Recent Payment Settlement System Developments in Sri Lanka

- Slides: 10

Recent Payment & Settlement System Developments in Sri Lanka 13 th SAARC Payments Council Meeting Thimpu, Bhutan July, 2013

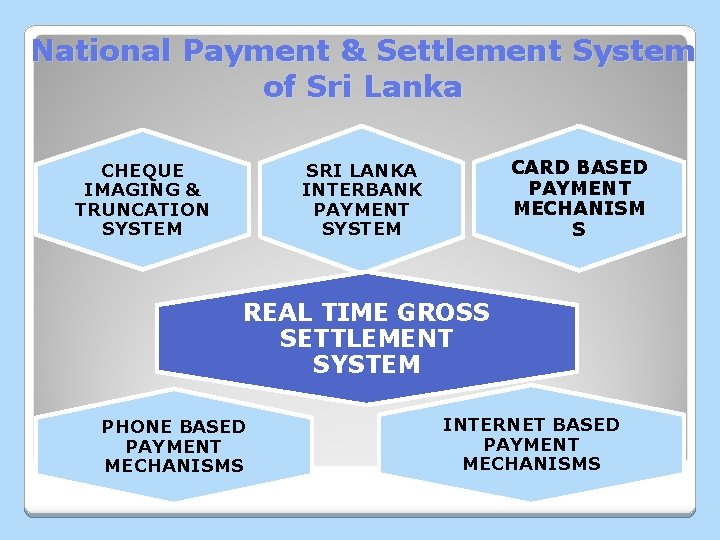

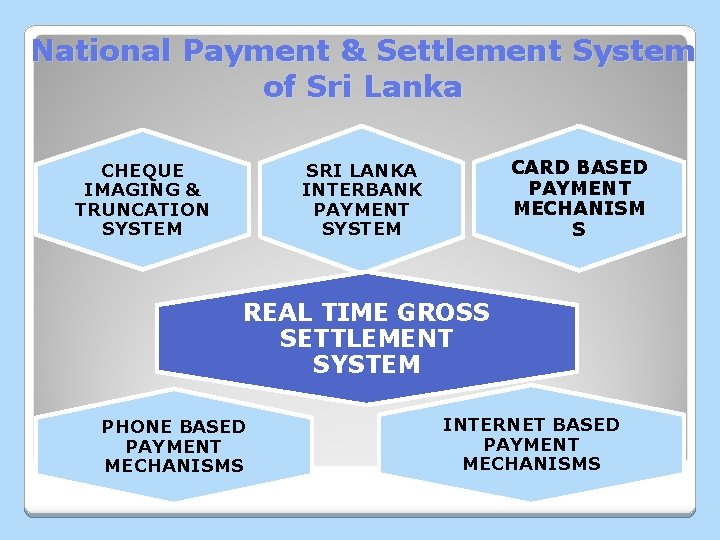

National Payment & Settlement System of Sri Lanka CHEQUE IMAGING & TRUNCATION SYSTEM CARD BASED PAYMENT MECHANISM S SRI LANKA INTERBANK PAYMENT SYSTEM REAL TIME GROSS SETTLEMENT SYSTEM PHONE BASED PAYMENT MECHANISMS INTERNET BASED PAYMENT MECHANISMS

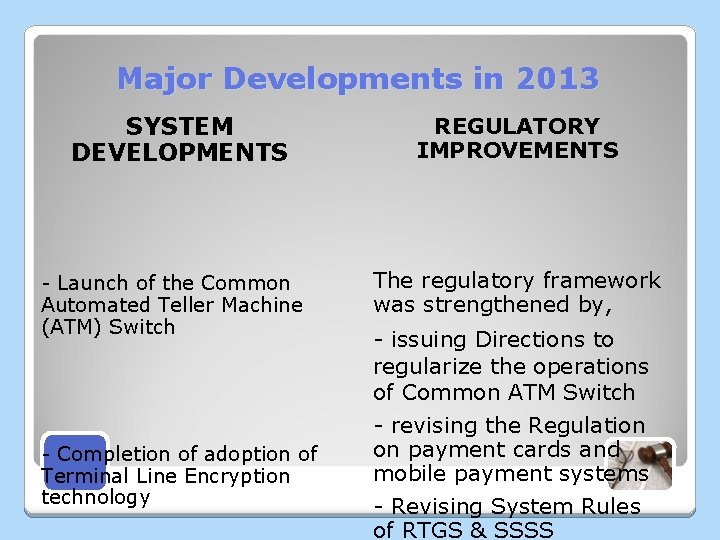

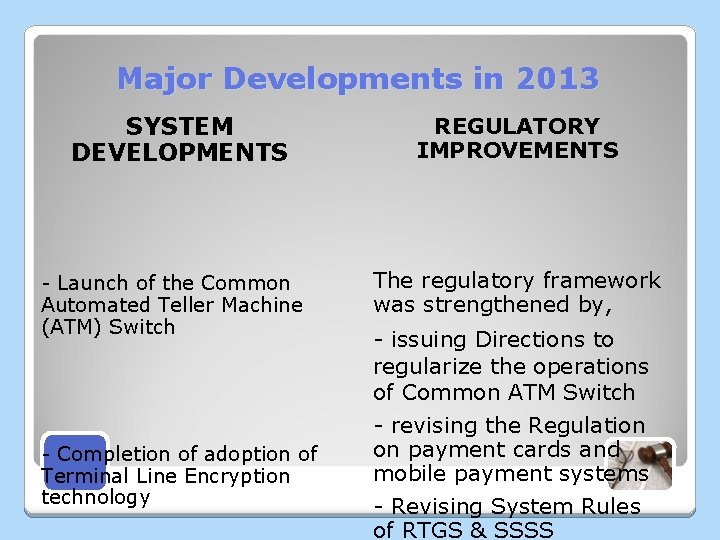

Major Developments in 2013 SYSTEM DEVELOPMENTS - Launch of the Common Automated Teller Machine (ATM) Switch - Completion of adoption of Terminal Line Encryption technology REGULATORY IMPROVEMENTS The regulatory framework was strengthened by, - issuing Directions to regularize the operations of Common ATM Switch - revising the Regulation on payment cards and mobile payment systems - Revising System Rules of RTGS & SSSS

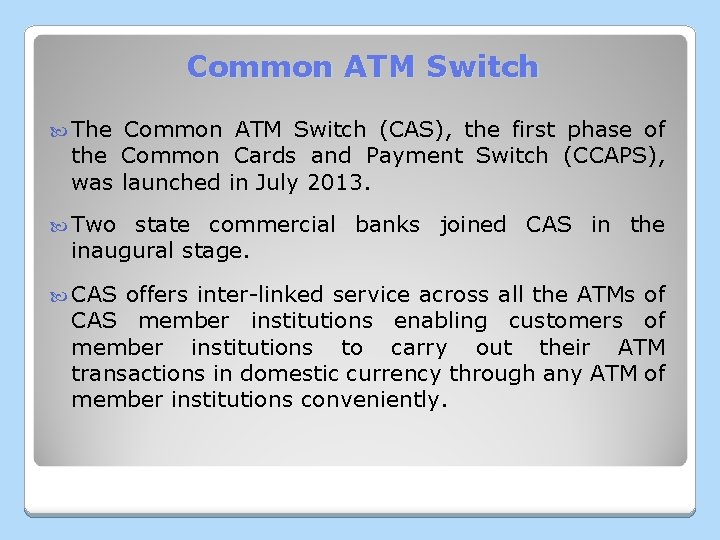

Common ATM Switch The Common ATM Switch (CAS), the first phase of the Common Cards and Payment Switch (CCAPS), was launched in July 2013. Two state commercial banks joined CAS in the inaugural stage. CAS offers inter-linked service across all the ATMs of CAS member institutions enabling customers of member institutions to carry out their ATM transactions in domestic currency through any ATM of member institutions conveniently.

Common ATM Switch CAS improves the efficiency and effectiveness of the domestic ATM network thereby reducing transaction costs in the financial system. More importantly, CAS will contain the outflow of foreign exchange involved in domestic ATM transactions that existed previously.

Terminal Line Encryption Technology Adoption of Terminal Line Encryption (TLE) technology in Point-of-Sale (POS) terminals was made mandatory for financial acquirers by the National Payments Council, which is the highest policy making body for the national payment system in Sri Lanka. Accordingly, March 2013. As migration to TLE was completed by 31 at end March 2013, the total number of TLE enabled POS terminals operating across the country amounted to 24, 949.

Regulating the Common ATM Switch Two Directions were issued in 2013 with respect to the Common ATM Switch, namely ◦ General Direction No. 01 of 2013 – Operations of the Common ATM Switch ◦ General Direction No. 02 of 2013 –Fees Chargeable on the Transactions effected through the Common ATM Switch

Regulating the Common ATM Switch General Direction No. 01 of 2013 – Operations of the Common ATM Switch ◦ To be adhered by the operator and members of CAS ◦ Specifies responsibilities of the operator and members of CAS, and arrangements for business continuity and maintaining data confidentiality General Direction No. 02 of 2013 –Fees Chargeable on the Transactions effected through the Common ATM Switch ◦ To be adhered by CAS members ◦ Sets out upper limits on fees to be charged from the customer by the issuer and interchange fees to be charged from the issuer by the acquirer, with respect to cash withdrawals and balance inquiries

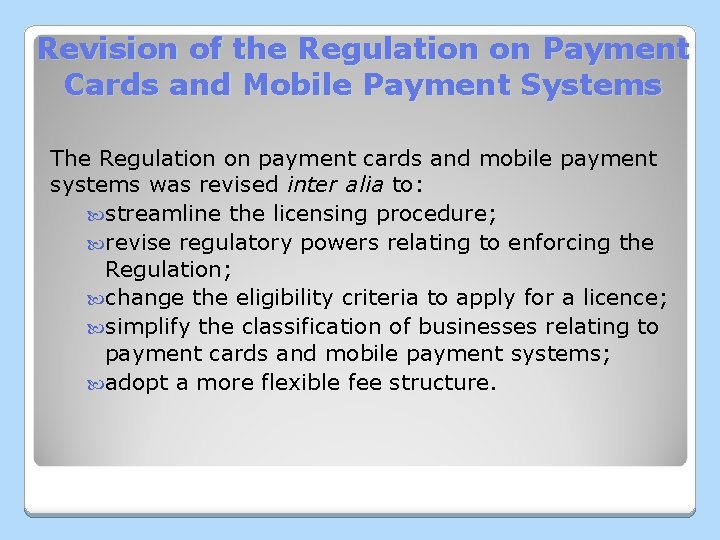

Revision of the Regulation on Payment Cards and Mobile Payment Systems The Regulation on payment cards and mobile payment systems was revised inter alia to: streamline the licensing procedure; revise regulatory powers relating to enforcing the Regulation; change the eligibility criteria to apply for a licence; simplify the classification of businesses relating to payment cards and mobile payment systems; adopt a more flexible fee structure.

THANK YOU !