ACADEMY OF ECONOMIC STUDIES DOCTORAL SCHOOL OF FINANCE

- Slides: 27

ACADEMY OF ECONOMIC STUDIES DOCTORAL SCHOOL OF FINANCE AND BANKING Dissertation paper Determinants of inflation in Romania Student: Balan Irina Supervisor: Professor Moisa Altar

Contents • Literature review • The data • Estimating the inflation rate • CPI model • PPI model • Concluding remarks

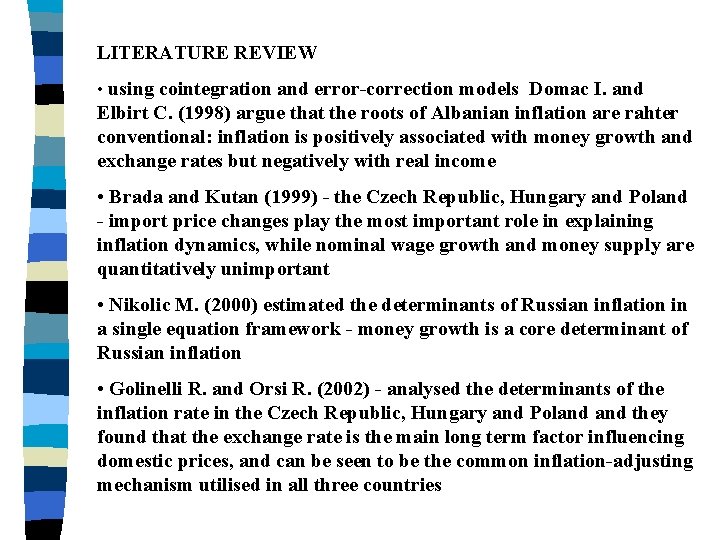

LITERATURE REVIEW • using cointegration and error-correction models Domac I. and Elbirt C. (1998) argue that the roots of Albanian inflation are rahter conventional: inflation is positively associated with money growth and exchange rates but negatively with real income • Brada and Kutan (1999) - the Czech Republic, Hungary and Poland - import price changes play the most important role in explaining inflation dynamics, while nominal wage growth and money supply are quantitatively unimportant • Nikolic M. (2000) estimated the determinants of Russian inflation in a single equation framework - money growth is a core determinant of Russian inflation • Golinelli R. and Orsi R. (2002) - analysed the determinants of the inflation rate in the Czech Republic, Hungary and Poland they found that the exchange rate is the main long term factor influencing domestic prices, and can be seen to be the common inflation-adjusting mechanism utilised in all three countries

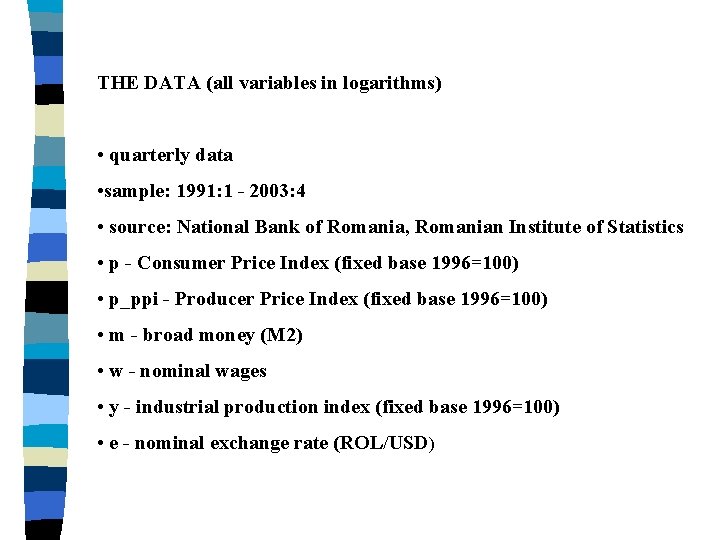

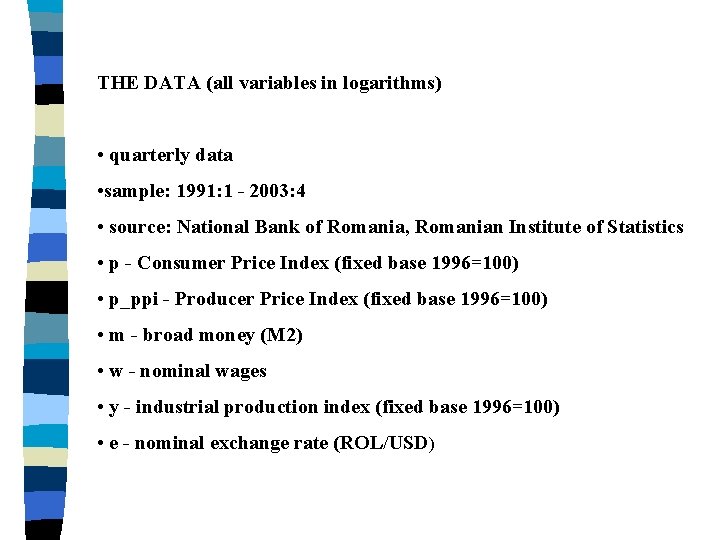

THE DATA (all variables in logarithms) • quarterly data • sample: 1991: 1 - 2003: 4 • source: National Bank of Romania, Romanian Institute of Statistics • p - Consumer Price Index (fixed base 1996=100) • p_ppi - Producer Price Index (fixed base 1996=100) • m - broad money (M 2) • w - nominal wages • y - industrial production index (fixed base 1996=100) • e - nominal exchange rate (ROL/USD)

THE GOAL • to estimate the determinants of inflation • methods: Cointegration technique, VAR and VEC models

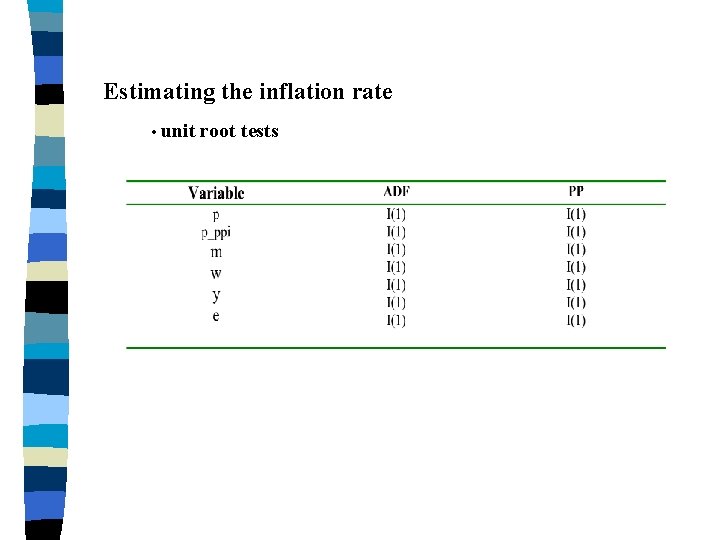

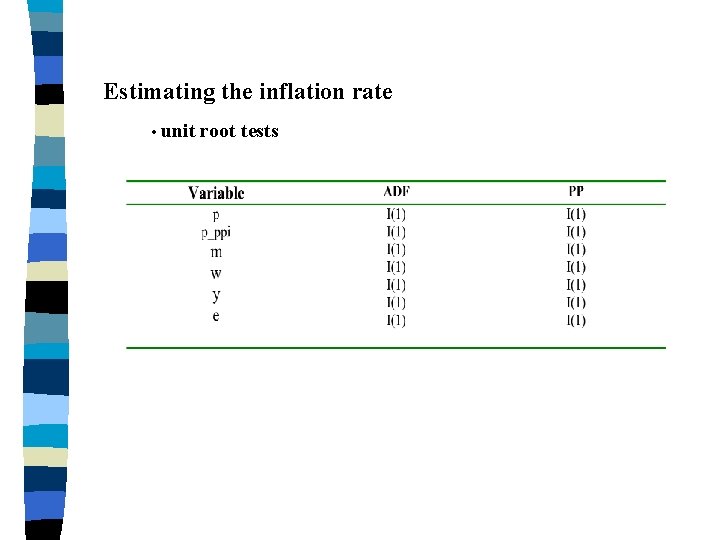

Estimating the inflation rate • unit root tests

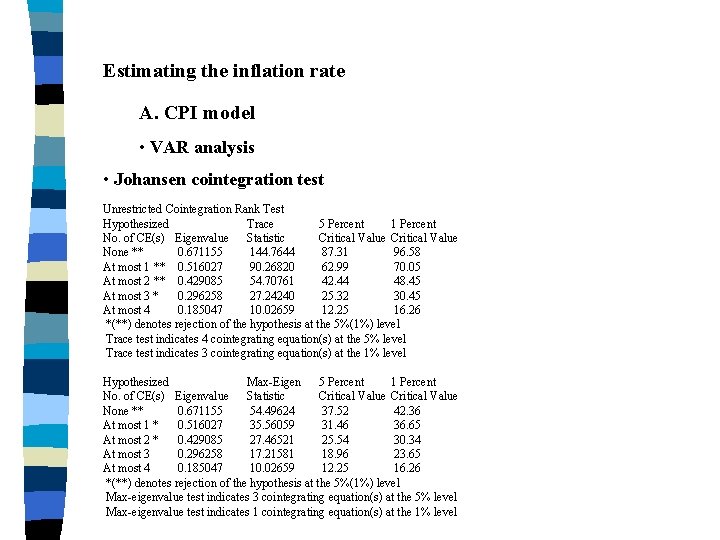

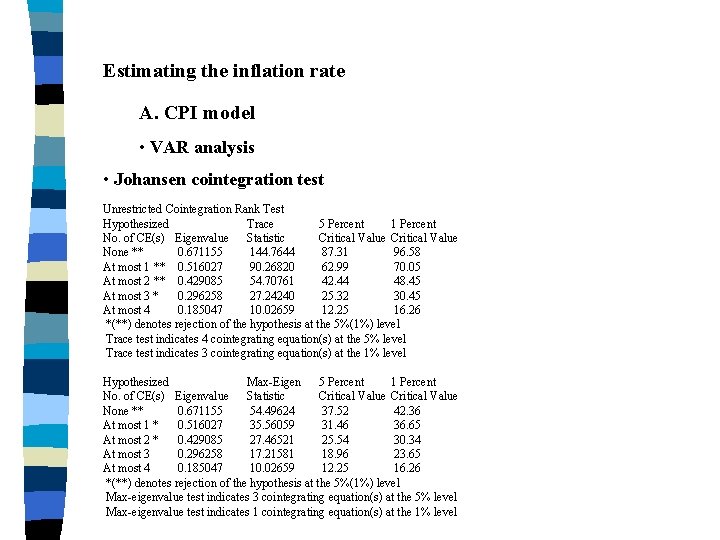

Estimating the inflation rate A. CPI model • VAR analysis • Johansen cointegration test Unrestricted Cointegration Rank Test Hypothesized Trace 5 Percent 1 Percent No. of CE(s) Eigenvalue Statistic Critical Value None ** 0. 671155 144. 7644 87. 31 96. 58 At most 1 ** 0. 516027 90. 26820 62. 99 70. 05 At most 2 ** 0. 429085 54. 70761 42. 44 48. 45 At most 3 * 0. 296258 27. 24240 25. 32 30. 45 At most 4 0. 185047 10. 02659 12. 25 16. 26 *(**) denotes rejection of the hypothesis at the 5%(1%) level Trace test indicates 4 cointegrating equation(s) at the 5% level Trace test indicates 3 cointegrating equation(s) at the 1% level Hypothesized Max-Eigen 5 Percent 1 Percent No. of CE(s) Eigenvalue Statistic Critical Value None ** 0. 671155 54. 49624 37. 52 42. 36 At most 1 * 0. 516027 35. 56059 31. 46 36. 65 At most 2 * 0. 429085 27. 46521 25. 54 30. 34 At most 3 0. 296258 17. 21581 18. 96 23. 65 At most 4 0. 185047 10. 02659 12. 25 16. 26 *(**) denotes rejection of the hypothesis at the 5%(1%) level Max-eigenvalue test indicates 3 cointegrating equation(s) at the 5% level Max-eigenvalue test indicates 1 cointegrating equation(s) at the 1% level

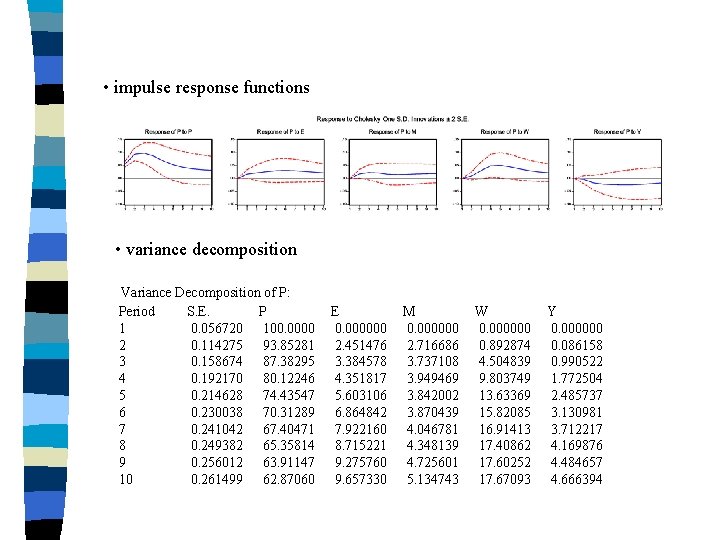

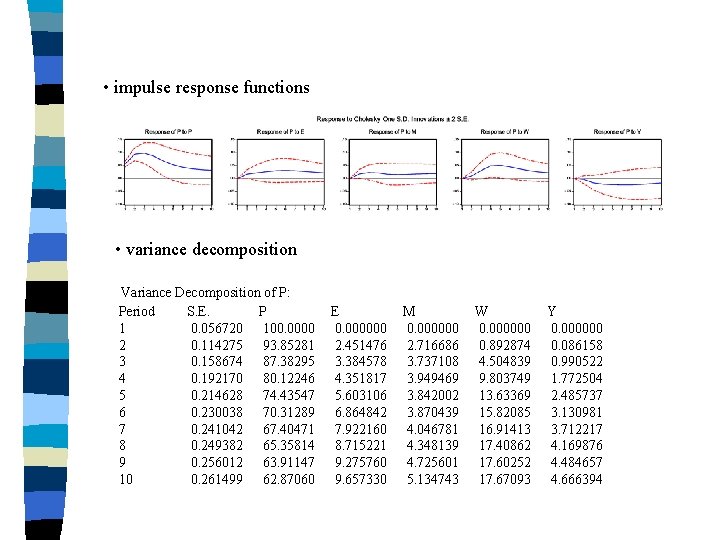

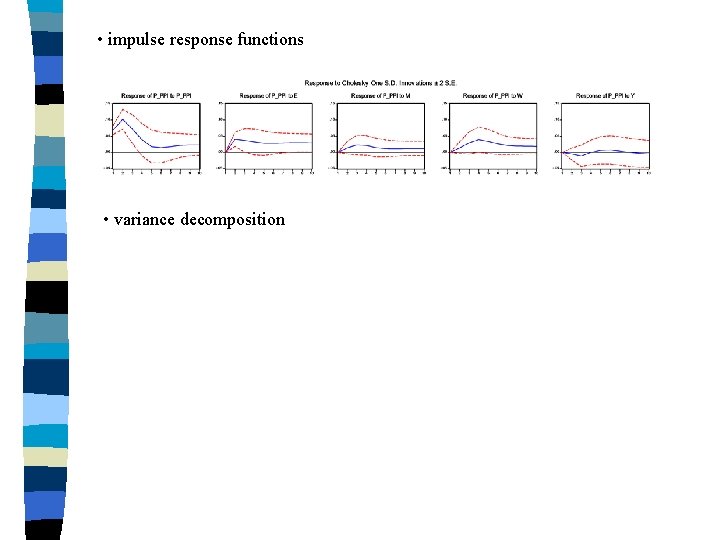

• impulse response functions • variance decomposition Variance Decomposition of P: Period S. E. P 1 0. 056720 100. 0000 2 0. 114275 93. 85281 3 0. 158674 87. 38295 4 0. 192170 80. 12246 5 0. 214628 74. 43547 6 0. 230038 70. 31289 7 0. 241042 67. 40471 8 0. 249382 65. 35814 9 0. 256012 63. 91147 10 0. 261499 62. 87060 E 0. 000000 2. 451476 3. 384578 4. 351817 5. 603106 6. 864842 7. 922160 8. 715221 9. 275760 9. 657330 M 0. 000000 2. 716686 3. 737108 3. 949469 3. 842002 3. 870439 4. 046781 4. 348139 4. 725601 5. 134743 W 0. 000000 0. 892874 4. 504839 9. 803749 13. 63369 15. 82085 16. 91413 17. 40862 17. 60252 17. 67093 Y 0. 000000 0. 086158 0. 990522 1. 772504 2. 485737 3. 130981 3. 712217 4. 169876 4. 484657 4. 666394

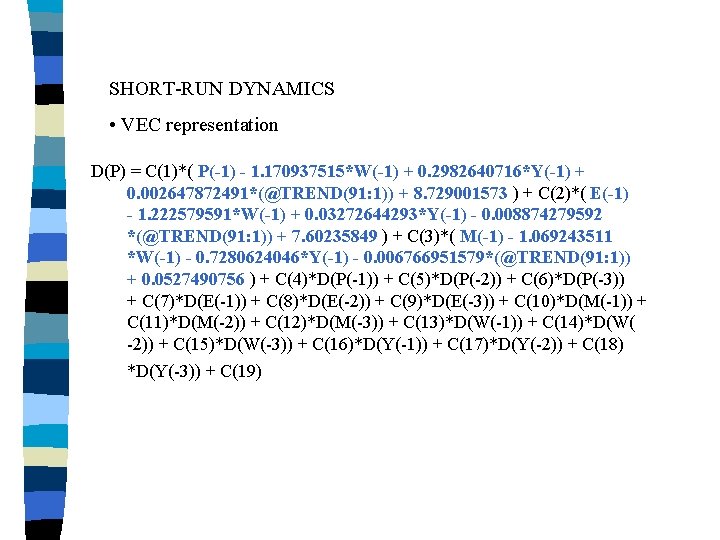

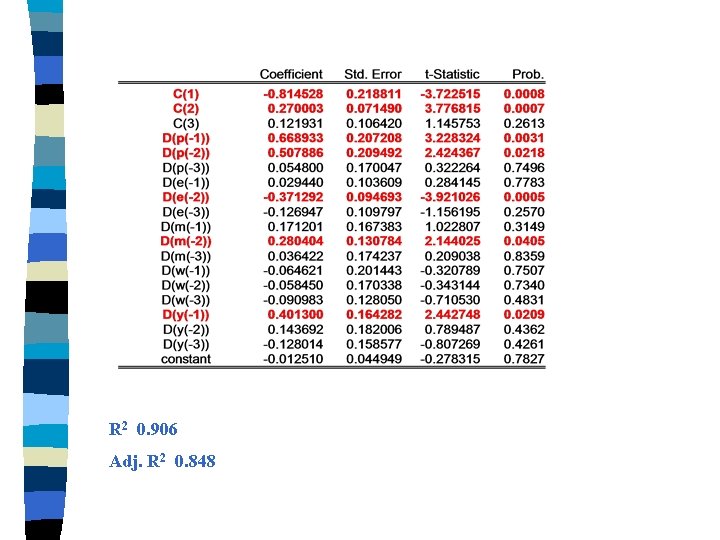

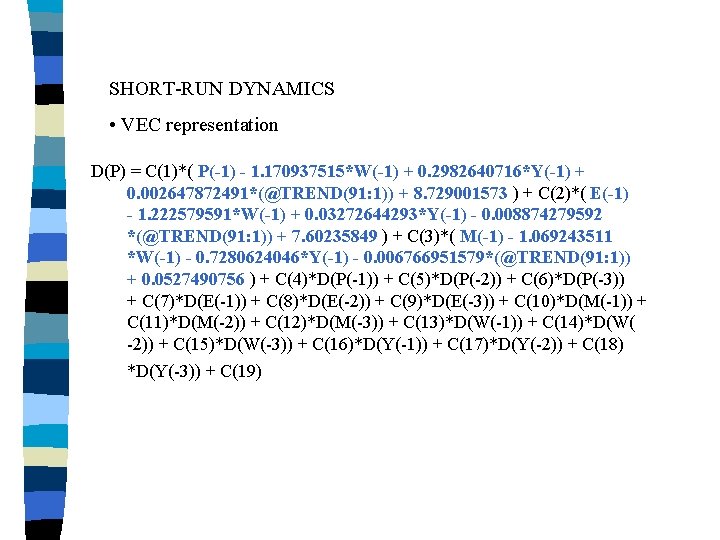

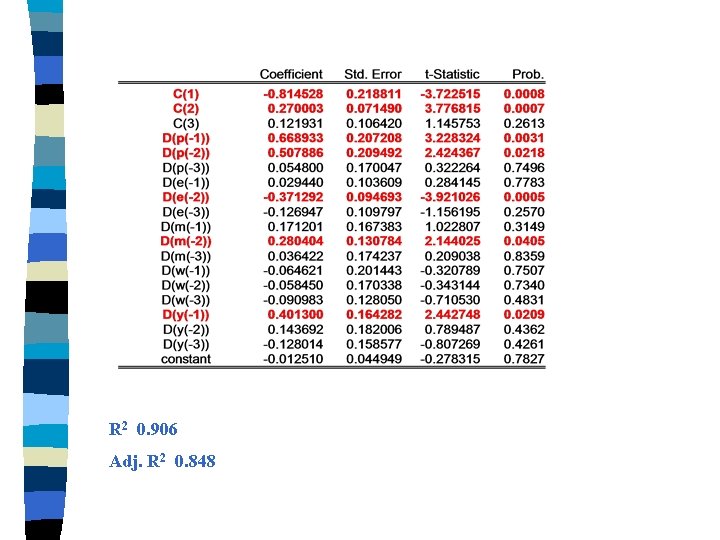

SHORT-RUN DYNAMICS • VEC representation D(P) = C(1)*( P(-1) - 1. 170937515*W(-1) + 0. 2982640716*Y(-1) + 0. 002647872491*(@TREND(91: 1)) + 8. 729001573 ) + C(2)*( E(-1) - 1. 222579591*W(-1) + 0. 03272644293*Y(-1) - 0. 008874279592 *(@TREND(91: 1)) + 7. 60235849 ) + C(3)*( M(-1) - 1. 069243511 *W(-1) - 0. 7280624046*Y(-1) - 0. 006766951579*(@TREND(91: 1)) + 0. 0527490756 ) + C(4)*D(P(-1)) + C(5)*D(P(-2)) + C(6)*D(P(-3)) + C(7)*D(E(-1)) + C(8)*D(E(-2)) + C(9)*D(E(-3)) + C(10)*D(M(-1)) + C(11)*D(M(-2)) + C(12)*D(M(-3)) + C(13)*D(W(-1)) + C(14)*D(W( -2)) + C(15)*D(W(-3)) + C(16)*D(Y(-1)) + C(17)*D(Y(-2)) + C(18) *D(Y(-3)) + C(19)

R 2 0. 906 Adj. R 2 0. 848

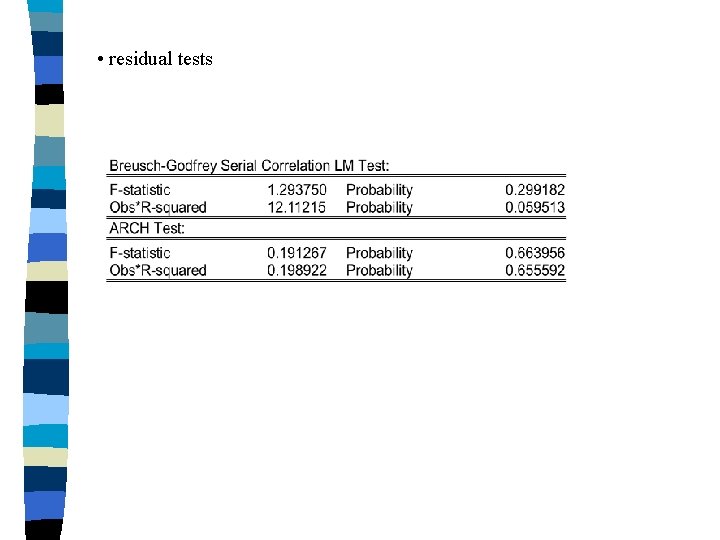

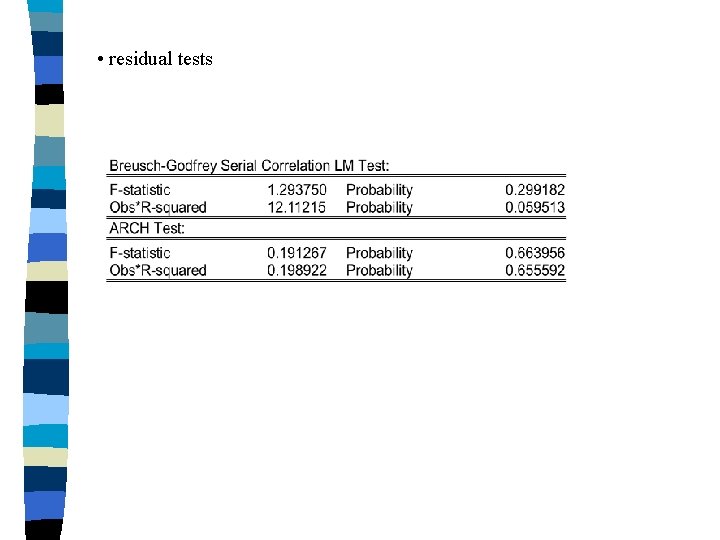

• residual tests

• stability test

• In-sample fit for the model

B. PPI model • VAR analysis • Johansen cointegration test

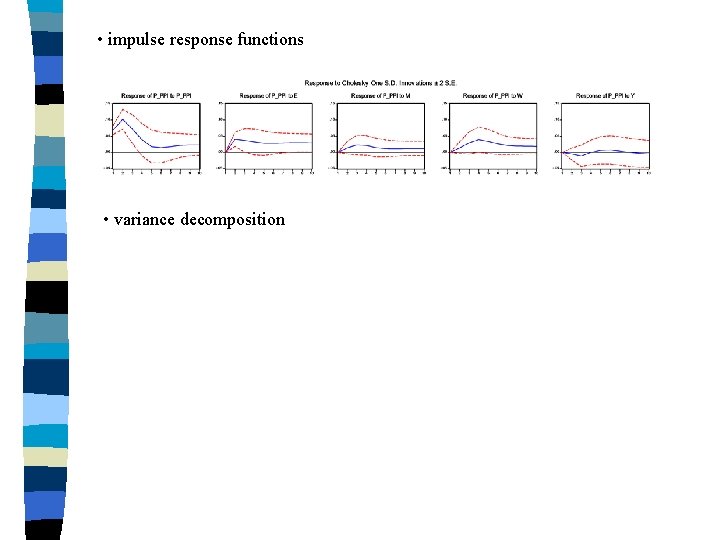

• impulse response functions • variance decomposition

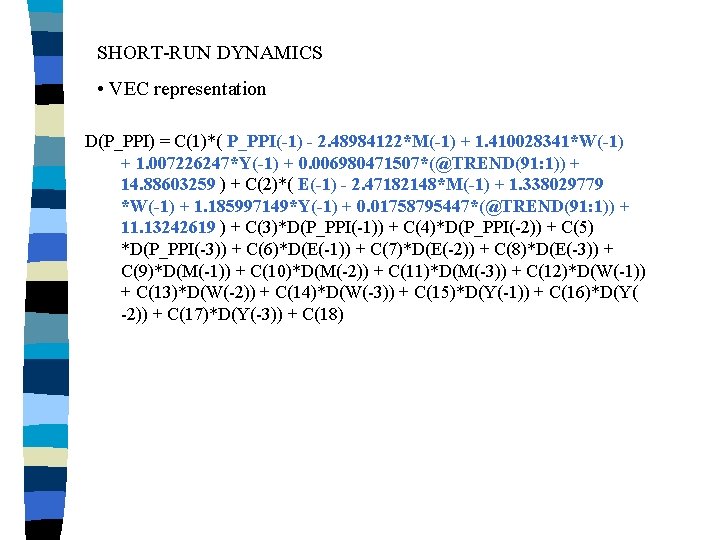

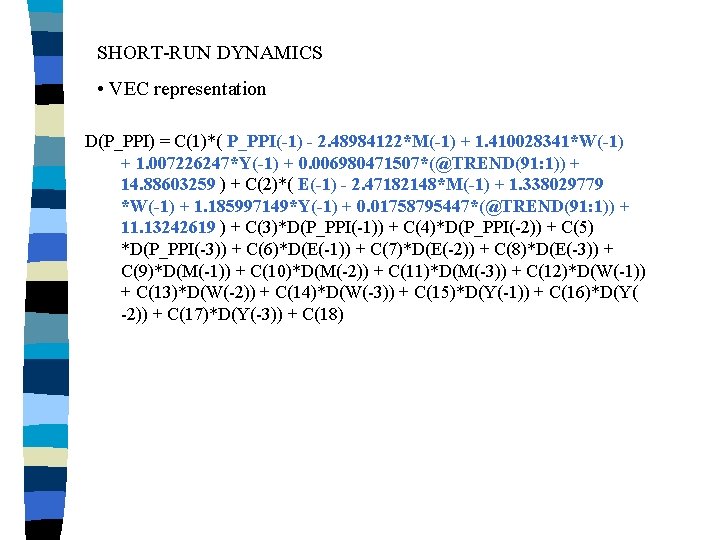

SHORT-RUN DYNAMICS • VEC representation D(P_PPI) = C(1)*( P_PPI(-1) - 2. 48984122*M(-1) + 1. 410028341*W(-1) + 1. 007226247*Y(-1) + 0. 006980471507*(@TREND(91: 1)) + 14. 88603259 ) + C(2)*( E(-1) - 2. 47182148*M(-1) + 1. 338029779 *W(-1) + 1. 185997149*Y(-1) + 0. 01758795447*(@TREND(91: 1)) + 11. 13242619 ) + C(3)*D(P_PPI(-1)) + C(4)*D(P_PPI(-2)) + C(5) *D(P_PPI(-3)) + C(6)*D(E(-1)) + C(7)*D(E(-2)) + C(8)*D(E(-3)) + C(9)*D(M(-1)) + C(10)*D(M(-2)) + C(11)*D(M(-3)) + C(12)*D(W(-1)) + C(13)*D(W(-2)) + C(14)*D(W(-3)) + C(15)*D(Y(-1)) + C(16)*D(Y( -2)) + C(17)*D(Y(-3)) + C(18)

R 2 0. 933 Adj. R 2 0. 895

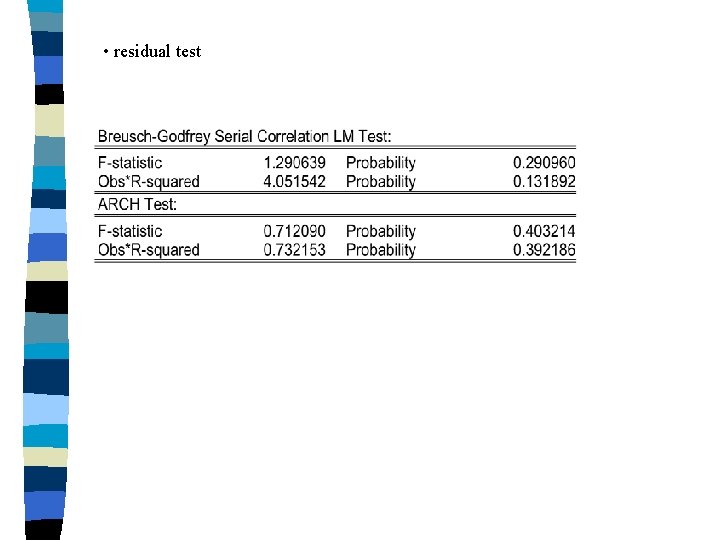

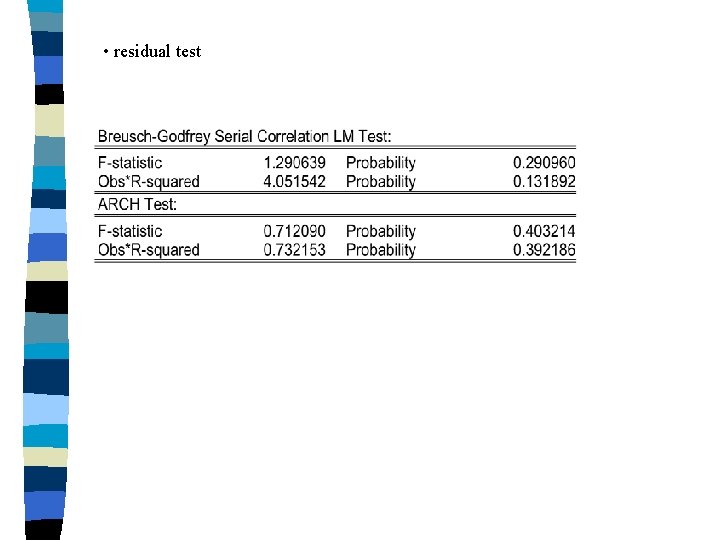

• residual test

• stability test

• In-sample fit for the model

Conclusions • the empirical results indicate that there is a long-run equilibrium relantionship between prices and e, m, w and y; • the findings show that in the long run inflation in Romania is positively related to the nominal exchange rate, money growth and nominal wage growth, while it is negatively related to the output (proxied by the industrial production index); • in terms of the magnitude of effects shocks to wages and nominal exchange rate have relatively larger impacts on prices; • the empirical findings from the error-correction model showed that inflation adjusts to its equilibrium fairly rapidly; • in the short run inflation is determined by its past values, the exchange rate and by the output;

• the significant and negative coefficient on the variable of the nominal exchange rate implies that the appreciation of the Romanian leu in the transition period has contributed to reducing inflation; • in the CPI model, in the short run, inflation is also determined by the money supply while in the PPI model moeny doesn’t affect inflation; • in the CPI model, in the short run, wages doesn’t influence inflation, while in the PPI model it does.

REFERENCES: Arratibel Olga, Rodriguez-Palenzuela Diego, Thimann Christian (2002)Inflation dynamics and dual inflation in accession countries: A “new keynesian” perspective , ECB WP. Brada Josef, King Arthur E. , . Kutan Ali M. (2000) - Inflation bias and productivity shocks in transitions economies: The case of the Czech Republic, ZEI WP. Bertocco Giancarlo, Fanelli Luca, Paruolo Paolo (2002)- On the determinants of inflation in Italy: evidence of cost-push effects before the European Monetary Union. Enders Walter – Applied Econometric Time Series, John. Wiley $ Sons, Inc. Engle R. F. , . Granger C. W. J (1987)- Cointegration and error correction: representation, estimation and testing , Econometrica. Gali J. , Gertler M. , Lopez-Salido J. D. (2001) - European inflation dynamics, European Economic Review. Gerlach Stefan, Svensson Lars E. O. (2000)- Money and inflation in the euro area: A case for monetary indicators? , NBER WP. Golinelli Roberto, Orsi Renzo (2002) - Modelling inflation in EU accession countries: The case of the Czech Republic, Ezoneplus WP.

Golinelli R. , Orsi R. (1998)- Exchange rate, inflation and unemployment in East European economies: the case of Poland Hungary. Golinelli R. , Rovelli R. ( 2001) - Painless disinflation? Monetary policy rules in Hungary (1991 - 1999). Hamilton James, D. (1994) – Time Series Analysis, Princeton University Press. Hubrich Kirstin (Aug. 2003)- Forecasting euro area inflation: does aggregating forecast accuracy? , ECB WP. Johansen Soren (1991)– Estimation and Hypothesis Testing of Contegration Vectors in Gaussian Vector Autoregressive Models, Econometrica, vol. 59, No. 6. Kim Byung-Yeong (2001)- Determinants of inflation in Poland: A structural cointegration approach, Bofit Discussion Papers. Lyziak Tomasz (2003) - Consumer inflation expectations in Poland, ECB WP. Mohanty M. S. , Klan Marc - What determines inflation in emerging market economies? , BIS WP;

CPI model

PPI model

The bucharest university of economic studies ranking

The bucharest university of economic studies ranking Eui doctoral programme

Eui doctoral programme Abd dissertation

Abd dissertation Nsf doctoral dissertation improvement grant

Nsf doctoral dissertation improvement grant Umbc doctoral programs

Umbc doctoral programs Doctoral initiative on minority attrition and completion

Doctoral initiative on minority attrition and completion College doctoral ubfc

College doctoral ubfc Power point tesis doctoral medicina

Power point tesis doctoral medicina South west and wales doctoral training partnership

South west and wales doctoral training partnership Nsf ddrig sociology

Nsf ddrig sociology Csu doctoral incentive program

Csu doctoral incentive program Paradigm shift from women studies to gender studies

Paradigm shift from women studies to gender studies Event studies in economics and finance

Event studies in economics and finance Event studies in economics and finance

Event studies in economics and finance Academy of lymphatic studies

Academy of lymphatic studies Georgia academy for economic development

Georgia academy for economic development Economic growth vs economic development

Economic growth vs economic development Economic development vs economic growth

Economic development vs economic growth Economics unit 1 lesson 2 difficult choices

Economics unit 1 lesson 2 difficult choices School of graduate studies upm

School of graduate studies upm Nafc courses

Nafc courses Robbinsville high school program of studies

Robbinsville high school program of studies Robbinsville high school program of studies

Robbinsville high school program of studies Interpersonal studies teks

Interpersonal studies teks He studies grade

He studies grade Primary 4 general studies worksheet

Primary 4 general studies worksheet Rtsd naviance

Rtsd naviance Ajou university graduate school of international studies

Ajou university graduate school of international studies