LIFE AFTER AMERICORPS MAXIMIZING YOUR ED AWARD Meredith

- Slides: 10

LIFE AFTER AMERICORPS: MAXIMIZING YOUR ED AWARD Meredith Dean Kentucky College Coaches Program Manager Kentucky Campus Compact

POP Quiz! • Is the Segal Education Award taxable income for KCCs? • Can I use my ed award to pay for current educational expenses including tuition, books and supplies, transportation, room and board, and other expenses? • Can I use my ed award to pay undergraduate OR graduate student loans? OR, can I use my ed award on future grad school loans? • Can I use my ed award to travel abroad? • Do I have a time limit on when I can use my award? • If I am at least 55 years of age, can I transfer my award to my child, grandchild, or foster child? • Are there universities that match my ed award? • Are there limitations on how many ed awards I can accumulate? • Are there other resources besides Meredith that can help me learn how to use my ed award?

Reporting Your Education Award On Taxes • Payments made using the award—subject to tax in the year each payment is made. ü Taxable income regardless of whether it’s used to pay current educational costs OR repay qualified student loans. • Payments made for interest accrued during term of service—ALSO subject to tax in the year each payment is made. *Note: the National Service Trust pays these on your behalf, but you have to request the payment be made. ü Good news: interest payments are not subtracted from your award balance! • The amount of the award used + any interest payments made impacts your income tax responsibility. ü Ex. Using entire amount of award in one calendar year? So, you include the entire amount as income on your taxes for that year (a. k. a. Meredith) ü Ex. Redeeming only a portion of your award in a year? So, you are responsible for any taxes owed on that portion. ü Ex. Did not redeem a portion of your award in a year? So, you are not responsible for taxes on your award that year. ü Regardless, all interest payments made on your behalf should be included as income in the year the payment was made • **If your education award and interest payments total $600 OR more in a calendar year, CNCS will send you an IRS Form 1099 to be used in preparing your income tax return. **

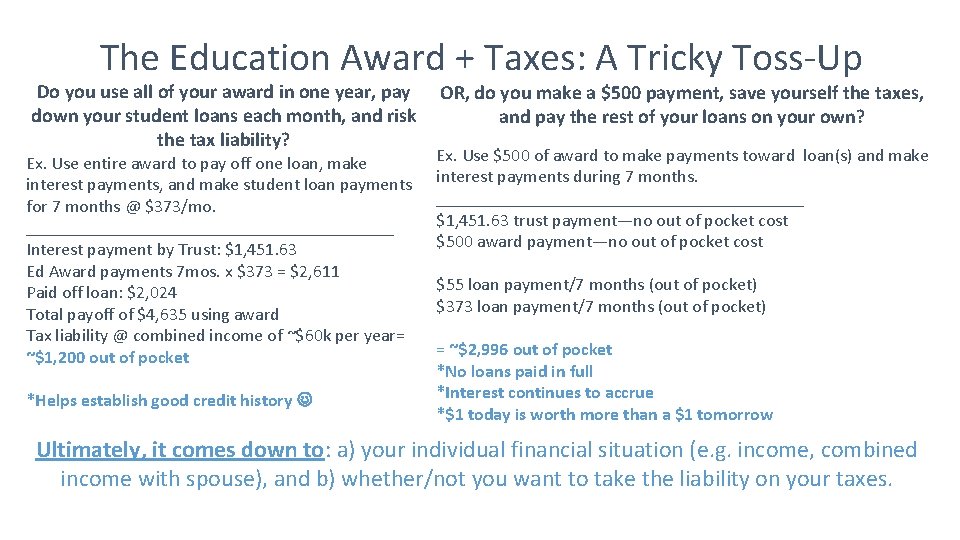

The Education Award + Taxes: A Tricky Toss-Up Do you use all of your award in one year, pay down your student loans each month, and risk the tax liability? Ex. Use entire award to pay off one loan, make interest payments, and make student loan payments for 7 months @ $373/mo. _____________________ Interest payment by Trust: $1, 451. 63 Ed Award payments 7 mos. x $373 = $2, 611 Paid off loan: $2, 024 Total payoff of $4, 635 using award Tax liability @ combined income of ~$60 k per year= ~$1, 200 out of pocket *Helps establish good credit history OR, do you make a $500 payment, save yourself the taxes, and pay the rest of your loans on your own? Ex. Use $500 of award to make payments toward loan(s) and make interest payments during 7 months. _____________________ $1, 451. 63 trust payment—no out of pocket cost $500 award payment—no out of pocket cost $55 loan payment/7 months (out of pocket) $373 loan payment/7 months (out of pocket) = ~$2, 996 out of pocket *No loans paid in full *Interest continues to accrue *$1 today is worth more than a $1 tomorrow Ultimately, it comes down to: a) your individual financial situation (e. g. income, combined income with spouse), and b) whether/not you want to take the liability on your taxes.

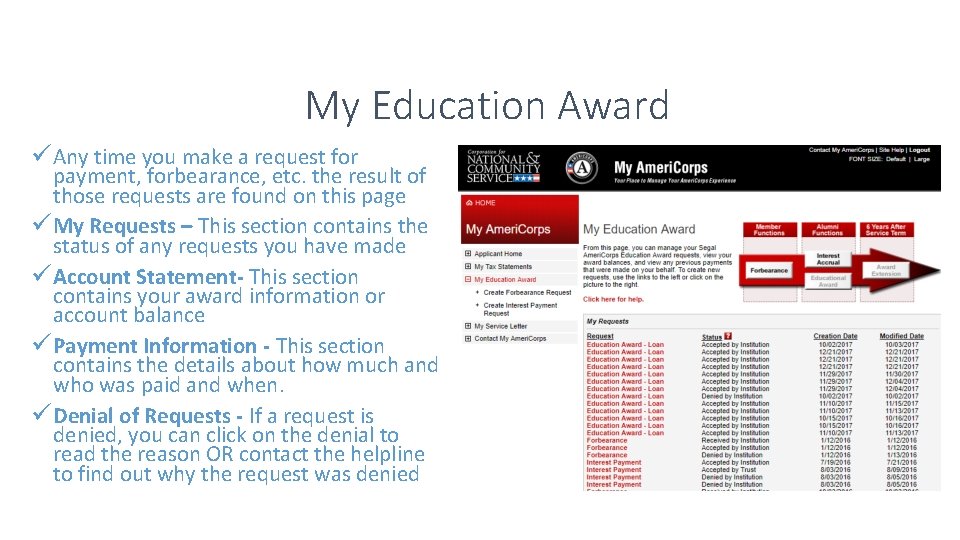

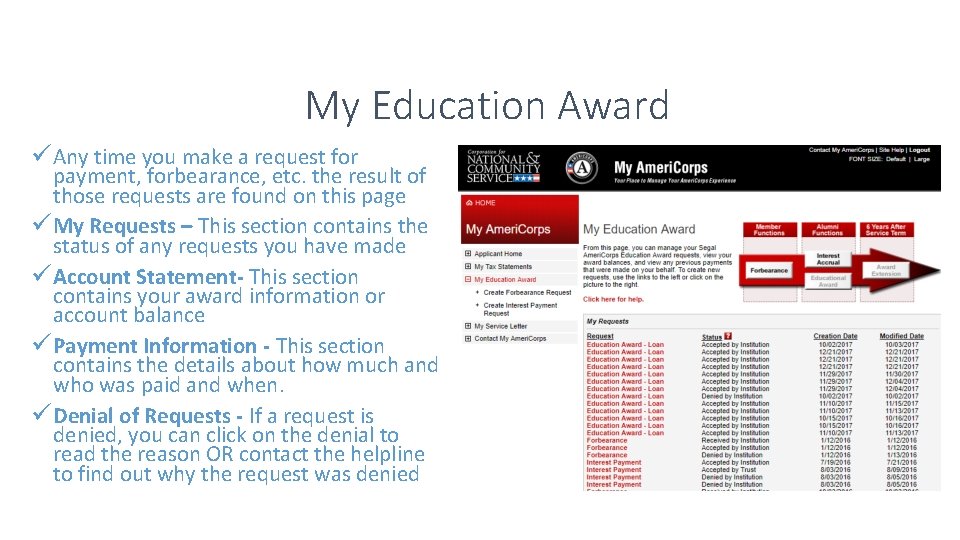

My Education Award ü Any time you make a request for payment, forbearance, etc. the result of those requests are found on this page ü My Requests – This section contains the status of any requests you have made ü Account Statement- This section contains your award information or account balance ü Payment Information - This section contains the details about how much and who was paid and when. ü Denial of Requests - If a request is denied, you can click on the denial to read the reason OR contact the helpline to find out why the request was denied

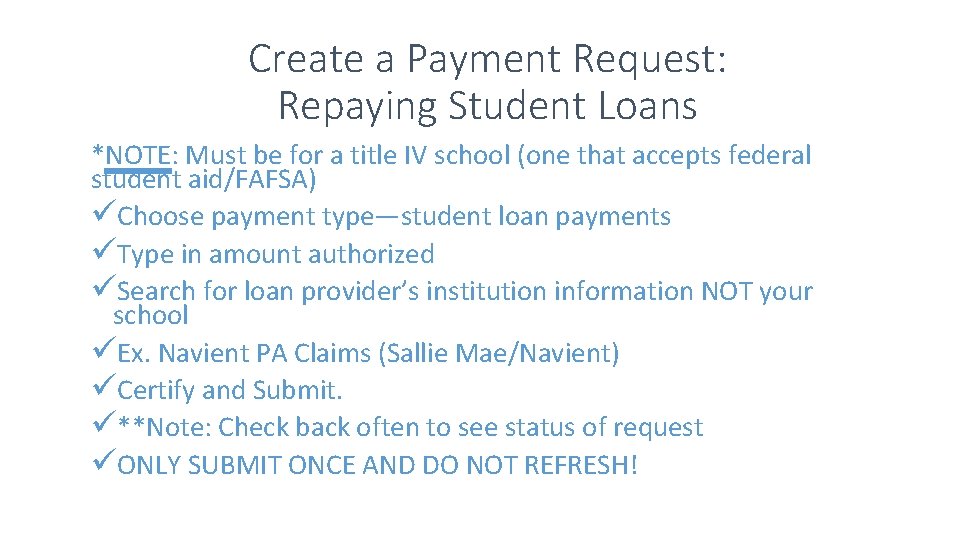

Create a Payment Request: Repaying Student Loans *NOTE: Must be for a title IV school (one that accepts federal student aid/FAFSA) üChoose payment type—student loan payments üType in amount authorized üSearch for loan provider’s institution information NOT your school üEx. Navient PA Claims (Sallie Mae/Navient) üCertify and Submit. ü**Note: Check back often to see status of request üONLY SUBMIT ONCE AND DO NOT REFRESH!

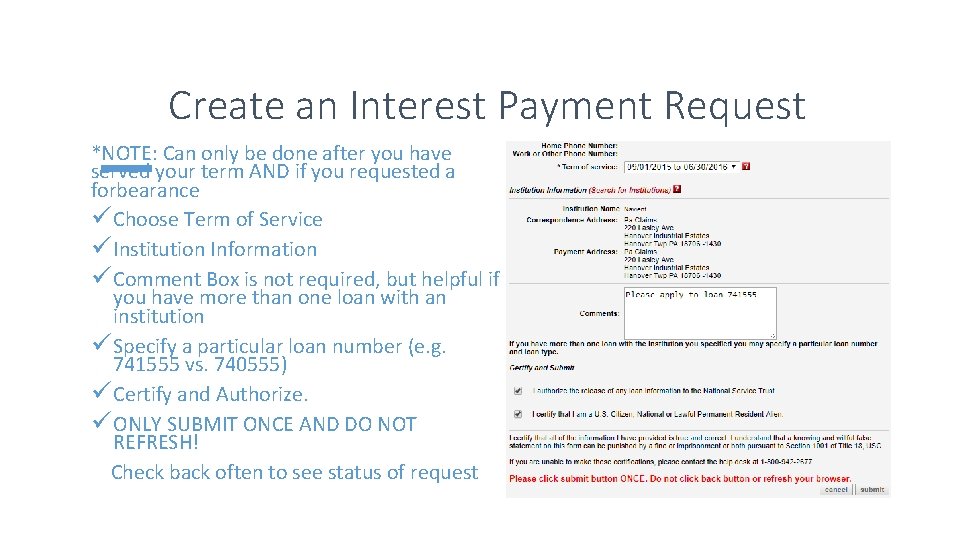

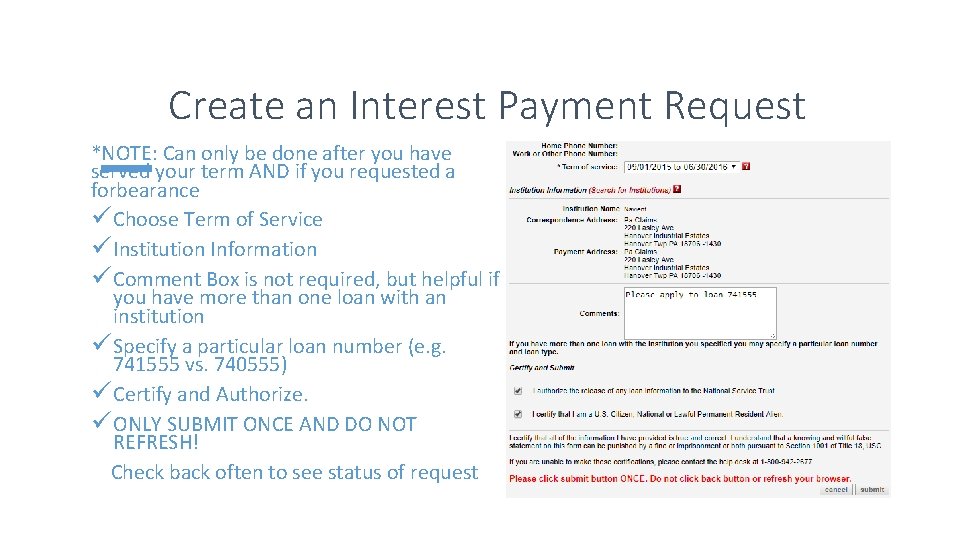

Create an Interest Payment Request *NOTE: Can only be done after you have served your term AND if you requested a forbearance ü Choose Term of Service ü Institution Information ü Comment Box is not required, but helpful if you have more than one loan with an institution ü Specify a particular loan number (e. g. 741555 vs. 740555) ü Certify and Authorize. ü ONLY SUBMIT ONCE AND DO NOT REFRESH! Check back often to see status of request

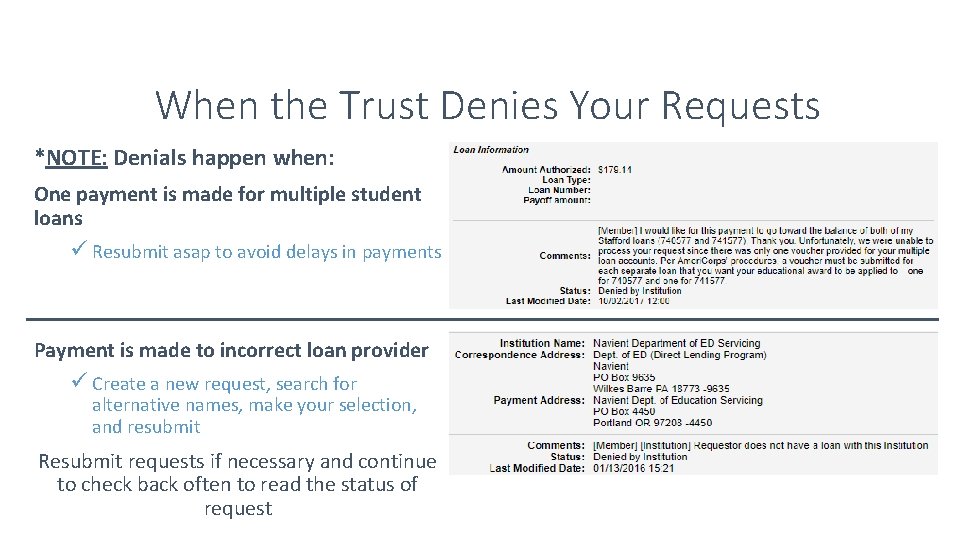

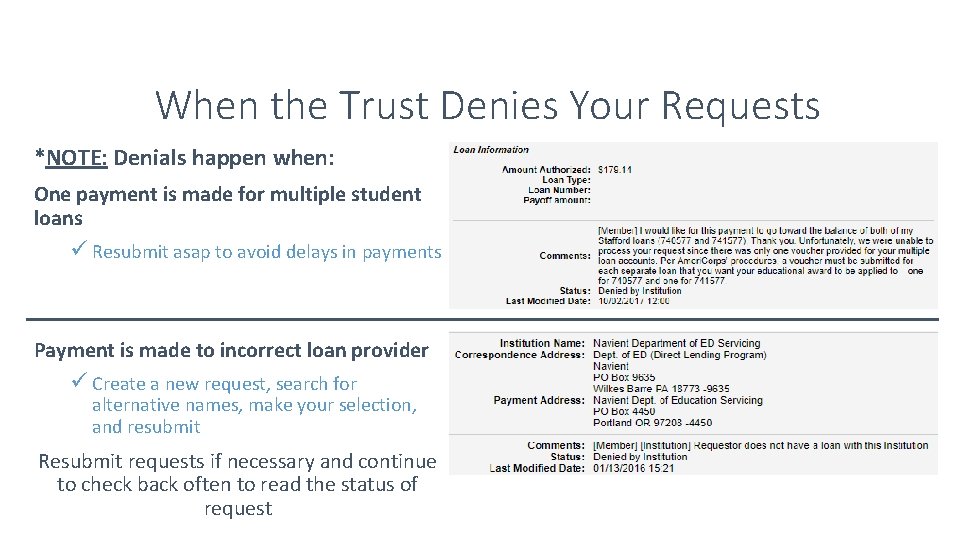

When the Trust Denies Your Requests *NOTE: Denials happen when: One payment is made for multiple student loans ü Resubmit asap to avoid delays in payments Payment is made to incorrect loan provider ü Create a new request, search for alternative names, make your selection, and resubmit Resubmit requests if necessary and continue to check back often to read the status of request

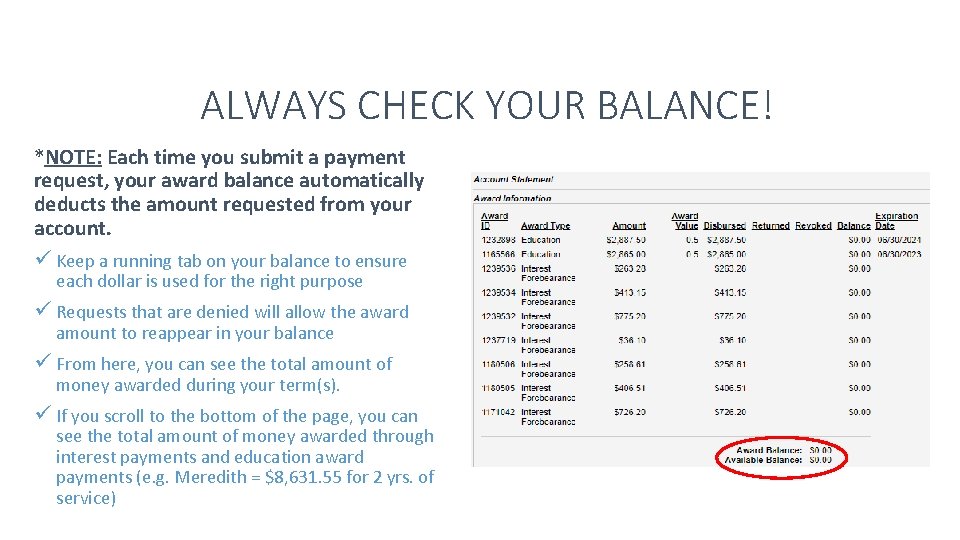

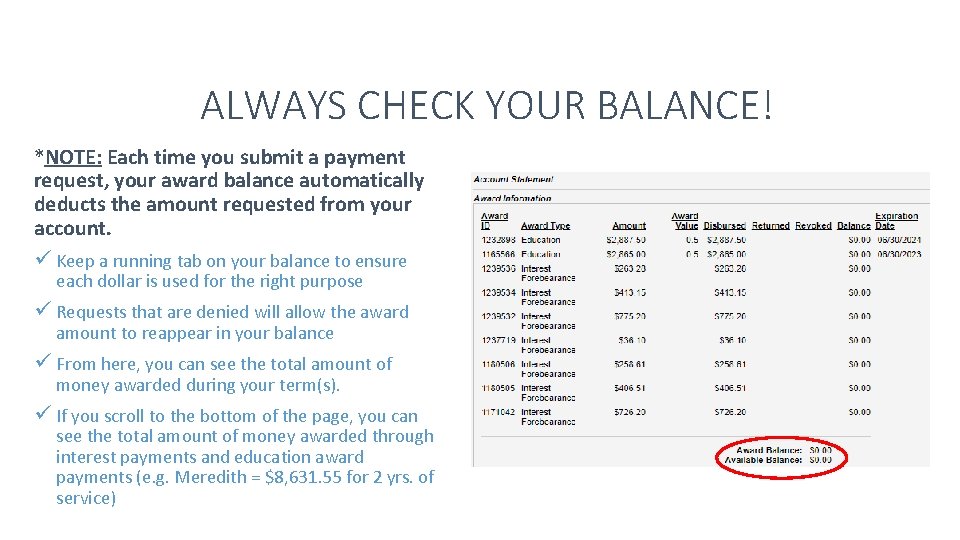

ALWAYS CHECK YOUR BALANCE! *NOTE: Each time you submit a payment request, your award balance automatically deducts the amount requested from your account. ü Keep a running tab on your balance to ensure each dollar is used for the right purpose ü Requests that are denied will allow the award amount to reappear in your balance ü From here, you can see the total amount of money awarded during your term(s). ü If you scroll to the bottom of the page, you can see the total amount of money awarded through interest payments and education award payments (e. g. Meredith = $8, 631. 55 for 2 yrs. of service)

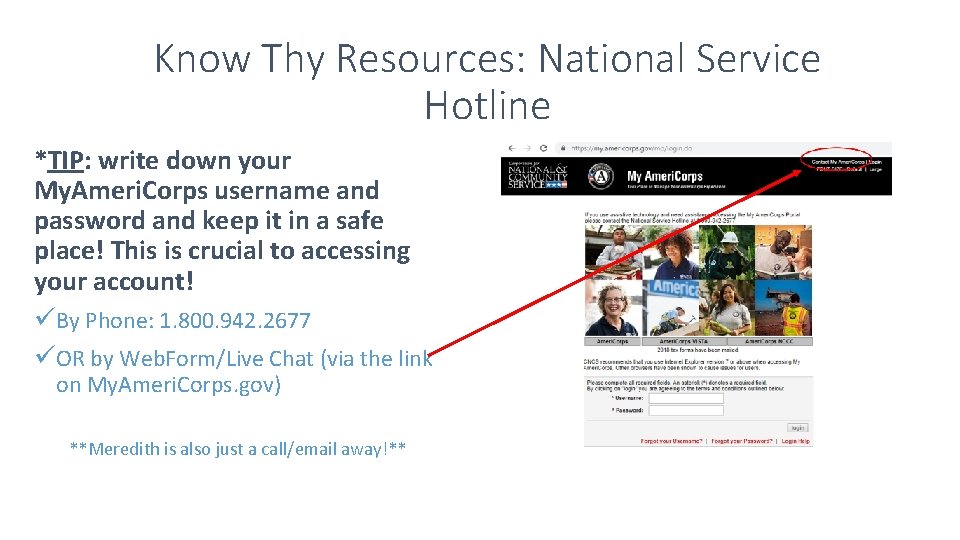

Know Thy Resources: National Service Hotline *TIP: write down your My. Ameri. Corps username and password and keep it in a safe place! This is crucial to accessing your account! üBy Phone: 1. 800. 942. 2677 üOR by Web. Form/Live Chat (via the link on My. Ameri. Corps. gov) **Meredith is also just a call/email away!**