Economic Policymaking Process GOVT 2305 Module 16 Fiscal

- Slides: 19

Economic Policymaking Process GOVT 2305. Module 16

Fiscal Policymaking Fiscal policy is government policy that involves taxes and spending. It is made by Congress and the president.

President’s Budget President sets economic goals and established overall revenue and expenditure levels. OMB sends guidelines to departments and agencies and asks them to prepare detailed budgets. OMB, agency heads, and perhaps even the president negotiate final spending levels. In January or February, the president sends the budget to Congress.

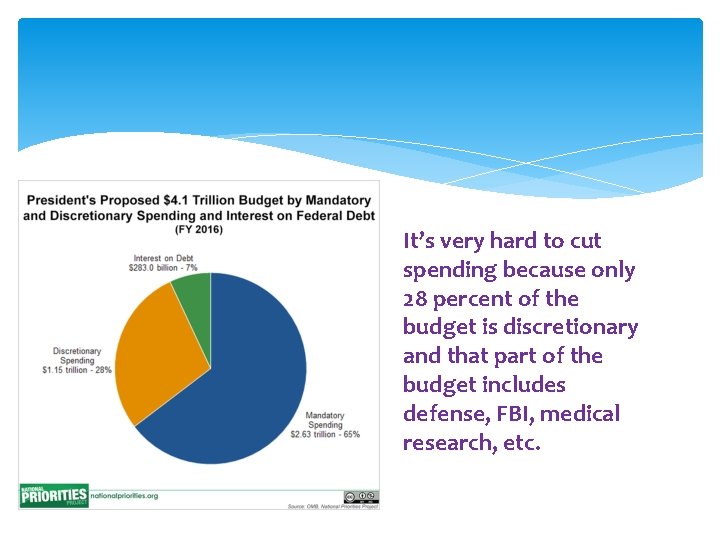

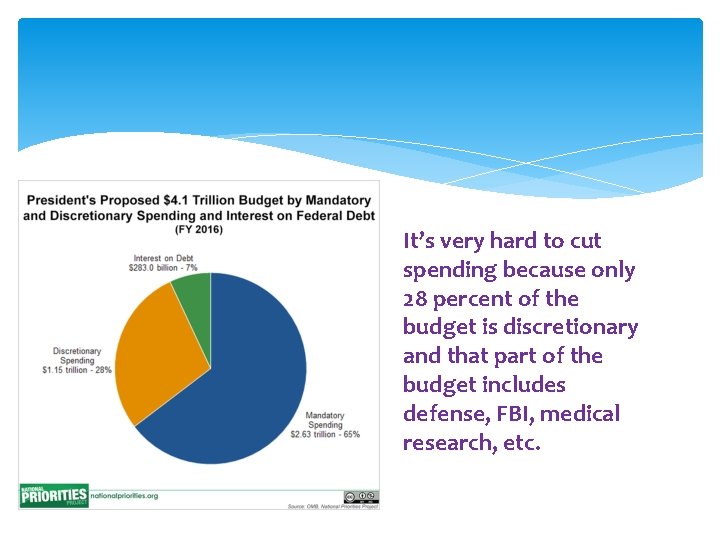

Mandatory & Discretionary Spending Mandatory spending refers to budgetary expenditures that are mandated by law, including entitlements and contractual commitments made in previous years. Discretionary spending includes budgetary expenditures that are not mandated by law or contract, including annual funding for education, the Coast Guard, space exploration, highway construction, defense, foreign aid, and the Federal Bureau of Investigation (FBI).

It’s very hard to cut spending because only 28 percent of the budget is discretionary and that part of the budget includes defense, FBI, medical research, etc.

Authorization Process The authorization process is the procedure through which Congress legislatively establishes a program, defines its general purpose, devises procedures for its operation, specifies an agency to implement the program, and indicates an approximate level of funding for the program (but does not actually provide money).

Appropriation Process Discretionary expenditures must be approved through the appropriation process, which is the procedure through which Congress legislatively provides money for a particular purpose.

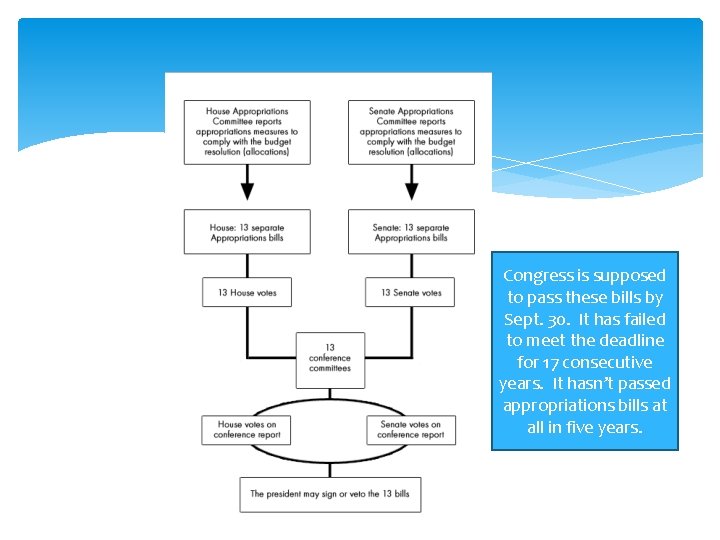

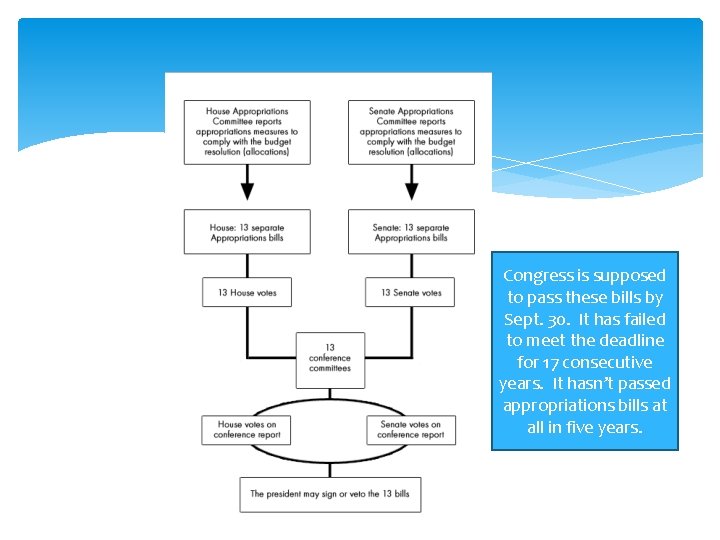

House Appropriations Committee The House Appropriations Committee divides the discretionary part of the budget into 13 separate categories for assignment to its 13 subcommittees. Congress never reunites the budget into a single document; instead, it passes 13 separate appropriation bills.

Congress is supposed to pass these bills by Sept. 30. It has failed to meet the deadline for 17 consecutive years. It hasn’t passed appropriations bills at all in five years.

Deadlines & Continuing Resolutions If Congress and the president have not agreed on appropriation legislation by October 1, Congress typically votes to continue government operations at their current funding rate. If Congress fails to act, the government must shut down non-essential services. The U. S. government has been operating on continuing resolutions for more than four years because the House and Senate have been unable to agree on a budget.

Tax Bills Congress and the president adopt tax measures through the legislative process with the constitutional stipulation that revenueraising bills must originate in the House.

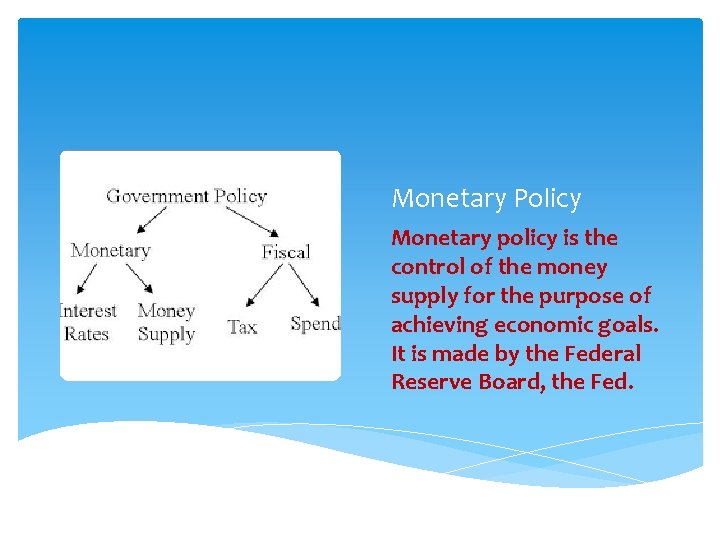

Monetary Policy

Monetary Policy Monetary policy is the control of the money supply for the purpose of achieving economic goals. It is made by the Federal Reserve Board, the Fed.

Federal Reserve The Federal Reserve (Fed) is the central banking system of the United States with authority to establish banking policies and influence the amount of credit available in the economy.

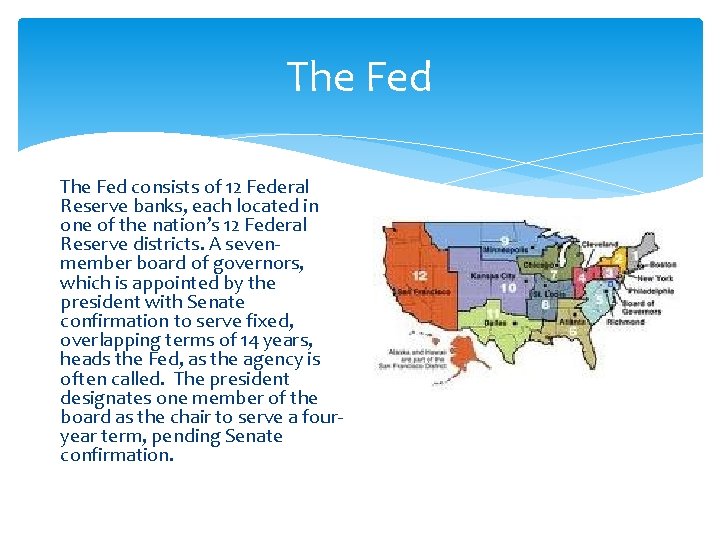

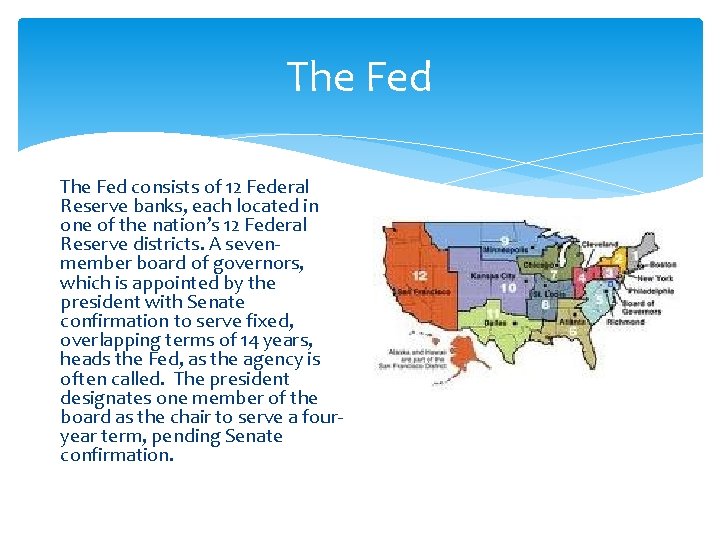

The Fed consists of 12 Federal Reserve banks, each located in one of the nation’s 12 Federal Reserve districts. A sevenmember board of governors, which is appointed by the president with Senate confirmation to serve fixed, overlapping terms of 14 years, heads the Fed, as the agency is often called. The president designates one member of the board as the chair to serve a fouryear term, pending Senate confirmation.

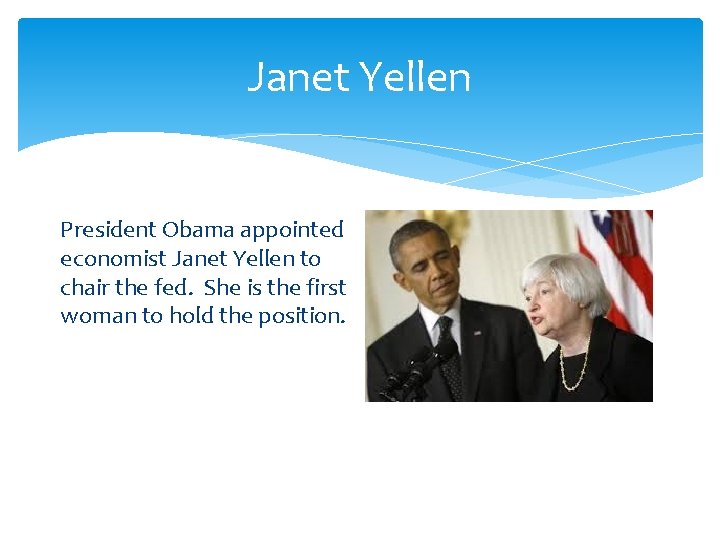

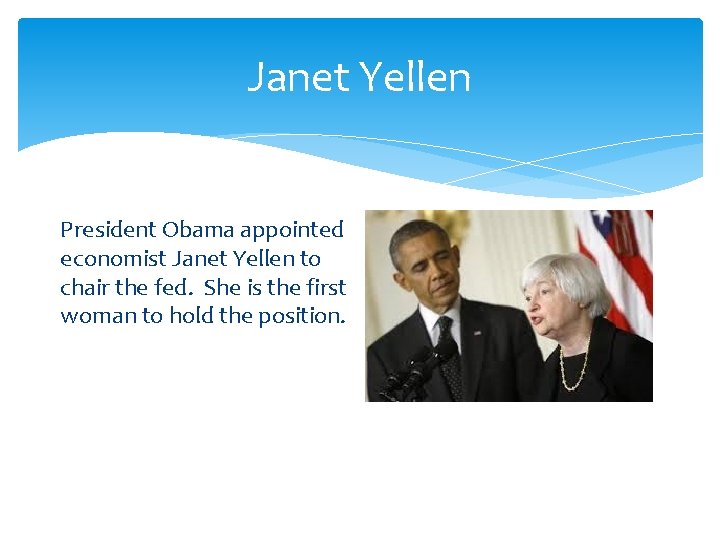

Janet Yellen President Obama appointed economist Janet Yellen to chair the fed. She is the first woman to hold the position.

Goals of the Fed Full Employment Price Stability

Fed and the Great Recession The Fed moved aggressively in 2008 -2009 to shore up the economy and stave off financial crisis. As economic activity slowed throughout 2008, the Fed lowered interest rates. By late 2008, the federal funds rate, which is the rate banks charge each other for loans, was effectively zero The Fed has kept interest rates low. percent. Republicans in Congress, however, would like to see higher rates because they are worried about inflation.

What You Have Learned What ground rules must Congress follow in adopting a budget? What is the difference between fiscal and monetary policy? How is fiscal policy made? How is monetary policy made? How did the Fed respond to the Great Recession?