Chapter 13 Appendix Calculation of Life Insurance Premiums

- Slides: 14

Chapter 13 Appendix Calculation of Life Insurance Premiums Copyright © 2008 Pearson Addison-Wesley. All rights reserved.

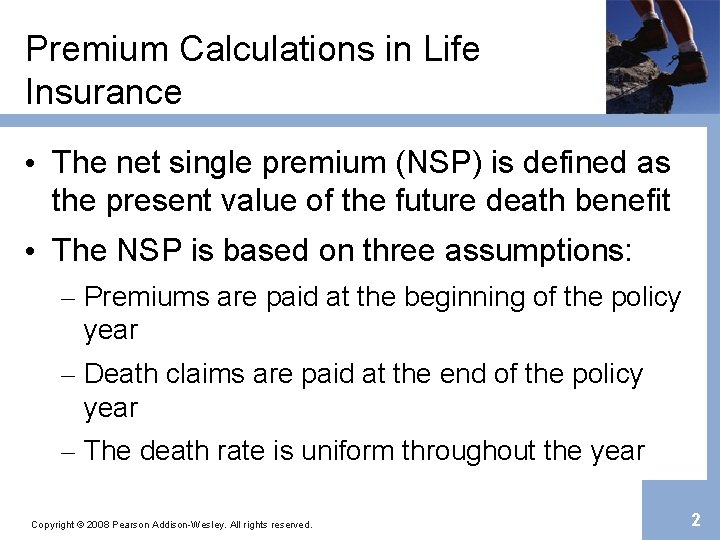

Premium Calculations in Life Insurance • The net single premium (NSP) is defined as the present value of the future death benefit • The NSP is based on three assumptions: – Premiums are paid at the beginning of the policy year – Death claims are paid at the end of the policy year – The death rate is uniform throughout the year Copyright © 2008 Pearson Addison-Wesley. All rights reserved. 2

Calculating the Net Single Premium for Term Insurance • For yearly renewable term insurance, the cost of each year’s insurance is easily determined: Copyright © 2008 Pearson Addison-Wesley. All rights reserved. 3

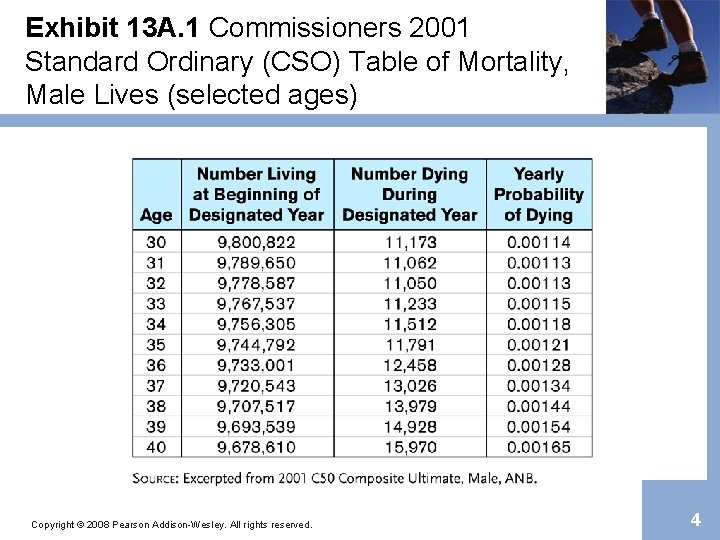

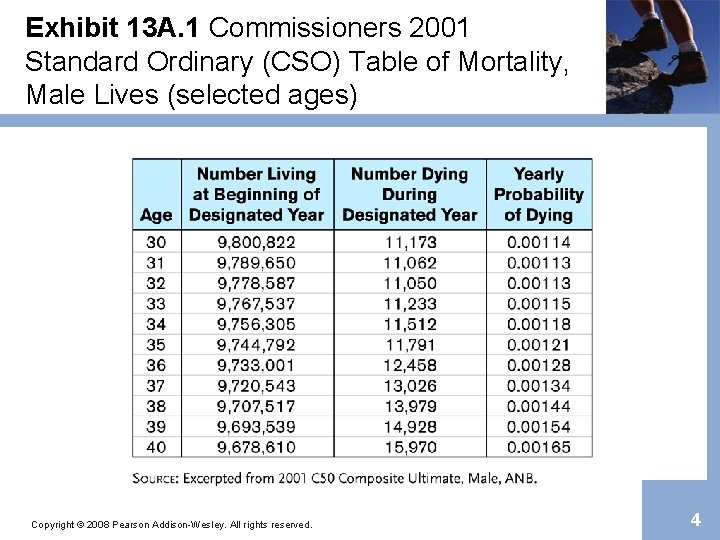

Exhibit 13 A. 1 Commissioners 2001 Standard Ordinary (CSO) Table of Mortality, Male Lives (selected ages) Copyright © 2008 Pearson Addison-Wesley. All rights reserved. 4

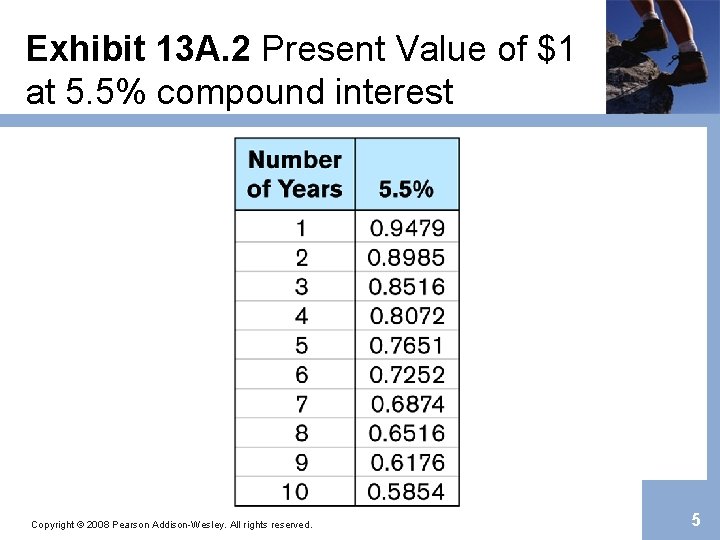

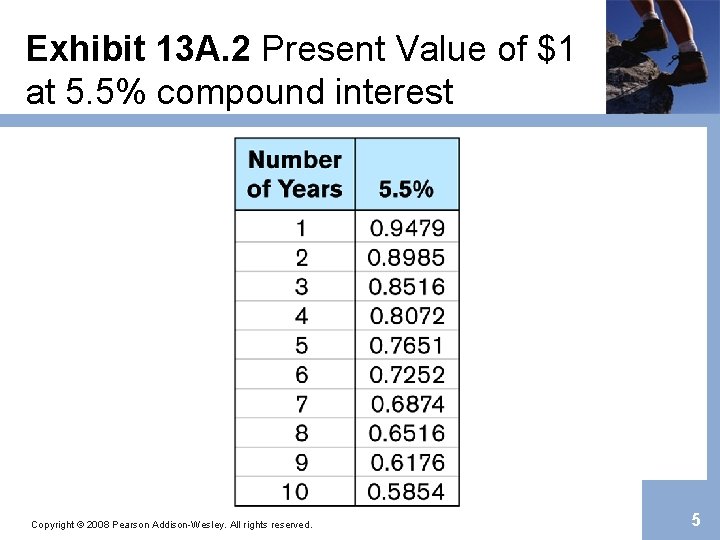

Exhibit 13 A. 2 Present Value of $1 at 5. 5% compound interest Copyright © 2008 Pearson Addison-Wesley. All rights reserved. 5

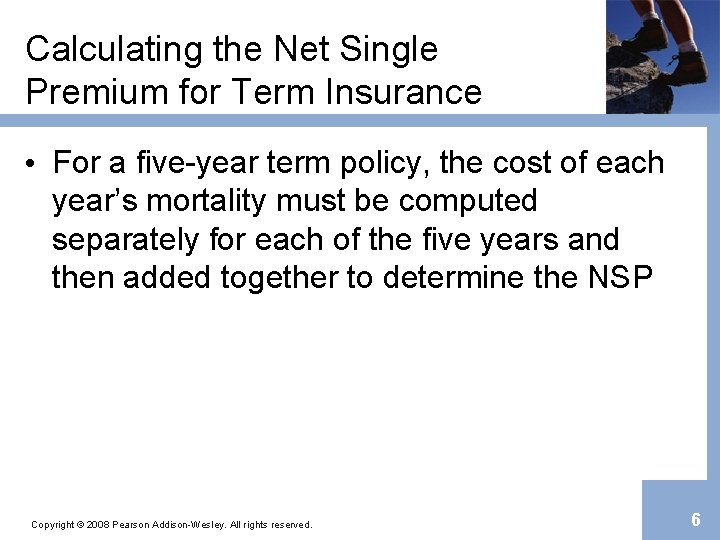

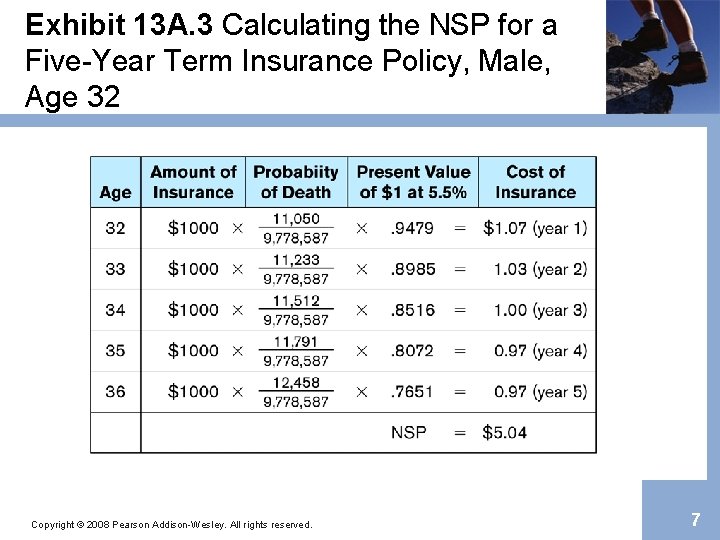

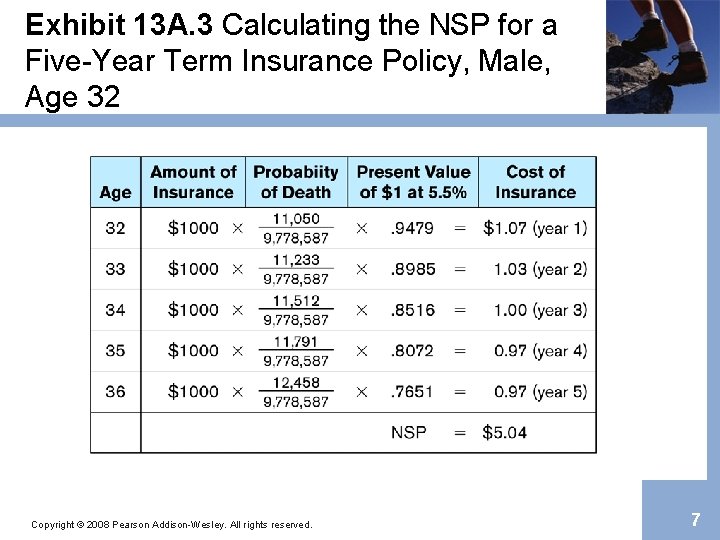

Calculating the Net Single Premium for Term Insurance • For a five-year term policy, the cost of each year’s mortality must be computed separately for each of the five years and then added together to determine the NSP Copyright © 2008 Pearson Addison-Wesley. All rights reserved. 6

Exhibit 13 A. 3 Calculating the NSP for a Five-Year Term Insurance Policy, Male, Age 32 Copyright © 2008 Pearson Addison-Wesley. All rights reserved. 7

Calculating the Net Single Premium for Ordinary Life Insurance • For an ordinary life insurance policy, the cost of each year’s mortality must be computed separately for each year to the end of the mortality table, and then added together to determine the NSP Copyright © 2008 Pearson Addison-Wesley. All rights reserved. 8

Calculating the Net Annual Level Premium • The net annual level premium is calculated using a formula: • If premiums are paid for life, the premium is called a whole life annuity due • If premiums are paid for only a temporary period, the premium is called a temporary life annuity due Copyright © 2008 Pearson Addison-Wesley. All rights reserved. 9

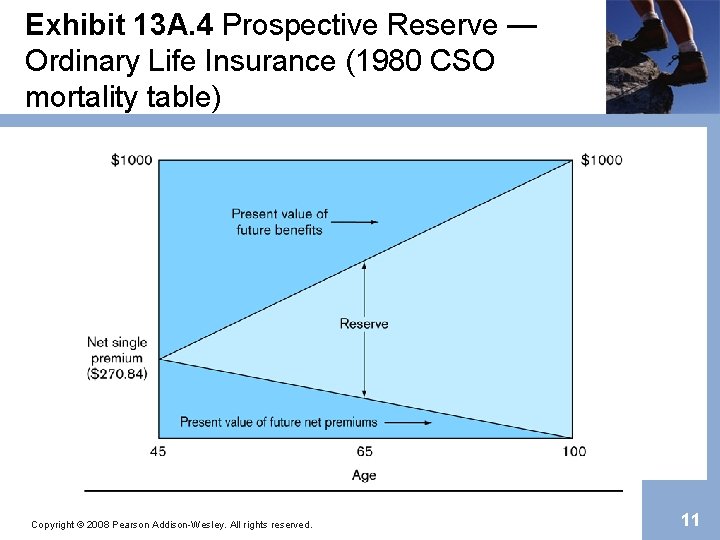

Policy Reserves • Under the level-premium method for paying premiums, premiums paid during early years are higher than necessary to pay death claims – The excess premiums are reflected in the policy reserve • Policy reserves are a liability item on the insurer’s balance sheet that must be offset by assets equal to that amount • The policy reserve is the difference between the PV of future benefits and the PV of future net premiums • The policy reserve has two purposes: – It is a formal recognition of the insurer’s obligation to pay future claims – It is a legal test of the insurer’s solvency Copyright © 2008 Pearson Addison-Wesley. All rights reserved. 10

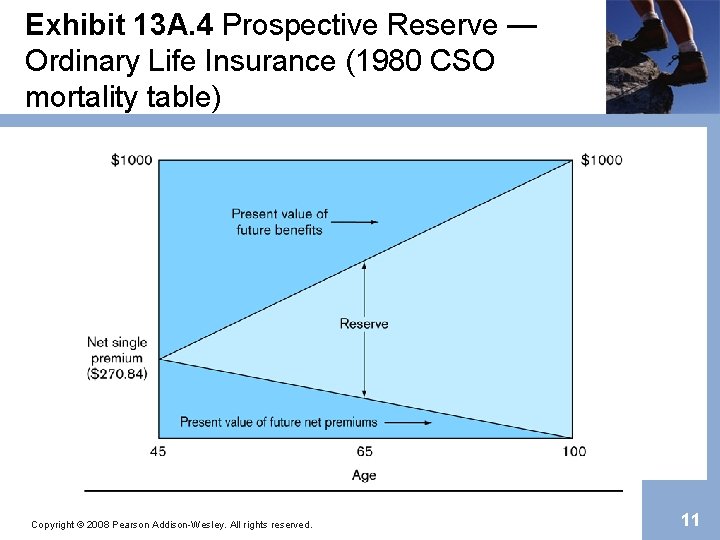

Exhibit 13 A. 4 Prospective Reserve — Ordinary Life Insurance (1980 CSO mortality table) Copyright © 2008 Pearson Addison-Wesley. All rights reserved. 11

Policy Reserves • The retrospective reserve represents the net premiums collected by the insurer for a particular block of policies, plus interest earnings at an assumed rate, less the amounts paid out as death claims • The prospective reserve is the difference between the present value of future benefits and the present value of future net premiums • Both methods will produce the same level of reserves at the end of any given year under the same actuarial assumptions Copyright © 2008 Pearson Addison-Wesley. All rights reserved. 12

Policy Reserves • A terminal reserve is the reserve at the end of any given policy year • The initial reserve is the reserve at the beginning of any policy year • The mean reserve is the average of the terminal and initial reserves. It is used to indicate the insurer’s reserve liabilities on its annual statement Copyright © 2008 Pearson Addison-Wesley. All rights reserved. 13

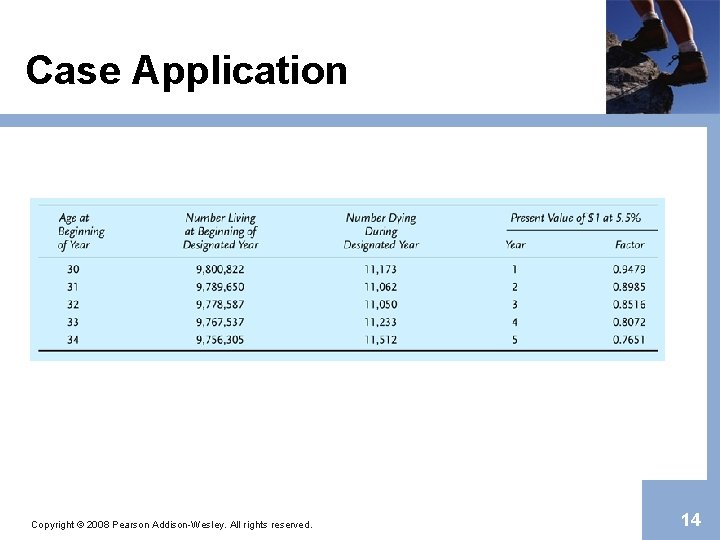

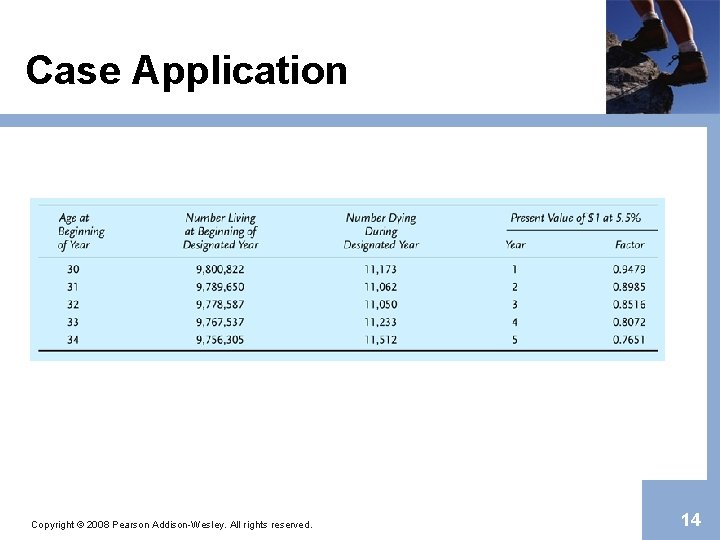

Case Application Copyright © 2008 Pearson Addison-Wesley. All rights reserved. 14

Nature and use of fire insurance

Nature and use of fire insurance Chapter 14 health disability and life insurance

Chapter 14 health disability and life insurance Chapter 10 financial planning with life insurance

Chapter 10 financial planning with life insurance Total body clearance equation

Total body clearance equation Half-life calculation example

Half-life calculation example Radioactive decay of iodine 131

Radioactive decay of iodine 131 Royal insurance corporation of bhutan

Royal insurance corporation of bhutan Desjardins assurance

Desjardins assurance Gcu annuities

Gcu annuities Life insurance customer journey map

Life insurance customer journey map Climbs life and general insurance cooperative

Climbs life and general insurance cooperative Claim life cycle in insurance

Claim life cycle in insurance Icuba benefits

Icuba benefits Bmo insurance

Bmo insurance Life insurance review letter

Life insurance review letter