The Michigan Department of Treasury Welcomes the MSATA

- Slides: 28

The Michigan Department of Treasury Welcomes the MSATA Conference Attendees 1

State Agency Collections Presented by : The Michigan Department of Treasury, Collection Division August 2006 2

STATE AGENCY COLLECTION AUTHORITY • Michigan Compiled Laws Section 205. 3 of the Revenue Act of 1941, as amended, states: “The department shall have all the powers and perform the duties formerly vested in a department, board, commission, or other agency, in connection with taxes due to or claimed by this state or any of its departments, institutions, or agencies that may be made payable to or collectible by the department created by this act. ” • Gives the department the authority to assess and collect state taxes as well as other state debt. • Defines enforcement powers and limits. • Outlines the collection process. 3

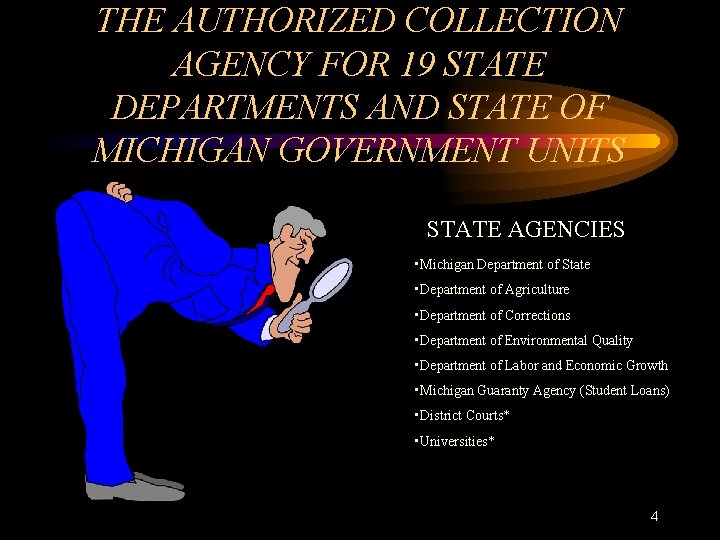

THE AUTHORIZED COLLECTION AGENCY FOR 19 STATE DEPARTMENTS AND STATE OF MICHIGAN GOVERNMENT UNITS STATE AGENCIES • Michigan Department of State • Department of Agriculture • Department of Corrections • Department of Environmental Quality • Department of Labor and Economic Growth • Michigan Guaranty Agency (Student Loans) • District Courts* • Universities* 4

INGREDIENTS TO SUCCESS 2003 Revenue Enhancement Initiative • Replaced staff lost to “early out” retirement. • Added additional staff to strategic positions. • Legislative response to suggested changes. • Administrative response to suggested changes. 5

MILESTONES • 1985 - Michigan Automated Collection System (MACS) contract implemented for income tax collection. First call in February 1986. • 1987 - State Agency accounts (including Student Loans) added to the system. • 1994 - District Court accounts collected. • 1997 - One Billionth dollar collected by MARCS (April 1 st). • 1997 - MARCS contract awarded (July 1 st). • 1999 - MARCS implemented (June 15 th). • 2006 – Two Billionth dollar collected by MARCS. – Total Collections to Date: $2. 3 Billion 6

MICHIGAN DEPARTMENT OF TREASURY COLLECTION DIVISION ORGANIZATIONAL STRUCTURE Collection Division Contracted Collection Agency Central Office Operations Field Collections 7

TREASURY OPERATIONS What is our approach to Collections? § Informed Mailings §Telephone Contact – Incoming/Outgoing §Installment Agreement and Monitoring Success §Enforcement Action §Quality Assurance 8

CENTRAL OFFICE – CALL CENTER • • • First Treasury Contact Mailings Triage of Information Installment Agreement Recommendation of Enforcement/Legal Action 9

PRIVATE COLLECTION AGENCY • • • Activity Monitored by State Personnel Receives Calls Generates Mailings Skip Trace for Contact Information Makes Calls - Call Campaigns Recommendations for Legal/Enforcement Action 10

TOOLS FOR SUCCESS • Clear Informative Letters – Including Consequences • Informative Call Scripts • Brochures/Hand outs in Initial Mailings • FAQ’s • Quality Assurance • Web Site 11

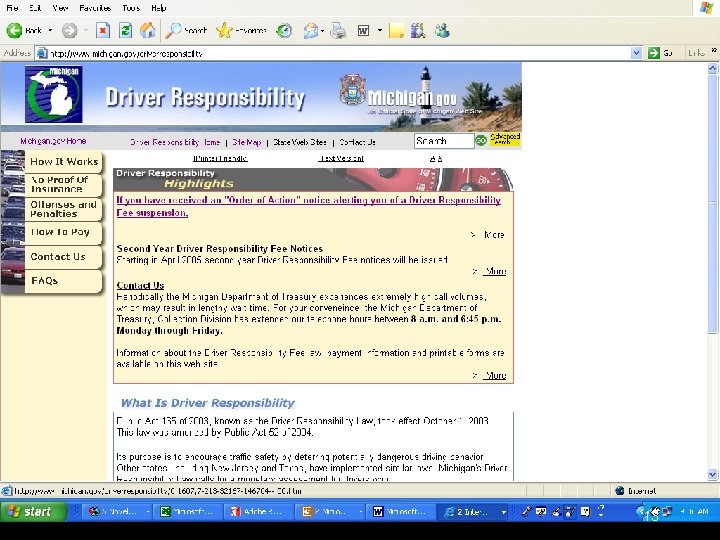

WEB PAGE www. michigan. gov/driverresponsibility 12

13

REQUIREMENTS FOR AGENCY COLLECTION REFERRALS TO TREASURY • Debt must have been delinquent for at least 180 days. • Debt must be greater than $100. • Agency must afford the debtor due process appeal privileges. 14

DRIVER RESPONSIBILITY FEE • Enacted by the Michigan Legislature in October 2003 to promote safer driving in Michigan. • Public Act 165 of 2003 Amended by Public Act 52 of 2004 • Driver code requires suspension of driver license when debt is delinquent. • The act targets drivers convicted of specific driving offenses. – Examples of specific qualifying offenses • Driving while under the influence of drugs or alcohol • Driving on a suspended license • Driving with no proof of insurance – The accumulation of seven or more points on their driving record. • Fee is in addition to any court imposed fines or penalties. 15

MICHIGAN DEPARTMENT OF STATE AND THE MICHIGAN DEPARTMENT OF TREASURY • Have partnered to administer the provisions of this statute. • Michigan Department of Treasury is required to assess , notify, and collect the fee from the driver. • Michigan Department of State notified of failure to pay. • Michigan Department of State will suspend a driver’s license for failure to pay the assessed fee. 16

MICHIGAN DEPARTMENT OF STATE AND THE MICHIGAN DEPARTMENT OF TREASURY • This fee is applicable to both residents and nonresidents of Michigan. • This fee is assessed for two years. • Fees range from $200. 00 to $1, 000. • Installment agreements are acceptable for amounts over $500. 17

INFORMATION PROCESSING ISSUES FOR DRIVER RESPONSIBILITY FEE COLLECTIONS • Michigan Department of State and Treasury maintain separate databases. • The Michigan Department of State system contains driver information. • State Treasury Accounts Receivable System contains financial detail information. • No financial information is exchanged. 18

INFORMATION PROCESSING ISSUES FOR DRIVER RESPONSIBILITY FEE COLLECTIONS • Necessary information is interfaced daily via mainframe to mainframe electronic file transfer process. • The Michigan Department of State sends new Driver Responsibility Fee debts to State Treasury Accounts Receivable System. • State Treasury Accounts Receivable System sends status code updates to the Michigan Department of State to either allow or prevent suspension of a drivers license. 19

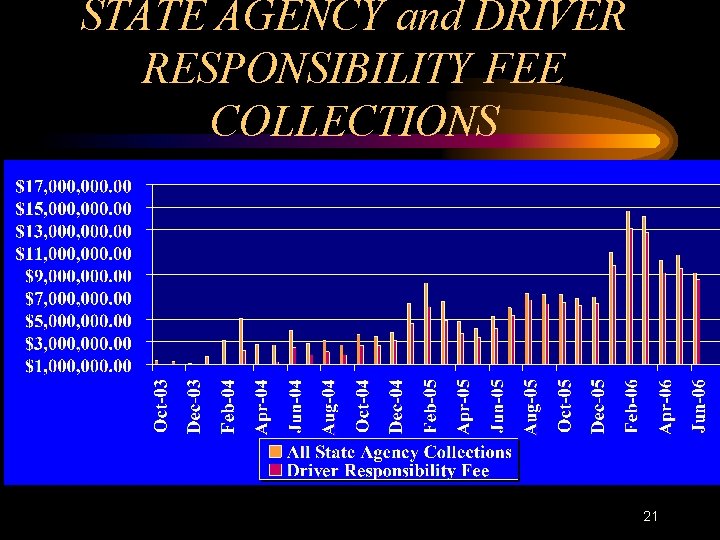

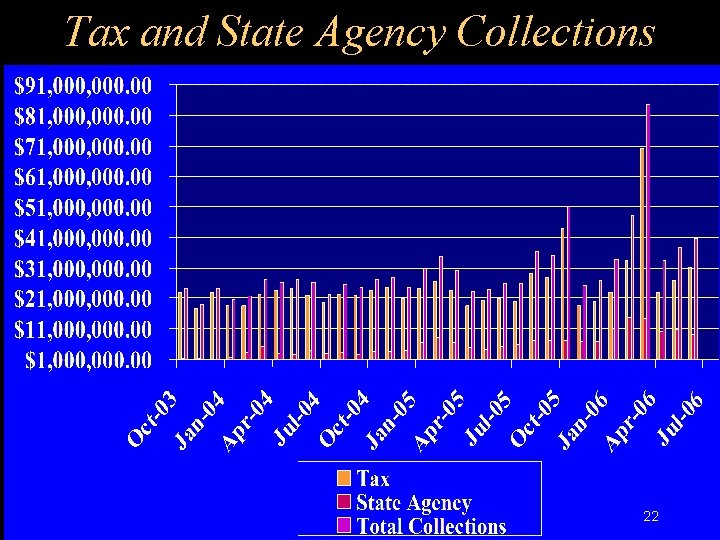

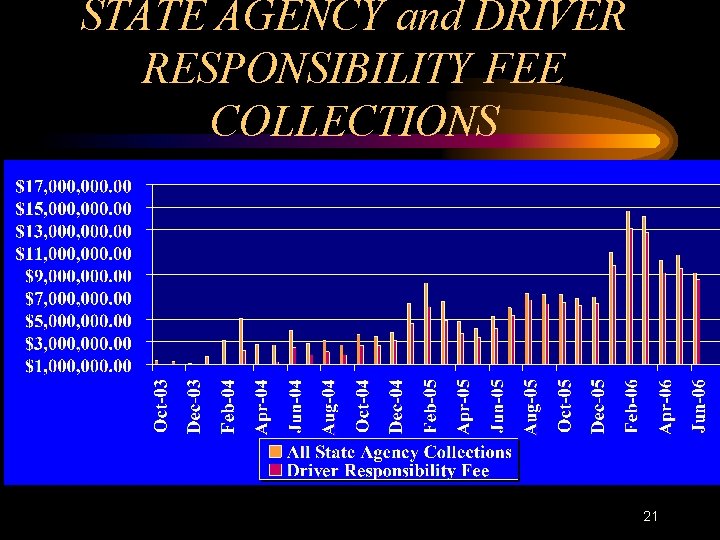

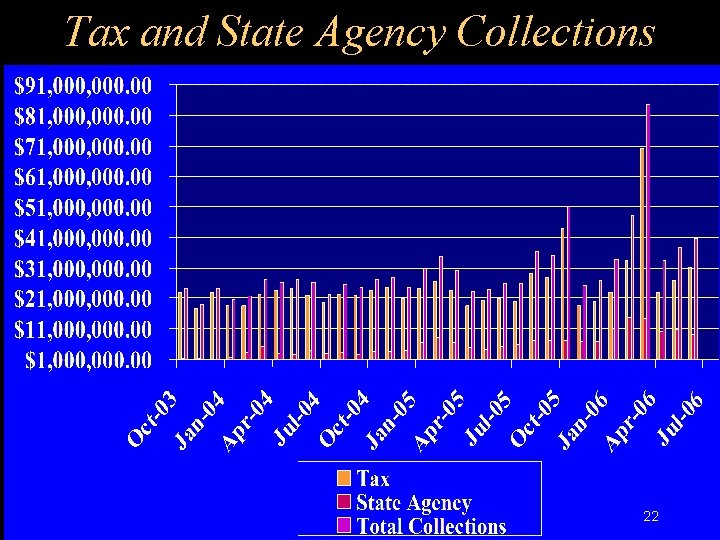

RECORD STATE AGENCY COLLECTIONS FOR THE MICHIGAN DEPARTMENT OF TREASURY • • • FYE 2002 $25. 06 million FYE 2003 $21. 55 million 15% decrease FYE 2004 $31. 97 million 48% increase FYE 2005 $66. 97 million 109% increase FYTD 2006 $91. 04 million 36% increase thru June 20

STATE AGENCY and DRIVER RESPONSIBILITY FEE COLLECTIONS 21

Tax and State Agency Collections 22

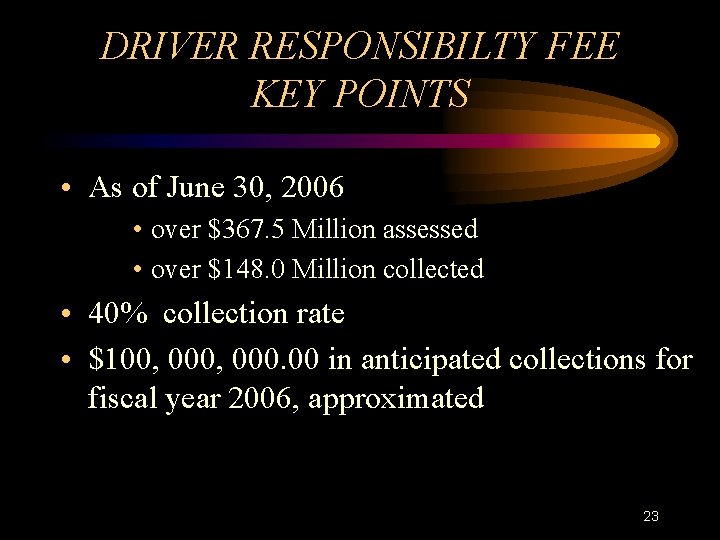

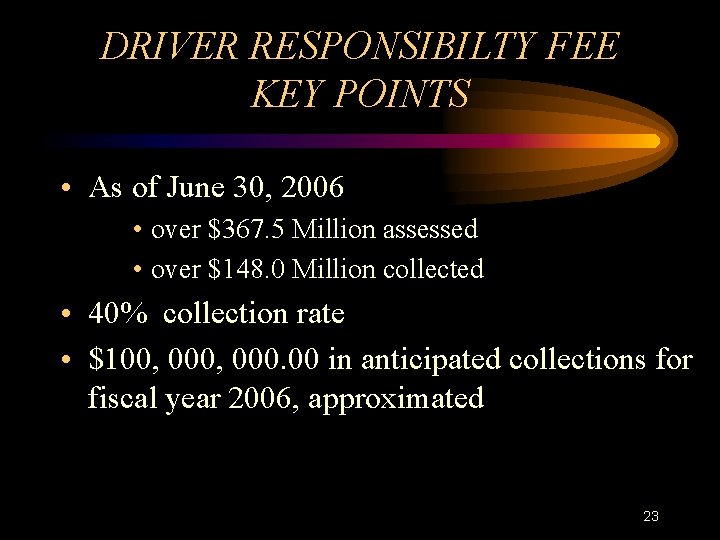

DRIVER RESPONSIBILTY FEE KEY POINTS • As of June 30, 2006 • over $367. 5 Million assessed • over $148. 0 Million collected • 40% collection rate • $100, 000. 00 in anticipated collections for fiscal year 2006, approximated 23

www. michigan. gov/driverresponsibility 24

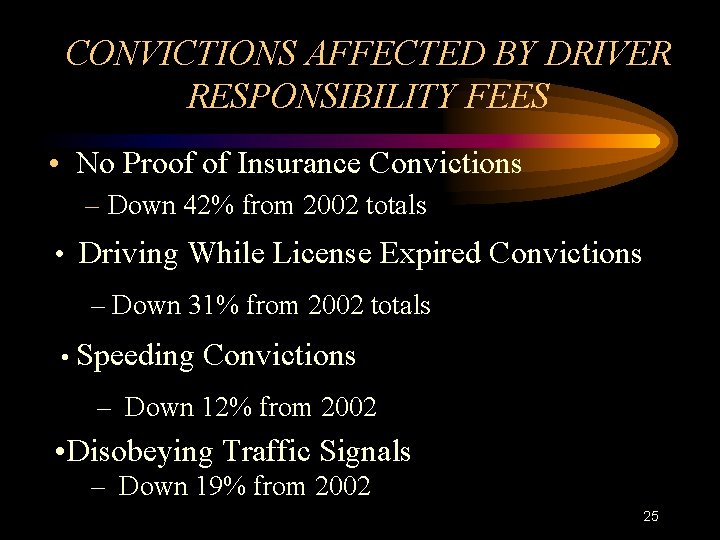

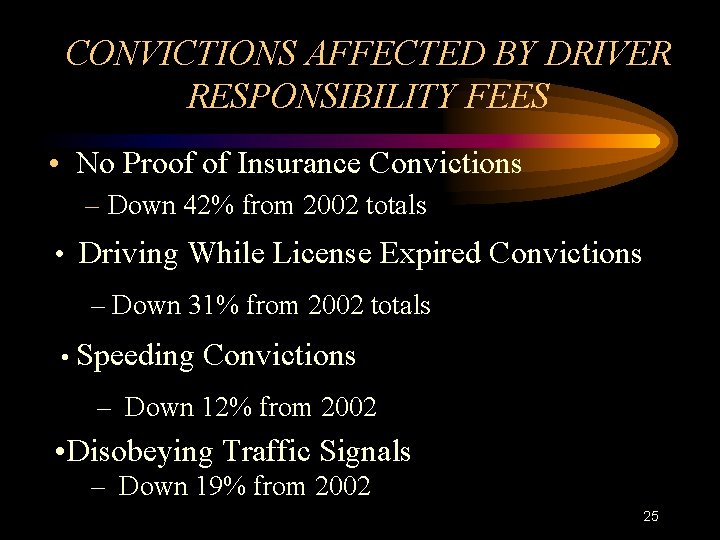

CONVICTIONS AFFECTED BY DRIVER RESPONSIBILITY FEES • No Proof of Insurance Convictions – Down 42% from 2002 totals • Driving While License Expired Convictions – Down 31% from 2002 totals • Speeding Convictions – Down 12% from 2002 • Disobeying Traffic Signals – Down 19% from 2002 25

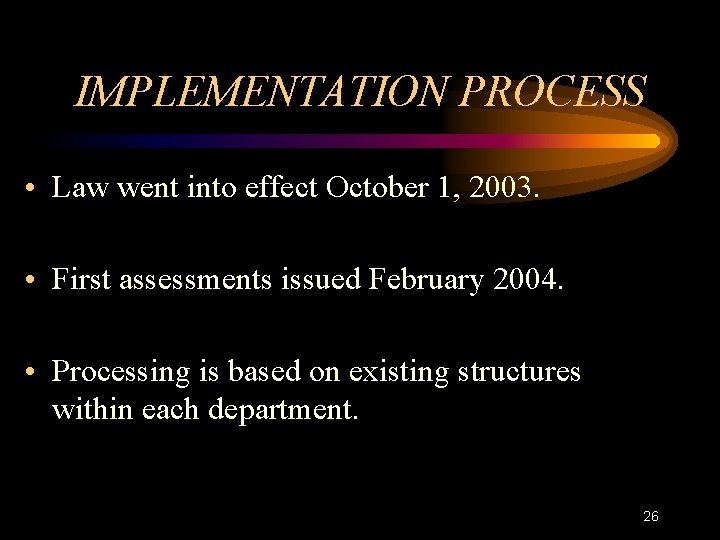

IMPLEMENTATION PROCESS • Law went into effect October 1, 2003. • First assessments issued February 2004. • Processing is based on existing structures within each department. 26

OBSTACLES AND CHALLENGES ENCOUNTERED • Making necessary system changes. • Educating the public about the law. • Managing the public’s hostility towards no proof of insurance provision. • Educating our staffs about the nuances of law. • Delineating areas of responsibility. • Managing increased workloads in both processing and phone call volumes. • Legislation that affects administrative processing. 27

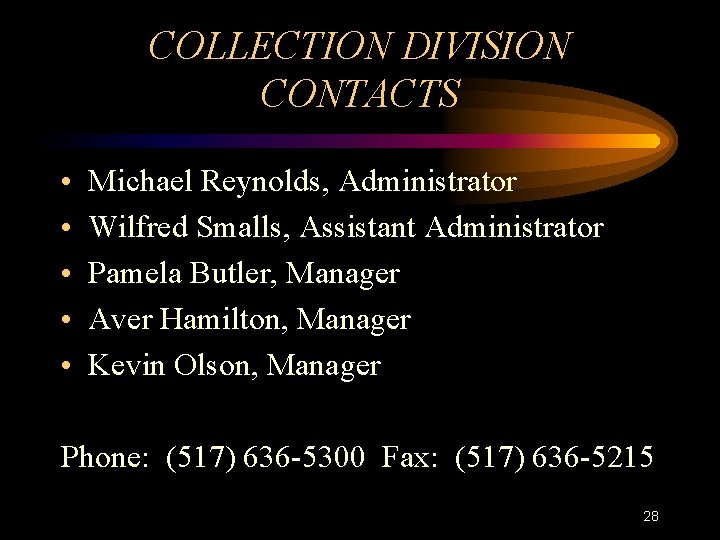

COLLECTION DIVISION CONTACTS • • • Michael Reynolds, Administrator Wilfred Smalls, Assistant Administrator Pamela Butler, Manager Aver Hamilton, Manager Kevin Olson, Manager Phone: (517) 636 -5300 Fax: (517) 636 -5215 28

Department of treasury

Department of treasury School welcomes you

School welcomes you God welcomes us

God welcomes us Ala carte services

Ala carte services School welcomes you

School welcomes you Family welcomes you

Family welcomes you School welcomes you

School welcomes you Http://www.freetranslation.com/

Http://www.freetranslation.com/ Michigan department of licensing and regulatory affairs

Michigan department of licensing and regulatory affairs Michigan department of education teacher certification

Michigan department of education teacher certification Michigan state university physics department

Michigan state university physics department Treasury report example

Treasury report example Treasury account symbol

Treasury account symbol Eperunding

Eperunding Abb treasury

Abb treasury Banking automation suite

Banking automation suite Wb treasury rules 2005

Wb treasury rules 2005 Georgia state treasury

Georgia state treasury Treasury cash balance

Treasury cash balance Sap treasury workstation

Sap treasury workstation Karakteristik korporasi dalam akuntansi

Karakteristik korporasi dalam akuntansi Fxall download

Fxall download Treasury inflation protected securities cfa

Treasury inflation protected securities cfa Retained earnings treasury stock

Retained earnings treasury stock Treasury

Treasury Asset management framework national treasury

Asset management framework national treasury Cyber treasury mponline

Cyber treasury mponline Treasury kpi metrics

Treasury kpi metrics Uf treasury management

Uf treasury management