Social Security GOVT 2305 Module 16 Social Security

- Slides: 13

Social Security GOVT 2305. Module 16

Social Security Defined Social Security is a federal pension and disability insurance program funded through a payroll tax on workers and their employers. Social Security is an entitlement program, but it is not means tested.

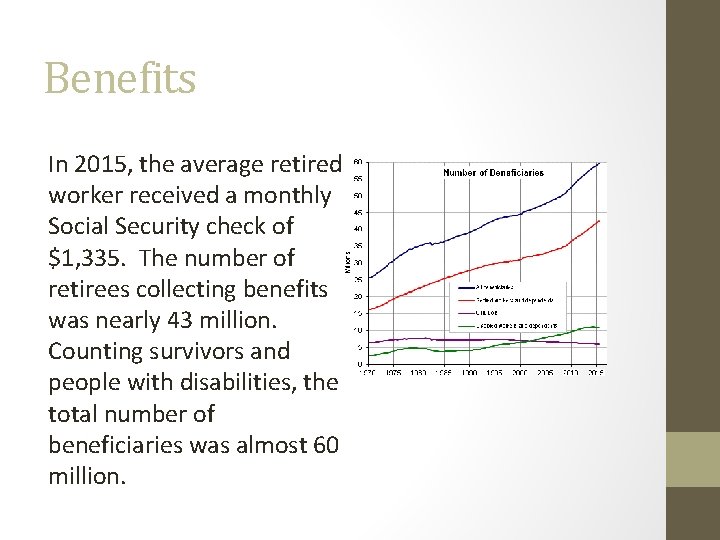

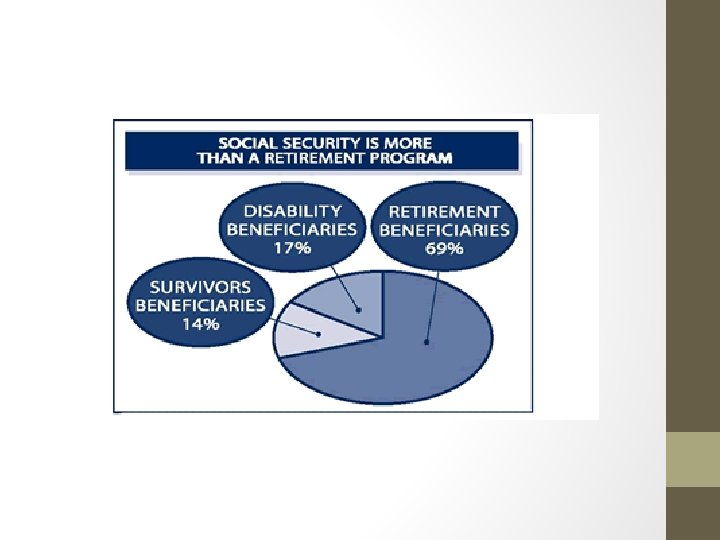

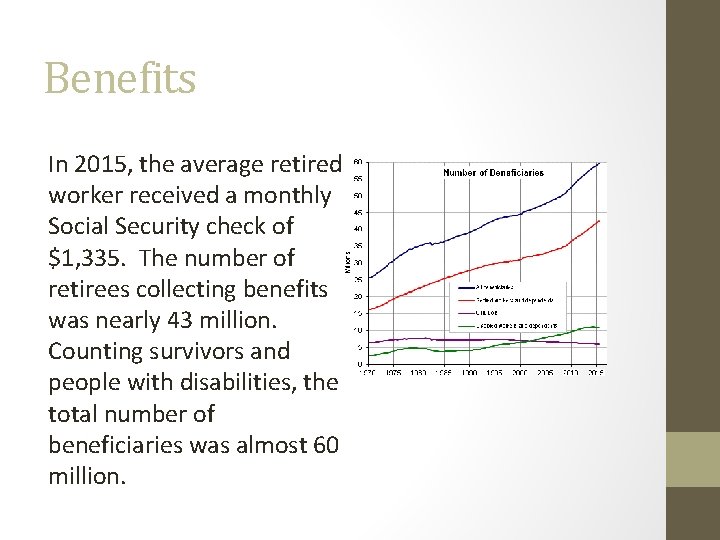

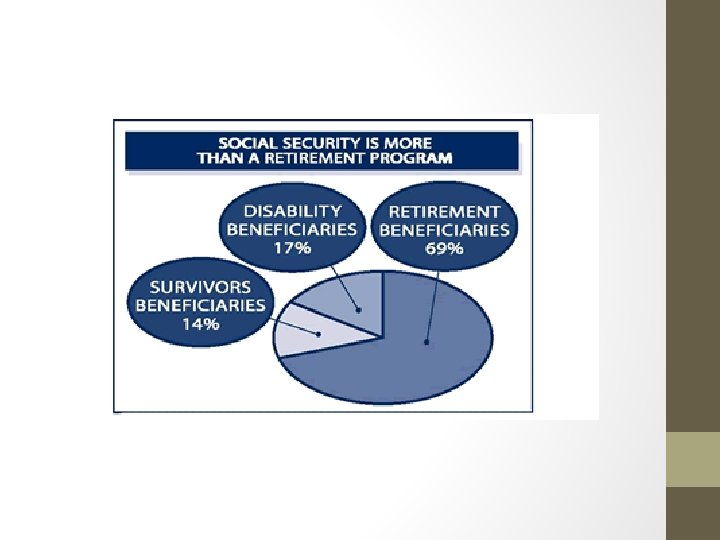

Benefits In 2015, the average retired worker received a monthly Social Security check of $1, 335. The number of retirees collecting benefits was nearly 43 million. Counting survivors and people with disabilities, the total number of beneficiaries was almost 60 million.

COLAs Social Security benefits increase with inflation as measured by the CPI. Beneficiaries receive an annual cost-of-living adjustment (COLA), which is an increase in the size of a payment to compensate for the effects of inflation.

Funding Mechanism The Social Security program can most accurately be described as a tax on workers to provide benefits to elderly retirees and disabled persons. Contrary to popular belief, Congress did not create Social Security as a pension/savings plan in which the government would simply refund the money retirees contributed over the years. Instead, current payroll taxes pay the benefits for current recipients.

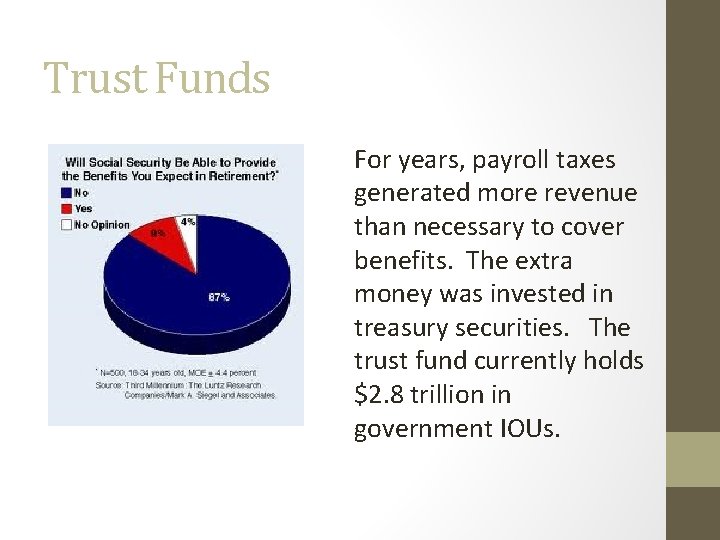

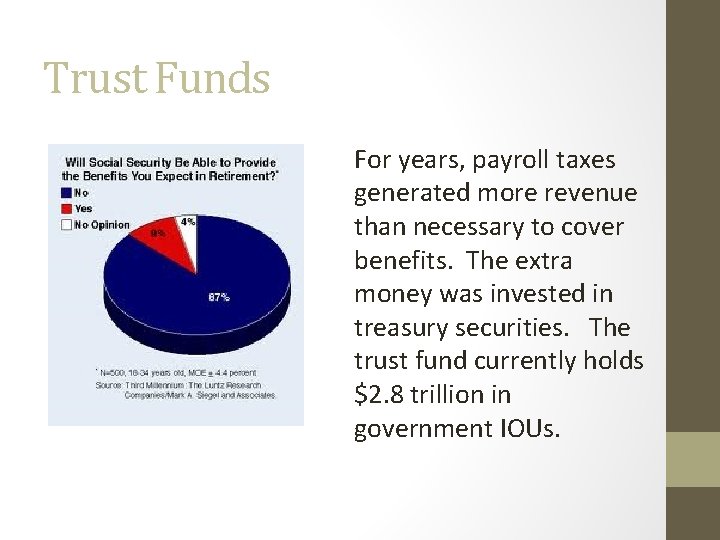

Trust Funds For years, payroll taxes generated more revenue than necessary to cover benefits. The extra money was invested in treasury securities. The trust fund currently holds $2. 8 trillion in government IOUs.

Trust Fund Balances Once the Social Security trust funds are empty of treasury securities, the system will have enough money coming in to pay 78 percent of benefits. The trust funds contain U. S. government securities. As the trustees cash out the securities to pay benefits, the U. S. government will have to borrow even more money. By 2037, the trust funds will be empty.

Proposed Reforms • Make Social Security means-tested. • Supplement Social Security with private accounts that would allow people to invest some of their money in stocks and bonds. • Cut benefits, perhaps by raising the retirement age. • Increase taxes, perhaps by raising the payroll tax cap.

What You Have Learned • What is Social Security and how does it work? • How is Social Security financed? • Why does Social Security face a long-term challenge? • What are the proposed reforms for the Social Security system?