Componential analysis applied to terminology Life insurance Terminology

- Slides: 33

Componential analysis applied to terminology Life insurance

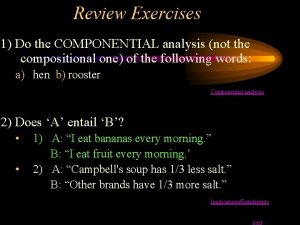

Terminology method componential analysis • a method of semantic analysis • modelled on phonology – isolating the smallest units • phonology : the phoneme (or phonetic feature) • semantics : the seme (or semantic feature) pioneered by POTTIER B. (1992), Sémantique générale. PUF

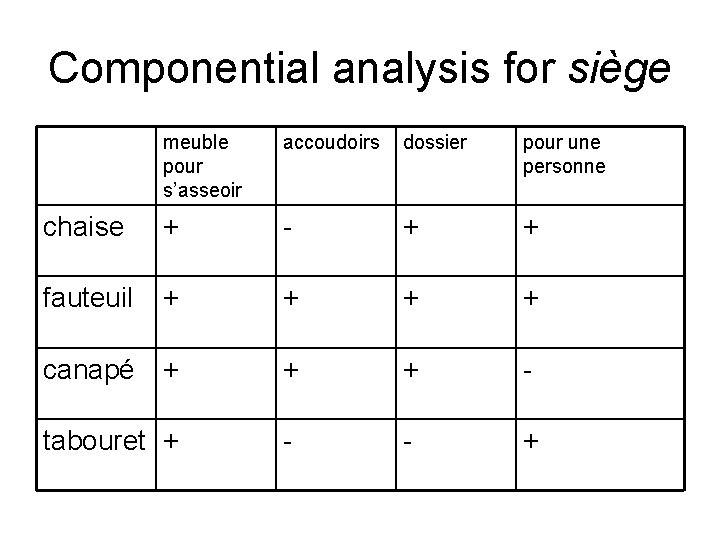

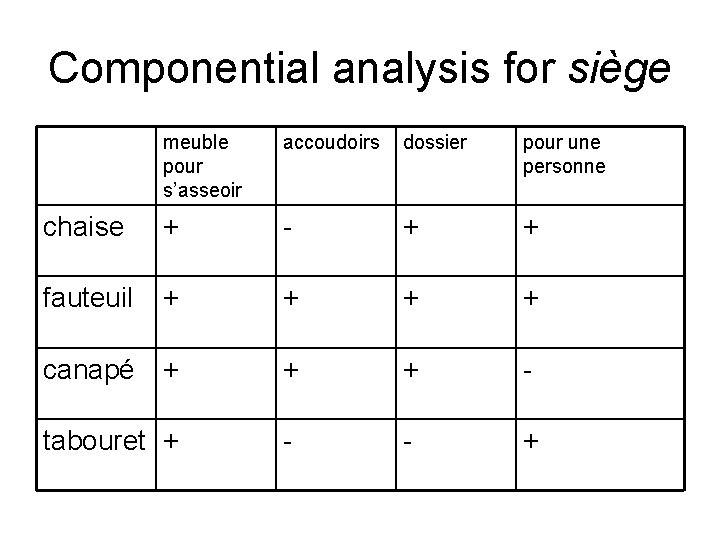

Componential analysis for siège meuble pour s’asseoir accoudoirs dossier pour une personne chaise + - + + fauteuil + + canapé + + + - tabouret + - - +

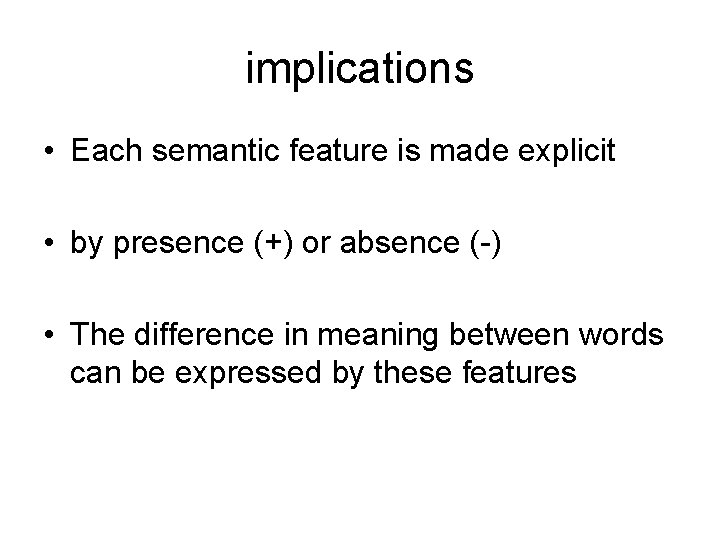

implications • Each semantic feature is made explicit • by presence (+) or absence (-) • The difference in meaning between words can be expressed by these features

thus • Chair is a piece of furniture to sit on [the shared feature for all the words in the group] with a back, without arms and for one person [distinctive features] • Stool is a piece of furniture to sit on without a back or arms for one person etc…

Problems? • language specific – can chairs have arms in English? • only works for certain semantic fields – footware, means of transport, etc. • therefore not a very comprehensive method of semantic analysis • but particularly appropriate for regulated fields (i. e. certain terminologies)

Using componential analysis for terminology • Certain fields of terminology can be adequatedly analysed using componential analysis – Manufactured items – Tertiary fields where categories are often implicit • such as insurance

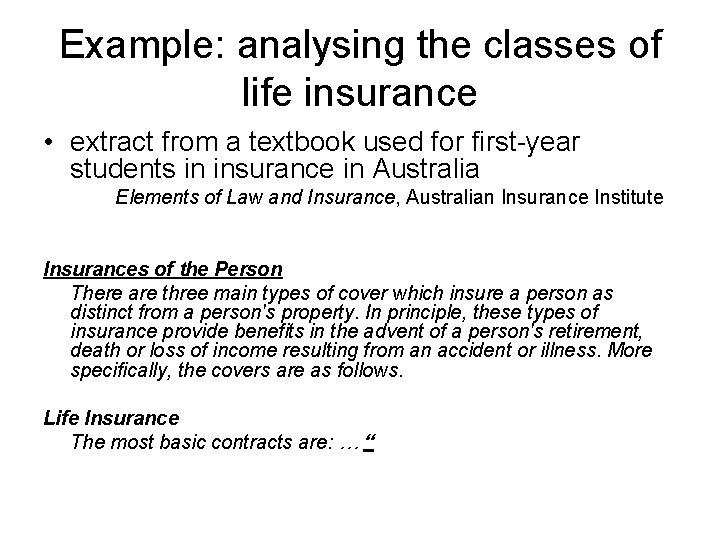

Example: analysing the classes of life insurance • extract from a textbook used for first-year students in insurance in Australia Elements of Law and Insurance, Australian Insurance Institute Insurances of the Person There are three main types of cover which insure a person as distinct from a person's property. In principle, these types of insurance provide benefits in the advent of a person's retirement, death or loss of income resulting from an accident or illness. More specifically, the covers are as follows. Life Insurance The most basic contracts are: … “

Whole of life insurance • The policy benefits of whole of life insurance are payable on the death of the life insured whenever this occurs. Premiums are payable for the entire life or, upon payment of an extra premium. Premiums may cease at say 60 or 65 years, the age of retirement [sic].

Endowment insurance • This is a combination of term insurance and pure endowment, the policy proceeds being payable upon the death of the life insured within the specified period, or at the end of that period, say ten, 15, 20, 25 or 30 years, if the life insured survives until the end of the period.

Pure endowment insurance • This is the same as endowment insurance except that no death cover is provided. In the event of the death of the person insured before the policy term expires there is usually a refund of premiums with interest. This cover is normally used for people who are not medically acceptable for a cover which includes death.

Term insurance • Under a term insurance policy the benefits are payable upon the death of the life insured, provided that death occurs within a specified period. If the life insured survives to the end of the period the cover ceases and no benefits are payable.

Confused…? • Each definition is drafted differently • Understanding one definition may depend on having understood the others • Which information is necessary to understand the difference between the four sorts of life insurance listed? • Which can be considered ‘background’ information?

Solution ? • Componential analysis is your friend! – Extract each feature from the definitions – Find the common feature (which will be the hyperonym) – Find all the other features – Determine by comparison which are defining features and which are redundant.

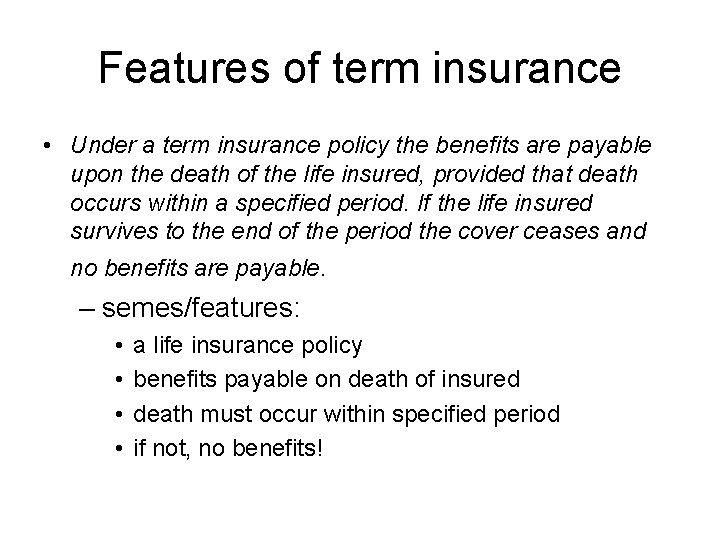

Features of term insurance • Under a term insurance policy the benefits are payable upon the death of the life insured, provided that death occurs within a specified period. If the life insured survives to the end of the period the cover ceases and no benefits are payable. – semes/features: • • a life insurance policy benefits payable on death of insured death must occur within specified period if not, no benefits!

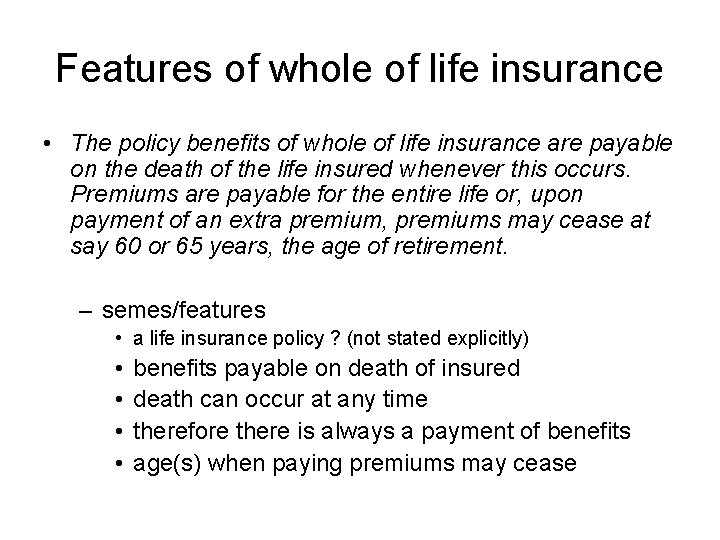

Features of whole of life insurance • The policy benefits of whole of life insurance are payable on the death of the life insured whenever this occurs. Premiums are payable for the entire life or, upon payment of an extra premium, premiums may cease at say 60 or 65 years, the age of retirement. – semes/features • a life insurance policy ? (not stated explicitly) • • benefits payable on death of insured death can occur at any time therefore there is always a payment of benefits age(s) when paying premiums may cease

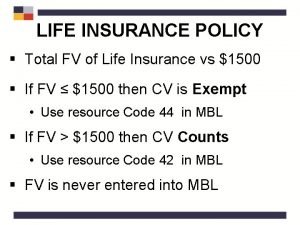

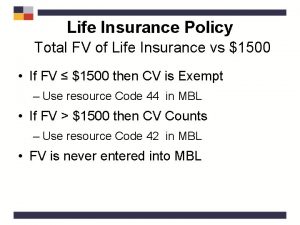

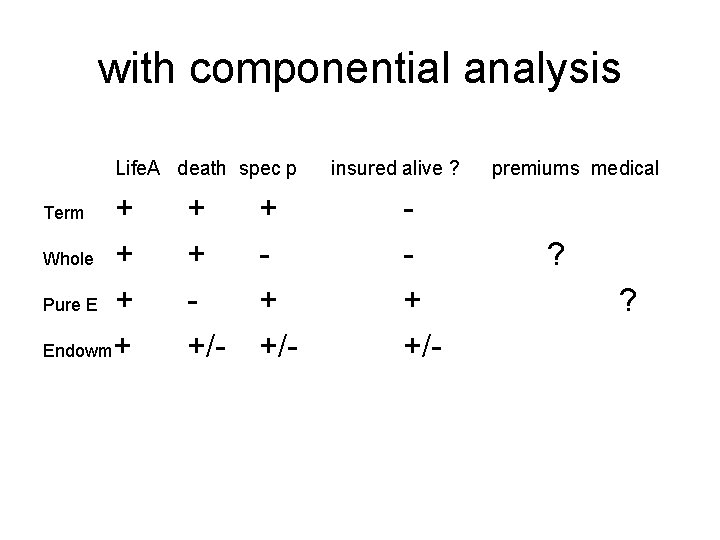

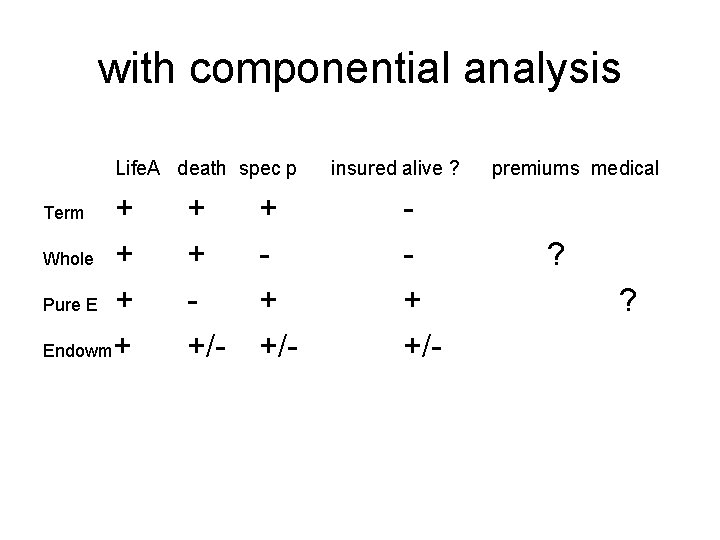

with componential analysis Life. A death spec p + Whole + Pure E + Endowm+ Term + + +/- insured alive ? + +/- premiums medical ? ?

Definitions derived from the table • Term insurance – life insurance (policy) which pays benefits on the death of the insured within a specified period

endowment • life insurance which pays benefits if the assured dies within a set period or at the end of the same period if the insured is still alive

pure endowment • life insurance which provides benefits at the end of a specified period, provided the insured is still alive

whole of life • life insurance (policy) which pays benefits on the death of the insured, whenever this occurs

Componential analysis • helps us to – understand the relations between concepts – identify additional information necessary to distinguish concepts – draft immediately comparable definitions – identify other features which may be relevant in other contexts • Eg. how and when premiums are paid for whole of life insurance

The study of meaning in language

The study of meaning in language Disadvantages of componential analysis

Disadvantages of componential analysis Componential analysis

Componential analysis Componential definition

Componential definition Elements of fire insurance contract

Elements of fire insurance contract Practical applications of polynomials in real-life

Practical applications of polynomials in real-life Time series analysis

Time series analysis Dimensions of behavior altering effects are:

Dimensions of behavior altering effects are: Applied conjoint analysis

Applied conjoint analysis Ethical issues in applied behavior analysis

Ethical issues in applied behavior analysis Applied behavior analysis cooper heron heward

Applied behavior analysis cooper heron heward Business management courses winnipeg

Business management courses winnipeg R for gis

R for gis Teori perilaku abc

Teori perilaku abc International institute for applied system analysis

International institute for applied system analysis Content and discourse analysis

Content and discourse analysis Applied conjoint analysis

Applied conjoint analysis Ricb life insurance

Ricb life insurance Desjardins life insurance

Desjardins life insurance Gcu initial deposit

Gcu initial deposit Life insurance customer journey map

Life insurance customer journey map Climbs life and general insurance cooperative

Climbs life and general insurance cooperative Claim life cycle

Claim life cycle Chapter 14 health disability and life insurance

Chapter 14 health disability and life insurance Icuba benefits

Icuba benefits Bmo insurance auto

Bmo insurance auto Life insurance review letter

Life insurance review letter Www.cfglife.com

Www.cfglife.com Chapter 10 financial planning with life insurance

Chapter 10 financial planning with life insurance Byu student alumni

Byu student alumni State life insurance table 03

State life insurance table 03 Life insurance contractual provisions

Life insurance contractual provisions Ethos life insurance bbb

Ethos life insurance bbb State life bonus rate 2020

State life bonus rate 2020