National University of Ireland Galway Presentation to Pension

- Slides: 41

National University of Ireland, Galway Presentation to Pension Scheme Members 10 th of March 2004, Siobhan Mc. Kenna Theatre 1 l Joint Pension Fund l (Incorporating Pension Scheme No. 1, Pension Scheme No. 2 and the Joint Pension Scheme).

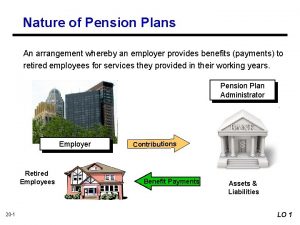

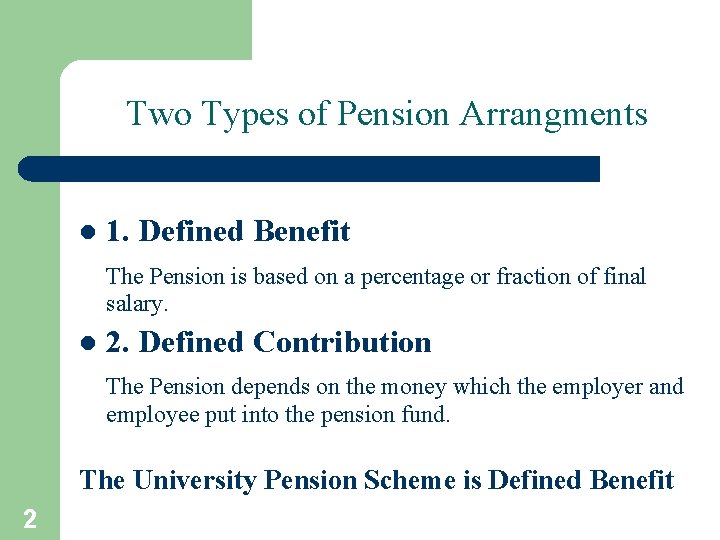

Two Types of Pension Arrangments l 1. Defined Benefit The Pension is based on a percentage or fraction of final salary. l 2. Defined Contribution The Pension depends on the money which the employer and employee put into the pension fund. The University Pension Scheme is Defined Benefit 2

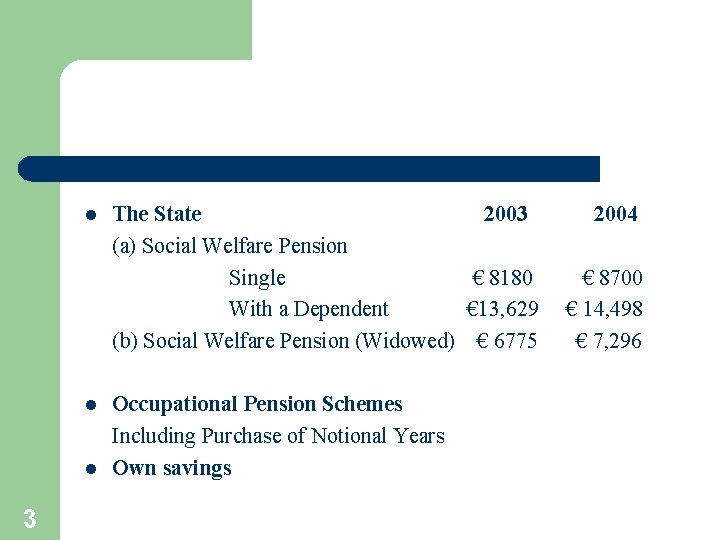

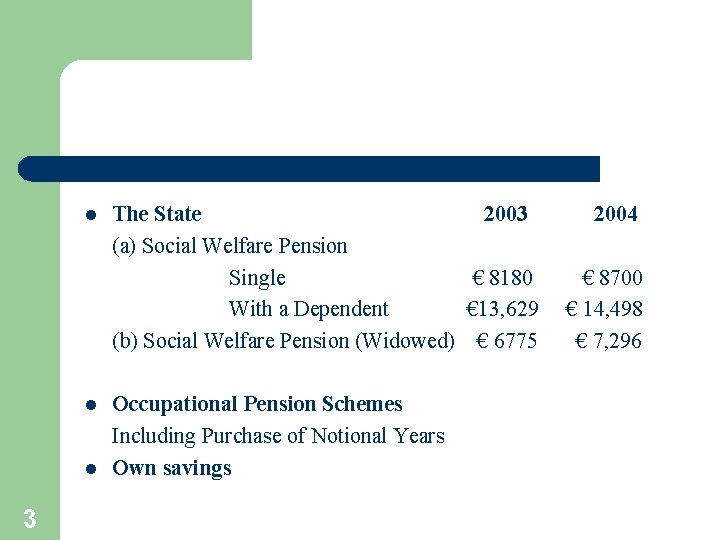

l l l 3 The State 2003 (a) Social Welfare Pension Single € 8180 With a Dependent € 13, 629 (b) Social Welfare Pension (Widowed) € 6775 Occupational Pension Schemes Including Purchase of Notional Years Own savings 2004 € 8700 € 14, 498 € 7, 296

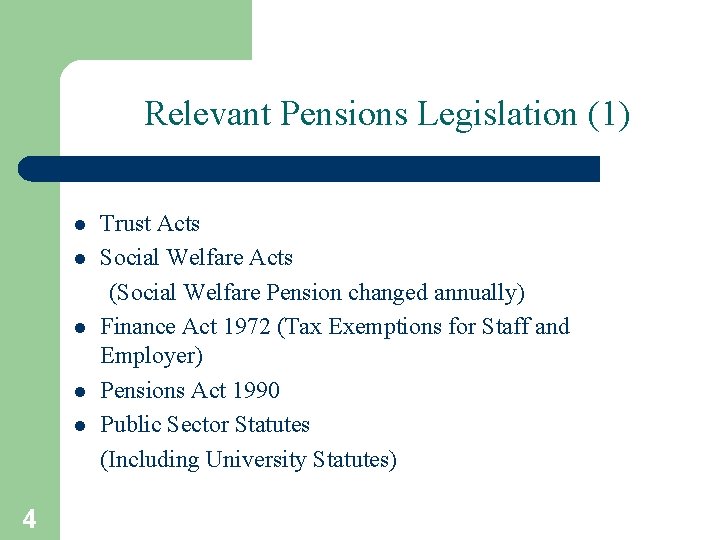

Relevant Pensions Legislation (1) l l l 4 Trust Acts Social Welfare Acts (Social Welfare Pension changed annually) Finance Act 1972 (Tax Exemptions for Staff and Employer) Pensions Act 1990 Public Sector Statutes (Including University Statutes)

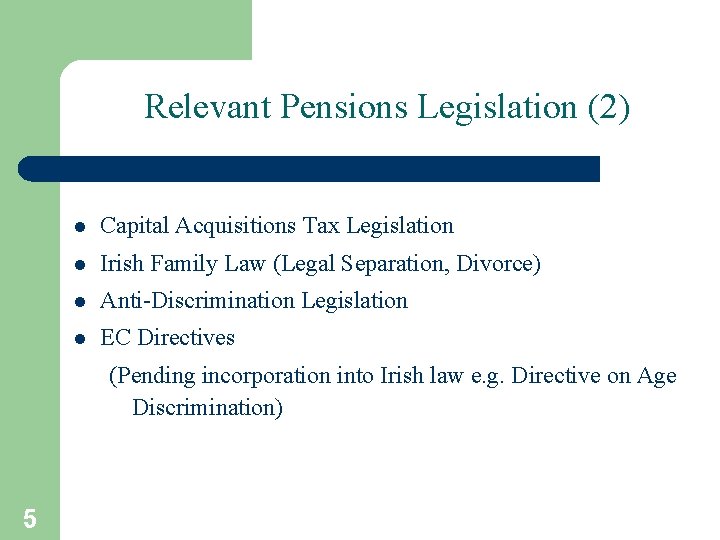

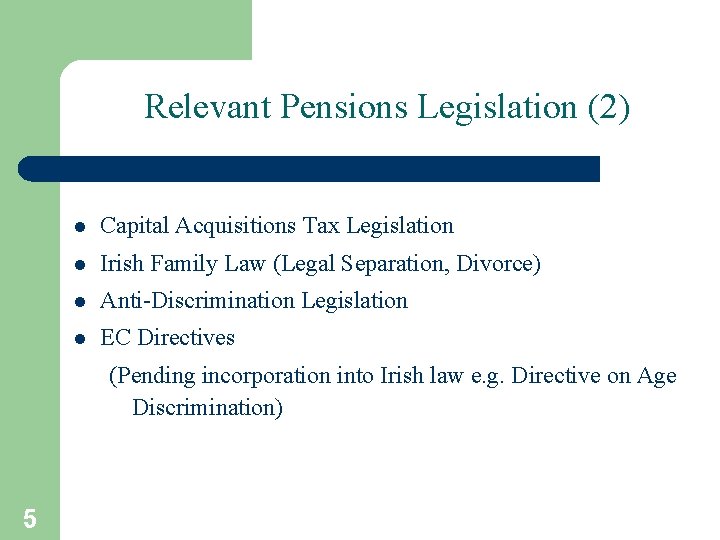

Relevant Pensions Legislation (2) l Capital Acquisitions Tax Legislation l Irish Family Law (Legal Separation, Divorce) l Anti-Discrimination Legislation l EC Directives (Pending incorporation into Irish law e. g. Directive on Age Discrimination) 5

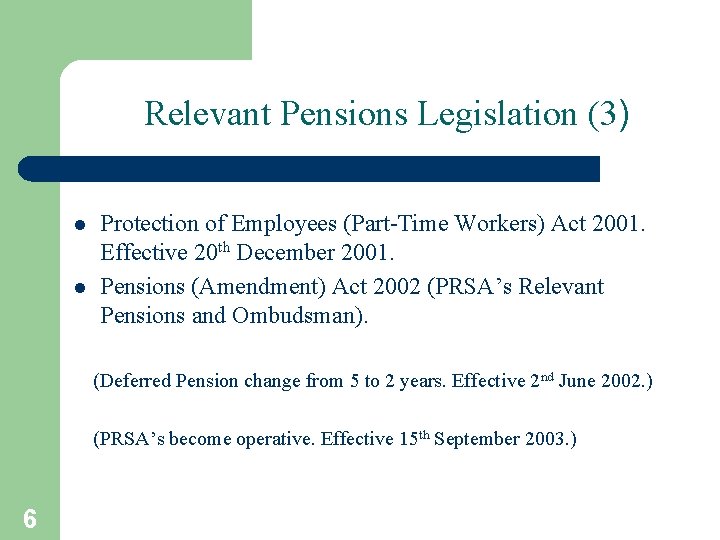

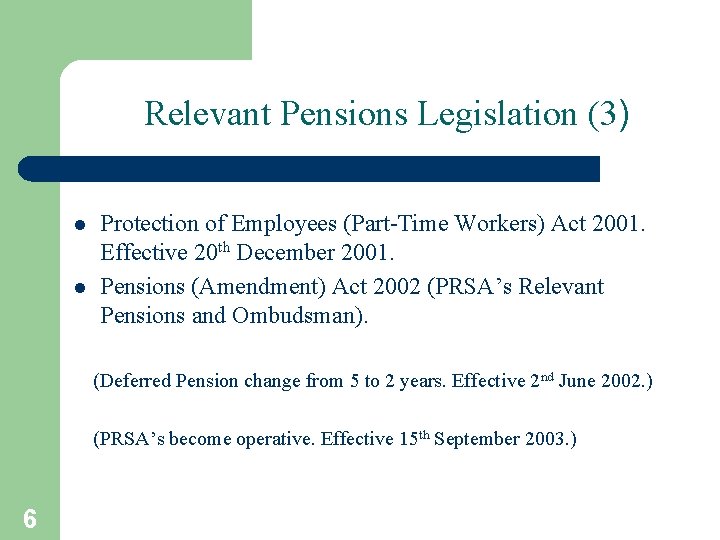

Relevant Pensions Legislation (3) l l Protection of Employees (Part-Time Workers) Act 2001. Effective 20 th December 2001. Pensions (Amendment) Act 2002 (PRSA’s Relevant Pensions and Ombudsman). (Deferred Pension change from 5 to 2 years. Effective 2 nd June 2002. ) (PRSA’s become operative. Effective 15 th September 2003. ) 6

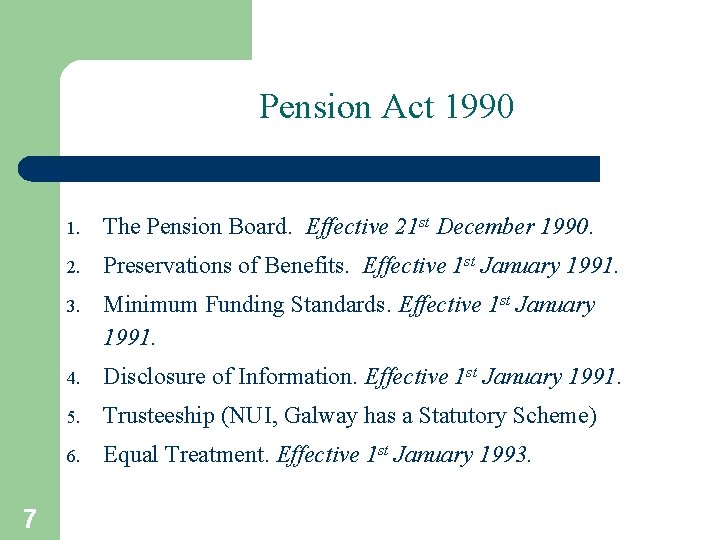

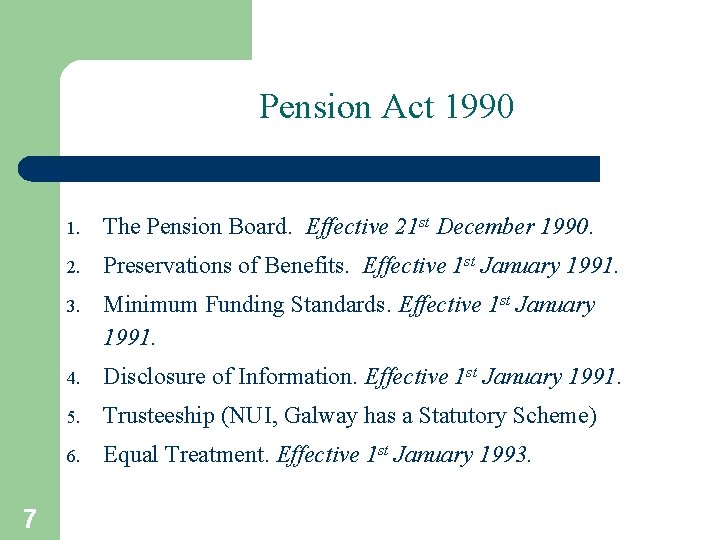

Pension Act 1990 7 1. The Pension Board. Effective 21 st December 1990. 2. Preservations of Benefits. Effective 1 st January 1991. 3. Minimum Funding Standards. Effective 1 st January 1991. 4. Disclosure of Information. Effective 1 st January 1991. 5. Trusteeship (NUI, Galway has a Statutory Scheme) 6. Equal Treatment. Effective 1 st January 1993.

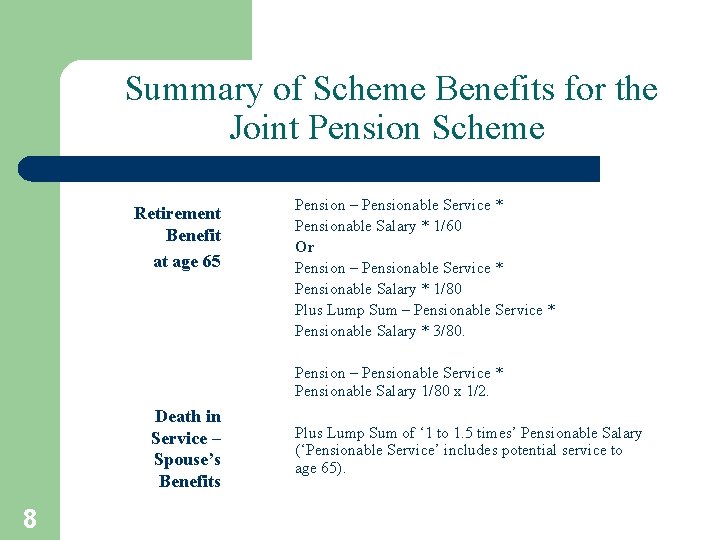

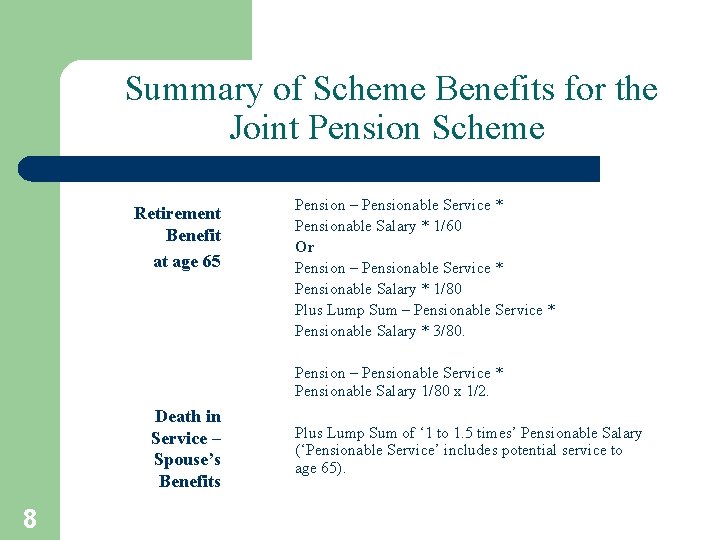

Summary of Scheme Benefits for the Joint Pension Scheme Retirement Benefit at age 65 Pension – Pensionable Service * Pensionable Salary * 1/60 Or Pension – Pensionable Service * Pensionable Salary * 1/80 Plus Lump Sum – Pensionable Service * Pensionable Salary * 3/80. Pension – Pensionable Service * Pensionable Salary 1/80 x 1/2. Death in Service – Spouse’s Benefits 8 Plus Lump Sum of ‘ 1 to 1. 5 times’ Pensionable Salary (‘Pensionable Service’ includes potential service to age 65).

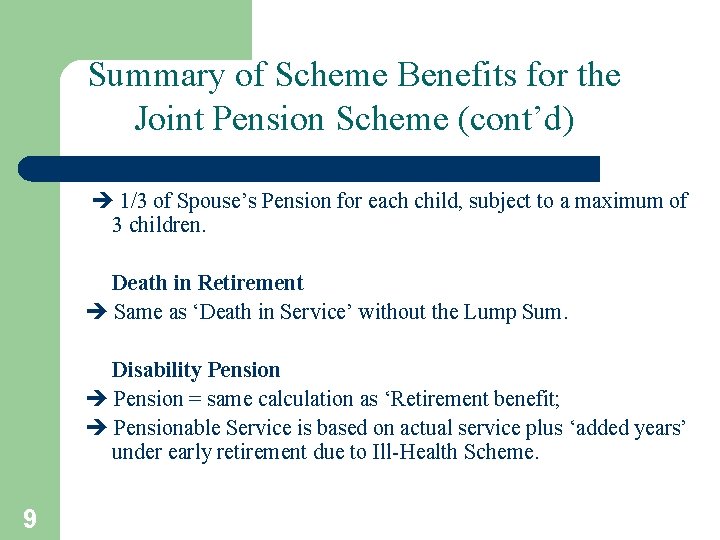

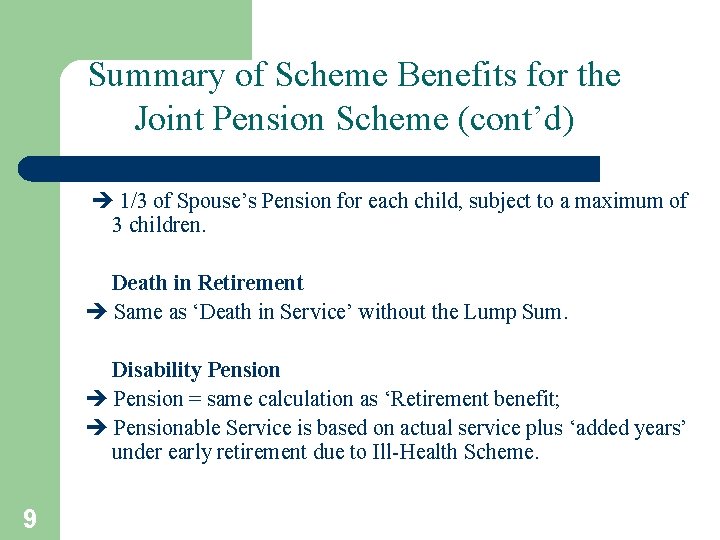

Summary of Scheme Benefits for the Joint Pension Scheme (cont’d) Death in Service – Children’s Benefits 1/3 of Spouse’s Pension for each child, subject to a maximum of 3 children. Death in Retirement Same as ‘Death in Service’ without the Lump Sum. Disability Pension = same calculation as ‘Retirement benefit; Pensionable Service is based on actual service plus ‘added years’ under early retirement due to Ill-Health Scheme. 9

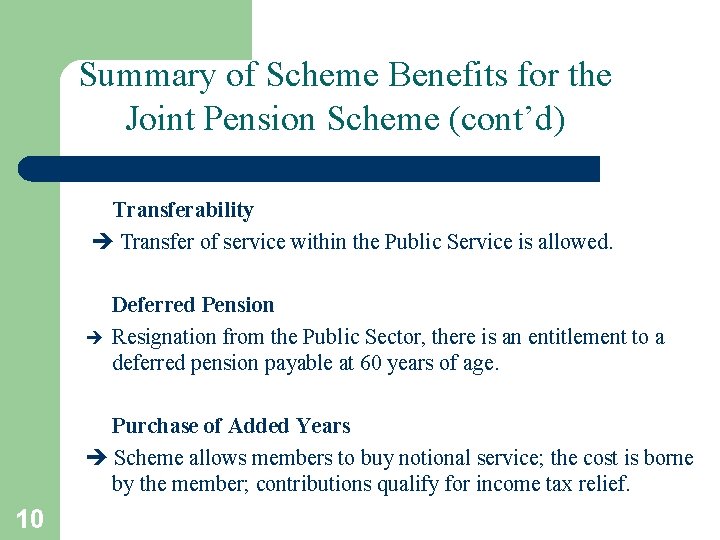

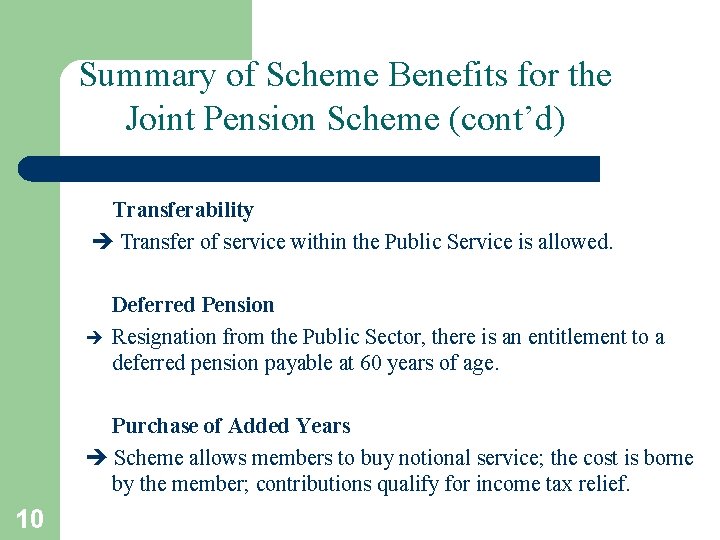

Summary of Scheme Benefits for the Joint Pension Scheme (cont’d) Transferability Transfer of service within the Public Service is allowed. Deferred Pension Resignation from the Public Sector, there is an entitlement to a deferred pension payable at 60 years of age. Purchase of Added Years Scheme allows members to buy notional service; the cost is borne by the member; contributions qualify for income tax relief. 10

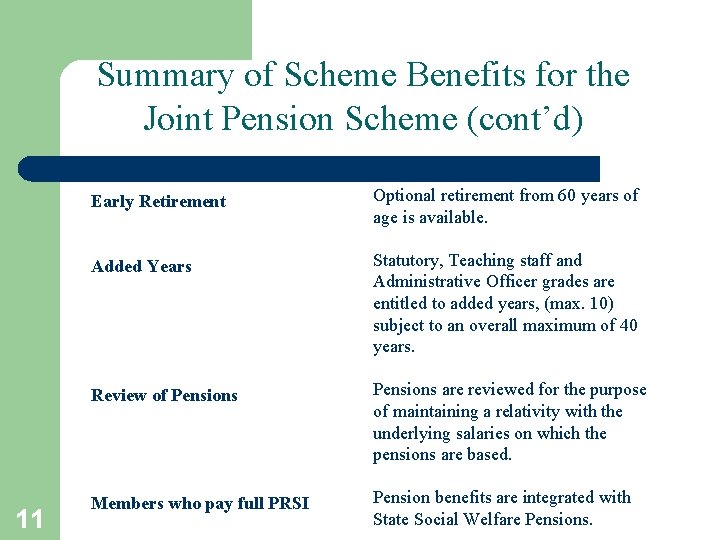

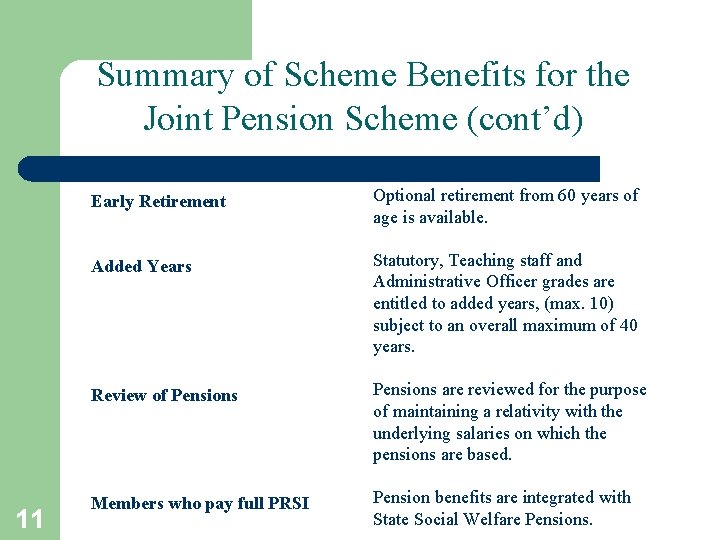

Summary of Scheme Benefits for the Joint Pension Scheme (cont’d) 11 Early Retirement Optional retirement from 60 years of age is available. Added Years Statutory, Teaching staff and Administrative Officer grades are entitled to added years, (max. 10) subject to an overall maximum of 40 years. Review of Pensions are reviewed for the purpose of maintaining a relativity with the underlying salaries on which the pensions are based. Members who pay full PRSI Pension benefits are integrated with State Social Welfare Pensions.

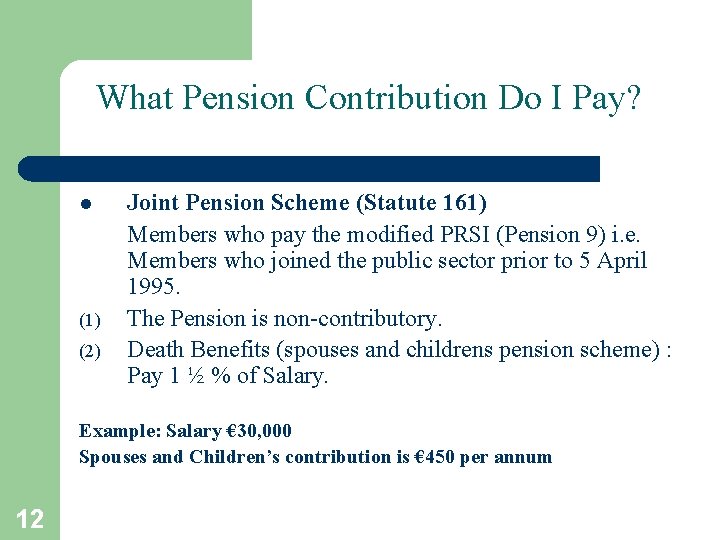

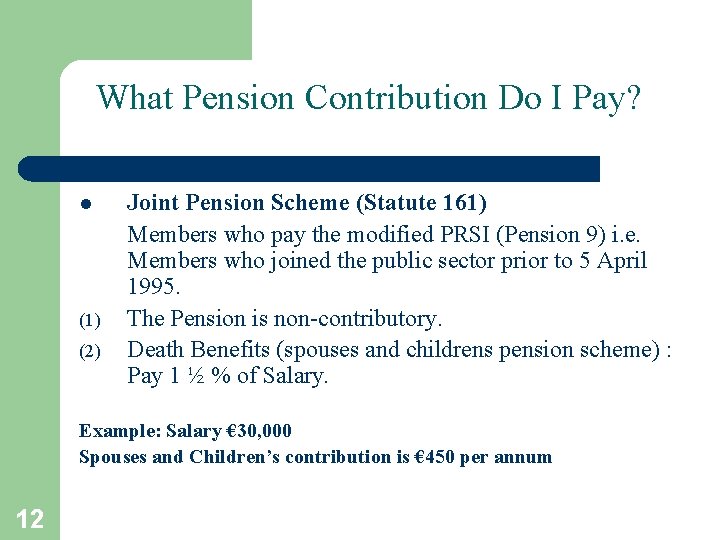

What Pension Contribution Do I Pay? l (1) (2) Joint Pension Scheme (Statute 161) Members who pay the modified PRSI (Pension 9) i. e. Members who joined the public sector prior to 5 April 1995. The Pension is non-contributory. Death Benefits (spouses and childrens pension scheme) : Pay 1 ½ % of Salary. Example: Salary € 30, 000 Spouses and Children’s contribution is € 450 per annum 12

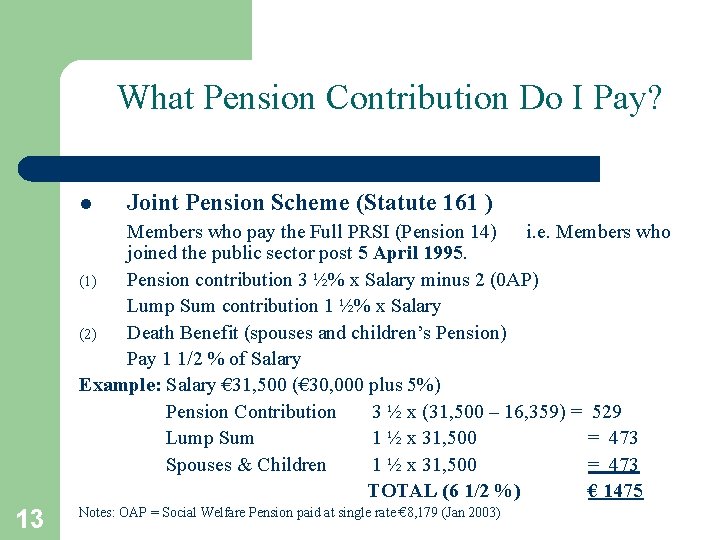

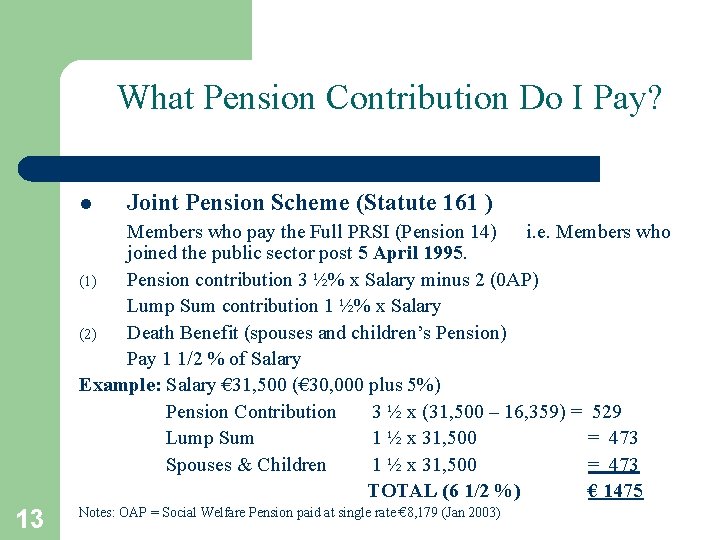

What Pension Contribution Do I Pay? l Joint Pension Scheme (Statute 161 ) Members who pay the Full PRSI (Pension 14) i. e. Members who joined the public sector post 5 April 1995. (1) Pension contribution 3 ½% x Salary minus 2 (0 AP) Lump Sum contribution 1 ½% x Salary (2) Death Benefit (spouses and children’s Pension) Pay 1 1/2 % of Salary Example: Salary € 31, 500 (€ 30, 000 plus 5%) Pension Contribution 3 ½ x (31, 500 – 16, 359) = 529 Lump Sum 1 ½ x 31, 500 = 473 Spouses & Children 1 ½ x 31, 500 = 473 TOTAL (6 1/2 %) € 1475 13 Notes: OAP = Social Welfare Pension paid at single rate € 8, 179 (Jan 2003)

Calculation of your Pension at Retirement 14 l Pension Scheme No. 1 and No. 2 l Joint Pension Scheme Modified PRSI (Pension 9) l Joint Pension Scheme PRSI Full (Pension 14)

Pension Based On: 1. Fraction 1/60 or 1/80 + Lump Sum 2. Final Salary 3. Service (Number of Years) 4. Social Welfare Pension Rates (January 2003) € 8, 179 Single Rate € 12, 269 1 ½ x Single Rate € 16, 359 2 x Single Rate 5. Taxation 15

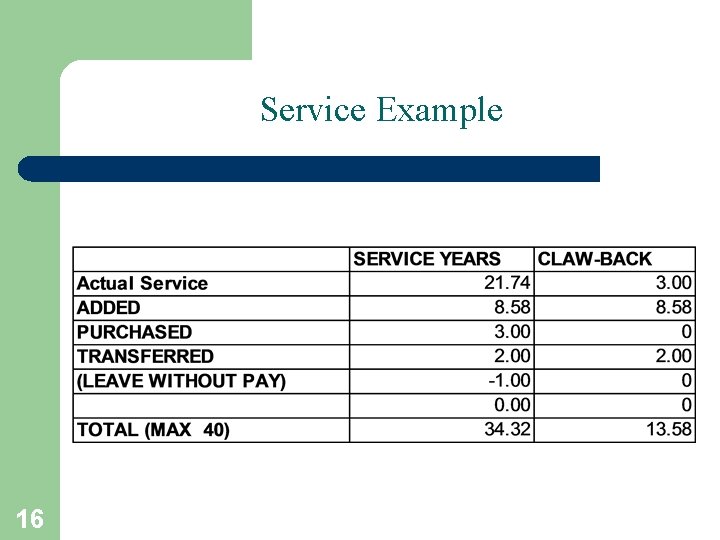

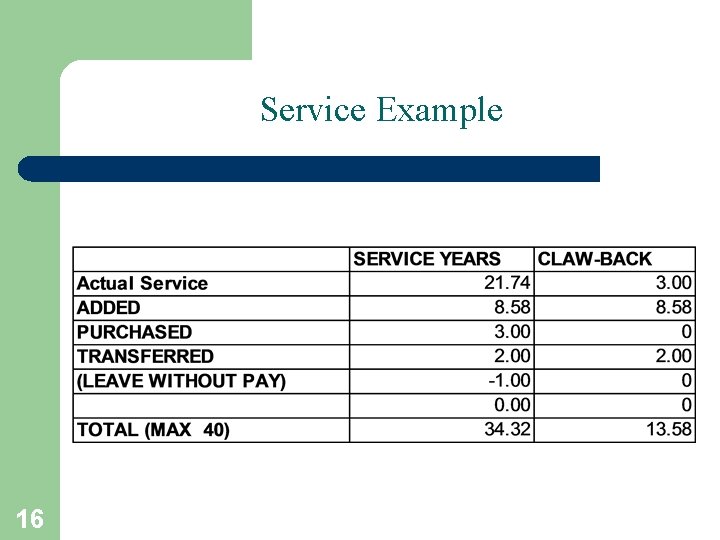

Service Example 16

Pensionable Salary Pensionable salary for the purpose of pension calculation is the annual basic remuneration payable at retirement or death. ALLOWANCES ARE NOT PENSIONABLE. Some Grades (e. g. : Technicians) get Salary Awards which are pensionable. In the case of persons who pay the full PRSI Contributions there is a ‘Net Final Salary’ which is used in the calculations of the Pension (‘Full PRSI Contributions’). The pensionable salary is (salary minus twice the old age retirement social welfare pension) in respect of a pension calculated in 1/80 ths (one- eightieths). 17

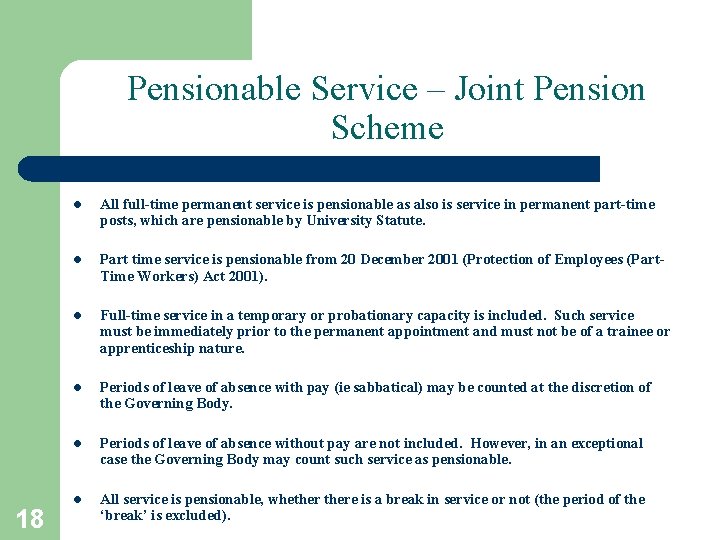

Pensionable Service – Joint Pension Scheme 18 l All full-time permanent service is pensionable as also is service in permanent part-time posts, which are pensionable by University Statute. l Part time service is pensionable from 20 December 2001 (Protection of Employees (Part. Time Workers) Act 2001). l Full-time service in a temporary or probationary capacity is included. Such service must be immediately prior to the permanent appointment and must not be of a trainee or apprenticeship nature. l Periods of leave of absence with pay (ie sabbatical) may be counted at the discretion of the Governing Body. l Periods of leave of absence without pay are not included. However, in an exceptional case the Governing Body may count such service as pensionable. l All service is pensionable, whethere is a break in service or not (the period of the ‘break’ is excluded).

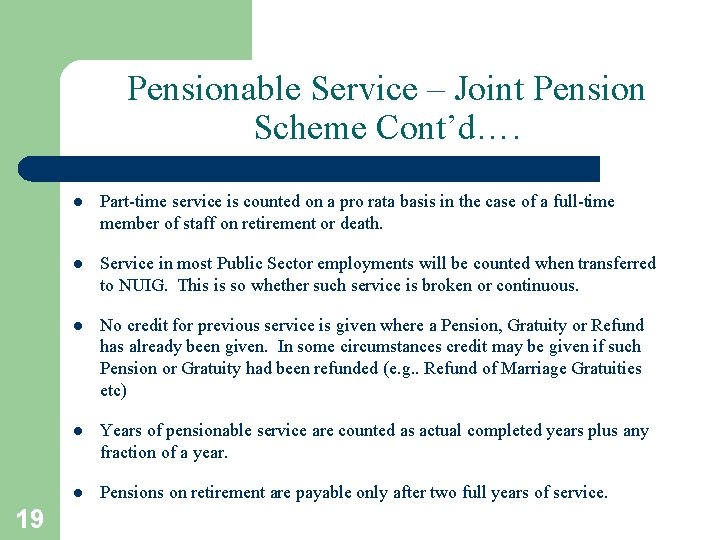

Pensionable Service – Joint Pension Scheme Cont’d…. 19 l Part-time service is counted on a pro rata basis in the case of a full-time member of staff on retirement or death. l Service in most Public Sector employments will be counted when transferred to NUIG. This is so whether such service is broken or continuous. l No credit for previous service is given where a Pension, Gratuity or Refund has already been given. In some circumstances credit may be given if such Pension or Gratuity had been refunded (e. g. . Refund of Marriage Gratuities etc) l Years of pensionable service are counted as actual completed years plus any fraction of a year. l Pensions on retirement are payable only after two full years of service.

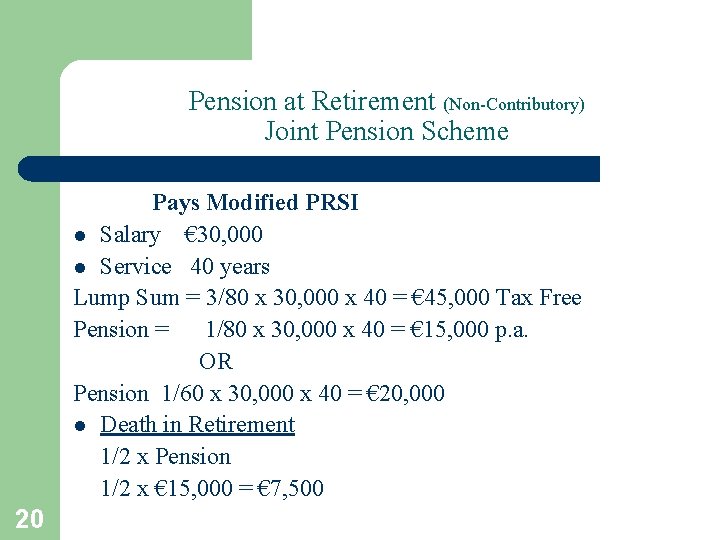

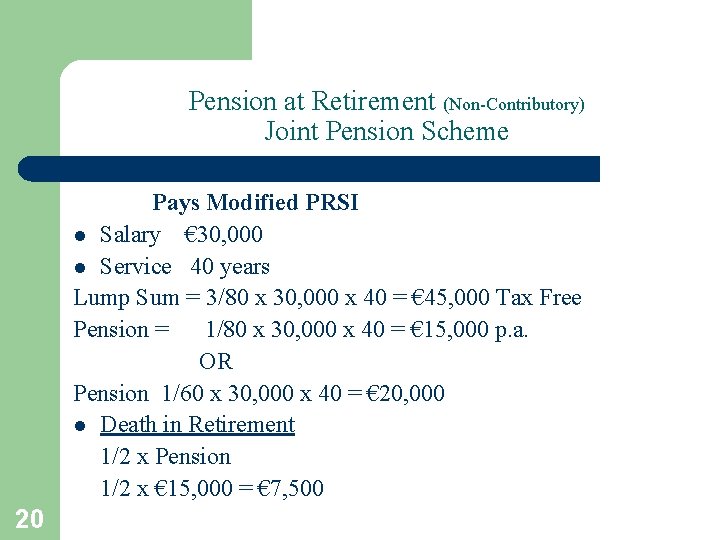

Pension at Retirement (Non-Contributory) Joint Pension Scheme Pays Modified PRSI l Salary € 30, 000 l Service 40 years Lump Sum = 3/80 x 30, 000 x 40 = € 45, 000 Tax Free Pension = 1/80 x 30, 000 x 40 = € 15, 000 p. a. OR Pension 1/60 x 30, 000 x 40 = € 20, 000 l Death in Retirement 1/2 x Pension 1/2 x € 15, 000 = € 7, 500 20

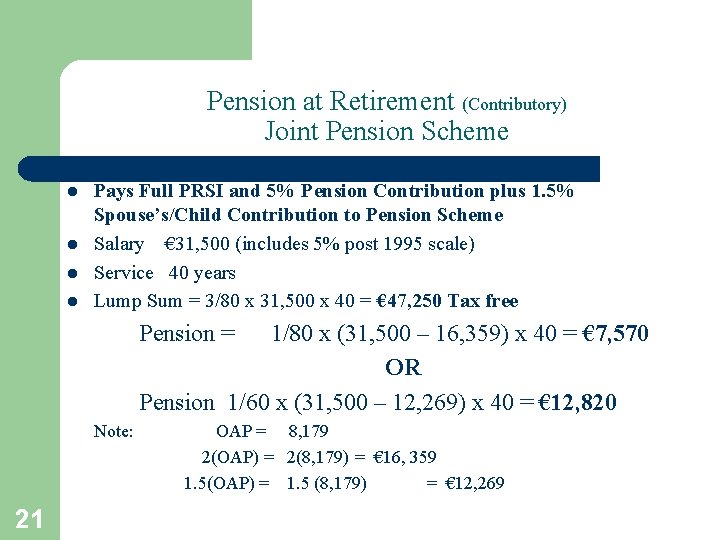

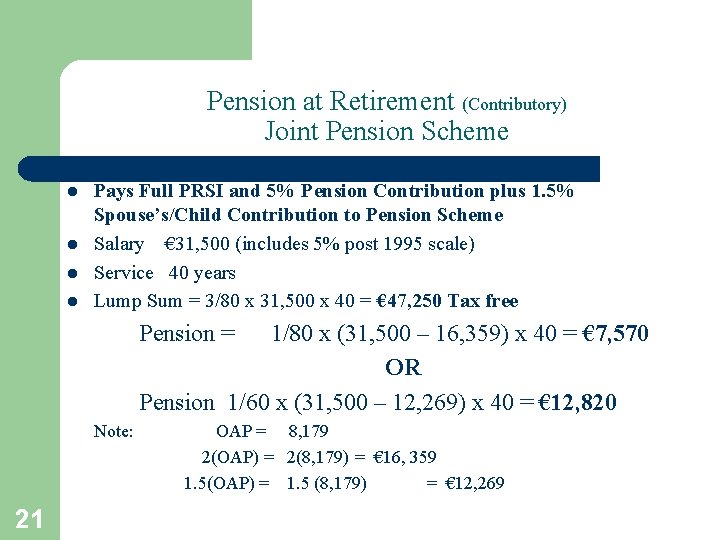

Pension at Retirement (Contributory) Joint Pension Scheme l l Pays Full PRSI and 5% Pension Contribution plus 1. 5% Spouse’s/Child Contribution to Pension Scheme Salary € 31, 500 (includes 5% post 1995 scale) Service 40 years Lump Sum = 3/80 x 31, 500 x 40 = € 47, 250 Tax free Pension = 1/80 x (31, 500 – 16, 359) x 40 = € 7, 570 OR Pension 1/60 x (31, 500 – 12, 269) x 40 = € 12, 820 Note: 21 OAP = 8, 179 2(OAP) = 2(8, 179) = € 16, 359 1. 5(OAP) = 1. 5 (8, 179) = € 12, 269

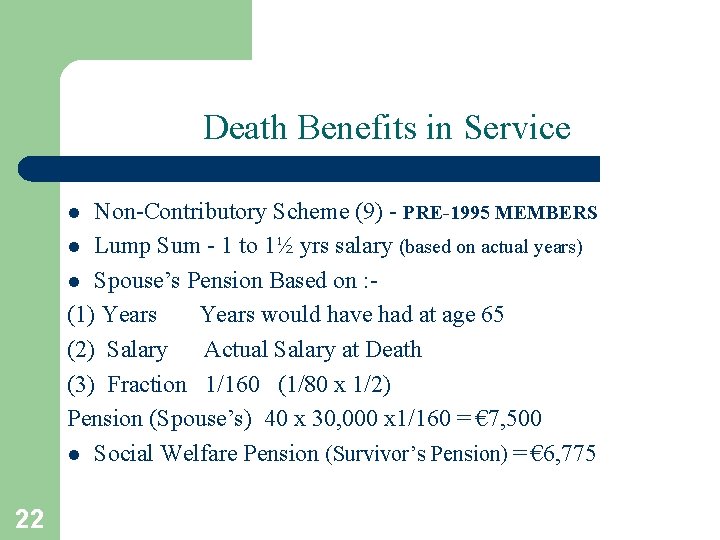

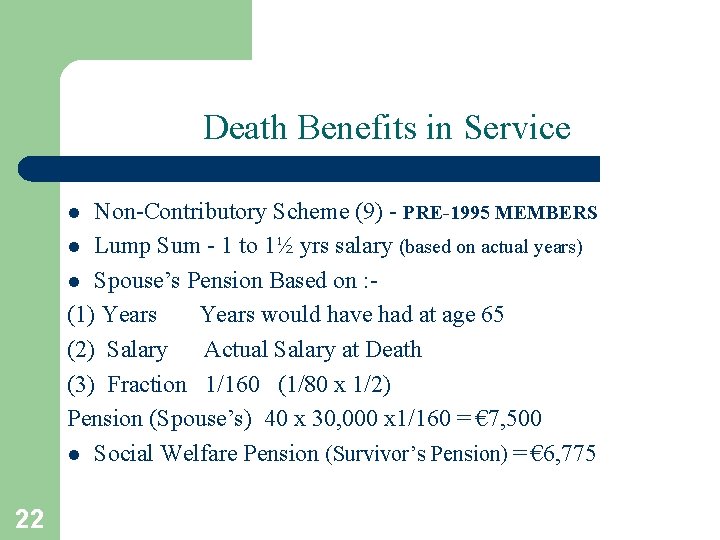

Death Benefits in Service Non-Contributory Scheme (9) - PRE-1995 MEMBERS l Lump Sum - 1 to 1½ yrs salary (based on actual years) l Spouse’s Pension Based on : (1) Years would have had at age 65 (2) Salary Actual Salary at Death (3) Fraction 1/160 (1/80 x 1/2) Pension (Spouse’s) 40 x 30, 000 x 1/160 = € 7, 500 l Social Welfare Pension (Survivor’s Pension) = € 6, 775 l 22

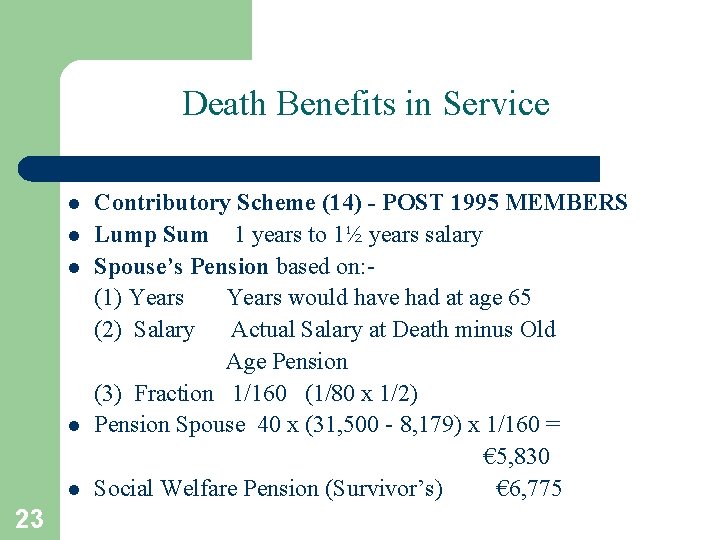

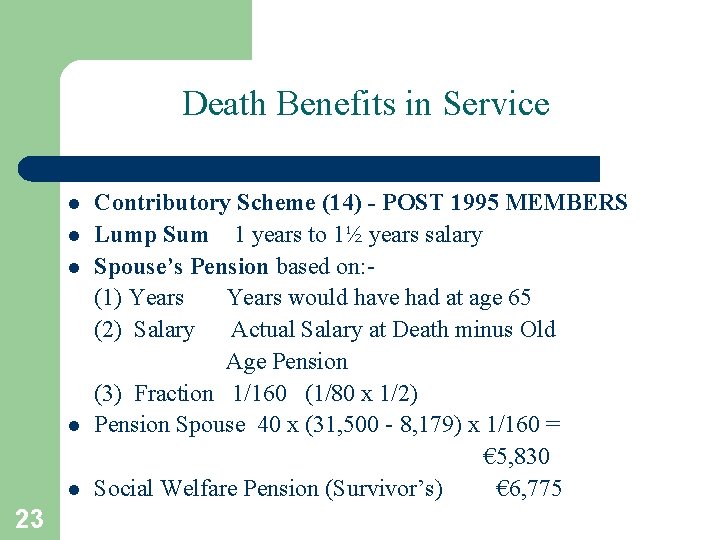

Death Benefits in Service l l l 23 Contributory Scheme (14) - POST 1995 MEMBERS Lump Sum 1 years to 1½ years salary Spouse’s Pension based on: (1) Years would have had at age 65 (2) Salary Actual Salary at Death minus Old Age Pension (3) Fraction 1/160 (1/80 x 1/2) Pension Spouse 40 x (31, 500 - 8, 179) x 1/160 = € 5, 830 Social Welfare Pension (Survivor’s) € 6, 775

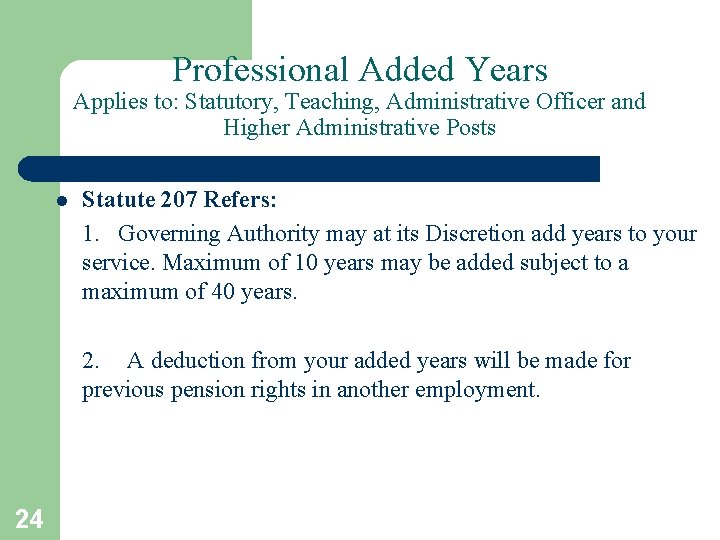

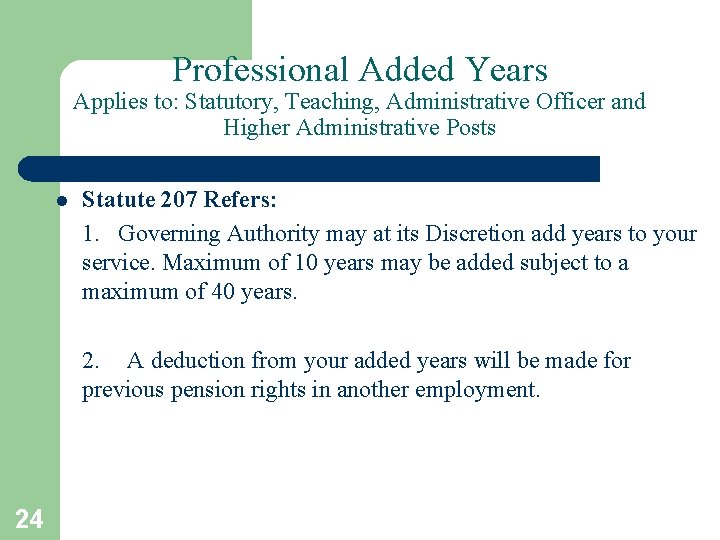

Professional Added Years Applies to: Statutory, Teaching, Administrative Officer and Higher Administrative Posts l Statute 207 Refers: 1. Governing Authority may at its Discretion add years to your service. Maximum of 10 years may be added subject to a maximum of 40 years. 2. A deduction from your added years will be made for previous pension rights in another employment. 24

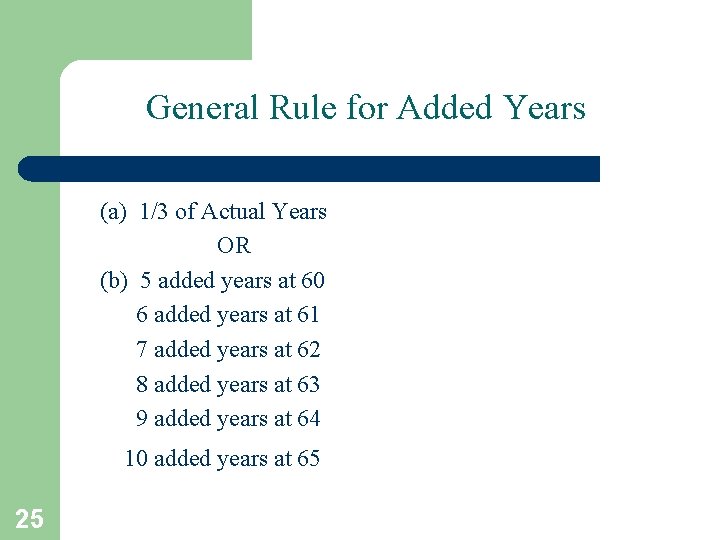

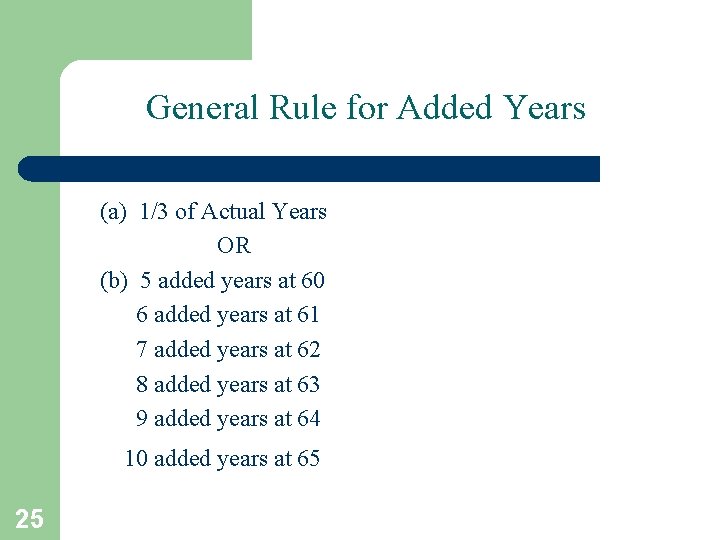

General Rule for Added Years (a) 1/3 of Actual Years OR (b) 5 added years at 60 6 added years at 61 7 added years at 62 8 added years at 63 9 added years at 64 10 added years at 65 25

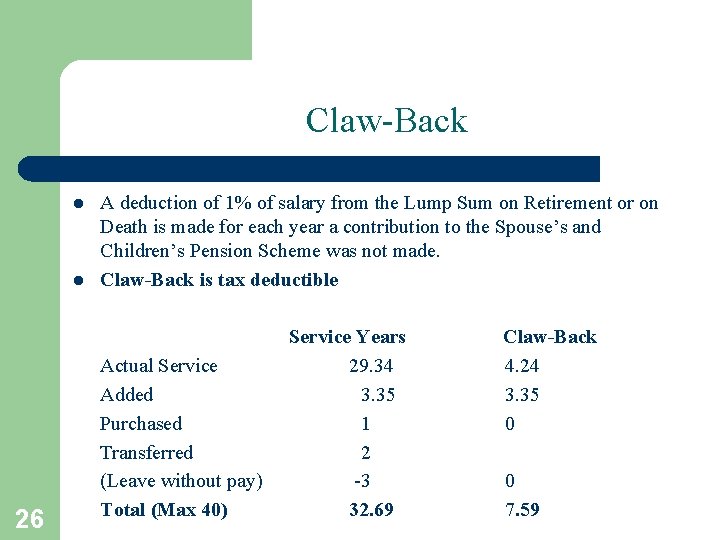

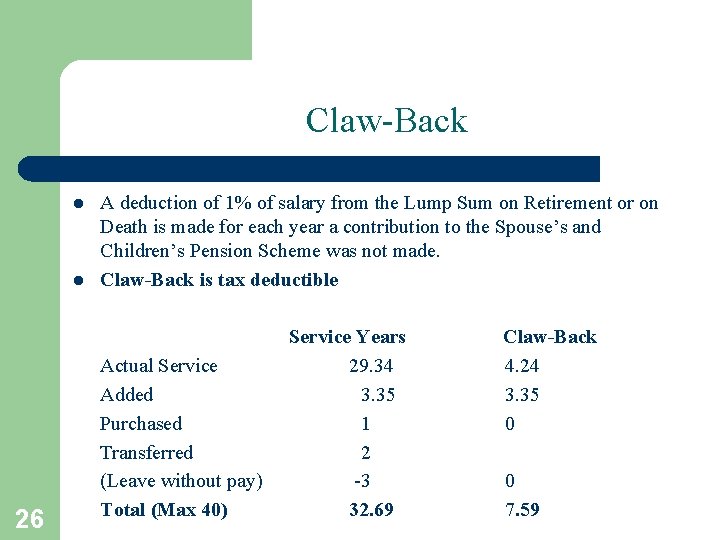

Claw-Back l l 26 A deduction of 1% of salary from the Lump Sum on Retirement or on Death is made for each year a contribution to the Spouse’s and Children’s Pension Scheme was not made. Claw-Back is tax deductible Actual Service Added Purchased Transferred (Leave without pay) Total (Max 40) Service Years 29. 34 3. 35 1 2 -3 32. 69 Claw-Back 4. 24 3. 35 0 0 7. 59

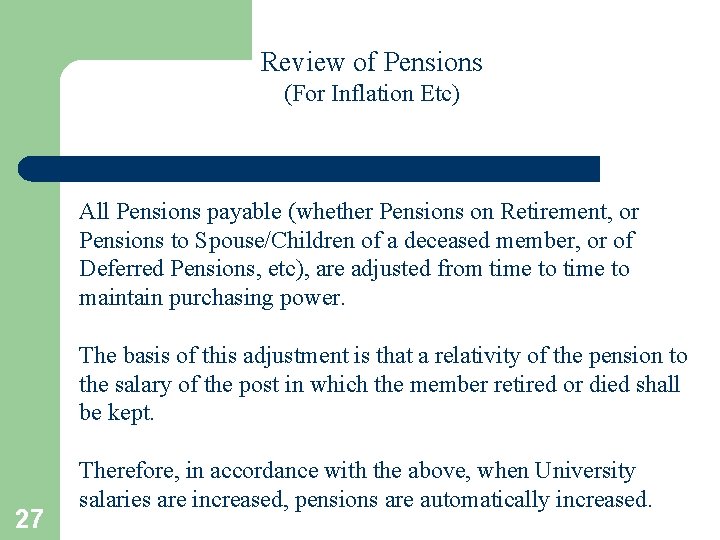

Review of Pensions (For Inflation Etc) All Pensions payable (whether Pensions on Retirement, or Pensions to Spouse/Children of a deceased member, or of Deferred Pensions, etc), are adjusted from time to maintain purchasing power. The basis of this adjustment is that a relativity of the pension to the salary of the post in which the member retired or died shall be kept. 27 Therefore, in accordance with the above, when University salaries are increased, pensions are automatically increased.

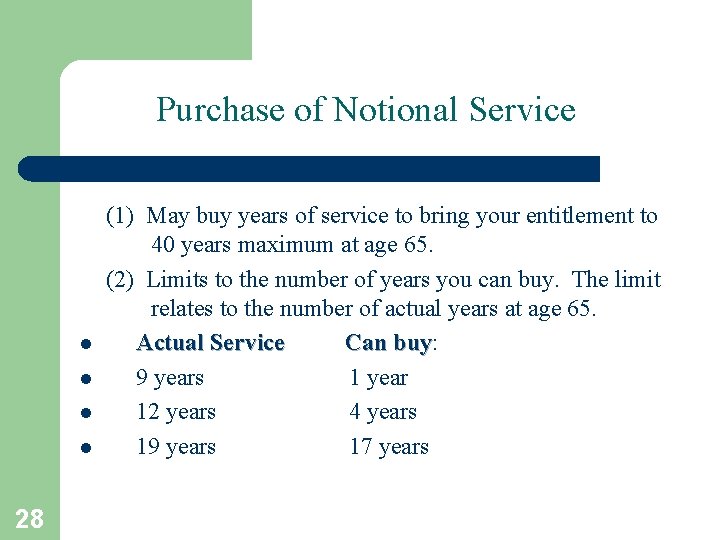

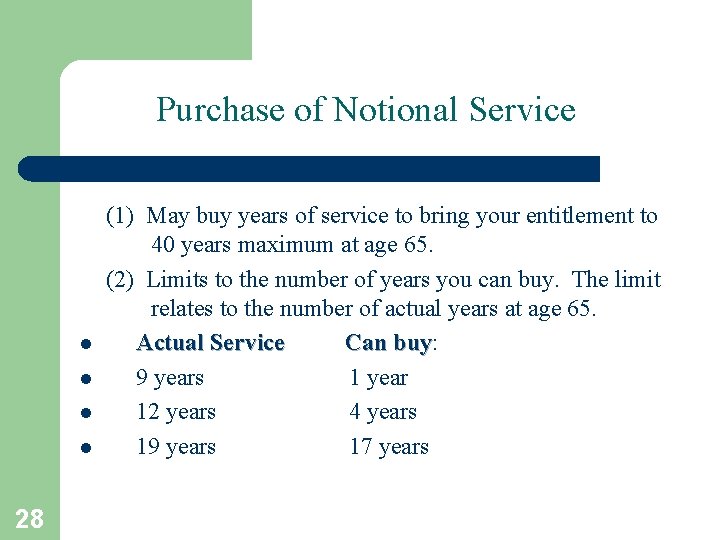

Purchase of Notional Service l l 28 (1) May buy years of service to bring your entitlement to 40 years maximum at age 65. (2) Limits to the number of years you can buy. The limit relates to the number of actual years at age 65. Actual Service Can buy: buy 9 years 1 year 12 years 4 years 19 years 17 years

Purchase of Notional Service Cont’d (3) Contributions to the Scheme are Tax Deductible at your Marginal Rate. (4) Notional Service can be bought by: (a) Monthly Contributions (b) Lump Sum (subject to conditions) 29

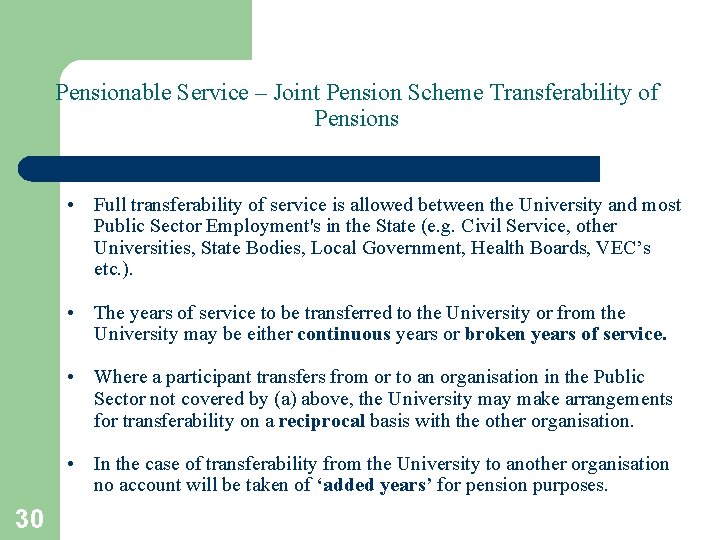

Pensionable Service – Joint Pension Scheme Transferability of Pensions • Full transferability of service is allowed between the University and most Public Sector Employment's in the State (e. g. Civil Service, other Universities, State Bodies, Local Government, Health Boards, VEC’s etc. ). • The years of service to be transferred to the University or from the University may be either continuous years or broken years of service. • Where a participant transfers from or to an organisation in the Public Sector not covered by (a) above, the University make arrangements for transferability on a reciprocal basis with the other organisation. • In the case of transferability from the University to another organisation no account will be taken of ‘added years’ for pension purposes. 30

Job Sharing l Job Sharing Staff: “Will be eligible for superannuation benefits on the same basis as full-time staff, save that each year of service in a job sharing capacity will reckon as six months for superannuation purposes. Pensionable salary will be based on full time salary. ” 31

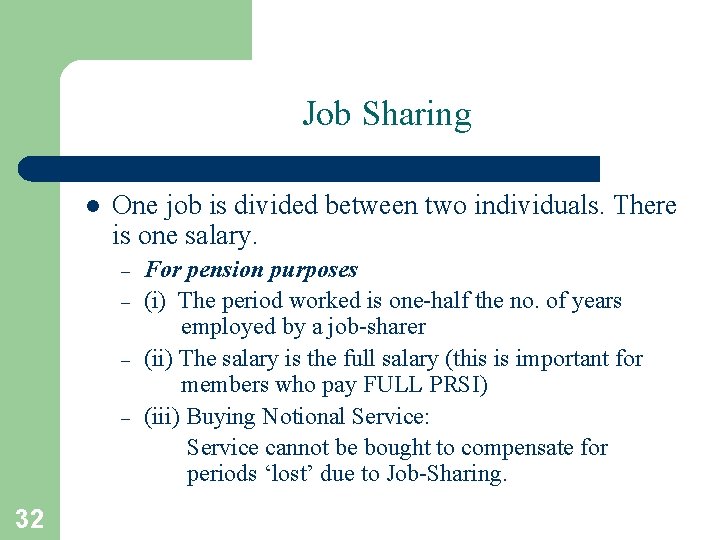

Job Sharing l One job is divided between two individuals. There is one salary. – – 32 For pension purposes (i) The period worked is one-half the no. of years employed by a job-sharer (ii) The salary is the full salary (this is important for members who pay FULL PRSI) (iii) Buying Notional Service: Service cannot be bought to compensate for periods ‘lost’ due to Job-Sharing.

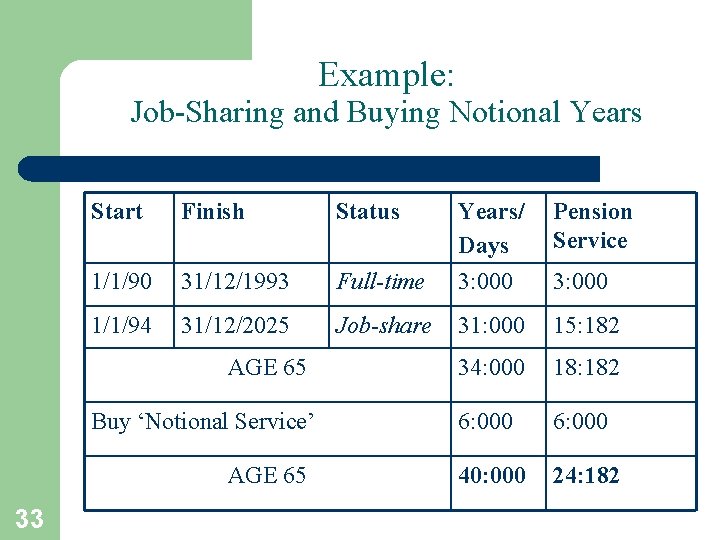

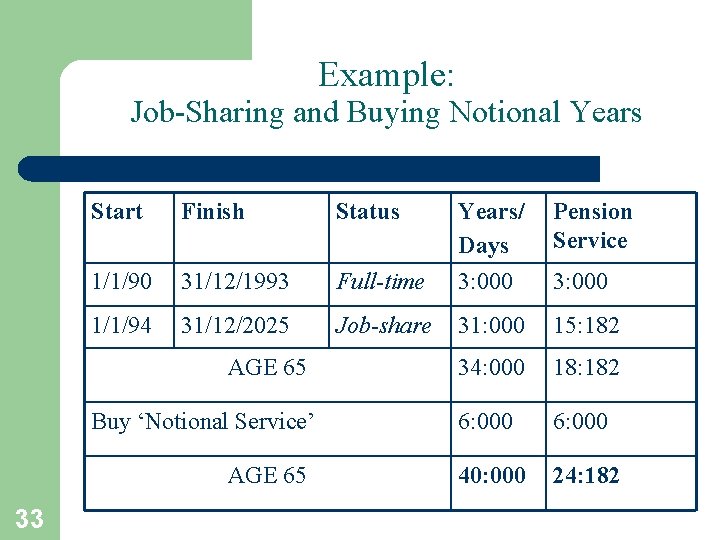

Example: Job-Sharing and Buying Notional Years Start Finish Status 1/1/90 31/12/1993 1/1/94 31/12/2025 AGE 65 Buy ‘Notional Service’ AGE 65 33 Pension Service Full-time Years/ Days 3: 000 Job-share 31: 000 15: 182 34: 000 18: 182 6: 000 40: 000 24: 182 3: 000

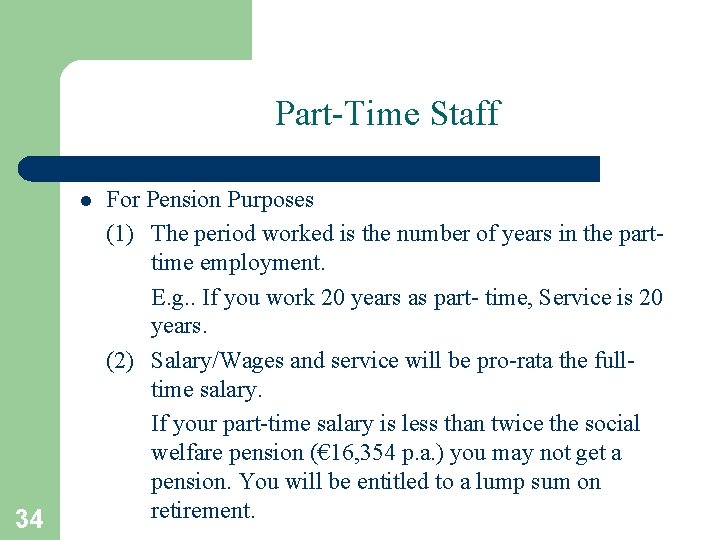

Part-Time Staff l 34 For Pension Purposes (1) The period worked is the number of years in the parttime employment. E. g. . If you work 20 years as part- time, Service is 20 years. (2) Salary/Wages and service will be pro-rata the fulltime salary. If your part-time salary is less than twice the social welfare pension (€ 16, 354 p. a. ) you may not get a pension. You will be entitled to a lump sum on retirement.

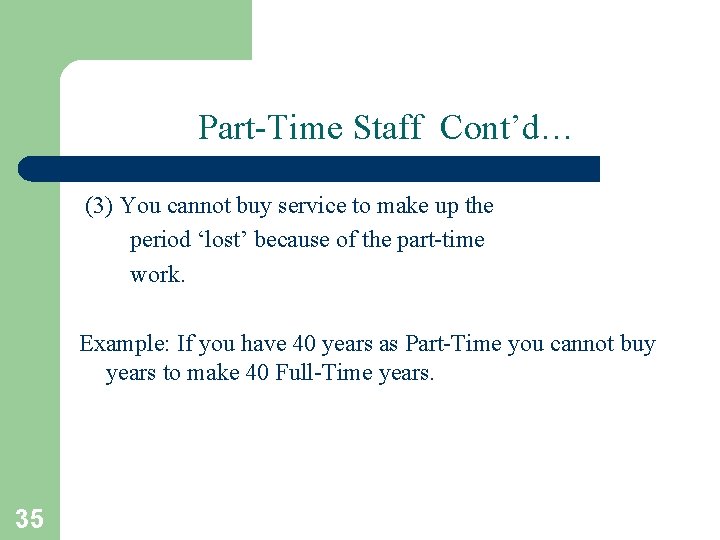

Part-Time Staff Cont’d… (3) You cannot buy service to make up the period ‘lost’ because of the part-time work. Example: If you have 40 years as Part-Time you cannot buy years to make 40 Full-Time years. 35

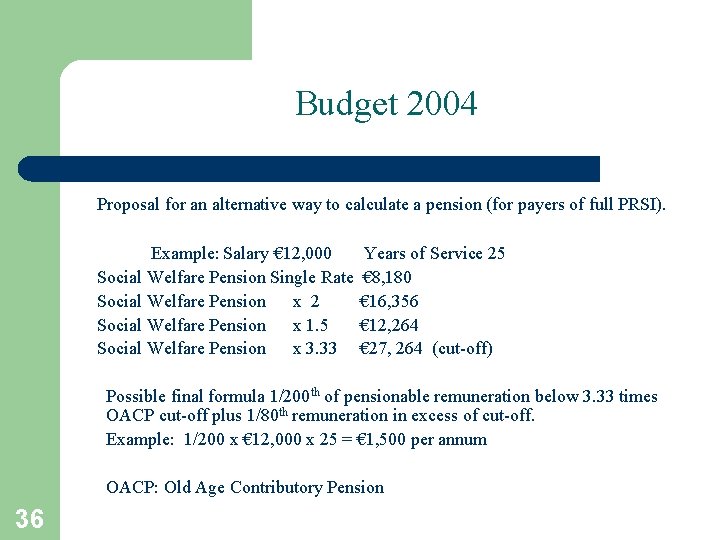

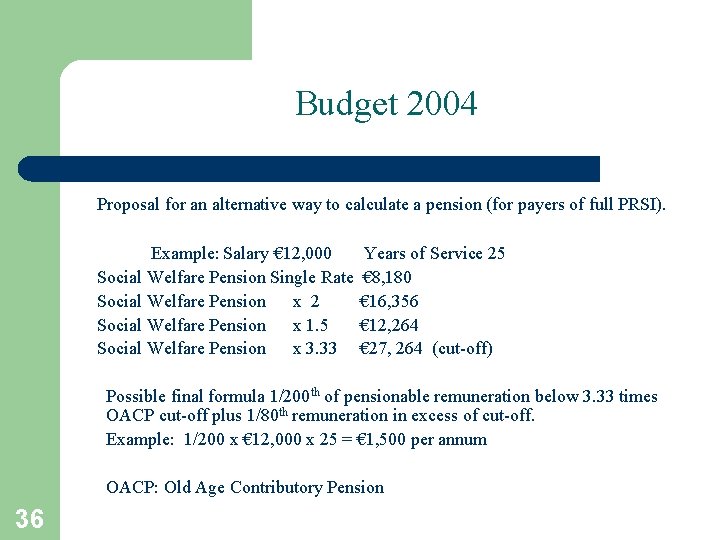

Budget 2004 Proposal for an alternative way to calculate a pension (for payers of full PRSI). Example: Salary € 12, 000 Social Welfare Pension Single Rate Social Welfare Pension x 2 Social Welfare Pension x 1. 5 Social Welfare Pension x 3. 33 Years of Service 25 € 8, 180 € 16, 356 € 12, 264 € 27, 264 (cut-off) Possible final formula 1/200 th of pensionable remuneration below 3. 33 times OACP cut-off plus 1/80 th remuneration in excess of cut-off. Example: 1/200 x € 12, 000 x 25 = € 1, 500 per annum OACP: Old Age Contributory Pension 36

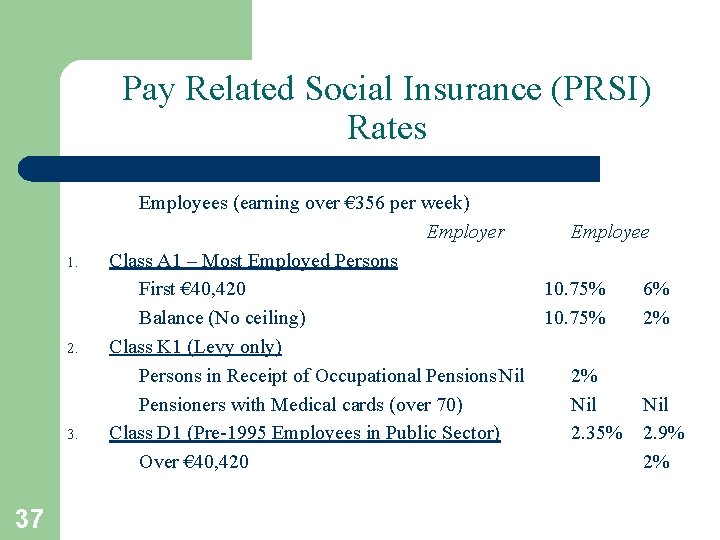

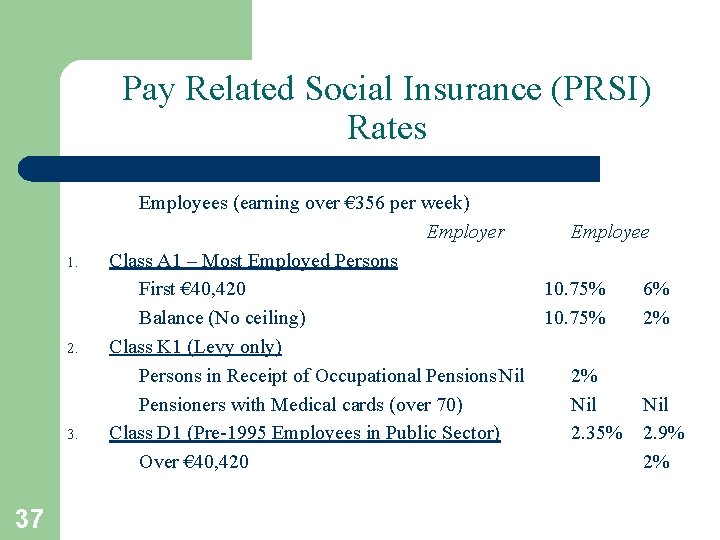

Pay Related Social Insurance (PRSI) Rates 1. 2. 37 Employees (earning over € 356 per week) Employer Employee Class A 1 – Most Employed Persons First € 40, 420 10. 75% 6% Balance (No ceiling) 10. 75% 2% Class K 1 (Levy only) Persons in Receipt of Occupational Pensions Nil 2% Pensioners with Medical cards (over 70) Nil Class D 1 (Pre-1995 Employees in Public Sector) 2. 35% 2. 9% Over € 40, 420 2%

Estimate Pension After Tax To calculate your after tax pension you do three calculations: 1. 2. 3. 38 Your Tax Credits The ‘Income Tax’ you pay. Mind the ‘Marginal Restriction Rule’ Subtract salary deductions (including income tax) from gross pension.

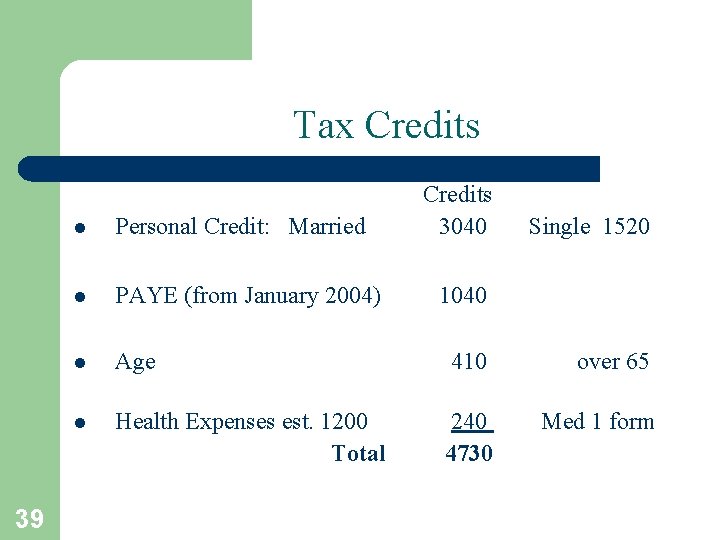

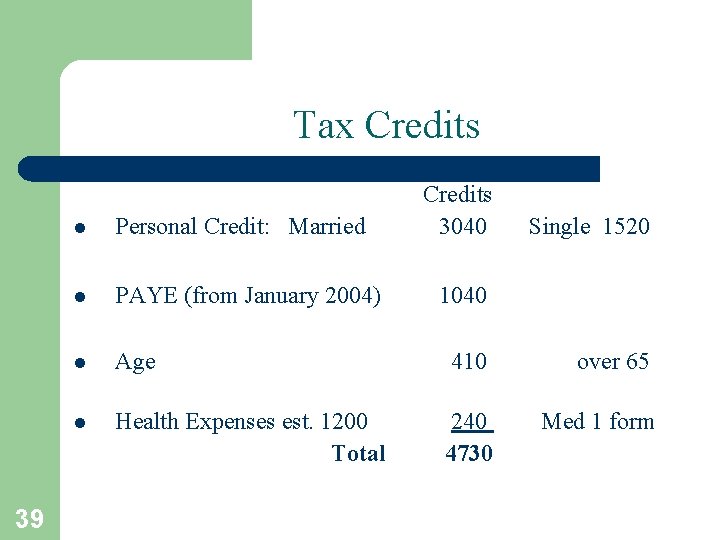

Tax Credits 39 Credits 3040 l Personal Credit: Married Single 1520 l PAYE (from January 2004) l Age 410 over 65 l Health Expenses est. 1200 Total 240 4730 Med 1 form 1040

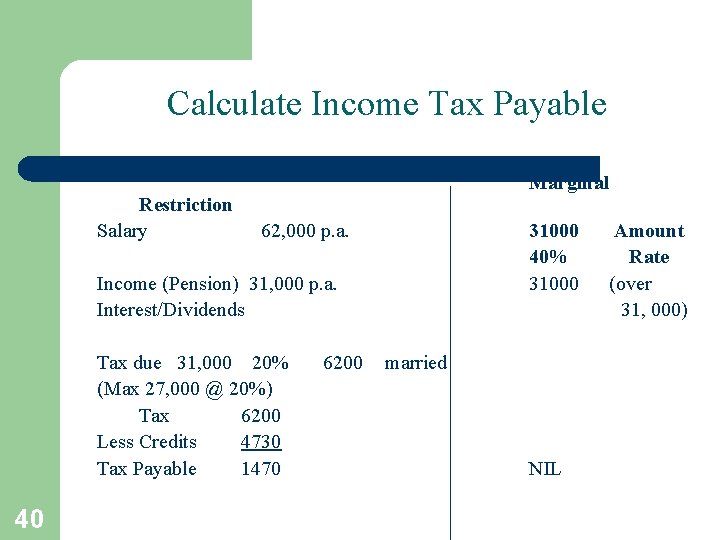

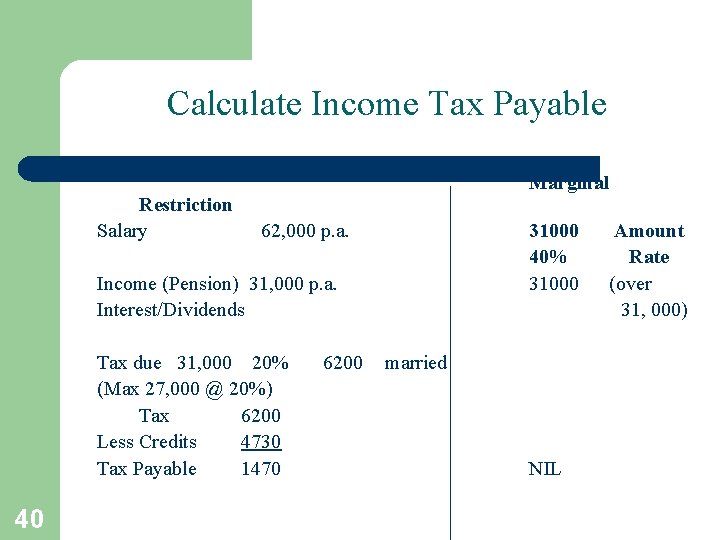

Calculate Income Tax Payable Restriction Salary Marginal 62, 000 p. a. 31000 40% 31000 Income (Pension) 31, 000 p. a. Interest/Dividends Tax due 31, 000 20% (Max 27, 000 @ 20%) Tax 6200 Less Credits 4730 Tax Payable 1470 40 6200 married NIL Amount Rate (over 31, 000)

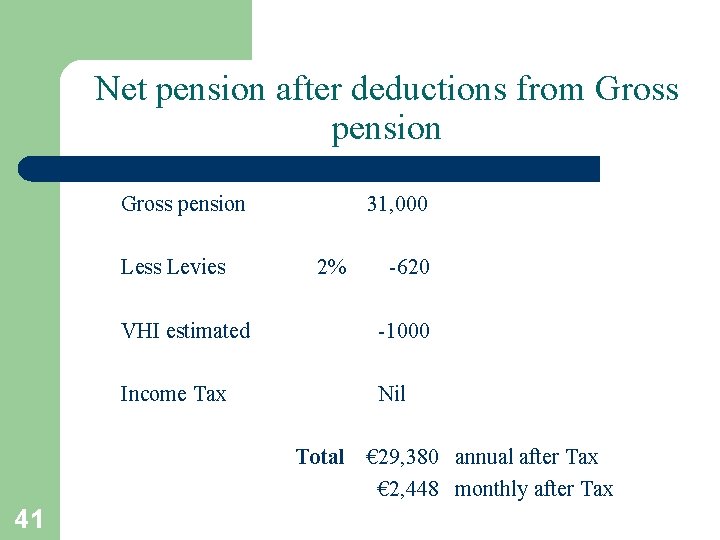

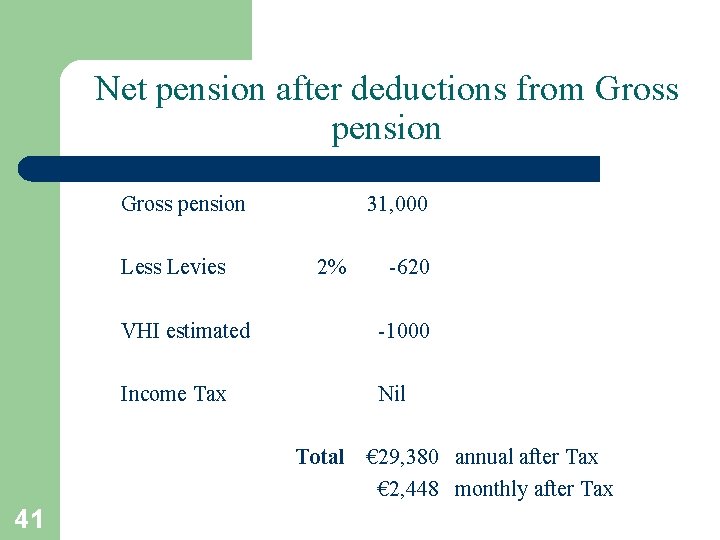

Net pension after deductions from Gross pension Less Levies 31, 000 2% -620 VHI estimated -1000 Income Tax Nil Total € 29, 380 annual after Tax € 2, 448 monthly after Tax 41

Meetup galway

Meetup galway Salary head meaning

Salary head meaning Iam national pension fund death benefit

Iam national pension fund death benefit University of ottawa pension plan

University of ottawa pension plan Cambridge university pension

Cambridge university pension Irelands national flower

Irelands national flower Yves beernaert

Yves beernaert Flower associated with northern ireland

Flower associated with northern ireland Northern ireland national flower

Northern ireland national flower Northern ireland national flower

Northern ireland national flower Union jack

Union jack Northern ireland national flower

Northern ireland national flower United kingdom flower symbol

United kingdom flower symbol Northern ireland national flag

Northern ireland national flag National flower of great britain

National flower of great britain Ireland global university

Ireland global university Sppa pension

Sppa pension Rtd/atu 1001 pension plan

Rtd/atu 1001 pension plan Pension master trust

Pension master trust How to calculate pension expense

How to calculate pension expense Nmdc pension scheme

Nmdc pension scheme Nhs pension examples

Nhs pension examples Nhs pension examples

Nhs pension examples Nhs pension examples

Nhs pension examples Defined contribution journal entry

Defined contribution journal entry Mbao pension plan balance

Mbao pension plan balance Tabla pension issste

Tabla pension issste Waterside house derry pensions

Waterside house derry pensions Hscni pension calculator

Hscni pension calculator Kpa föräldramöte

Kpa föräldramöte Tabla pension issste

Tabla pension issste Max cpp payment 2021

Max cpp payment 2021 Aviva my future focus growth

Aviva my future focus growth Prms ntpc

Prms ntpc Pension russe meaning

Pension russe meaning Bsnl sampann

Bsnl sampann Pension planning northamptonshire

Pension planning northamptonshire Portalq

Portalq Pension planning cambridgeshire

Pension planning cambridgeshire Spfo pension

Spfo pension Bel retired employees medical scheme

Bel retired employees medical scheme Pension schultze

Pension schultze