Financing Alternatives in Todays Economic Climate A Canadian

- Slides: 14

Financing Alternatives in Today’s Economic Climate: A Canadian Assessment Presenter: Tel. : Email: Janne Duncan Partner, Toronto office November 30, 2009 416 202 -6715 janne. duncan@macleoddixon. com Calgary Toronto Moscow Almaty/Atyrau Caracas Rio de Janeiro

Emerging from the Dark Ages? • Dark Ages for Mining Companies: Late 2008 to Current – Global financial crisis following the collapse of Lehman Brothers in mid-September 2008 negatively impacted almost every industry • Commodity prices suffered as a result of lower demand for goods and services • Gilded Age: 2001 to 2008 – Long bull market, driven by growth in the BRIC countries: Brazil, Russia, India and China • Renaissance? – Market rally during last half of 2009

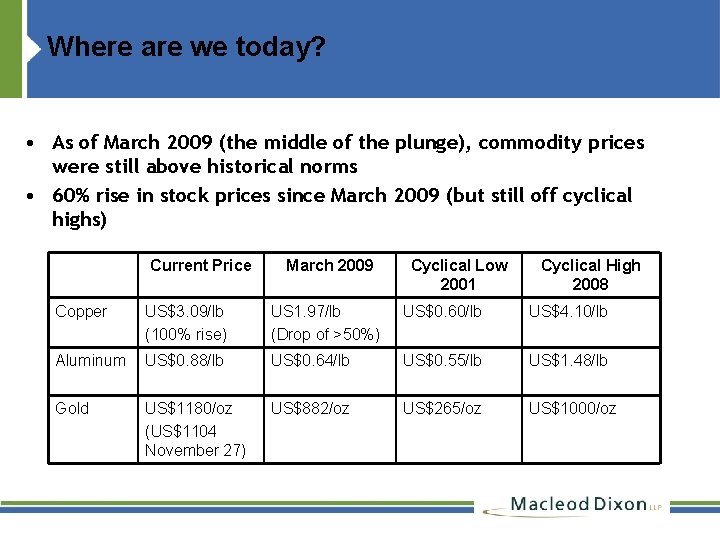

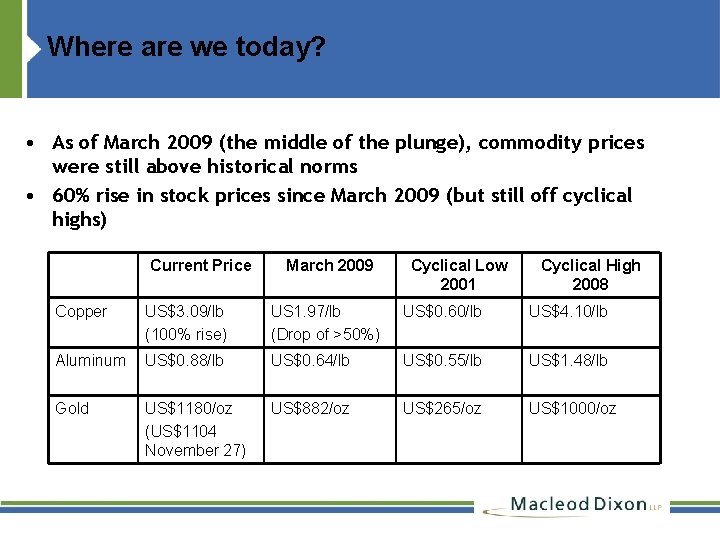

Where are we today? • As of March 2009 (the middle of the plunge), commodity prices were still above historical norms • 60% rise in stock prices since March 2009 (but still off cyclical highs) Current Price March 2009 Cyclical Low 2001 Cyclical High 2008 Copper US$3. 09/lb (100% rise) US 1. 97/lb (Drop of >50%) US$0. 60/lb US$4. 10/lb Aluminum US$0. 88/lb US$0. 64/lb US$0. 55/lb US$1. 48/lb Gold US$1180/oz (US$1104 November 27) US$882/oz US$265/oz US$1000/oz

Traditional sources of financing • Mining companies have 3 traditional sources of financing: – Internal cash flow from operations – Borrowing (issuing debt) – Equity (issuing shares)

Effects of volatility on traditional sources of financing • Before the crash, listed companies (of all stages) could raise equity: – Initial public offering (IPO) – Secondary offering of equity (short form prospectus) – Sometimes, secondary bond offerings

Effects of volatility on traditional sources of financing • Stock price volatility has made it extremely difficult to obtain cash flow from its 3 traditional sources of financing: – Internal cash flow from operations - affected by low commodity prices – Borrowing (issuing debt) – unavailable during the financial crisis – Equity (issuing shares) – companies that issue stock while stock prices are low risk substantial dilution

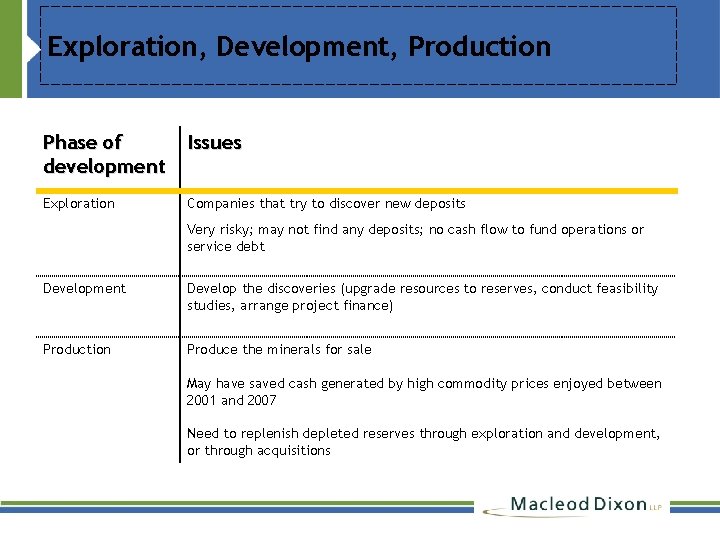

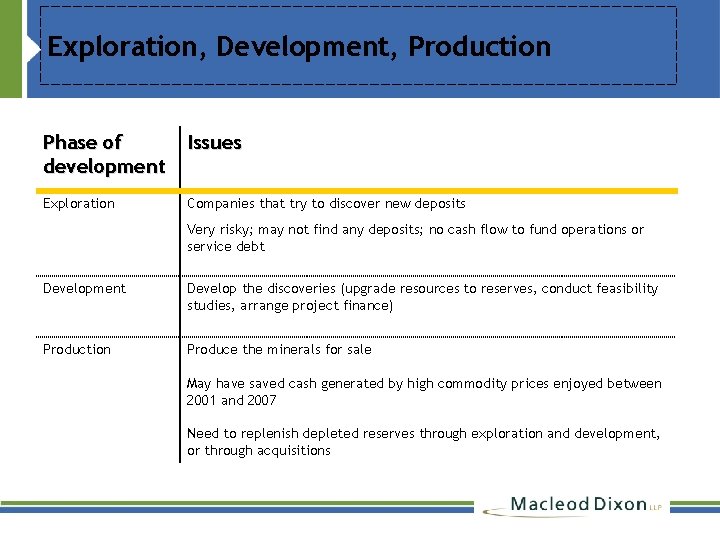

Exploration, Development, Production Phase of development Issues Exploration Companies that try to discover new deposits Very risky; may not find any deposits; no cash flow to fund operations or service debt Development Develop the discoveries (upgrade resources to reserves, conduct feasibility studies, arrange project finance) Production Produce the minerals for sale May have saved cash generated by high commodity prices enjoyed between 2001 and 2007 Need to replenish depleted reserves through exploration and development, or through acquisitions

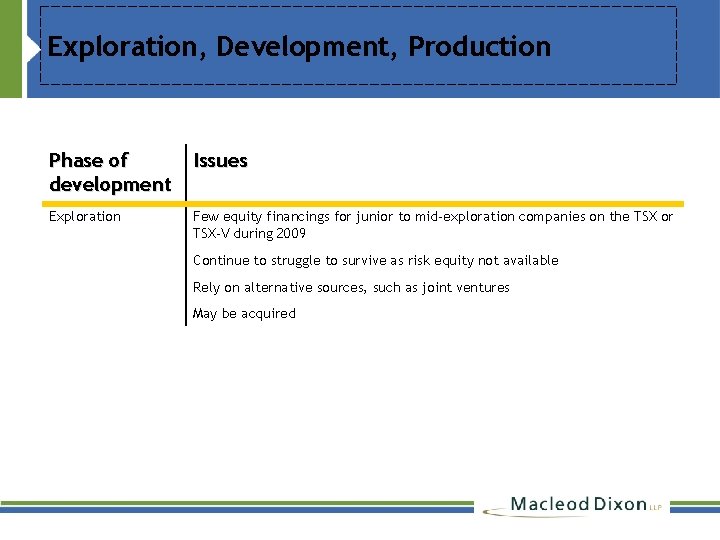

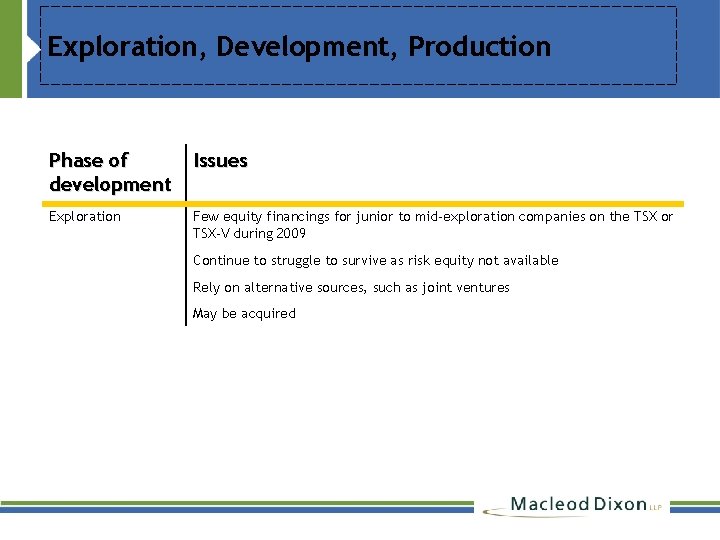

Exploration, Development, Production Phase of development Issues Exploration Few equity financings for junior to mid-exploration companies on the TSX or TSX-V during 2009 Continue to struggle to survive as risk equity not available Rely on alternative sources, such as joint ventures May be acquired

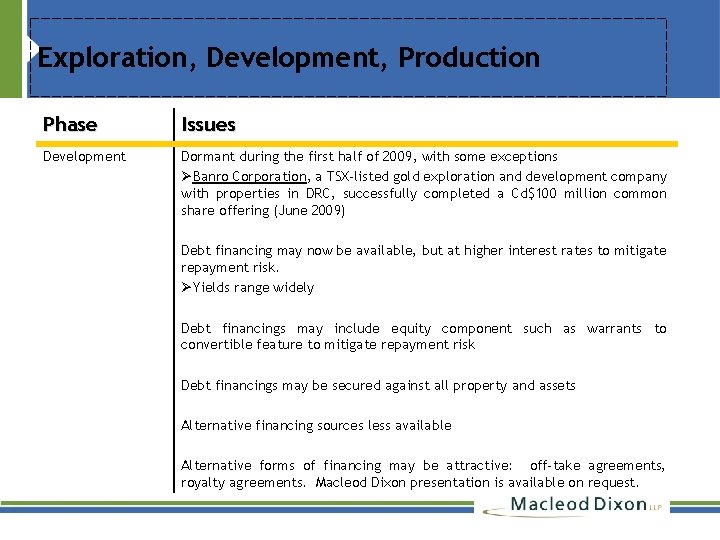

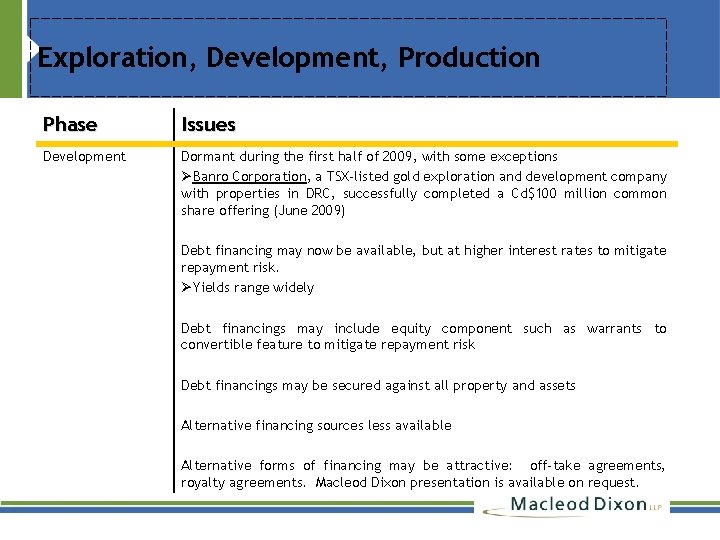

Exploration, Development, Production Phase Issues Development Dormant during the first half of 2009, with some exceptions ØBanro Corporation, a TSX-listed gold exploration and development company with properties in DRC, successfully completed a Cd$100 million common share offering (June 2009) Debt financing may now be available, but at higher interest rates to mitigate repayment risk. ØYields range widely Debt financings may include equity component such as warrants to convertible feature to mitigate repayment risk Debt financings may be secured against all property and assets Alternative financing sources less available Alternative forms of financing may be attractive: off-take agreements, royalty agreements. Macleod Dixon presentation is available on request.

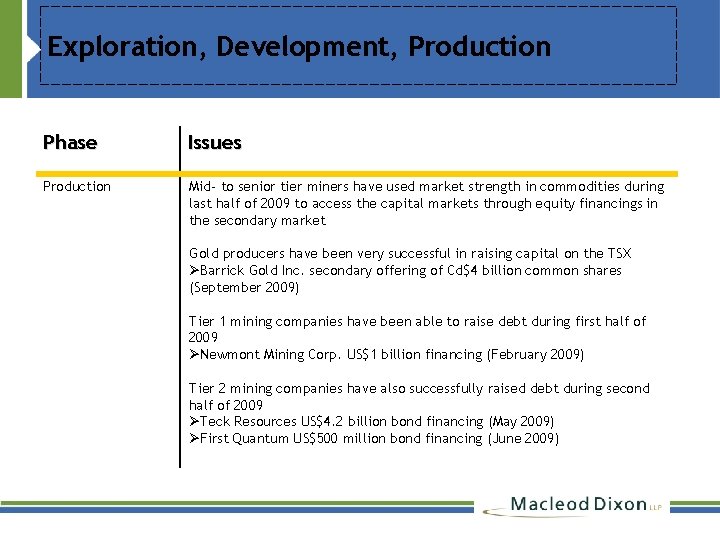

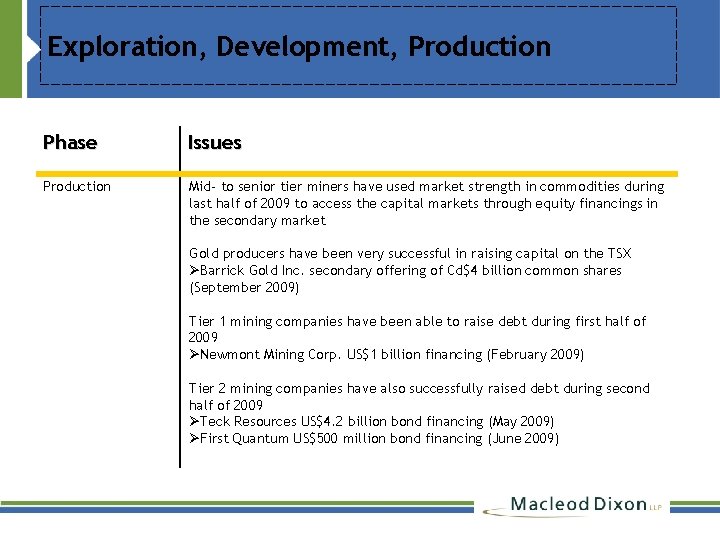

Exploration, Development, Production Phase Issues Production Mid- to senior tier miners have used market strength in commodities during last half of 2009 to access the capital markets through equity financings in the secondary market Gold producers have been very successful in raising capital on the TSX ØBarrick Gold Inc. secondary offering of Cd$4 billion common shares (September 2009) Tier 1 mining companies have been able to raise debt during first half of 2009 ØNewmont Mining Corp. US$1 billion financing (February 2009) Tier 2 mining companies have also successfully raised debt during second half of 2009 ØTeck Resources US$4. 2 billion bond financing (May 2009) ØFirst Quantum US$500 million bond financing (June 2009)

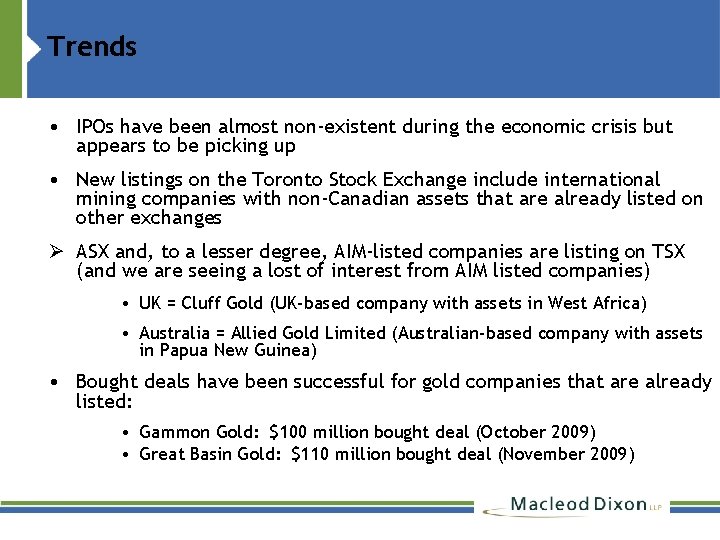

Trends • IPOs have been almost non-existent during the economic crisis but appears to be picking up • New listings on the Toronto Stock Exchange include international mining companies with non-Canadian assets that are already listed on other exchanges Ø ASX and, to a lesser degree, AIM-listed companies are listing on TSX (and we are seeing a lost of interest from AIM listed companies) • UK = Cluff Gold (UK-based company with assets in West Africa) • Australia = Allied Gold Limited (Australian-based company with assets in Papua New Guinea) • Bought deals have been successful for gold companies that are already listed: • Gammon Gold: $100 million bought deal (October 2009) • Great Basin Gold: $110 million bought deal (November 2009)

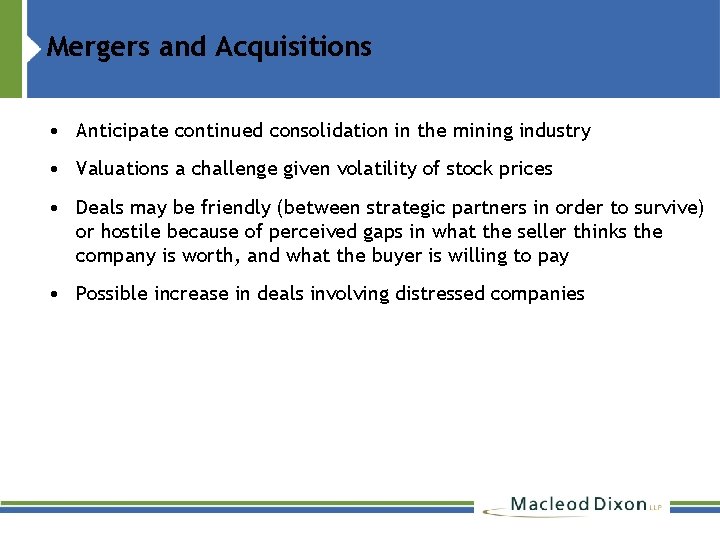

Mergers and Acquisitions • Anticipate continued consolidation in the mining industry • Valuations a challenge given volatility of stock prices • Deals may be friendly (between strategic partners in order to survive) or hostile because of perceived gaps in what the seller thinks the company is worth, and what the buyer is willing to pay • Possible increase in deals involving distressed companies

How to prepare • Listing on recognized exchange • Corporate Transparency – corporate governance – continuous disclosure, including in Technical Reports • Political stability • Favourable mining regulatory environment

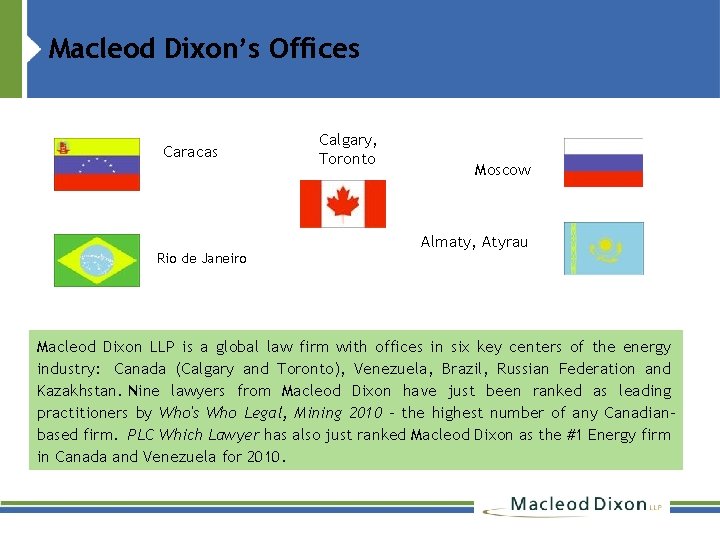

Macleod Dixon’s Offices Caracas Rio de Janeiro Calgary, Toronto Moscow Almaty, Atyrau Macleod Dixon LLP is a global law firm with offices in six key centers of the energy industry: Canada (Calgary and Toronto), Venezuela, Brazil, Russian Federation and Kazakhstan. Nine lawyers from Macleod Dixon have just been ranked as leading practitioners by Who's Who Legal, Mining 2010 - the highest number of any Canadianbased firm. PLC Which Lawyer has also just ranked Macleod Dixon as the #1 Energy firm in Canada and Venezuela for 2010.

Financing education in a climate of change

Financing education in a climate of change Canadian community economic development network

Canadian community economic development network Canadian foundation for economic education

Canadian foundation for economic education Climate change 2014 mitigation of climate change

Climate change 2014 mitigation of climate change Economic growth vs economic development

Economic growth vs economic development Economic development vs economic growth

Economic development vs economic growth Economic systems lesson 2 our economic choices

Economic systems lesson 2 our economic choices Good morning students how are you

Good morning students how are you Todays objective

Todays objective Whats thermal energy

Whats thermal energy Todays whether

Todays whether Whats todays temperature

Whats todays temperature Todays sabbath lesson

Todays sabbath lesson Todays class

Todays class Todays objective

Todays objective