Overview 1 The Hartford provides access to online

- Slides: 17

Overview 1

The Hartford provides access to online retirement planning and investment guidance through Morningstar® Clear. Future® Will you retire on target? “The Hartford” is Hartford Financial Services Group, Inc. and its subsidiaries, including issuing company Hartford Life Insurance Company. 2

Confused about planning for retirement? u What is my retirement goal? u How much should I be saving? u How much income can I expect in retirement? u In which retirement plan investment choices should I invest? u How much should I invest in each? u When, and why, should I make investment changes? u When will I be able to retire? 3

Retire on Target. 4

Retirement Plan Investment Recommendations which are …. u Personalized - all recommendations factor in your risk tolerance, your time horizon and your unique goals u Objective - Morningstar Associates, LLC is an independent investment adviser and has no vested interest in any of the investments recommended u Customized - all recommendations reflect the features and investment choices in your company retirement plan u Professional - Morningstar Associates, LLC is a federally registered investment adviser 5

Morningstar Clear. Future is. . . u Convenient - around-the-clock access via the Internet u Easy - log in from home, work, or wherever you are u Fast - receive a personalized recommendation on how to invest in your retirement plan in 20 minutes or less u Secure - Morningstar uses leading-edge encryption technology to ensure confidentiality at all times 6

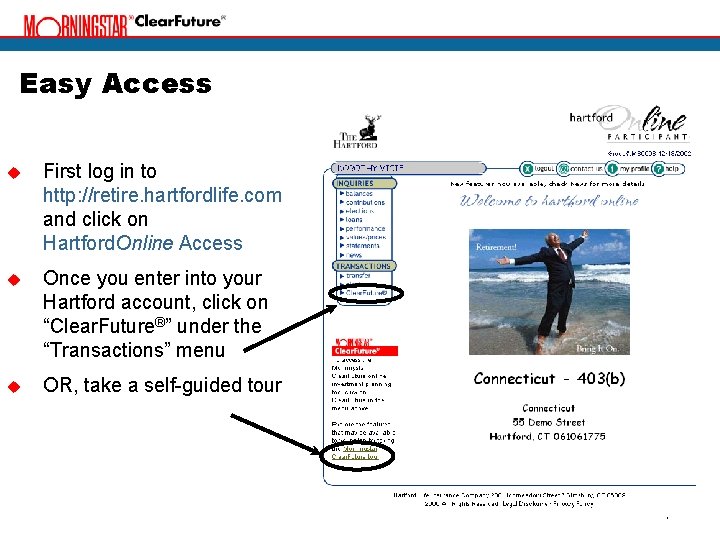

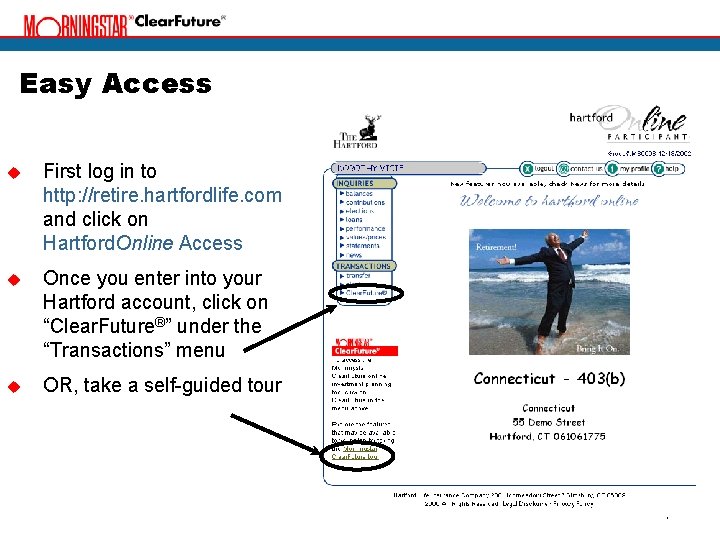

Easy Access u First log in to http: //retire. hartfordlife. com and click on Hartford. Online Access u Once you enter into your Hartford account, click on “Clear. Future®” under the “Transactions” menu u OR, take a self-guided tour 7

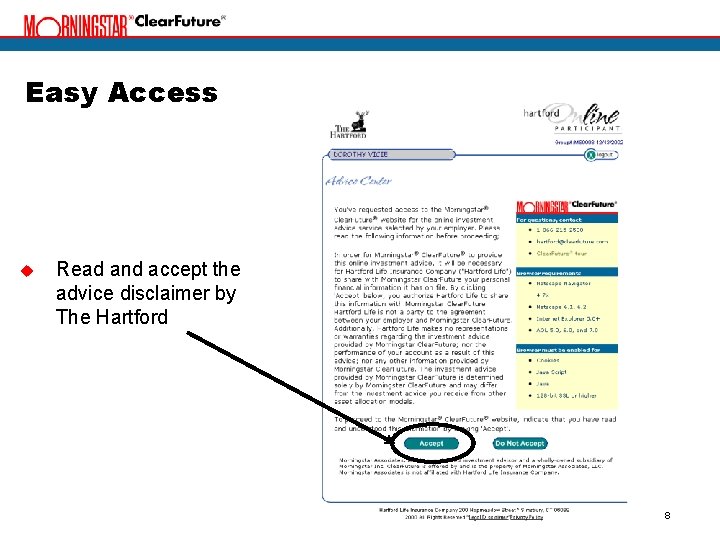

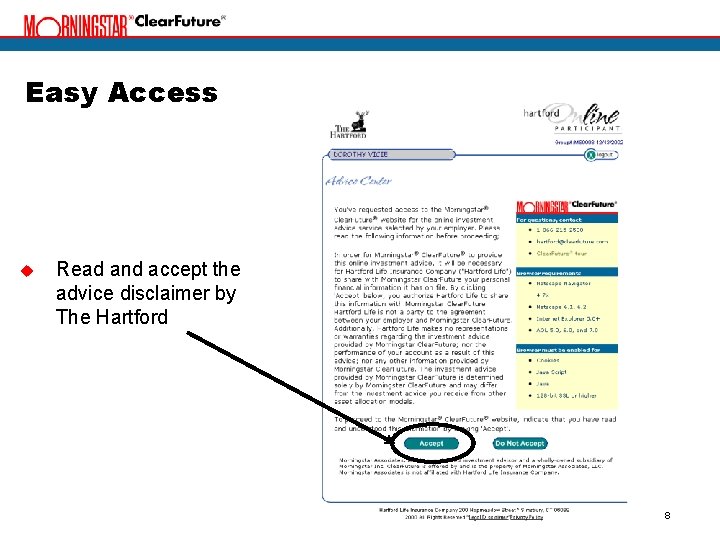

Easy Access u Read and accept the advice disclaimer by The Hartford 8

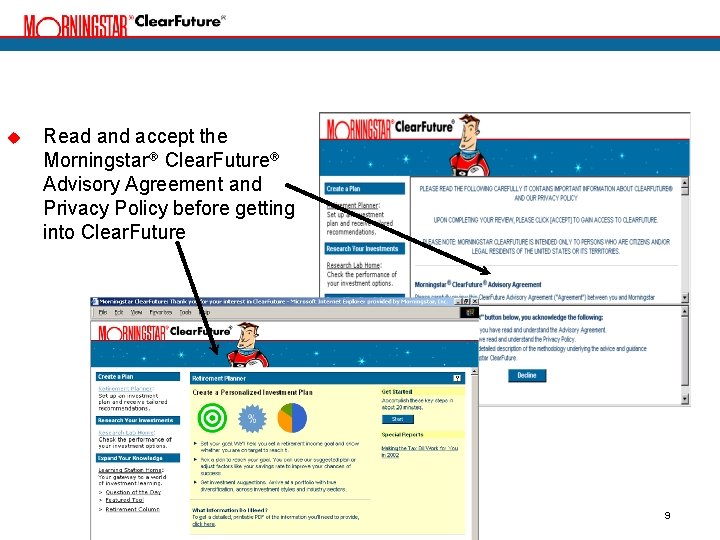

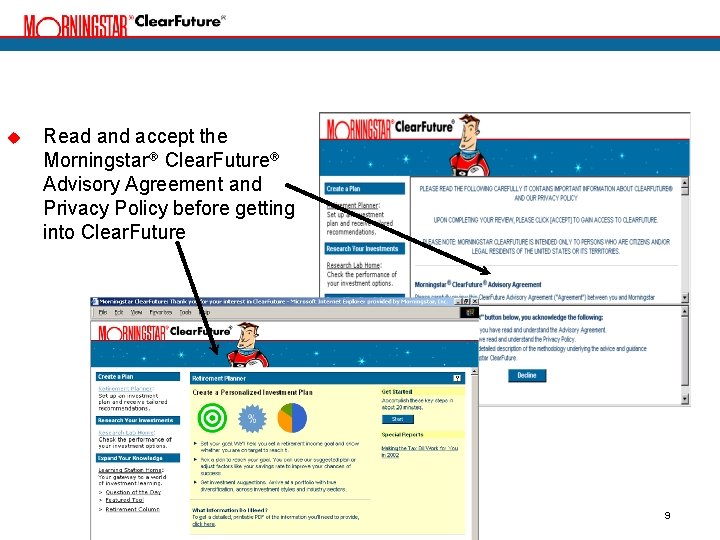

u Read and accept the Morningstar Clear. Future Advisory Agreement and Privacy Policy before getting into Clear. Future 9

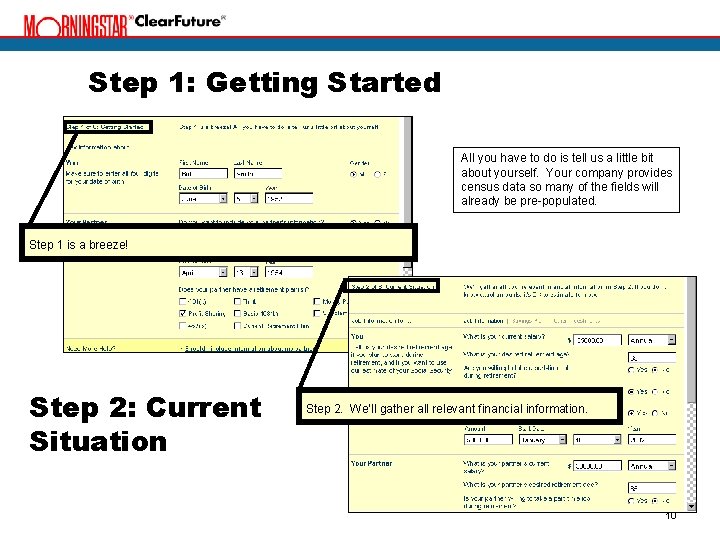

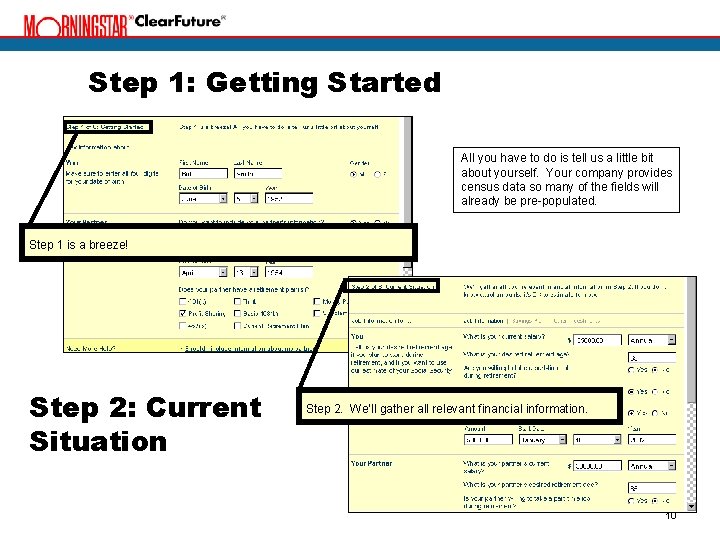

Step 1: Getting Started All you have to do is tell us a little bit about yourself. Your company provides census data so many of the fields will already be pre-populated. Step 1 is a breeze! Step 2: Current Situation Step 2. We’ll gather all relevant financial information. 10

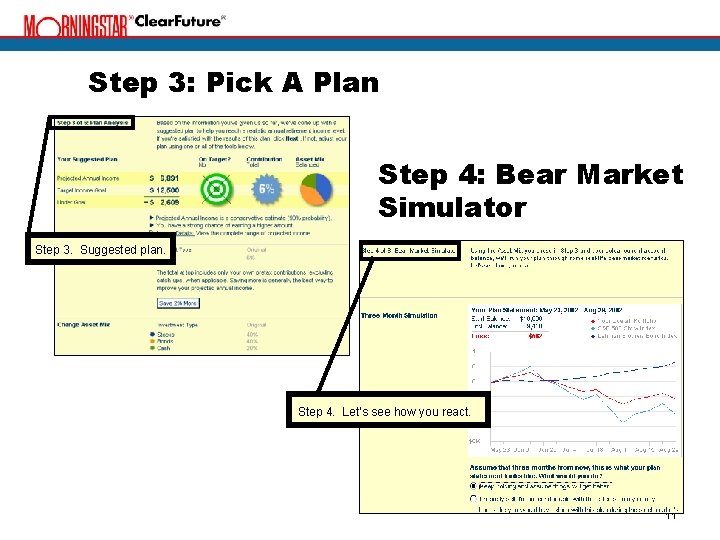

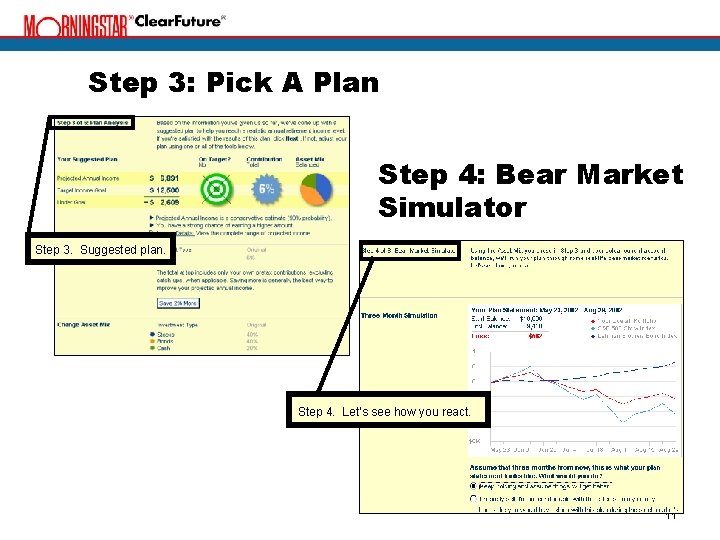

Step 3: Pick A Plan Step 4: Bear Market Simulator Step 3. Suggested plan. Step 4. Let’s see how you react. 11

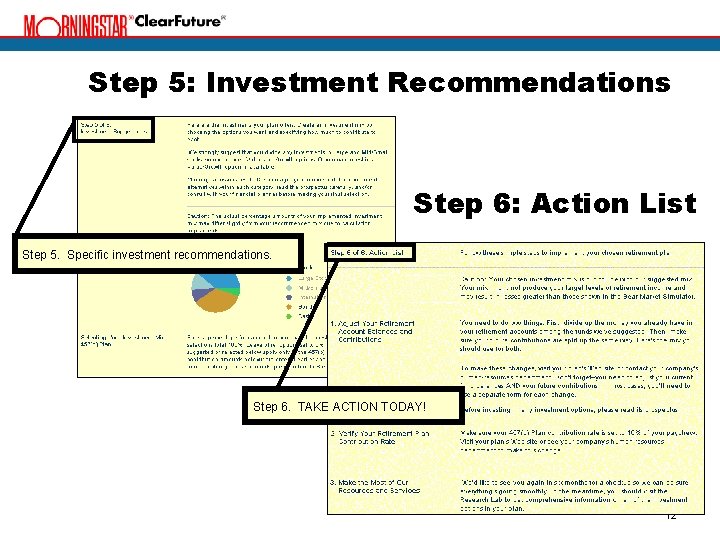

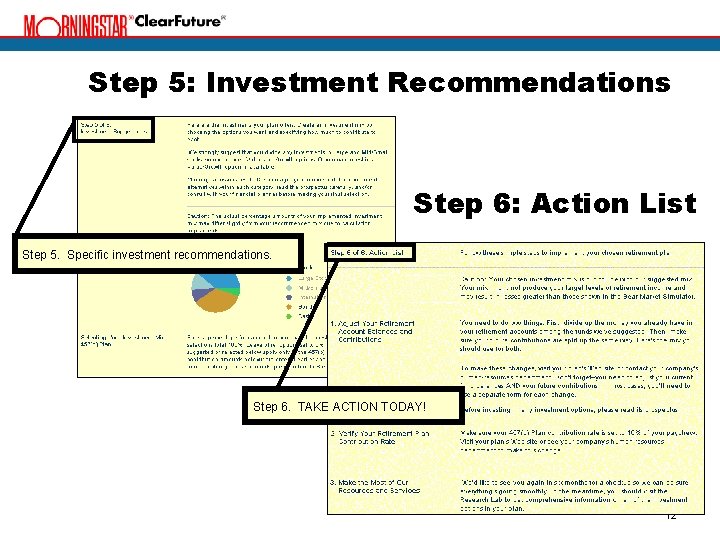

Step 5: Investment Recommendations Step 6: Action List Step 5. Specific investment recommendations. Step 6. TAKE ACTION TODAY! 12

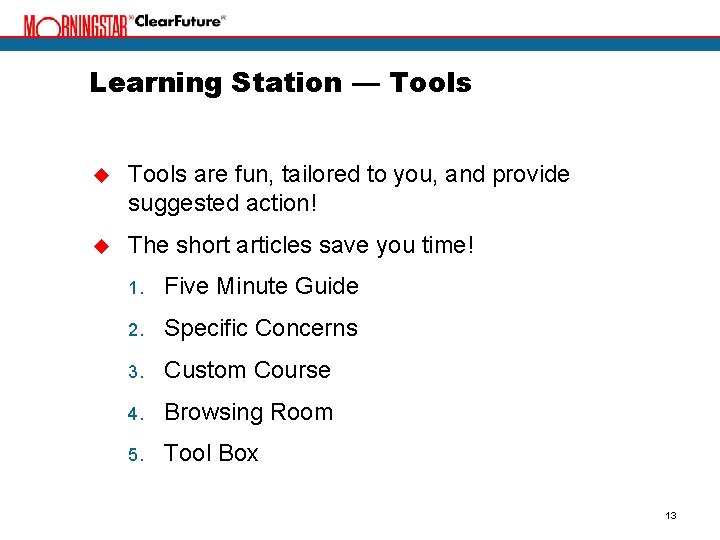

Learning Station — Tools u Tools are fun, tailored to you, and provide suggested action! u The short articles save you time! 1. Five Minute Guide 2. Specific Concerns 3. Custom Course 4. Browsing Room 5. Tool Box 13

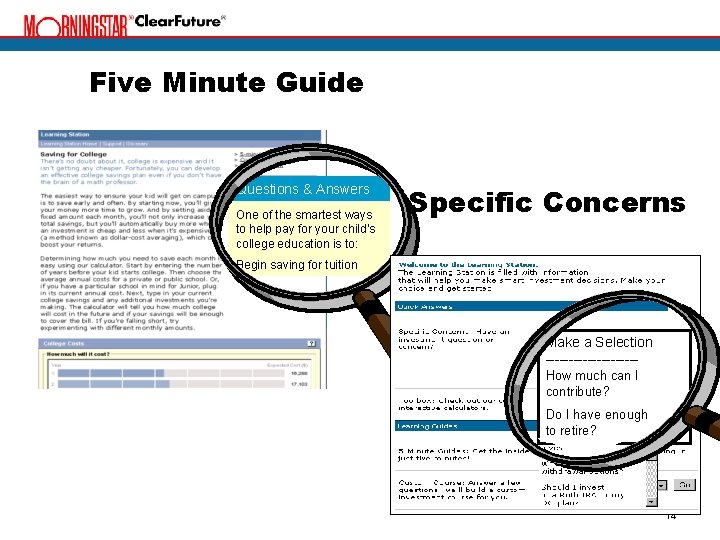

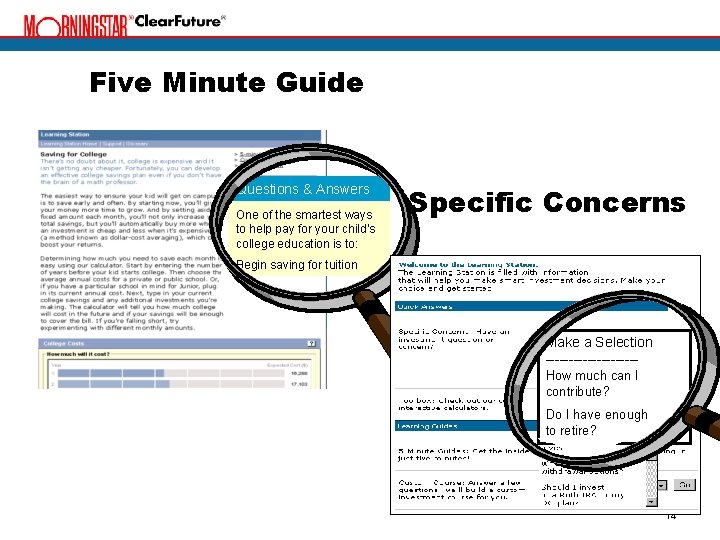

Five Minute Guide Questions & Answers One of the smartest ways to help pay for your child’s college education is to: Specific Concerns Begin saving for tuition Make a Selection ----------How much can I contribute? Do I have enough to retire? 14

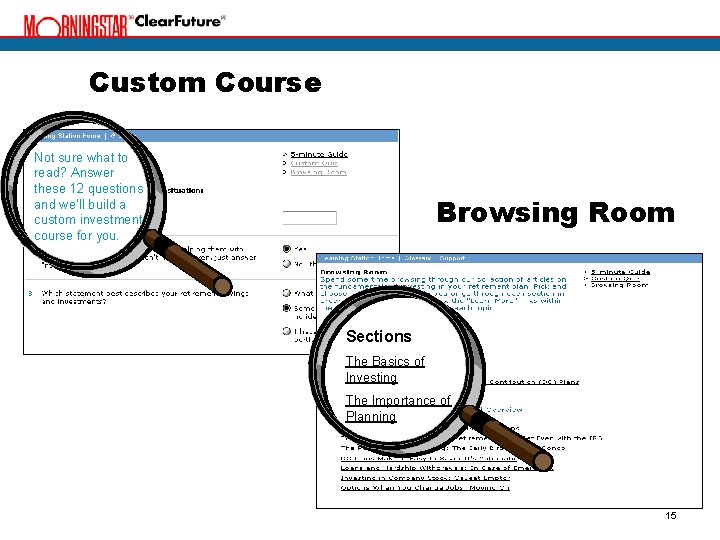

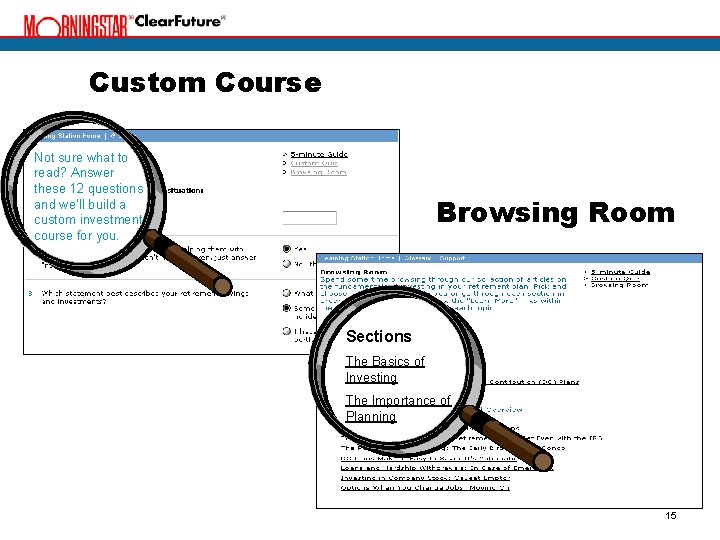

Custom Course Not sure what to read? Answer these 12 questions and we’ll build a custom investment course for you. Browsing Room Sections The Basics of Investing The Importance of Planning 15

Research Lab u Overview of investment choices u Customized search capabilities u Morningstar® Investment Profile™ reports 16

Will you retire on target? “The Hartford” is The Hartford Financial Services Group, Inc. and its subsidiaries, including issuing company Hartford Life Insurance Company. Retirement programs are funded by group variable annuity contracts (HL-15811, HVL-11002 and HVL-21002 series, HVL-14000, HVL-14001 and HVL-20000, HL-14848, HL-15420 with Rider HL-16957 and HVL-11002 and HVL-21002 series for NY, HL-14991, NY & FL: HL-14973) and group variable funding agreements (HL-16553 and HL-16553 for NY), or The Hartford Mutual Funds. Group variable annuities and group variable funding agreements issued by Hartford Life Insurance Company. Group variable annuity contracts are underwritten and distributed by Hartford Securities Distribution Company, Inc. where applicable. The Hartford Mutual Funds are underwritten and distributed by Hartford Investment Financial Services, LLC. For more complete information on The Hartford's group variable annuities, group variable funding agreements, or The Hartford Mutual Funds, including charges and expenses, call us at 1 -800 -874 -2502 to obtain a prospectus or disclosure documents (including the Program Overview, Program Highlights, Investment Option Fee Schedule and applicable historical investment option performance information), whichever is applicable. Read this material carefully before you invest or send money. Neither The Hartford nor its agents or employees provide investment, financial, tax, legal or accounting advice. Please consult with professional advisors if you need these services. 17

Figure 12-1 provides an overview of the lymphatic vessels

Figure 12-1 provides an overview of the lymphatic vessels Leads provides access to

Leads provides access to Exchange online protection overview

Exchange online protection overview Greater hartford board of realtors

Greater hartford board of realtors Urban-craig nomogram

Urban-craig nomogram Marquee new hartford

Marquee new hartford What is the capital of new york

What is the capital of new york Hartford funds media replay

Hartford funds media replay Hartford

Hartford Respuesta

Respuesta Hartford webtpa

Hartford webtpa Hartford safe haven program

Hartford safe haven program The hartford times

The hartford times Scott thumma

Scott thumma Started an all-female academy in hartford, connecticut.

Started an all-female academy in hartford, connecticut. Terminal access controller access-control system

Terminal access controller access-control system Terminal access controller access-control system

Terminal access controller access-control system Online public access catalogue

Online public access catalogue