Rural Demand In India Satisfying Enormous Growth Potential

- Slides: 22

Rural Demand In India Satisfying Enormous Growth Potential 7 th to 9 th October-2009, Rio de Janerio, Brazil Presentation by: Apurva Chandra, Joint Secretary(Marketing) Ministry of Petroleum and Natural Gas, Government of India

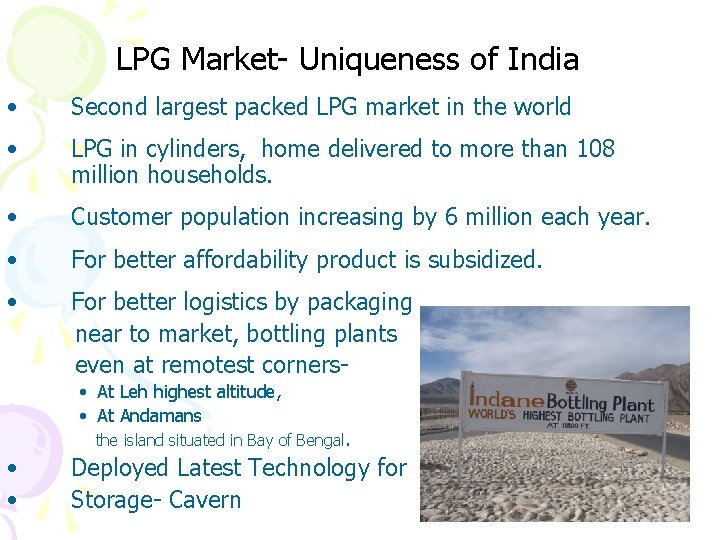

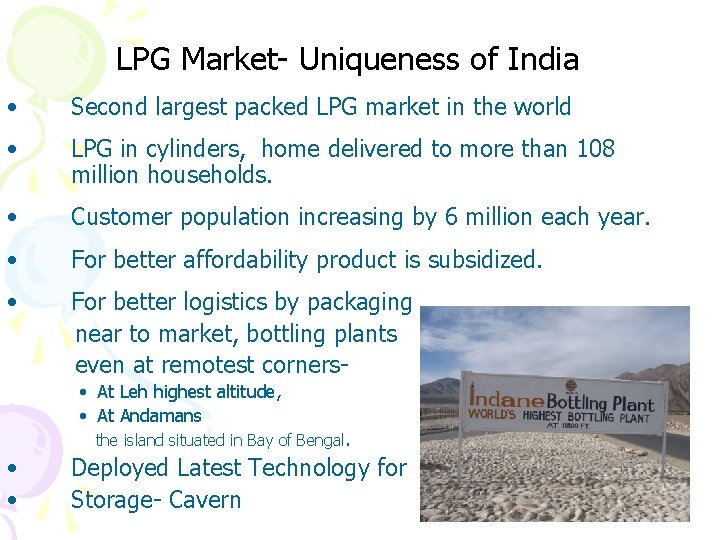

LPG Market- Uniqueness of India • Second largest packed LPG market in the world • LPG in cylinders, home delivered to more than 108 million households. • Customer population increasing by 6 million each year. • For better affordability product is subsidized. • For better logistics by packaging near to market, bottling plants even at remotest corners • At Leh highest altitude, • At Andamans the island situated in Bay of Bengal. • • Deployed Latest Technology for Storage- Cavern

LPG- History & Background • LPG Marketing Commenced in India in 1955 Customer growth rate(in millions) 1985 -2009 – Started by Burmah Shell in Mumbai – Public Sector Oil Company , Indian Oil Commenced Operation of LPG Marketing in 1965 at Kolkatta and Patna • Product availability improved from 1998 – Customer strength grew from 20 M to 100 M in a decade – Sales jumped from 1241 TMT in 1985 to 11400 TMT in 2008 – Currently catering to more than 50% of Indian population. • Growth poised more towards rural markets Sales in TMT 1985 -2009

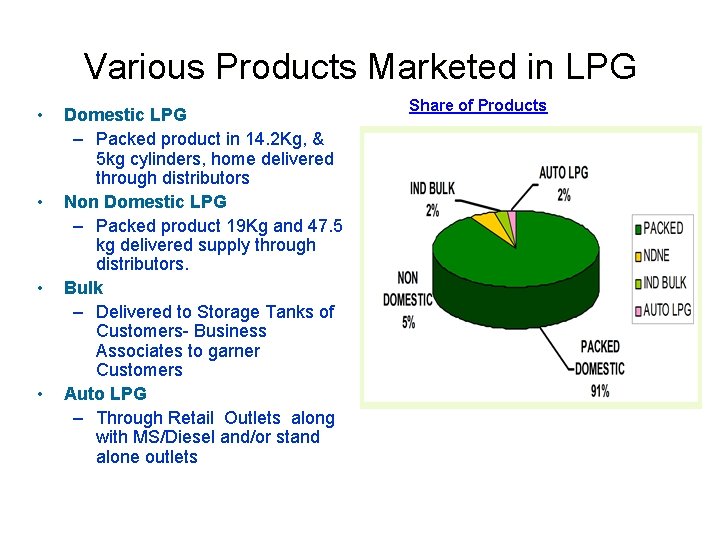

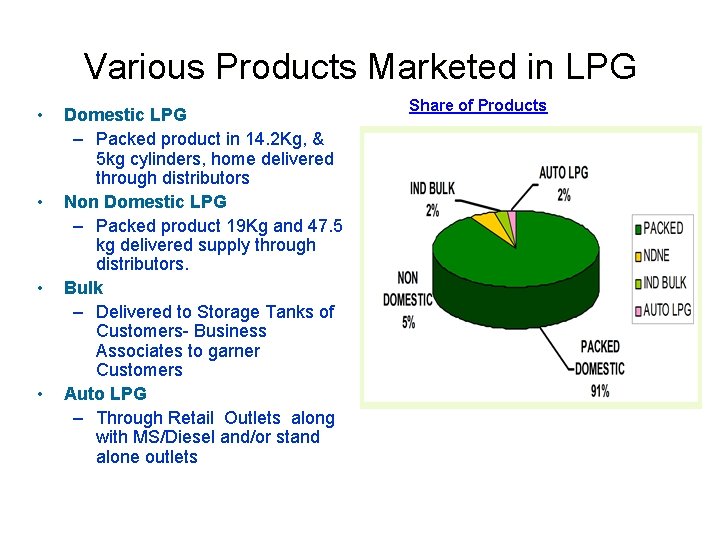

Various Products Marketed in LPG • • Domestic LPG – Packed product in 14. 2 Kg, & 5 kg cylinders, home delivered through distributors Non Domestic LPG – Packed product 19 Kg and 47. 5 kg delivered supply through distributors. Bulk – Delivered to Storage Tanks of Customers- Business Associates to garner Customers Auto LPG – Through Retail Outlets along with MS/Diesel and/or stand alone outlets Share of Products

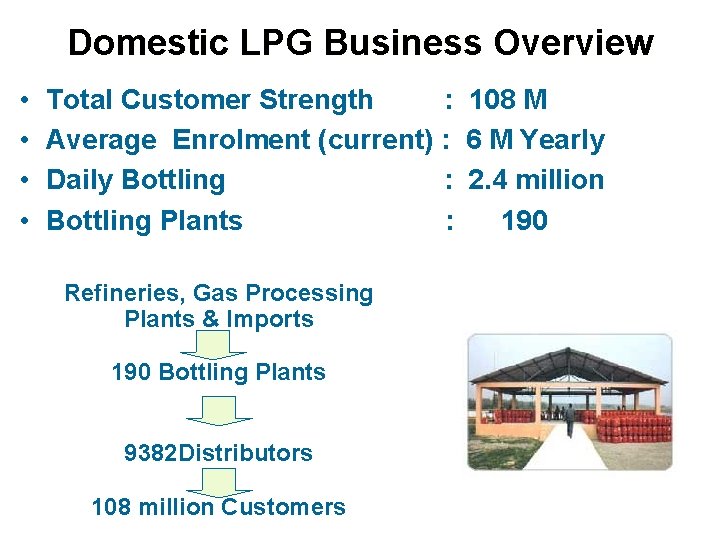

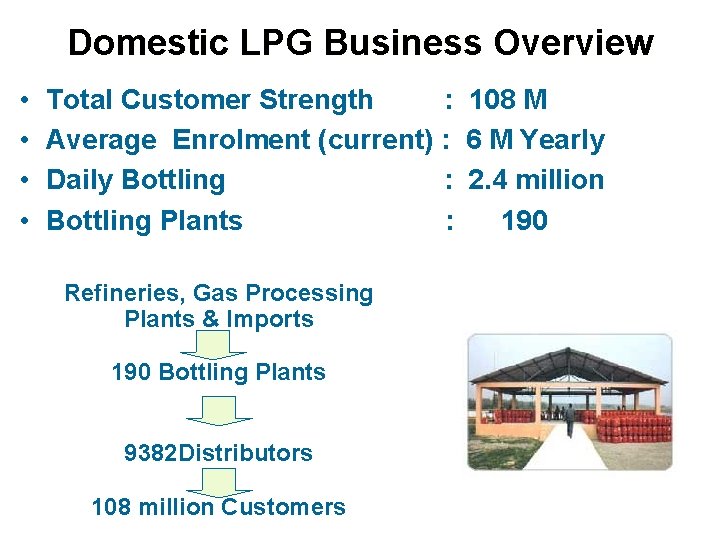

Domestic LPG Business Overview • • Total Customer Strength : 108 M Average Enrolment (current) : 6 M Yearly Daily Bottling : 2. 4 million Bottling Plants : 190 Refineries, Gas Processing Plants & Imports 190 Bottling Plants 9382 Distributors 108 million Customers

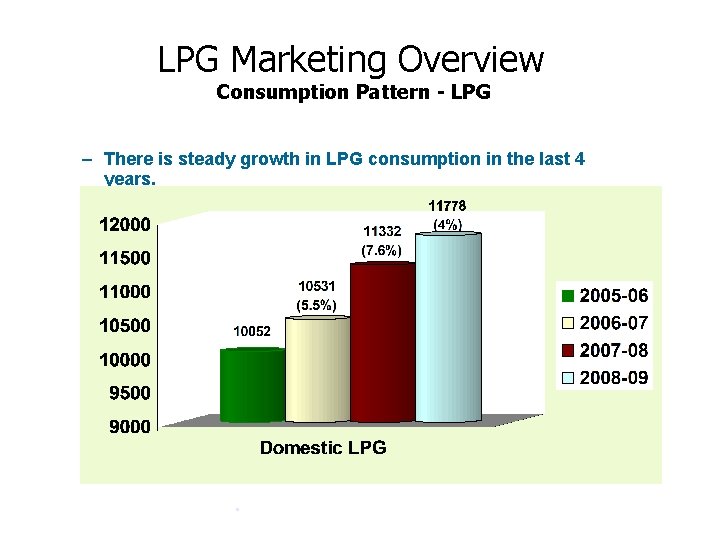

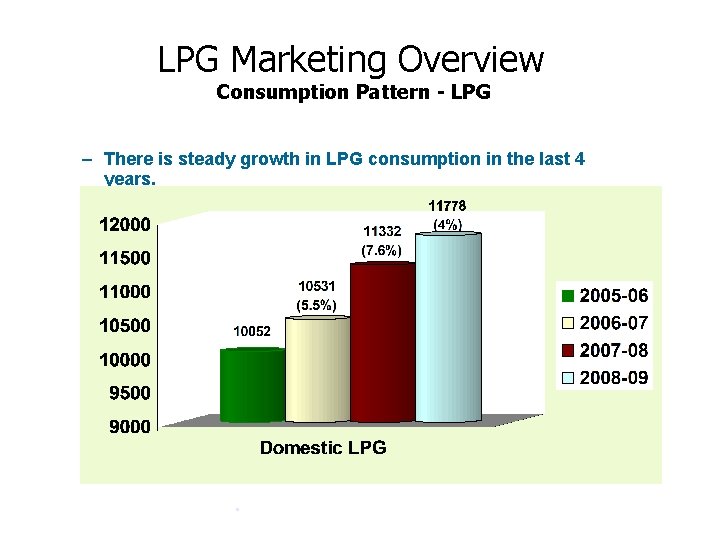

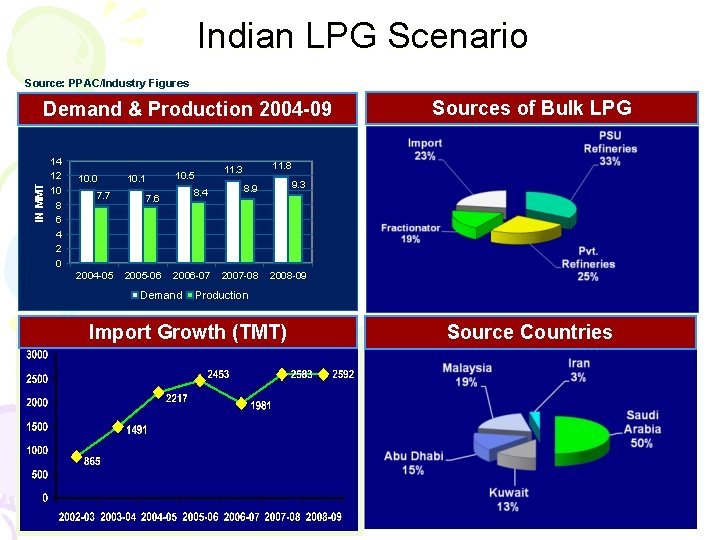

LPG Marketing Overview Consumption Pattern - LPG – There is steady growth in LPG consumption in the last 4 years. (Figs. In TMT) .

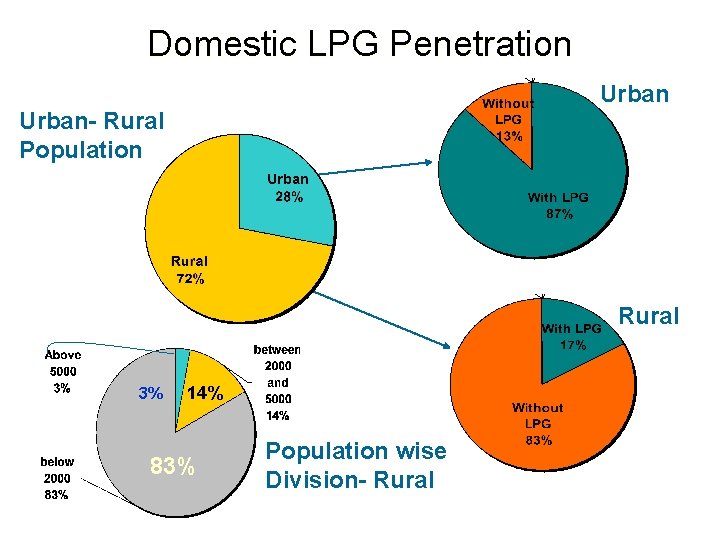

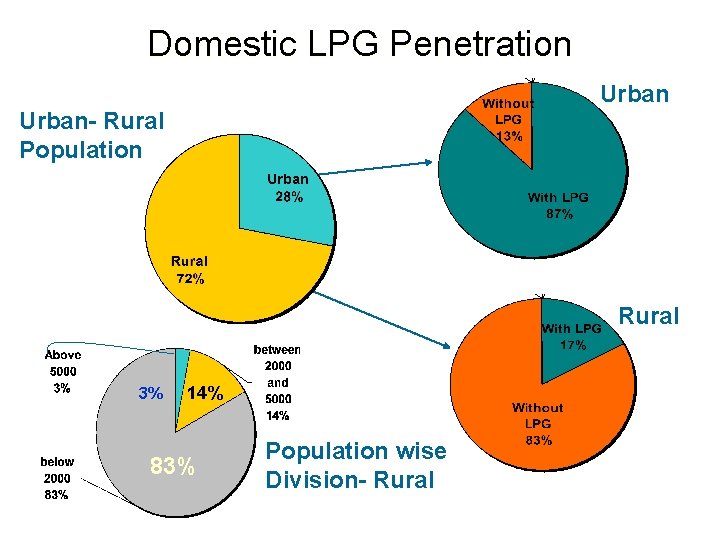

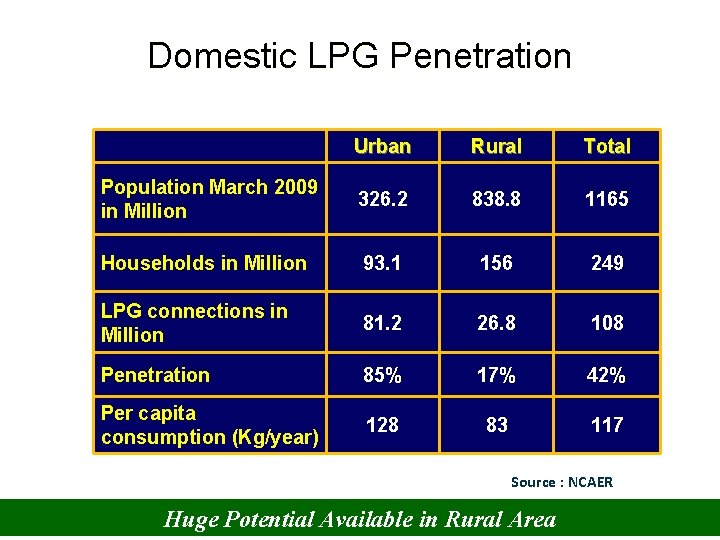

Domestic LPG Penetration Urban- Rural Population Rural 3% 14% 83% Population wise Division- Rural

LPG Penetration- Issues in Rural Areas v Most of Rural Households natural biomass or kerosene Biomass based fuels lead to health hazards and pollution v Use of Kerosene by the households at a subsidised rate. v Per Capita Income of rural areas- affordability v Viability of distribution cost as rural households are scattered. Potential Available in Rural Area- more than 50 million

Vision 2015 - Govt. ’s Thrust on LPG in Rural Areas • To enroll total of 55 m new LPG connections by 2015 • 8. 5 million every year • Mostly in Rural areas • Through existing distributors and Small Format Distributors • Conversion of Kerosene customers

Strategies for Rural Market- Penetration Models to improve reach • Through existing Distribution network • By Expanding Existing model of Distributor Network • Low Cost , Self Employment based LPG distributors as a viable model • Community Kitchen Strategies to improve affordability • Continue to give Favorable relative price • Access Subsidization • For economically Backward • By State Governments • Oil Marketing Companies • Corporate Social Responsibility • Conversion of Kerosene Model based on Viability

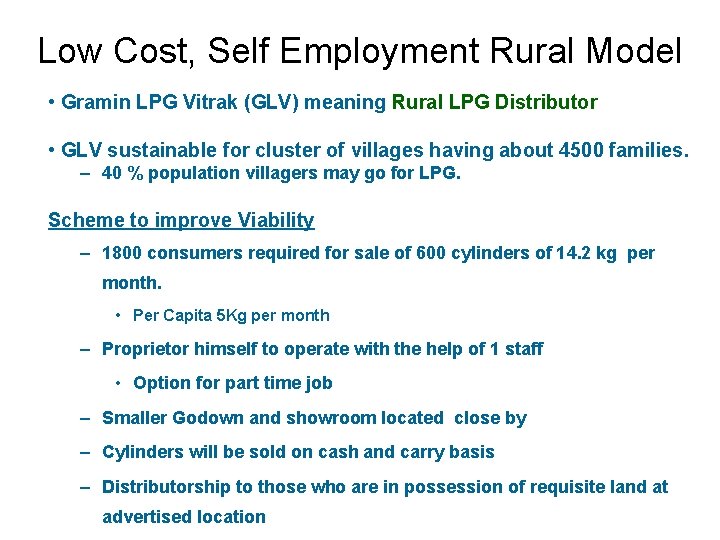

Low Cost, Self Employment Rural Model • Gramin LPG Vitrak (GLV) meaning Rural LPG Distributor • GLV sustainable for cluster of villages having about 4500 families. – 40 % population villagers may go for LPG. Scheme to improve Viability – 1800 consumers required for sale of 600 cylinders of 14. 2 kg per month. • Per Capita 5 Kg per month – Proprietor himself to operate with the help of 1 staff • Option for part time job – Smaller Godown and showroom located close by – Cylinders will be sold on cash and carry basis – Distributorship to those who are in possession of requisite land at advertised location

Community Kitchen • Scheme introduced in 2003 -04 for Community Kitchens in Hospitals, Mid day meal scheme etc. • Model extended to areas below viability of distributorships and for villagers with low purchasing power. • Kitchen to be set up by nearest distributor. • Utensils and stoves through Marketing Companies/State Government. • Villagers to use facility on user fee basis. • Care taker by Village officials/Distributor.

Supply Demand Balance Historical • LPG Demand Projections • Expected – CAGR 8% • Asia Pacific – CAGR 6% • LPG Supply Outlook • Existing Refineries being expanded and 3 new Refineries being commissioned. • However, dependence on Imports to continue • Two import facilities Kochi & Chennai 1400 TMTPA Demand Indigenous Production Import Projection Demand Indigenous Production Import

LPG Infrastructure Jalandhar Panipat Bhatinda Delhi Loni Digboi Ajmer Kanpur Guwahati Barauni Kolkatta Kandla Existing Pipelines Proposed Pipelines Jamnagar Haldia Hazira Mumbai High Mumbai Secunderabad Paradip Vizag Vijayawada Mangalore Kochi Chennai Facility Existing Plan/Under Construction Refinery 19 3 Gas Plants 10 - Import 4(3500 TMT) 2(1400 TMT) Bottling Plants 189 13 2182 KM 1000 KM Pipelines

LPG Infrastructure / Logistics Modes of Transportation : Pipeline contribution upto 35% by 2015

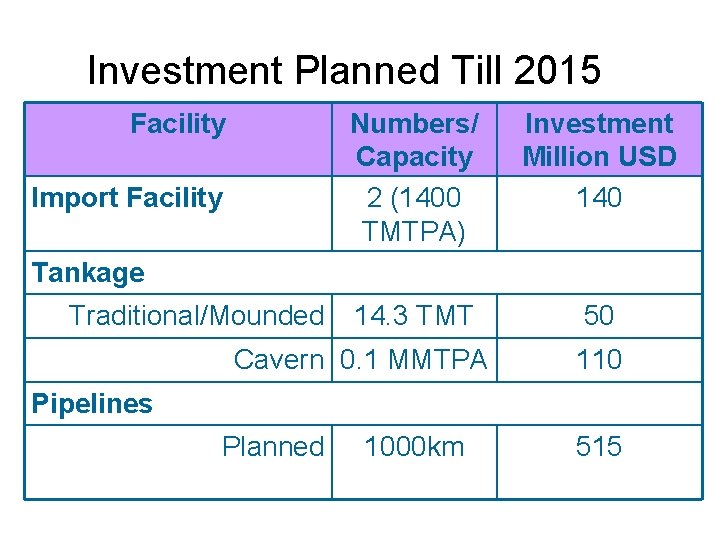

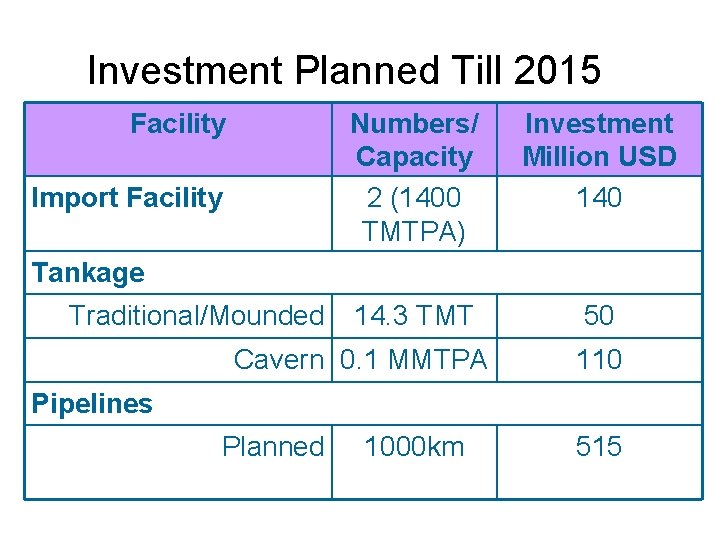

Investment Planned Till 2015 Facility Import Facility Numbers/ Capacity 2 (1400 TMTPA) Investment Million USD 140 14. 3 TMT 50 Tankage Traditional/Mounded Cavern 0. 1 MMTPA 110 Pipelines Planned 1000 km 515

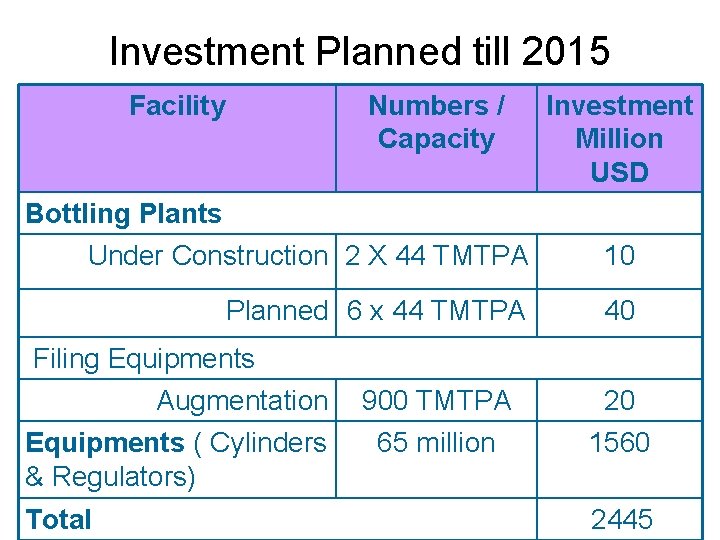

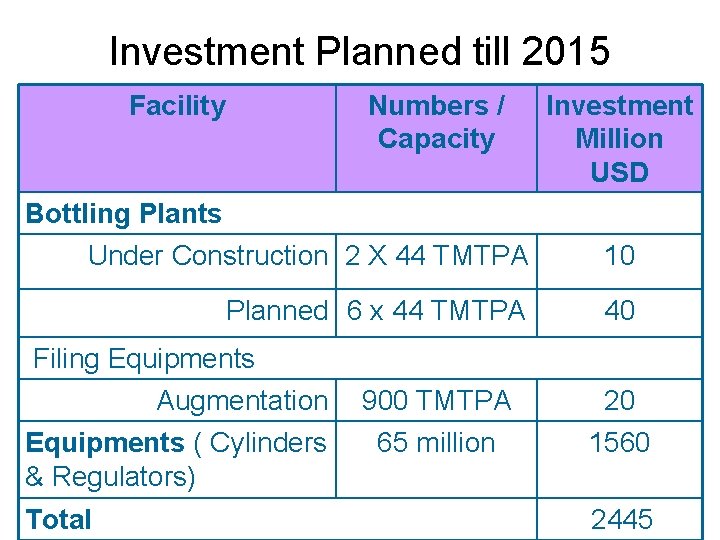

Investment Planned till 2015 Facility Numbers / Capacity Investment Million USD Bottling Plants Under Construction 2 X 44 TMTPA 10 Planned 6 x 44 TMTPA 40 Filing Equipments Augmentation Equipments ( Cylinders & Regulators) Total 900 TMTPA 20 65 million 1560 2445

Conclusion • In India, LPG is the most sought after fuel for domestic use. • Government of India has developed a Vision 2015 document for increasing use of LPG in India. • The Vision 2015 document is focused to improve customer Service and availability of LPG. • Government of India is committed to increase the penetration of LPG in Rural India by providing LPG at affordable price. • As a commitment to Environment, Government of India is also committed to replace kerosene by LPG at the earliest.

Thank You

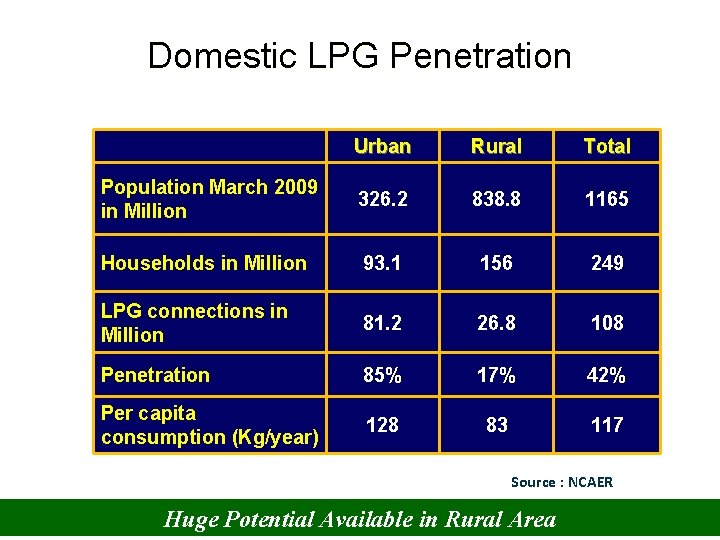

Domestic LPG Penetration Urban Rural Total Population March 2009 in Million 326. 2 838. 8 1165 Households in Million 93. 1 156 249 LPG connections in Million 81. 2 26. 8 108 Penetration 85% 17% 42% Per capita consumption (Kg/year) 128 83 117 Source : NCAER Huge Potential Available in Rural Area

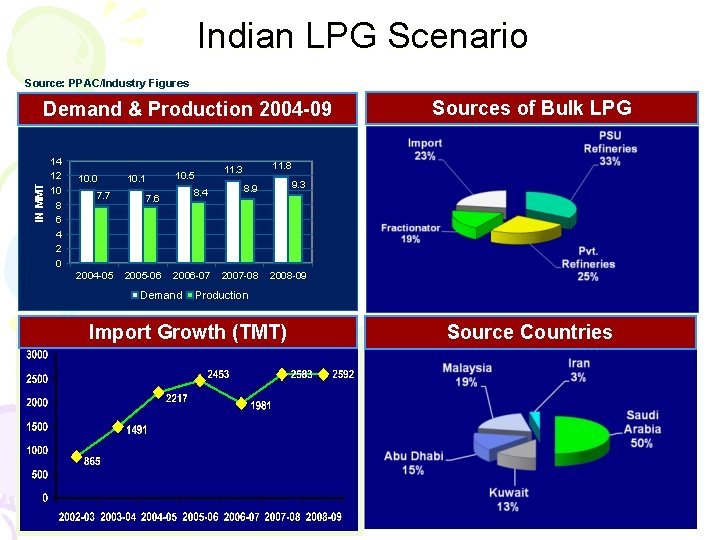

Indian LPG Scenario Source: PPAC/Industry Figures IN MMT Demand & Production 2004 -09 14 12 10 8 6 4 2 0 10. 0 7. 7 7. 6 2004 -05 2005 -06 11. 8 11. 3 10. 5 10. 1 8. 4 8. 9 9. 3 2006 -07 2007 -08 2008 -09 Demand Sources of Bulk LPG Production Import Growth (TMT) Source Countries

Concept of rural banking

Concept of rural banking Osmotic potential vs water potential

Osmotic potential vs water potential Negative water potential

Negative water potential Water potential

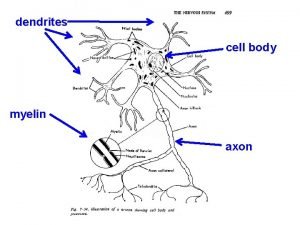

Water potential Neuronal pool

Neuronal pool Types of graded potentials

Types of graded potentials Characteristics of graded potential

Characteristics of graded potential Difference between action and graded potential

Difference between action and graded potential Saltatory conduction

Saltatory conduction Water potential

Water potential Action potential resting potential

Action potential resting potential End-plate potential vs action potential

End-plate potential vs action potential Intubating dose succinylcholine

Intubating dose succinylcholine Axon hillock

Axon hillock Action potential resting potential

Action potential resting potential Market potential and forecasting

Market potential and forecasting Equipotential lines

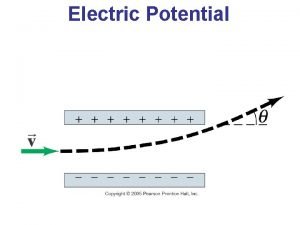

Equipotential lines Unit of potential

Unit of potential Electric potential

Electric potential Potential due to electric dipole

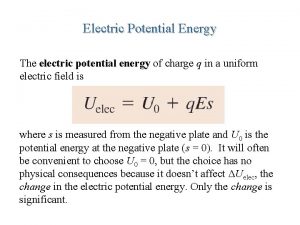

Potential due to electric dipole Electric potential energy definition

Electric potential energy definition Joules to newtons

Joules to newtons What is electric potential

What is electric potential