Analysis of Tax Aggressiveness and Financial Reporting Aggressiveness

- Slides: 25

Analysis of Tax Aggressiveness and Financial Reporting Aggressiveness on Public Companies in Indonesia 2010 -2014 Rina Indah Sari Ginting and Dwi Martani

Agenda Introduction Literature Review Research Method Empiricial Result Conclusion 2

Introduction • The quality of financial statements is important to stakeholder in making decisions related to investment, credit and improves market efficiency. • The intended use of the financial statements may create incentives for the management company to manipulate financial statements in order to report the company's best performance and meet the expectations of stakeholders. Companies are trying to manage their net income profit which is often called by financial reporting aggressiveness. • Financial reporting aggressiveness actions can have negative impacts for the company through the payment of taxes. • Frank et al (2009) states that the tax planning by lowering the value of the taxable income, either through tax evasion or not, is referred to tax aggressiveness. • Tax aggressiveness can be done in various ways, including finding a gap (loopholes) contained in the tax laws so often referred to as tax avoidance, tax sheltering and tax management (Hanlon and Heitzman, 2010). 3

Introduction • Frank et al (2009) conducted a research on the relationship of tax and financial reporting aggressiveness in America using residual permanent differences (DTAX) as the measurement. He found that there is a strong positive relation between these two constructs. It means that the company able to increase the level of corporate profits but reported a low tax payment. • Tanya and Fifth (2012) developed another way to measures tax aggressiveness, that called abnormal book tax differences (ABTD). • The purpose: – Expand the Frank et al (2009) by using Indonesian capital market data – Using the other proxy of tax aggressiveness that developed by Tanya and Fifth (2012) 4

Literature Review Quality of Financial Reporting • Financial statements contains a lot of information that can be used by stakeholders to assist the decision making process. • High financial statements quality can be used to make the right decision. • To meet stockholder expectation, management used to do the earning management to maximize profits and increase the value of the company's market value. • This earnings management activities will impact the difference in taxable income and hide the actual condition of the company. • At which time the company reported accounting profit is higher than the burden of the tax to be paid will be higher also. • Such conditions indicate a tradeoff between earnings management activities and management of corporate taxes. 5

Literature Review Financial Reporting Aggressiveness • Frank et al (2009) states that the activities aimed at increasing the company's profit with earnings management, whether appropriate or not in accordance with generally accepted accounting principles known as the financial reporting aggressiveness. • In this study, financial reporting aggressiveness have the same context with earnings management. • Aggressive financial reporting can be measured by discretionary accruals. • Several measure that usually used in detected aggressive financial are Model Jones (1991), Dechow et al (1995), Kasznik (1999) and Kothari (2005). 6

Literature Review Tax Aggressiveness • Tax avoidance is define as the reduction of explicit taxes ( Hanlon and Heitzman, 2010 ; Dyreng et al. , 2008). • The tax aggressiveness represents a continuum of tax planning strategies of the company. • Different people will have different opinions about the degree of aggressiveness of a transaction. • Tax planning behavior of the company and can be discuss in various terms such as tax aggressiveness, tax sheltering, tax evasion or non-compliance. • Hanlon and Heitzman (2010) emphasizes that the definition of tax aggressiveness are not limited to specific measurement methods. • Tax avoidance measure by several methods such as effective tax rate, long run effective tax rate, book tax differences, discretionary or abnormal measure of tax avoidance, unrecognized tax benefits and tax shelter firms. 7

Literature Review Tax Aggressiveness Measurement • Frank et al (2009) is the first literature conducted research about the relationship of tax and financial reporting aggressiveness. • Using their own of proxy of discretionary permanent differences (DTAX), Frank et al (2009) include that tax and financial reporting aggressiveness are significantly and positively related. • It indicates that there is nonconformity between financial accounting standards and tax law allows firm to manage book income upward and taxable income downward. • Similar studies have also been carried out in Indonesia by Kamila (2014) and Ridha (2014). The results show that there is no tradeoff between tax and financial reporting aggressiveness in Indonesia’s manufacturing company. 8

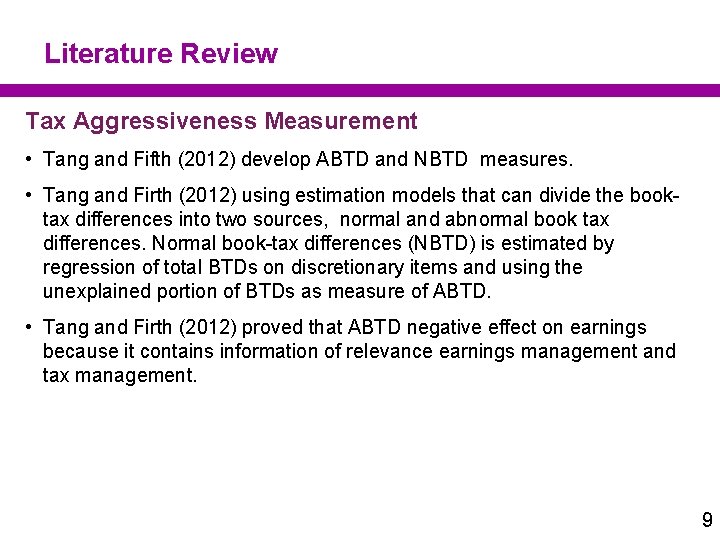

Literature Review Tax Aggressiveness Measurement • Tang and Fifth (2012) develop ABTD and NBTD measures. • Tang and Firth (2012) using estimation models that can divide the booktax differences into two sources, normal and abnormal book tax differences. Normal book-tax differences (NBTD) is estimated by regression of total BTDs on discretionary items and using the unexplained portion of BTDs as measure of ABTD. • Tang and Firth (2012) proved that ABTD negative effect on earnings because it contains information of relevance earnings management and tax management. 9

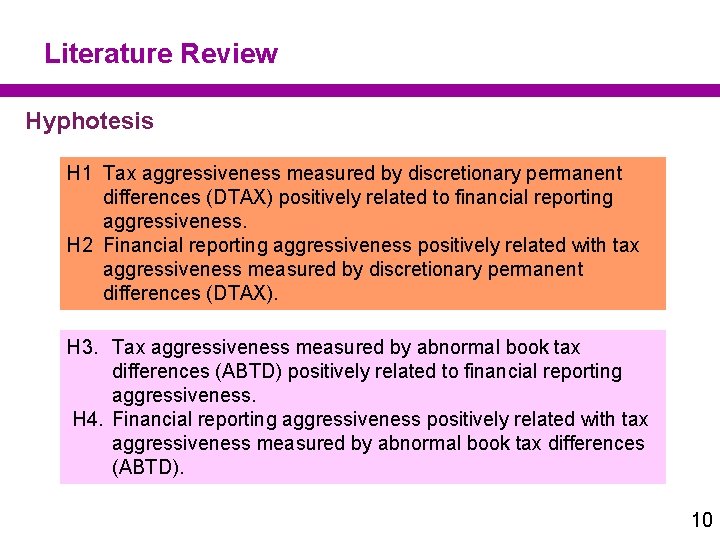

Literature Review Hyphotesis H 1 Tax aggressiveness measured by discretionary permanent differences (DTAX) positively related to financial reporting aggressiveness. H 2 Financial reporting aggressiveness positively related with tax aggressiveness measured by discretionary permanent differences (DTAX). H 3. Tax aggressiveness measured by abnormal book tax differences (ABTD) positively related to financial reporting aggressiveness. H 4. Financial reporting aggressiveness positively related with tax aggressiveness measured by abnormal book tax differences (ABTD). 10

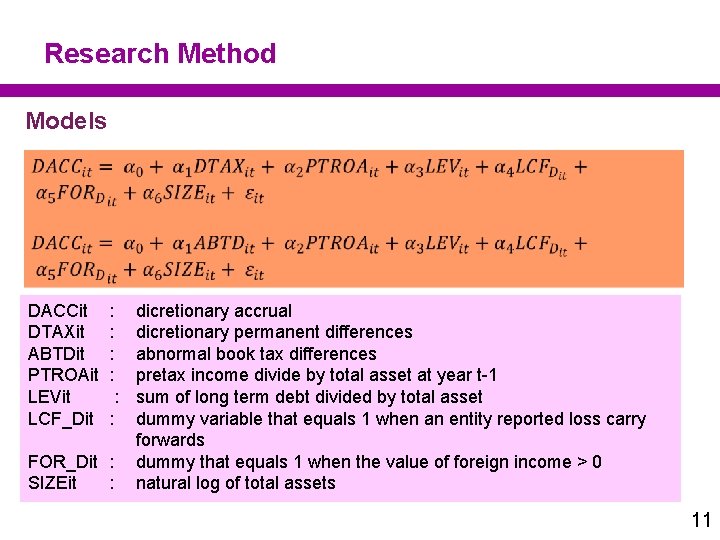

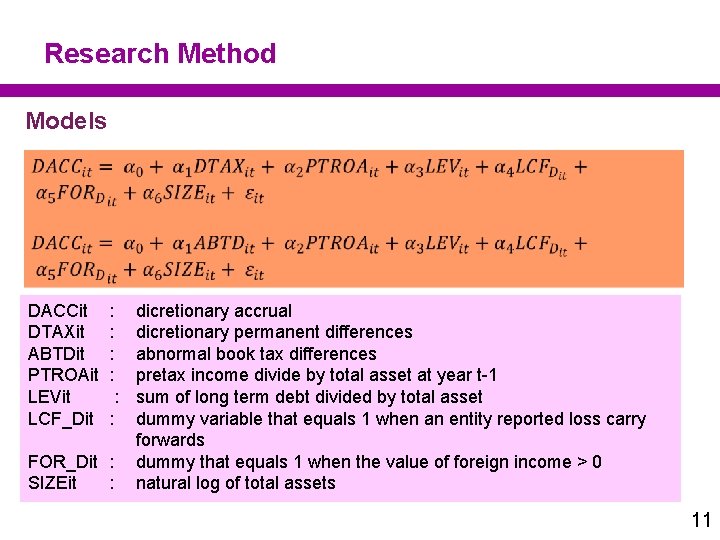

Research Method Models DACCit DTAXit ABTDit PTROAit LEVit LCF_Dit : : dicretionary accrual dicretionary permanent differences abnormal book tax differences pretax income divide by total asset at year t-1 : sum of long term debt divided by total asset : dummy variable that equals 1 when an entity reported loss carry forwards FOR_Dit : dummy that equals 1 when the value of foreign income > 0 SIZEit : natural log of total assets 11

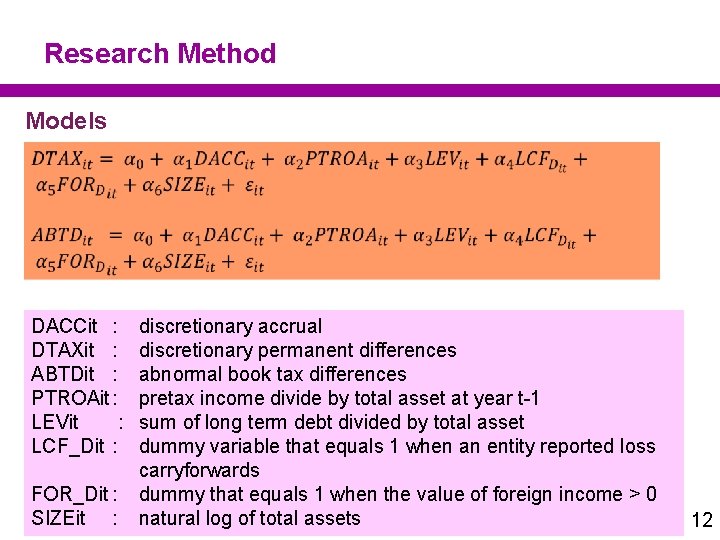

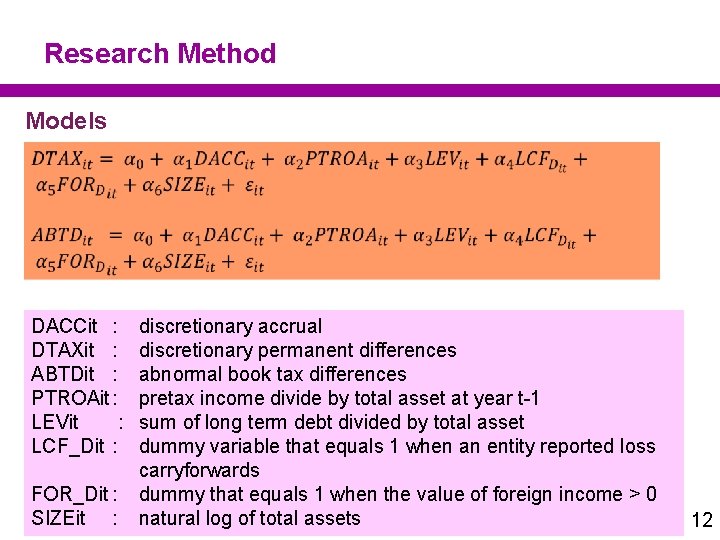

Research Method Models DACCit : DTAXit : ABTDit : PTROAit : LEVit : LCF_Dit : FOR_Dit : SIZEit : discretionary accrual discretionary permanent differences abnormal book tax differences pretax income divide by total asset at year t-1 sum of long term debt divided by total asset dummy variable that equals 1 when an entity reported loss carryforwards dummy that equals 1 when the value of foreign income > 0 natural log of total assets 12

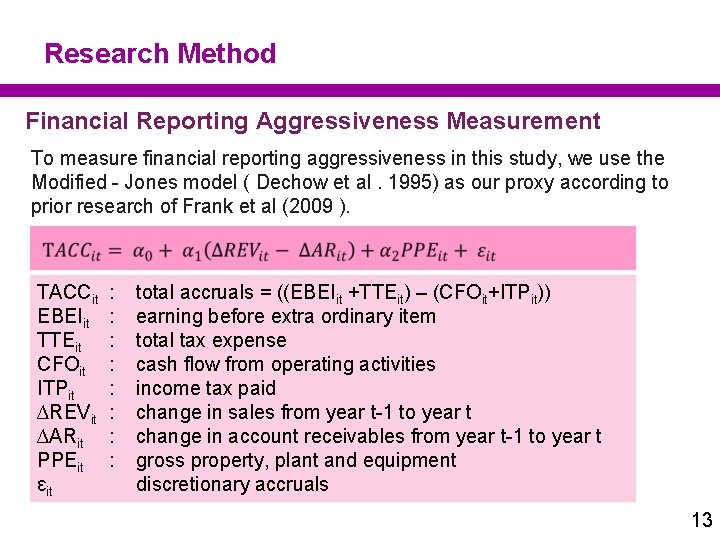

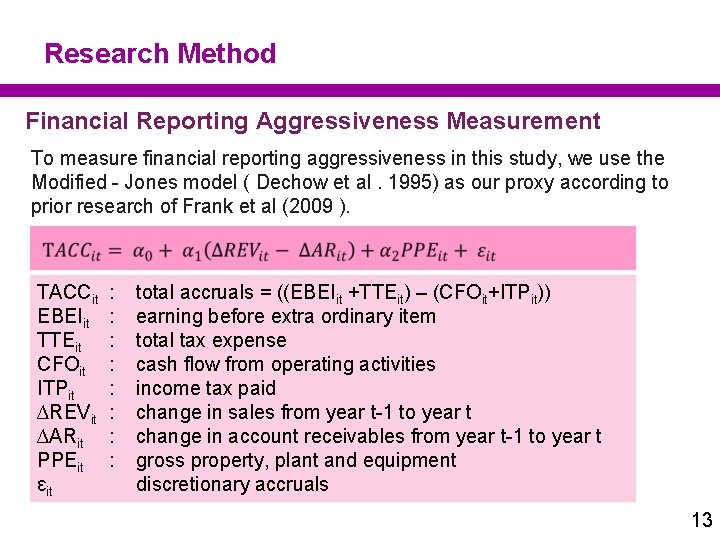

Research Method Financial Reporting Aggressiveness Measurement To measure financial reporting aggressiveness in this study, we use the Modified - Jones model ( Dechow et al. 1995) as our proxy according to prior research of Frank et al (2009 ). TACCit EBEIit TTEit CFOit ITPit ∆REVit ∆ARit PPEit ԑit : : : : total accruals = ((EBEIit +TTEit) – (CFOit+ITPit)) earning before extra ordinary item total tax expense cash flow from operating activities income tax paid change in sales from year t-1 to year t change in account receivables from year t-1 to year t gross property, plant and equipment discretionary accruals 13

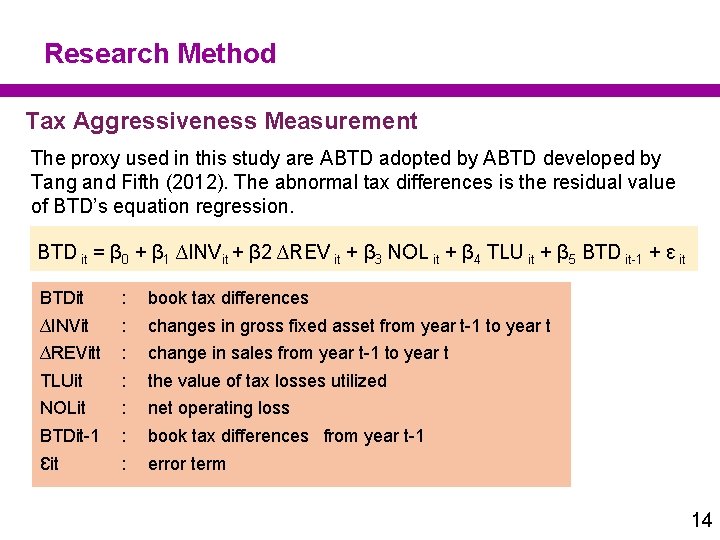

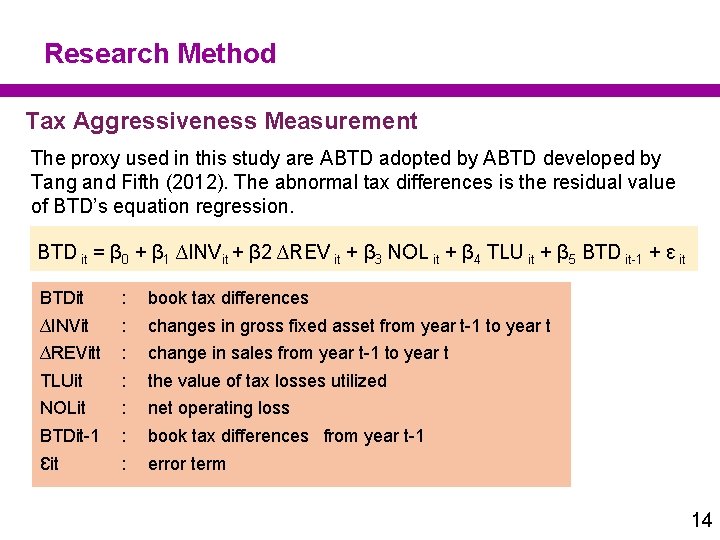

Research Method Tax Aggressiveness Measurement The proxy used in this study are ABTD adopted by ABTD developed by Tang and Fifth (2012). The abnormal tax differences is the residual value of BTD’s equation regression. BTD it = β 0 + β 1 ∆INVit + β 2 ∆REV it + β 3 NOL it + β 4 TLU it + β 5 BTD it-1 + ԑ it BTDit : book tax differences ∆INVit : changes in gross fixed asset from year t-1 to year t ∆REVitt : change in sales from year t-1 to year t TLUit : the value of tax losses utilized NOLit : net operating loss BTDit-1 : book tax differences from year t-1 Ԑit : error term 14

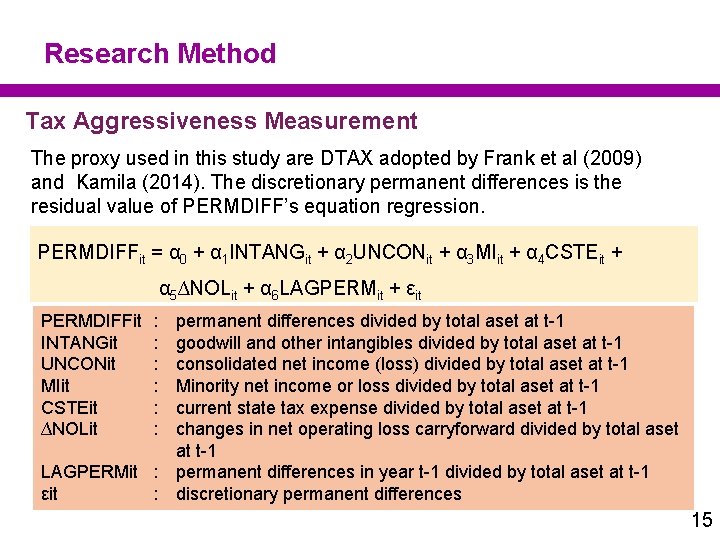

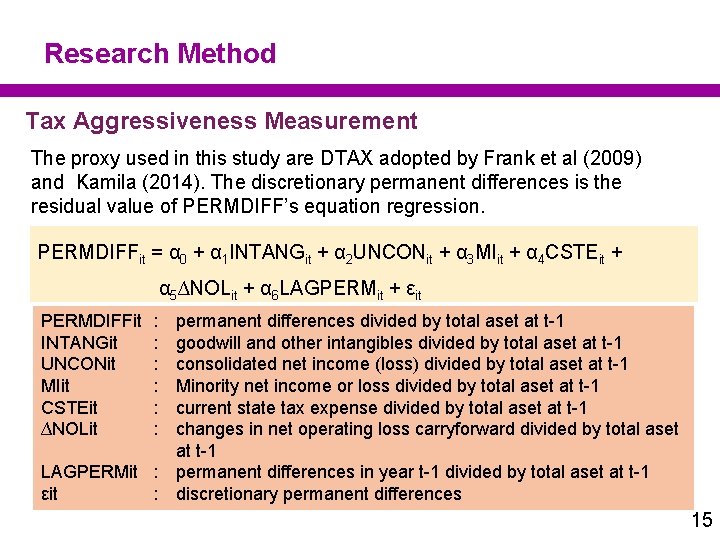

Research Method Tax Aggressiveness Measurement The proxy used in this study are DTAX adopted by Frank et al (2009) and Kamila (2014). The discretionary permanent differences is the residual value of PERMDIFF’s equation regression. PERMDIFFit = α 0 + α 1 INTANGit + α 2 UNCONit + α 3 MIit + α 4 CSTEit + α 5∆NOLit + α 6 LAGPERMit + εit PERMDIFFit INTANGit UNCONit MIit CSTEit ∆NOLit : : : permanent differences divided by total aset at t-1 goodwill and other intangibles divided by total aset at t-1 consolidated net income (loss) divided by total aset at t-1 Minority net income or loss divided by total aset at t-1 current state tax expense divided by total aset at t-1 changes in net operating loss carryforward divided by total aset at t-1 LAGPERMit : permanent differences in year t-1 divided by total aset at t-1 εit : discretionary permanent differences 15

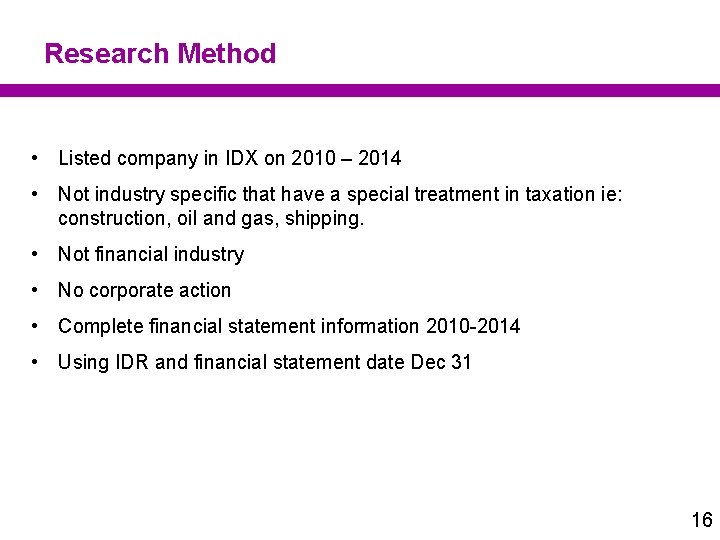

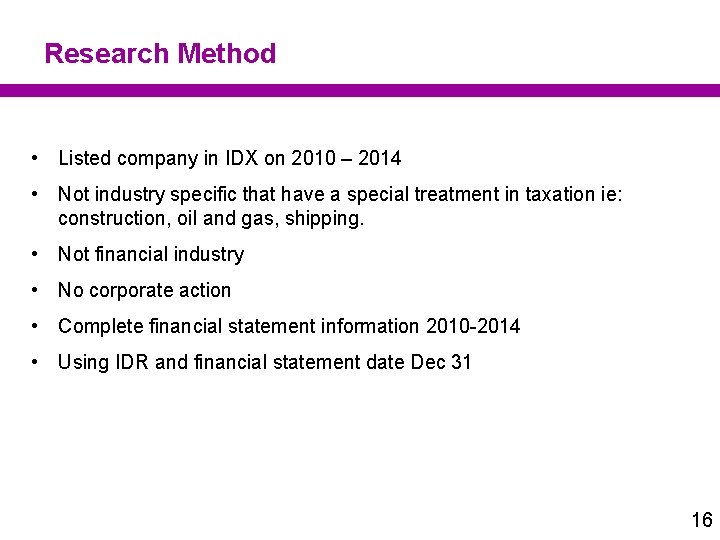

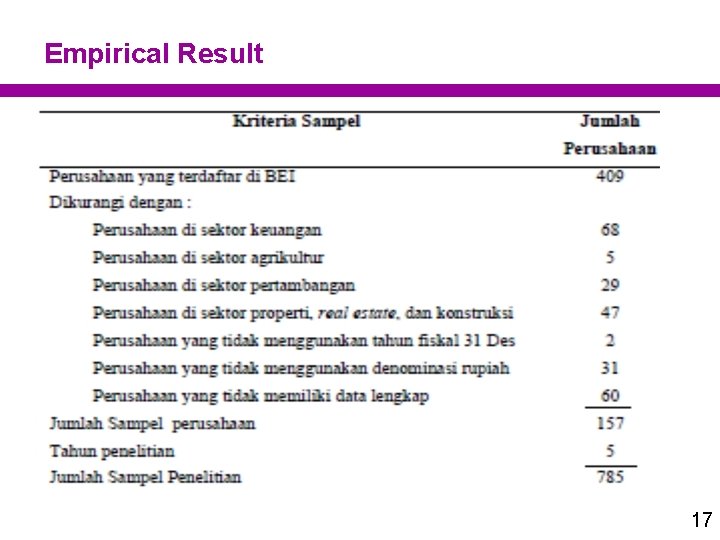

Research Method • Listed company in IDX on 2010 – 2014 • Not industry specific that have a special treatment in taxation ie: construction, oil and gas, shipping. • Not financial industry • No corporate action • Complete financial statement information 2010 -2014 • Using IDR and financial statement date Dec 31 16

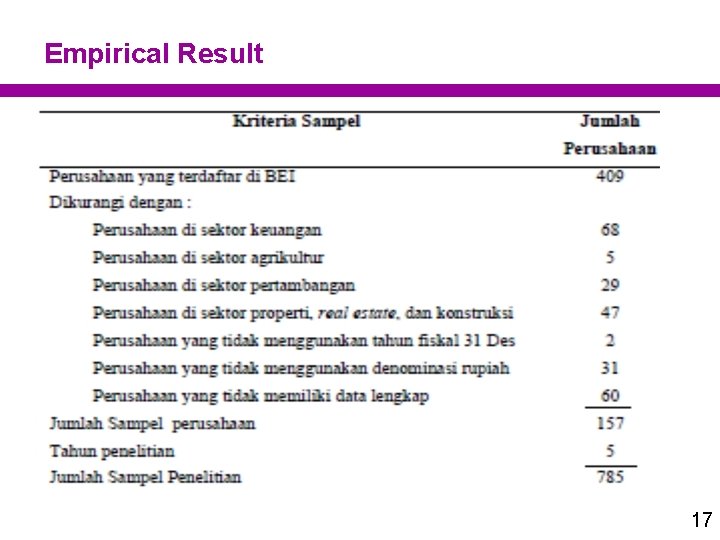

Empirical Result 17

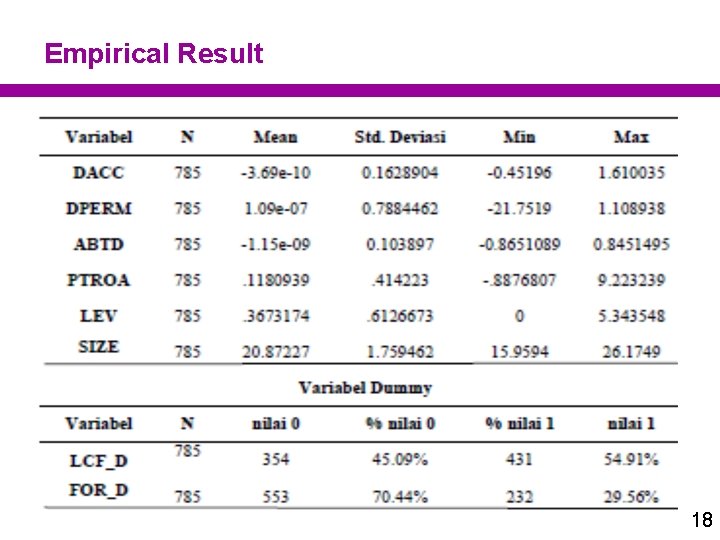

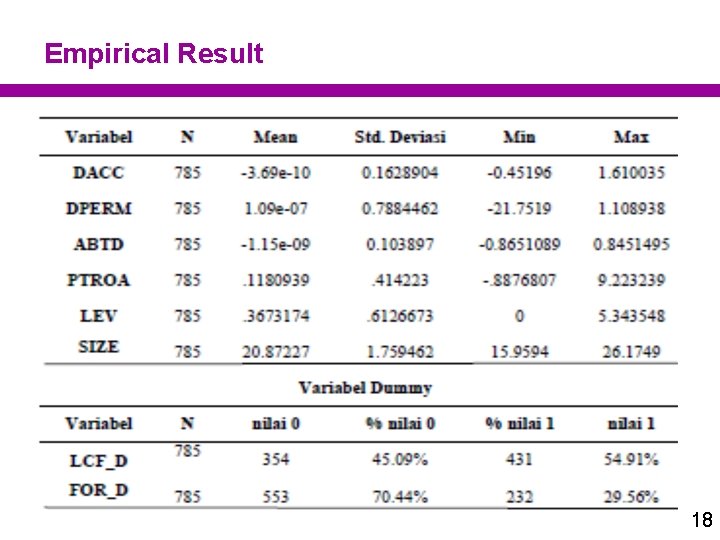

Empirical Result 18

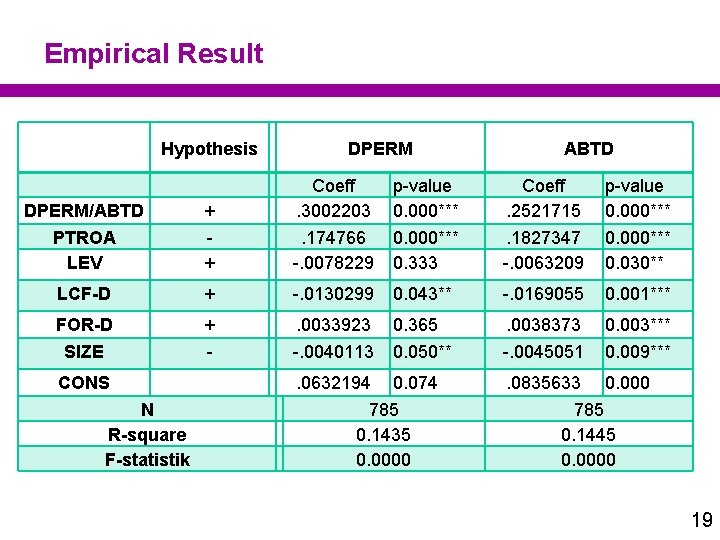

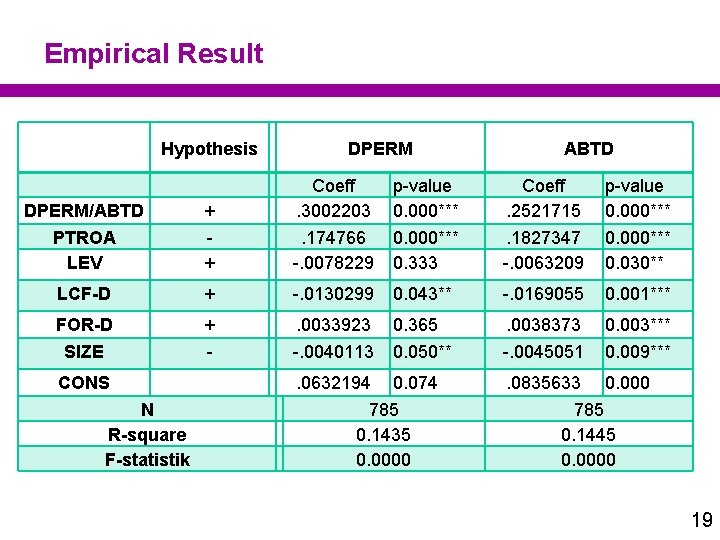

Empirical Result Hypothesis DPERM ABTD DPERM/ABTD + Coeff. 3002203 PTROA LEV + . 174766 -. 0078229 0. 000*** 0. 333 . 1827347 -. 0063209 0. 000*** 0. 030** LCF-D + -. 0130299 0. 043** -. 0169055 0. 001*** FOR-D + . 0033923 0. 365 . 0038373 0. 003*** SIZE - -. 0040113 0. 050** -. 0045051 0. 009*** . 0632194 0. 074 . 0835633 0. 000 CONS N R-square F-statistik p-value 0. 000*** Coeff. 2521715 p-value 0. 000*** 785 0. 1435 0. 0000 785 0. 1445 0. 0000 19

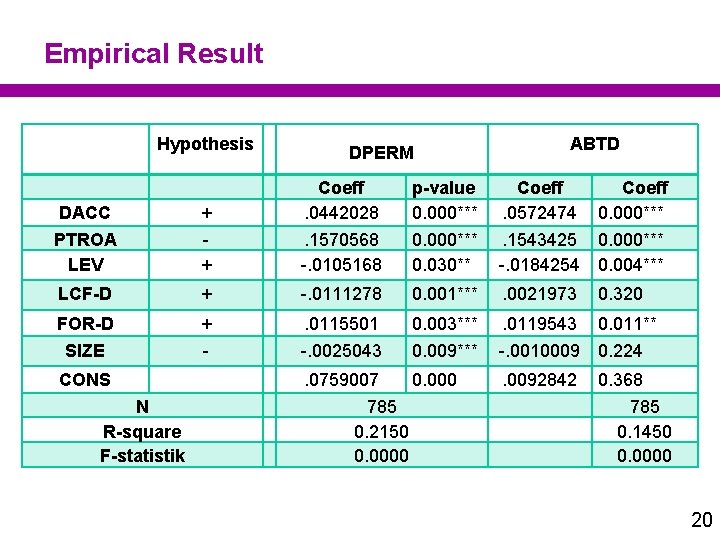

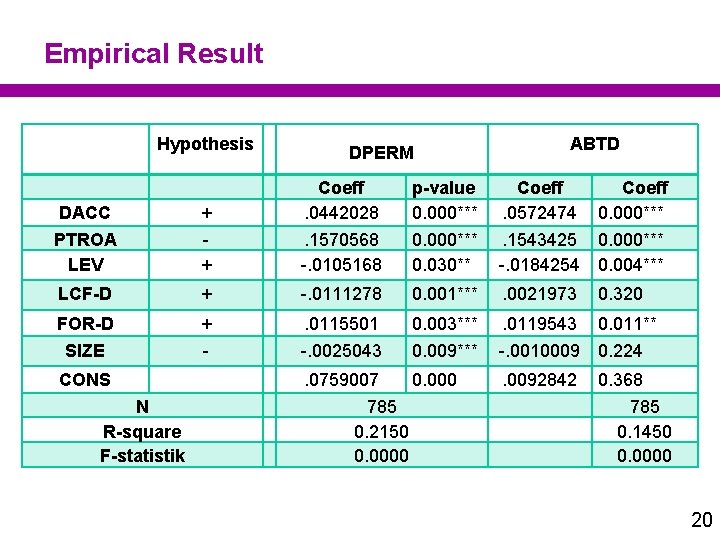

Empirical Result Hypothesis DPERM ABTD DACC PTROA LEV + + Coeff. 0442028. 1570568 -. 0105168 LCF-D + -. 0111278 0. 001*** . 0021973 FOR-D SIZE + - . 0115501 -. 0025043 0. 003*** 0. 009*** . 0119543 0. 011** -. 0010009 0. 224 CONS N R-square F-statistik p-value 0. 000*** 0. 030** Coeff. 0572474 0. 000***. 1543425 0. 000*** -. 0184254 0. 004*** . 0759007 0. 000 785 0. 2150 0. 0000 . 0092842 0. 320 0. 368 785 0. 1450 0. 0000 20

Empirical Result § Tax aggressiveness influence the financial reporting aggressiveness and vice versa. § Both measurement DPERM and ABTD consistently have positive influence to financial reporting aggressiveness. § ABTD as proxy to measuring tax aggressiveness show the consistent result with DPERM. § Control variables effect on the research results also show a similar value between DPERM and ABTD proxy. § The result refers to prior research by Hanlon and Heitzman (2010 ) which states that the various method of measurement of tax aggressiveness with permanent differences content show consistent results. § But in this study, ABTD can not be said to be better in measuring the tax aggressiveness compared with DPERM proxy because we need to do further research. 21

Conclusion • • • The results show that there is a positive and significant relation between tax and financial reporting aggressiveness. This indicates that in accordance with the study of Frank et al (2009), a public company in Indonesia does not face the problem of trade-offs in decision making related to the value of net income and tax payment. This may be an indication that the accounting rules and taxation Indonesia has loopholes that can be exploited by companies to manage their book and tax income. The results also showed that aggressiveness measurement using a permanent tax differences (DPERM) or abnormal book tax differences (ABTD) showed consistent results. This proves that the content of permanent differences in both proxies are able to be used as a method of measuring tax aggressiveness in accordance with the research done by Hanlon and Heitzman (2010). 22

Conclusion Implication • The results show that in accordance with previous studies that companies in Indonesia does not have a trad off in doing the tax and financial reporting aggressiveness. • This indicates that the company can reduce taxable income without reducing net income for accounting purposes. • So the regulator needed to increase awareness in examinations because of of tax and financial reporting aggressiveness increasingly difficult to detect. • The study found that ABTD measurement showed consistent results with DPERM. Thus, ABTD can be used as an alternative method of measuring the tax aggressiveness or tax avoidance. 23

Conclusion Limitation § Due to limited time , the study was conducted within only 5 years period. Further research is recommended to add the study period for the activities of tax and financial reporting aggressiveness can be seen more reliably. § The model is limited research on the model of aggressiveness taxes by Frank et al (2009 ) and Tang and Fifth ( 2012) as well as a model of financial reporting aggressiveness by modified Jones (Dechow et al, 1995). Further research can be done using different measuring methods. § This study also limited to controlling only five control variables, which are PTROA , LEV , LCF_D , FOR_D and SIZE. § Further research can exploit the other variables such as family ownership structure , the effectiveness of corporate governance and changes in corporate tax rates. 24

THANK YOU 25

Direct vs indirect cash flow

Direct vs indirect cash flow What is aggressiveness

What is aggressiveness Gst conclusion

Gst conclusion Ralphs annual income is about $32 000

Ralphs annual income is about $32 000 The business tax and financial environment

The business tax and financial environment Adoption and foster care analysis and reporting system

Adoption and foster care analysis and reporting system Frx report designer

Frx report designer Aabe application form

Aabe application form Financial statement purpose

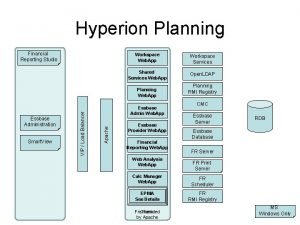

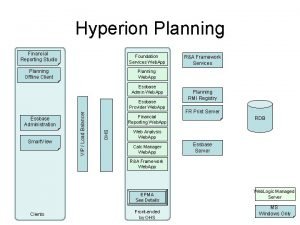

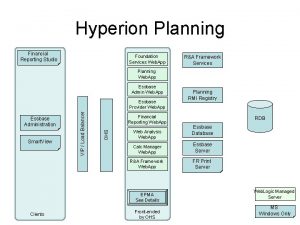

Financial statement purpose Essbase financial reporting studio

Essbase financial reporting studio What is financial reporting studio?

What is financial reporting studio? Second level of conceptual framework

Second level of conceptual framework Financial accounting standards

Financial accounting standards What is financial reporting studio?

What is financial reporting studio? Corporate financial reporting objectives

Corporate financial reporting objectives Cbd financial reporting framework

Cbd financial reporting framework Ias 34 interim financial reporting

Ias 34 interim financial reporting Project management financial reporting

Project management financial reporting Normalised earnings limitations

Normalised earnings limitations Chapter 2 conceptual framework for financial reporting

Chapter 2 conceptual framework for financial reporting International financial reporting standards 9

International financial reporting standards 9 Limitations of financial reporting

Limitations of financial reporting Chapter 2 conceptual framework for financial reporting

Chapter 2 conceptual framework for financial reporting Non-financial methods of motivation

Non-financial methods of motivation Financial statements and ratio analysis chapter 3

Financial statements and ratio analysis chapter 3 Financial statements and ratio analysis chapter 3

Financial statements and ratio analysis chapter 3