MERGERS AND ACQUISITIONS IN A DOWN ECONOMY Western

- Slides: 27

MERGERS AND ACQUISITIONS IN A DOWN ECONOMY Western Independent Bankers June 2, 2009 Presented By: Dave Muchnikoff and Barry Taff Silver, Freedman & Taff, L. L. P. 3299 K Street, N. W. , Suite 100 Washington, D. C. 20007 (202) 295 -4500 dmm@sftlaw. com btaff@sftlaw. com Silver, Freedman & Taff, L. L. P.

LOCAL BANKS FACE BIG LOSSES Journal Study of 940 Lenders Shows Potential for Deep Hit on Commericial Property Wall Street Journal Headline: May 19, 2009 Silver, Freedman & Taff, L. L. P. 1

Who Is Selling? Community Bank n Unlikely to sell in down market - succession may be only reason to sell Distressed Bank n Acquire at a large discount to book value Stalled De Novo n Acquire undeployed capital at a minimal cost Silver, Freedman & Taff, L. L. P. 2

Why Buy Today? n n n n n Bank stocks are down – many trading below book value Lower trading multiples Weak earnings Targets forced to sell Alternatives are limited Limited competition Capital is king Cost savings and cross-marketing opportunities Expand branch/ATM locations, improve customer access Silver, Freedman & Taff, L. L. P. 3

Why Not Buy Today? n n n What are you acquiring? -- Unknown Asset Quality -- How big is the hole? Don’t want to acquire someone else’s problems Capital is more expensive Possible Regulatory problems Limited secondary market Silver, Freedman & Taff, L. L. P. 4

Who Should Be Buying? Well Capitalized Banks with: • Strong capital/credit • Good standing with regulators • Experience • Good asset quality and generation Private Equity with: • Large amount of money raised • Varied strategies • Minimum return expectations approach 20% or more • Bank holding company status can be an obstacle Over Capitalized De Novo: • Alternative strategy to deploy excess capital • Limited universe of suitable targets Banks interested in a Merger of Equals Silver, Freedman & Taff, L. L. P. 5

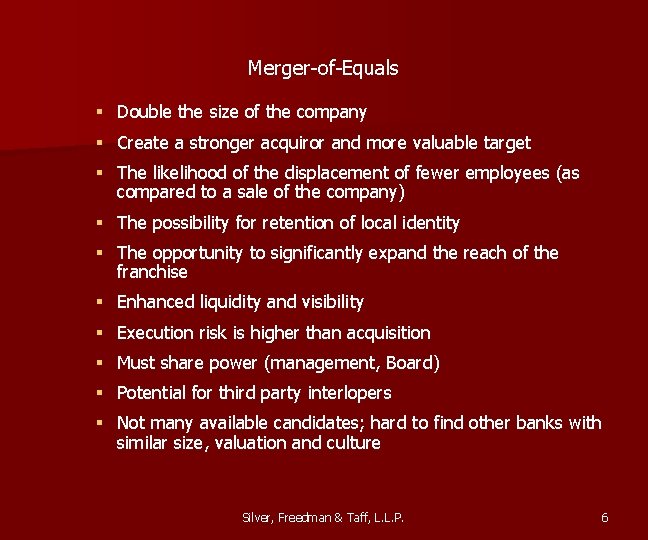

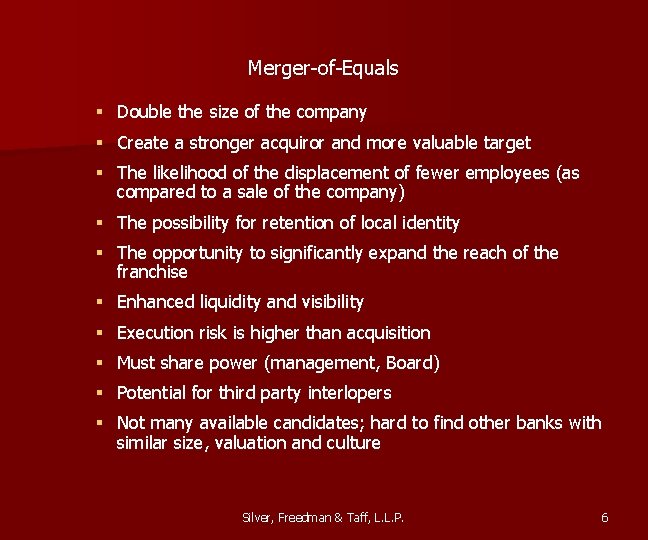

Merger-of-Equals § Double the size of the company § Create a stronger acquiror and more valuable target § The likelihood of the displacement of fewer employees (as compared to a sale of the company) § The possibility for retention of local identity § The opportunity to significantly expand the reach of the franchise § Enhanced liquidity and visibility § Execution risk is higher than acquisition § Must share power (management, Board) § Potential for third party interlopers § Not many available candidates; hard to find other banks with similar size, valuation and culture Silver, Freedman & Taff, L. L. P. 6

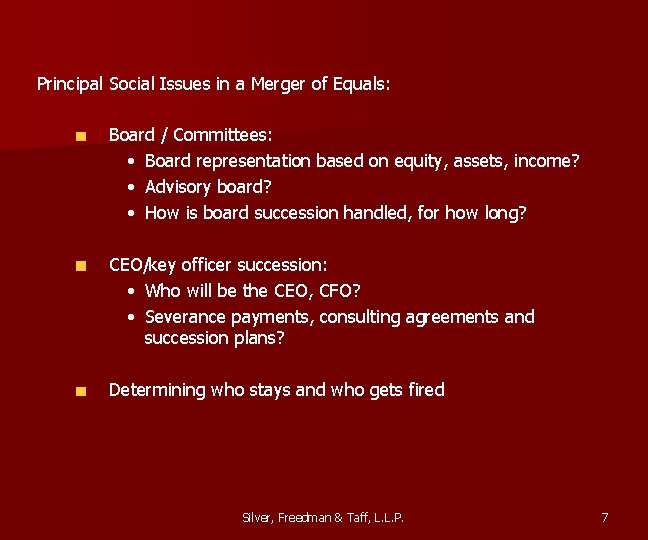

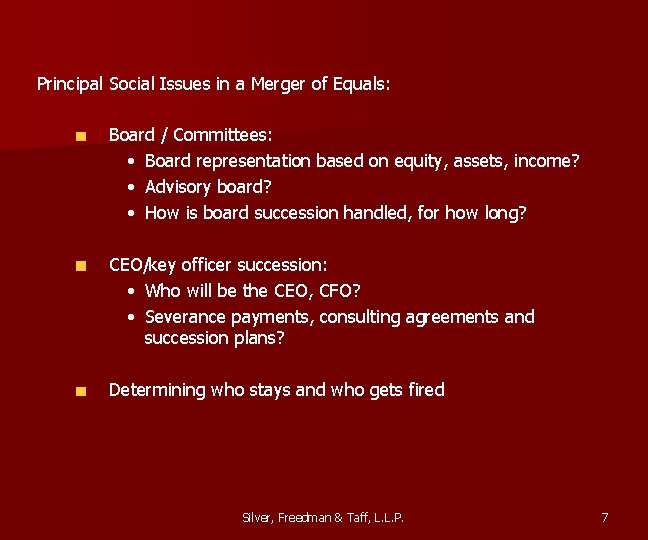

Principal Social Issues in a Merger of Equals: Board / Committees: • Board representation based on equity, assets, income? • Advisory board? • How is board succession handled, for how long? CEO/key officer succession: • Who will be the CEO, CFO? • Severance payments, consulting agreements and succession plans? Determining who stays and who gets fired Silver, Freedman & Taff, L. L. P. 7

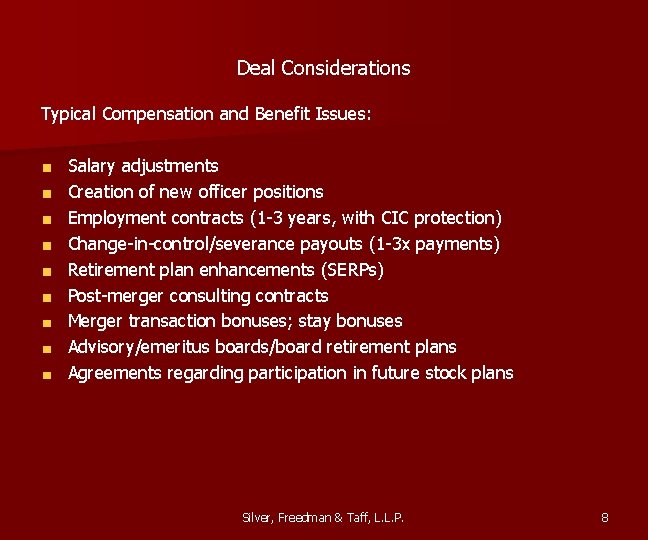

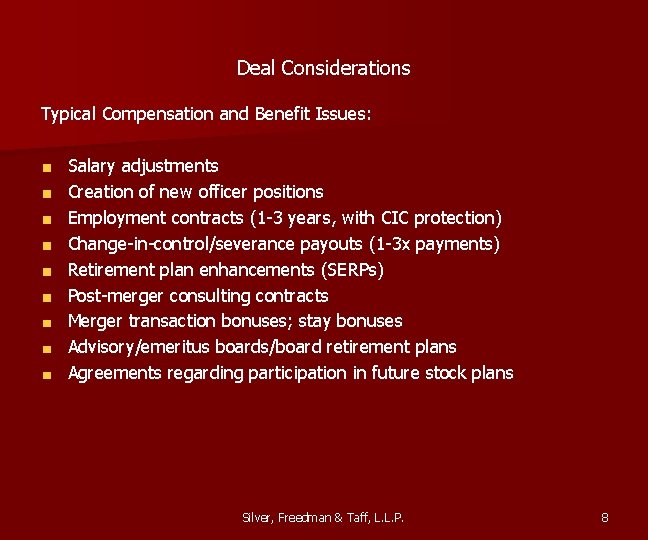

Deal Considerations Typical Compensation and Benefit Issues: Salary adjustments Creation of new officer positions Employment contracts (1 -3 years, with CIC protection) Change-in-control/severance payouts (1 -3 x payments) Retirement plan enhancements (SERPs) Post-merger consulting contracts Merger transaction bonuses; stay bonuses Advisory/emeritus boards/board retirement plans Agreements regarding participation in future stock plans Silver, Freedman & Taff, L. L. P. 8

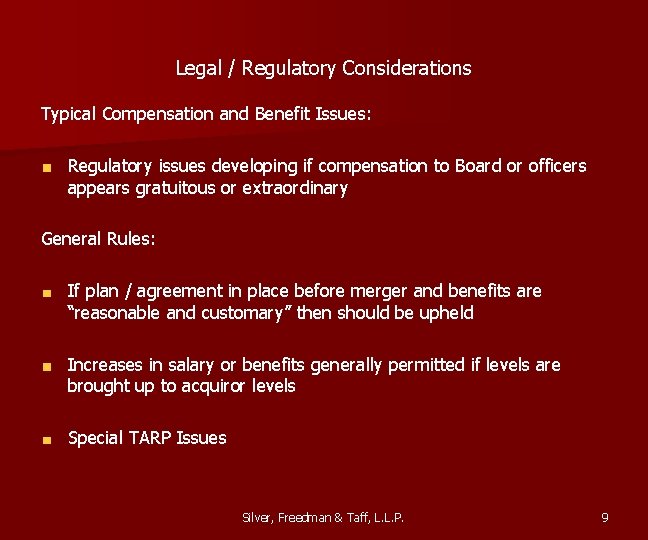

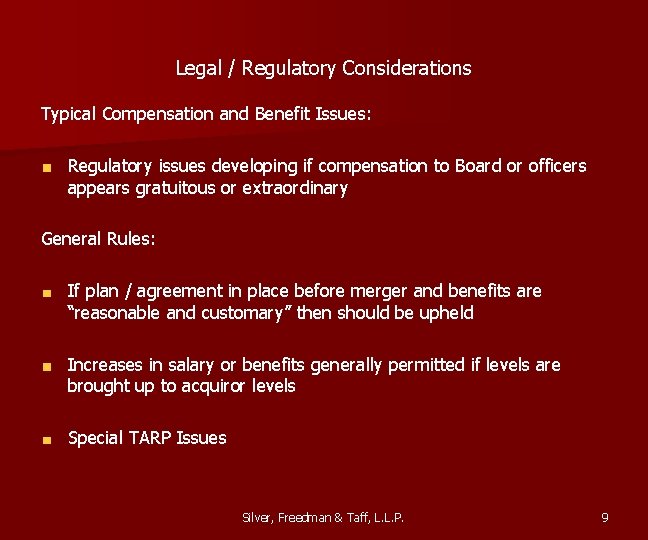

Legal / Regulatory Considerations Typical Compensation and Benefit Issues: Regulatory issues developing if compensation to Board or officers appears gratuitous or extraordinary General Rules: If plan / agreement in place before merger and benefits are “reasonable and customary” then should be upheld Increases in salary or benefits generally permitted if levels are brought up to acquiror levels Special TARP Issues Silver, Freedman & Taff, L. L. P. 9

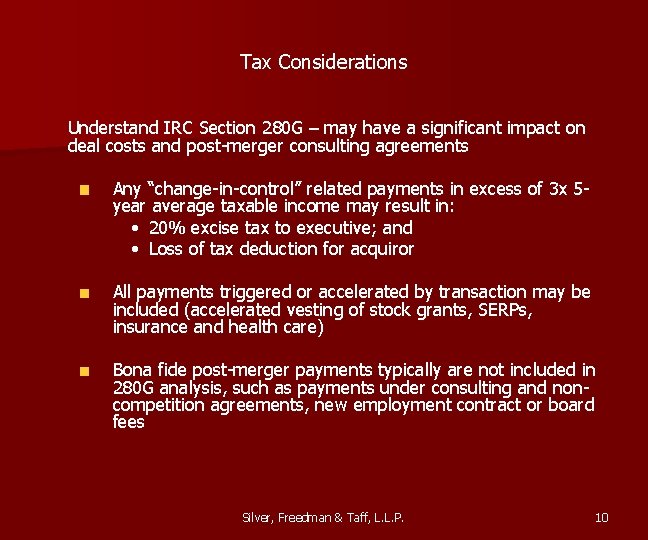

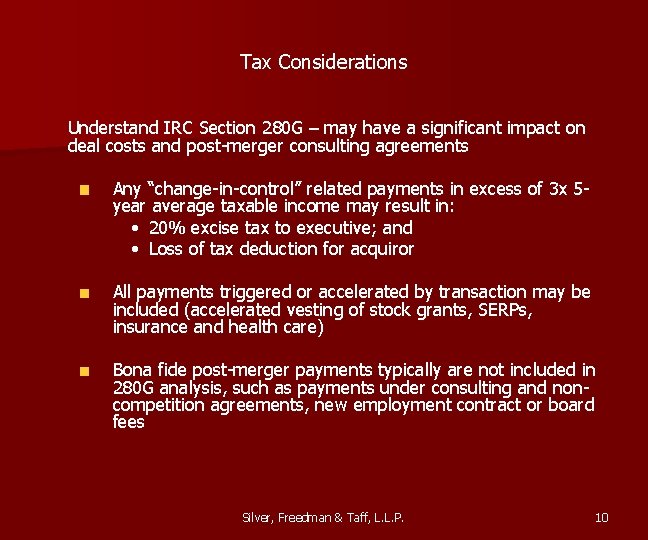

Tax Considerations Understand IRC Section 280 G – may have a significant impact on deal costs and post-merger consulting agreements Any “change-in-control” related payments in excess of 3 x 5 year average taxable income may result in: • 20% excise tax to executive; and • Loss of tax deduction for acquiror All payments triggered or accelerated by transaction may be included (accelerated vesting of stock grants, SERPs, insurance and health care) Bona fide post-merger payments typically are not included in 280 G analysis, such as payments under consulting and noncompetition agreements, new employment contract or board fees Silver, Freedman & Taff, L. L. P. 10

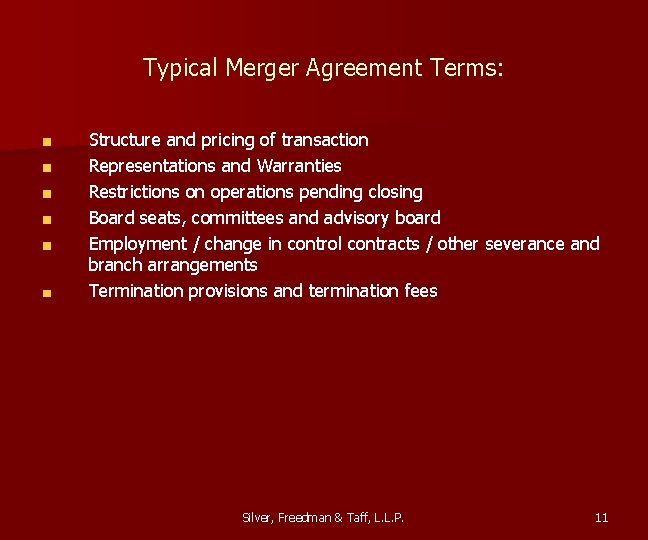

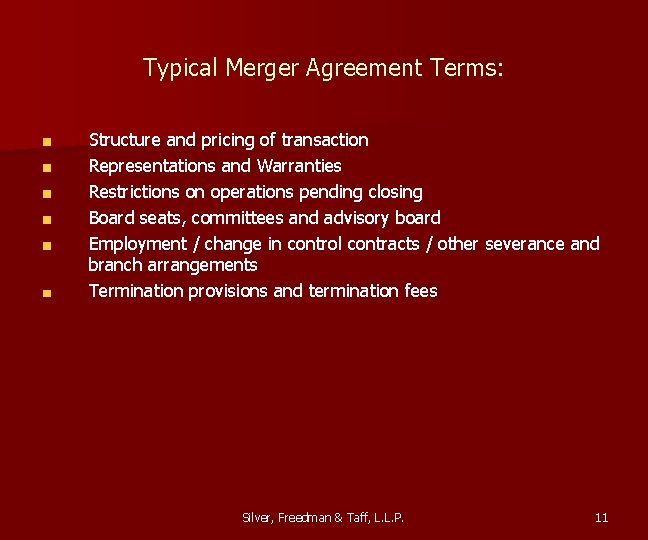

Typical Merger Agreement Terms: Structure and pricing of transaction Representations and Warranties Restrictions on operations pending closing Board seats, committees and advisory board Employment / change in control contracts / other severance and branch arrangements Termination provisions and termination fees Silver, Freedman & Taff, L. L. P. 11

Typical Due Diligence Documents Regulatory exam reports / correspondence Corporate minutes Audit reports / correspondence Internal audit reports / correspondence Underwriting policies and procedures Large loan files / classified or watch list loans Corporate governance documents (charter, bylaws) Litigation / personnel files Environmental reports Material contracts Silver, Freedman & Taff, L. L. P. 12

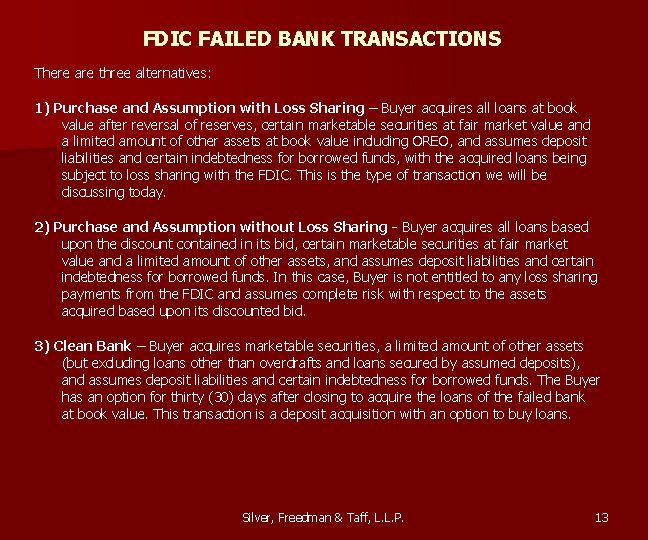

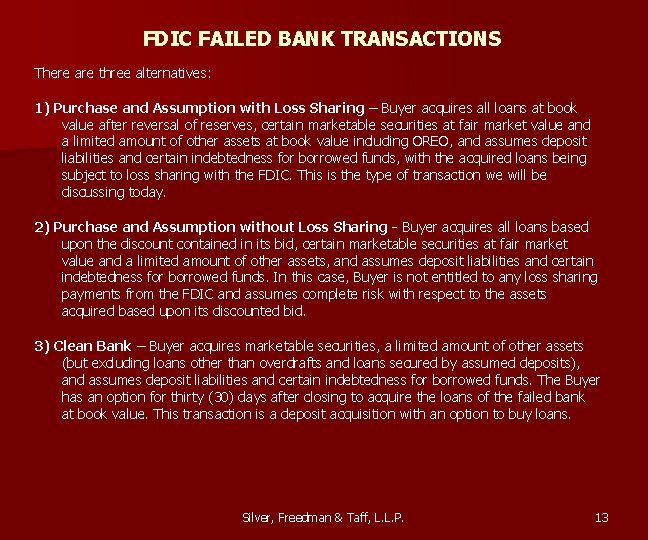

FDIC FAILED BANK TRANSACTIONS There are three alternatives: 1) Purchase and Assumption with Loss Sharing – Buyer acquires all loans at book value after reversal of reserves, certain marketable securities at fair market value and a limited amount of other assets at book value including OREO, and assumes deposit liabilities and certain indebtedness for borrowed funds, with the acquired loans being subject to loss sharing with the FDIC. This is the type of transaction we will be discussing today. 2) Purchase and Assumption without Loss Sharing - Buyer acquires all loans based upon the discount contained in its bid, certain marketable securities at fair market value and a limited amount of other assets, and assumes deposit liabilities and certain indebtedness for borrowed funds. In this case, Buyer is not entitled to any loss sharing payments from the FDIC and assumes complete risk with respect to the assets acquired based upon its discounted bid. 3) Clean Bank – Buyer acquires marketable securities, a limited amount of other assets (but excluding loans other than overdrafts and loans secured by assumed deposits), and assumes deposit liabilities and certain indebtedness for borrowed funds. The Buyer has an option for thirty (30) days after closing to acquire the loans of the failed bank at book value. This transaction is a deposit acquisition with an option to buy loans. Silver, Freedman & Taff, L. L. P. 13

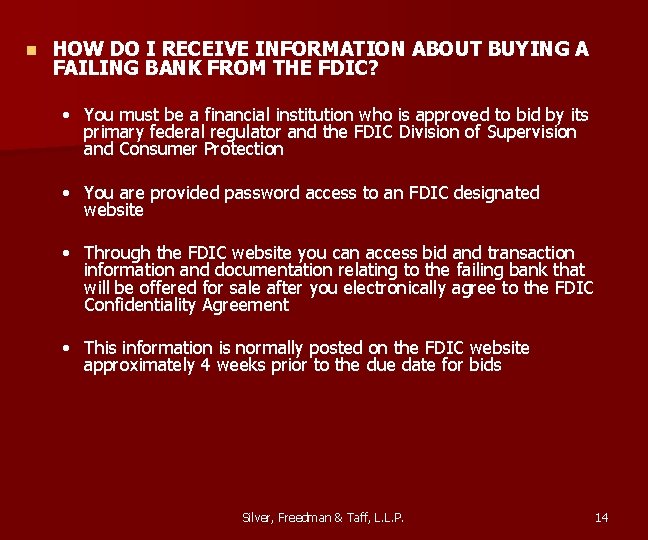

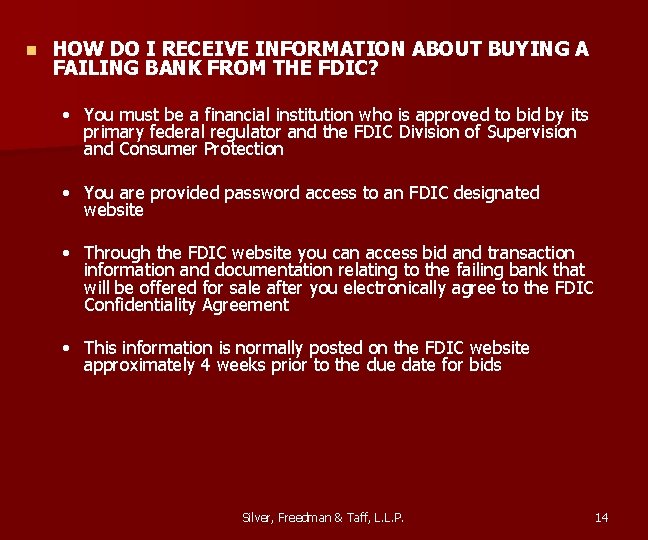

n HOW DO I RECEIVE INFORMATION ABOUT BUYING A FAILING BANK FROM THE FDIC? • You must be a financial institution who is approved to bid by its primary federal regulator and the FDIC Division of Supervision and Consumer Protection • You are provided password access to an FDIC designated website • Through the FDIC website you can access bid and transaction information and documentation relating to the failing bank that will be offered for sale after you electronically agree to the FDIC Confidentiality Agreement • This information is normally posted on the FDIC website approximately 4 weeks prior to the due date for bids Silver, Freedman & Taff, L. L. P. 14

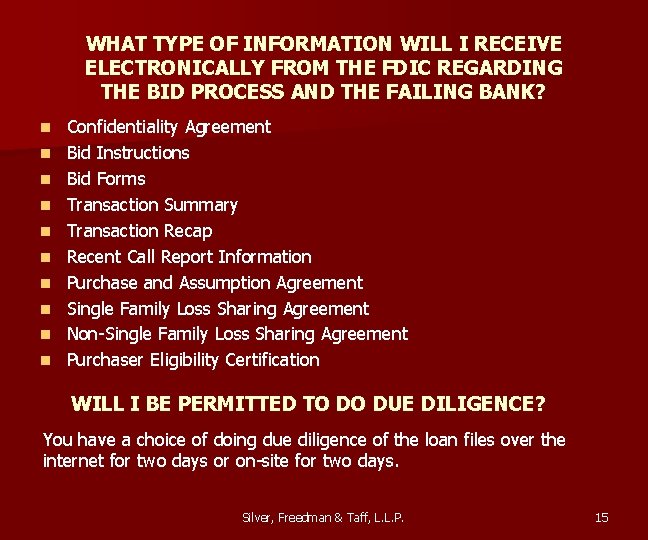

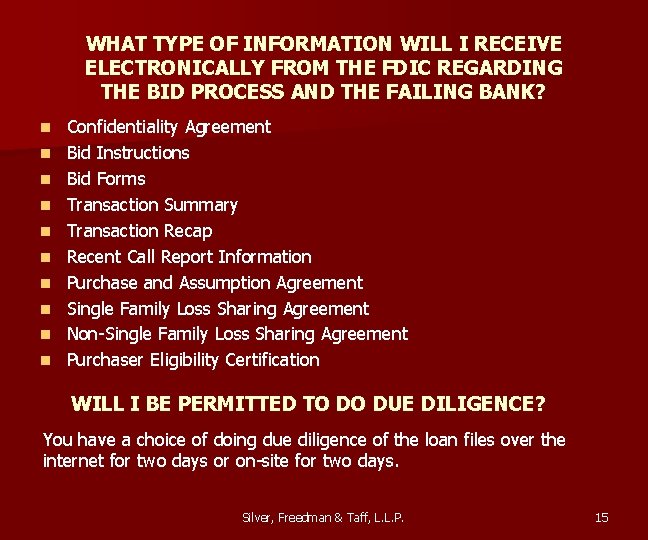

WHAT TYPE OF INFORMATION WILL I RECEIVE ELECTRONICALLY FROM THE FDIC REGARDING THE BID PROCESS AND THE FAILING BANK? n n n n n Confidentiality Agreement Bid Instructions Bid Forms Transaction Summary Transaction Recap Recent Call Report Information Purchase and Assumption Agreement Single Family Loss Sharing Agreement Non-Single Family Loss Sharing Agreement Purchaser Eligibility Certification WILL I BE PERMITTED TO DO DUE DILIGENCE? You have a choice of doing due diligence of the loan files over the internet for two days or on-site for two days. Silver, Freedman & Taff, L. L. P. 15

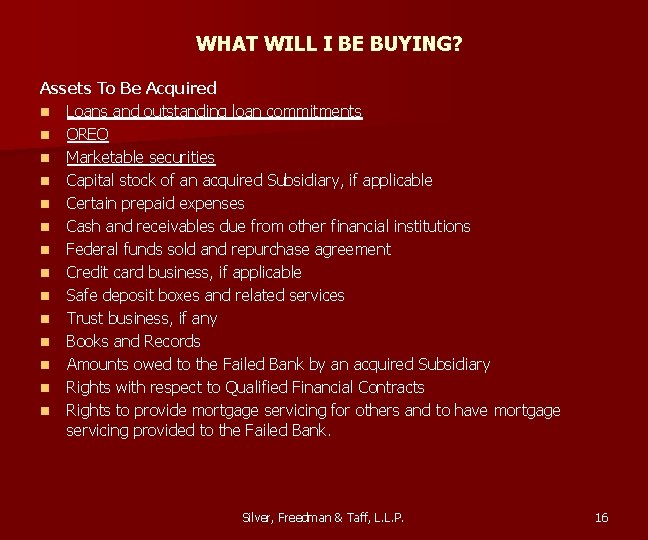

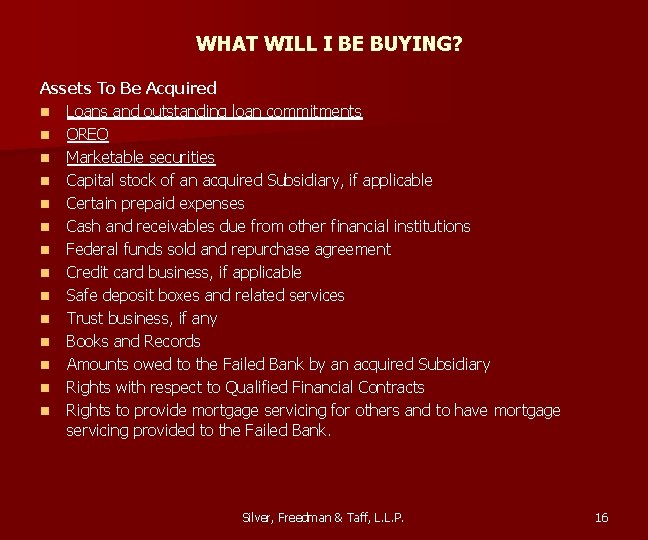

WHAT WILL I BE BUYING? Assets To Be Acquired n Loans and outstanding loan commitments n OREO n Marketable securities n Capital stock of an acquired Subsidiary, if applicable n Certain prepaid expenses n Cash and receivables due from other financial institutions n Federal funds sold and repurchase agreement n Credit card business, if applicable n Safe deposit boxes and related services n Trust business, if any n Books and Records n Amounts owed to the Failed Bank by an acquired Subsidiary n Rights with respect to Qualified Financial Contracts n Rights to provide mortgage servicing for others and to have mortgage servicing provided to the Failed Bank. Silver, Freedman & Taff, L. L. P. 16

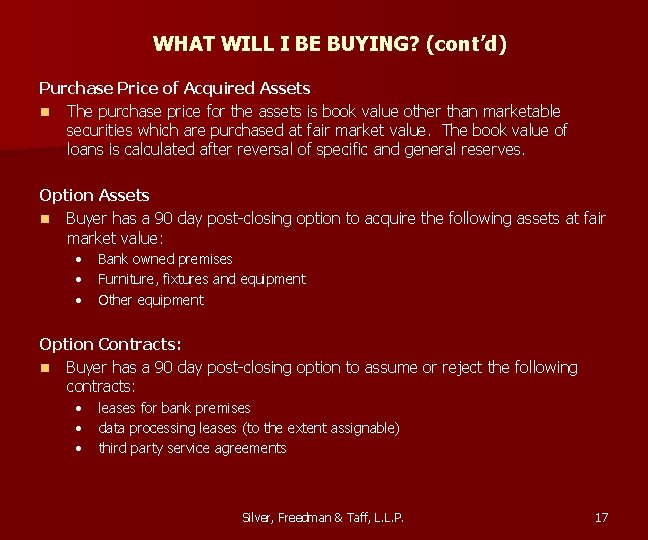

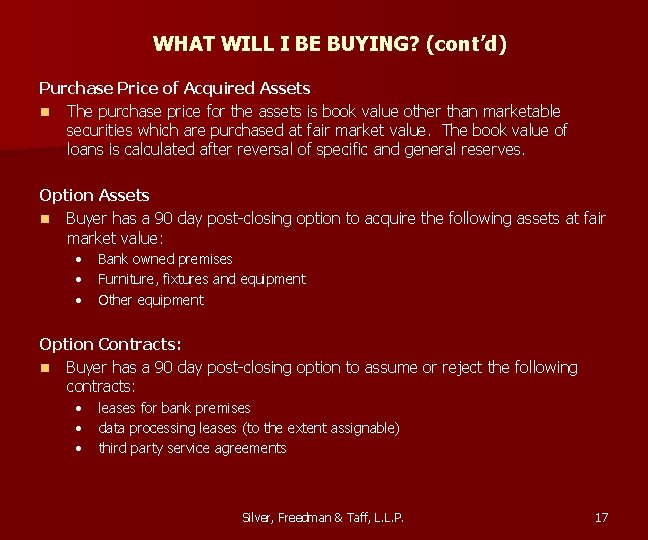

WHAT WILL I BE BUYING? (cont’d) Purchase Price of Acquired Assets n The purchase price for the assets is book value other than marketable securities which are purchased at fair market value. The book value of loans is calculated after reversal of specific and general reserves. Option Assets n Buyer has a 90 day post-closing option to acquire the following assets at fair market value: • • • Bank owned premises Furniture, fixtures and equipment Other equipment Option Contracts: n Buyer has a 90 day post-closing option to assume or reject the following contracts: • • • leases for bank premises data processing leases (to the extent assignable) third party service agreements Silver, Freedman & Taff, L. L. P. 17

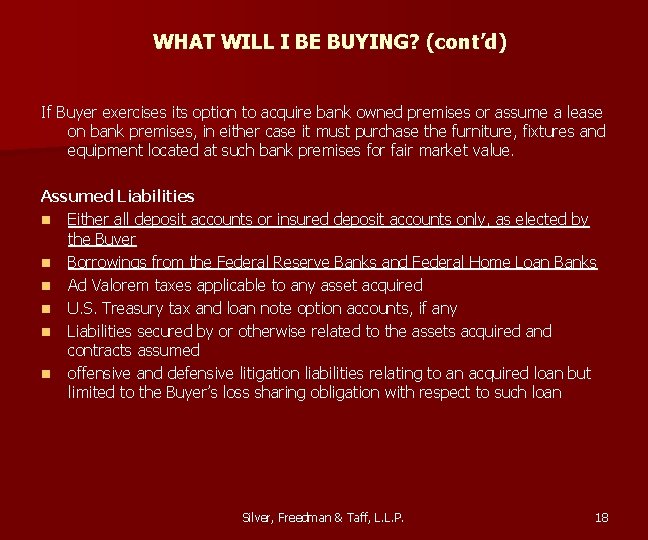

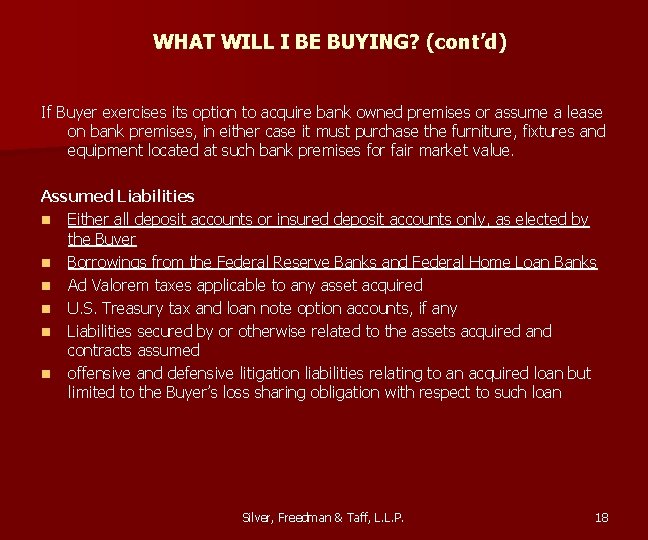

WHAT WILL I BE BUYING? (cont’d) If Buyer exercises its option to acquire bank owned premises or assume a lease on bank premises, in either case it must purchase the furniture, fixtures and equipment located at such bank premises for fair market value. Assumed Liabilities n Either all deposit accounts or insured deposit accounts only, as elected by the Buyer n Borrowings from the Federal Reserve Banks and Federal Home Loan Banks n Ad Valorem taxes applicable to any asset acquired n U. S. Treasury tax and loan note option accounts, if any n Liabilities secured by or otherwise related to the assets acquired and contracts assumed n offensive and defensive litigation liabilities relating to an acquired loan but limited to the Buyer’s loss sharing obligation with respect to such loan Silver, Freedman & Taff, L. L. P. 18

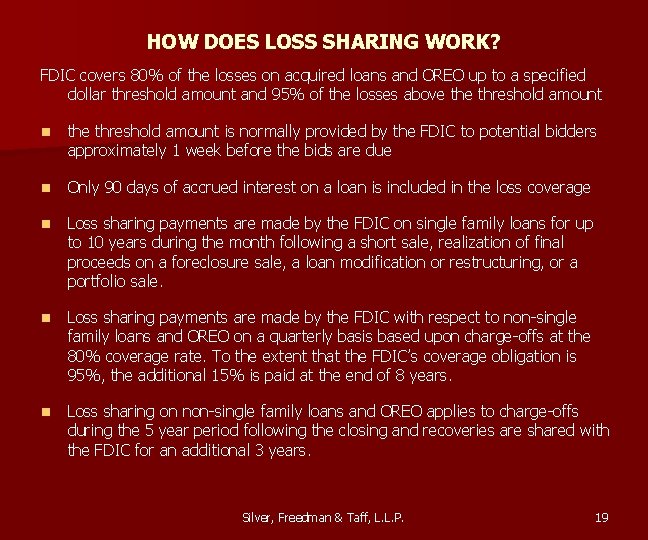

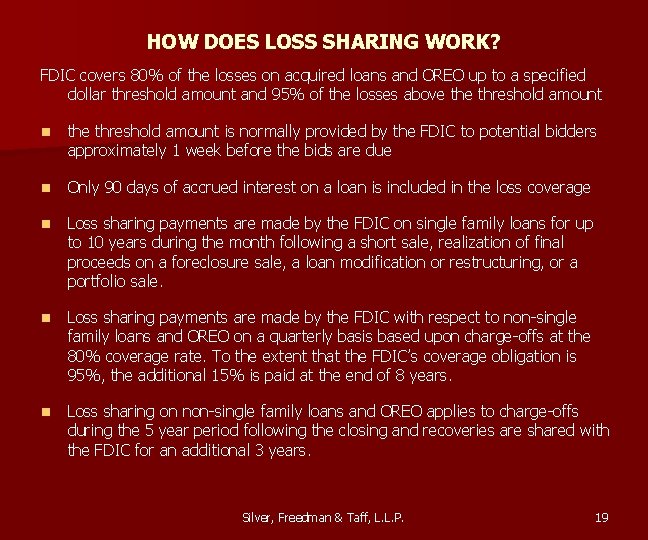

HOW DOES LOSS SHARING WORK? FDIC covers 80% of the losses on acquired loans and OREO up to a specified dollar threshold amount and 95% of the losses above threshold amount n the threshold amount is normally provided by the FDIC to potential bidders approximately 1 week before the bids are due n Only 90 days of accrued interest on a loan is included in the loss coverage n Loss sharing payments are made by the FDIC on single family loans for up to 10 years during the month following a short sale, realization of final proceeds on a foreclosure sale, a loan modification or restructuring, or a portfolio sale. n Loss sharing payments are made by the FDIC with respect to non-single family loans and OREO on a quarterly basis based upon charge-offs at the 80% coverage rate. To the extent that the FDIC’s coverage obligation is 95%, the additional 15% is paid at the end of 8 years. n Loss sharing on non-single family loans and OREO applies to charge-offs during the 5 year period following the closing and recoveries are shared with the FDIC for an additional 3 years. Silver, Freedman & Taff, L. L. P. 19

HOW DO BIDDERS KNOW WHAT TO BID? n n You bid a specific amount as an asset premium or discount and separate amount as a deposit premium. Normally, the asset bid is a negative (discount) amount and the deposit bid is a positive (premium) amount. In many instances, the bidding has been competitive. In some cases, there have been no bids. Most winning bids contained a net negative (discount) bid that was less than the winning bidder’s loss exposure on the acquired loans. For example, if the winning bidder is liable for 20% of the losses on $100 million of acquired loans (i. e. , $20 million) and 5% on the remaining $300 million of acquired loans (i. e. , $15 million), the winning bidder requested a payment from the FDIC that was less than $35 million. Other Examples -- Risks Silver, Freedman & Taff, L. L. P. 20

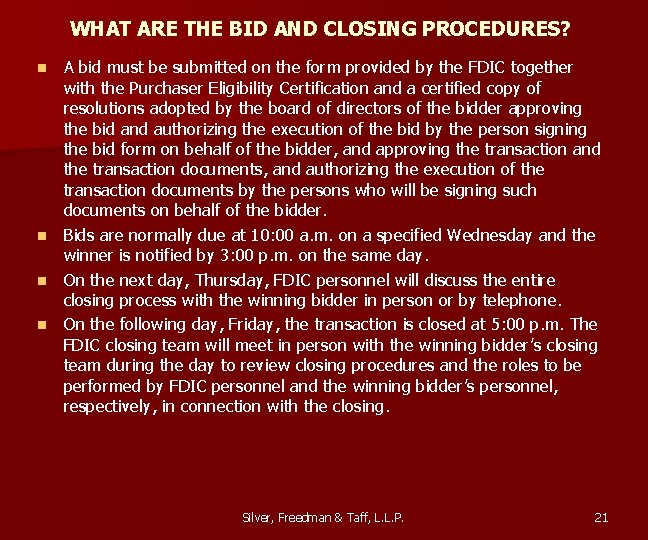

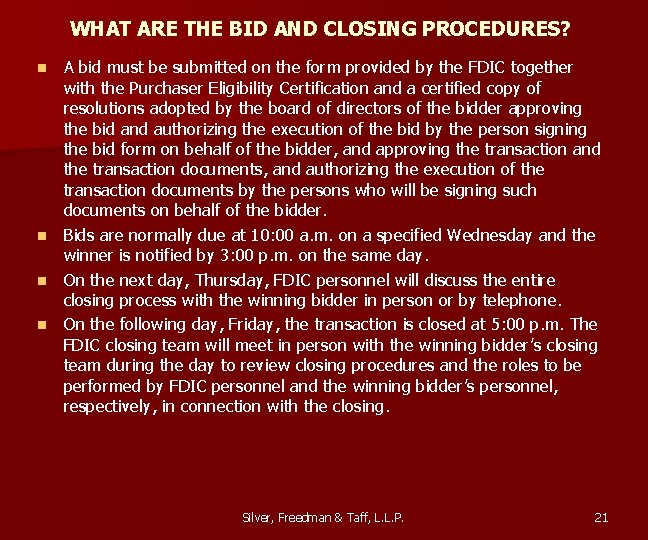

WHAT ARE THE BID AND CLOSING PROCEDURES? A bid must be submitted on the form provided by the FDIC together with the Purchaser Eligibility Certification and a certified copy of resolutions adopted by the board of directors of the bidder approving the bid and authorizing the execution of the bid by the person signing the bid form on behalf of the bidder, and approving the transaction and the transaction documents, and authorizing the execution of the transaction documents by the persons who will be signing such documents on behalf of the bidder. n Bids are normally due at 10: 00 a. m. on a specified Wednesday and the winner is notified by 3: 00 p. m. on the same day. n On the next day, Thursday, FDIC personnel will discuss the entire closing process with the winning bidder in person or by telephone. n On the following day, Friday, the transaction is closed at 5: 00 p. m. The FDIC closing team will meet in person with the winning bidder ’s closing team during the day to review closing procedures and the roles to be performed by FDIC personnel and the winning bidder’s personnel, respectively, in connection with the closing. n Silver, Freedman & Taff, L. L. P. 21

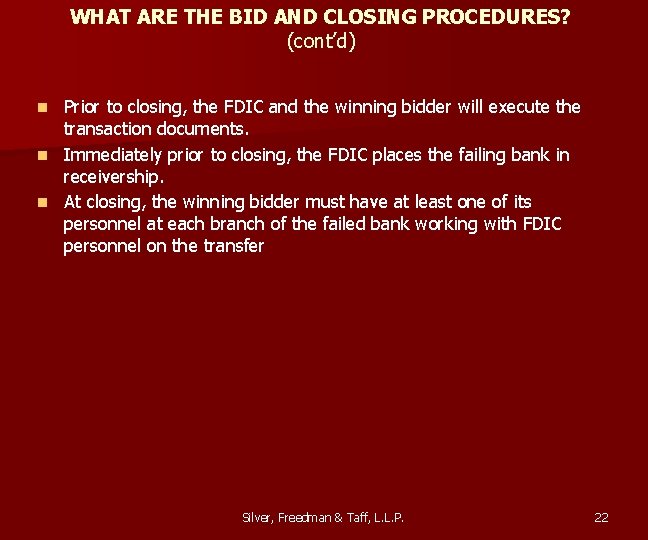

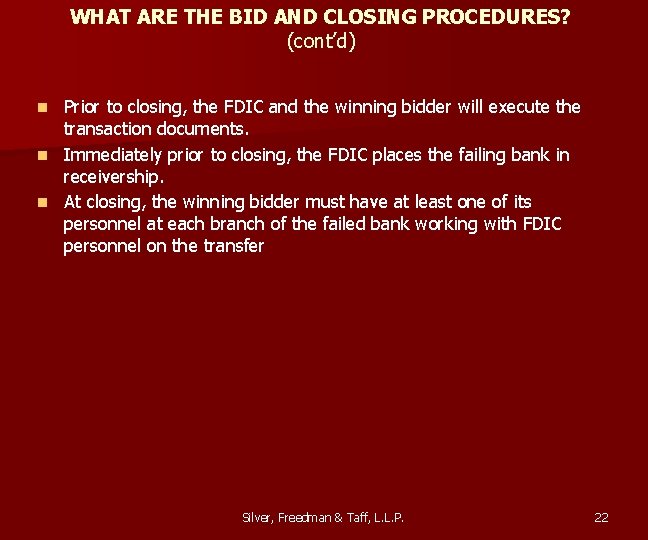

WHAT ARE THE BID AND CLOSING PROCEDURES? (cont’d) Prior to closing, the FDIC and the winning bidder will execute the transaction documents. n Immediately prior to closing, the FDIC places the failing bank in receivership. n At closing, the winning bidder must have at least one of its personnel at each branch of the failed bank working with FDIC personnel on the transfer n Silver, Freedman & Taff, L. L. P. 22

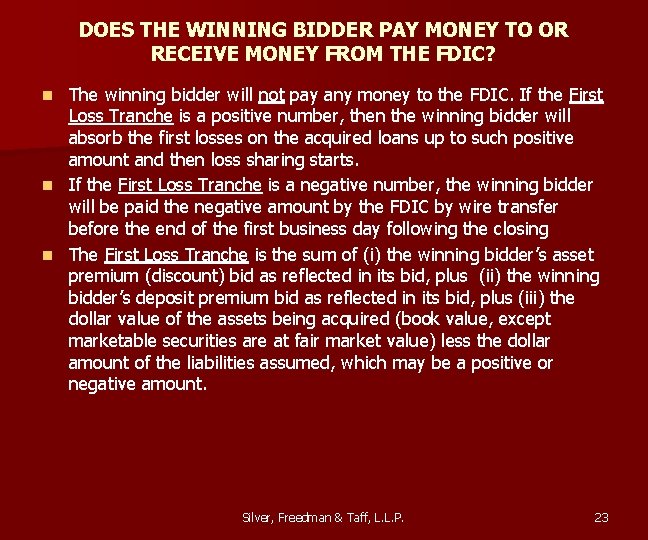

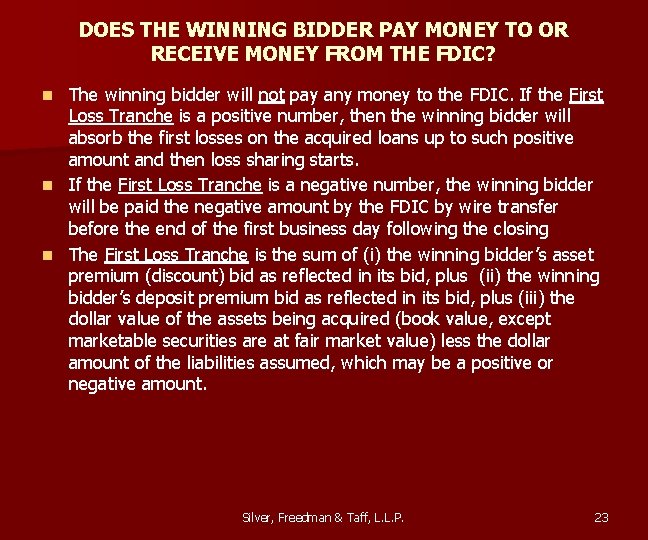

DOES THE WINNING BIDDER PAY MONEY TO OR RECEIVE MONEY FROM THE FDIC? The winning bidder will not pay any money to the FDIC. If the First Loss Tranche is a positive number, then the winning bidder will absorb the first losses on the acquired loans up to such positive amount and then loss sharing starts. n If the First Loss Tranche is a negative number, the winning bidder will be paid the negative amount by the FDIC by wire transfer before the end of the first business day following the closing n The First Loss Tranche is the sum of (i) the winning bidder’s asset premium (discount) bid as reflected in its bid, plus (ii) the winning bidder’s deposit premium bid as reflected in its bid, plus (iii) the dollar value of the assets being acquired (book value, except marketable securities are at fair market value) less the dollar amount of the liabilities assumed, which may be a positive or negative amount. n Silver, Freedman & Taff, L. L. P. 23

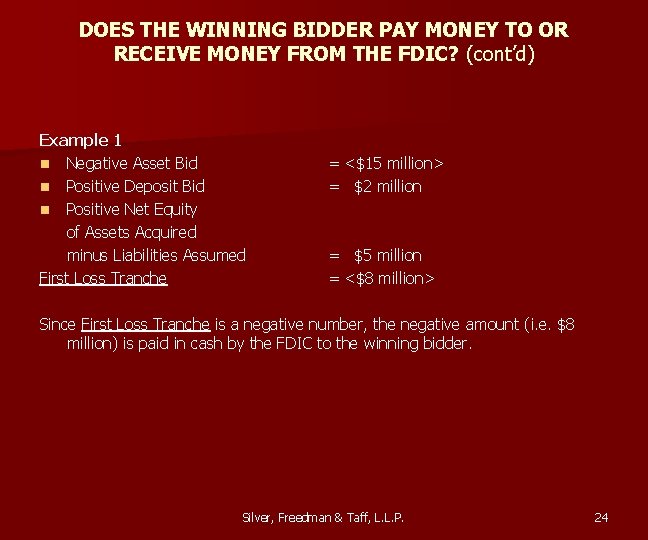

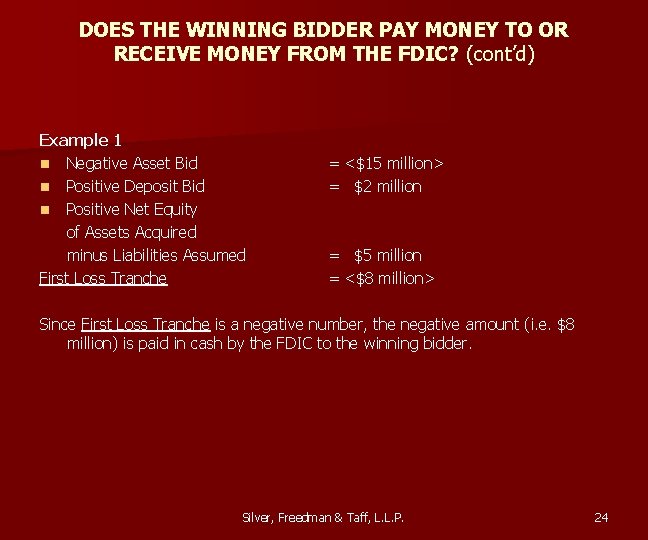

DOES THE WINNING BIDDER PAY MONEY TO OR RECEIVE MONEY FROM THE FDIC? (cont’d) Example 1 n Negative Asset Bid n Positive Deposit Bid n Positive Net Equity of Assets Acquired minus Liabilities Assumed First Loss Tranche = <$15 million> = $2 million = $5 million = <$8 million> Since First Loss Tranche is a negative number, the negative amount (i. e. $8 million) is paid in cash by the FDIC to the winning bidder. Silver, Freedman & Taff, L. L. P. 24

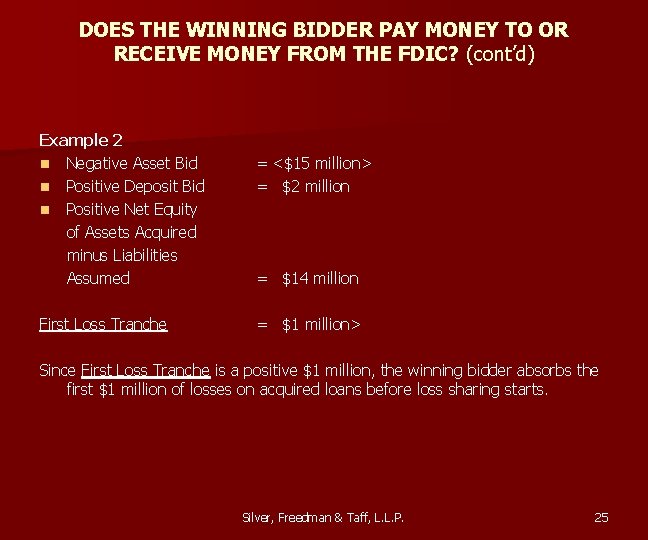

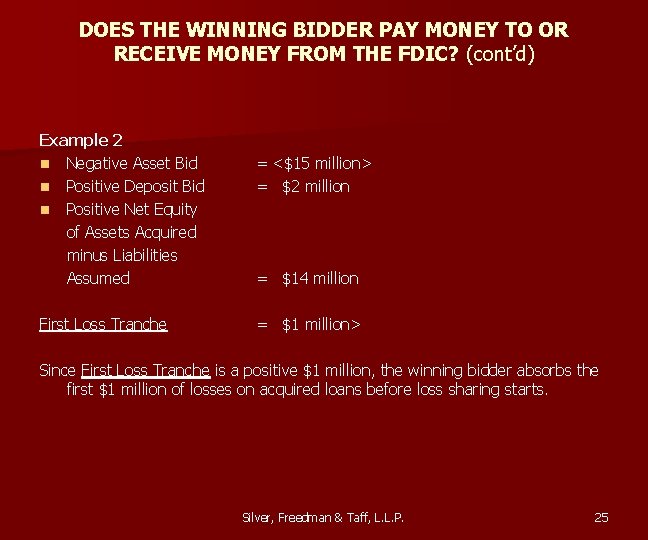

DOES THE WINNING BIDDER PAY MONEY TO OR RECEIVE MONEY FROM THE FDIC? (cont’d) Example 2 n Negative Asset Bid n Positive Deposit Bid n Positive Net Equity of Assets Acquired minus Liabilities Assumed First Loss Tranche = <$15 million> = $2 million = $14 million = $1 million> Since First Loss Tranche is a positive $1 million, the winning bidder absorbs the first $1 million of losses on acquired loans before loss sharing starts. Silver, Freedman & Taff, L. L. P. 25

Who We Are Silver, Freedman & Taff, L. L. P. Washington, D. C. based law firm specializing in financial institutions: • Mergers and acquisitions • Regulatory and Enforcement Matters • Debt and Equity Securities Offerings • Recapitalizations • Compensation and Employee Benefit Matters • Securitizations • Credit Union to Thrift Conversions • Mutual to Stock Conversions • Charter Conversions • Holding Company and MHC Formations/Reorganizations • Bank and Thrift De Novo Formations Silver, Freedman & Taff, L. L. P. 26

Radiology mergers and acquisitions

Radiology mergers and acquisitions Hr issues in mergers and acquisitions

Hr issues in mergers and acquisitions Franchise mergers and acquisitions

Franchise mergers and acquisitions Define corporate restructuring

Define corporate restructuring Mergers in strategic management

Mergers in strategic management Mergers and acquisitions rumors

Mergers and acquisitions rumors Non equity alliance

Non equity alliance What is merger and consolidation

What is merger and consolidation Duncan forbes hr

Duncan forbes hr Western australia economy

Western australia economy Athens and sparta were both

Athens and sparta were both Corporations mergers and multinationals

Corporations mergers and multinationals New evidence and perspectives on mergers

New evidence and perspectives on mergers Aqa merger of

Aqa merger of Purchase cycle audit

Purchase cycle audit Audit of capital acquisition and repayment cycle pdf

Audit of capital acquisition and repayment cycle pdf The united states emerges as a world power

The united states emerges as a world power Alliances and acquisitions

Alliances and acquisitions Difference between merger and acquisition

Difference between merger and acquisition Telecom mergers

Telecom mergers Disadvantage of mergers are

Disadvantage of mergers are Basic rules of photography

Basic rules of photography Difference between merger and acquisition

Difference between merger and acquisition Tech sector mergers

Tech sector mergers When are capabilities-motivated acquisitions essential?

When are capabilities-motivated acquisitions essential? Us territorial acquisitions 1803-1853

Us territorial acquisitions 1803-1853 Effects of westward expansion

Effects of westward expansion I fled him down the nights and down the days

I fled him down the nights and down the days