Adjusting and Forecasting Financial Statements Adjusting the Financial

- Slides: 29

Adjusting and Forecasting Financial Statements

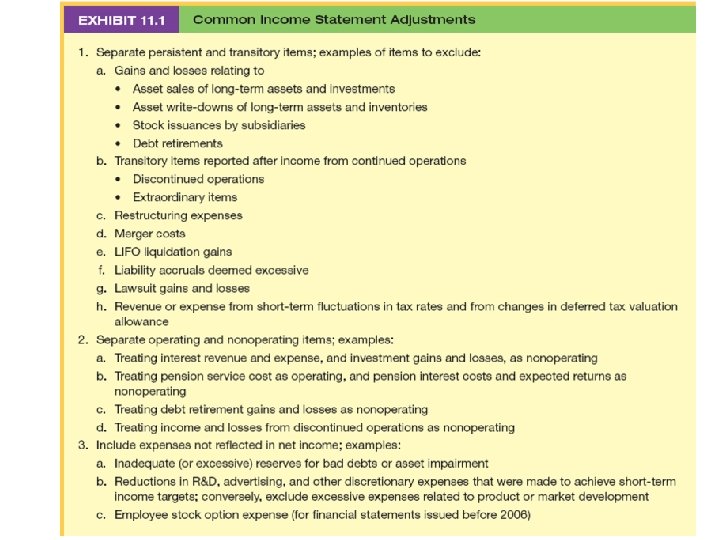

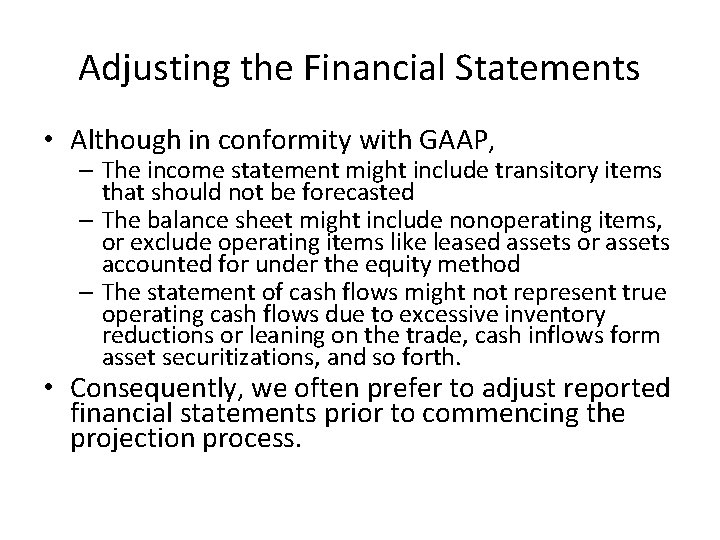

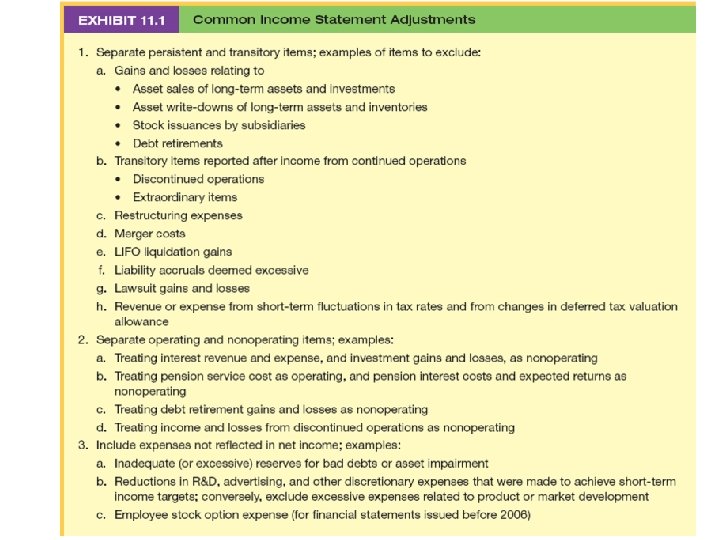

Adjusting the Financial Statements • Although in conformity with GAAP, – The income statement might include transitory items that should not be forecasted – The balance sheet might include nonoperating items, or exclude operating items like leased assets or assets accounted for under the equity method – The statement of cash flows might not represent true operating cash flows due to excessive inventory reductions or leaning on the trade, cash inflows form asset securitizations, and so forth. • Consequently, we often prefer to adjust reported financial statements prior to commencing the projection process.

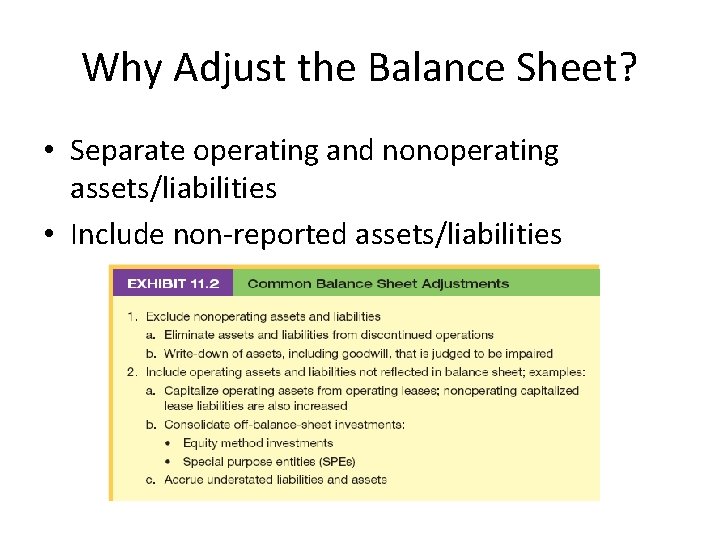

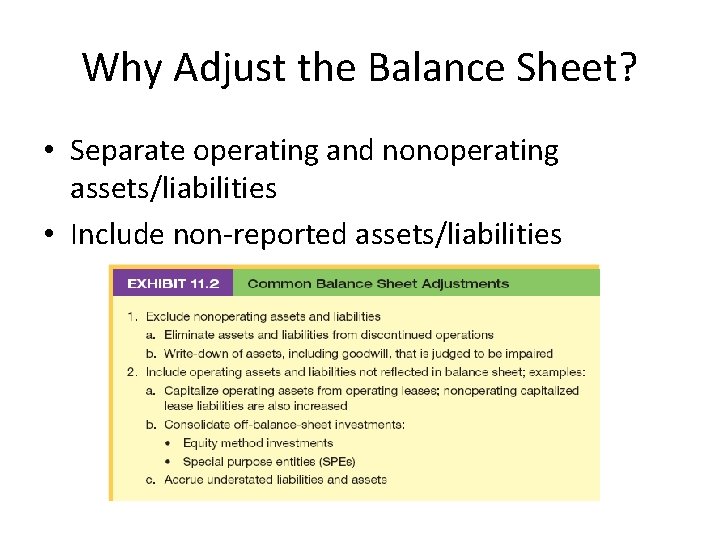

Why Adjust the Balance Sheet? • Separate operating and nonoperating assets/liabilities • Include non-reported assets/liabilities

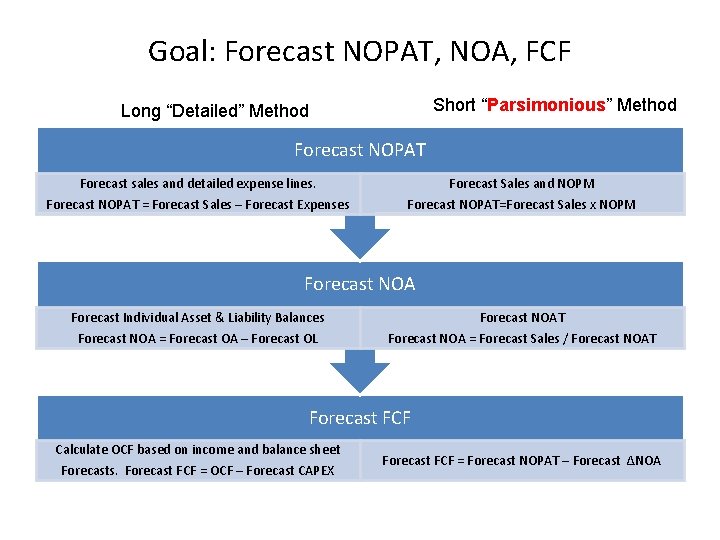

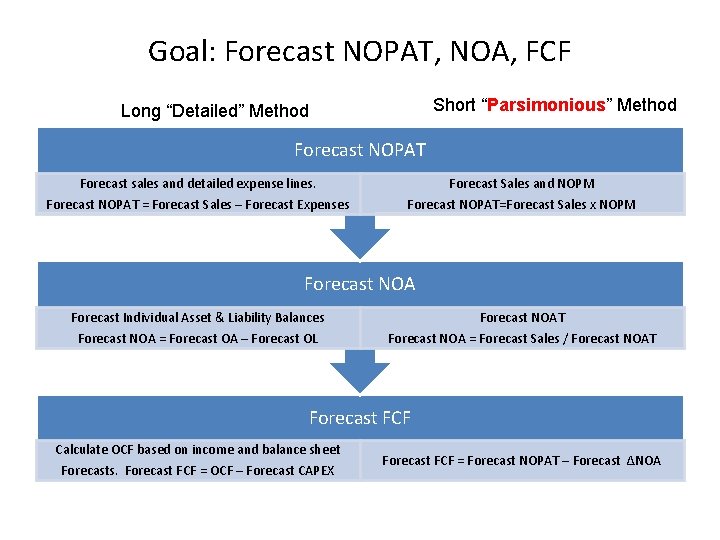

Goal: Forecast NOPAT, NOA, FCF Short “Parsimonious” Method Long “Detailed” Method Forecast NOPAT Forecast sales and detailed expense lines. Forecast Sales and NOPM Forecast NOPAT = Forecast Sales – Forecast Expenses Forecast NOPAT=Forecast Sales x NOPM Forecast NOA Forecast Individual Asset & Liability Balances Forecast NOAT Forecast NOA = Forecast OA – Forecast OL Forecast NOA = Forecast Sales / Forecast NOAT Forecast FCF Calculate OCF based on income and balance sheet Forecasts. Forecast FCF = OCF – Forecast CAPEX Forecast FCF = Forecast NOPAT – Forecast ∆NOA

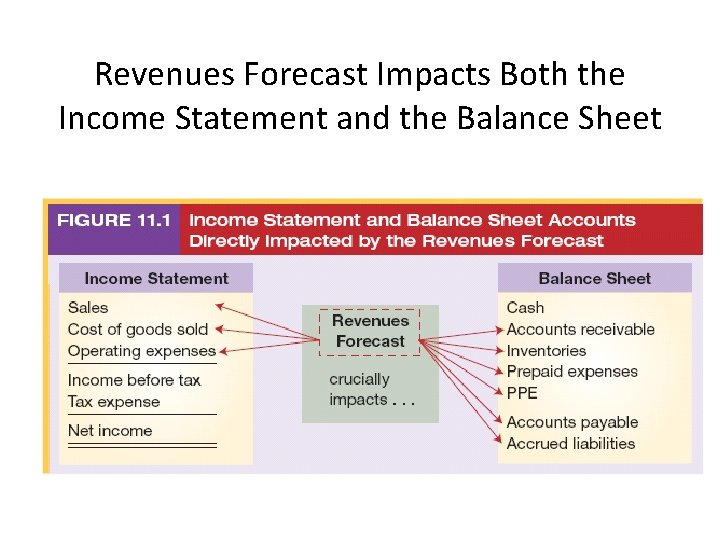

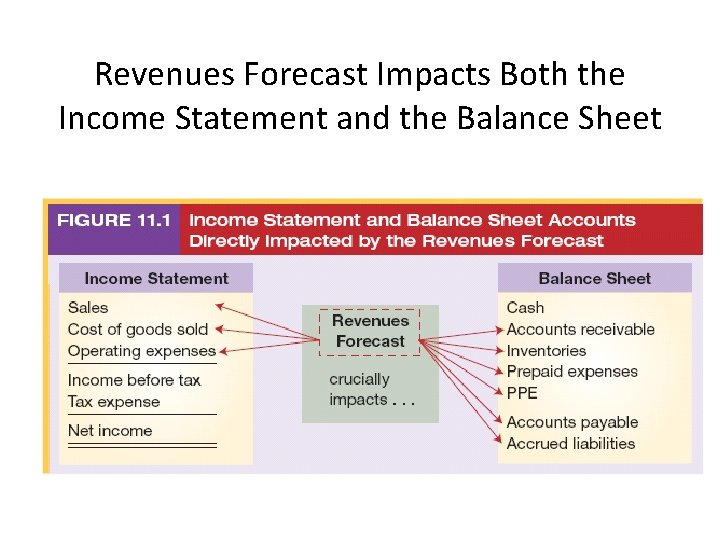

Revenues Forecast Impacts Both the Income Statement and the Balance Sheet

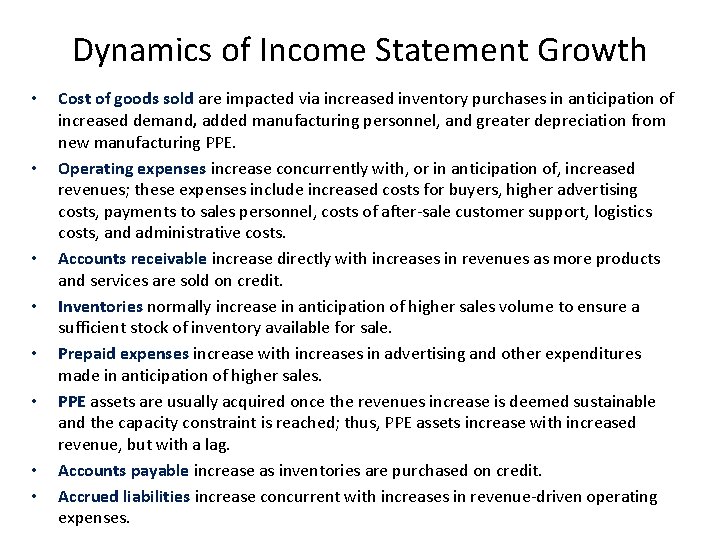

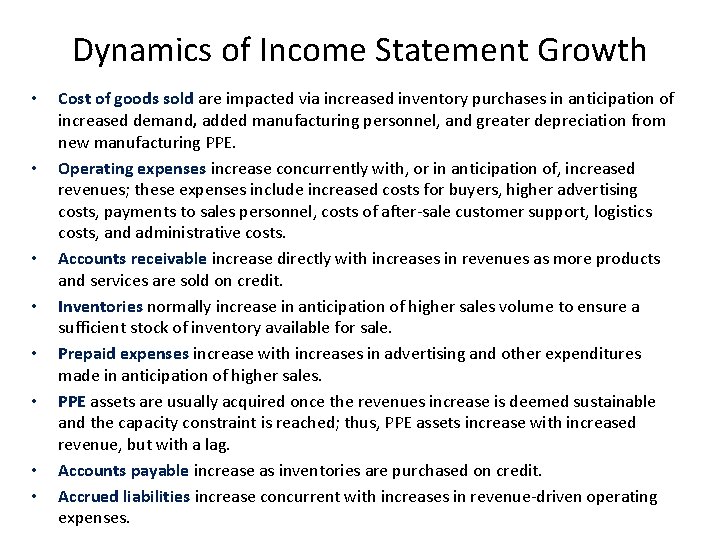

Dynamics of Income Statement Growth • • Cost of goods sold are impacted via increased inventory purchases in anticipation of increased demand, added manufacturing personnel, and greater depreciation from new manufacturing PPE. Operating expenses increase concurrently with, or in anticipation of, increased revenues; these expenses include increased costs for buyers, higher advertising costs, payments to sales personnel, costs of after-sale customer support, logistics costs, and administrative costs. Accounts receivable increase directly with increases in revenues as more products and services are sold on credit. Inventories normally increase in anticipation of higher sales volume to ensure a sufficient stock of inventory available for sale. Prepaid expenses increase with increases in advertising and other expenditures made in anticipation of higher sales. PPE assets are usually acquired once the revenues increase is deemed sustainable and the capacity constraint is reached; thus, PPE assets increase with increased revenue, but with a lag. Accounts payable increase as inventories are purchased on credit. Accrued liabilities increase concurrent with increases in revenue-driven operating expenses.

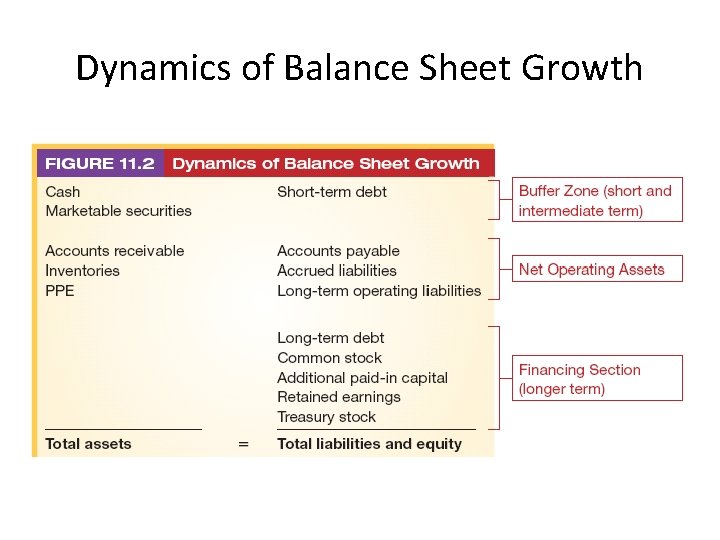

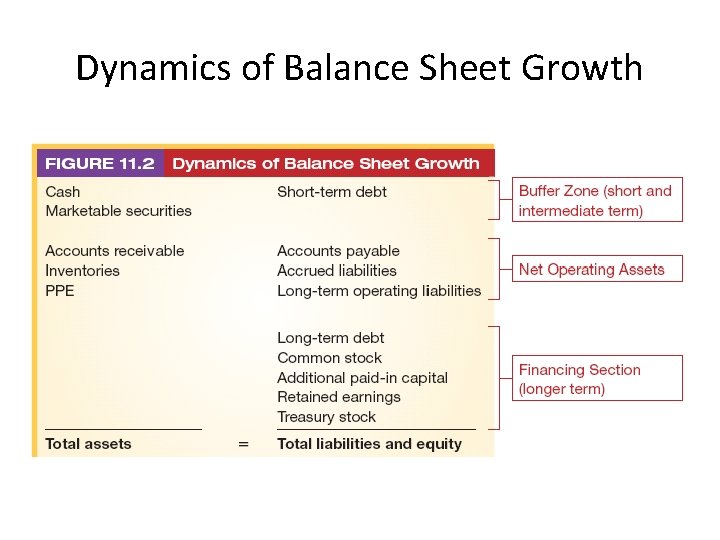

Dynamics of Balance Sheet Growth

Forecasting Steps 1. Forecast revenues. 2. Forecast operating and nonoperating expenses. We assume a relation between revenue and each specific expense account. 3. Forecast operating and nonoperating assets, liabilities and equity. We assume a relation between revenue and each specific balance sheet account. We set cash equal to the amount necessary to balance the balance sheet. 4. (Optional) Adjust the balance sheet to the target cash balance. (No class discussion)

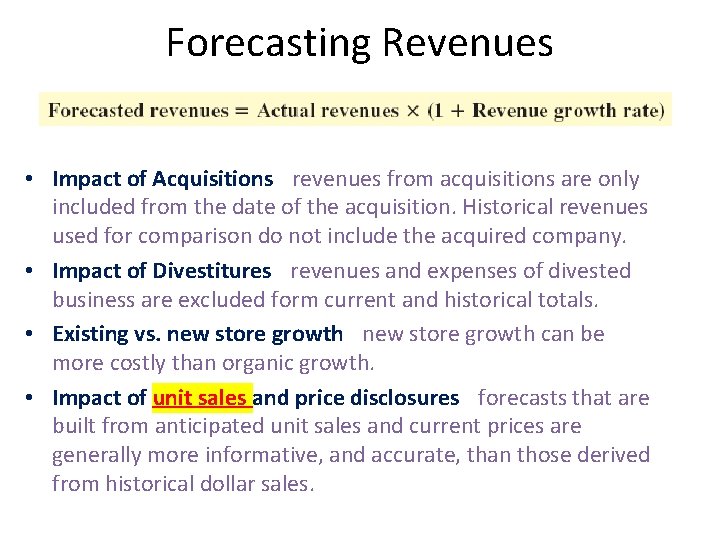

Forecasting Revenues • Impact of Acquisitions - revenues from acquisitions are only included from the date of the acquisition. Historical revenues used for comparison do not include the acquired company. • Impact of Divestitures - revenues and expenses of divested business are excluded form current and historical totals. • Existing vs. new store growth - new store growth can be more costly than organic growth. • Impact of unit sales and price disclosures - forecasts that are built from anticipated unit sales and current prices are generally more informative, and accurate, than those derived from historical dollar sales.

Sources of Information • Public disclosures via meetings and calls • Public reports: segment disclosures and MD&A

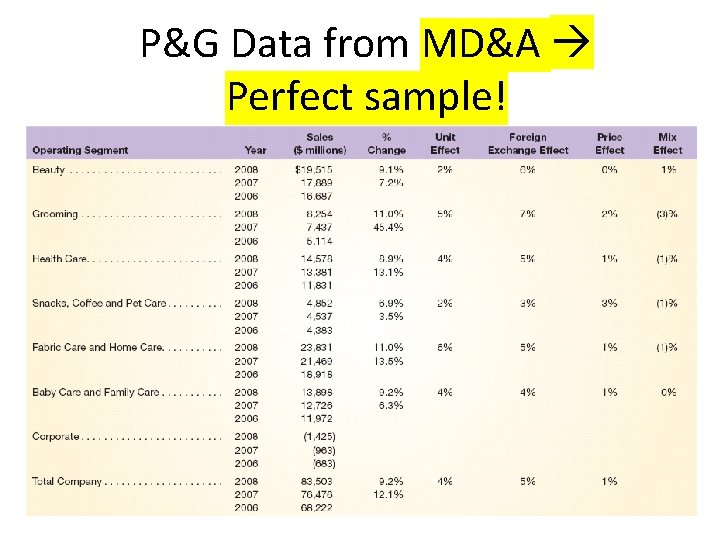

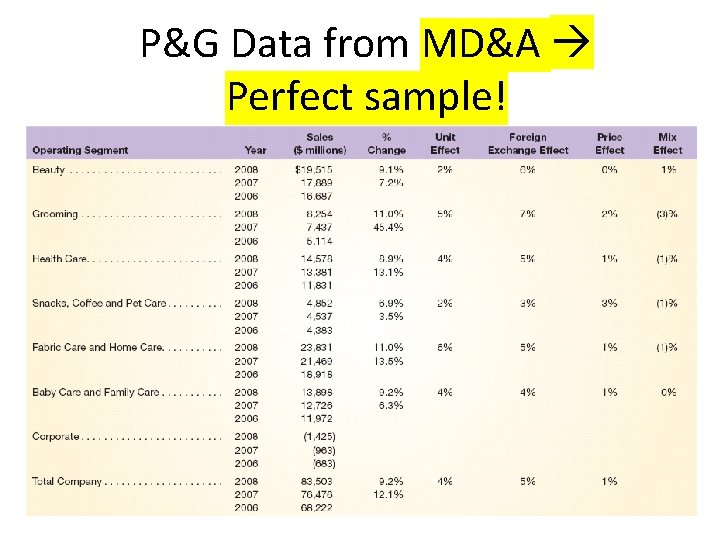

P&G Data from MD&A Perfect sample!

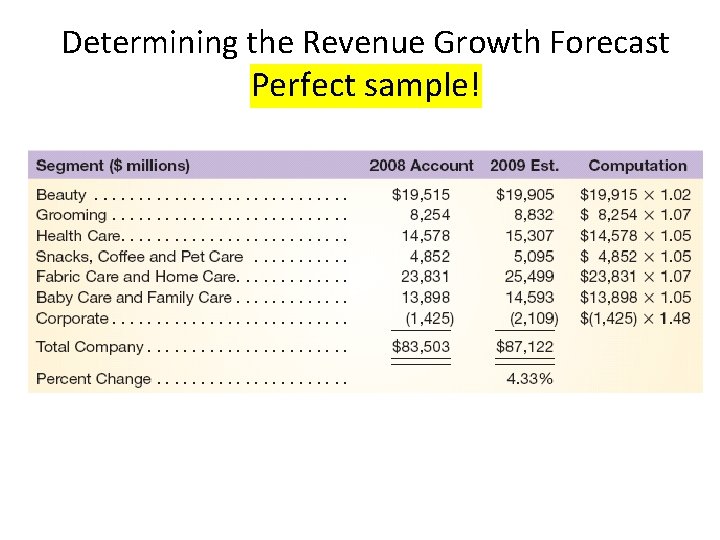

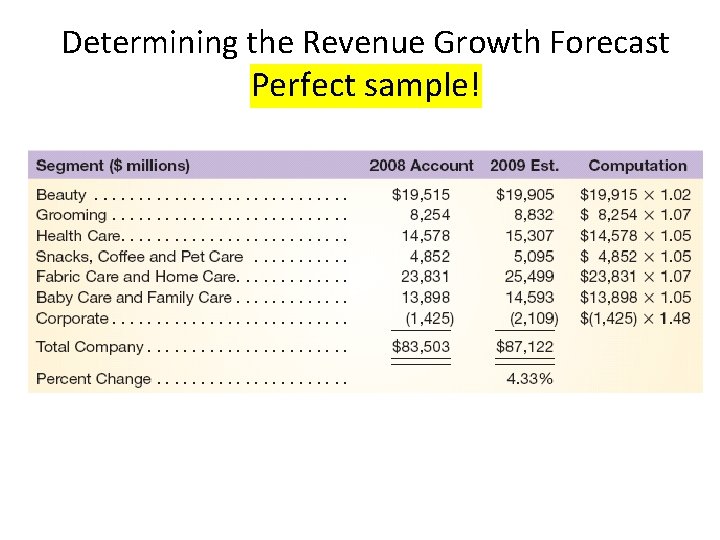

Determining the Revenue Growth Forecast Perfect sample!

Impact of Foreign Exchange Rates Skip this part on the project Final P&G revenues forecast is $82, 944 million = $83, 503 x (1 – [4. 33% - 5%]).

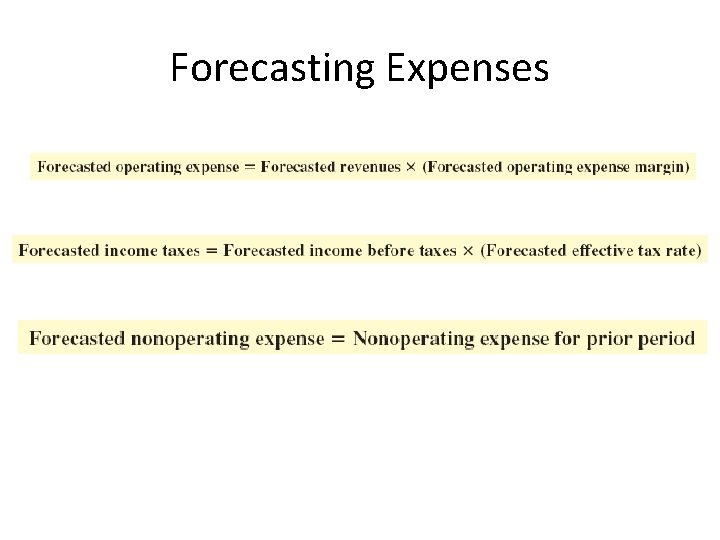

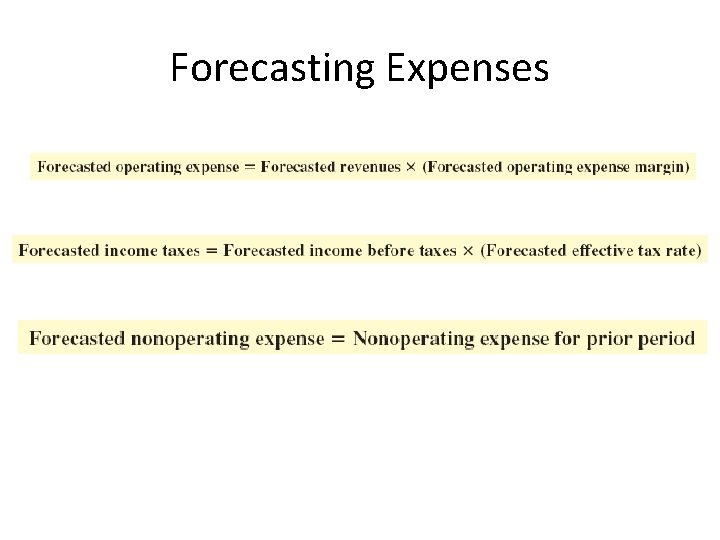

Forecasting Expenses

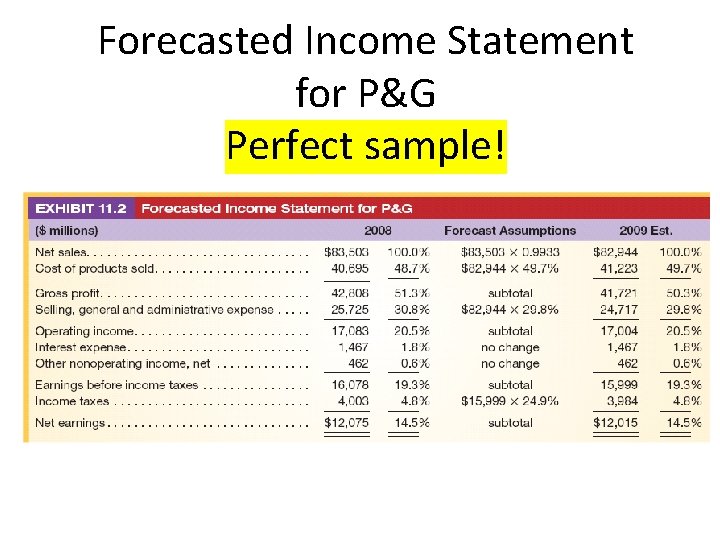

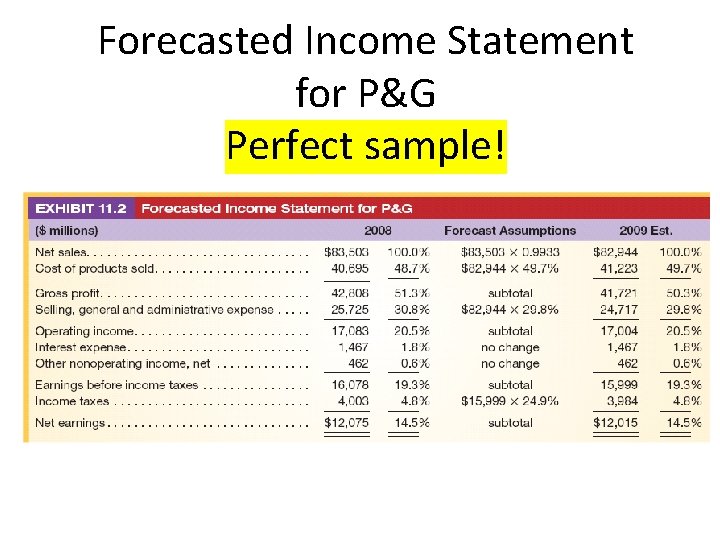

Forecasted Income Statement for P&G Perfect sample!

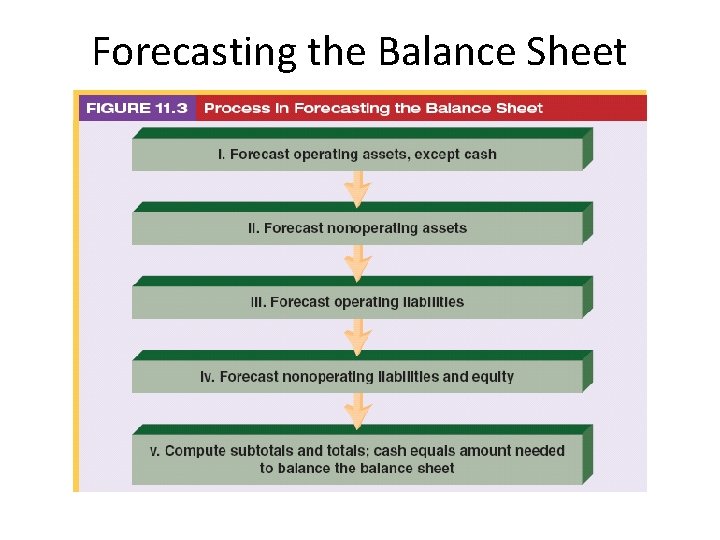

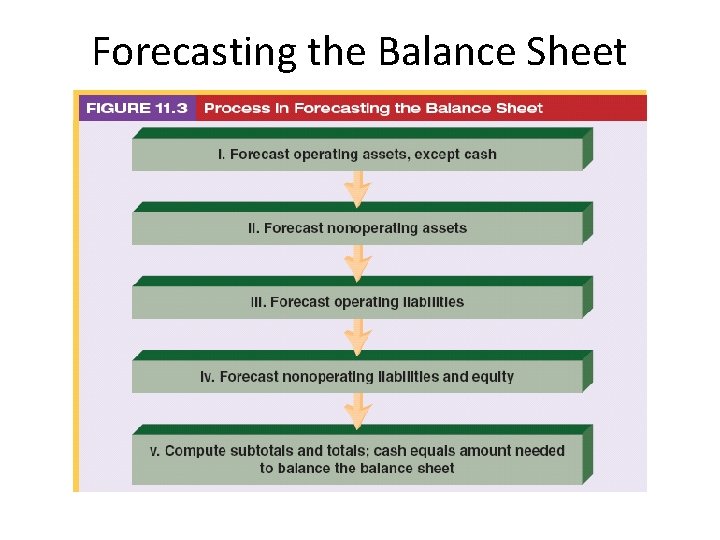

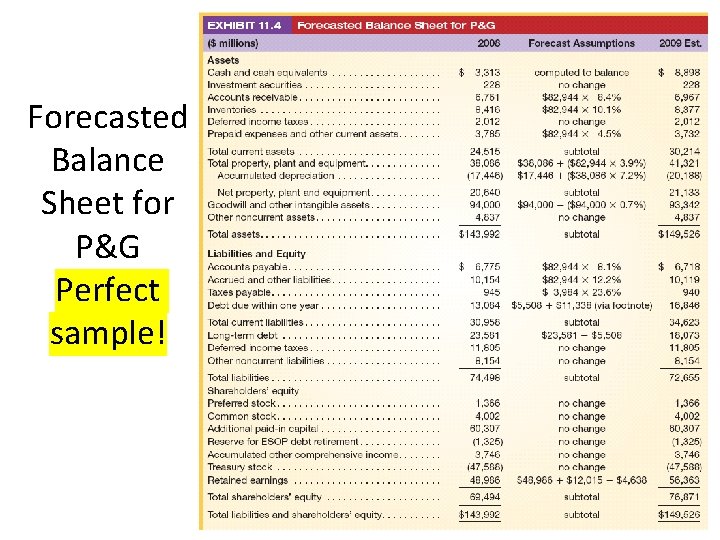

Forecasting the Balance Sheet

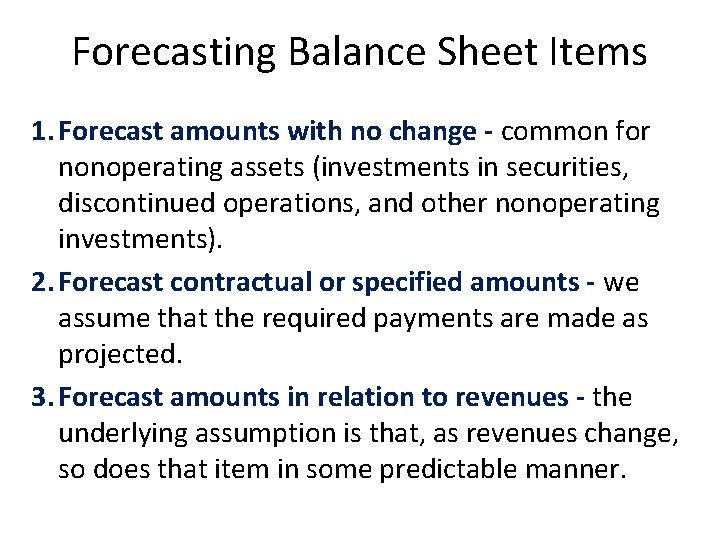

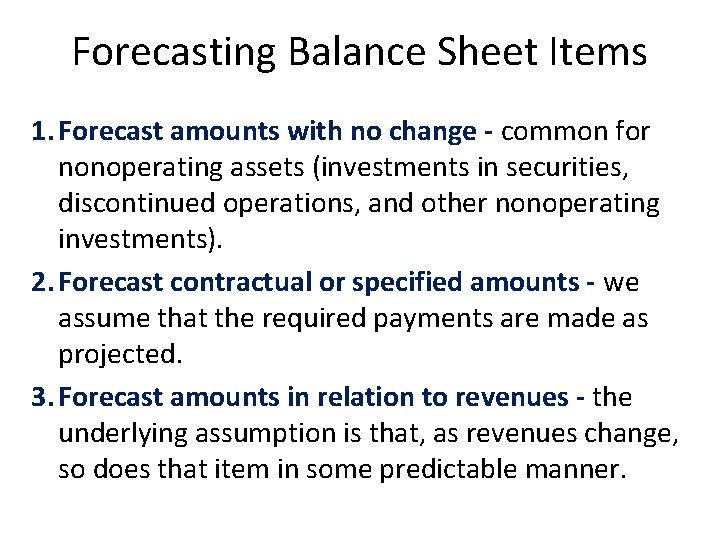

Forecasting Balance Sheet Items 1. Forecast amounts with no change - common for nonoperating assets (investments in securities, discontinued operations, and other nonoperating investments). 2. Forecast contractual or specified amounts - we assume that the required payments are made as projected. 3. Forecast amounts in relation to revenues - the underlying assumption is that, as revenues change, so does that item in some predictable manner.

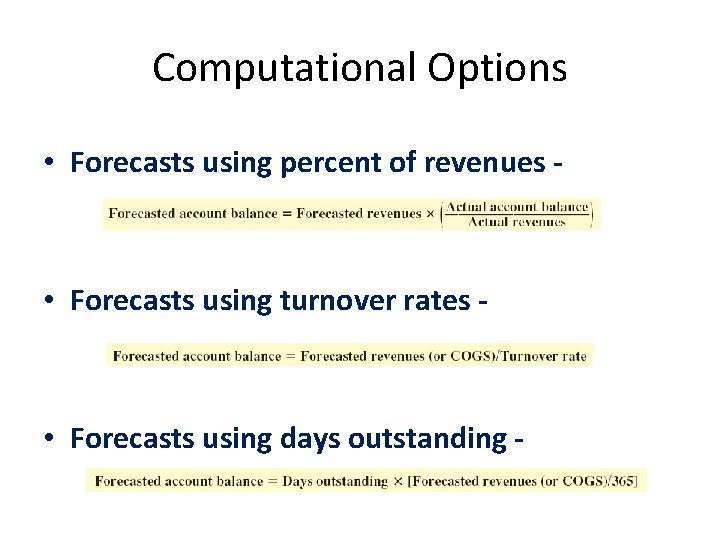

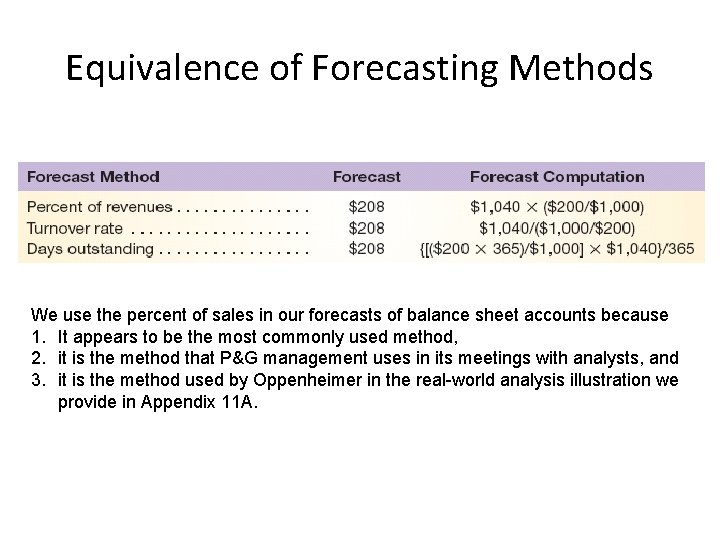

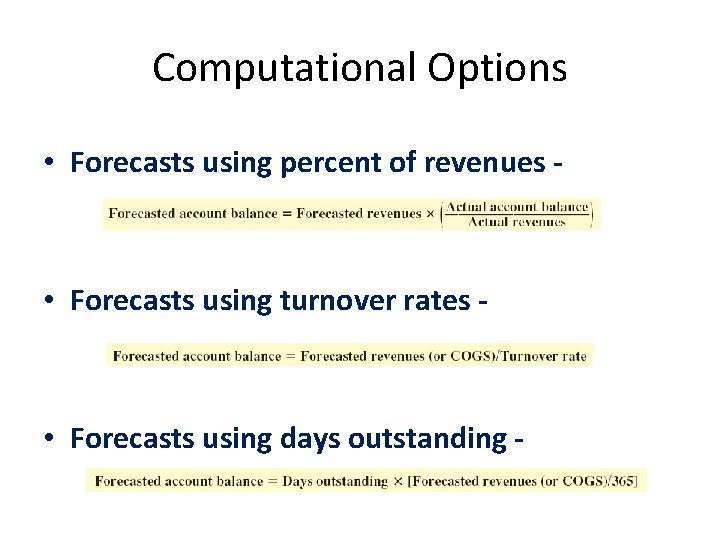

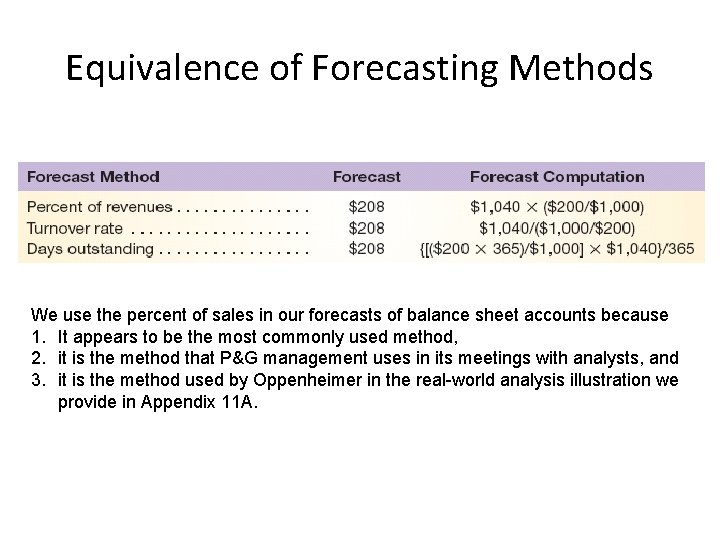

Computational Options • Forecasts using percent of revenues - • Forecasts using turnover rates - • Forecasts using days outstanding -

Equivalence of Forecasting Methods We use the percent of sales in our forecasts of balance sheet accounts because 1. It appears to be the most commonly used method, 2. it is the method that P&G management uses in its meetings with analysts, and 3. it is the method used by Oppenheimer in the real-world analysis illustration we provide in Appendix 11 A.

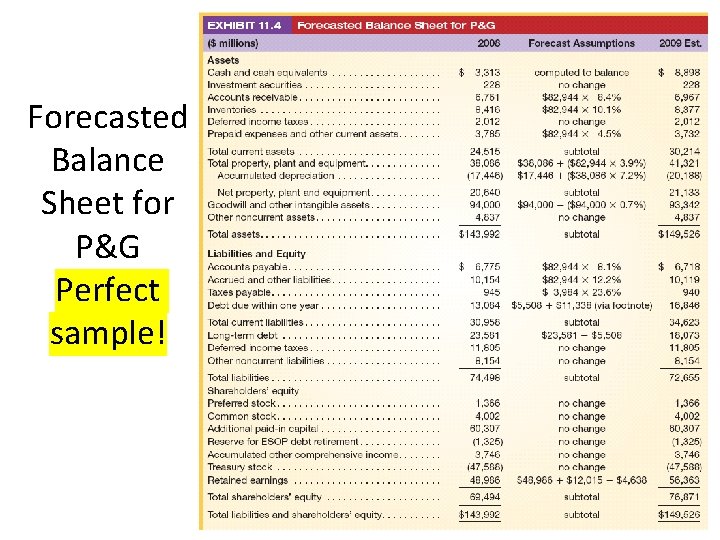

Forecasted Balance Sheet for P&G Perfect sample!

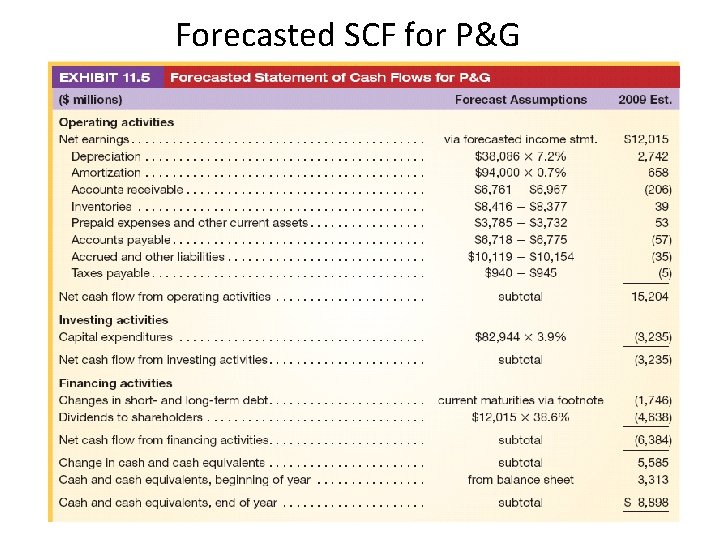

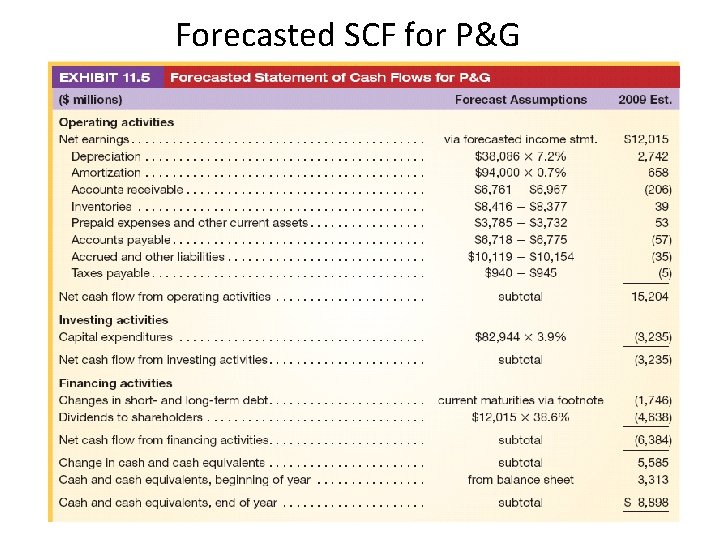

Forecasted SCF for P&G

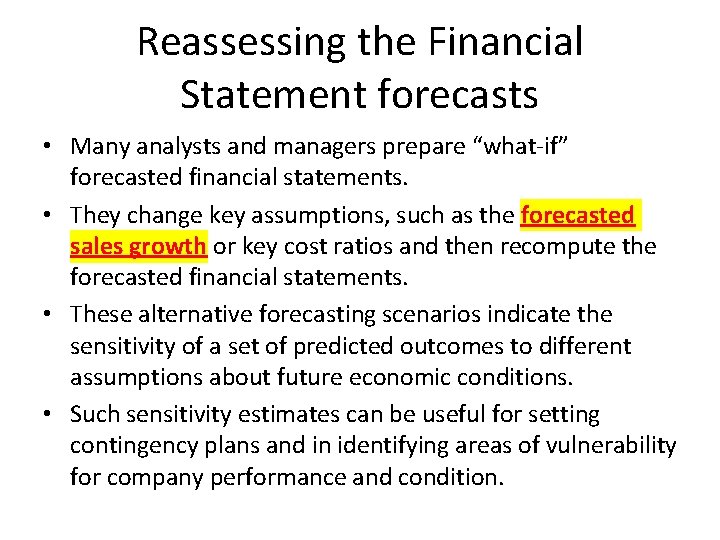

Reassessing the Financial Statement forecasts • Many analysts and managers prepare “what-if” forecasted financial statements. • They change key assumptions, such as the forecasted sales growth or key cost ratios and then recompute the forecasted financial statements. • These alternative forecasting scenarios indicate the sensitivity of a set of predicted outcomes to different assumptions about future economic conditions. • Such sensitivity estimates can be useful for setting contingency plans and in identifying areas of vulnerability for company performance and condition.

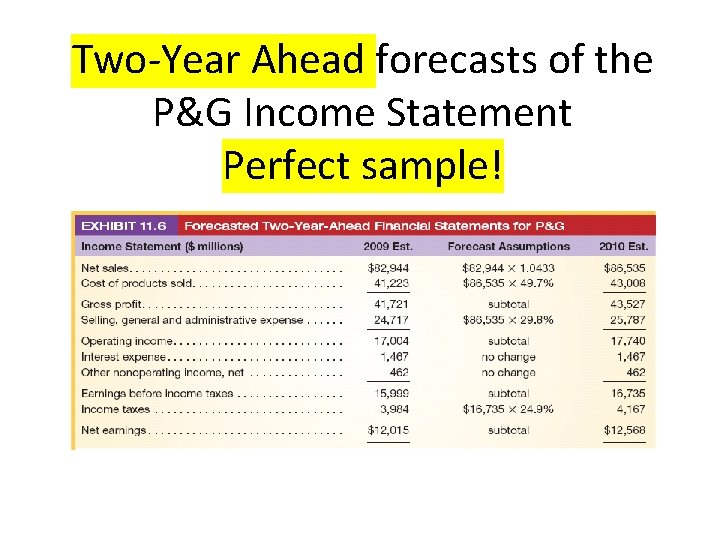

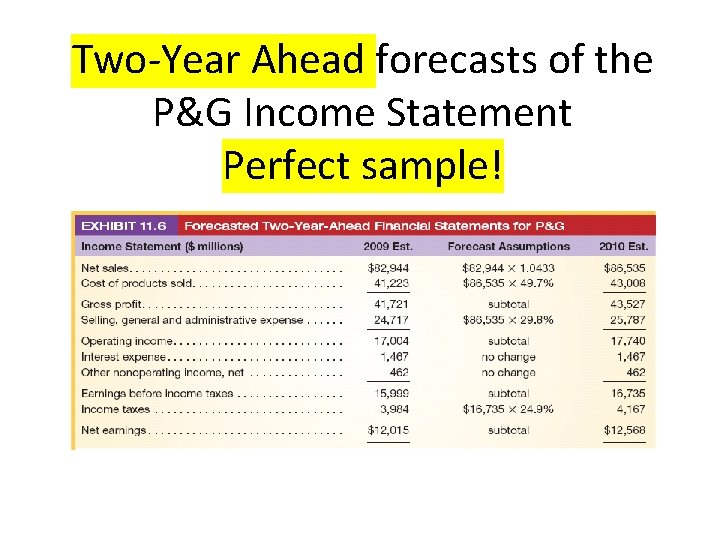

Two-Year Ahead forecasts of the P&G Income Statement Perfect sample!

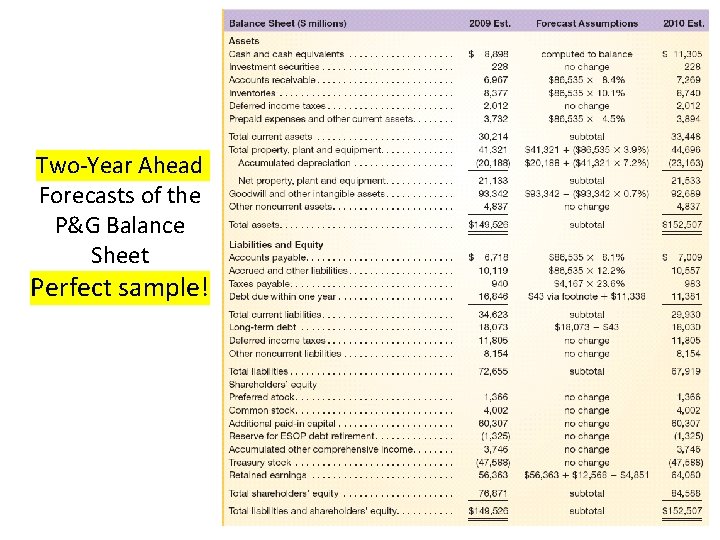

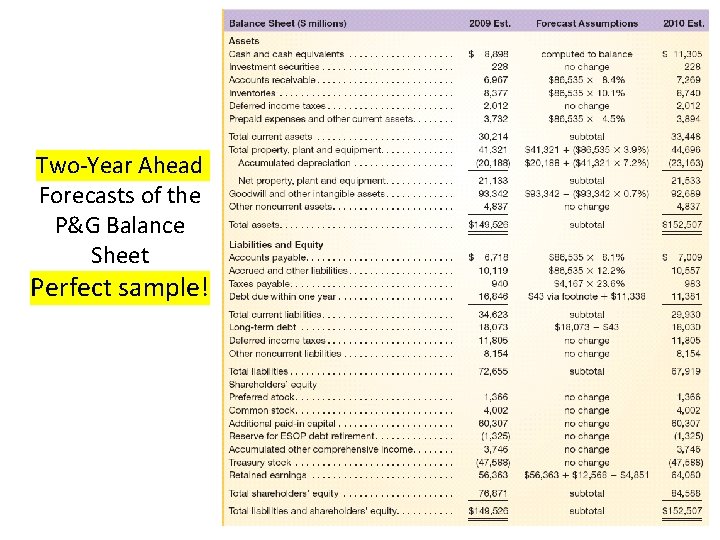

Two-Year Ahead Forecasts of the P&G Balance Sheet Perfect sample!

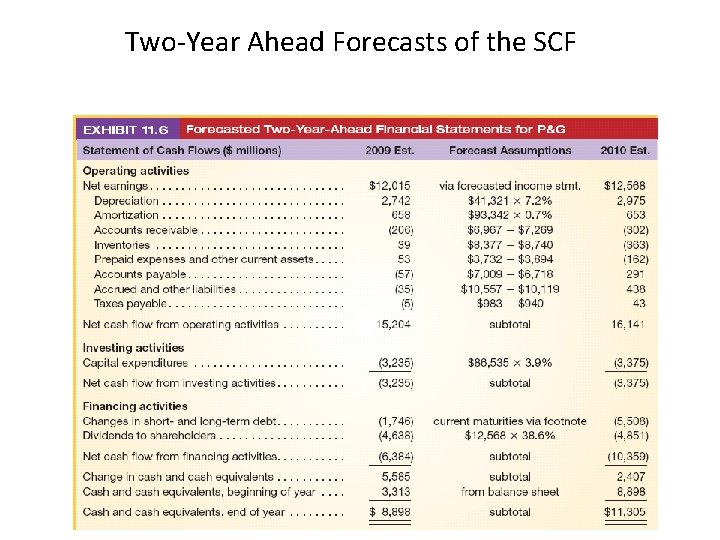

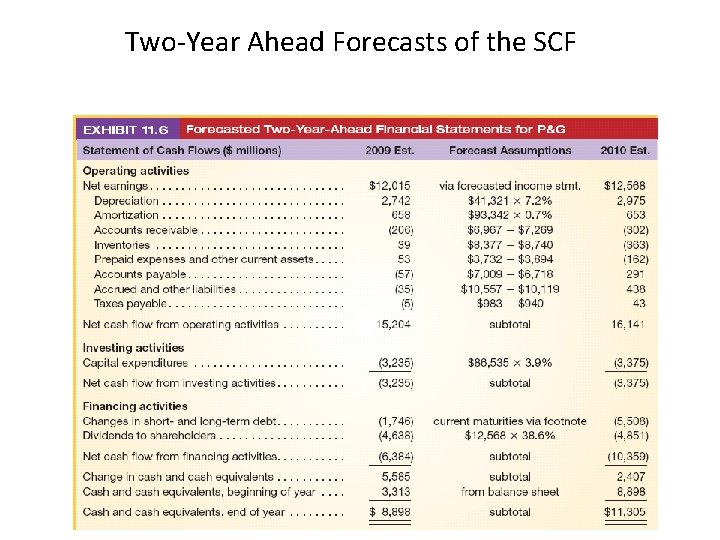

Two-Year Ahead Forecasts of the SCF

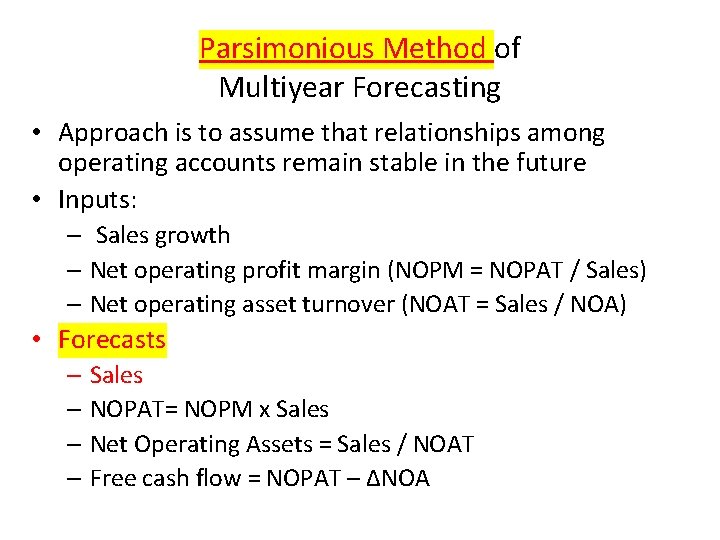

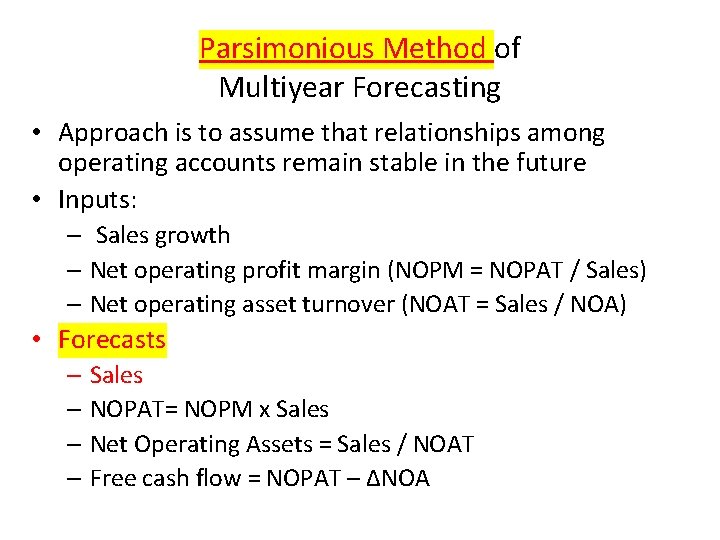

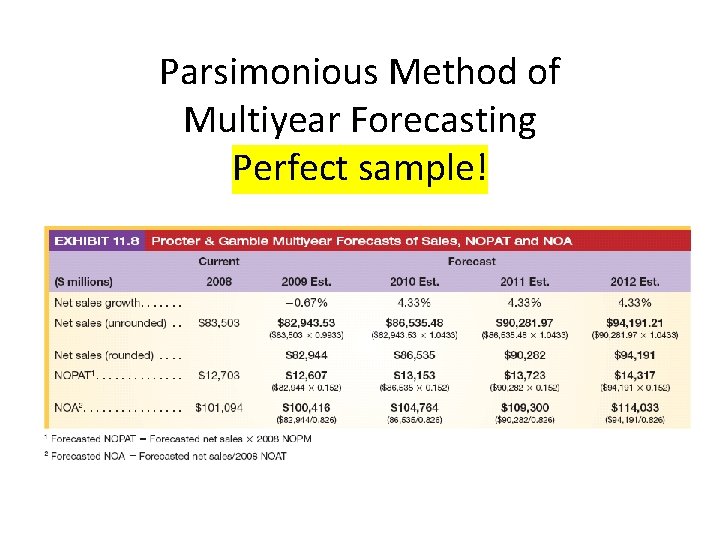

Parsimonious Method of Multiyear Forecasting • Approach is to assume that relationships among operating accounts remain stable in the future • Inputs: – Sales growth – Net operating profit margin (NOPM = NOPAT / Sales) – Net operating asset turnover (NOAT = Sales / NOA) • Forecasts – Sales – NOPAT= NOPM x Sales – Net Operating Assets = Sales / NOAT – Free cash flow = NOPAT – ∆NOA

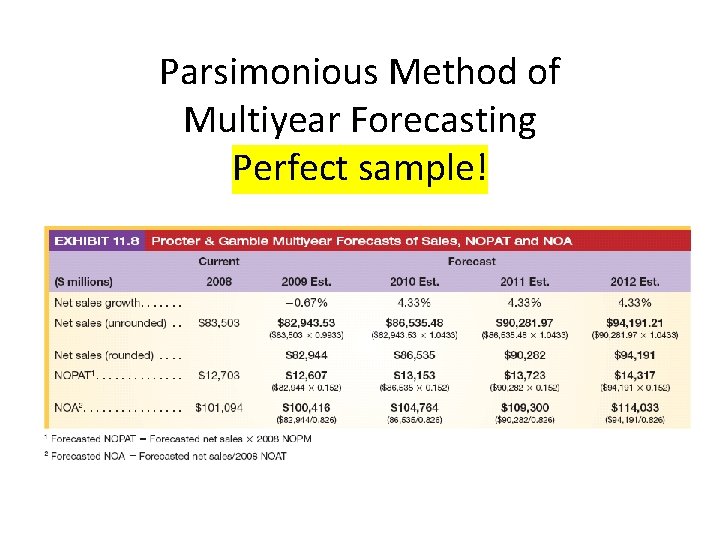

Parsimonious Method of Multiyear Forecasting Perfect sample!

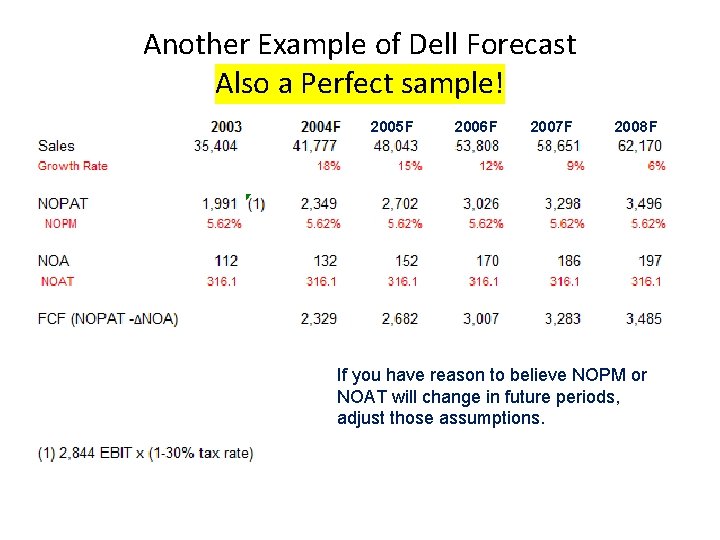

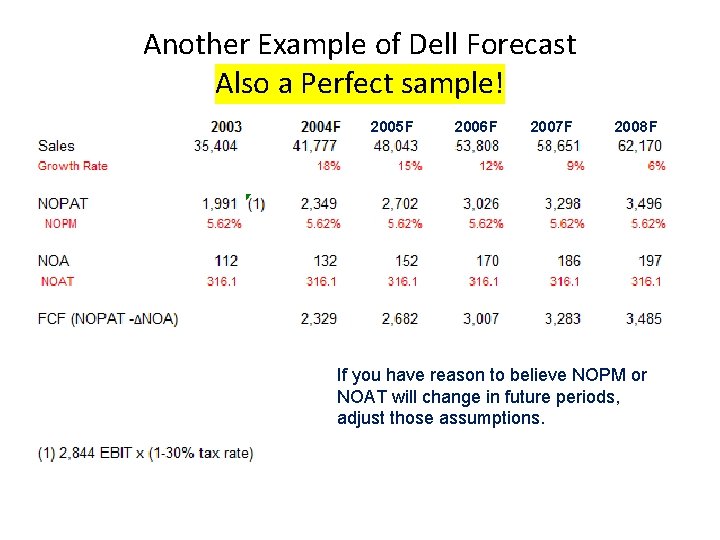

Another Example of Dell Forecast Also a Perfect sample! 2005 F 2006 F 2007 F 2008 F If you have reason to believe NOPM or NOAT will change in future periods, adjust those assumptions.