Same Day ACH Corporate Considerations and Opportunities CRISTINA

- Slides: 13

Same Day ACH Corporate Considerations and Opportunities CRISTINA HELLEMS, AAP VP/SENIOR PRODUCT MANAGER MUFG UNION BANK TRANSACTION BANKING OCTOBER 20, 2016 A member of MUFG, a global financial group

Current US Faster Payments Initiatives Payment Organizations Working on Moving Electronic Payments Faster in the US : Most significant NACHA rule change in over 40 years Evolution of electronic payments Improves liquidity Reduces reliance on checks Provides flexibility for handling unforeseen business circumstances Strategies for Improving the U. S. Payment System Real Time Payments New payment rails Available 24/7 Credit push Final/No Returns Same-Day ACH September 9, 2016

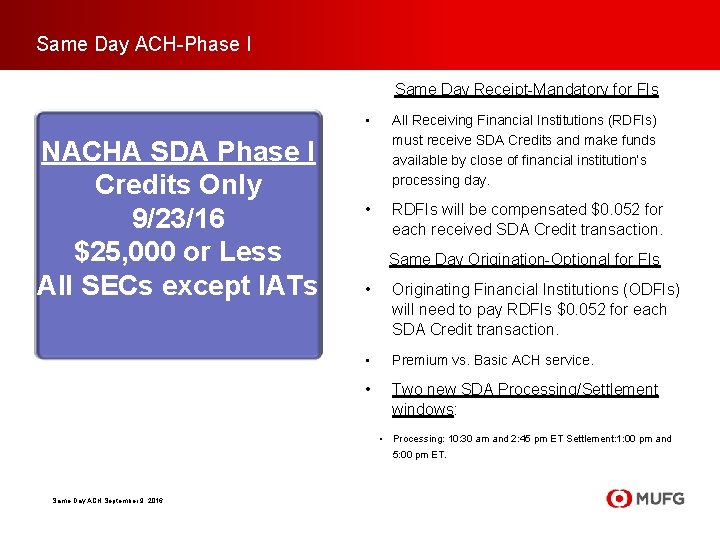

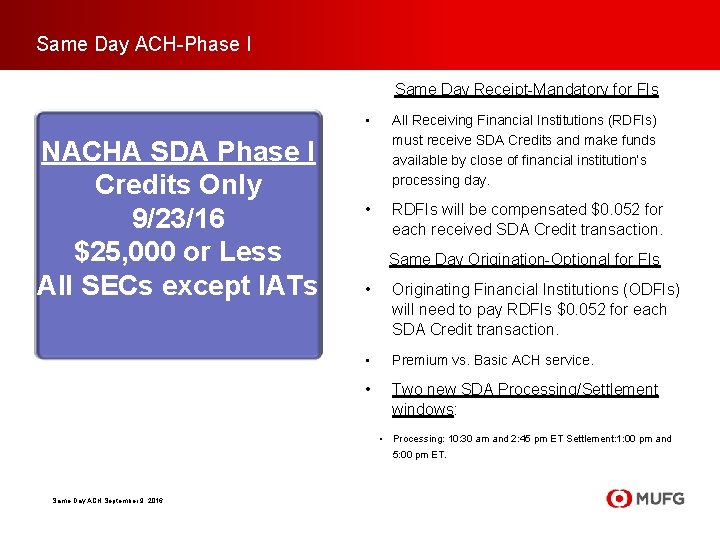

Same Day ACH-Phase I Same Day Receipt-Mandatory for FIs NACHA SDA Phase I Credits Only 9/23/16 $25, 000 or Less All SECs except IATs • All Receiving Financial Institutions (RDFIs) must receive SDA Credits and make funds available by close of financial institution’s processing day. • RDFIs will be compensated $0. 052 for each received SDA Credit transaction. Same Day Origination-Optional for FIs • Originating Financial Institutions (ODFIs) will need to pay RDFIs $0. 052 for each SDA Credit transaction. • Premium vs. Basic ACH service. • Two new SDA Processing/Settlement windows: • Processing: 10: 30 am and 2: 45 pm ET Settlement: 1: 00 pm and 5: 00 pm ET. Same-Day ACH September 9, 2016

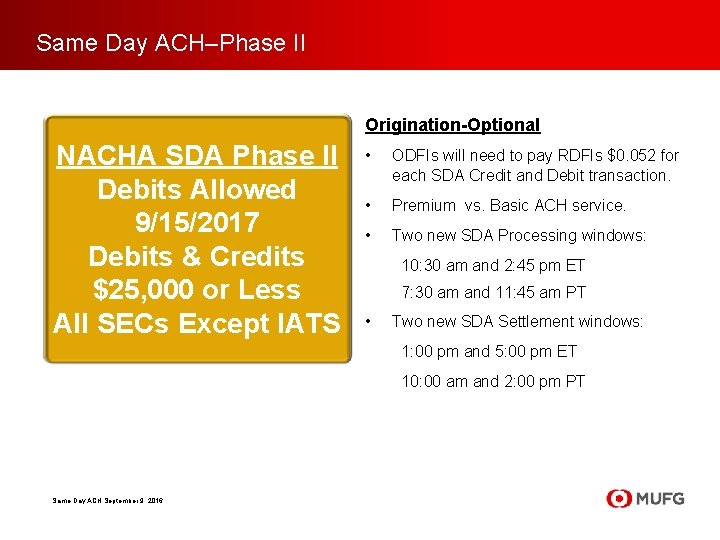

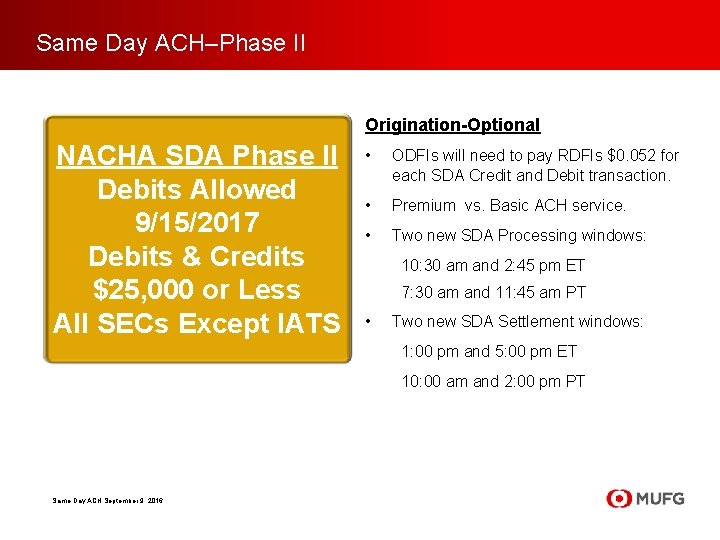

Same Day ACH–Phase II Origination-Optional NACHA SDA Phase II Debits Allowed 9/15/2017 Debits & Credits $25, 000 or Less All SECs Except IATS • ODFIs will need to pay RDFIs $0. 052 for each SDA Credit and Debit transaction. • Premium vs. Basic ACH service. • Two new SDA Processing windows: 10: 30 am and 2: 45 pm ET 7: 30 am and 11: 45 am PT • Two new SDA Settlement windows: 1: 00 pm and 5: 00 pm ET 10: 00 am and 2: 00 pm PT Same-Day ACH September 9, 2016

Same Day ACH-Phase III NACHA SDA Phase III 3/16/2018 Same-Day ACH September 9, 2016 • Must make funds available by 5: 00 pm local time.

Same Day ACH Use Cases Common Use Cases of Same Day ACH Same-Day ACH September 9, 2016

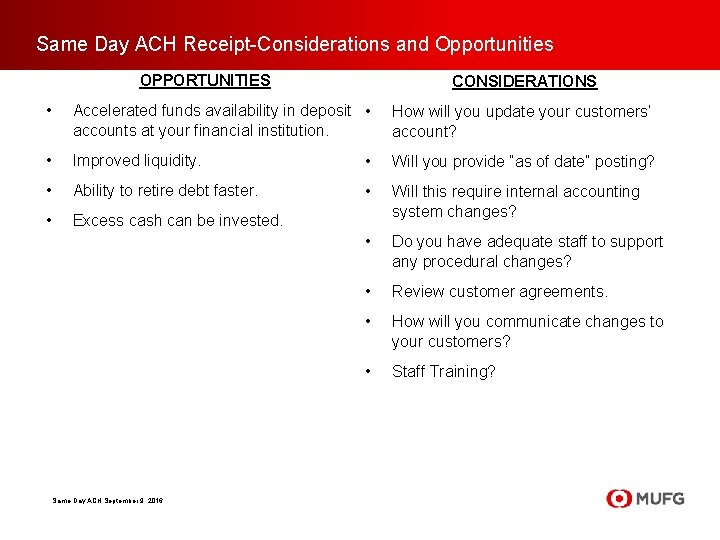

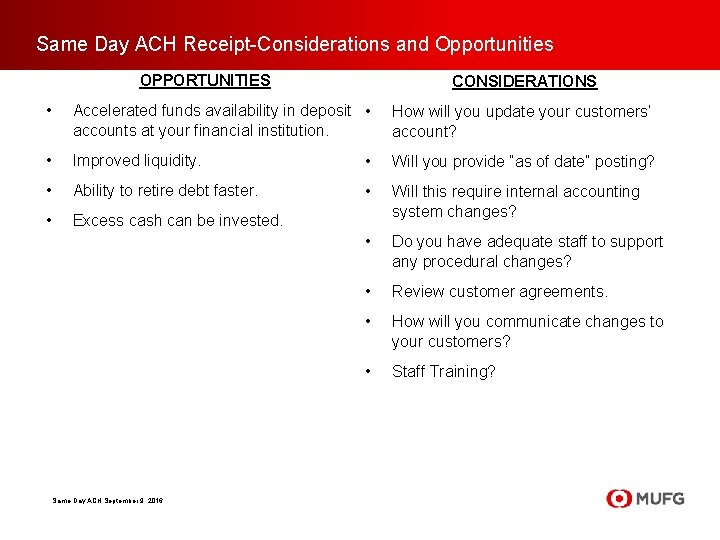

Same Day ACH Receipt-Considerations and Opportunities OPPORTUNITIES CONSIDERATIONS • Accelerated funds availability in deposit • accounts at your financial institution. How will you update your customers’ account? • Improved liquidity. • Will you provide “as of date” posting? • Ability to retire debt faster. • • Excess cash can be invested. Will this require internal accounting system changes? • Do you have adequate staff to support any procedural changes? • Review customer agreements. • How will you communicate changes to your customers? • Staff Training? Same-Day ACH September 9, 2016

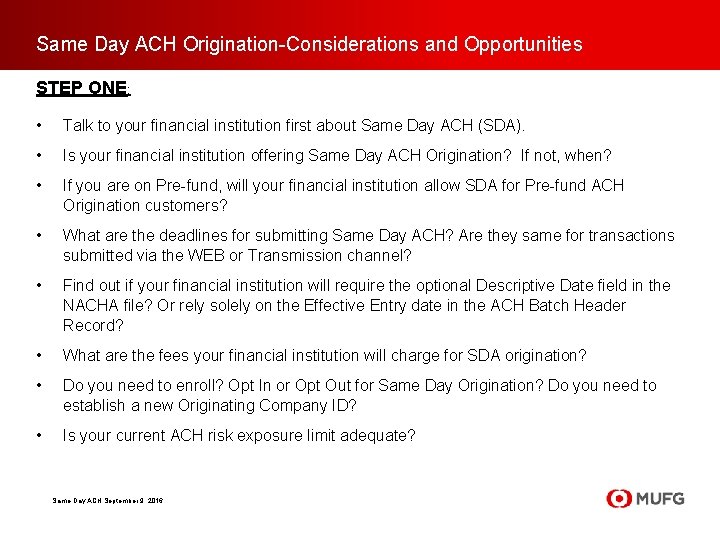

Same Day ACH Origination-Considerations and Opportunities STEP ONE: • Talk to your financial institution first about Same Day ACH (SDA). • Is your financial institution offering Same Day ACH Origination? If not, when? • If you are on Pre-fund, will your financial institution allow SDA for Pre-fund ACH Origination customers? • What are the deadlines for submitting Same Day ACH? Are they same for transactions submitted via the WEB or Transmission channel? • Find out if your financial institution will require the optional Descriptive Date field in the NACHA file? Or rely solely on the Effective Entry date in the ACH Batch Header Record? • What are the fees your financial institution will charge for SDA origination? • Do you need to enroll? Opt In or Opt Out for Same Day Origination? Do you need to establish a new Originating Company ID? • Is your current ACH risk exposure limit adequate? Same-Day ACH September 9, 2016

Same Day ACH Origination-Considerations and Opportunities-continued CONSIDERATIONS • • What changes will you need to make to your ERP system? What is the timeline, cost • , and resources needed to make changes to • your systems to support SDA? If your system uses the File Creation date as the Effective Entry date, financial institutions’ back end ACH systems will no longer edit the Effective Entry date of the file. If a file is received with the current date and is within the SDA processing window , the financial institution will process as an SDA file resulting in SDA settlement and SDA fees. Did you really intend for the file to be sent SDA? • Will SDA require internal accounting system changes? Will you provide “as of date” posting? Do you have adequate staff to support any procedural changes? • Review your agreements or customer communication? • Will you pass SDA costs to your customers? • Do you need to update internal procedures? • • ACH processing and funding units need to be aware of SDA transactions as settlement will impact liquidity. • Engage your IT, Accounting, Accounts Payable, Account Receivable, and HR departments Same-Day ACH September 9, 2016 How will you update your customers’ accounts? • What kinds of control do you currently have in place? Will you need additional controls? Staff Training?

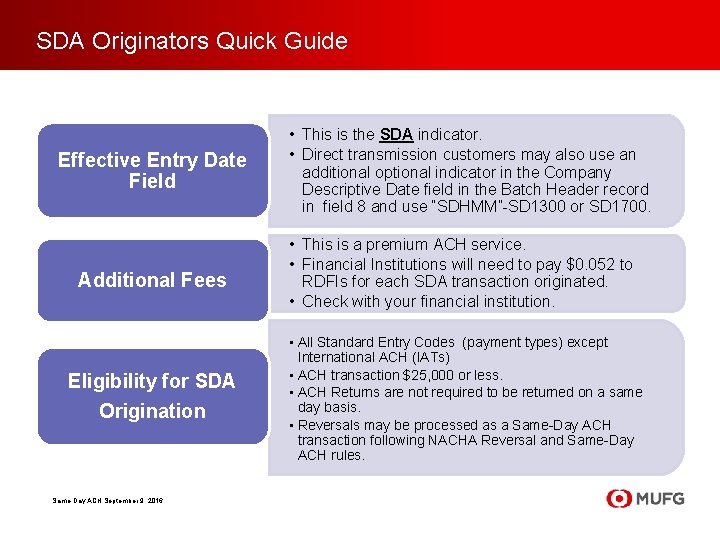

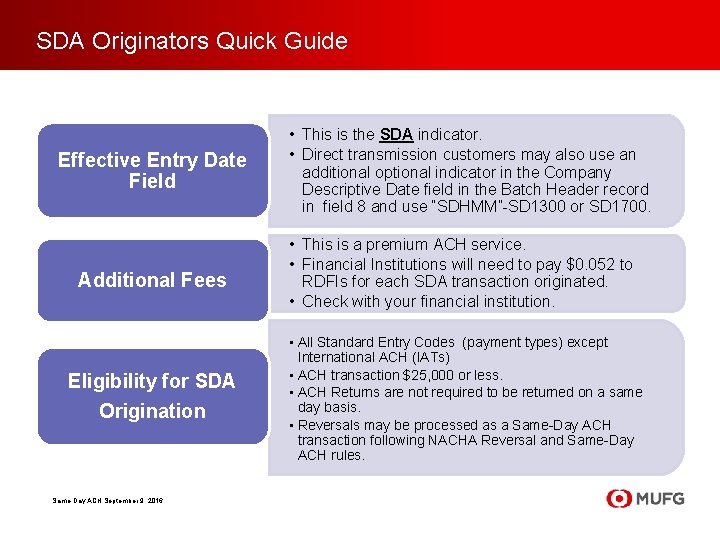

SDA Originators Quick Guide Effective Entry Date Field Additional Fees Eligibility for SDA Origination Same-Day ACH September 9, 2016 • This is the SDA indicator. • Direct transmission customers may also use an additional optional indicator in the Company Descriptive Date field in the Batch Header record in field 8 and use “SDHMM”-SD 1300 or SD 1700. • This is a premium ACH service. • Financial Institutions will need to pay $0. 052 to RDFIs for each SDA transaction originated. • Check with your financial institution. • All Standard Entry Codes (payment types) except International ACH (IATs) • ACH transaction $25, 000 or less. • ACH Returns are not required to be returned on a same day basis. • Reversals may be processed as a Same-Day ACH transaction following NACHA Reversal and Same-Day ACH rules.

Use of Fraud Deterrent Products Talk your financial institution about Fraud Deterrent Products • ACH industry expects online ACH fraud to see an increase with Same Day ACH, particularly in Credit Origination. • Best Practices/Guiding Principles • Implement Dual Payments and Dual User Administration. • For ACH Receipt debit protection, use ACH Blocks or ACH Positive Pay. • Look out for Business Email Compromise schemes. • Conduct ongoing training staff on online security. Same-Day ACH September 9, 2016

Additional Same Day ACH Resources NACHA https: //resourcecenter. nacha. org/? q=taxonomy/term/8 Wes. Pay http: //www. wespay. org/wpa/wespaypublic Federal Reserve https: //www. frbservices. org/resourcecenter/sameday_ach/ The Clearing House (EPN) https: //www. theclearinghouse. org/payments/real-time-payments Same-Day ACH September 9, 2016

Questions Same-Day ACH September 9, 2016

Day 1 day 2 day 3 day 4

Day 1 day 2 day 3 day 4 Day 1 day 2 day 817

Day 1 day 2 day 817 Goal of corporate finance

Goal of corporate finance Same place same time

Same place same time Same place same passion

Same place same passion Similar figures have the same but not necessarily the same

Similar figures have the same but not necessarily the same Similarity statement

Similarity statement Trans name

Trans name Nach theory

Nach theory Writing strategies and ethical considerations

Writing strategies and ethical considerations Ethical issues in experimental research

Ethical issues in experimental research Pricing considerations and approaches

Pricing considerations and approaches Guate ach

Guate ach Myathesia

Myathesia