DOMESTIC POLICY SOCIAL WELFARE Social Welfare Policies Provide

- Slides: 24

DOMESTIC POLICY SOCIAL WELFARE

Social Welfare Policies • Provide benefits to individuals • Based on either Entitlement (regardless of need; Social Security/Medicare) or Means. Tested programs (based on need; Food Stamps or Medicaid)

Means-Tested Programs • Controversial due to philosophical differences • Deserving Poor vs. Undeserving Poor • Social Darwinism vs. Cyclical / Structural Poverty

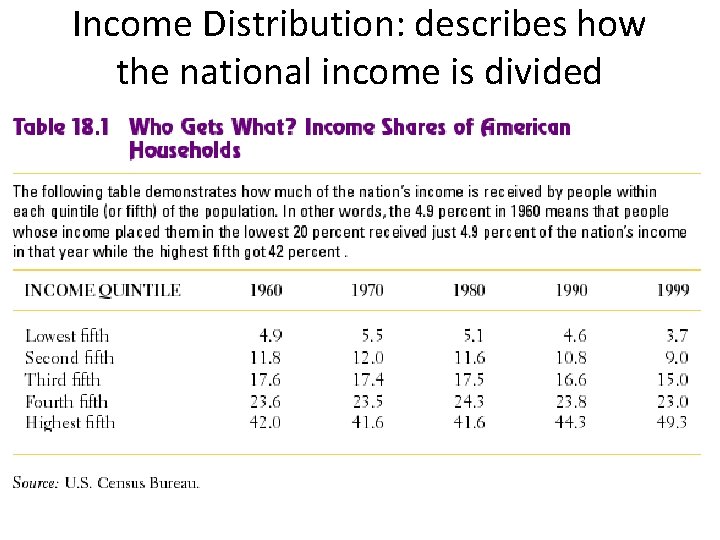

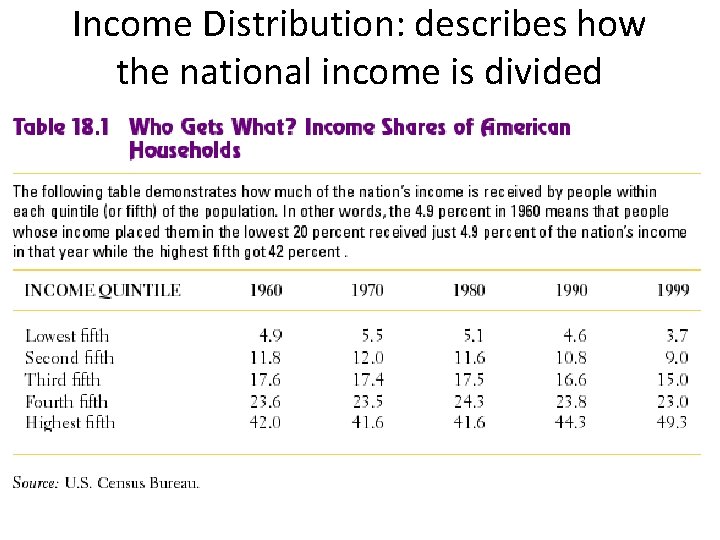

Income Distribution: describes how the national income is divided

• Relative Deprivation: perception by an individual that they are not doing well economically in comparison to others • Income: amount of money collected between two points in time • Wealth: Value of all assets owned (stocks, bonds, bank accounts, cars, houses, etc. ) – 1/3 of wealth held by 1%, – 1/3 by next 9%, – remaining 1/3 by the other 90%

Poverty Line • Income threshold below which people are considered poor • 1 person = 11, 170 • 4 persons = 23, 050 • 43. 6 million, about 14. 3%, officially poor in 2009 • ‘Feminization of Poverty’: increasing concentration of poverty among women

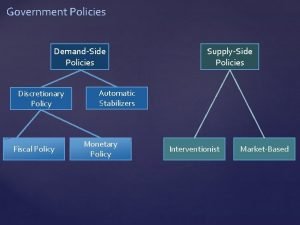

Gov’t. ’s Affect on Income • Government can affect income via two ways: –Taxation & Expenditures

TAXATION • • Progressive Tax: bigger % from rich Proportional Tax: same % from all Regressive Tax: bigger % from poor Earned Income Tax Credit (EITC): refundable credit for working people who earn low incomes

EXPENDITURES • Transfer Payments: benefits directly to individuals – cash, food stamps, low % loans

Evolution of “Welfare State” • 1789 -1935: parents care for children who take care of parents as they age • 1935: Social Security Act created as part of FDR’s New Deal – $ for retired, disabled – Aid for Families with Dependent Children (AFDC) • 1964: LBJ’s “War on Poverty” – Medicare/Medicaid

• 1980’s: De-funding of social welfare programs under Reagan • 1996: Welfare Reform Act, WJ Clinton – Must find work within 2 years – Total of 5 years welfare – AFDC changes to TANF (“Temporary Assistance for Needy Families”)

Political Conflict • Social Darwinism/dependency (“Deserving Poor”) vs. Cyclical/Structural Poverty (“Undeserving Poor”)

• Americans tend to see welfare recipients as overwhelmingly African-American, lazy, and undeserving • Feelings on race affect feelings on welfare • Media portrays recipients as minority when majority are White

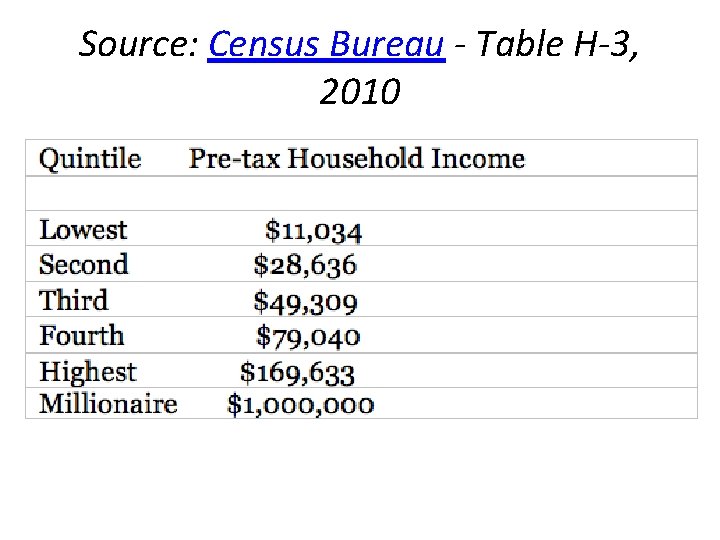

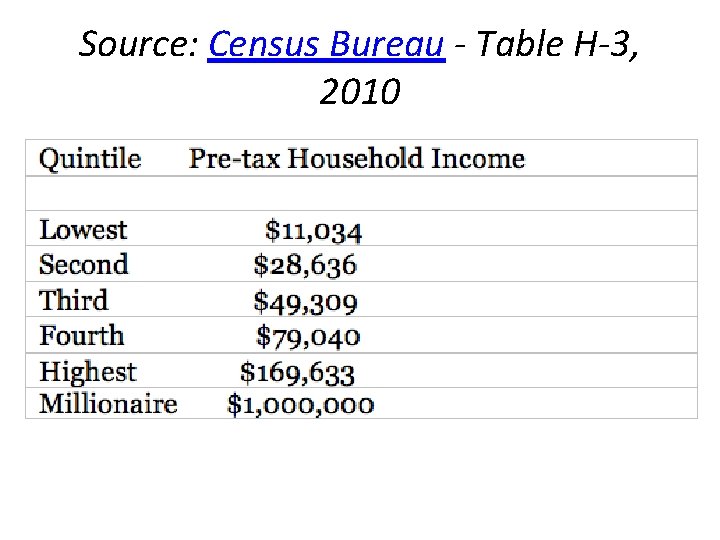

Source: Census Bureau - Table H-3, 2010

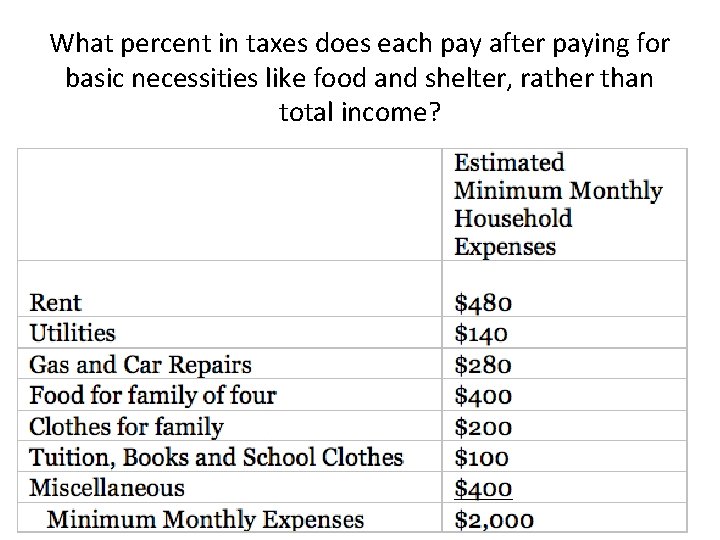

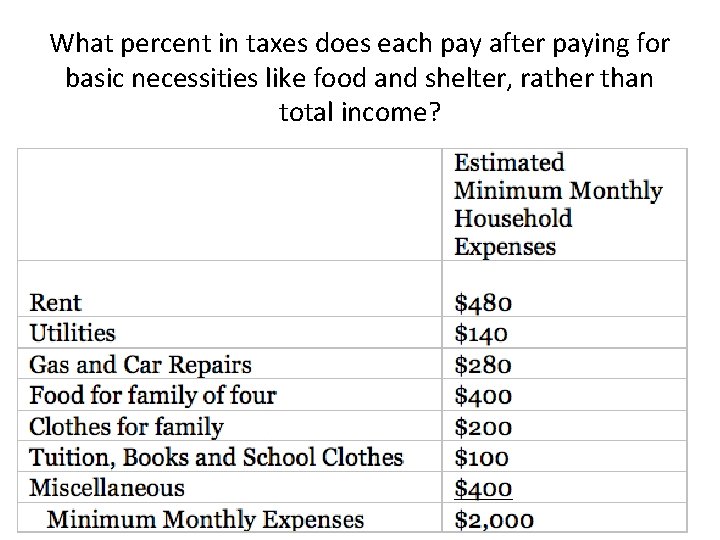

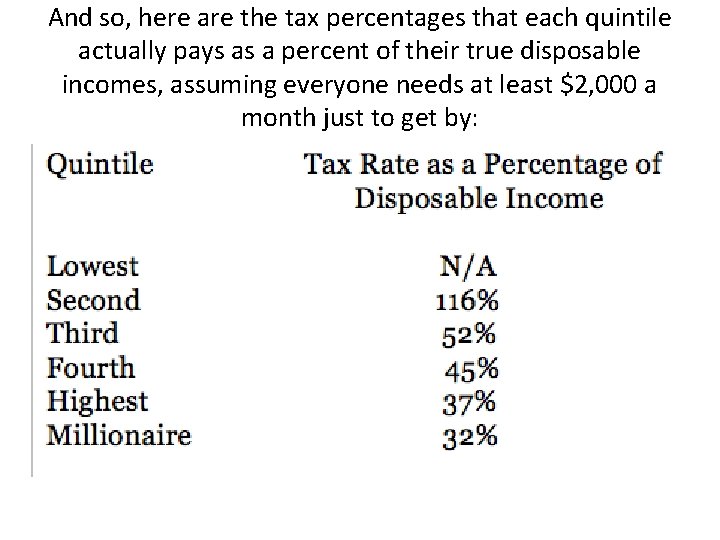

What percent in taxes does each pay after paying for basic necessities like food and shelter, rather than total income?

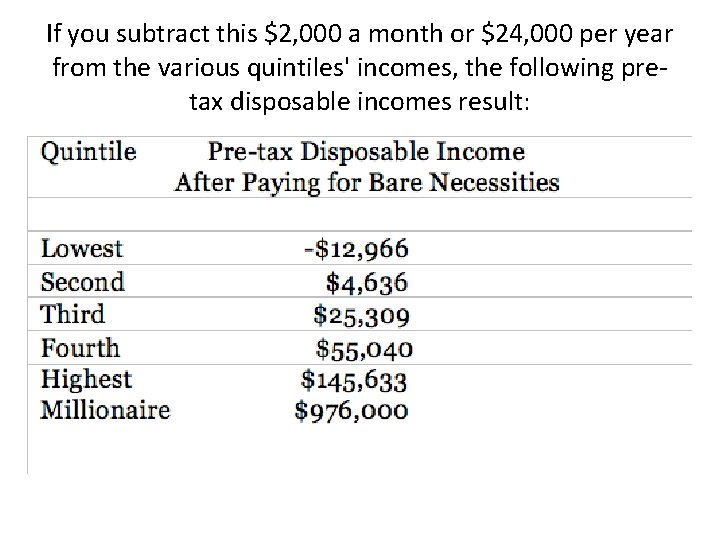

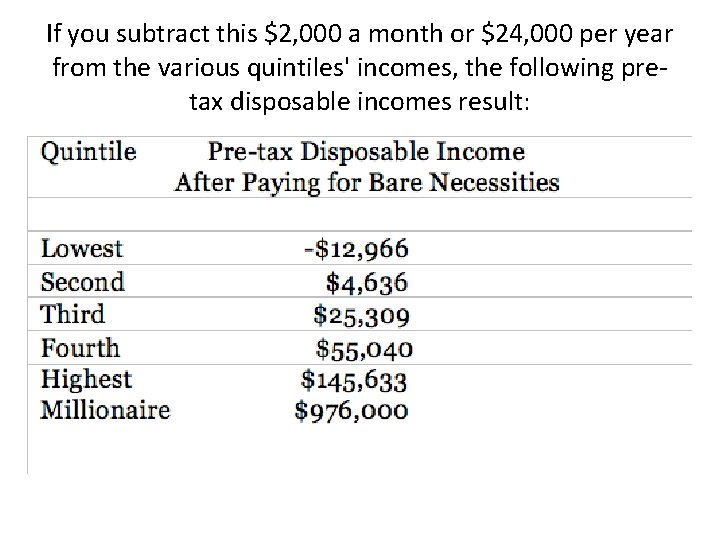

If you subtract this $2, 000 a month or $24, 000 per year from the various quintiles' incomes, the following pretax disposable incomes result:

And here are the actual average taxes paid by quintile:

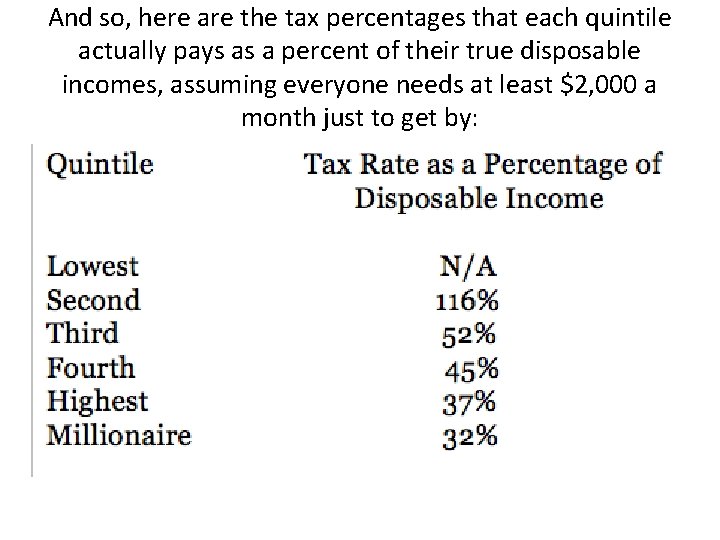

And so, here are the tax percentages that each quintile actually pays as a percent of their true disposable incomes, assuming everyone needs at least $2, 000 a month just to get by:

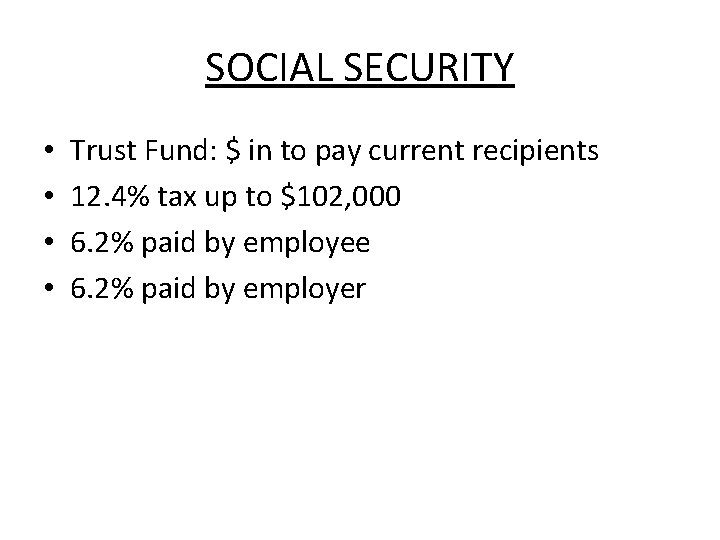

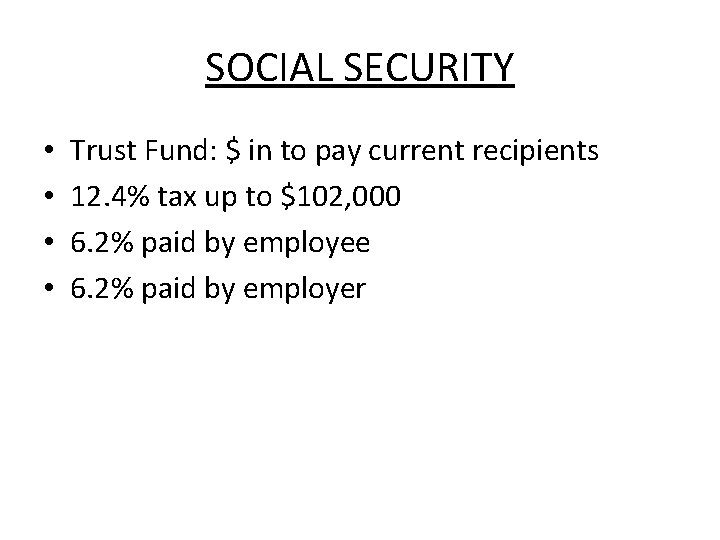

SOCIAL SECURITY • • Trust Fund: $ in to pay current recipients 12. 4% tax up to $102, 000 6. 2% paid by employee 6. 2% paid by employer

INSOLVENCY • Life expectancy: 1935 = < 65; 2009 = >78 • Baby Boom = fewer workers-to-recipients ratio • Fund has been ‘raided’ over the years to pay for other programs

SOLUTION(S)? • • Increase Payroll Taxes Decrease benefits for recipients Increase age at which benefits are received Means-Testing recipients

Efficacy of Groups re: Social Welfare Policymaking • Elderly: well-organized with a high amount of resources = effective • Poor: vote less, less money, fewer organizations = less effective

Fear be conquered

Fear be conquered Eisenhower domestic policy

Eisenhower domestic policy Castro's domestic policies

Castro's domestic policies Domestic policies of napoleon

Domestic policies of napoleon Napoleon's domestic policies

Napoleon's domestic policies John f kennedy domestic policies

John f kennedy domestic policies National policy and legislation

National policy and legislation A unified welfare analysis of government policies

A unified welfare analysis of government policies 2nd social welfare policy in pakistan

2nd social welfare policy in pakistan William h taft domestic policy

William h taft domestic policy Domestic policy of hitler

Domestic policy of hitler What is domestic policy

What is domestic policy Thomas jefferson domestic policy

Thomas jefferson domestic policy Hatshepsut's family tree

Hatshepsut's family tree Domestic policy

Domestic policy George washingtons domestic policy

George washingtons domestic policy Social welfare vs social work

Social welfare vs social work Chapter 4 choosing a form of business ownership

Chapter 4 choosing a form of business ownership Examples of social welfare programs

Examples of social welfare programs Industrial achievement model of social welfare

Industrial achievement model of social welfare Models of group work practice

Models of group work practice Social welfare

Social welfare Social welfare models

Social welfare models Conclusion of welfare economics

Conclusion of welfare economics Tools of normative analysis

Tools of normative analysis