Chapter 12 Electronic Payment Systems Electronic Commerce Prentice

- Slides: 42

Chapter 12 Electronic Payment Systems Electronic Commerce Prentice Hall © 2006

Learning Objectives 1. 2. 3. 4. Understand the shifts that are occurring with regards to non-cash and online payments. Discuss the players and processes involved in using credit cards online. Discuss the different categories and potential uses of smart cards. Discuss various online alternatives to credit card payments and identify under what circumstances they are best used. Electronic Commerce Prentice Hall © 2006 2

Learning Objectives 5. 6. 7. 8. Describe the processes and parties involved in echecking. Describe payment methods in B 2 B EC, including payments for global trade. Discuss electronic bill and invoice presentment and payment. Understand the sales tax implications of e-payments. Electronic Commerce Prentice Hall © 2006 3

The Payment Revolution • Crucial Factors – – – – Independence Interoperability and portability Security Anonymity Divisibility Ease of use Transaction fees Regulations Electronic Commerce Prentice Hall © 2006 4

Using Payments Cards Online payment card Electronic card that contains information that can be used for payment purposes • Three forms of payment cards: – – – Credit cards Charge cards Debit cards Electronic Commerce Prentice Hall © 2006 5

Using Payments Cards Online • Processing Credit Cards Online authorization Determines whether a buyer’s card is active and whether the customer has sufficient funds settlement Transferring money from the buyer’s to the merchant’s account Electronic Commerce Prentice Hall © 2006 6

Using Payments Cards Online • Processing Credit Cards Online payment service provider (PSP) A third-party service connecting a merchant’s EC systems to the appropriate acquirers. PSPs must be registered with the various card associations they support Electronic Commerce Prentice Hall © 2006 7

Using Payments Cards Online – Key participants in processing credit card payments online include the following: • Acquiring bank • Credit card association • Customer • Issuing bank • Merchant • Payment processing service • Processor Electronic Commerce Prentice Hall © 2006 8

Using Payments Cards Online • Fraudulent Credit Card Transactions Address Verification System (AVS) Detects fraud by comparing the address entered on a Web page with the address information on file with cardholder’s issuing bank Electronic Commerce Prentice Hall © 2006 9

Using Payments Cards Online card verification number (CVN) Detects fraud by comparing the verification number printed on the signature strip on the back of the card with the information on file with the cardholder’s issuing bank Electronic Commerce Prentice Hall © 2006 10

Using Payments Cards Online • Fraudulent Credit Card Transactions – Additional tools used to combat fraud include: • Manual review • Fraud screens and decision models • Negative files • Card association payer authentication services Electronic Commerce Prentice Hall © 2006 11

Using Payments Cards Online virtual credit card An e-payment system in which a credit card issuer gives a special transaction number that can be used online in place of regular credit card numbers Electronic Commerce Prentice Hall © 2006 12

Smart Cards smart card An electronic card containing an embedded microchip that enables predefined operations or the addition, deletion, or manipulation of information on the card Electronic Commerce Prentice Hall © 2006 13

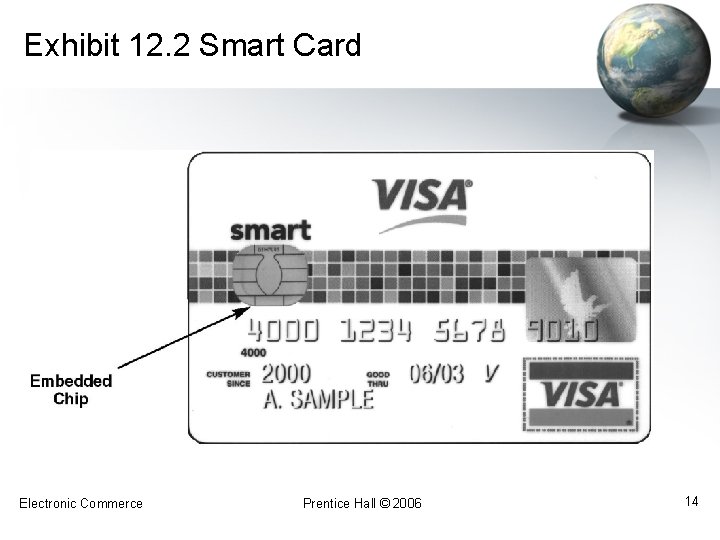

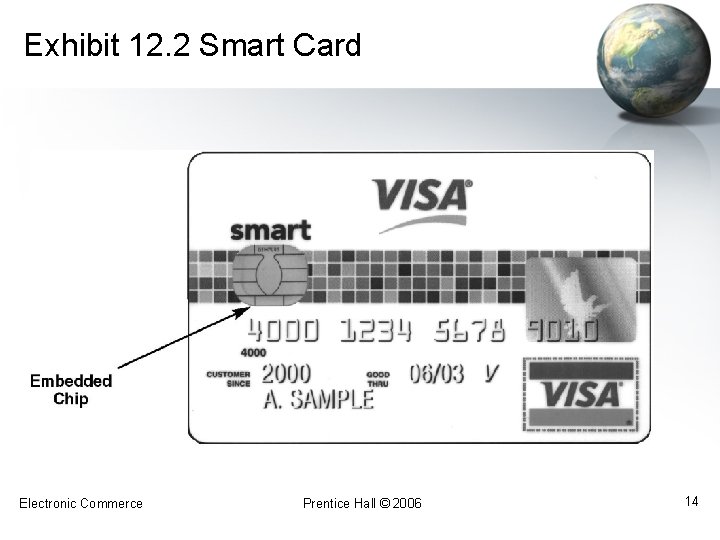

Exhibit 12. 2 Smart Card Electronic Commerce Prentice Hall © 2006 14

Smart Cards • Types of Smart Cards contact card A smart card containing a small gold plate on the face that when inserted in a smart card reader makes contact and passes data to and from the embedded microchip Electronic Commerce Prentice Hall © 2006 15

Smart Cards • Types of Smart Cards contactless (proximity) card A smart card with an embedded antenna, by means of which data and applications are passed to and from a card reader unit or other device without contact between the card and the card reader Electronic Commerce Prentice Hall © 2006 16

Smart Cards smart card reader Activates and reads the contents of the chip on a smart card, usually passing the information on to a host system smart card operating system Special system that handles file management, security, input/output (I/O), and command execution and provides an application programming interface (API) for a smart card Electronic Commerce Prentice Hall © 2006 17

Smart Cards • Applications of Smart Cards – – – Retail Purchases e-purse Smart card application that loads money from a card holder’s bank account onto the smart card’s chip Common Electronic Purse Specification (CEPS) Standards governing the operation and interoperability of e-purse offerings Transit Fares E-Identification Electronic Commerce Prentice Hall © 2006 18

Smart Cards • Applications of Smart Cards – Transit Fares To eliminate the inconvenience of multiple types of tickets used in public transportation, most major transit operators in the United States are implementing smart card fareticketing systems – E-Identification Because they have the capability to store personal information, including pictures, biometric identifiers, digital signatures, and private security keys, smart cards are being used in a variety of identification, access control, and authentication applications Electronic Commerce Prentice Hall © 2006 19

Smart Cards • Applications of Smart Cards in Health Care – – Storing vital medical information in case of emergencies Preventing patients from obtaining multiple prescriptions from different physicians Verifying a patient’s identity and insurance coverage Speeding up the hospital or emergency room admissions process Electronic Commerce Prentice Hall © 2006 20

Smart Cards • Applications of Smart Cards in Health Care – – Storing vital medical information in case of emergencies Providing medical practitioners with secure access to a patient’s complete medical history Speeding up the payment and claims process Enabling patients to access their medical records over the Internet Electronic Commerce Prentice Hall © 2006 21

Smart Cards • Securing Smart Cards – – – Smart cards store or provide access to either valuable assets or to sensitive information Because of this, they must be secured against theft, fraud, or misuse The possibility of hacking into a smart card is classified as a “class 3” attack, which means that the cost of compromising the card far exceeds the benefits Electronic Commerce Prentice Hall © 2006 22

Stored-Value Cards stored-value card A card that has monetary value loaded onto it and that is usually rechargeable Electronic Commerce Prentice Hall © 2006 23

E-Micropayments e-micropayments Small online payments, typically under US $10 • Companies with e-micropayment products: – – Bit. Pass (bitpass. com) Paystone (paystone. com) Pay. Loadz (payloadz. com) Peppercoin (peppercoin. com) Electronic Commerce Prentice Hall © 2006 24

E-Checking e-check A legally valid electronic version or representation of a paper check Automated Clearing House (ACH) Network A nationwide batch-oriented electronic funds transfer system that provides for the interbank clearing of electronic payments for participating financial institutions Electronic Commerce Prentice Hall © 2006 25

E-Checking • Benefits of e-check processing: – – It reduces the merchant’s administrative costs by providing faster and less paper-intensive collection of funds It improves the efficiency of the deposit process for merchants and financial institutions Electronic Commerce Prentice Hall © 2006 26

E-Checking • Benefits of e-check processing: – – – It speeds the checkout process for consumers It provides consumers with more information about their purchases on their account statements It reduces the float period and the number of checks that bounce because of insufficient funds (NSFs) Electronic Commerce Prentice Hall © 2006 27

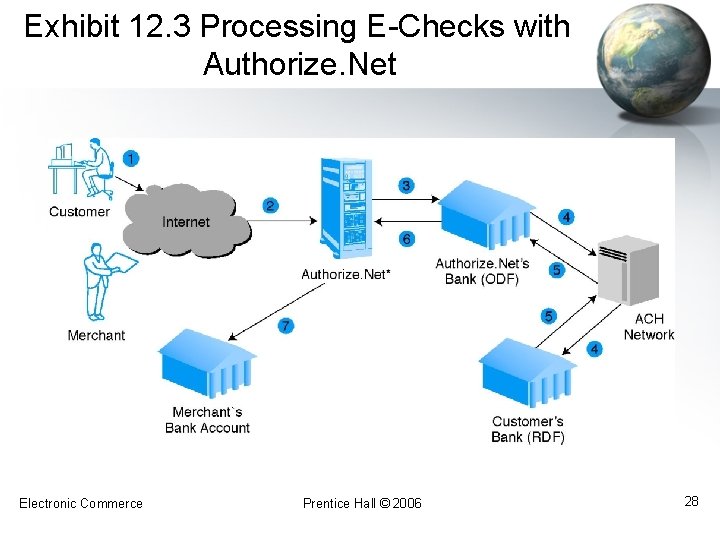

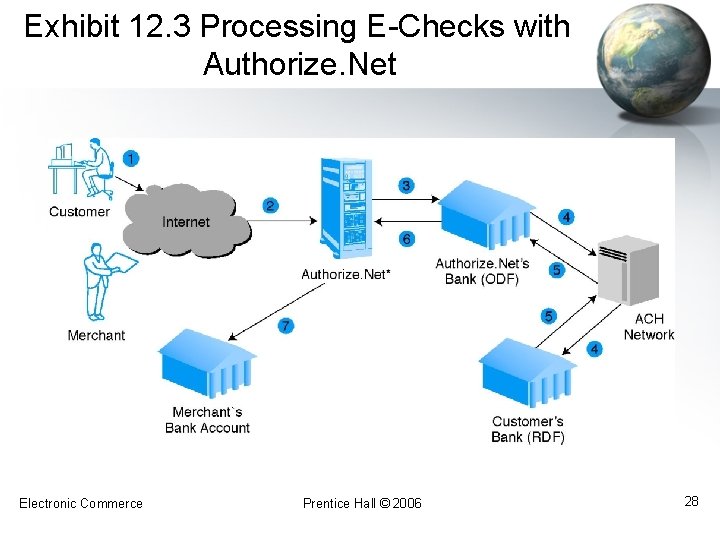

Exhibit 12. 3 Processing E-Checks with Authorize. Net Electronic Commerce Prentice Hall © 2006 28

Electronic Bill Presentment and Payment electronic bill presentment and payment (EBPP) Presenting and enabling payment of a bill online. Usually refers to a B 2 C transaction Electronic Commerce Prentice Hall © 2006 29

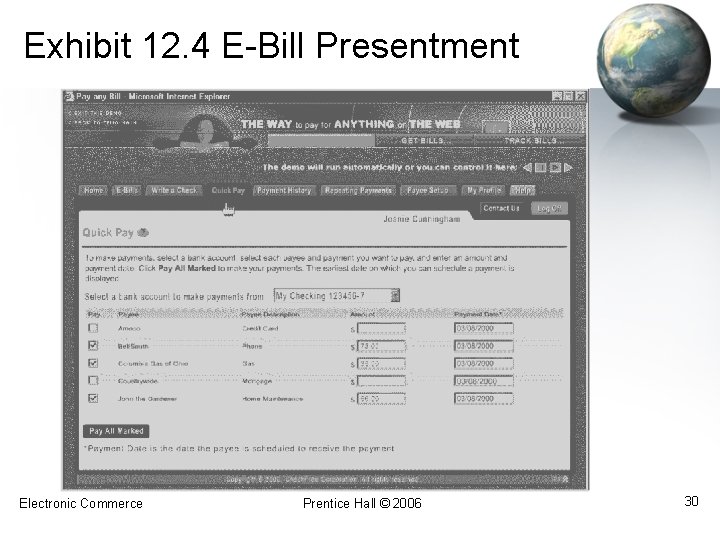

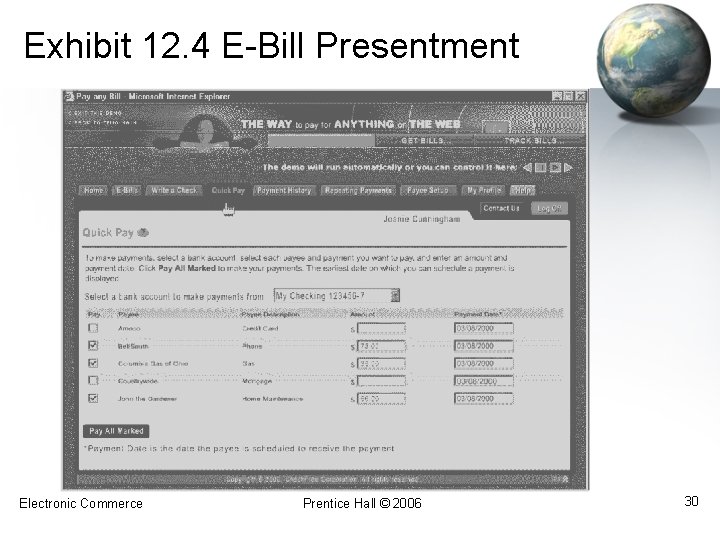

Exhibit 12. 4 E-Bill Presentment Electronic Commerce Prentice Hall © 2006 30

Electronic Bill Presentment and Payment • Types of E-Billing – – – Online banking Biller direct Bill consolidator Electronic Commerce Prentice Hall © 2006 31

Electronic Bill Presentment and Payment • Advantages of E-Billing – – – Reduction in expenses related to billing and processing payments Electronic advertising inserts can be customized to the individual customer Reduces customer’s expenses Electronic Commerce Prentice Hall © 2006 32

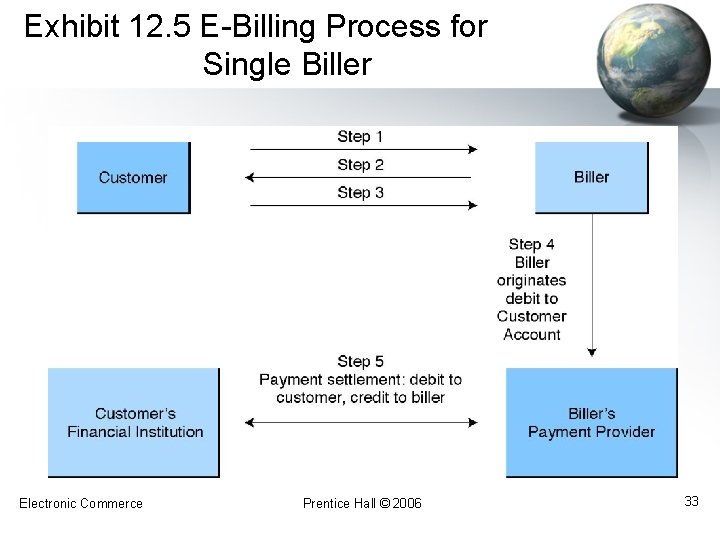

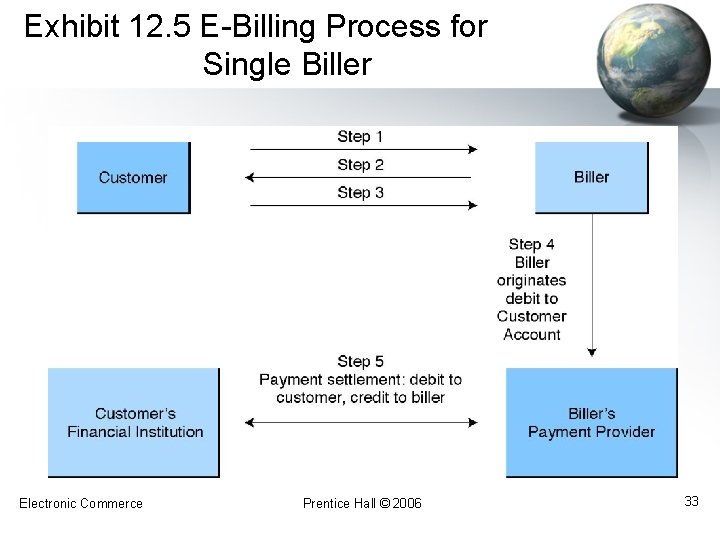

Exhibit 12. 5 E-Billing Process for Single Biller Electronic Commerce Prentice Hall © 2006 33

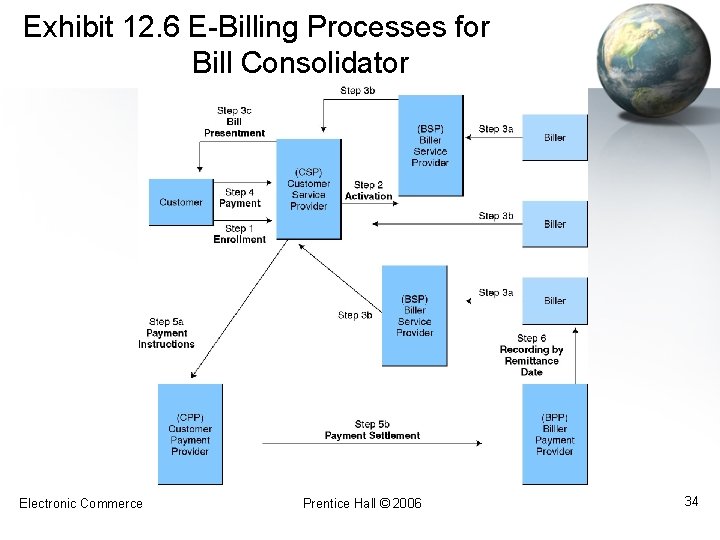

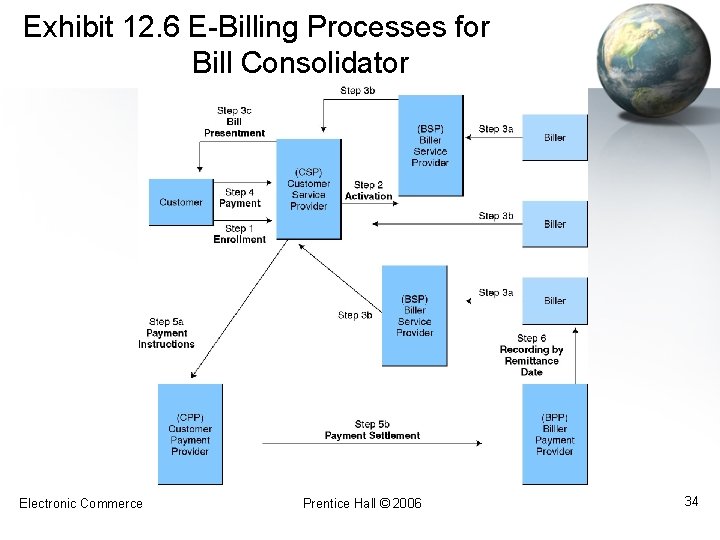

Exhibit 12. 6 E-Billing Processes for Bill Consolidator Electronic Commerce Prentice Hall © 2006 34

B 2 B Electronic Payments • Current B 2 B Payment Practices – Financial supply chains of most companies are characterized by inefficiencies created by a number of factors, including: • • • The time required to create, transfer, and process paper documentation The cost and errors associated with manual creation and reconciliation of documentation The lack of transparency in inventory and cash positions when goods are in the supply chain Disputes arising from inaccurate or missing data Fragmented point solutions that do not address the complete end-to-end processes of the trade cycle Electronic Commerce Prentice Hall © 2006 35

B 2 B Electronic Payments • Enterprise Invoice Presentment and Payment enterprise invoice presentment and payment (EIPP) Presenting and paying B 2 B invoices online – EIPP Models • Seller Direct • Buyer Direct • Consolidator Electronic Commerce Prentice Hall © 2006 36

B 2 B Electronic Payments – EIPP Options • ACH Network purchasing cards (p-cards) Special-purpose payment cards issued to a company’s employees to be used solely for purchasing nonstrategic materials and services up to a preset dollar limit Electronic Commerce Prentice Hall © 2006 37

B 2 B Electronic Payments • Fedwire or Wire Transfer letter of credit (LC) A written agreement by a bank to pay the seller, on account of the buyer, a sum of money upon presentation of certain documents Electronic Commerce Prentice Hall © 2006 38

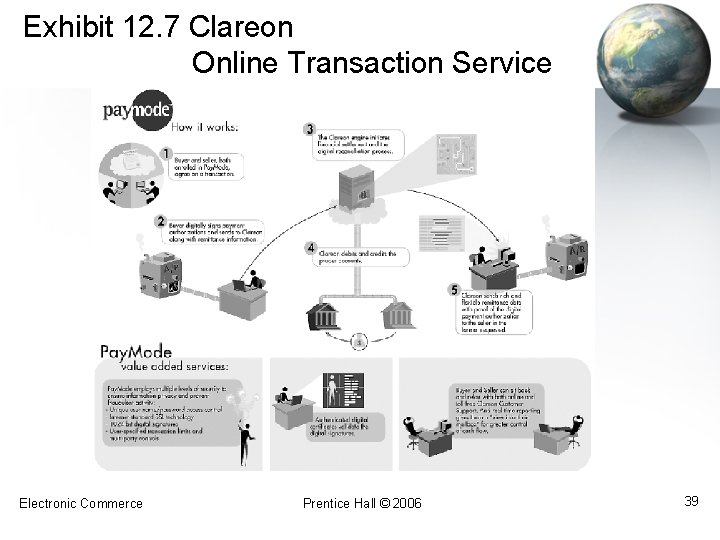

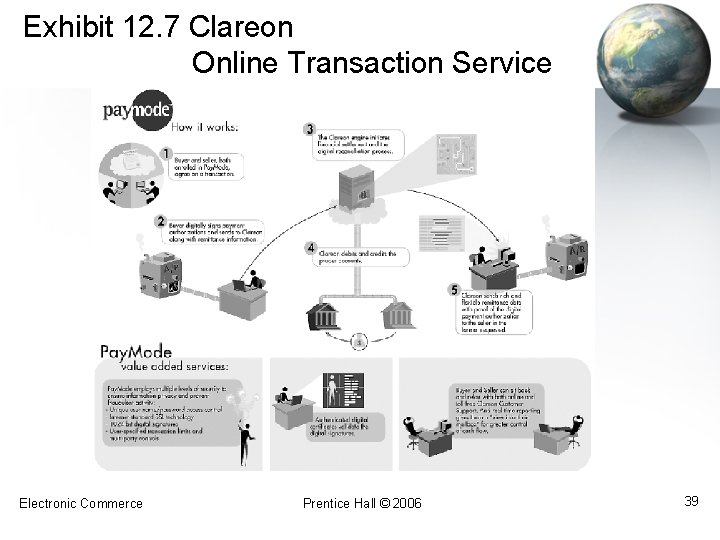

Exhibit 12. 7 Clareon Online Transaction Service Electronic Commerce Prentice Hall © 2006 39

The Sales Tax Issue • Because of the complexities, many online businesses (B 2 C and B 2 B) rely on specialized third-party software and services to calculate the taxes associated with a sale Electronic Commerce Prentice Hall © 2006 40

Managerial Issues 1. What B 2 C payment methods should we use? 2. What B 2 B payment methods should we use? 3. Should we use an in-house payment mechanism or outsource it? 4. How secure are e-payments? Electronic Commerce Prentice Hall © 2006 41

Summary 1. 2. 3. 4. 5. 6. 7. 8. 9. Payment revolution. Using payment cards online. Smart cards. Stored-value cards. E-micropayments. E-checking. Electronic bill presentment and payment. B 2 B electronic payments. Tax issues. Electronic Commerce Prentice Hall © 2006 42