ACADEMY OF ECONOMIC STUDIES DOCTORAL SCHOOL OF FINANCE

![Whole Period ARCHLM test ROMANIA BET 10 5 0, 382733 [0. 860877] 10 0, Whole Period ARCHLM test ROMANIA BET 10 5 0, 382733 [0. 860877] 10 0,](https://slidetodoc.com/presentation_image/42924eb6ef58c69b16c36f55024b1ca7/image-18.jpg)

- Slides: 29

ACADEMY OF ECONOMIC STUDIES DOCTORAL SCHOOL OF FINANCE AND BANKING DISSERTATION PAPER The day of the week effect on stock market return and volatility: International evidence Student: Sorin Stoica Supervisor: Professor Moisa Altar BUCHAREST, JULY 2008

Contents 1. Introduction 2. Literature review 3. Data and Model description 4. Empirical results 5. Conclusions 6. Bibliography

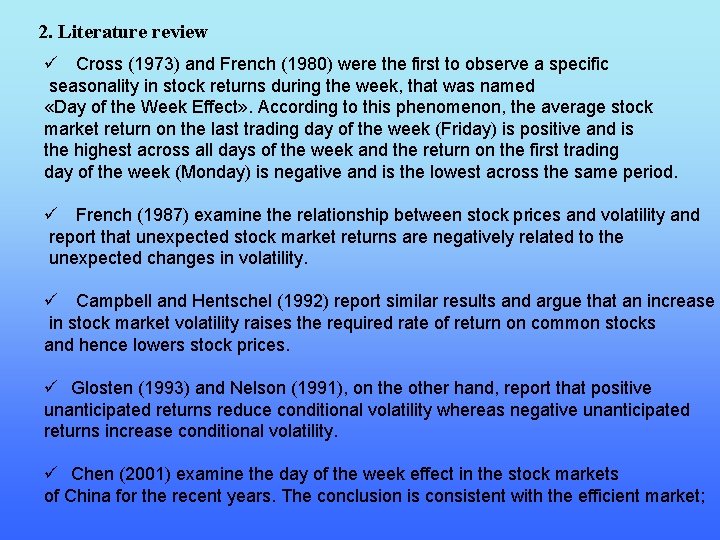

1. Introduction The day of the week effect refers to the existence of a pattern of stock returns during the week, a seasonal «anomaly» , which contradicts the «Efficient Market Hypothesis» * A market is efficient if prices fully and instantaneously reflect all available information and no profit opportunities are left unexploited. In an efficient situation, new information is unpredictable, so stock market returns cannot be predicted and there is therefore no trading pattern, which an investor can follow in order to make unexpected profits. *(The efficient-market hypothesis was developed by Professor Eugene Fama at the University of Chicago Graduate School of Business as an academic concept of study through his published Ph. D. thesis in the early 1960 s at the same school)

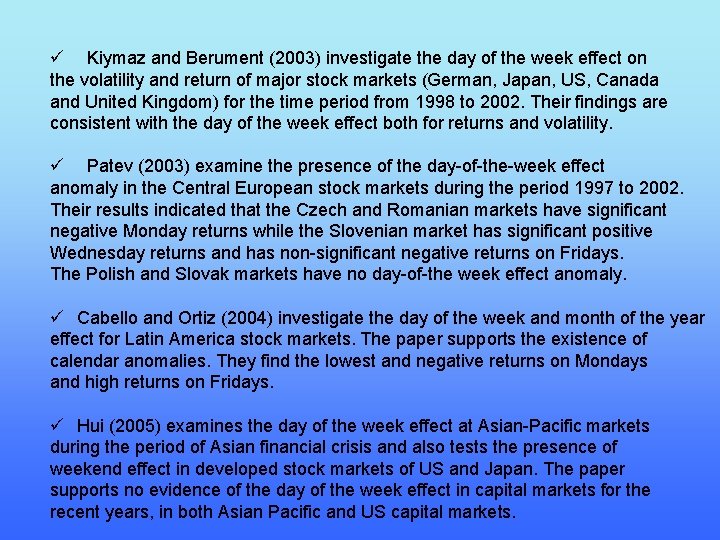

2. Literature review ü Cross (1973) and French (1980) were the first to observe a specific seasonality in stock returns during the week, that was named «Day of the Week Effect» . According to this phenomenon, the average stock market return on the last trading day of the week (Friday) is positive and is the highest across all days of the week and the return on the first trading day of the week (Monday) is negative and is the lowest across the same period. ü French (1987) examine the relationship between stock prices and volatility and report that unexpected stock market returns are negatively related to the unexpected changes in volatility. ü Campbell and Hentschel (1992) report similar results and argue that an increase in stock market volatility raises the required rate of return on common stocks and hence lowers stock prices. ü Glosten (1993) and Nelson (1991), on the other hand, report that positive unanticipated returns reduce conditional volatility whereas negative unanticipated returns increase conditional volatility. ü Chen (2001) examine the day of the week effect in the stock markets of China for the recent years. The conclusion is consistent with the efficient market;

ü Kiymaz and Berument (2003) investigate the day of the week effect on the volatility and return of major stock markets (German, Japan, US, Canada and United Kingdom) for the time period from 1998 to 2002. Their findings are consistent with the day of the week effect both for returns and volatility. ü Patev (2003) examine the presence of the day-of-the-week effect anomaly in the Central European stock markets during the period 1997 to 2002. Their results indicated that the Czech and Romanian markets have significant negative Monday returns while the Slovenian market has significant positive Wednesday returns and has non-significant negative returns on Fridays. The Polish and Slovak markets have no day-of-the week effect anomaly. ü Cabello and Ortiz (2004) investigate the day of the week and month of the year effect for Latin America stock markets. The paper supports the existence of calendar anomalies. They find the lowest and negative returns on Mondays and high returns on Fridays. ü Hui (2005) examines the day of the week effect at Asian-Pacific markets during the period of Asian financial crisis and also tests the presence of weekend effect in developed stock markets of US and Japan. The paper supports no evidence of the day of the week effect in capital markets for the recent years, in both Asian Pacific and US capital markets.

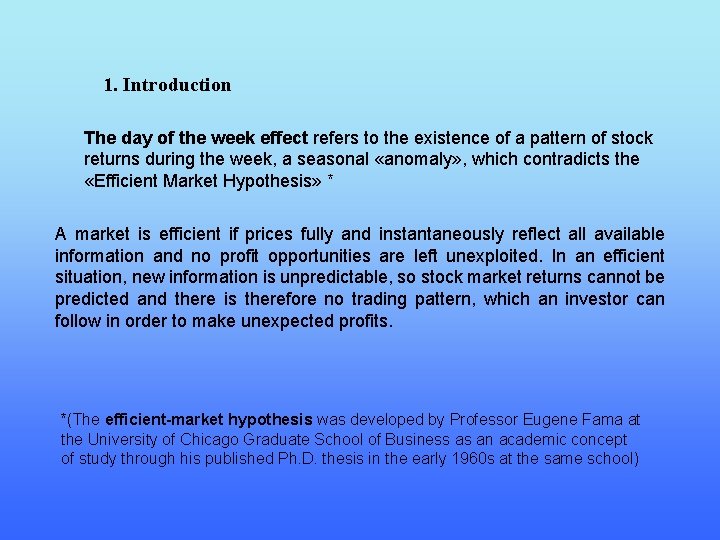

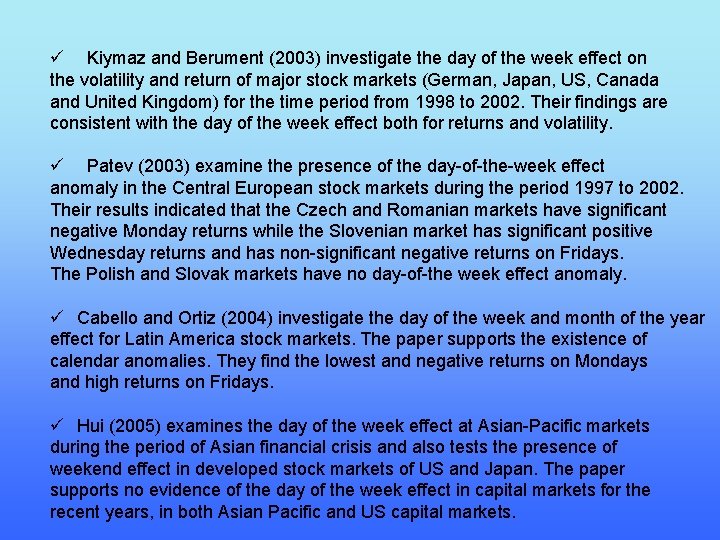

3. Data and Model description 3. 1 Data The data set used in this study consists of six European Index values obtained from Bloomberg. For econometric reasons, for working days that the stock markets did not open and of course the indices did not change, the value of the previous day has been used. Period Downtrend Uptrend ROMANIA BET 10 FRANCE CAC 40 GERMANY DAX 30 UK FTSE 100 SPAIN MADRID ITALY MIBTEL 1/10/200128/3/2003 1/10/200128/3/2003 (390) (390) 31/3/200320/6/2008 31/3/200320/6/2008 (1365) (1365) Notes: Numbers in parentheses depict observations used in each period The returns used in each of the time series are computed as follows:

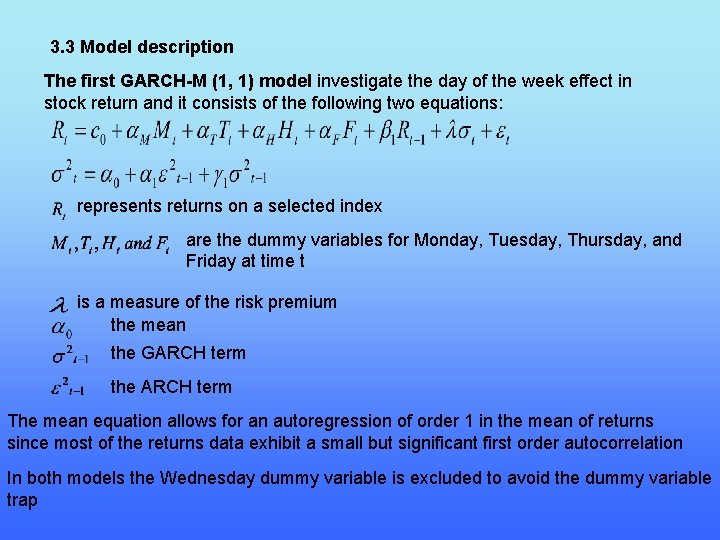

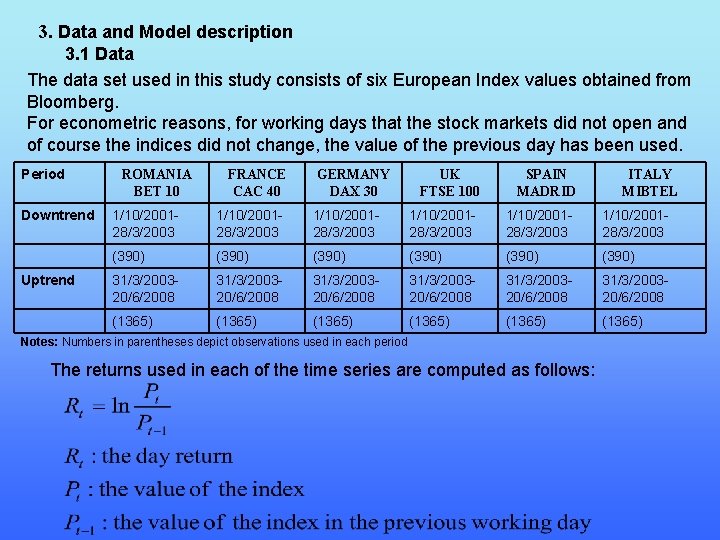

3. 3 Model description The first GARCH-M (1, 1) model investigate the day of the week effect in stock return and it consists of the following two equations: represents returns on a selected index are the dummy variables for Monday, Tuesday, Thursday, and Friday at time t is a measure of the risk premium the mean the GARCH term the ARCH term The mean equation allows for an autoregression of order 1 in the mean of returns since most of the returns data exhibit a small but significant first order autocorrelation In both models the Wednesday dummy variable is excluded to avoid the dummy variable trap

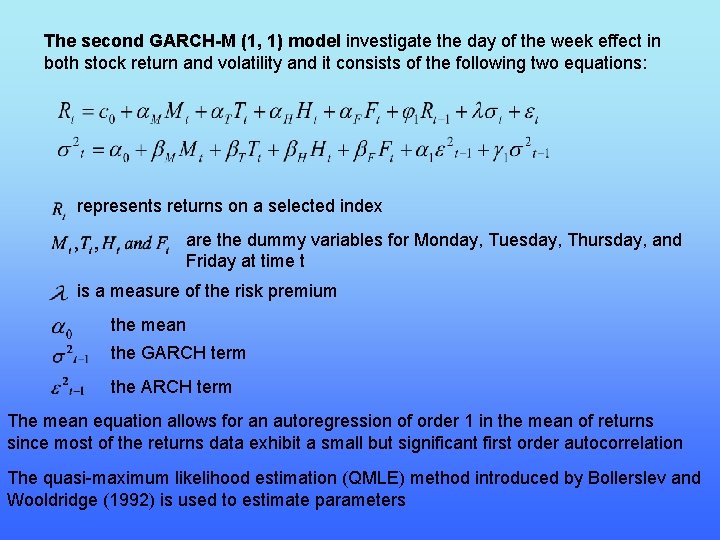

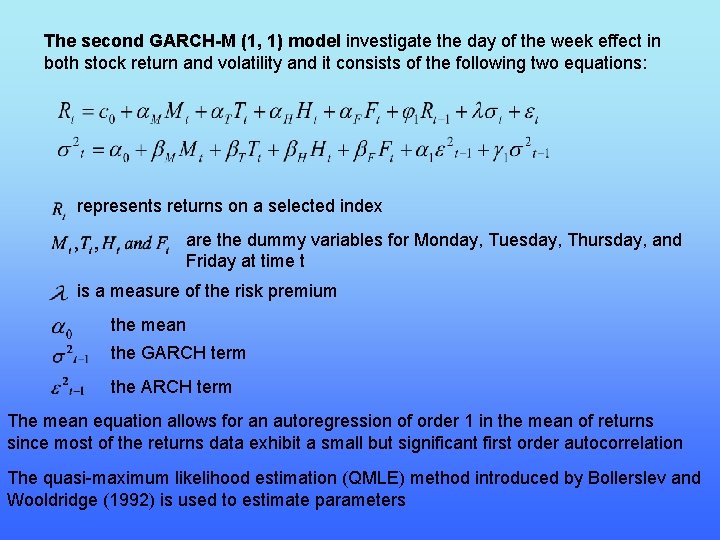

The second GARCH-M (1, 1) model investigate the day of the week effect in both stock return and volatility and it consists of the following two equations: represents returns on a selected index are the dummy variables for Monday, Tuesday, Thursday, and Friday at time t is a measure of the risk premium the mean the GARCH term the ARCH term The mean equation allows for an autoregression of order 1 in the mean of returns since most of the returns data exhibit a small but significant first order autocorrelation The quasi-maximum likelihood estimation (QMLE) method introduced by Bollerslev and Wooldridge (1992) is used to estimate parameters

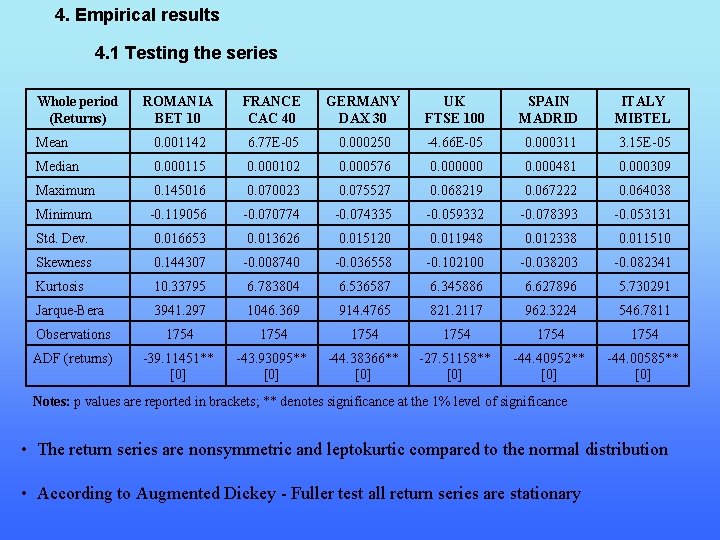

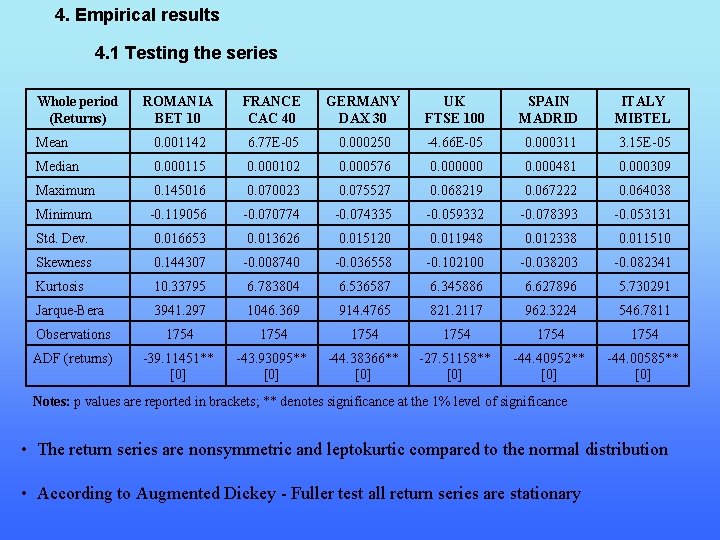

4. Empirical results 4. 1 Testing the series Whole period (Returns) ROMANIA BET 10 FRANCE CAC 40 GERMANY DAX 30 UK FTSE 100 SPAIN MADRID ITALY MIBTEL Mean 0. 001142 6. 77 E-05 0. 000250 -4. 66 E-05 0. 000311 3. 15 E-05 Median 0. 000115 0. 000102 0. 000576 0. 000000 0. 000481 0. 000309 Maximum 0. 145016 0. 070023 0. 075527 0. 068219 0. 067222 0. 064038 Minimum -0. 119056 -0. 070774 -0. 074335 -0. 059332 -0. 078393 -0. 053131 Std. Dev. 0. 016653 0. 013626 0. 015120 0. 011948 0. 012338 0. 011510 Skewness 0. 144307 -0. 008740 -0. 036558 -0. 102100 -0. 038203 -0. 082341 Kurtosis 10. 33795 6. 783804 6. 536587 6. 345886 6. 627896 5. 730291 Jarque-Bera 3941. 297 1046. 369 914. 4765 821. 2117 962. 3224 546. 7811 Observations 1754 1754 ADF (returns) -39. 11451** [0] -43. 93095** [0] -44. 38366** [0] -27. 51158** [0] -44. 40952** [0] -44. 00585** [0] Notes: p values are reported in brackets; ** denotes significance at the 1% level of significance • The return series are nonsymmetric and leptokurtic compared to the normal distribution • According to Augmented Dickey - Fuller test all return series are stationary

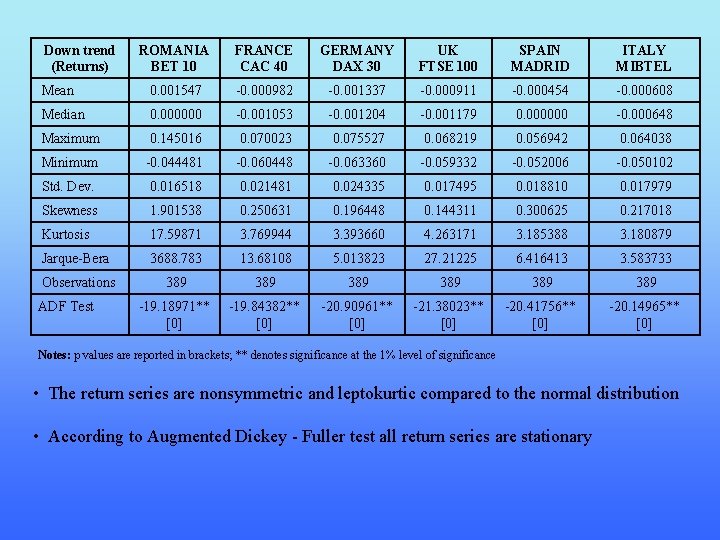

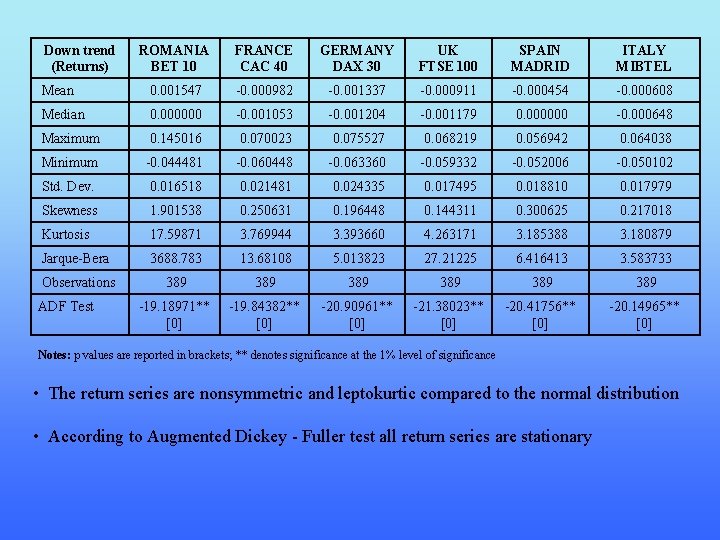

Down trend (Returns) ROMANIA BET 10 FRANCE CAC 40 GERMANY DAX 30 UK FTSE 100 SPAIN MADRID ITALY MIBTEL Mean 0. 001547 -0. 000982 -0. 001337 -0. 000911 -0. 000454 -0. 000608 Median 0. 000000 -0. 001053 -0. 001204 -0. 001179 0. 000000 -0. 000648 Maximum 0. 145016 0. 070023 0. 075527 0. 068219 0. 056942 0. 064038 Minimum -0. 044481 -0. 060448 -0. 063360 -0. 059332 -0. 052006 -0. 050102 Std. Dev. 0. 016518 0. 021481 0. 024335 0. 017495 0. 018810 0. 017979 Skewness 1. 901538 0. 250631 0. 196448 0. 144311 0. 300625 0. 217018 Kurtosis 17. 59871 3. 769944 3. 393660 4. 263171 3. 185388 3. 180879 Jarque-Bera 3688. 783 13. 68108 5. 013823 27. 21225 6. 416413 3. 583733 Observations 389 389 389 -19. 18971** [0] -19. 84382** [0] -20. 90961** [0] -21. 38023** [0] -20. 41756** [0] -20. 14965** [0] ADF Test Notes: p values are reported in brackets; ** denotes significance at the 1% level of significance • The return series are nonsymmetric and leptokurtic compared to the normal distribution • According to Augmented Dickey - Fuller test all return series are stationary

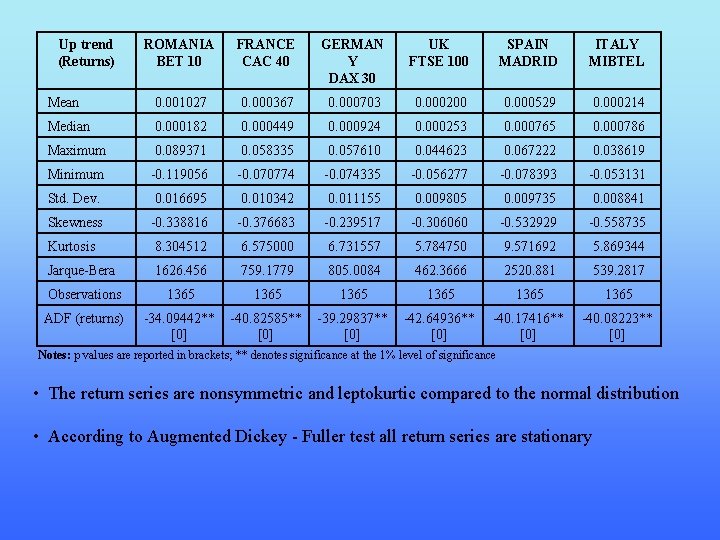

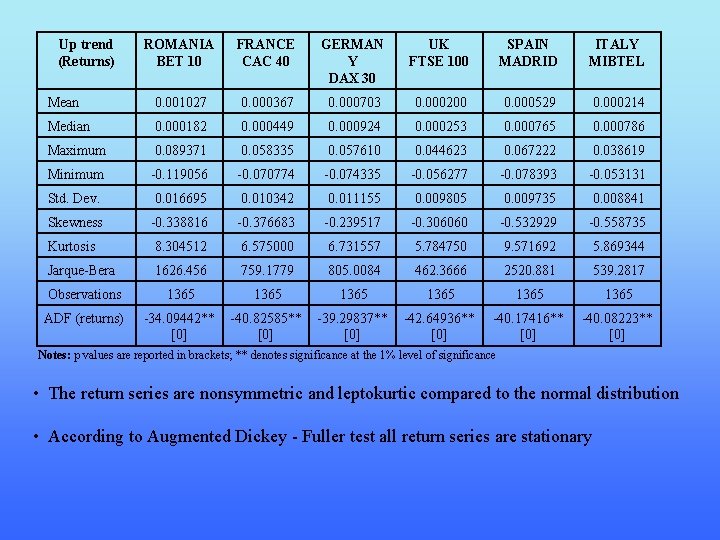

Up trend (Returns) ROMANIA BET 10 FRANCE CAC 40 GERMAN Y DAX 30 UK FTSE 100 SPAIN MADRID ITALY MIBTEL Mean 0. 001027 0. 000367 0. 000703 0. 000200 0. 000529 0. 000214 Median 0. 000182 0. 000449 0. 000924 0. 000253 0. 000765 0. 000786 Maximum 0. 089371 0. 058335 0. 057610 0. 044623 0. 067222 0. 038619 Minimum -0. 119056 -0. 070774 -0. 074335 -0. 056277 -0. 078393 -0. 053131 Std. Dev. 0. 016695 0. 010342 0. 011155 0. 009805 0. 009735 0. 008841 Skewness -0. 338816 -0. 376683 -0. 239517 -0. 306060 -0. 532929 -0. 558735 Kurtosis 8. 304512 6. 575000 6. 731557 5. 784750 9. 571692 5. 869344 Jarque-Bera 1626. 456 759. 1779 805. 0084 462. 3666 2520. 881 539. 2817 Observations 1365 1365 ADF (returns) -34. 09442** [0] -40. 82585** [0] -39. 29837** [0] -42. 64936** [0] -40. 17416** [0] -40. 08223** [0] Notes: p values are reported in brackets; ** denotes significance at the 1% level of significance • The return series are nonsymmetric and leptokurtic compared to the normal distribution • According to Augmented Dickey - Fuller test all return series are stationary

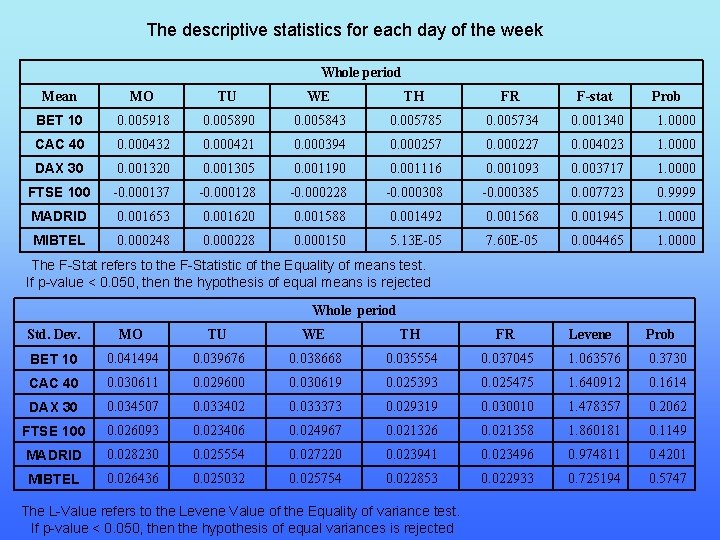

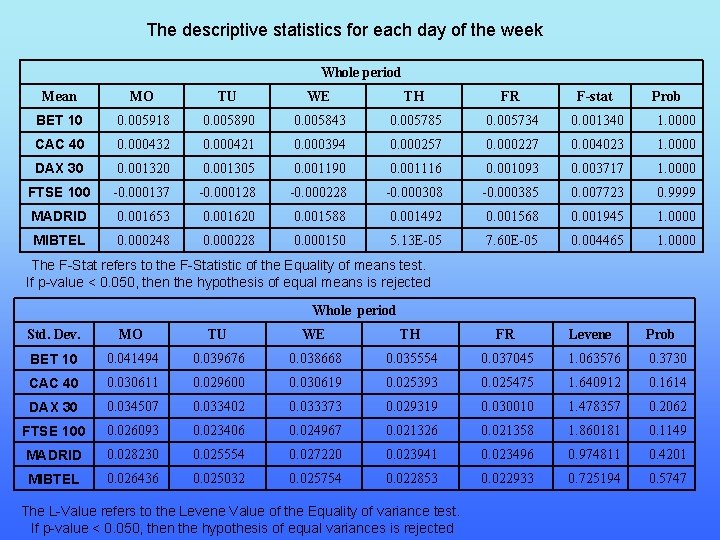

The descriptive statistics for each day of the week Whole period Mean MO TU WE TH FR F-stat Prob BET 10 0. 005918 0. 005890 0. 005843 0. 005785 0. 005734 0. 001340 1. 0000 CAC 40 0. 000432 0. 000421 0. 000394 0. 000257 0. 000227 0. 004023 1. 0000 DAX 30 0. 001320 0. 001305 0. 001190 0. 001116 0. 001093 0. 003717 1. 0000 FTSE 100 -0. 000137 -0. 000128 -0. 000228 -0. 000308 -0. 000385 0. 007723 0. 9999 MADRID 0. 001653 0. 001620 0. 001588 0. 001492 0. 001568 0. 001945 1. 0000 MIBTEL 0. 000248 0. 000228 0. 000150 5. 13 E-05 7. 60 E-05 0. 004465 1. 0000 The F-Stat refers to the F-Statistic of the Equality of means test. If p-value < 0. 050, then the hypothesis of equal means is rejected Whole period Std. Dev. MO TU WE TH FR Levene Prob BET 10 0. 041494 0. 039676 0. 038668 0. 035554 0. 037045 1. 063576 0. 3730 CAC 40 0. 030611 0. 029600 0. 030619 0. 025393 0. 025475 1. 640912 0. 1614 DAX 30 0. 034507 0. 033402 0. 033373 0. 029319 0. 030010 1. 478357 0. 2062 FTSE 100 0. 026093 0. 023406 0. 024967 0. 021326 0. 021358 1. 860181 0. 1149 MADRID 0. 028230 0. 025554 0. 027220 0. 023941 0. 023496 0. 974811 0. 4201 MIBTEL 0. 026436 0. 025032 0. 025754 0. 022853 0. 022933 0. 725194 0. 5747 The L-Value refers to the Levene Value of the Equality of variance test. If p-value < 0. 050, then the hypothesis of equal variances is rejected

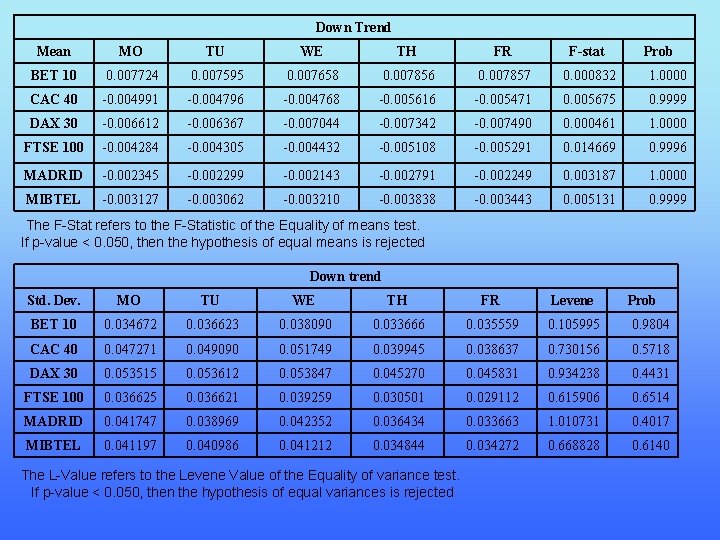

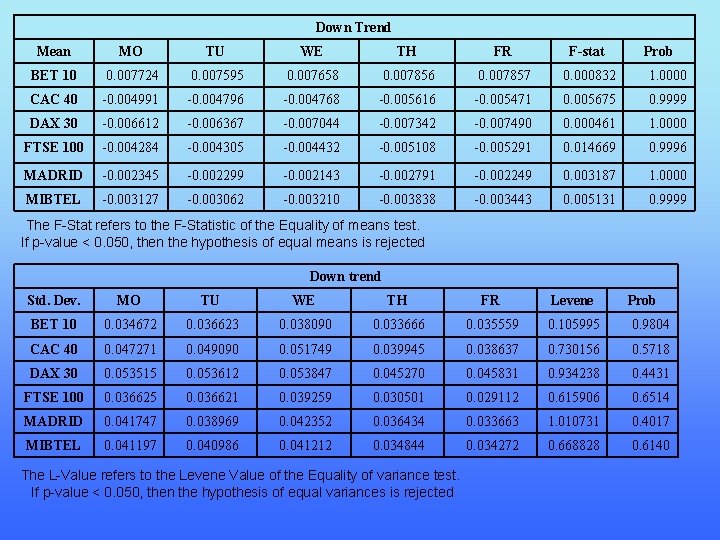

Down Trend Mean MO TU WE TH FR F-stat Prob BET 10 0. 007724 0. 007595 0. 007658 0. 007856 0. 007857 0. 000832 1. 0000 CAC 40 -0. 004991 -0. 004796 -0. 004768 -0. 005616 -0. 005471 0. 005675 0. 9999 DAX 30 -0. 006612 -0. 006367 -0. 007044 -0. 007342 -0. 007490 0. 000461 1. 0000 FTSE 100 -0. 004284 -0. 004305 -0. 004432 -0. 005108 -0. 005291 0. 014669 0. 9996 MADRID -0. 002345 -0. 002299 -0. 002143 -0. 002791 -0. 002249 0. 003187 1. 0000 MIBTEL -0. 003127 -0. 003062 -0. 003210 -0. 003838 -0. 003443 0. 005131 0. 9999 The F-Stat refers to the F-Statistic of the Equality of means test. If p-value < 0. 050, then the hypothesis of equal means is rejected Down trend Std. Dev. MO TU WE TH FR Levene Prob BET 10 0. 034672 0. 036623 0. 038090 0. 033666 0. 035559 0. 105995 0. 9804 CAC 40 0. 047271 0. 049090 0. 051749 0. 039945 0. 038637 0. 730156 0. 5718 DAX 30 0. 053515 0. 053612 0. 053847 0. 045270 0. 045831 0. 934238 0. 4431 FTSE 100 0. 036625 0. 036621 0. 039259 0. 030501 0. 029112 0. 615906 0. 6514 MADRID 0. 041747 0. 038969 0. 042352 0. 036434 0. 033663 1. 010731 0. 4017 MIBTEL 0. 041197 0. 040986 0. 041212 0. 034844 0. 034272 0. 668828 0. 6140 The L-Value refers to the Levene Value of the Equality of variance test. If p-value < 0. 050, then the hypothesis of equal variances is rejected

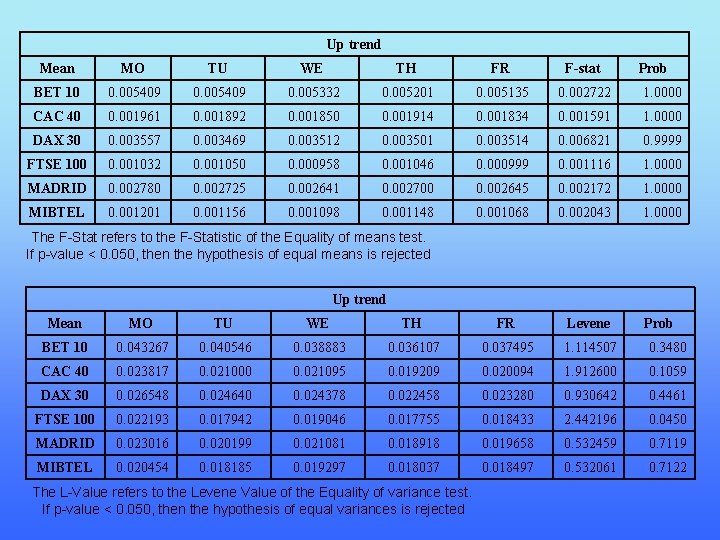

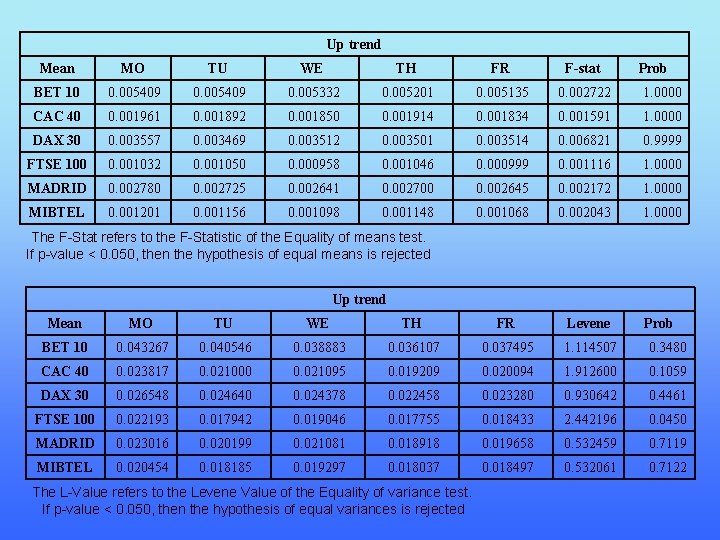

Up trend Mean MO TU WE TH FR F-stat Prob BET 10 0. 005409 0. 005332 0. 005201 0. 005135 0. 002722 1. 0000 CAC 40 0. 001961 0. 001892 0. 001850 0. 001914 0. 001834 0. 001591 1. 0000 DAX 30 0. 003557 0. 003469 0. 003512 0. 003501 0. 003514 0. 006821 0. 9999 FTSE 100 0. 001032 0. 001050 0. 000958 0. 001046 0. 000999 0. 001116 1. 0000 MADRID 0. 002780 0. 002725 0. 002641 0. 002700 0. 002645 0. 002172 1. 0000 MIBTEL 0. 001201 0. 001156 0. 001098 0. 001148 0. 001068 0. 002043 1. 0000 Prob The F-Stat refers to the F-Statistic of the Equality of means test. If p-value < 0. 050, then the hypothesis of equal means is rejected Up trend Mean MO TU WE TH FR Levene BET 10 0. 043267 0. 040546 0. 038883 0. 036107 0. 037495 1. 114507 0. 3480 CAC 40 0. 023817 0. 021000 0. 021095 0. 019209 0. 020094 1. 912600 0. 1059 DAX 30 0. 026548 0. 024640 0. 024378 0. 022458 0. 023280 0. 930642 0. 4461 FTSE 100 0. 022193 0. 017942 0. 019046 0. 017755 0. 018433 2. 442196 0. 0450 MADRID 0. 023016 0. 020199 0. 021081 0. 018918 0. 019658 0. 532459 0. 7119 MIBTEL 0. 020454 0. 018185 0. 019297 0. 018037 0. 018497 0. 532061 0. 7122 The L-Value refers to the Levene Value of the Equality of variance test. If p-value < 0. 050, then the hypothesis of equal variances is rejected

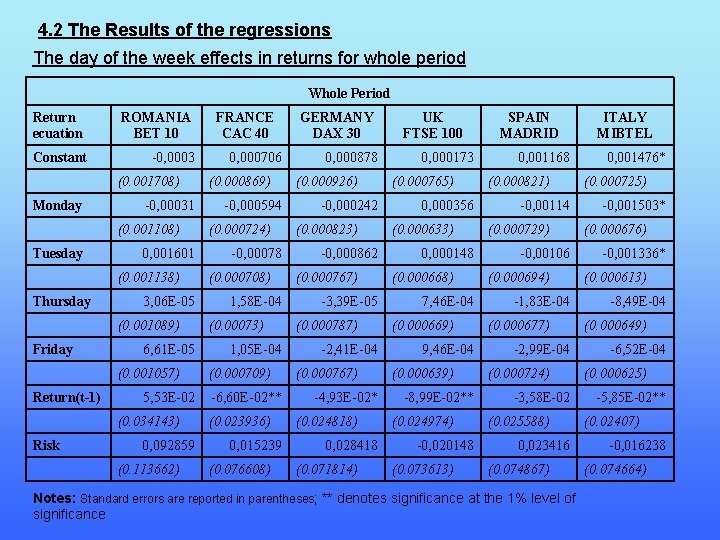

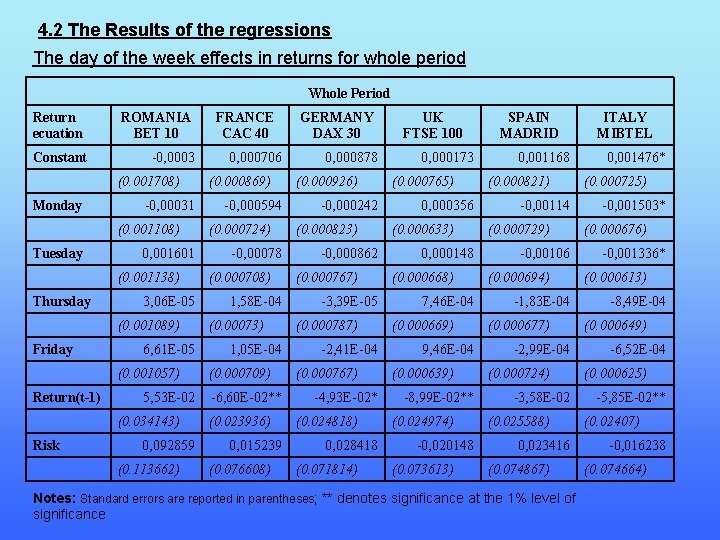

4. 2 The Results of the regressions The day of the week effects in returns for whole period Whole Period Return ecuation ROMANIA BET 10 Constant -0, 0003 (0. 001708) Monday -0, 00031 (0. 001108) Tuesday 0, 001601 (0. 001138) Thursday 3, 06 E-05 (0. 001089) Friday 6, 61 E-05 (0. 001057) Return(t-1) 5, 53 E-02 (0. 034143) Risk 0, 092859 (0. 113662) FRANCE CAC 40 0, 000706 (0. 000869) -0, 000594 (0. 000724) -0, 00078 (0. 000708) 1, 58 E-04 (0. 00073) 1, 05 E-04 (0. 000709) -6, 60 E-02** (0. 023936) 0, 015239 (0. 076608) GERMANY DAX 30 0, 000878 (0. 000926) -0, 000242 (0. 000823) -0, 000862 (0. 000767) -3, 39 E-05 (0. 000787) -2, 41 E-04 (0. 000767) -4, 93 E-02* (0. 024818) 0, 028418 (0. 071814) UK FTSE 100 0, 000173 (0. 000765) 0, 000356 (0. 000633) 0, 000148 (0. 000668) 7, 46 E-04 (0. 000669) 9, 46 E-04 (0. 000639) -8, 99 E-02** (0. 024974) -0, 020148 (0. 073613) SPAIN MADRID 0, 001168 (0. 000821) -0, 00114 (0. 000729) -0, 00106 (0. 000694) -1, 83 E-04 (0. 000677) -2, 99 E-04 (0. 000724) -3, 58 E-02 (0. 025588) 0, 023416 (0. 074867) Notes: Standard errors are reported in parentheses; ** denotes significance at the 1% level of significance ITALY MIBTEL 0, 001476* (0. 000725) -0, 001503* (0. 000676) -0, 001336* (0. 000613) -8, 49 E-04 (0. 000649) -6, 52 E-04 (0. 000625) -5, 85 E-02** (0. 02407) -0, 016238 (0. 074664)

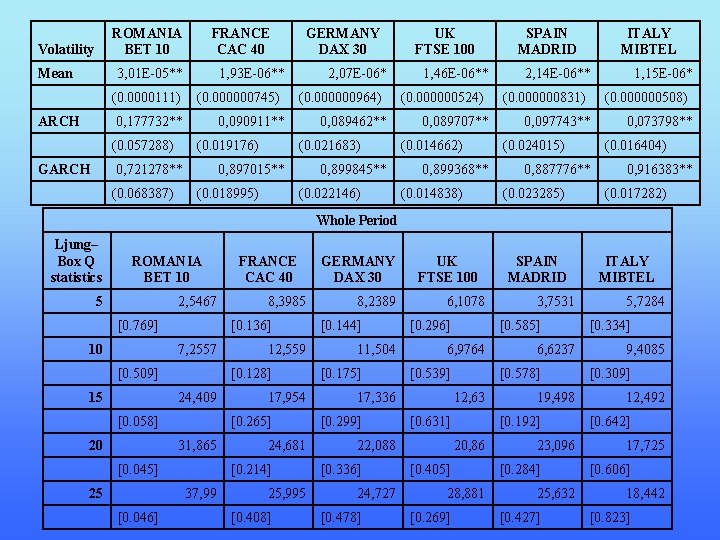

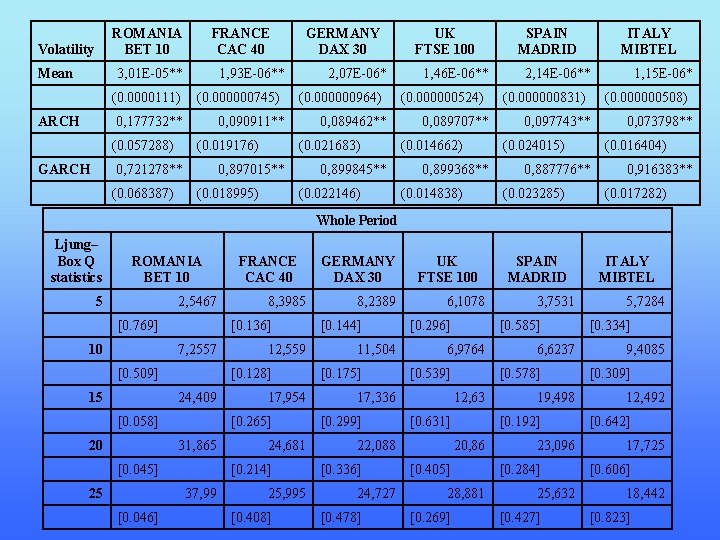

ROMANIA BET 10 Volatility Mean FRANCE CAC 40 3, 01 E-05** (0. 0000111) ARCH 1, 93 E-06** (0. 000000745) 0, 177732** (0. 057288) GARCH 2, 07 E-06* (0. 000000964) 0, 090911** (0. 019176) 0, 721278** (0. 068387) GERMANY DAX 30 0, 089462** (0. 021683) 0, 897015** (0. 018995) 0, 899845** (0. 022146) UK FTSE 100 1, 46 E-06** (0. 000000524) 0, 089707** (0. 014662) 0, 899368** (0. 014838) SPAIN MADRID ITALY MIBTEL 2, 14 E-06** (0. 000000831) (0. 000000508) 0, 097743** (0. 024015) 0, 073798** (0. 016404) 0, 887776** (0. 023285) 1, 15 E-06* 0, 916383** (0. 017282) Whole Period Ljung– Box Q statistics ROMANIA BET 10 5 2, 5467 [0. 769] 10 [0. 509] [0. 058] [0. 045] 24, 681 [0. 214] 37, 99 [0. 046] 17, 954 [0. 265] 31, 865 25 12, 559 [0. 128] 24, 409 20 8, 3985 [0. 136] 7, 2557 15 FRANCE CAC 40 25, 995 [0. 408] GERMANY DAX 30 8, 2389 [0. 144] 11, 504 [0. 175] UK FTSE 100 6, 1078 [0. 296] [0. 299] [0. 539] [0. 336] 24, 727 [0. 478] [0. 631] 19, 498 [0. 192] 20, 86 [0. 405] 28, 881 [0. 269] 6, 6237 [0. 578] 12, 63 22, 088 3, 7531 [0. 585] 6, 9764 17, 336 SPAIN MADRID 23, 096 [0. 284] 25, 632 [0. 427] ITALY MIBTEL 5, 7284 [0. 334] 9, 4085 [0. 309] 12, 492 [0. 642] 17, 725 [0. 606] 18, 442 [0. 823]

![Whole Period ARCHLM test ROMANIA BET 10 5 0 382733 0 860877 10 0 Whole Period ARCHLM test ROMANIA BET 10 5 0, 382733 [0. 860877] 10 0,](https://slidetodoc.com/presentation_image/42924eb6ef58c69b16c36f55024b1ca7/image-18.jpg)

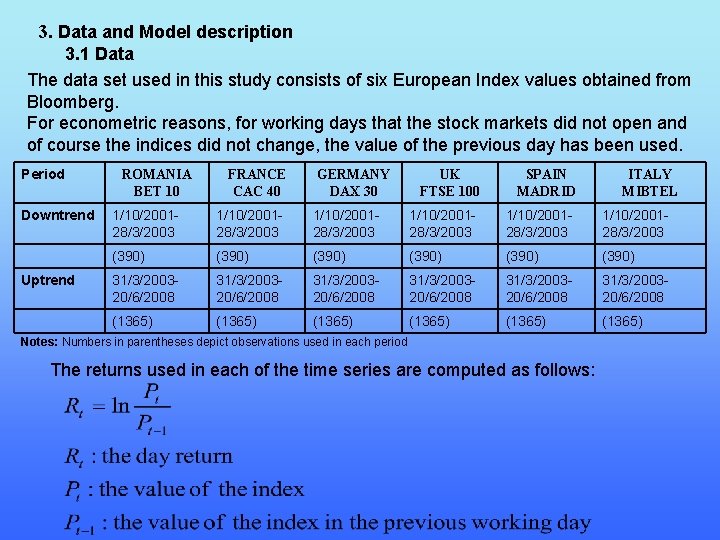

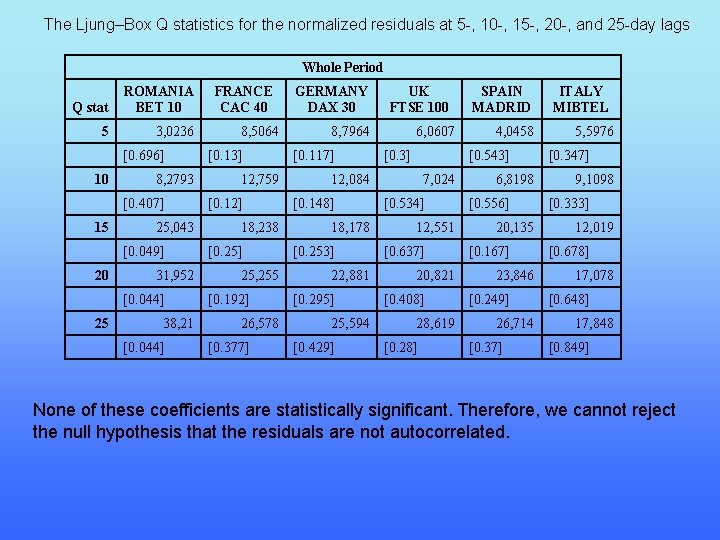

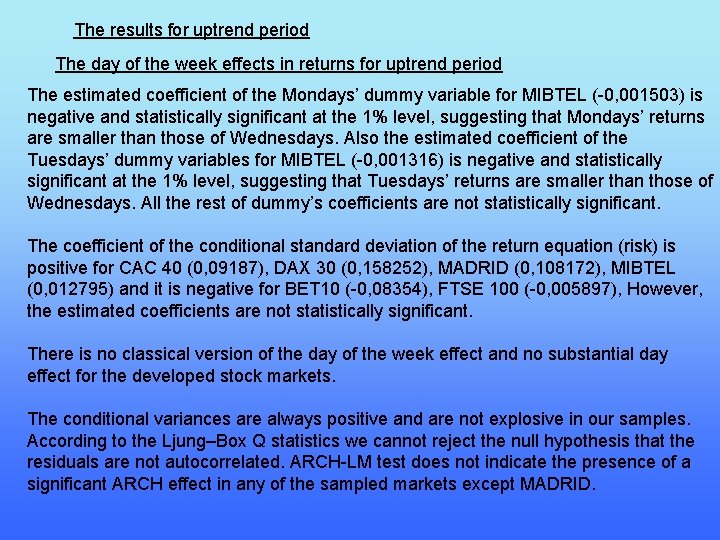

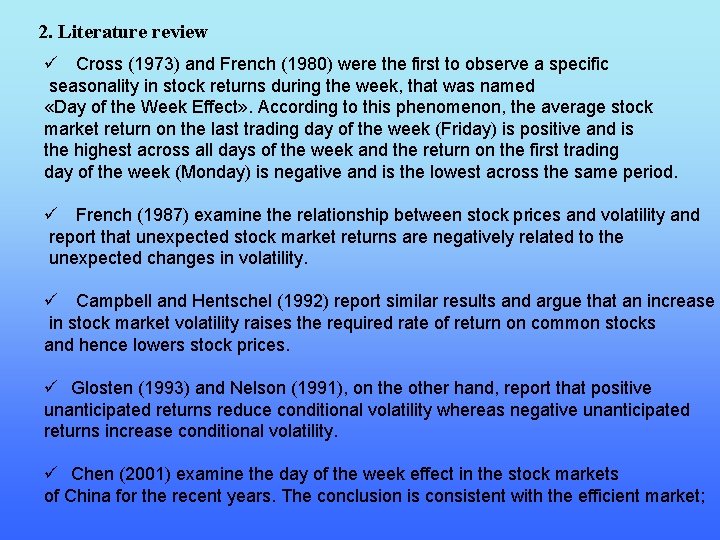

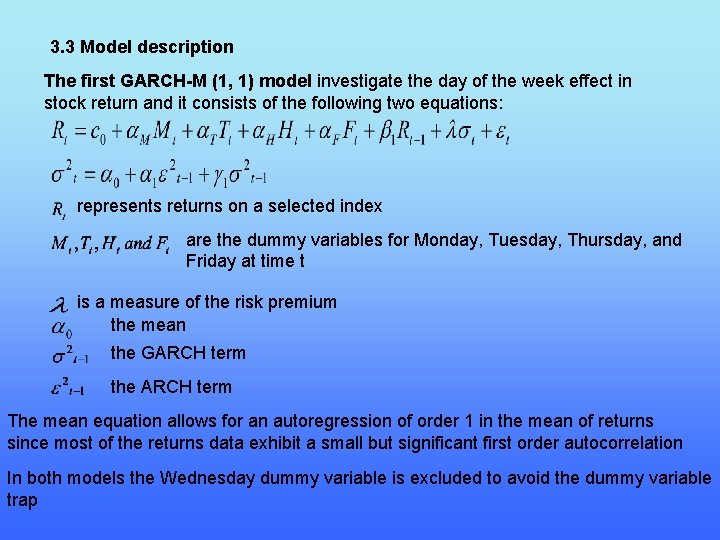

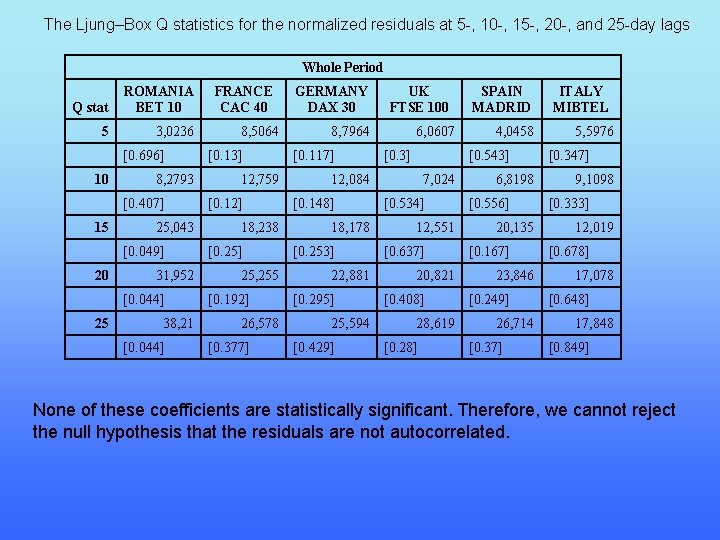

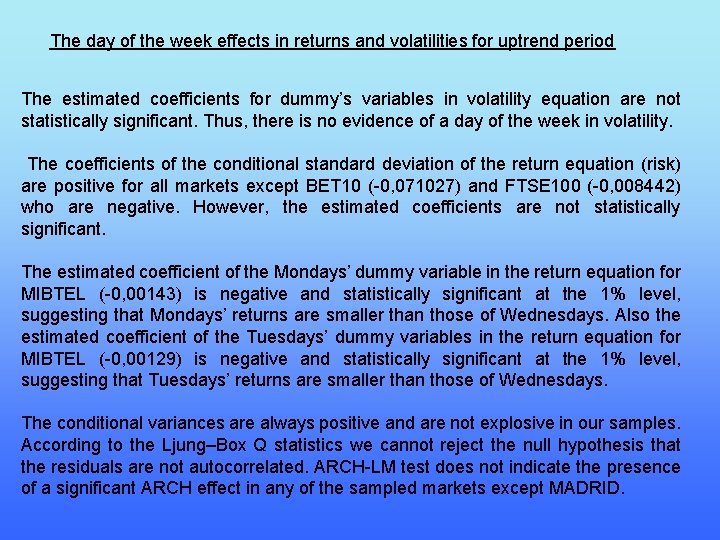

Whole Period ARCHLM test ROMANIA BET 10 5 0, 382733 [0. 860877] 10 0, 381393 [0. 955162] 15 0, 319659 [0. 993643] 20 0, 280678 [0. 999309] 25 0, 764475 [0. 790675] FRANCE CAC 40 1, 727216 [0. 125118] 0, 927862 [0. 5062] 1, 106179 [0. 344869] 0, 937869 [0. 537914] 1, 090896 [0. 344074] GERMANY DAX 30 1, 129006 [0. 342759] 0, 649215 [0. 772107] 0, 835782 [0. 637904] 0, 794883 [0. 722357] 0, 796243 [0. 750802] UK FTSE 100 0, 69928 [0. 624008] 0, 850661 [0. 579599] 1, 612083 [0. 063357] 1, 348491 [0. 138103] 1, 160234 [0. 265791] SPAIN MADRID 4, 075016 [0. 00111] 2, 106105 [0. 021217] 1, 900103 [0. 019338] 1, 953253 [0. 007002] 1, 746724 [0. 012622] ITALY MIBTEL 0, 933572 [0. 458033] 0, 714608 [0. 711419] 1, 063579 [0. 386045] 0, 978515 [0. 48565] 1, 119203 [0. 310641] The conditional variances are always positive and are not explosive in our samples. According to the Ljung–Box Q statistics we can not reject the null hypothesis that the residuals are not autocorrelated. The ARCH-LM test does not indicate the presence of a significant ARCH effect in any of the sampled markets except MADRID.

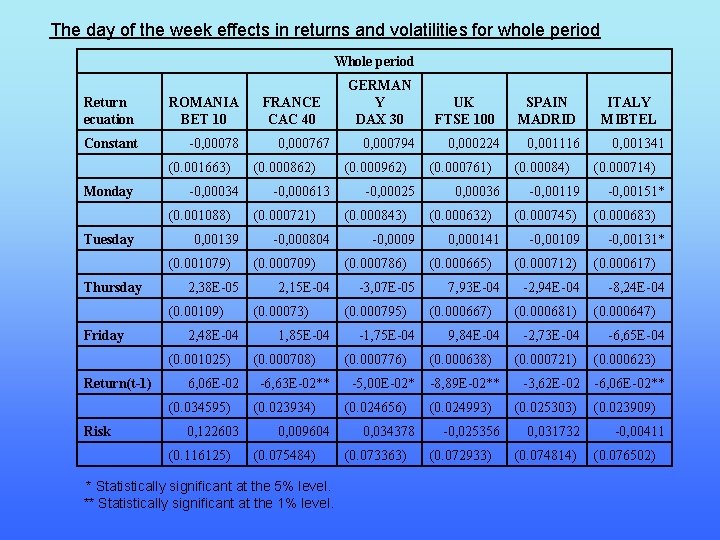

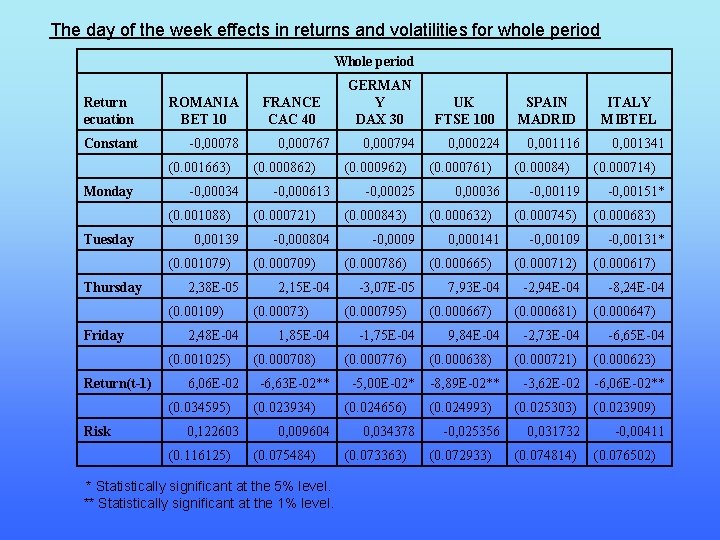

The day of the week effects in returns and volatilities for whole period Whole period Return ecuation ROMANIA BET 10 Constant -0, 00078 (0. 001663) Monday -0, 00034 (0. 001088) Tuesday 0, 00139 (0. 001079) Thursday 2, 38 E-05 (0. 00109) Friday 2, 48 E-04 (0. 001025) Return(t-1) 6, 06 E-02 (0. 034595) Risk 0, 122603 (0. 116125) FRANCE CAC 40 0, 000767 (0. 000862) -0, 000613 (0. 000721) -0, 000804 (0. 000709) 2, 15 E-04 (0. 00073) 1, 85 E-04 (0. 000708) -6, 63 E-02** (0. 023934) 0, 009604 (0. 075484) * Statistically significant at the 5% level. ** Statistically significant at the 1% level. GERMAN Y DAX 30 0, 000794 (0. 000962) -0, 00025 (0. 000843) -0, 0009 (0. 000786) -3, 07 E-05 (0. 000795) -1, 75 E-04 (0. 000776) -5, 00 E-02* (0. 024656) 0, 034378 (0. 073363) UK FTSE 100 0, 000224 (0. 000761) 0, 00036 (0. 000632) 0, 000141 (0. 000665) 7, 93 E-04 (0. 000667) 9, 84 E-04 (0. 000638) -8, 89 E-02** (0. 024993) -0, 025356 (0. 072933) SPAIN MADRID 0, 001116 (0. 00084) -0, 00119 (0. 000745) -0, 00109 (0. 000712) -2, 94 E-04 (0. 000681) -2, 73 E-04 (0. 000721) -3, 62 E-02 (0. 025303) 0, 031732 (0. 074814) ITALY MIBTEL 0, 001341 (0. 000714) -0, 00151* (0. 000683) -0, 00131* (0. 000617) -8, 24 E-04 (0. 000647) -6, 65 E-04 (0. 000623) -6, 06 E-02** (0. 023909) -0, 00411 (0. 076502)

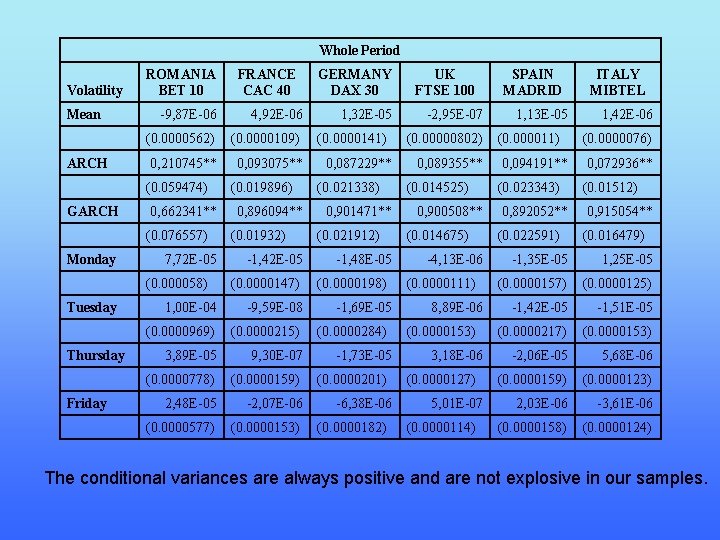

Whole Period Volatility Mean ARCH ROMANIA BET 10 -9, 87 E-06 4, 92 E-06 (0. 0000562) (0. 0000109) 0, 210745** 0, 093075** (0. 059474) GARCH 0, 662341** (0. 076557) Monday 7, 72 E-05 (0. 000058) Tuesday Thursday Friday FRANCE CAC 40 (0. 019896) 0, 896094** (0. 01932) -1, 42 E-05 (0. 0000147) 1, 00 E-04 -9, 59 E-08 (0. 0000969) (0. 0000215) 3, 89 E-05 9, 30 E-07 (0. 0000778) (0. 0000159) 2, 48 E-05 -2, 07 E-06 (0. 0000577) (0. 0000153) GERMANY DAX 30 1, 32 E-05 (0. 0000141) 0, 087229** (0. 021338) 0, 901471** (0. 021912) -1, 48 E-05 (0. 0000198) -1, 69 E-05 (0. 0000284) -1, 73 E-05 (0. 0000201) -6, 38 E-06 (0. 0000182) UK FTSE 100 -2, 95 E-07 (0. 00000802) 0, 089355** (0. 014525) 0, 900508** (0. 014675) -4, 13 E-06 (0. 0000111) 8, 89 E-06 (0. 0000153) 3, 18 E-06 (0. 0000127) 5, 01 E-07 (0. 0000114) SPAIN MADRID 1, 13 E-05 (0. 000011) 0, 094191** (0. 023343) 0, 892052** (0. 022591) ITALY MIBTEL 1, 42 E-06 (0. 0000076) 0, 072936** (0. 01512) 0, 915054** (0. 016479) -1, 35 E-05 1, 25 E-05 (0. 0000157) (0. 0000125) -1, 42 E-05 -1, 51 E-05 (0. 0000217) (0. 0000153) -2, 06 E-05 5, 68 E-06 (0. 0000159) (0. 0000123) 2, 03 E-06 -3, 61 E-06 (0. 0000158) (0. 0000124) The conditional variances are always positive and are not explosive in our samples.

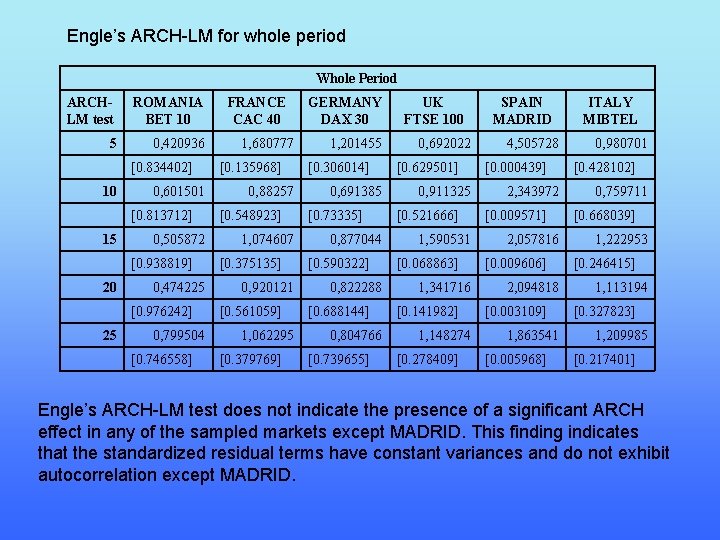

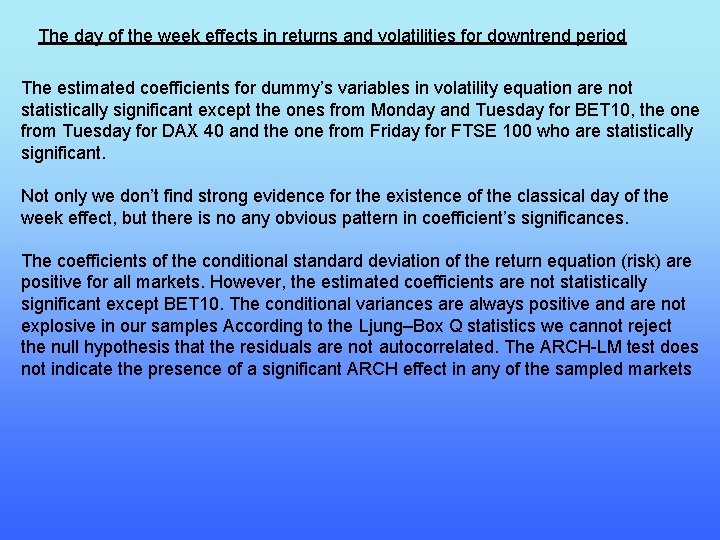

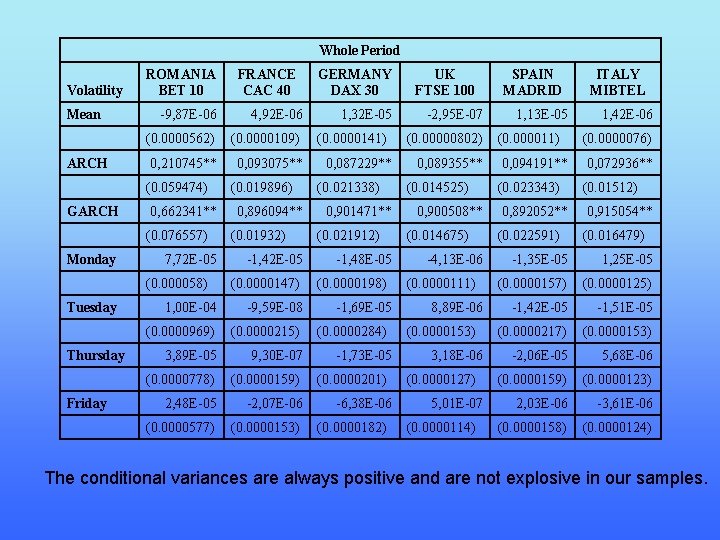

The Ljung–Box Q statistics for the normalized residuals at 5 -, 10 -, 15 -, 20 -, and 25 -day lags Whole Period Q stat ROMANIA BET 10 5 3, 0236 [0. 696] 10 8, 2793 [0. 407] 15 25, 043 [0. 049] 20 31, 952 [0. 044] 25 38, 21 [0. 044] FRANCE CAC 40 8, 5064 [0. 13] 12, 759 [0. 12] 18, 238 [0. 25] 25, 255 [0. 192] 26, 578 [0. 377] GERMANY DAX 30 UK FTSE 100 8, 7964 [0. 117] 6, 0607 [0. 3] 18, 178 [0. 253] 22, 881 [0. 295] 25, 594 [0. 429] 4, 0458 [0. 543] 12, 084 [0. 148] SPAIN MADRID 7, 024 [0. 534] 12, 551 [0. 637] 20, 821 [0. 408] 28, 619 [0. 28] 6, 8198 [0. 556] 20, 135 [0. 167] 23, 846 [0. 249] 26, 714 [0. 37] ITALY MIBTEL 5, 5976 [0. 347] 9, 1098 [0. 333] 12, 019 [0. 678] 17, 078 [0. 648] 17, 848 [0. 849] None of these coefficients are statistically significant. Therefore, we cannot reject the null hypothesis that the residuals are not autocorrelated.

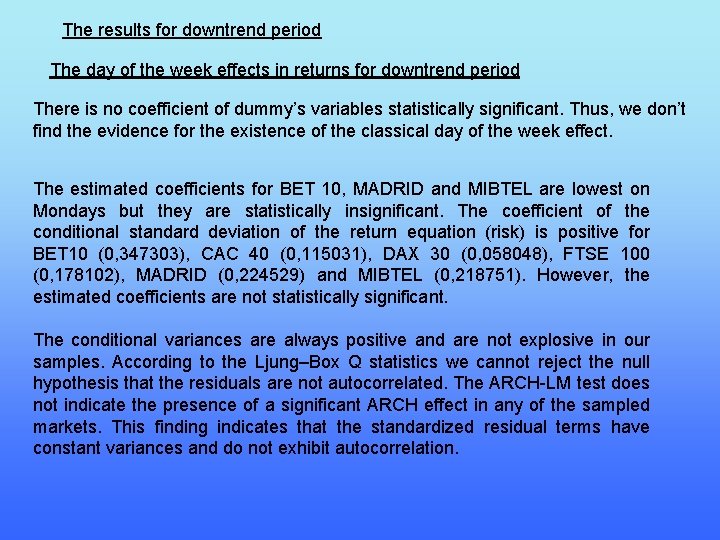

Engle’s ARCH-LM for whole period Whole Period ARCHLM test ROMANIA BET 10 5 0, 420936 [0. 834402] 10 0, 601501 [0. 813712] 15 0, 505872 [0. 938819] 20 0, 474225 [0. 976242] 25 0, 799504 [0. 746558] FRANCE CAC 40 1, 680777 [0. 135968] 0, 88257 [0. 548923] 1, 074607 [0. 375135] 0, 920121 [0. 561059] 1, 062295 [0. 379769] GERMANY DAX 30 1, 201455 [0. 306014] 0, 691385 [0. 73335] 0, 877044 [0. 590322] 0, 822288 [0. 688144] 0, 804766 [0. 739655] UK FTSE 100 0, 692022 [0. 629501] 0, 911325 [0. 521666] 1, 590531 [0. 068863] 1, 341716 [0. 141982] 1, 148274 [0. 278409] SPAIN MADRID 4, 505728 [0. 000439] 2, 343972 [0. 009571] 2, 057816 [0. 009606] 2, 094818 [0. 003109] 1, 863541 [0. 005968] ITALY MIBTEL 0, 980701 [0. 428102] 0, 759711 [0. 668039] 1, 222953 [0. 246415] 1, 113194 [0. 327823] 1, 209985 [0. 217401] Engle’s ARCH-LM test does not indicate the presence of a significant ARCH effect in any of the sampled markets except MADRID. This finding indicates that the standardized residual terms have constant variances and do not exhibit autocorrelation except MADRID.

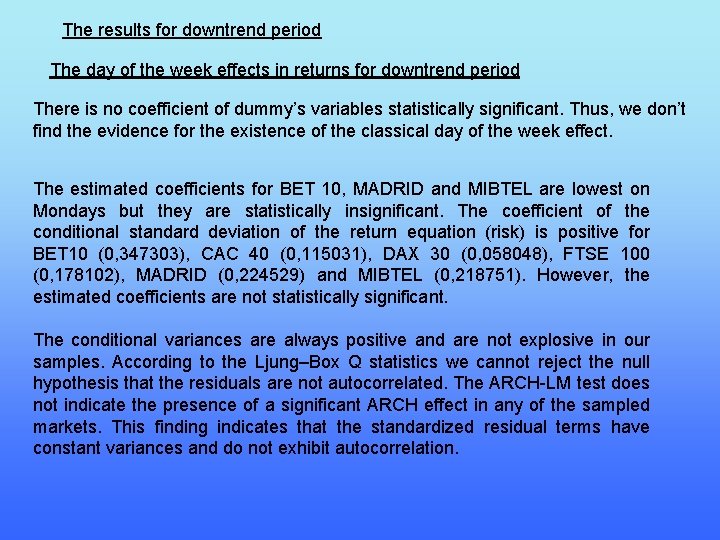

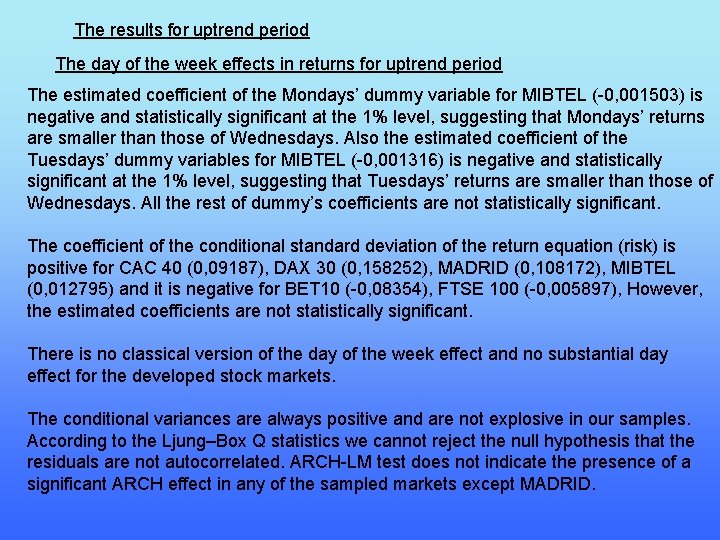

The results for downtrend period The day of the week effects in returns for downtrend period There is no coefficient of dummy’s variables statistically significant. Thus, we don’t find the evidence for the existence of the classical day of the week effect. The estimated coefficients for BET 10, MADRID and MIBTEL are lowest on Mondays but they are statistically insignificant. The coefficient of the conditional standard deviation of the return equation (risk) is positive for BET 10 (0, 347303), CAC 40 (0, 115031), DAX 30 (0, 058048), FTSE 100 (0, 178102), MADRID (0, 224529) and MIBTEL (0, 218751). However, the estimated coefficients are not statistically significant. The conditional variances are always positive and are not explosive in our samples. According to the Ljung–Box Q statistics we cannot reject the null hypothesis that the residuals are not autocorrelated. The ARCH-LM test does not indicate the presence of a significant ARCH effect in any of the sampled markets. This finding indicates that the standardized residual terms have constant variances and do not exhibit autocorrelation.

The day of the week effects in returns and volatilities for downtrend period The estimated coefficients for dummy’s variables in volatility equation are not statistically significant except the ones from Monday and Tuesday for BET 10, the one from Tuesday for DAX 40 and the one from Friday for FTSE 100 who are statistically significant. Not only we don’t find strong evidence for the existence of the classical day of the week effect, but there is no any obvious pattern in coefficient’s significances. The coefficients of the conditional standard deviation of the return equation (risk) are positive for all markets. However, the estimated coefficients are not statistically significant except BET 10. The conditional variances are always positive and are not explosive in our samples According to the Ljung–Box Q statistics we cannot reject the null hypothesis that the residuals are not autocorrelated. The ARCH-LM test does not indicate the presence of a significant ARCH effect in any of the sampled markets

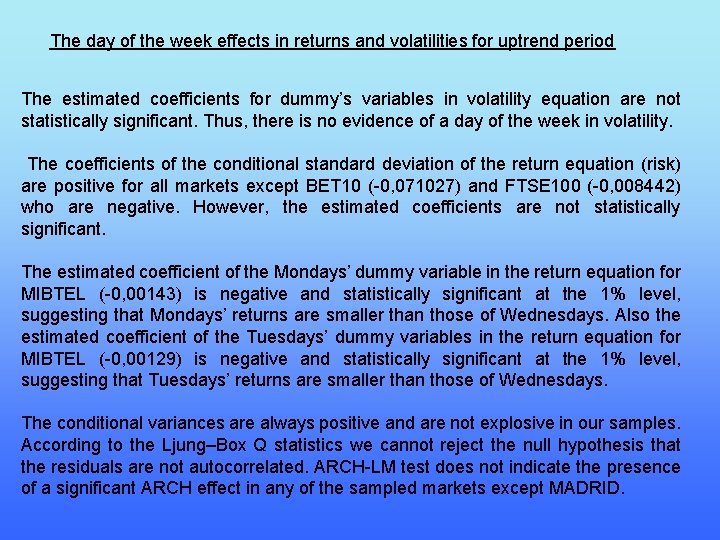

The results for uptrend period The day of the week effects in returns for uptrend period The estimated coefficient of the Mondays’ dummy variable for MIBTEL (-0, 001503) is negative and statistically significant at the 1% level, suggesting that Mondays’ returns are smaller than those of Wednesdays. Also the estimated coefficient of the Tuesdays’ dummy variables for MIBTEL (-0, 001316) is negative and statistically significant at the 1% level, suggesting that Tuesdays’ returns are smaller than those of Wednesdays. All the rest of dummy’s coefficients are not statistically significant. The coefficient of the conditional standard deviation of the return equation (risk) is positive for CAC 40 (0, 09187), DAX 30 (0, 158252), MADRID (0, 108172), MIBTEL (0, 012795) and it is negative for BET 10 (-0, 08354), FTSE 100 (-0, 005897), However, the estimated coefficients are not statistically significant. There is no classical version of the day of the week effect and no substantial day effect for the developed stock markets. The conditional variances are always positive and are not explosive in our samples. According to the Ljung–Box Q statistics we cannot reject the null hypothesis that the residuals are not autocorrelated. ARCH-LM test does not indicate the presence of a significant ARCH effect in any of the sampled markets except MADRID.

The day of the week effects in returns and volatilities for uptrend period The estimated coefficients for dummy’s variables in volatility equation are not statistically significant. Thus, there is no evidence of a day of the week in volatility. The coefficients of the conditional standard deviation of the return equation (risk) are positive for all markets except BET 10 (-0, 071027) and FTSE 100 (-0, 008442) who are negative. However, the estimated coefficients are not statistically significant. The estimated coefficient of the Mondays’ dummy variable in the return equation for MIBTEL (-0, 00143) is negative and statistically significant at the 1% level, suggesting that Mondays’ returns are smaller than those of Wednesdays. Also the estimated coefficient of the Tuesdays’ dummy variables in the return equation for MIBTEL (-0, 00129) is negative and statistically significant at the 1% level, suggesting that Tuesdays’ returns are smaller than those of Wednesdays. The conditional variances are always positive and are not explosive in our samples. According to the Ljung–Box Q statistics we cannot reject the null hypothesis that the residuals are not autocorrelated. ARCH-LM test does not indicate the presence of a significant ARCH effect in any of the sampled markets except MADRID.

5. The Conclusions The phenomenon of the «Day of the Week Effect» seems to disappears from the developed stock markets and not to have a specific pattern in general. Nowadays, the stock markets are more liquid than ever and seem to be more efficient that the previous decades because of the easiest capital transmission, the technological changes and the changes in the stock market microstructure. So, it is logical for investors to react more mature, something that induces less inefficient results. Finally, the conclusion of this study is that the phenomenon of the «Day of the Week Effect» seems to be weaker than it was in previous decades as a result of investor’s behavior. Investors are more mature, well educated, with more professional attitude, characteristics that help stock markets to become more efficient.

6. Bibliography 1. Joshi, N. K. , F. K. C. Bahadur (2006). “The Nepalese Stock Market: Efficiency and Calendar Anomalies”. Economic Review 17. 2. Chiaku Chukwuogor-Ndu (2006). ” Stock Market Returns Analysis, Day-of-the-Week Effect, Volatility of Returns: Evidence from European Financial Markets 1997 -2004. ” ISSN 1450 -2887 International Research Journal of Finance and Economics 3. Berument, H. , & Kiymaz, H. (2001). The day of the week effect on stock market volatility. Journal of Economics and Finance, 25, 181– 193. 4. Halil Kiymaza, Hakan Berument “The day of the week effect on stock market volatility and volume: International evidence” Review of Financial Economics 12 (2003) 363– 380 5. Lyroudi, K. , D. Subeniotis, G. Komisopoulos (2002). “Market Anomalies in the A. S. E. : The Day of the Week Effect”. European Financial Management Association, London Meetings.

6. Lakonishok, J. , S. Smidt, (1988), “Are seasonal anomalies real? A ninety-year perspective”, Review of Financial Studies, 1, 403 -25. 7. Morton B. Brown and Alan B. Forsythe (1974), “Robust Tests for the Equality of Variances” Journal of the American Statistical Association, Vol. 69, No. 346, (Jun. , 1974), pp. 364 -367 8. Keim, B. D. , R. F. Stambaugh, (1984), “A further investigation of the weekend effect in stock returns”, Journal of Finance, 39, 819 -840. 9. Dimitris Balios, Sophia Stavraki (2007), “Stock Market Trends, Day of the Week Effect and Investor’s Behavior after the September’s 2001 Attacks”, European Journal of Economics, Finance and Administrative Sciences ISSN 1450 -2887 Issue 8 (2007) 10. Green, William H. (2000), Econometric Analysis, New York University

Bucharest university of economic studies ranking

Bucharest university of economic studies ranking Eui doctoral programme

Eui doctoral programme All but dissertation (abd) status

All but dissertation (abd) status Nsf doctoral dissertation improvement grant

Nsf doctoral dissertation improvement grant Umbc doctoral programs

Umbc doctoral programs Doctoral initiative on minority attrition and completion

Doctoral initiative on minority attrition and completion College doctoral ubfc

College doctoral ubfc Power point tesis doctoral medicina

Power point tesis doctoral medicina South west doctoral training partnership

South west doctoral training partnership Ddrig

Ddrig Csu doctoral incentive program

Csu doctoral incentive program Paradigm shift from women studies to gender studies

Paradigm shift from women studies to gender studies Event studies in economics and finance

Event studies in economics and finance Event studies in economics and finance

Event studies in economics and finance Academy of lymphatic studies

Academy of lymphatic studies Georgia academy for economic development

Georgia academy for economic development Economic growth vs economic development

Economic growth vs economic development Difference between economic growth and economic development

Difference between economic growth and economic development Lesson 2 our economic choices

Lesson 2 our economic choices School of graduate studies upm

School of graduate studies upm Nafc marine centre

Nafc marine centre Robbinsville high school program of studies

Robbinsville high school program of studies Robbinsville high school program of studies

Robbinsville high school program of studies What is interpersonal studies in high school

What is interpersonal studies in high school He studies grade

He studies grade Primary 5 general studies exercise

Primary 5 general studies exercise Mindful coach radnor

Mindful coach radnor Ajou university graduate school of international studies

Ajou university graduate school of international studies Georgetown school of continuing studies reputation

Georgetown school of continuing studies reputation Radnor home access center

Radnor home access center