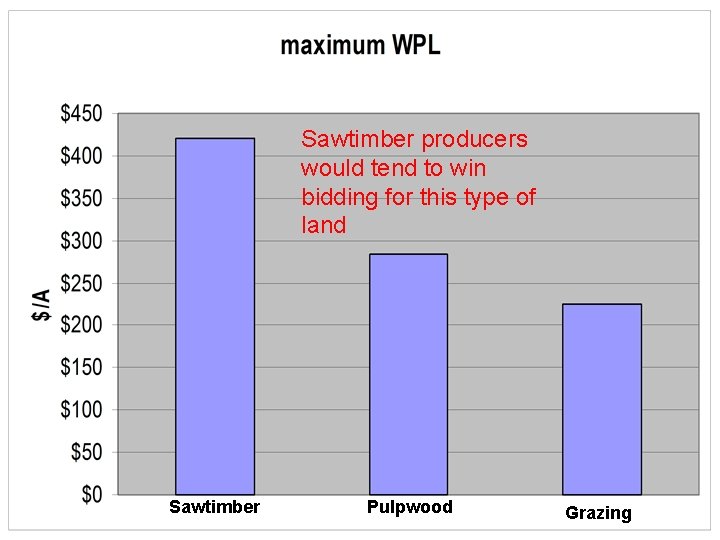

Compare WPL • Even-aged sawtimber • Pulpwood rotation • Grazing

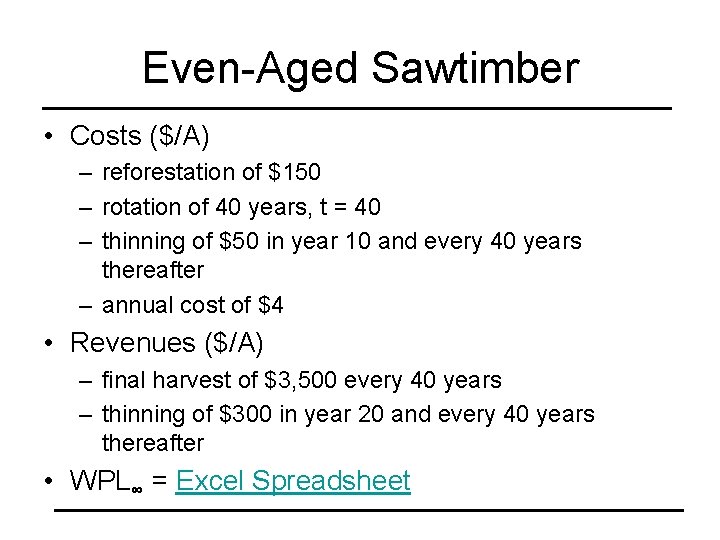

Even-Aged Sawtimber • Costs ($/A) – reforestation of $150 – rotation of 40 years, t = 40 – thinning of $50 in year 10 and every 40 years thereafter – annual cost of $4 • Revenues ($/A) – final harvest of $3, 500 every 40 years – thinning of $300 in year 20 and every 40 years thereafter • WPL∞ = Excel Spreadsheet

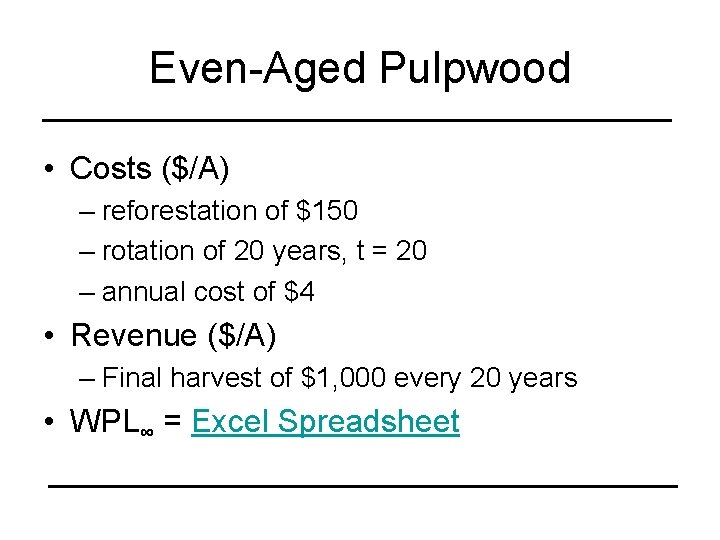

Even-Aged Pulpwood • Costs ($/A) – reforestation of $150 – rotation of 20 years, t = 20 – annual cost of $4 • Revenue ($/A) – Final harvest of $1, 000 every 20 years • WPL∞ = Excel Spreadsheet

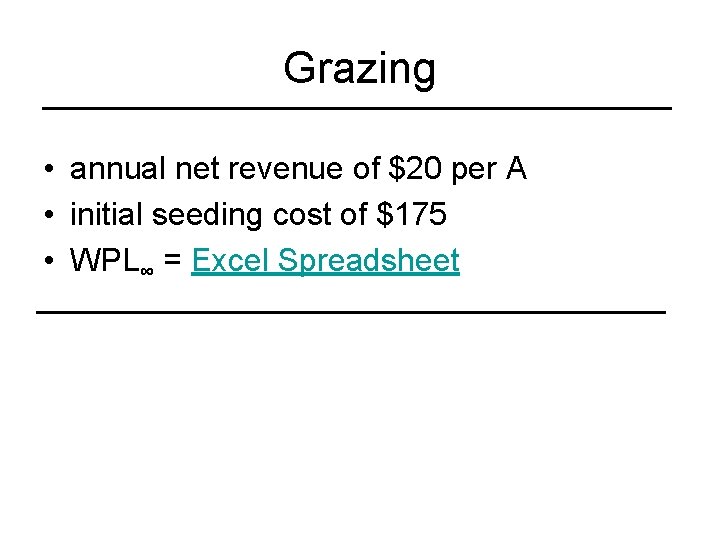

Grazing • annual net revenue of $20 per A • initial seeding cost of $175 • WPL∞ = Excel Spreadsheet

Sawtimber producers would tend to win bidding for this type of land Sawtimber Pulpwood Grazing

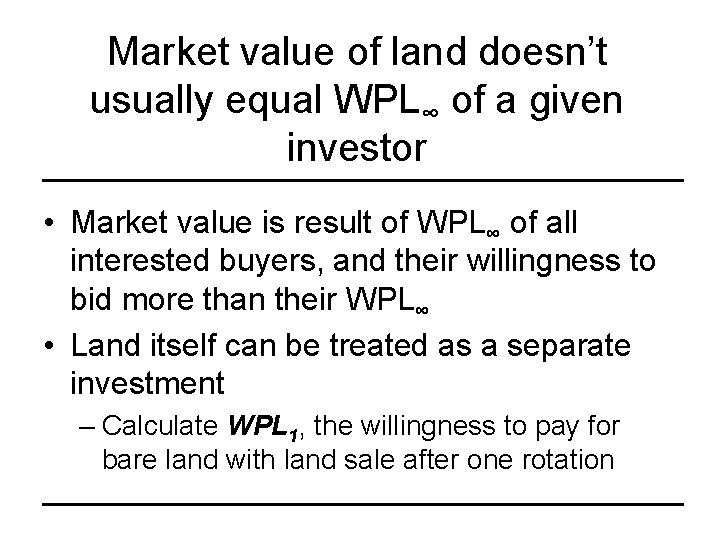

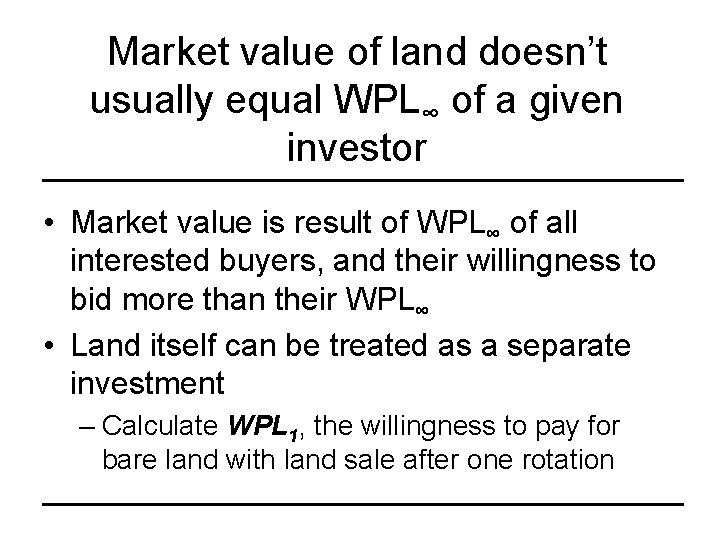

Market value of land doesn’t usually equal WPL∞ of a given investor • Market value is result of WPL∞ of all interested buyers, and their willingness to bid more than their WPL∞ • Land itself can be treated as a separate investment – Calculate WPL 1, the willingness to pay for bare land with land sale after one rotation

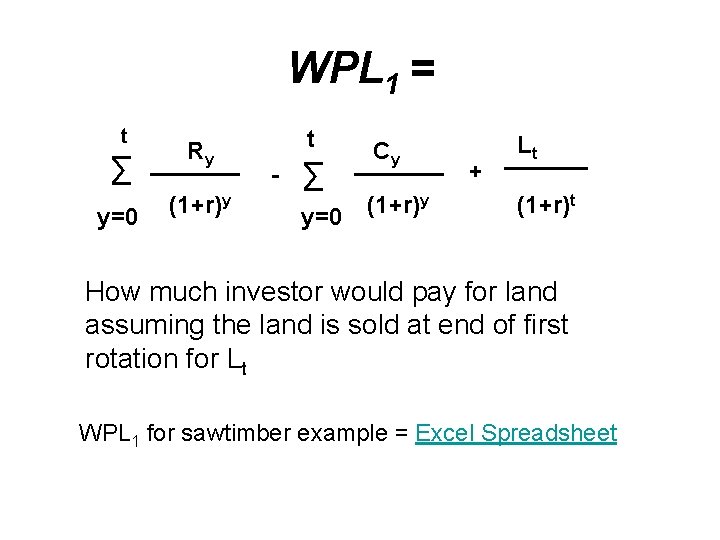

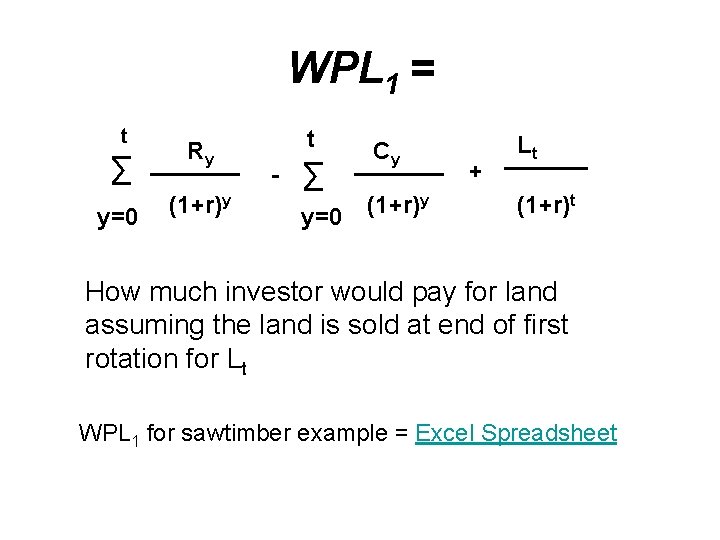

WPL 1 = t ∑ y=0 Ry (1+r)y t - ∑ y=0 Cy (1+r)y + Lt (1+r)t How much investor would pay for land assuming the land is sold at end of first rotation for Lt WPL 1 for sawtimber example = Excel Spreadsheet

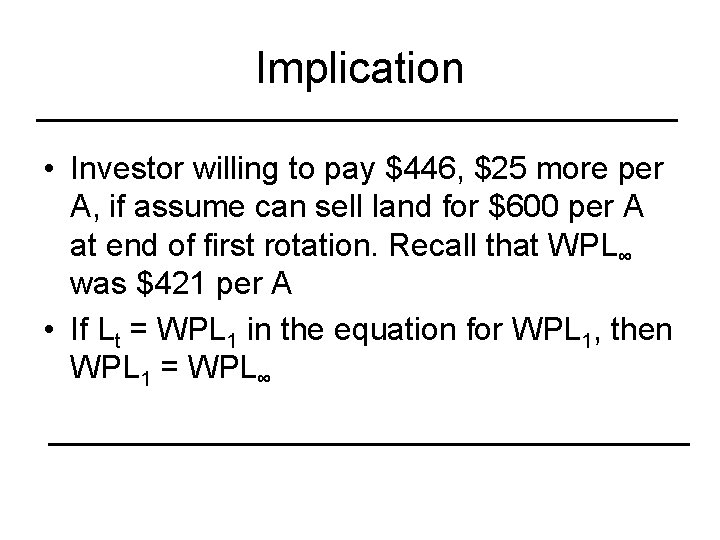

Implication • Investor willing to pay $446, $25 more per A, if assume can sell land for $600 per A at end of first rotation. Recall that WPL∞ was $421 per A • If Lt = WPL 1 in the equation for WPL 1, then WPL 1 = WPL∞

Sensitivity Analyses • Recalculate WPL with different assumptions about important variables – MAR – Productivity – Product prices – Increases in annual costs – etc.

Market Allocation of Land Uses • Theoretically yields private optimum land use pattern • Social optimum may be different • How does government try to get closer to social optimum? – Planning and Zoning – Purchase of private land for public uses – Conservation easements

Capital Performance Indicators • Assessment of the return your capital is earning, e. g. – General measure, • ROI, return on investment, • IRR is a ROI measure – Measure for stock • Price-Earnings ratio (P/E) – Measure for bonds • Yield

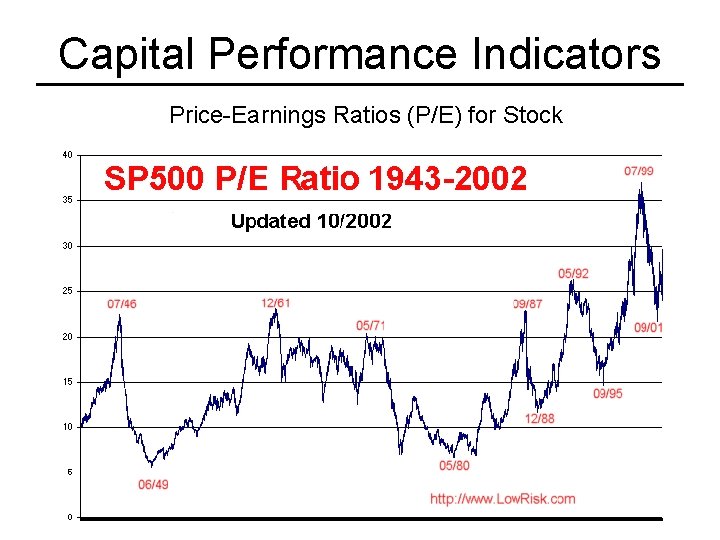

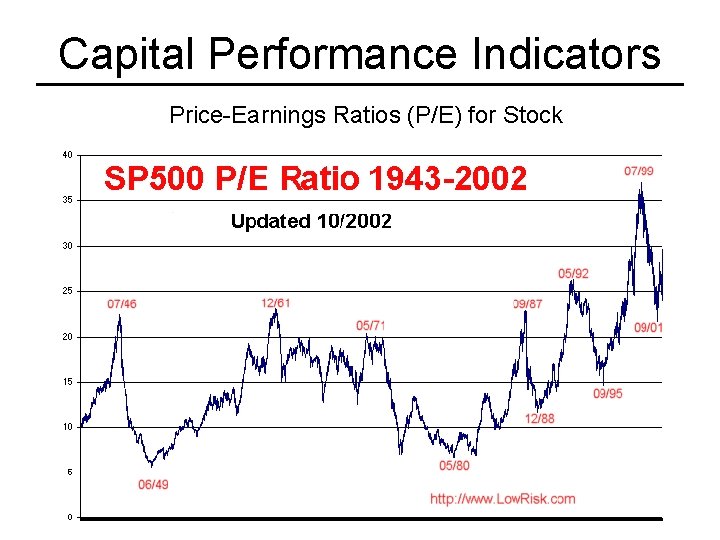

Capital Performance Indicators Price-Earnings Ratios (P/E) for Stock

Capital Performance Indicators • Measures forest-related investments – Overall measure • IRR – Individual tree • Financial maturity – Forest • Forest value growth % forest

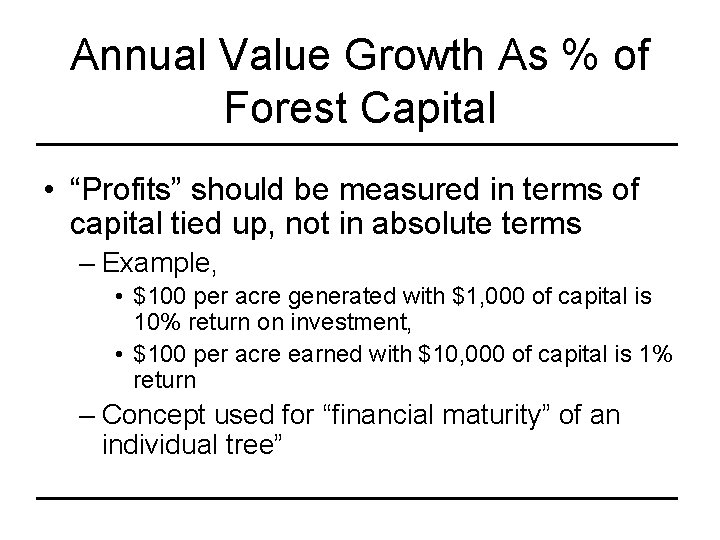

Annual Value Growth As % of Forest Capital • “Profits” should be measured in terms of capital tied up, not in absolute terms – Example, • $100 per acre generated with $1, 000 of capital is 10% return on investment, • $100 per acre earned with $10, 000 of capital is 1% return – Concept used for “financial maturity” of an individual tree”

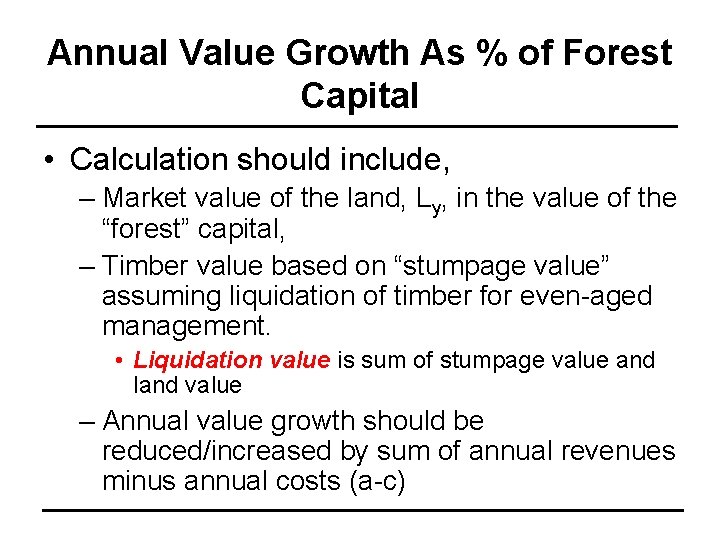

Annual Value Growth As % of Forest Capital • Calculation should include, – Market value of the land, Ly, in the value of the “forest” capital, – Timber value based on “stumpage value” assuming liquidation of timber for even-aged management. • Liquidation value is sum of stumpage value and land value – Annual value growth should be reduced/increased by sum of annual revenues minus annual costs (a-c)

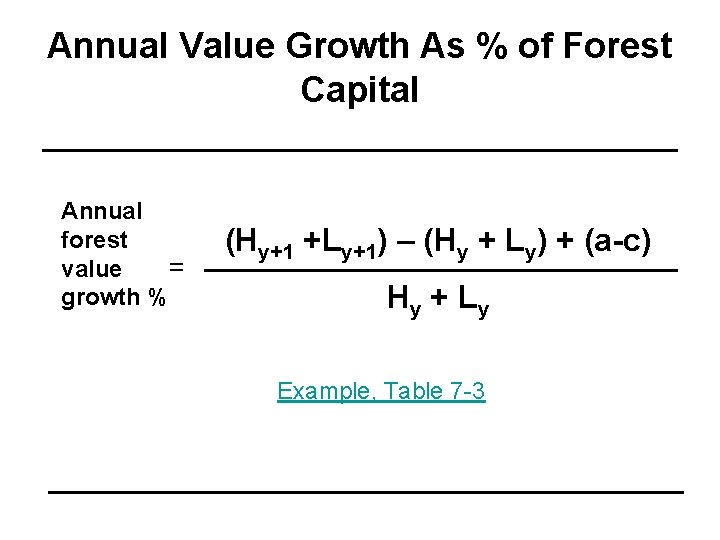

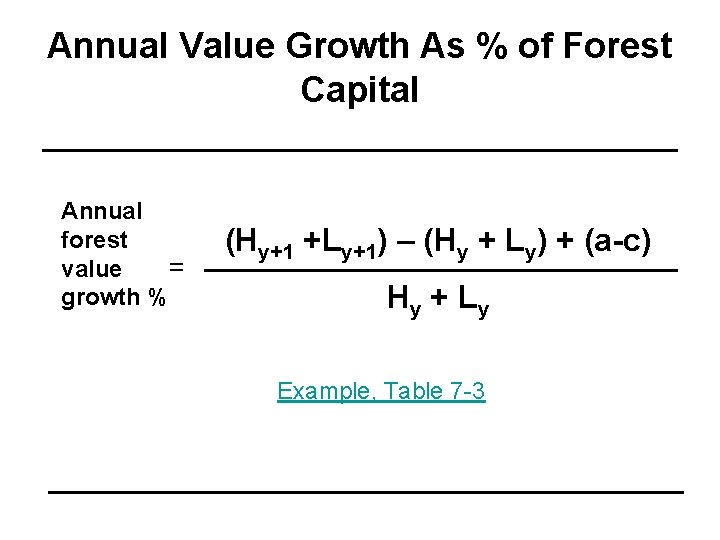

Annual Value Growth As % of Forest Capital Annual forest value = growth % (Hy+1 +Ly+1) – (Hy + Ly) + (a-c) Hy + L y Example, Table 7 -3

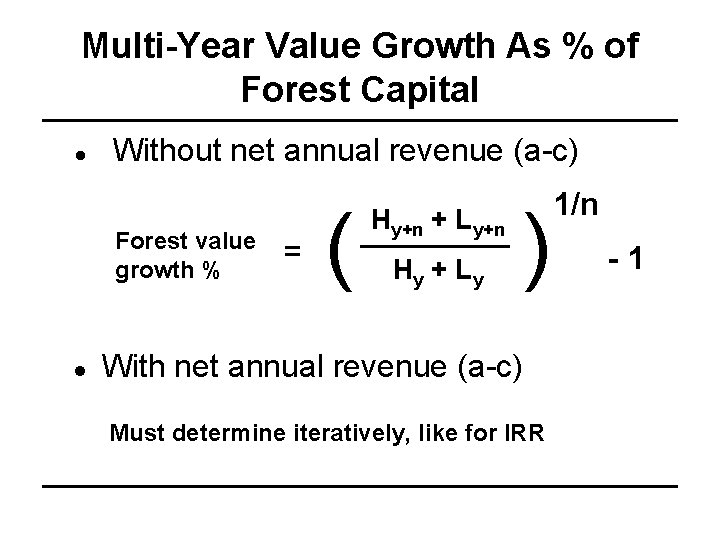

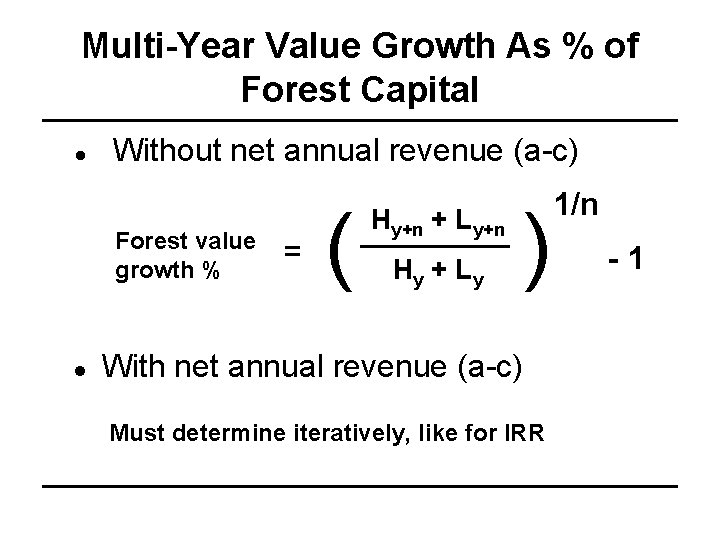

Multi-Year Value Growth As % of Forest Capital Without net annual revenue (a-c) Forest value growth % = ( Hy+n + Ly+n Hy + L y ) With net annual revenue (a-c) Must determine iteratively, like for IRR 1/n -1

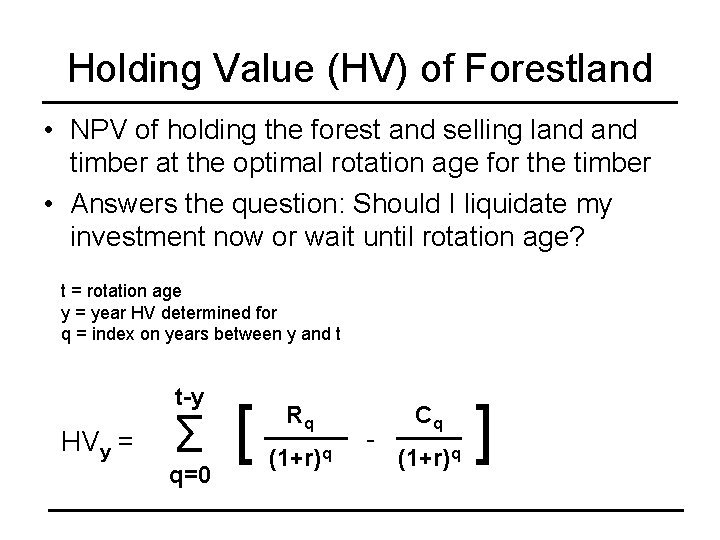

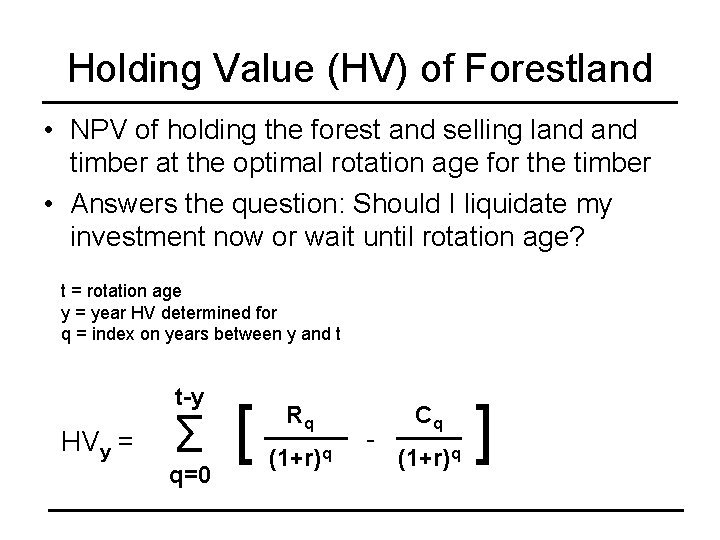

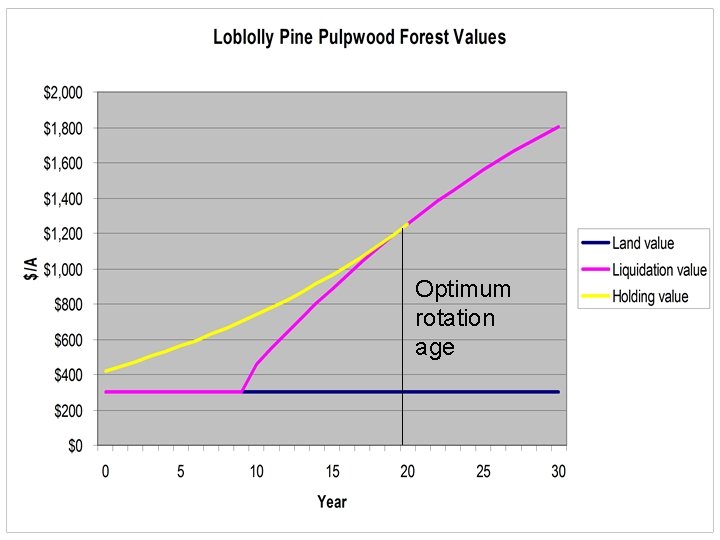

Holding Value (HV) of Forestland • NPV of holding the forest and selling land timber at the optimal rotation age for the timber • Answers the question: Should I liquidate my investment now or wait until rotation age? t = rotation age y = year HV determined for q = index on years between y and t t-y HVy = ∑ q=0 [ Rq (1+r)q - Cq (1+r)q ]

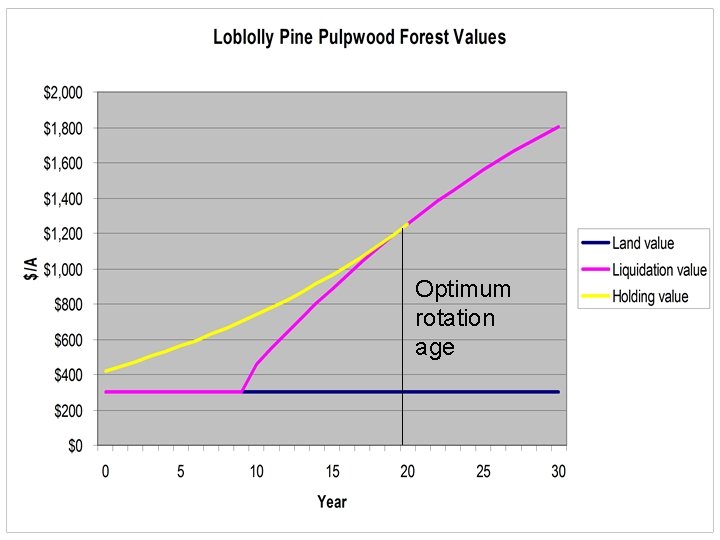

Optimum rotation age

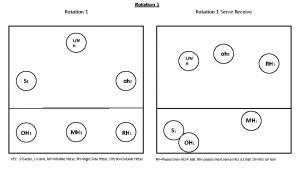

The forestland group

The forestland group 5-1 volleyball rotation serve receive

5-1 volleyball rotation serve receive Translations reflections and rotations

Translations reflections and rotations Rotation reflection translation dilation

Rotation reflection translation dilation Translations and reflections

Translations and reflections Translations reflections and rotations

Translations reflections and rotations What transformation can verify congruence

What transformation can verify congruence Dilations translations rotations and reflections

Dilations translations rotations and reflections Trig identities from reflections and rotations

Trig identities from reflections and rotations Reflectio

Reflectio Medical terminology lesson 6

Medical terminology lesson 6 School of business and economics maastricht

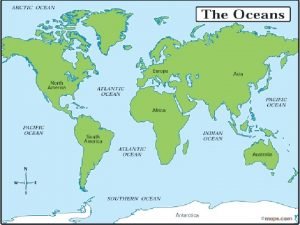

School of business and economics maastricht What are landforms

What are landforms Grassland landforms

Grassland landforms Land economics lecture notes

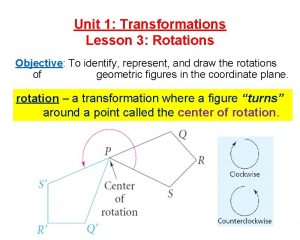

Land economics lecture notes Lesson 3 rotations

Lesson 3 rotations Rotations on the coordinate plane

Rotations on the coordinate plane Clockwise rotation

Clockwise rotation Rules for rotations

Rules for rotations Zones in volleyball court

Zones in volleyball court 9.3 rotations

9.3 rotations Lesson 3 rotations answer key

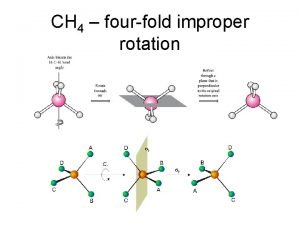

Lesson 3 rotations answer key Ih point group

Ih point group 9-3 rotations

9-3 rotations Permutation volleyball

Permutation volleyball Rotation and revolution of earth

Rotation and revolution of earth Volleyball rotations 6-2

Volleyball rotations 6-2 Winkelgeschwindigkeit sekundenzeiger

Winkelgeschwindigkeit sekundenzeiger