Slide 38 1 Chapter 38 Departmental accounts Frank

- Slides: 13

Slide 38. 1 Chapter 38 Departmental accounts Frank Wood and Alan Sangster , Frank Wood’s Business Accounting 1 , 12 th Edition, © Pearson Education Limited 2012

Slide 38. 2 Learning objectives After you have studied this chapter, you should be able to: Ø Draw up departmental income statements on the gross profit basis Ø Draw up departmental income statements on the contribution basis Ø Calculate the contribution made by each section of a business Frank Wood and Alan Sangster , Frank Wood’s Business Accounting 1 , 12 th Edition, © Pearson Education Limited 2012

Slide 38. 3 Learning objectives (Continued) Ø Explain why departmental accounts can be more meaningful to management than a single income statement Ø Apportion expenses between departments on an appropriate basis Frank Wood and Alan Sangster , Frank Wood’s Business Accounting 1 , 12 th Edition, © Pearson Education Limited 2012

Slide 38. 4 Use of departmental accounts Ø It can be useful to know how individual sections of a business are doing. Ø For instance, if one aspect of a business is doing badly it could be skewing the result of all departments, giving an overall result that is favourable but that could be excellent. Ø Departmental accounts are prepared to show the position of each aspect of a business. Frank Wood and Alan Sangster , Frank Wood’s Business Accounting 1 , 12 th Edition, © Pearson Education Limited 2012

Slide 38. 5 Allocation of expenses Ø When individual income statements are to be calculated, it is necessary to allocate whole-business expenditure to the individual departments. Ø This is done using a method of apportionment so that the whole-business expenses can be allocated fairly to each department. Frank Wood and Alan Sangster , Frank Wood’s Business Accounting 1 , 12 th Edition, © Pearson Education Limited 2012

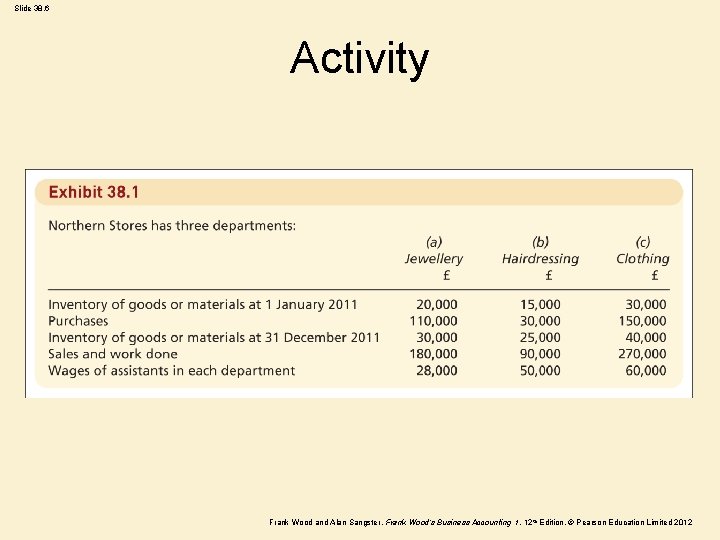

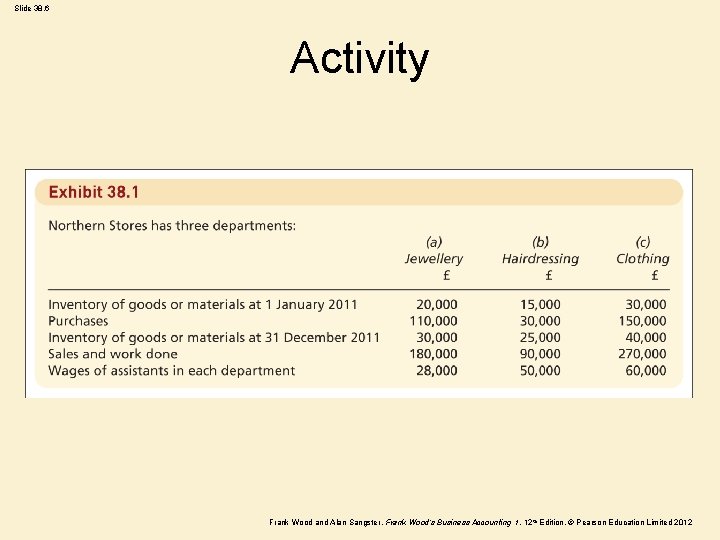

Slide 38. 6 Activity Frank Wood and Alan Sangster , Frank Wood’s Business Accounting 1 , 12 th Edition, © Pearson Education Limited 2012

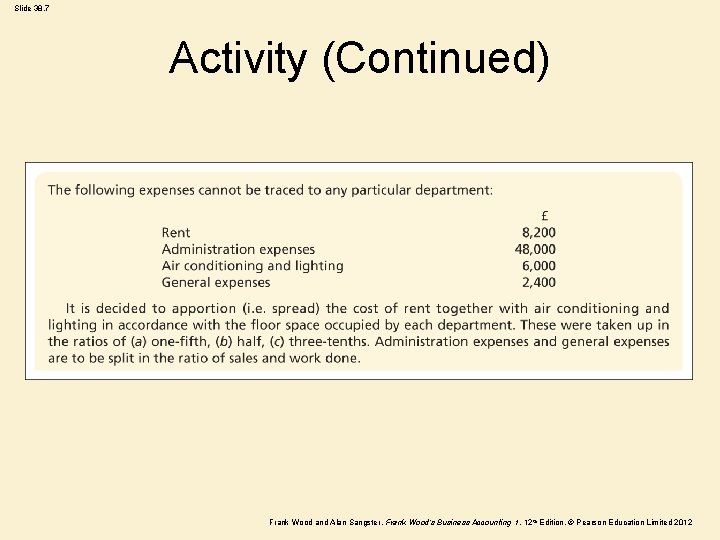

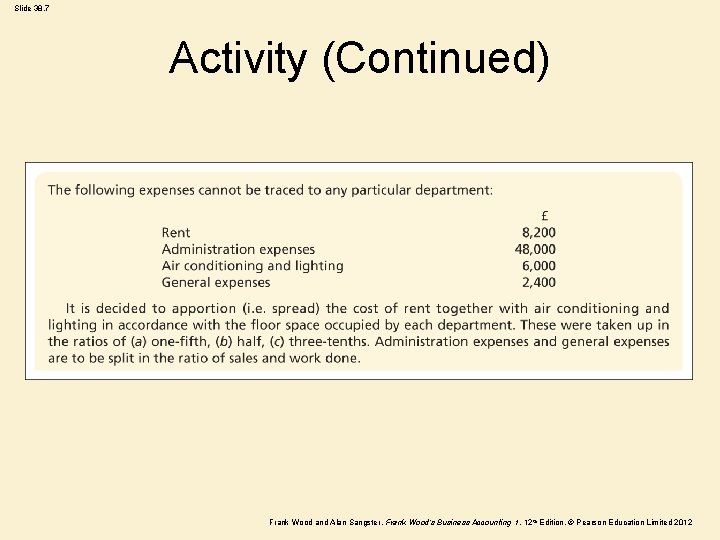

Slide 38. 7 Activity (Continued) Frank Wood and Alan Sangster , Frank Wood’s Business Accounting 1 , 12 th Edition, © Pearson Education Limited 2012

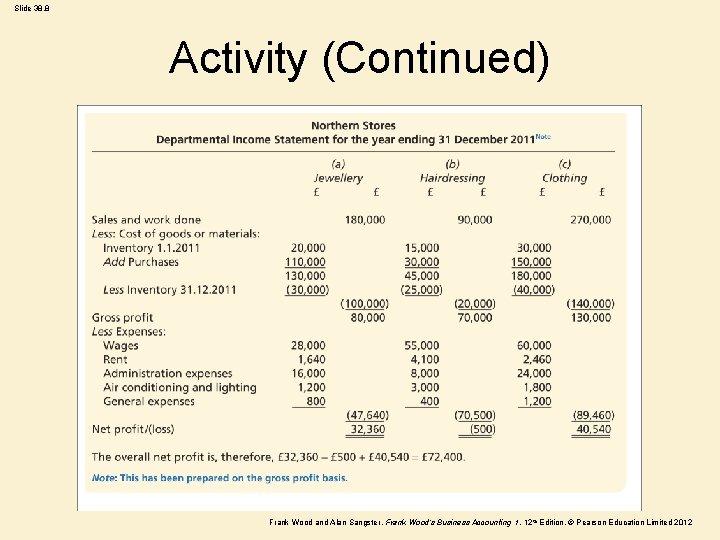

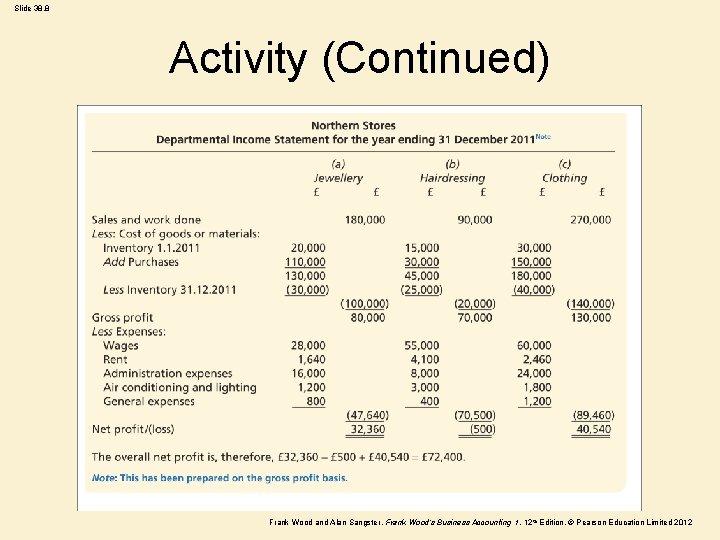

Slide 38. 8 Activity (Continued) Frank Wood and Alan Sangster , Frank Wood’s Business Accounting 1 , 12 th Edition, © Pearson Education Limited 2012

Slide 38. 9 Activity (Continued) Ø There can be an interpretation that if the hairdressing department were to close, the £ 500 loss would be saved. Ø However, this may not be the case. While the direct staffing costs of the hairdressing department might be saved, the indirect costs may not fall, which would affect the other departments. Ø Therefore, there is a better way of allocating expenses, and it uses a different format. Frank Wood and Alan Sangster , Frank Wood’s Business Accounting 1 , 12 th Edition, © Pearson Education Limited 2012

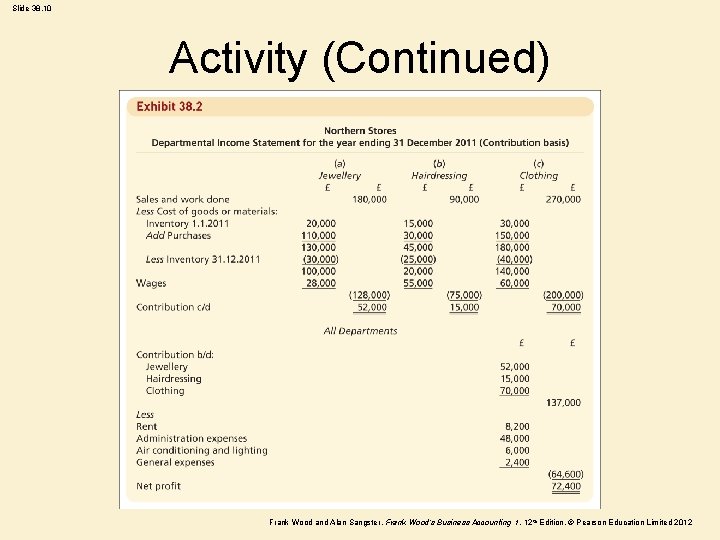

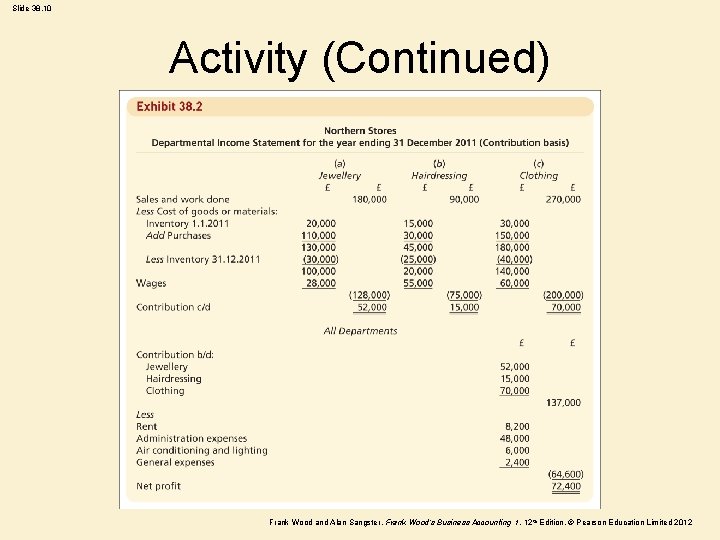

Slide 38. 10 Activity (Continued) Frank Wood and Alan Sangster , Frank Wood’s Business Accounting 1 , 12 th Edition, © Pearson Education Limited 2012

Slide 38. 11 Activity (Continued) Ø This new format calculates the same net profit as before. Ø No department is seen to be making a loss. Ø The efficiency of each department can be judged by the level of contribution. Ø Level of contribution is most easily judged using the contribution to revenue ratio. Frank Wood and Alan Sangster , Frank Wood’s Business Accounting 1 , 12 th Edition, © Pearson Education Limited 2012

Slide 38. 12 Learning outcomes You should have now learnt: 1. How to prepare departmental income statements on the gross profit basis 2. How to prepare departmental income statements on the contribution basis 3. That it is desirable for the contribution of each section of a business to be calculated to aid management decisions and that the contribution-based income statement is more appropriate for departmental closure decisions than the gross-profit-based statement Frank Wood and Alan Sangster , Frank Wood’s Business Accounting 1 , 12 th Edition, © Pearson Education Limited 2012

Slide 38. 13 Learning outcomes (Continued) 4. That costs should be divided between those which can logically be allocated to departments and those which cannot 5. That a negative contribution is only one guide as to whether a section of a business should be closed. There may be other factors which would go against such a closure, and others that would suggest that even departments with positive contributions should be closed Frank Wood and Alan Sangster , Frank Wood’s Business Accounting 1 , 12 th Edition, © Pearson Education Limited 2012

Preparation of departmental accounts

Preparation of departmental accounts Departmental accounts format

Departmental accounts format How to heel toe dance

How to heel toe dance Frank william abagnale jr wife

Frank william abagnale jr wife How to factor binomials

How to factor binomials Departmental inquiry report format

Departmental inquiry report format Departmental inquiry report format

Departmental inquiry report format Departmental management

Departmental management Daily order sheet in departmental enquiry

Daily order sheet in departmental enquiry Nau student and departmental account services

Nau student and departmental account services Interdepartmental transaction

Interdepartmental transaction Chapter 4 checking accounts worksheet answers

Chapter 4 checking accounts worksheet answers Chapter 3 adjusting accounts for financial statements

Chapter 3 adjusting accounts for financial statements How to record accrued expense

How to record accrued expense