Active Investment of Surplus Treasury Cash IMF FOTEGAL

- Slides: 31

Active Investment of Surplus Treasury Cash IMF – FOTEGAL Workshop Washington DC 17 February 2017 John Gardner – Consultant

What is Meant by ‘Surplus Cash’? • Surplus cash can be generated through i. Structural surpluses relating to the budget/fiscal policy ii. Unexpected budget surpluses iii. Short-term cash surpluses from timing mismatches of budgeted revenues and expenditures • • (i) consists of all types of Sovereign Wealth Funds based on commodities; unusual income (e. g. citizenship/privatization revenues); deliberate budget savings (e. g. earthquake selfinsurance schemes); fiscal constraint. These have their own defined risk management and governance regimes unrelated to cash management operations (i) is normally not part of the remit of the Treasury although the design of the savings structure should be – especially with ‘Financing Fund’ structures – below. 2

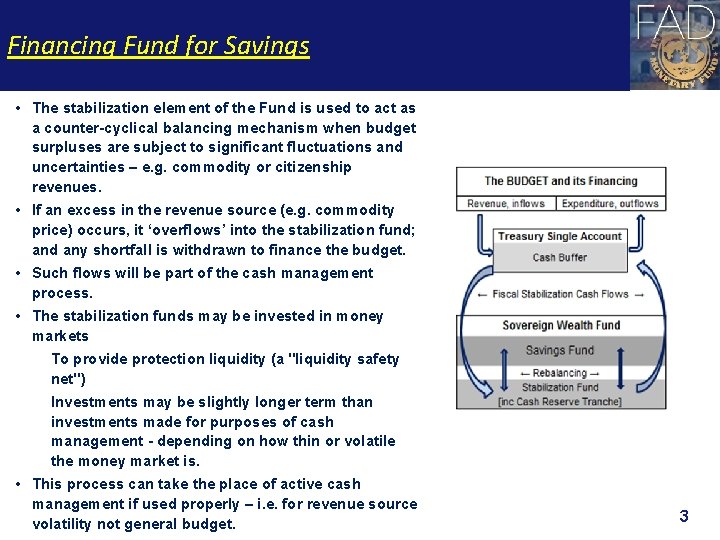

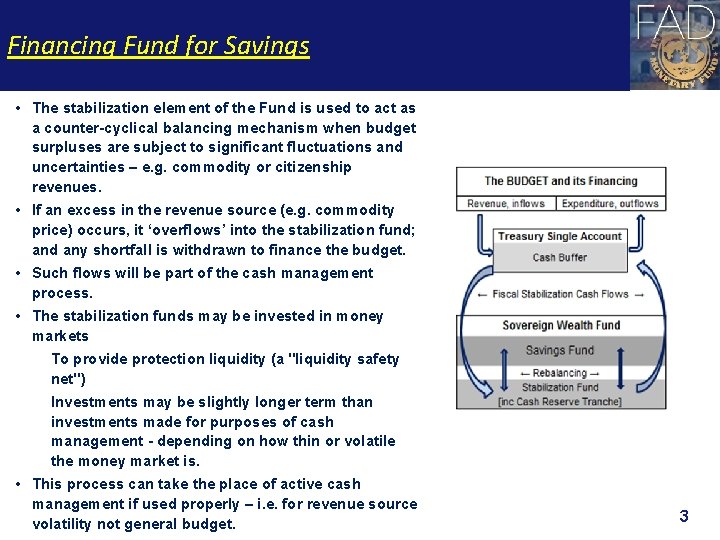

Financing Fund for Savings • The stabilization element of the Fund is used to act as a counter-cyclical balancing mechanism when budget surpluses are subject to significant fluctuations and uncertainties – e. g. commodity or citizenship revenues. • If an excess in the revenue source (e. g. commodity price) occurs, it ‘overflows’ into the stabilization fund; and any shortfall is withdrawn to finance the budget. • Such flows will be part of the cash management process. • The stabilization funds may be invested in money markets To provide protection liquidity (a "liquidity safety net") Investments may be slightly longer term than investments made for purposes of cash management - depending on how thin or volatile the money market is. • This process can take the place of active cash management if used properly – i. e. for revenue source volatility not general budget. 3

What is Meant by ‘Surplus Cash’? • Category (ii) is clearly difficult being ‘unexpected’. If the budget is not fully credible, this is always a problem for cash managers. • Analysis of cash flow forecast errors will reveal the source of the surplus. • Budget execution forecast errors – underspending & overcollection can be sorted into in-year or permanent discrepancies. In-year treated as in (iii). • Permanent => coordination with macrofiscal, budget, and debt management departments should determine the appropriate investment strategy. • Category (iii) is wholly the responsibility of the cash managers and surplus cash investment in this case is an intrinsic part of the cash management function. It is not simply an arbitrary add-on which can be handled separately by another section of the Treasury or central bank. 4

Cash Management • Primary objective – to ensure that the government can meet all its budget payment obligations as they arise – no need for expenditure arrears or cash rationing activities. • Secondary objective – to manage the budget cash resources of the government efficiently. • These objectives rely heavily on a credible budget and good cash flow forecasting – if these exist, active cash management operations (borrowing and investing) can ensure that both objectives are met. If they do not, only the first objective is feasible and then at potentially large cost of holding cash reserves to meet unexpected demands. 5

Cash Management • Cash management is necessary because, during the fiscal year, there always exist timing mismatches between budget expenditures and revenues – broadly defined (i. e. including all flows such as debt servicing). • Under a credible budget framework, annual expenditures = annual revenues + budget deficit financing (or – budget surplus). If this holds and the TSA accounts for all budget cash flows, its balance at the start of the year = balance at end of year. The deficit is financed or a surplus invested. • If a forecast can be obtained of (daily, weekly, monthly) expenditures, ordinary revenues, grants, loans, external financing, domestic financing, and debt servicing, a profile of the TSA balance can be projected across the fiscal year. 6

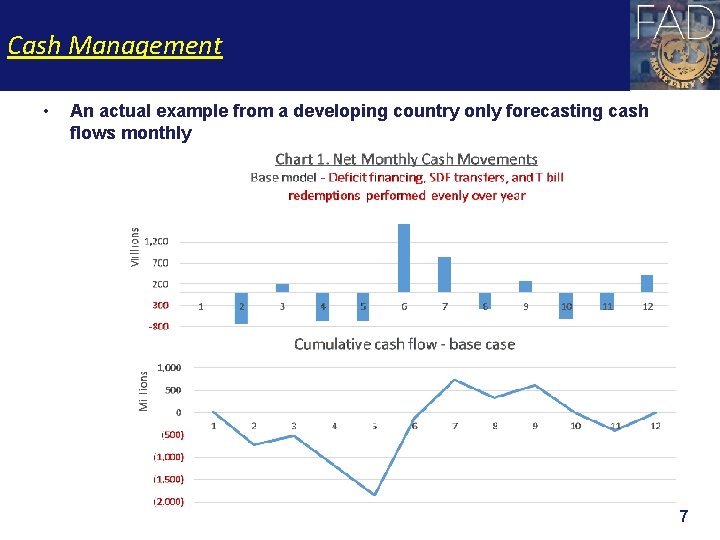

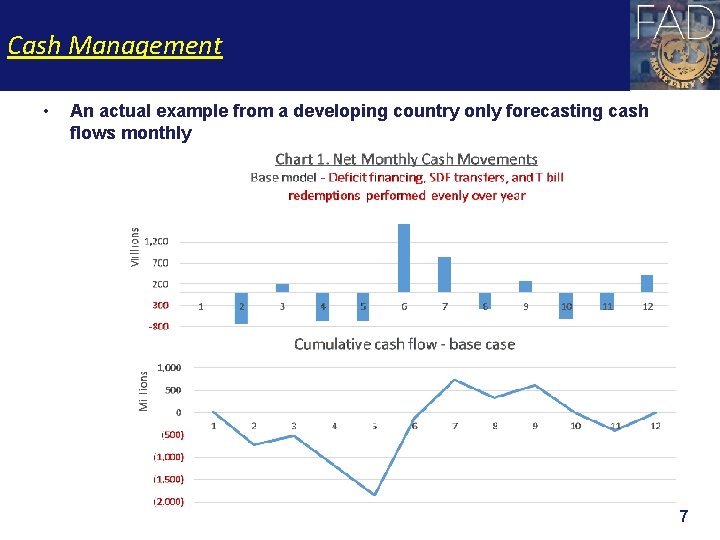

Cash Management • An actual example from a developing country only forecasting cash flows monthly 7

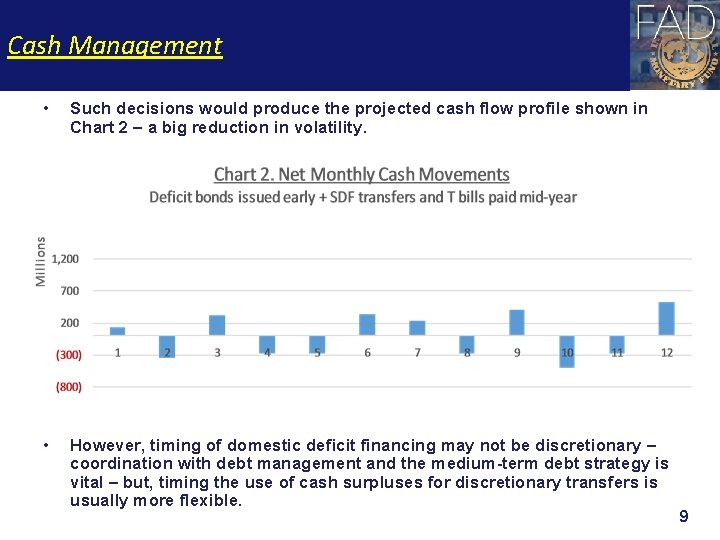

Cash Management • • • Cash management objectives are met if cash flow volatility (and therefore the TSA profile) over the year is as smooth as possible. Thus, the balance at the start of the year is maintained at approximately the same level until the end of the year. • This smoothing of government cash flows through the TSA allows the government to reduce debt servicing costs, make all necessary payments, and greatly assists the operation of monetary policy In the above example, timing of domestic deficit financing, paying off a budgeted amount of T bills, and a contribution to the sovereign development fund are considered to be discretionary. All other budget flows are assumed fixed as per the forecast. ‘Rough smoothing’ suggests a policy decision based on the base forecast should be to issue the domestic financing in months 2, 4, 5; and use s-t cash surpluses to make transfers to the SDF and pay down T bills in months 6 and 7 – rather than evenly. 8

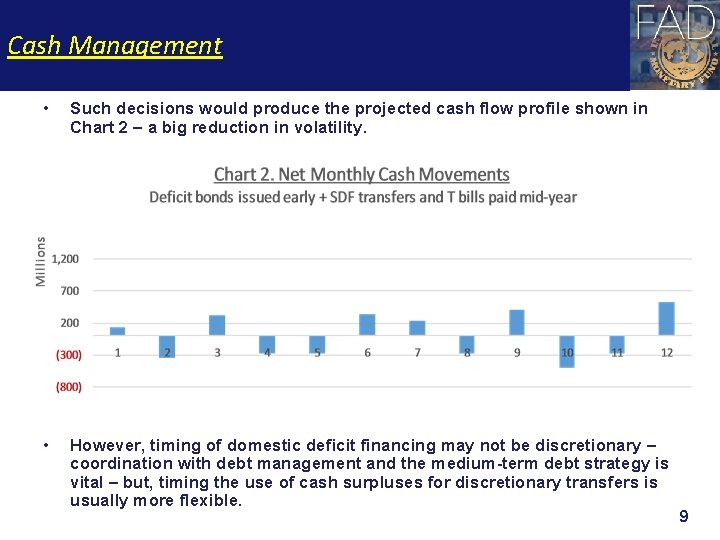

Cash Management • Such decisions would produce the projected cash flow profile shown in Chart 2 – a big reduction in volatility. • However, timing of domestic deficit financing may not be discretionary – coordination with debt management and the medium-term debt strategy is vital – but, timing the use of cash surpluses for discretionary transfers is usually more flexible. 9

Cash Management • There often exists a tension between cash management and debt management policies – especially when debt market development and/or pre -funding is important: • The debt managers will wish to issue bills and bonds at regular intervals in regular sizes; or may pre-fund some time before a major maturity. • The proceeds of these issues are often not in line with cash requirements and can mean that cash must be invested whilst borrowing is increasing. • This tension becomes apparent in the market e. g. when T bills are being issued and cash investments are being sought simultaneously. 10

Cash Management • Coordination and understanding is required between the cash and debt managers and the market must be informed of developments. • In many developed countries where a regular T bill issuance plan exists, the market is informed of the cash flow situation and understands if excess borrowing is necessary by the issuance of “cash management bills” or investments made through “cash management reverse repo operations” (e. g. USA, New Zealand, UK). • Some countries use in-year surplus cash to make s-t loans to SOEs, Munis, etc. which might be considered either as discretionary budget transfers or investments. (e. g. Russia). • Where feasible, however, controlling discretionary budget execution timing is usually the most efficient use of inyear surpluses since it avoids unnecessary borrowing. 11

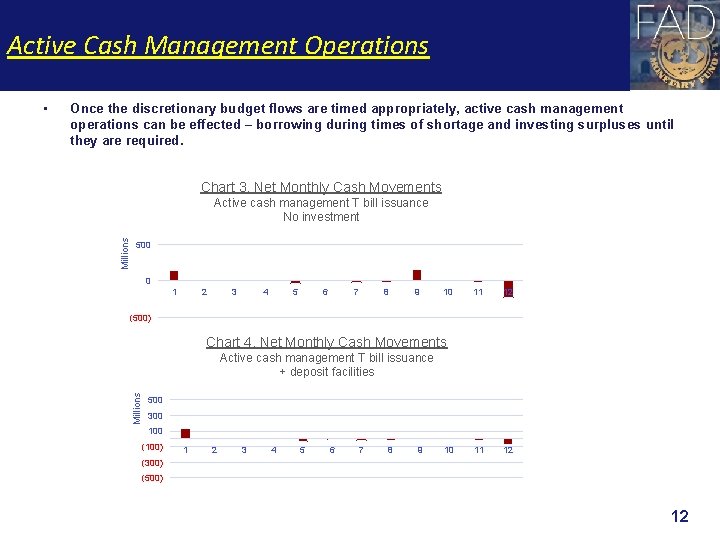

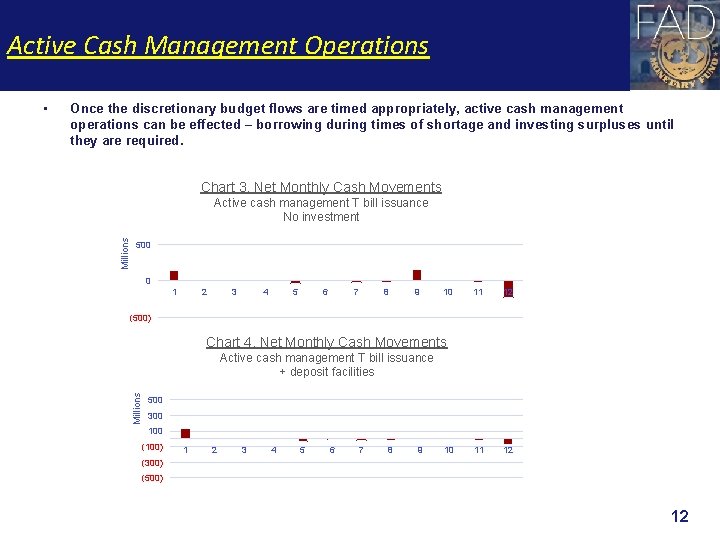

Active Cash Management Operations Once the discretionary budget flows are timed appropriately, active cash management operations can be effected – borrowing during times of shortage and investing surpluses until they are required. Chart 3. Net Monthly Cash Movements Millions Active cash management T bill issuance No investment 500 0 1 2 3 4 5 6 7 8 9 10 11 12 (500) Chart 4. Net Monthly Cash Movements Active cash management T bill issuance + deposit facilities Millions • 500 300 100 (100) 1 2 3 4 5 6 7 8 9 10 (300) (500) 12

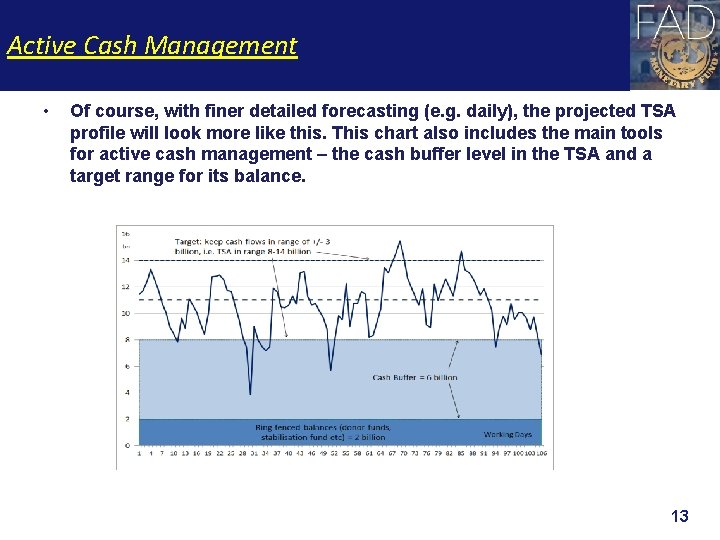

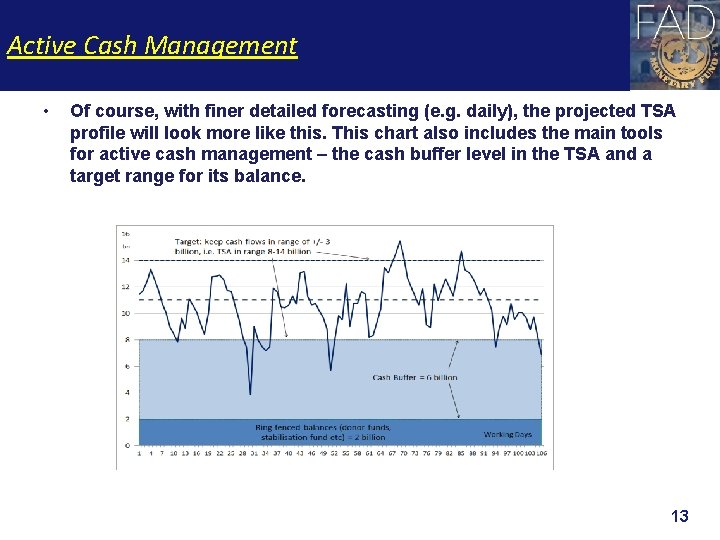

Active Cash Management • Of course, with finer detailed forecasting (e. g. daily), the projected TSA profile will look more like this. This chart also includes the main tools for active cash management – the cash buffer level in the TSA and a target range for its balance. 13

Active Cash Management Investment Operations • Investment of cash resources relating to cash management are, by definition, short-term, usually less than 3 months, and tied closely to the necessary shortterm cash borrowing activities. • Defining how much to invest and for how long depends on the cash management operating model. • In the rough tuning example using only monthly forecasts, this is answered quite easily by looking at the projected cash flows. In chart 4, a single term deposit has been made in period 9 for maturity in period 12 for the amount of projected surplus. • N. B. Here no account has been taken of potential forecast errors which may mean that unnecessary borrowing and locking-in of required cash can occur. (Important - Forecast errors have symmetric risks. ) 14

Active Cash Management Investment Operations • For more complex, sophisticated models where cash flow forecasts are much more detailed in time, and forecast errors are taken into account, a variety of fine tuning options are used. • In countries where the forecasts are considered to be highly accurate (on a short-term basis at least), the decision to make a cash investment can be • To use any surplus during the day/week which is known to exist • To maintain a specified cash surplus and invest any expected excess (France, Italy) • To maintain a cash deficit as expenditures are made and reimburse that through borrowings as necessary (Holland, Germany) • To maintain a roughly neutral balance (UK, Sweden) • The overriding concept is that expenditure payments must be made as required and that holding a buffer balance is costly. 15

Active Cash Management Investment Operations • The more accurate the forecasting and the more liquid the T bill (or s-t borrowing) market, the lower the buffer needs to be. • By definition, the buffer needs to be the most liquid part of a government cash holding since it is needed to absorb forecast errors of cash demand. • In many countries, the cash buffer is held on call at the central bank in the TSA with little or no remuneration. This should create an incentive on the government to improve its forecasts and deepen its T bill market so that its buffer level is minimized(!). • However, if there is agreement for the C Bk to remunerate government cash holdings, it usually attracts the overnight risk-free policy rate at best. 16

Cash Buffer Composition • Another investment decision to be taken is the currency composition of the cash buffer. Where this is not 100% domestic currency, this decision is very country-specific. • Since the buffer is designed to absorb unexpected cash demands during budget execution, currency composition will often be determined by expenditure factors. • Many countries have large payments to be made in USD or other currencies which are not easily forecastable and it is sensible to maintain at least a portion of the buffer in these currencies. • Other ALM factors will be the building up of a reserve to pay FX debt servicing, or specifically, the investment of pre-funded bond issuance proceeds until used to pay maturing debt stock. (E. g. Jamaica debt restructuring). • Use of proceeds in this manner can be dangerous however if expenditure forecasts are poor and the buffer is at risk of depletion – a separate fund may be preferable. 17

Cash Buffer Composition • When there is an alternative justification for the size of the buffer other than a forecast error cushion, it can have different investment criteria: • For credit enhancement purposes, some countries have, at times, needed to show the markets that there is enough cash available to meet at least the next bond maturities. If this implies that this (part of the) buffer will not be used for other expenditures, it can be invested for the same maturity and in the same currency as the associated bonds. (e. g. Brazil, Iceland). 18

Investment of Cash Management Surpluses – Rough Tuning • As in the earlier example, rough tuning, performed on wider forecast times (e. g. monthly) rely on smoothing large timing imbalances between revenues and expenditures. • The terms of the investment are known and will usually between one and six months. • Several options are open to the cash managers for this type of investment • • • Repayment of T bills (or not rolling them over for the period). Term deposits with the central bank or commercial banks. Reverse repos. Certificate of Deposits (CDs) – negotiable or non-negotiable. Money Market Mutual Funds (MMMFs) and CP. 19

Regularly Used Investment Vehicles • Reverse repos • Very important in most money markets, offering competitive short-term market rates (fixed or variable), used by central banks for OMOs. • Sale and repurchase of an underlying security which should be government (or central bank) security - serves as collateral which is assessed by ‘marking to market’ daily. • Term deposits in commercial banks • Similar to market repo rates but usually includes penalty if redeemed in advance. • Must (over) collateralise to avoid credit risk. • Should require a competitive auction process usually only between preapproved institutions. • Certificates of Deposit (CDs) • Low liquidity risk (if negotiable). • Greatly increased credit risk - cannot collateralise. 20

Less Useful Investment Vehicles • Other instruments were more utilized before financial crisis. Now rarely. • Money market mutual funds • MMMFs invest in short-term instruments not necessarily of top quality. • They benefit from diversified market access; but performance may vary and is not without risk. • Commercial paper • Issued by highly credit rated large banks and non-financial corporations. • High performance but potentially more risky. • Higher liquidity risk. 21

Investment of Cash Management Surpluses – Fine Tuning • Fine tuning of short-term cash surpluses usually is for a shorter period than rough tuning investments – often a few days to 30 days. Government cash flow forecasting needs to be accurate to justify implementation risks. • Operation depends very much on the development of the money market • Where the repo market is highly developed, the use of reverse repos for investment can be made very quickly, safely, and in significant size. • Term deposits can be undertaken with the provision of high-quality collateral. • A number of pre-approved banks are eligible to participate. • Where money markets are less developed, only very short repos (1 to 7 days? ) will be available and collateral for deposits may be restricted. • Other instruments are usually not utilized for fine tuning investment operations due to greater liquidity and credit risks. 22

Active Cash Management Policy Objectives • The legal framework typically should allow the cash managers to make investments only in highly liquid securities, high quality deposits (collateralized) with suitable (eligible) financial institutions and repos. • Management of risks on short-term investments: • Liquidity risk: ability to convert an investment into cash before maturity without suffering an unacceptable loss of principal. Requires emphasis on marketable short-term investments or negotiated conditions on breaking term deposits. • Credit risk: possibility that the issuer of an instrument (or any counterparty) does not meet the repayment of principal and/or interest in full, on time and in accordance with the terms of the transaction. Requires high quality assets and collateral; diversification and "marking to market“ for collateral assessment. 23

Active Cash Management Policy Objectives • Market risk: arising from adverse changes in market rates; will be small if the instruments are short term. • Legal risk: contracts may not legally enforceable. Requires clearly documented signed agreements with counterparties (e. g. overall master repurchase agreement (GMRA) for repos). • Operational risk: resulting from inadequate or failed internal processes, people and systems or external events. Requires defined and regulated procedures, segregation of duties, internal control and business continuity plan – will normally be identical to debt management operational risks. 24

Operational Policy • The legal framework on investment policy at the operational level must specify: • What investments are possible and acceptable. • What legal investment documentation is necessary. • Objectives in terms of risk, liquidity and yield. • Policy on market, credit, liquidity, legal and operational risks. Includes for example: • Exposure limits to credit risk relating to counterparty or issuer diversification or concentration requirements, credit ratings, preapproval of eligible institutions. • Collateral Management Framework. 25

Operational Policy • Performance measurement and performance criteria – (this should not be solely directed at cash investments since performance of the whole cash forecasting and active management functions should be included) • Must have cash to meet commitments – essential. • Cost of maintaining buffer cash (e. g. Canada). • In connection with saving of interest, can be estimated by comparing with a situation of inactivity; e. g. , return on deposits (e. g. France). • Smoothing benefits are difficult to measure (e. g. UK – not used). • Consider other objectives – e. g. benefits to operation of monetary policy (e. g. UK, USA). 26

International Experience • Cash management is probably the PFM topic with the largest gap between developed and developing countries • Mostly due to problems with cash flow forecasting. • Very difficult institutional process to move from cash rationing to cash management. • Where reasonable cash flow forecasting has been achieved, often a lack of domestic money market facilities and development, and collateral availability, hampers active cash management operations. • With high forecast errors and little money market liquidity, the need for large cash buffers may be considered impossible to maintain. • Without adequate buffer and s-t borrowing facilities, unexpected demand quickly leads back to cash rationing and expenditure arrears. • S-t surplus cash investment becomes the least important part of budget execution. 27

Summary – Pre-conditions and Challenges • The most important pre-condition for justifying investment of temporary surplus cash resources is accurate cash flow forecasting of all flows through the TSA (however structured). Without this, the cash manager may be placing cash on term deposit or repo when it is vitally required for payments. This is costly and might also require extra borrowing. • Advancing to fine tuning operations requires much more accurate, detailed forecasts. Its advantage is that the requisite buffer level can be far lower than for rough tuning needs. • A reasonably liquid money (repo) market must exist and/or sufficient high-quality collateral to back-up term deposits at commercial banks. (Some countries rely on state-owned banks to avoid this, e. g. China) Term deposits at the central bank, if available, are useful but will normally hinder the operation of monetary policy if large. 28

Summary – Pre-conditions and Challenges • Institutionally, cash flow forecasting may be undertaken by the Treasury but actual cash investment should follow the risk management and performance assessment functions of the debt management office and therefore be performed there. (e. g. UK, NZ) • For many countries, the concept of holding a buffer of cash in the TSA to absorb forecasting errors is anathema. It is considered to be a contingency fund and often ends up being deliberately spent. Even when its role is understood, it may not be allowed to contain sufficiently large reserves. • When active cash management operations go wrong, for any of these reasons, it is often easy to revert to ‘budgetary control’ i. e. cash rationing and all that it implies. 29

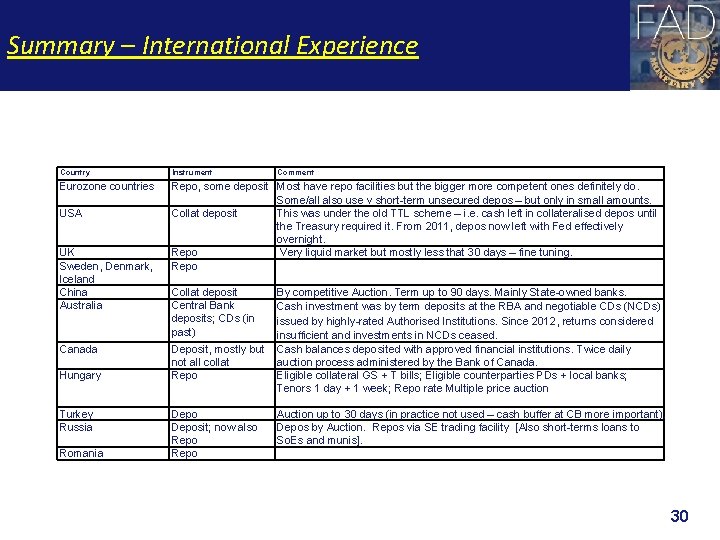

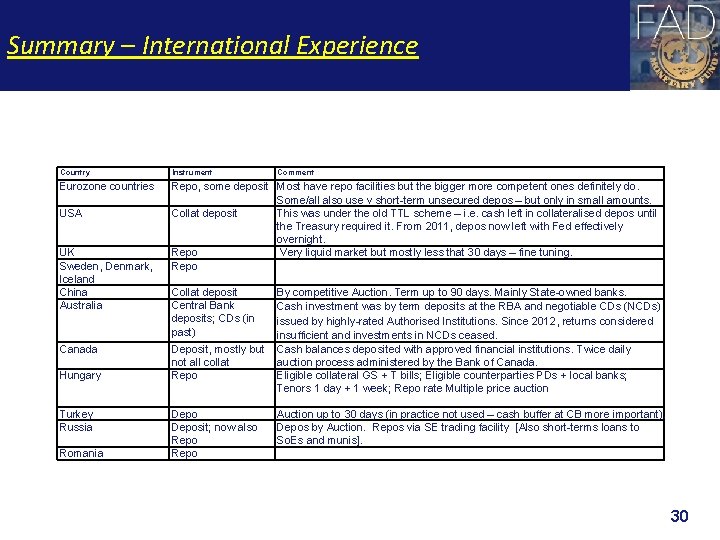

Summary – International Experience Country Instrument Eurozone countries Repo, some deposit Most have repo facilities but the bigger more competent ones definitely do. Some/all also use v short-term unsecured depos – but only in small amounts. Collat deposit This was under the old TTL scheme – i. e. cash left in collateralised depos until the Treasury required it. From 2011, depos now left with Fed effectively overnight. Repo Very liquid market but mostly less that 30 days – fine tuning. Repo USA UK Sweden, Denmark, Iceland China Australia Canada Hungary Turkey Russia Romania Comment Collat deposit Central Bank deposits; CDs (in past) By competitive Auction. Term up to 90 days. Mainly State-owned banks. Cash investment was by term deposits at the RBA and negotiable CDs (NCDs) issued by highly-rated Authorised Institutions. Since 2012, returns considered insufficient and investments in NCDs ceased. Deposit, mostly but Cash balances deposited with approved financial institutions. Twice daily not all collat auction process administered by the Bank of Canada. Repo Eligible collateral GS + T bills; Eligible counterparties PDs + local banks; Tenors 1 day + 1 week; Repo rate Multiple price auction Deposit; now also Repo Auction up to 30 days (in practice not used – cash buffer at CB more important). Depos by Auction. Repos via SE trading facility [Also short-terms loans to So. Es and munis]. 30

Conclusion • This list does not include either the many countries which are just starting on the road to effective cash management, or Latin American countries. • I very much look forward to hearing the progress and developments in this region from you now. THANK YOU! 31

Consumer surplus and producer surplus

Consumer surplus and producer surplus Consumer surplus and producer surplus

Consumer surplus and producer surplus Producer and consumer surplus graph

Producer and consumer surplus graph Treasury cash balance

Treasury cash balance Fixed investment and inventory investment

Fixed investment and inventory investment A form for recording transactions in chronological order

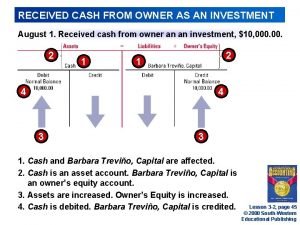

A form for recording transactions in chronological order Received cash from owner as an investment

Received cash from owner as an investment Recieved cash from owner as an investment

Recieved cash from owner as an investment Investment of cash by owner

Investment of cash by owner Imf voting power

Imf voting power Imf gdp per capita

Imf gdp per capita Imf system

Imf system Types of intermolecular forces

Types of intermolecular forces Imf

Imf Imf practice

Imf practice Molecular attraction

Molecular attraction Imf

Imf Debt imf

Debt imf Difference between imf and world bank

Difference between imf and world bank Department vs division

Department vs division Wto objectives

Wto objectives Imf financial statistics

Imf financial statistics Imf history

Imf history Lambang imf

Lambang imf Materi tentang lembaga keuangan internasional

Materi tentang lembaga keuangan internasional Intermolecular forces

Intermolecular forces Imf chemistry

Imf chemistry Imf financial statistics

Imf financial statistics Imf adalah

Imf adalah Imf chemistry

Imf chemistry India imf loan history

India imf loan history List six reasons why a bank may dishonor a check

List six reasons why a bank may dishonor a check