PRESENTATION OF FINANCIAL STATEMENTS LKAS 01 Rangajewa Herath

- Slides: 23

PRESENTATION OF FINANCIAL STATEMENTS (LKAS 01) Rangajewa Herath B. Sc. Accountancy and Financial Management(Sp. ) (Hons. ) (USJ) , Master of Business Administration -PIM(USJ) 1

LKAS 1 - Presentation of Financial Statements prescribes the basis for the presentation of general purpose financial statements for public limited companies. It sets out the overall requirements for presentation of financial statements, guideline for structure 2

GENERAL PURPOSE FINANCIAL STATEMENTS General Purpose Financial Statements are the financial statements those intended to meet the needs of users who are not in a position to require an entity to prepare reports tailored to their particular information needs. 3

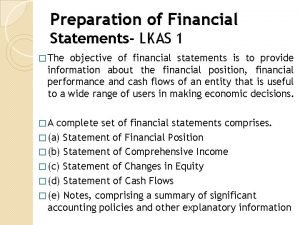

OBJECTIVES OF FINANCIAL STATEMENTS The objective of financial statements is to provide information about the financial position, financial performance and cash flows of an entity to wide range of users in making economic decisions. 4

FINANCIAL STATEMENTS PROVIDES INFORMATION ABOUT AN ENTITY’S Assets; Liabilities; Equity; Income and expenses; Contribution from and distribution to owners in their capacity of owners; and Cash flows 5

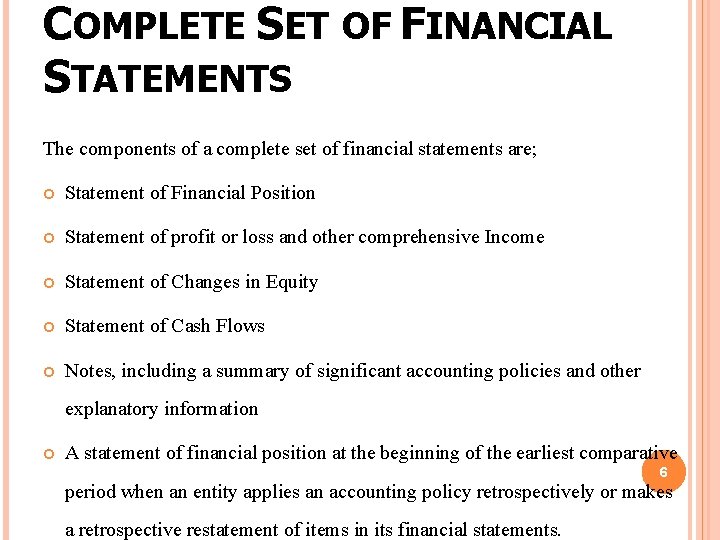

COMPLETE SET OF FINANCIAL STATEMENTS The components of a complete set of financial statements are; Statement of Financial Position Statement of profit or loss and other comprehensive Income Statement of Changes in Equity Statement of Cash Flows Notes, including a summary of significant accounting policies and other explanatory information A statement of financial position at the beginning of the earliest comparative 6 period when an entity applies an accounting policy retrospectively or makes a retrospective restatement of items in its financial statements.

STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME Other comprehensive income comprises items of income and expenses that are not recognized in profit or loss as required or permitted by other SLFRS. Profit or loss is the total income less expenses excluding the components of other comprehensive income. 7

OTHER COMPREHENSIVE INCOME ü Changes in revaluation surplus. ü Gains or losses arising from translating the Financial Statements of a foreign operation. ü Gains or losses on re-measuring available-for-sale financial assets. ü The effective portion of gains and losses on hedging instruments in a cash flow hedges. ü Actuarial gains and losses on defined benefit plans. 8

TOTAL COMPREHENSIVE INCOME The change in equity during a period resulting from transactions and other events, other than those changes resulting from transactions with owners in their capacity as owners. Total Comprehensive = Profit or Loss + OCI Income 9

GOING CONCERN When preparing financial statements, management shall make an assessment of the entity’s ability to continue as going concern. An entity should prepare the financial statements on going concern basis unless the management either intends to liquidate the business or cease trading, or has no realistic alternative but to do so. 10

ACCRUAL BASIS OF ACCOUNTING An entity should prepare its financial statements, except for the cash flow information, on accrual basis. 11

MATERIALITY AND AGGREGATION Each material class of similar items should be separately presented. Immaterial items can be aggregated and presented according to either their nature or function. 12

OFFSETTING An entity shall not offset assets and liabilities or income and expenses, unless required or permitted by an SLFRS. 13

COMPARATIVE INFORMATION An entity should disclose comparative information in respect of the previous period for all amounts reported in the current period’s Financial Statements. 14

ASSETS ARE RESOURCES CONTROLLED BY THE BUSINESS AS A RESULT OF PAST EVENT OF WHICH FUTURE ECONOMIC BENEFITS EXPECTED TO FLOW TO THE ENTITY. 15 ARE

Accounting Policies, Changes in Accounting Estimates and Errors (LKAS 08) 16

ACCOUNTING POLICIES Accounting policies are the specific principles, bases, conventions, rules and practices applied by an entity in preparing and presenting financial statements. 17

Selection of Accounting Policies Accounting policies should be selected using the following methods. (1)Use of Accounting standard (2)Based on management Judgment 18

CHANGES IN ACCOUNTING POLICIES An entity shall change an accounting policy only if the change: (a) is required by a Standard; or (b) results in the financial statements providing reliable and more relevant information about the effects of transactions, other events or conditions on the entity's financial position, financial performance or cash flows. 19

ACCOUNTING FOR CHANGES IN ACCOUNTING POLICIES Retrospective application is applying a new accounting policy to transactions, other events and conditions as if that policy had always been applied. 20

CHANGES IN ACCOUNTING ESTIMATES Accounting Estimates Examples (1) useful assets of an asset (2) Residual value of an asset (3) Depreciation method (4) Impairment of receivables (6) Net realizable value (7) Provision for warranty (8) Provision for claim 21

ACCOUNTING FOR CHANGES IN ACCOUNTING ESTIMATES The effect of a change in an accounting estimate shall be recognized prospectively by including it in profit or loss in: only; or (b) the period of the change and future periods, if the change affects both. 22

ERRORS Prior period errors are omissions from, and misstatements in, the entity's financial statements for one or more prior periods arising from a failure to use, or misuse of, reliable information that: (a) was available when financial statements for those periods were authorized for issue; and (b) could reasonably be expected to have been obtained and taken into account in the preparation and presentation of those financial statements. 23

Lkas 7 summary

Lkas 7 summary Rangajeewa herath

Rangajeewa herath Slfrf

Slfrf Lkas16

Lkas16 Ipsas 24 summary

Ipsas 24 summary Aasb 8

Aasb 8 Lkas 1

Lkas 1 Lkas 2 definition

Lkas 2 definition Purpose of financial reporting

Purpose of financial reporting Benefits of audit planning isa 300

Benefits of audit planning isa 300 Sample notes to financial statements for small entities

Sample notes to financial statements for small entities Analysis of financial statements

Analysis of financial statements Financial statements translation

Financial statements translation Fge financial management

Fge financial management Financial statements and ratio analysis chapter 3

Financial statements and ratio analysis chapter 3 2-2 journal: financial statements and cash flow management

2-2 journal: financial statements and cash flow management Acct 100

Acct 100 Forecasting income statement

Forecasting income statement Fees earned debit or credit

Fees earned debit or credit Consolidated financial statements date of acquisition

Consolidated financial statements date of acquisition Ssars 21 preparation of financial statements

Ssars 21 preparation of financial statements What are accounting constraints

What are accounting constraints Ias consolidated financial statements

Ias consolidated financial statements Common base year balance sheet

Common base year balance sheet